EIA WPSR Summary for week ending 1-31-25

Summary

Crude: +8.7 MMB

SPR: +0.3 MMB

Cushing: +0.1 MMB

Gasoline: +2.2 MMB

Distillate: -5.5 MMB

Jet: -1.2 MMB

Ethanol: +0.7 MMB

Propane: -4.8 MMB

Other Oil: -3.0 MMB

Total: -2.7 MMB

It’s been a volatile week for spot oil price. Spot WTI is currently $71. Prices remain below estimated fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply increased by 8.7 MMB. Crude inventories are currently 5% below the seasonal average.

0.3 MMB were added to the SPR.

SPR Inventories are at levels November 2022 and April 1984 levels.

US crude imports increased above average. Shippers were likely trying to beat sanctions.

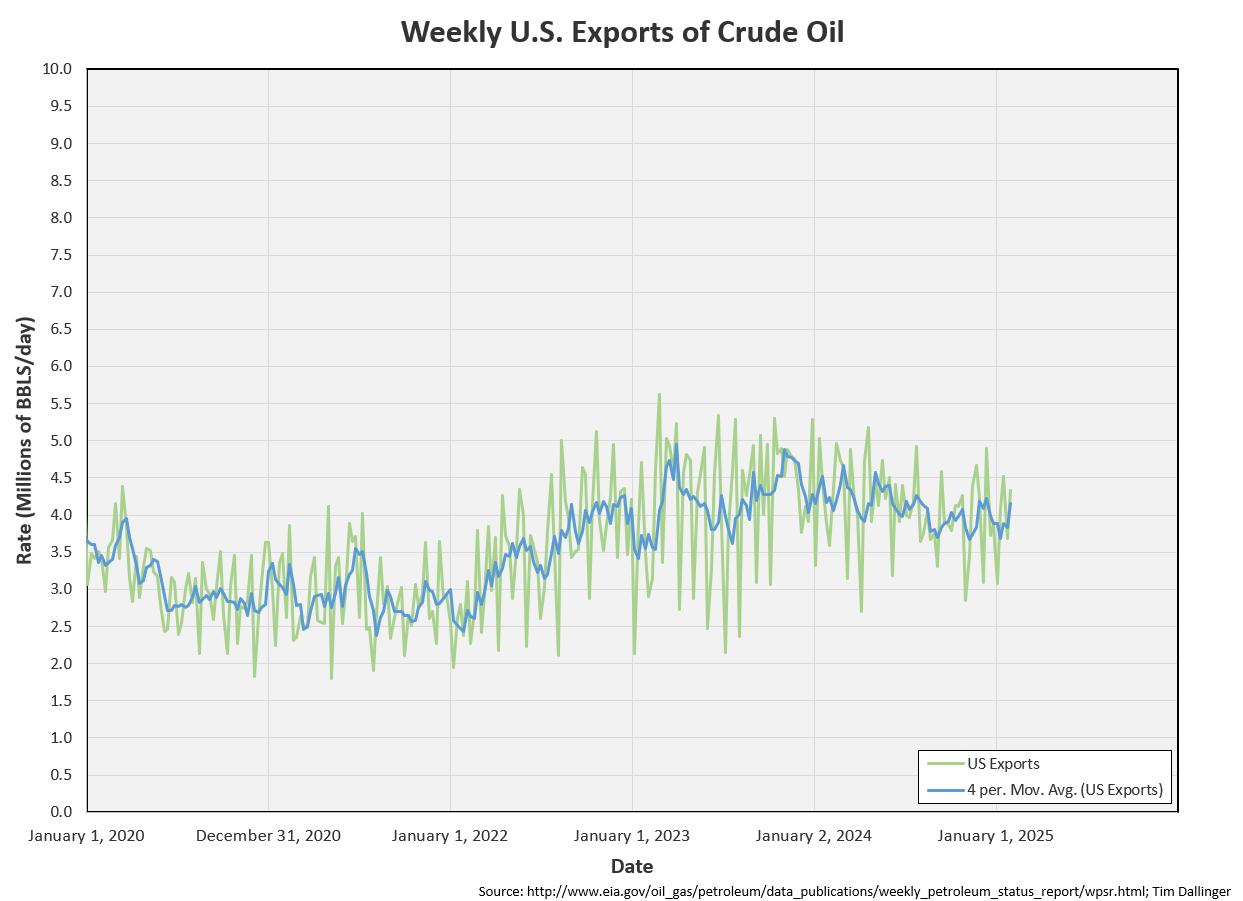

Crude exports were also up.

Unaccounted for crude reverted back near 0.

Cushing

Crude storage in Cushing, OK, built by 0.1 MMB week on week. Cushing inventories remain near operational lows.

