EIA WPSR Summary for week ending 8-8-25

Summary

Crude: +3.0 MMB

SPR: +0.2 MMB

Cushing: +0.1 MMB

Gasoline: -0.8MMB

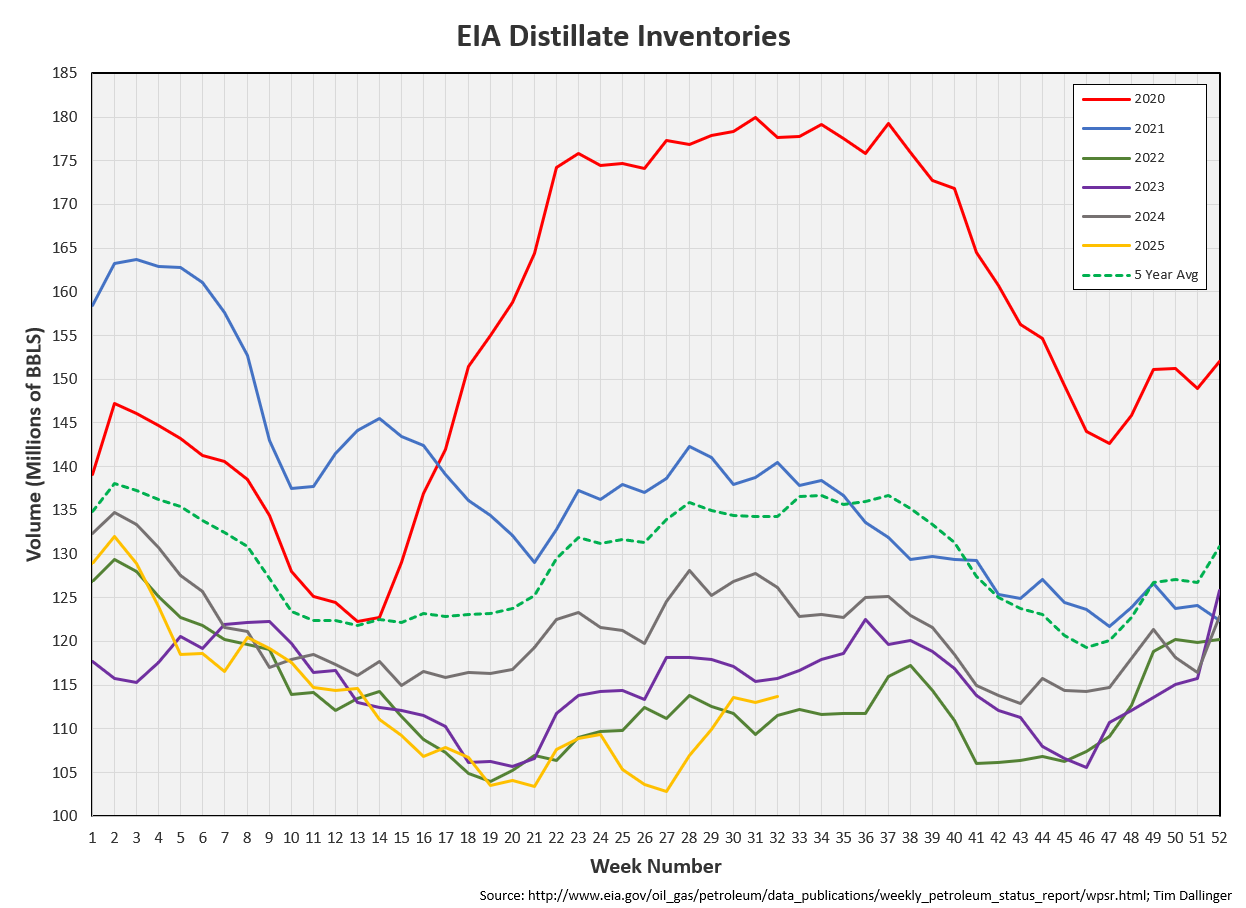

Distillate: +0.7 MMB

