EIA WPSR Summary for week ending 5-23-25

Summary

Crude: -2.8 MMB

SPR: +0.8 MMB

Cushing: +0.1 MMB

Gasoline: -2.4 MMB

Distillate: -0.7 MMB

Jet: +0.6 MMB

Ethanol: -0.7 MMB

Propane: +2.0 MMB

Other Oil: +3.1 MMB

Total: -0.7 MMB

Spot WTI is currently pricing $60. Prices remain steeply discounted in relation to estimated fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply drew by 2.8 MMB. Crude inventories are currently 6% below the seasonal average.

0.8 MMB were added to the SPR.

The SPR inventory FOIA request was granted.

It appears that there was damage to the caverns during the draw down. However, much of the damage is reported to have been repaired.

There is still significant volume unavailable. But that’s due to the DOE Life-Extension-II project which was planned and initiated prior to drawdown.

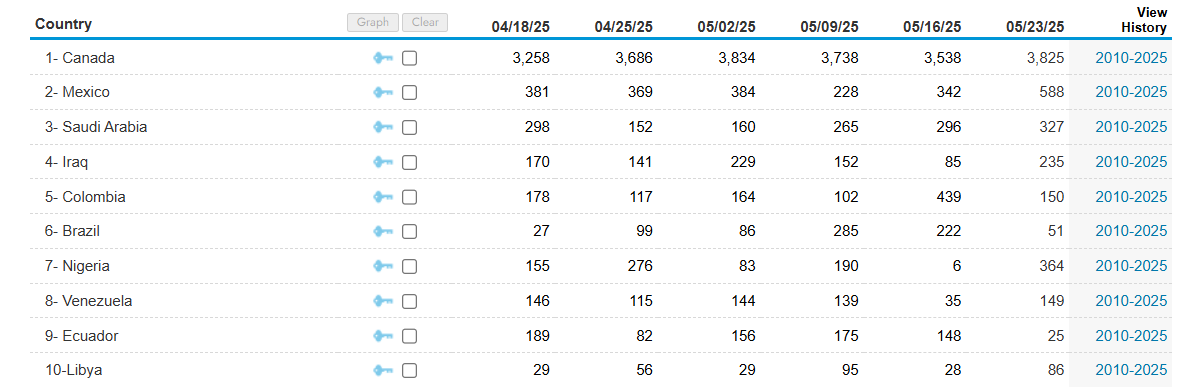

US crude imports picked up and are near 2025 average levels.

8 of the top 10 importers were up week-on-week.

Crude exports increased slightly but remain below average levels.

Unaccounted for crude was flat.

The EIA model continues to predict US production growing after recently re-benchmarking. A new petroleum supply monthly and EIA-0914 will be released tomorrow. Production will be checked then.

Cushing

Crude storage in Cushing, OK, built by 0.1 MMB week on week. Storage is still low, early in driving season.

Gasoline

Total motor gasoline inventories decreased by 2.4 MMB and are about 3% below the seasonal 5-year average.

Both finished gasoline and blending components decreased.

Distillate

Distillate fuel inventories decreased by 0.7 MMB last week and are about 17% below the seasonal 5-year average.

Total distillate stocks return to multi-decade lows.

