EIA WPSR Summary for week ending 1-5-24

Okay, Campers, Rise and Shine, and Don't Forget Your Booties 'Cause It's Cold Out There Today

EIA WPSR Summary for week ending 1-5-24

Summary

Bearish report.

Crude: +1.9 MMB

SPR: +1.3 MMB

Cushing: -0.5 MMB

Gasoline: +8.0 MMB

Ethanol: +0.8 MMB

Distillate: +6.5 MMB

Jet: -0.4 MMB

Propane: -3.6 MMB

Other Oil: -4.3 MMB

Total: +9.5 MMB

Spot WTI is currently pricing $71. With the past two weeks’ large consecutive product build, this approached fair value based on a price model derived from reported EIA inventories.

Crude

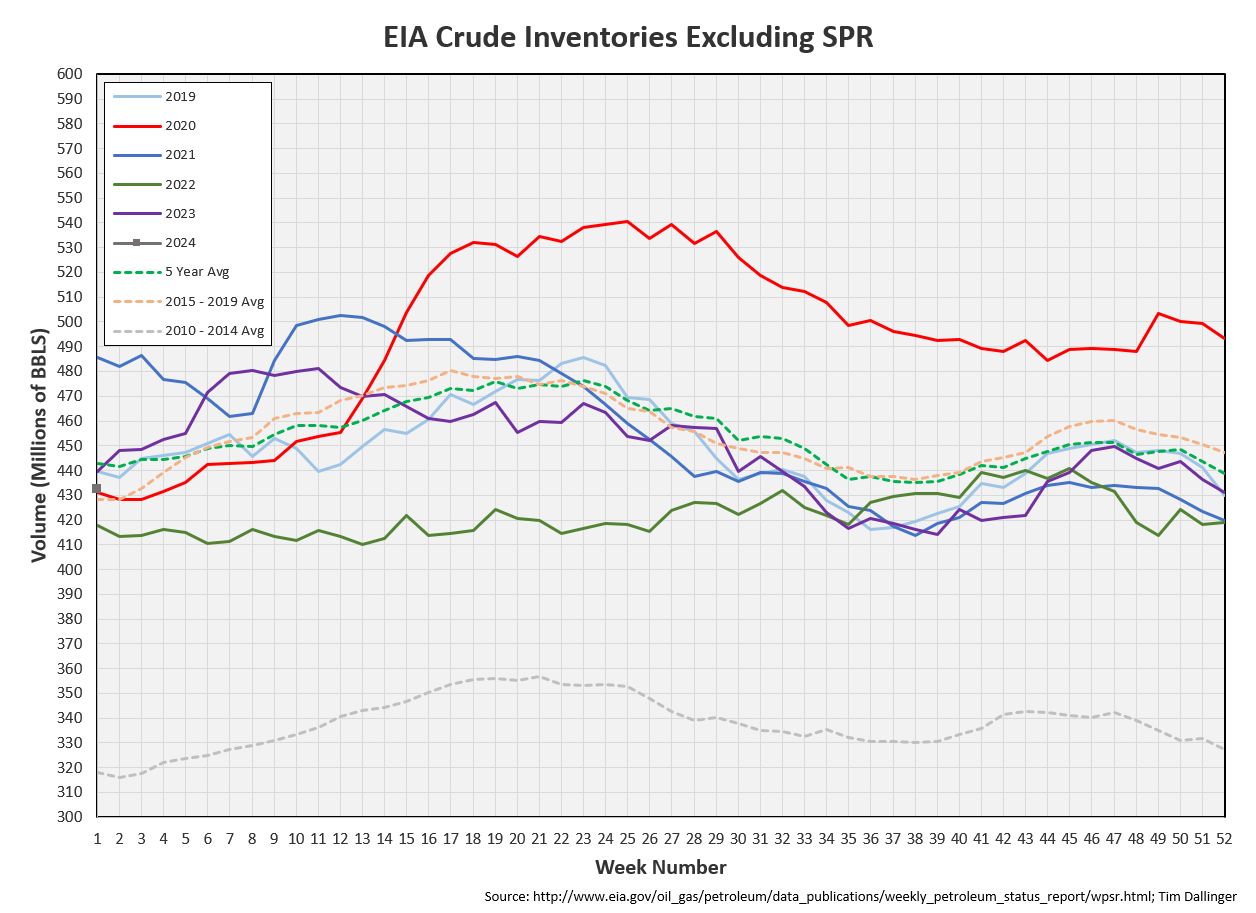

U.S. commercial crude oil inventories increased by 1.3 MMB from the previous week and are about 1% below the seasonal 5-year average.

1.3 MMB were added to the SPR. This is the start of the purchased barrels for the 2024 delivery. SPR inventories currently sit 15 MMB lower than this time last year.

Weekly US crude imports fell.

US crude exports cratered. Independent ship trackers did not confirm this movement. This should be a timing issue with US Customs and the export figure should bounce back.

Unaccounted for oil is near zero. Perhaps the weekly inventory model is improving. Time will tell.

There remains a constant ~700 kbd of “transfers to crude oil supply” since the EIA started breaking this figure out.

Cushing

Cushing drew 0.5 MMB. There’s no clear signal as to what to expect for Cushing 2024 Q1 behavior.

Gasoline

Total motor gasoline inventories increased by 8.0 MMB and are about 1% above the seasonal 5-year average. Gasoline usually builds seasonally, however the past 2 weeks have been much larger figures than expected.

Ethanol

Ethanol inventories built by 0.8 MMB. Inventories are above average.

Distillate

Distillate fuel inventories increased by 6.5 MMB last week and are about 4% below the season 5-year average. There may be one more build week before distillate draws start due to increased heating oil demand.

Jet

Kerosene type jet fuels decreased by 0.4 MMB.

Propane

Propane/propylene inventories decreased by 3.6 MMB from last week and are 12% above the seasonal 5-year average. Propane inventories start the year even with 2023.

Other Oil

Other oil drew 4.3 MMB, nearing seasonal averages.

Total Commercial Inventory

Total commercial inventories built by 9.5 MMB and start the year at the seasonal average.

Natural Gas

As last week’s EIA WSPR was delayed due to holiday, natural gas inventories have not been updated. The first gas report of 2024 is released tomorrow.