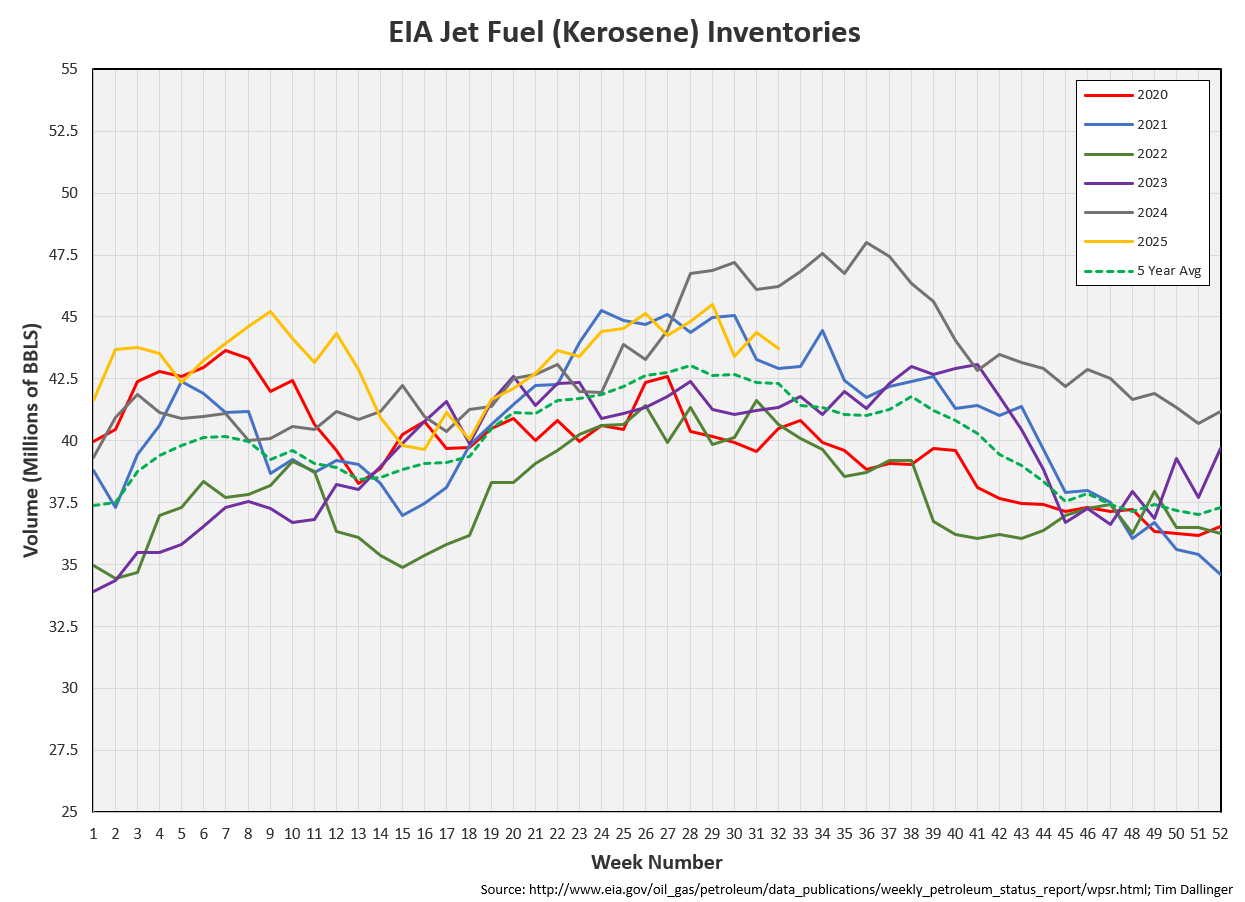

Jet: -0.6 MMB

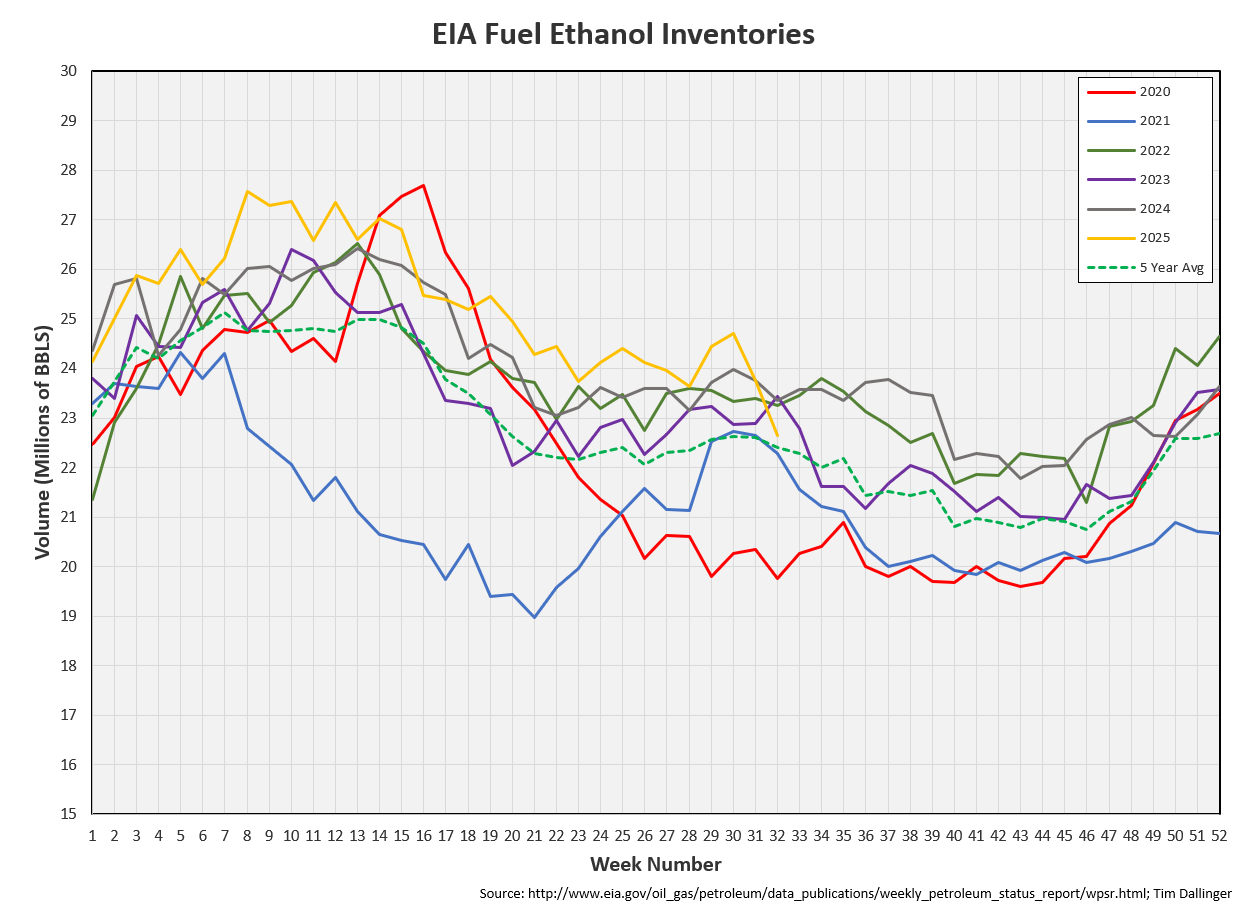

Ethanol: -1.1 MMB

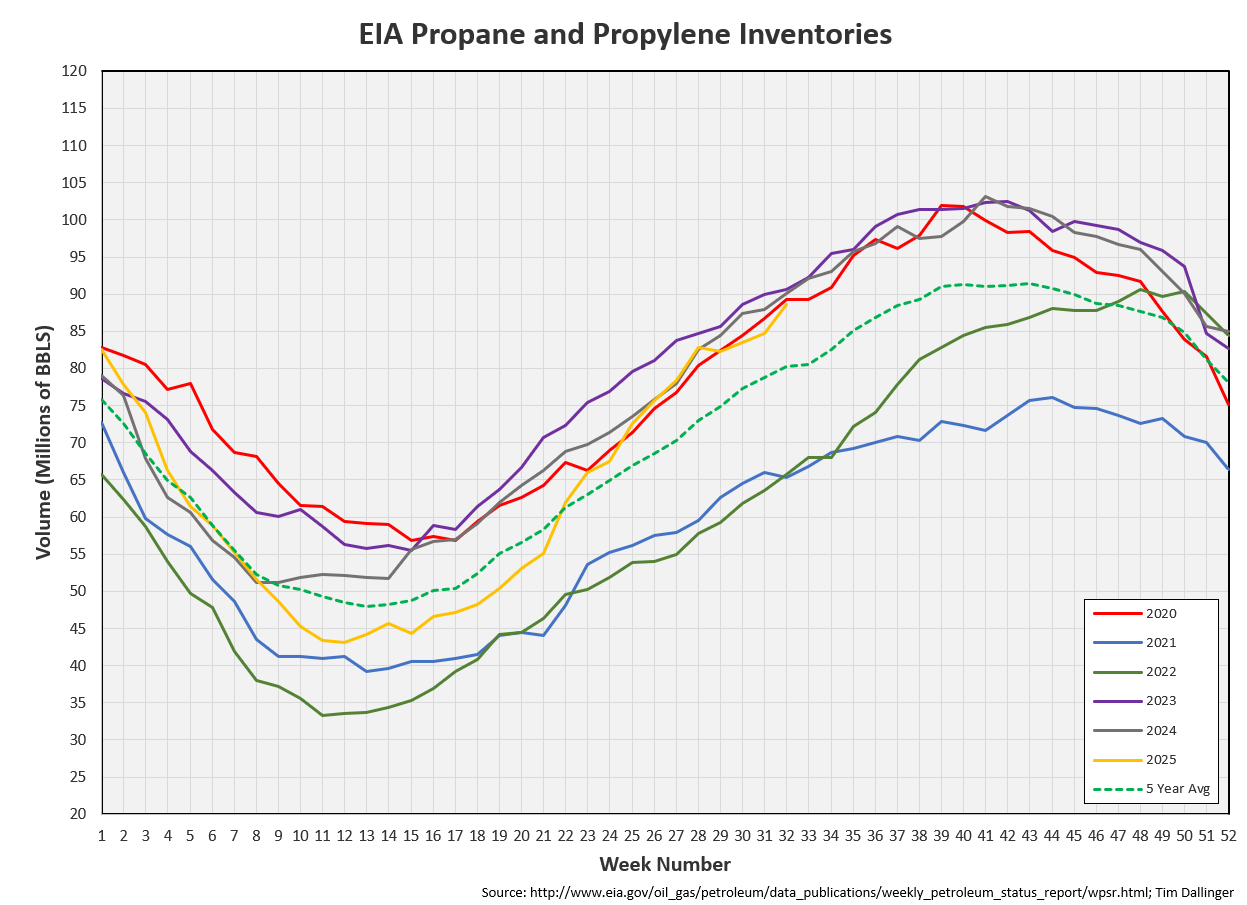

Propane: +3.9 MMB

Other Oil: +2.5 MMB

Total: +7.5 MMB

Spot WTI is currently pricing $62. Spot price remains steeply discounted in relation to estimated fair value based on a price model derived from reported EIA inventories.