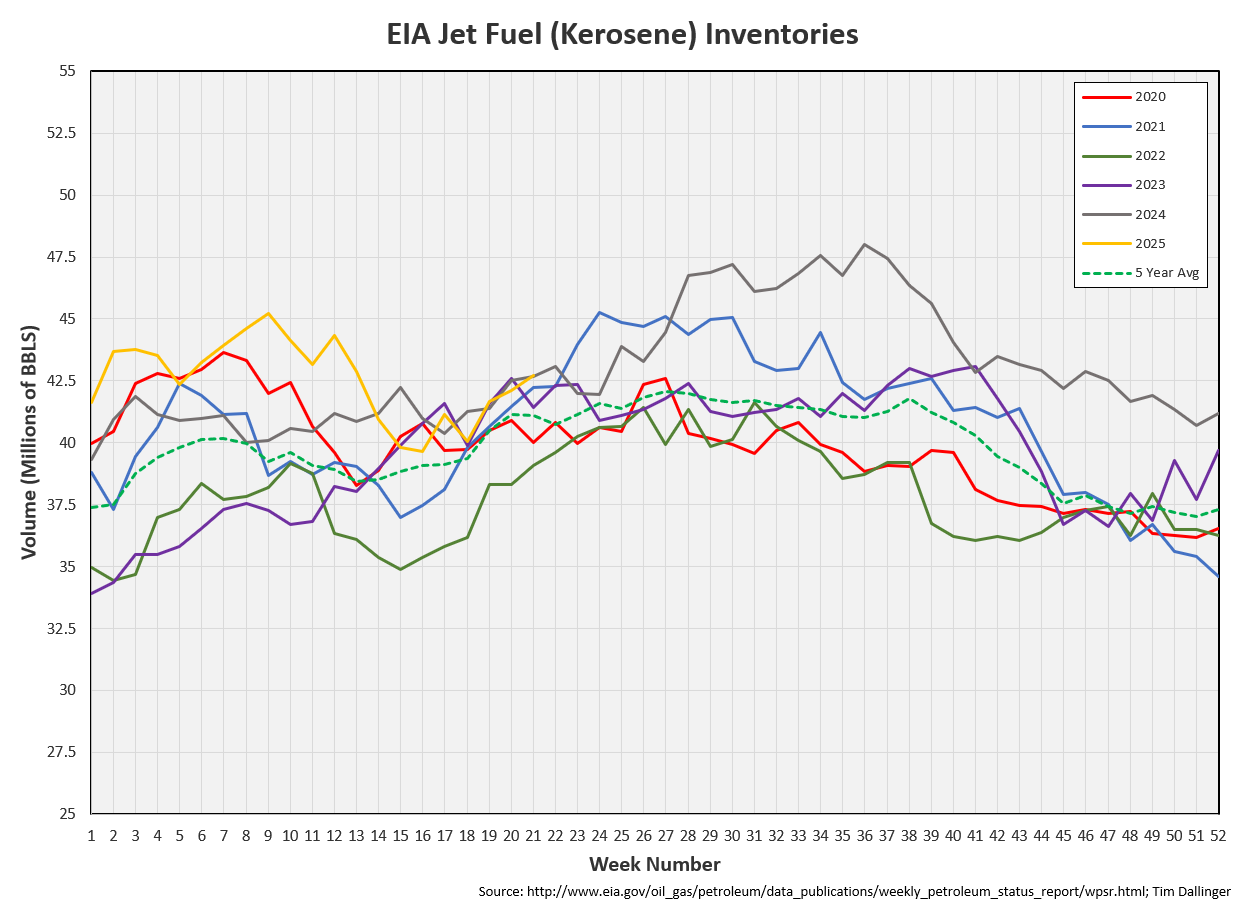

Jet

Kerosene type jet fuels increased by 0.6 MMB and are identical to 2024 levels.

