Summary

Extremely bullish report.

Crude: -10.6 MMB

SPR: +0.6 MMB

Cushing: -1.5 MMB

Gasoline: -0.2 MMB

Ethanol: -1.2 MMB

Distillate: +1.2 MMB

Jet: -0.7 MMB

Total: -8.0 MMB

Spot WTI crude oil is pricing $81 at the time of this report. This is below modeled fair market value.

Crude

Crude oil drew by 10.6 MMB due to a recovery in exports and continued refiner strength.

The US has now added 2.8 MMB to the SPR of planned 6 MMB for 2023. This is a rounding error after releasing 270 MMB over the past 2 years.

Crude import remain higher than anticipated.

Saudi Arabian imports will fall back.

Crude exports remain elevated. Independent ship trackers pegged US exports over 5 MMBD this week, while the EIA showed 4.5 MMBD. It will be interesting to see if those barrels are counted next week.

Unaccounted for oil drops back with the increase in benchmark weekly production.

Cushing

Cushing drew 1.5 MMB and sits at 29 MMB of inventory. Tank bottoms come into play in the low 20’s. Watch levels at the end of September for potential fireworks.

Gasoline

Total motor gasoline inventories drew 0.2 MMB and are about 5% below the seasonal five-year average.

Ethanol

Ethanol decreased 1.2 MMB and are about 2% below the five year average.

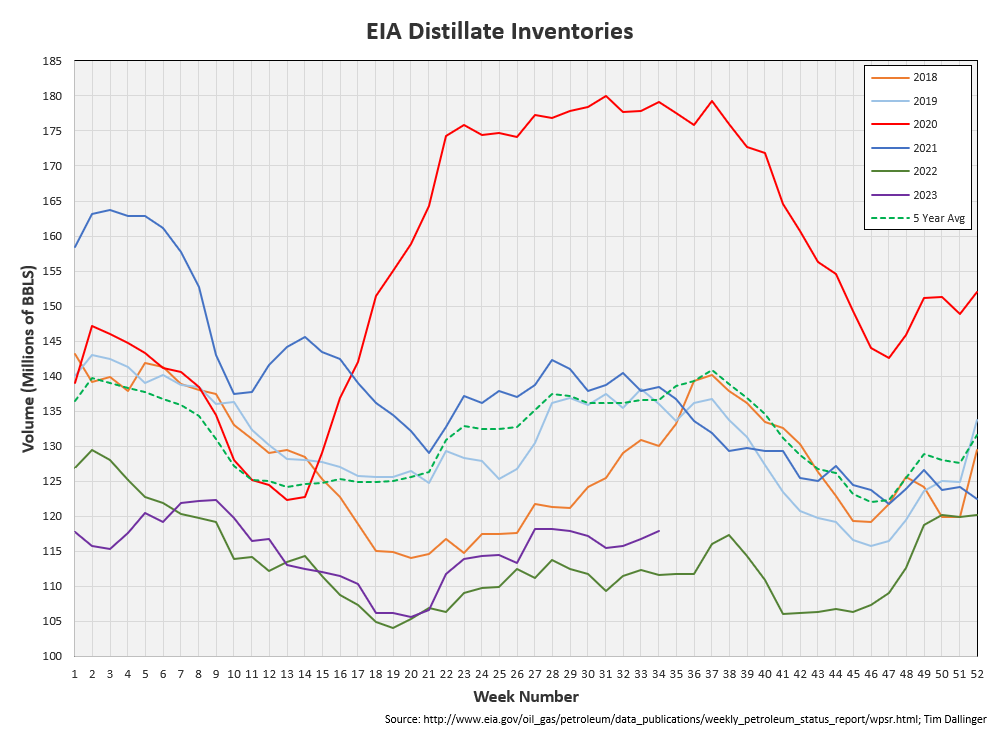

Distillate

Distillate fuel inventories increased by 1.2 MMB and are about 15% below the seasonal five year average.