Gasoline

Total motor gasoline inventories increased by 2.2 MMB and are near the seasonal 5-year average. Draws should start within the next 2 weeks.

Gasoline blending component inventories are high but below last year.

Distillate

Distillate fuel inventories decreased by 5.5 MMB last week and are about 12% below the seasonal 5-year average. Distillate inventories haven’t been this low in February since 2014.

Jet

Kerosene type jet fuels drew by 1.2 MMB. Inventories are above seasonal average.

TSA traveler numbers are fluctuating near or just above record 2024 levels.

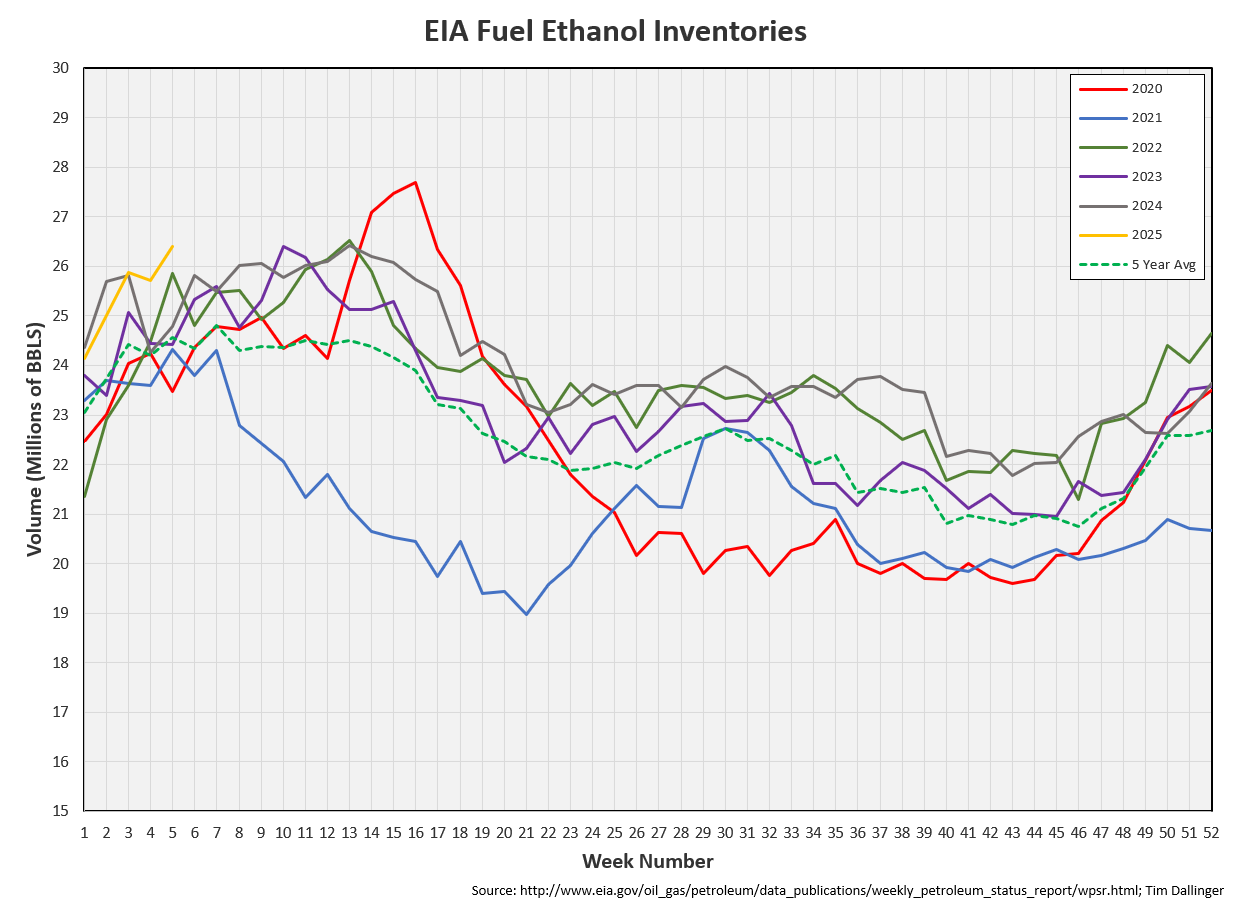

Ethanol

Ethanol inventories increased 0.7 MMB week-on-week. Inventories are above seasonal averages.