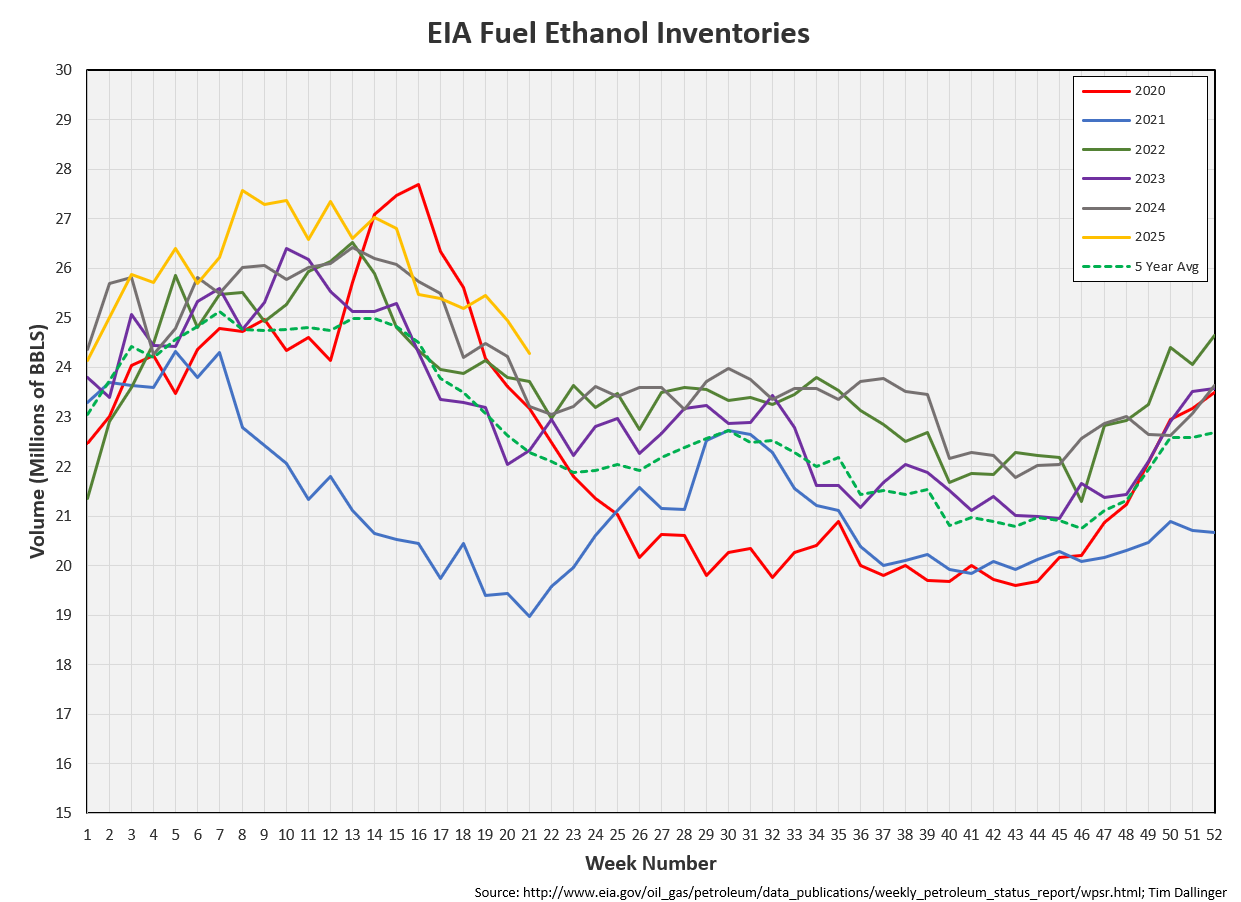

Ethanol

Ethanol inventories decreased 0.7 MMB week-on-week. Inventories are above seasonal averages but falling at a seasonally normal trajectory.