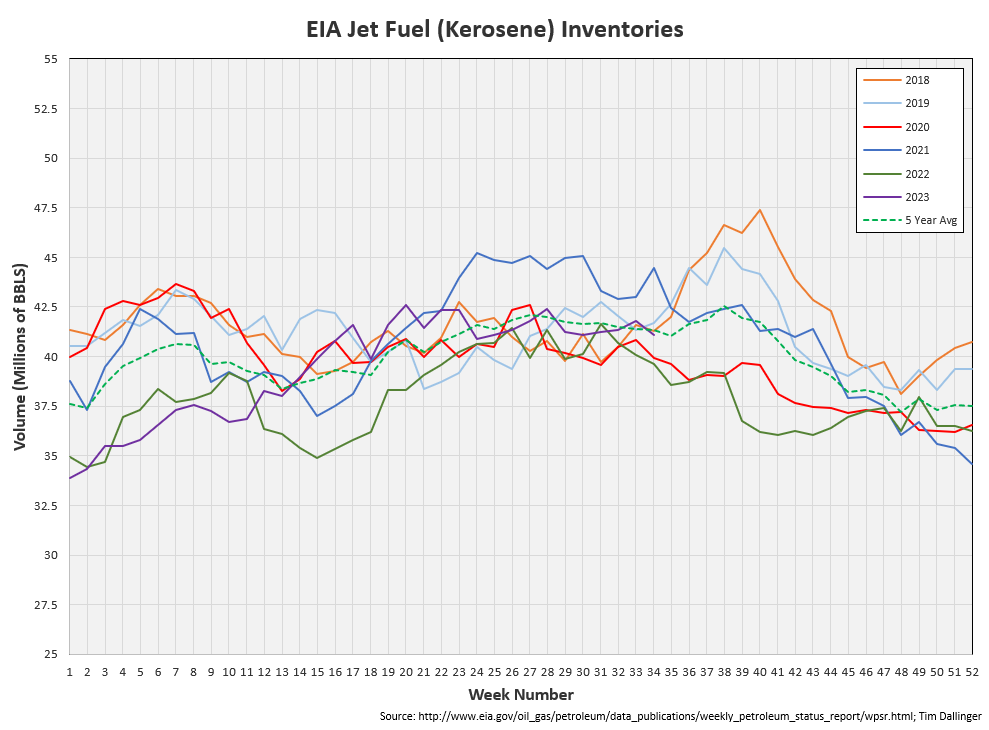

Jet

Kerosene type jet fuel drew 0.7 MMB. Inventories are just above average levels.

Global flight miles are on par with 2019 levels. China has guided that international testing measures will be eased in September, potentially driving more China recovery. Jet demand should improve further.

https://www.airportia.com/flights-monitor/

Propane

Propane inventories increased by 3.2 million barrels last week and are about 23% above the five year average. Propane is only the glut.