Crude

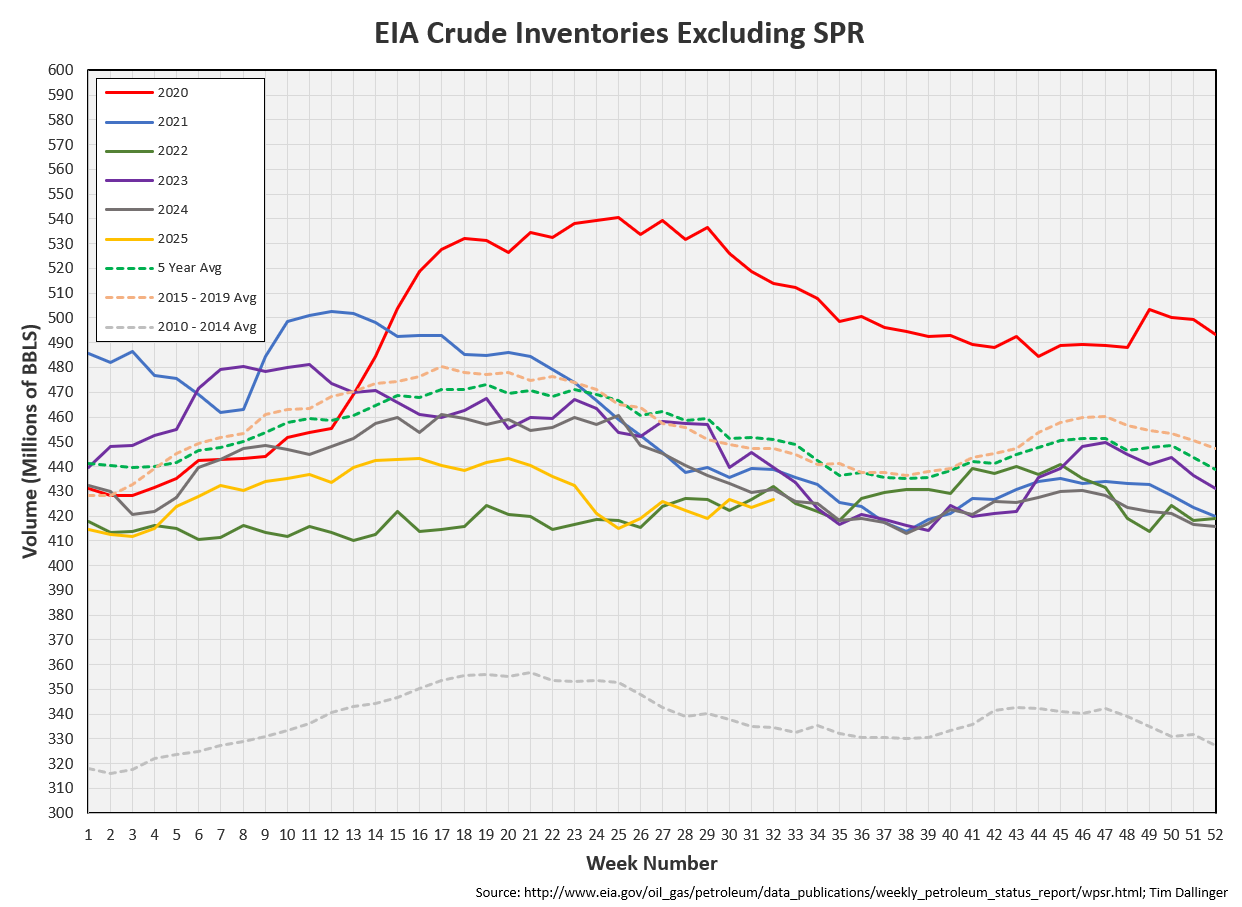

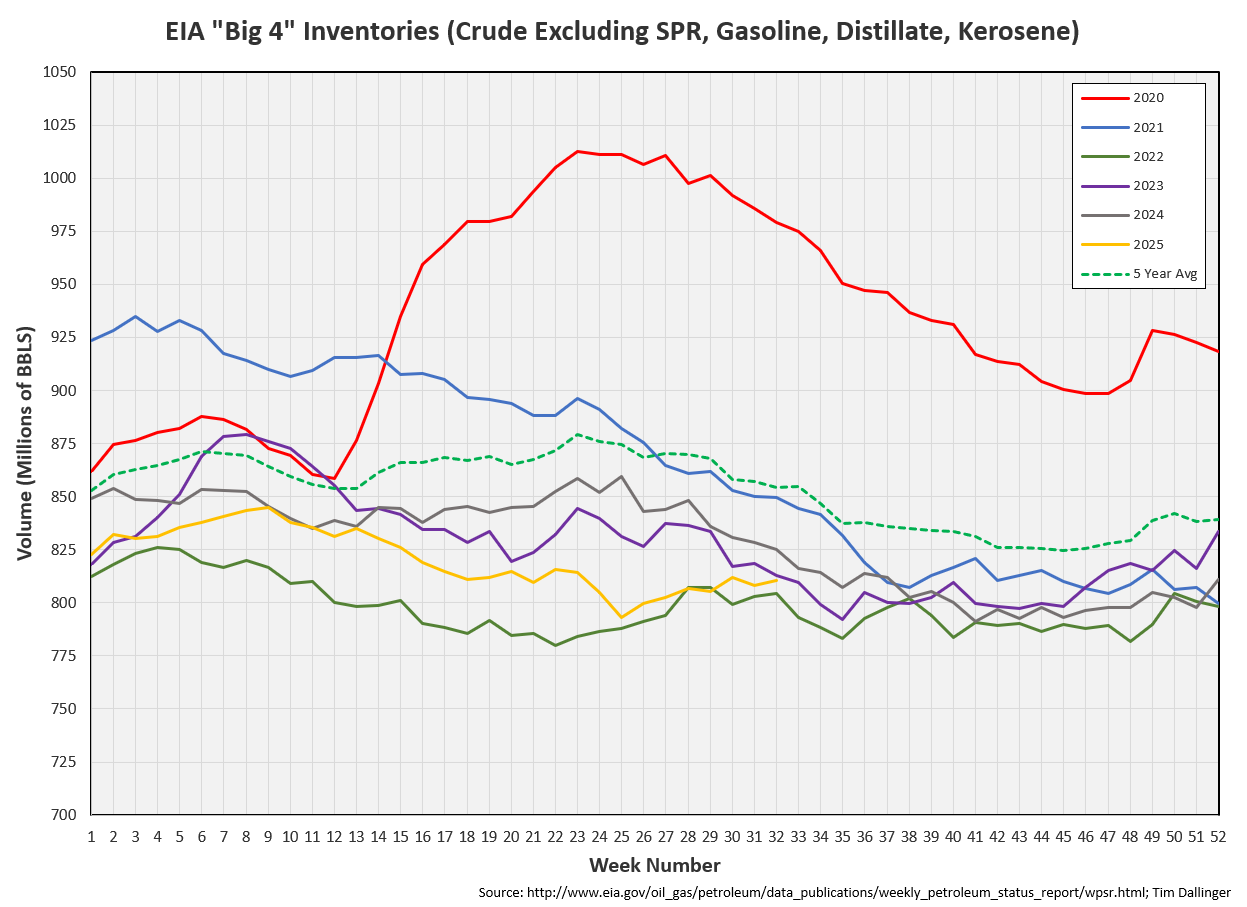

US Crude oil supply built by 3 MMB. Crude