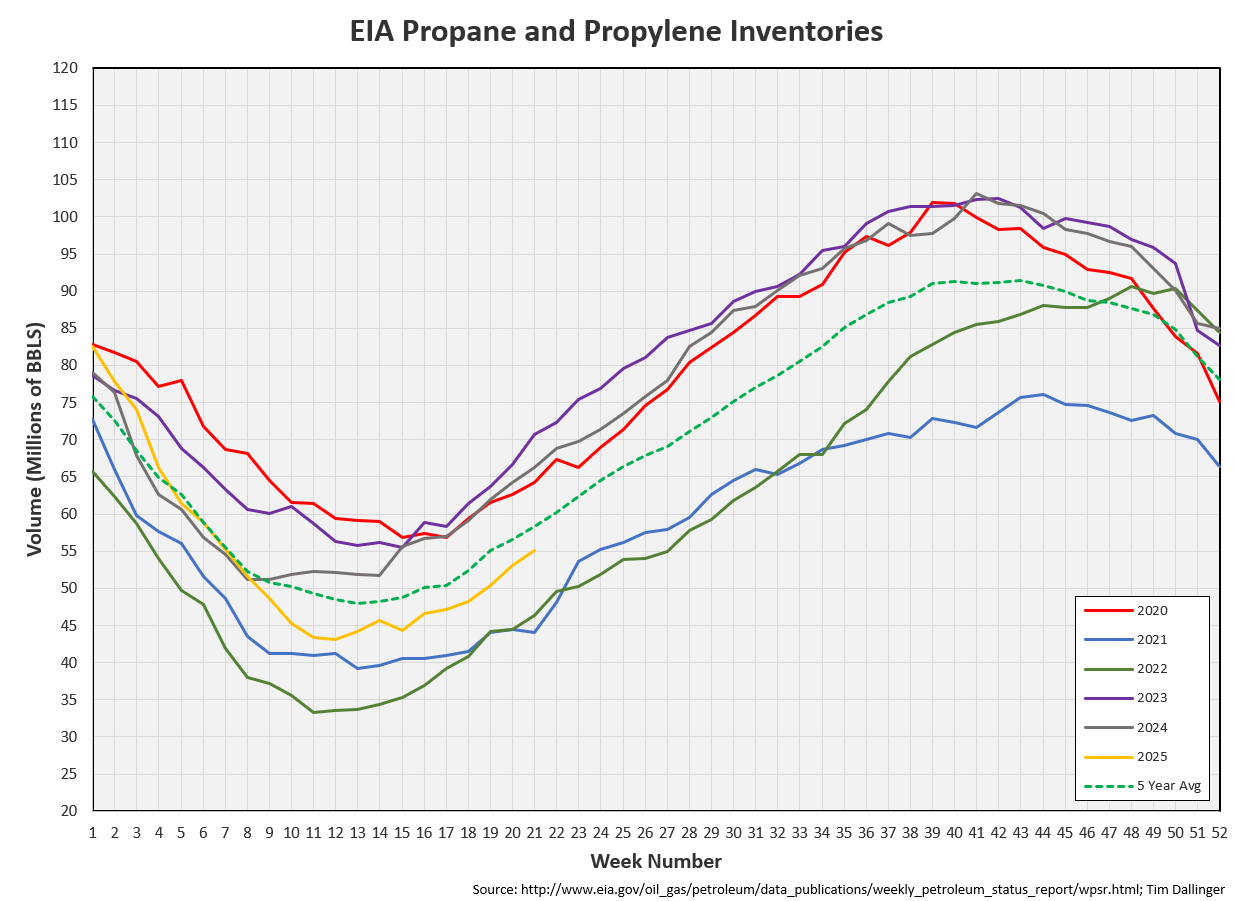

Propane

Propane/propylene inventories increased by 2 MMB and are 4% below the 5-year seasonal average.

Other Oil

Other oil increased by 3.1 MMB. Inventories are above average.

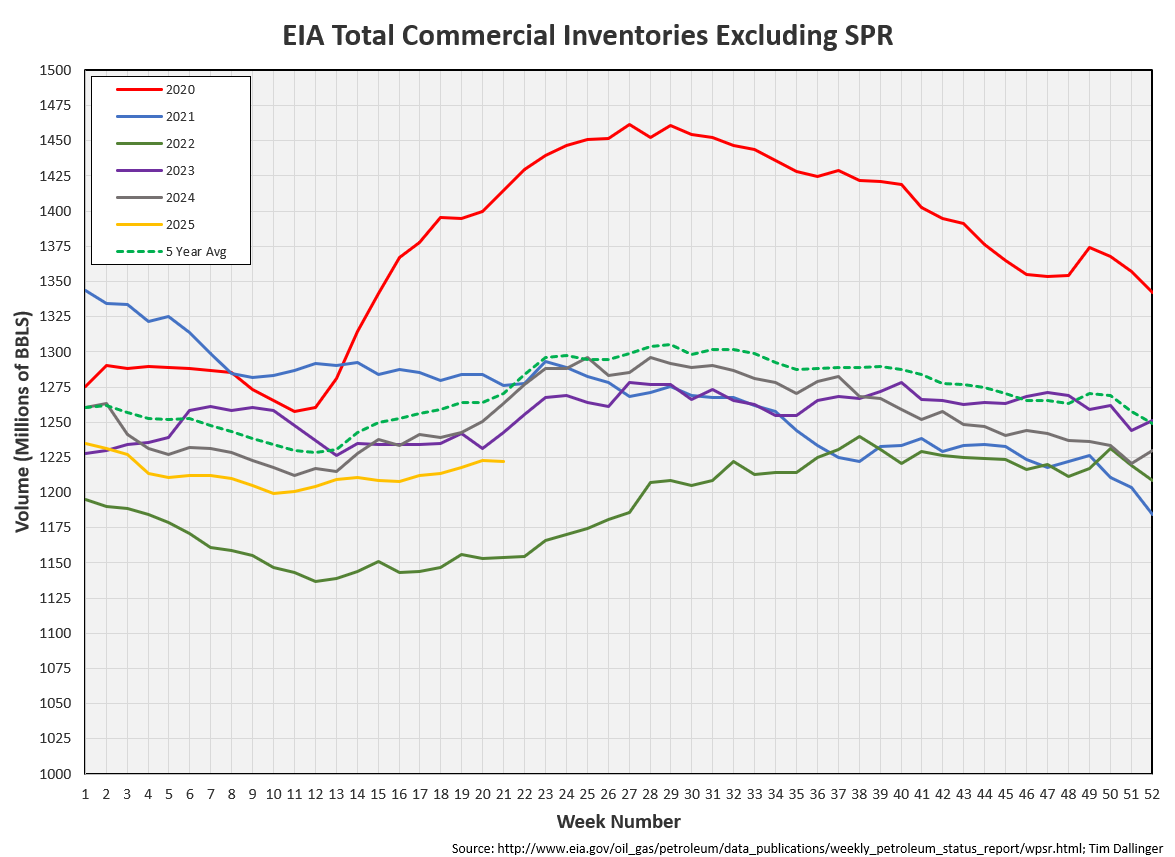

Total Commercial Inventory

Total commercial inventory drew by 0.7 MMB and remain below average levels.

Natural Gas

Natural gas inventories continue to build above average. Demand is high but so is supply from associated gas production.

Refiners

Refiners slowed slightly last week but remain at a higher throughput level than every year except 2024. Refiners should ramp more soon.