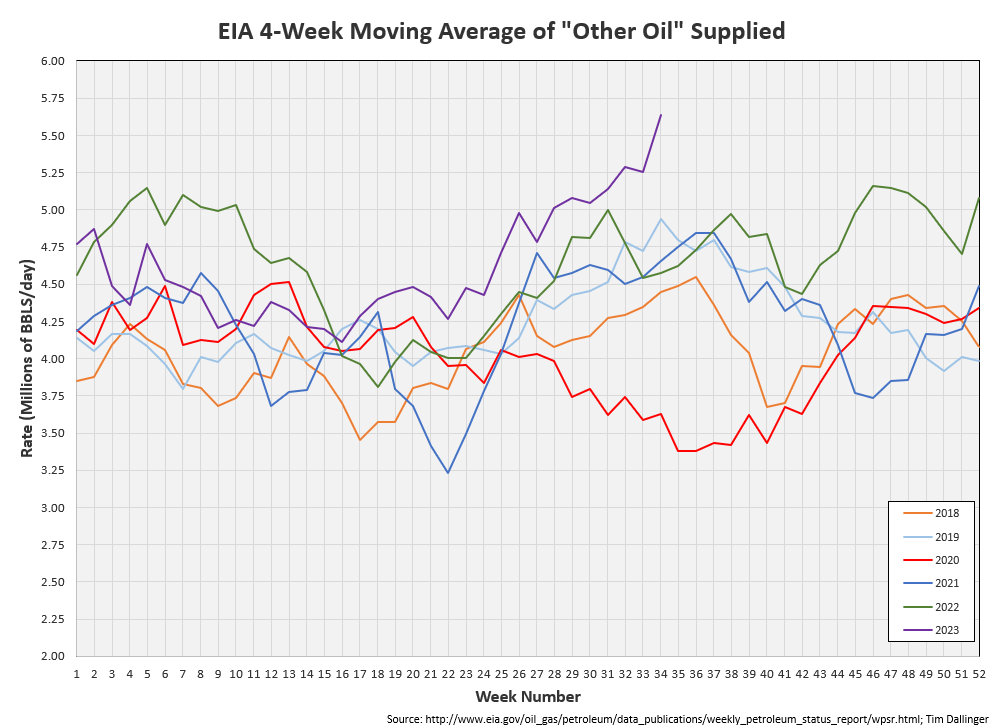

Other Oil

Other oil drew 0.4 MMB. Inventories are at average levels.

The EIA demand proxy for other oil is showing all-time record strength.

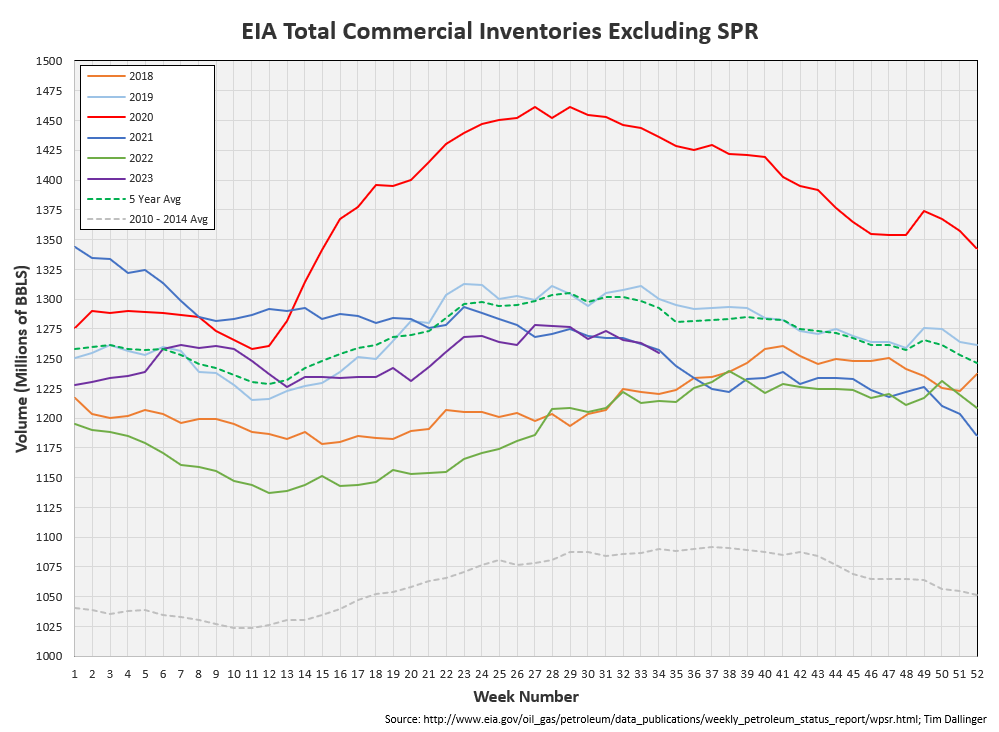

Total Commercial Inventory

Total commercial inventories drew 8.0 MMB. They’re at 2021 levels but appear poised to challenge seasonal record lows in September.

Natural Gas

Natural gas gets a little more support from high power burn, especially in the southern region.

It looks to be another scorcher of a week approaching.

Discussion

Refiners processes slightly less crude week on week, as early maintenance starts. Next week crude input should drop further as Marathon’s Garryville facility was impacted by a severe fire. The fire has been extinguished. Significant repair is expected before full operation can return.