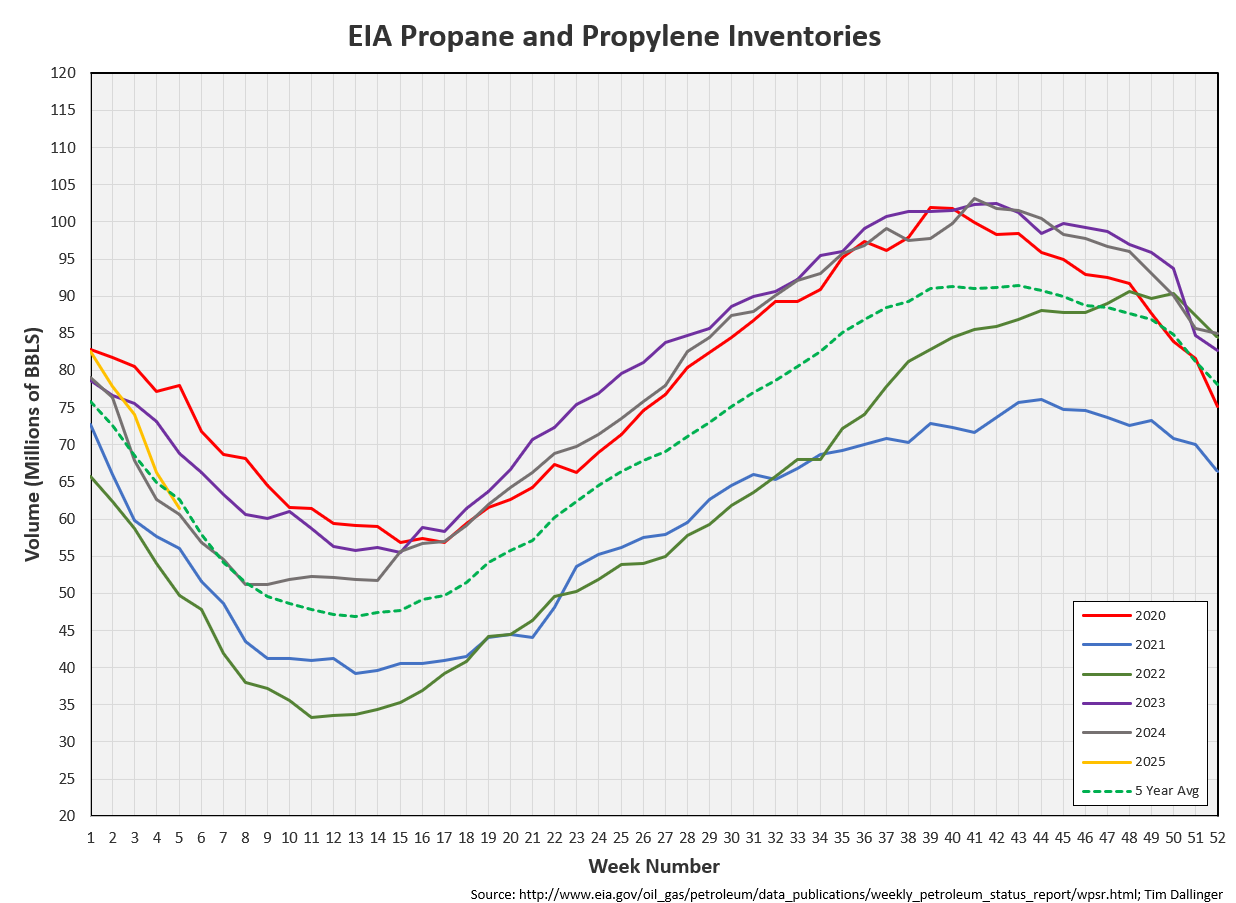

Propane

Propane/propylene inventories drew by 4.8 MMB and fall below the 5-year seasonal average.

Other Oil

Other oil drew by 3.0 MMB. Some “other oil” is being used as additives for winter blend gasoline. Builds will return as refiners start to produce summer blend.