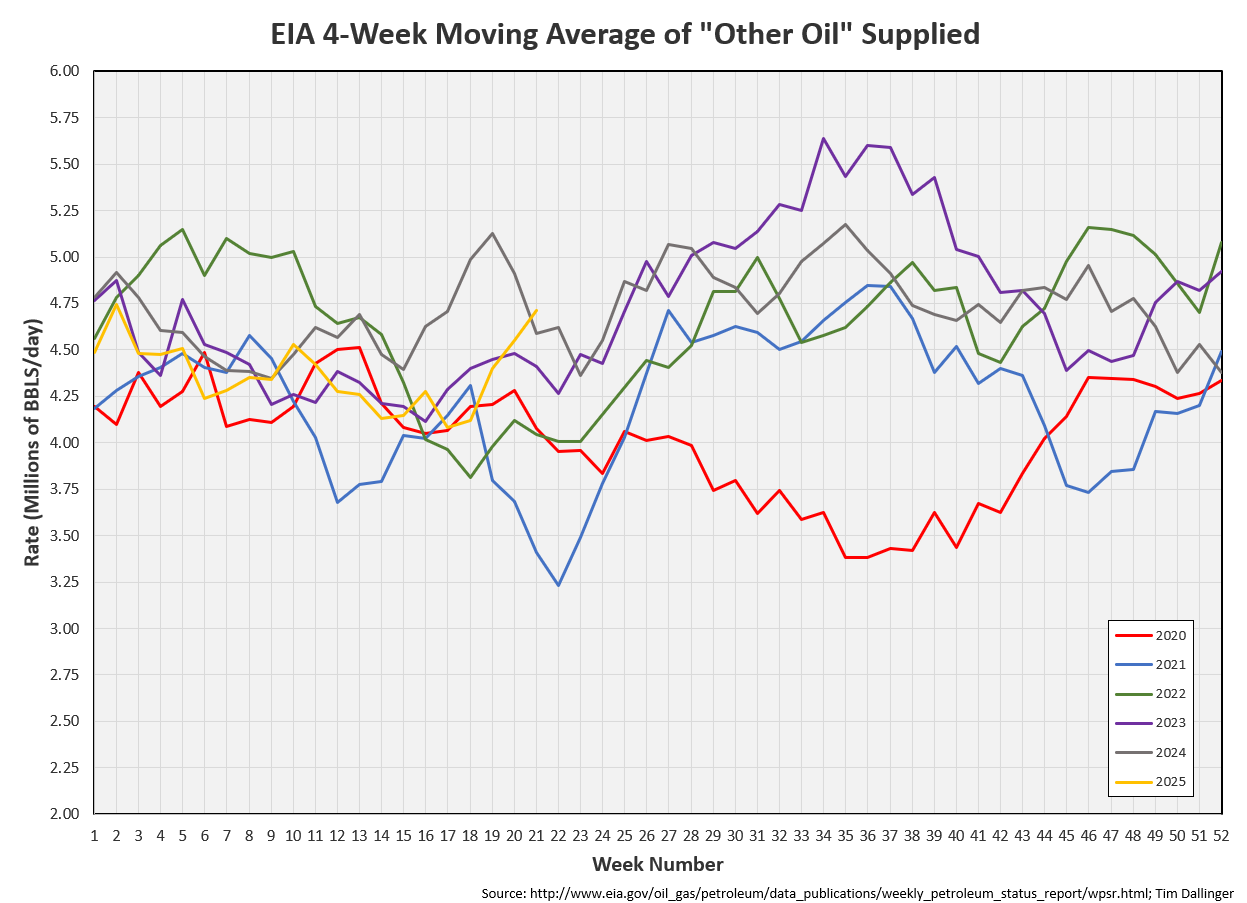

The moving average for the EIA’s product demand proxy returns near seasonally record levels. If the analysts highlighting the weakness last week don’t comment on this change, the last intellectual integrity.

Implied “other oil” demand is has a significant effect.

However, it’s not only “other oil” implied demand that’s increasing.

Transportation inventories return to drawing after last week’s build.

If crude is included, only 2022 is lower.

Simple cracks retreated from records but still remain healthy.

Discussion

OPEC+ met this week, deciding to forgo another production hike for July. That initially added some strength but prices have fallen back since. Kazakhstan’s energy minister stated that they will not adhere to their promised cuts, instead producing at capacity. This is leading to fear and speculation about the internal cohesion of OPEC+.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Rock metal band, Metallica released the classic album, Master of Puppets, in 1986 with the last song being “Damage, Inc.”