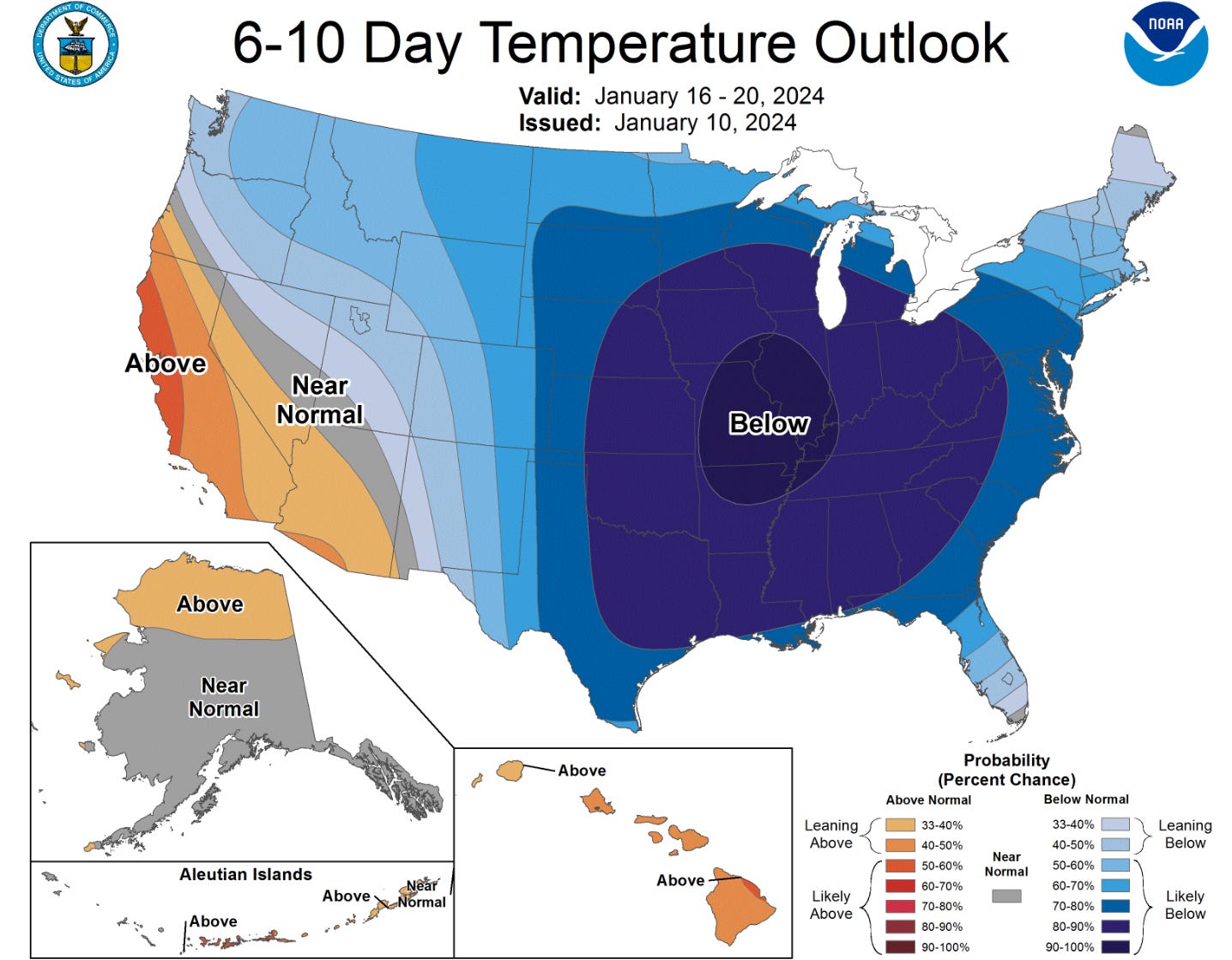

The cold weather pattern mentioned briefly last week has developed into a significant weather system. Natural gas and heating demand will increase as much of the US deals with temperatures significantly below the seasonal average.

Prepare for cold weather. Fill up gas tanks ahead of approaching storms. Check tire pressures. Keep blankets or warm clothes in vehicles in the event of car trouble. Plan ahead and try to minimize travel, especially during the coldest parts of the day. Dress appropriately when outside. Stock water and non-perishable food such as canned goods in case of power loss.

Discussion

US refiners start the year processing the most crude oil since 2020.

EIA showed another week of impacted demand via the product supplied proxy. 4 week moving averages seem normal though.

Transportation inventories have built off of the bottom. Inventories are still a bit below seasonal average. Builds should continue over the next several weeks. The magnitude should be smaller though.

Despite these significant product builds, cracks remain healthy. This suggests demand is not impacted.

The WTI and Brent futures curve is mostly flat, suggesting the physical market remains adequately supplied.

The middle east turmoil continues.

Violence continues in Gaza.

Hezbollah and Israel trade fire along the Lebanese border.

Iran suffered two bombings. An Afghanistan ISIS Shi-ite group has claimed responsibility.

Houthis continue to disrupt Red Sea transit. Shipping costs have escalated.

Libyan Sharara oilfield remains closed after protests cause force majeure on production.

Despite widespread uncertainly, no oil supply has been removed from the market besides the Libya. The market is unwilling to pay a war premium until its clear supply is impacted.

Review of the 2024 energy market outlook will be postponed a bit longer to gauge the compliance of OPEC+ 2024 supply cuts.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Radio DJ’s (repeatedly) wake Phil Connors, portrayed by Bill Murray, in the 1993 American dark comedy “Groundhog Day.”