EIA’s consumer demand proxy is above every year except 2019. Critics may claim that’s due to the “other oil” category. While this is true, other oil isn’t a very distinct classification. There’s much lumped into this group.

Transportation inventories have built above 2019 levels but are still relatively low.

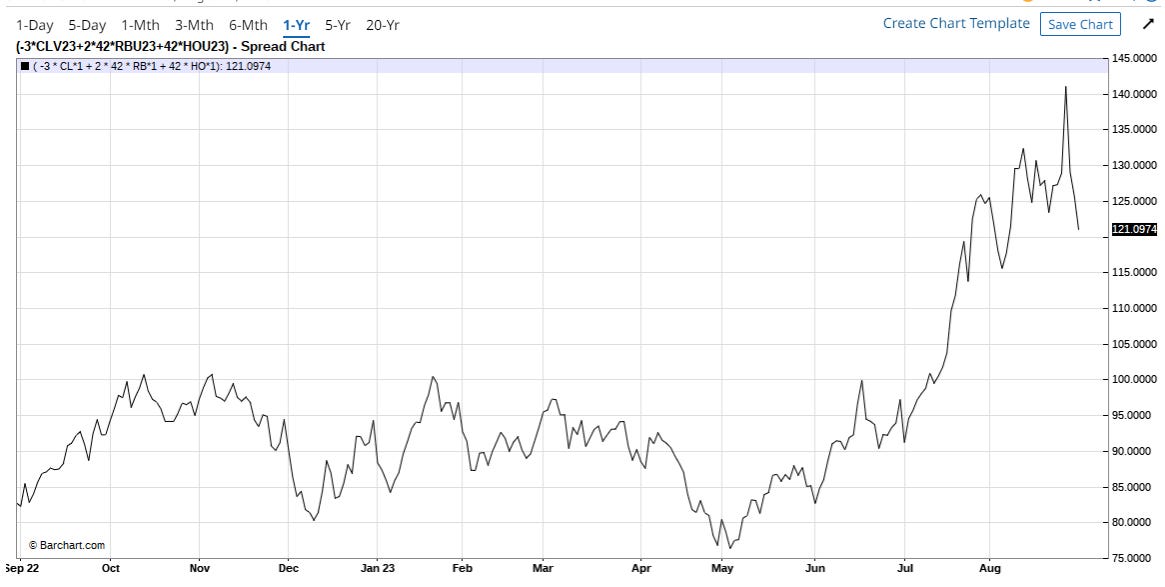

Cracks have eased off record levels with a partial restart of Garyville and China increasing product export for their teapot refiners.

The dollar strength does appear to be somewhat of a headwind here.

The following graph from industry analyst group Vortexa has been circulating online. It shows the fastest ever draw of global crude inventory. Without satellite data access, this cannot be independently corroborated. If it’s true, one must wonder why prices aren’t showing more strength.

Timespreads are improving, especially for Brent, suggesting this data is at least directionally correct.

These are not bad prices, however, based on previous messaging, they are not yet high enough for Saudi Arabia’s desire. The longer prices remain depressed, the more resilient OPEC+ will be become. Critics claim the “Fragile 5” are having internal arguments and this cohesion will not last. There is no reason to expect that development. OPEC+ has done exactly what they’ve guided.

This weekend Saudi should announce another month extension of the 1 MMBD “lollipop” cut.

Physical inventories are drawing at record pace as demand appears healthy and imminent recession seems less likely. Yet spot WTI price remains steady around $80 when inventories suggest it should be $10+ higher. The financial market cannot be divorced from a physical commodity market forever. US and Global inventories will continue to draw, although the current rate is unsustainable.

Macro headwinds still exist but the bullish thesis remains intact. I think prices go higher.

https://twitter.com/DallingerTim/status/1695467228211171461

Thank you, Sandra Smith, Phil Flynn and FOX News American Report, for providing me the opportunity to discuss crude markets.

Not investment advice. Informational purposes only.