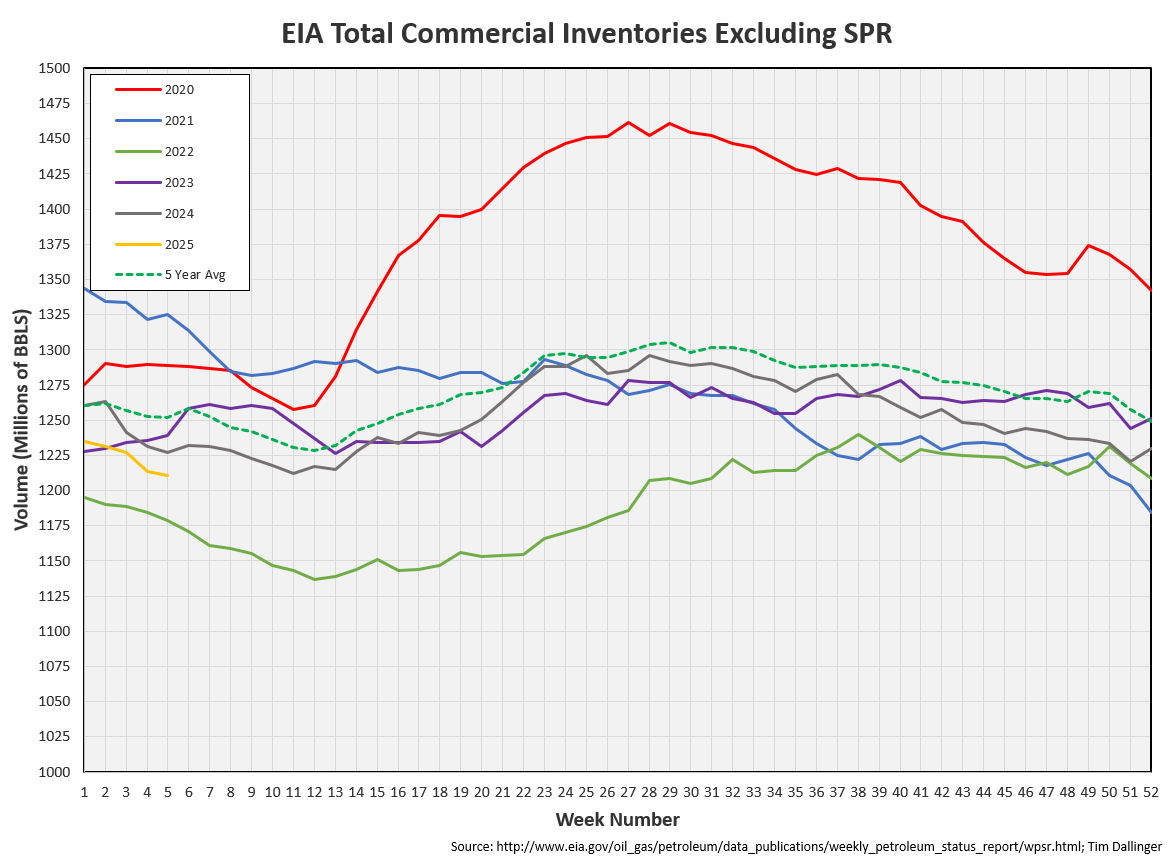

Total Commercial Inventory

Total commercial inventory drew by 2.7 MMB. Only 2022 levels have been lower in the past 5 years.

Natural Gas

Natural gas inventories experienced another considerable draw, boosting prices.

Graphical outlooks provided by the National Oceanic and Atmospheric Administration graphs are frequently included in this write-up.

However Dr. Ryan Maue, who publishes here on Substack under the profile name “Weather Trader,” provides better high-quality, frequently updated, weather outlooks.

He first identified the polar activity mentioned as a potential last week, when mainstream publications were claiming winter was over. While this week appears warm, that polar activity appears poised to move south and create a cold late February through the US. This will drive heating oil, propane and natural gas demand.

Refiners

The amount of crude oil refiners processed more crude oil last week. This was unexpected. Maintenance season should be starting. Expect utilization to decrease further until late February.

The EIA’s product demand proxy also showed a bounce. Only 2022 has had higher implied demand in the past 5 years.

This year, implied demand isn’t being driven just by other oil. Implied demand for transportation inventories also appears strong.

That’s leading to a transportation inventory draw

Simple cracks are responding, in turn.

Discussion

Timespreads remain in backwardation, although the magnitude has decreased.

It’s been a volatile week. 25% sanctions on imported goods from Mexico, Canada and China were announced late last week. President Donald Trump said that they were still trying to decide if oil would be exempt. Over the weekend, it was announced that crude oil would be included in sanctions, but at a rate of 10%. The broad market dumped at the open on Monday morning. It was then announced that sanctions would be postponed and reevaluated again in 30 days. This publication has maintained that sanctions on Canadian crude would hurt Canadian producers. But it would also hit Midwest US refiners and the consumer would also experience higher refined product prices. Despite the Monday morning scare, sanctions on Canadian crude oil remains an extremely low probability event.

OPEC met this week and maintained the production quotas outlined during the December 2024 meeting. The Joint Ministerial Monitoring Committee replaced Rystad Energy and the Energy Information Administration (EIA) with Kpler, OilX, and ESAI, as part of the secondary sources used to assess the crude oil production. No further reasoning for this change was provided. The IEA data has been ignored since its removal in 2022.

The EIA, OPEC and the IEA frequently have diverse outlooks, making it difficult to assess the status of energy markets. Models are important but inventories tell the real story.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Charlie Sheen plays Topper Harly, in the 1993 American action parody film, “Hot Shots! Part Deux.”