inventories are currently 6% below the seasonal average. Although this week showed a crude build, crude oil inventories are still seasonally lower than they’ve been in years.

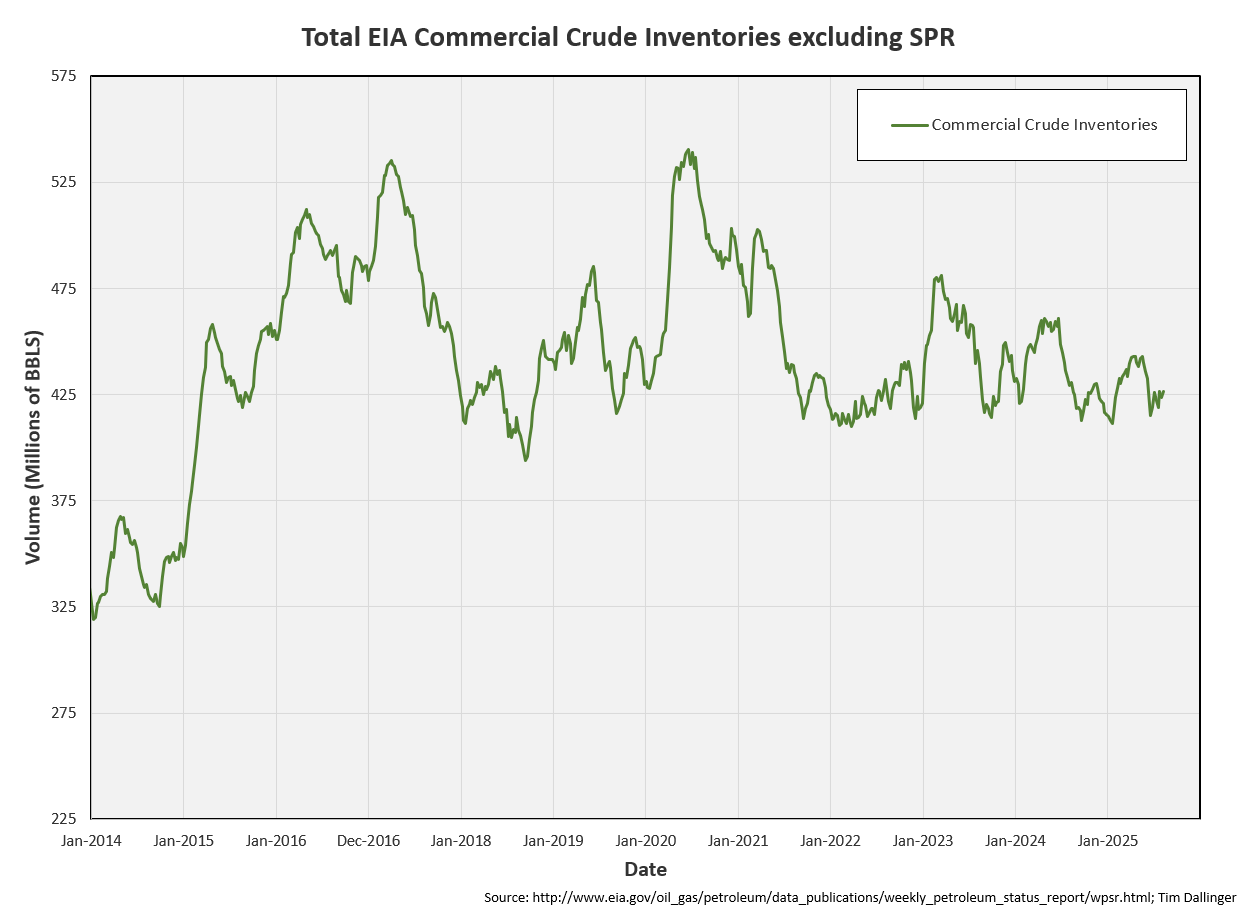

On an absolute basis, US crude oil inventories are also low.

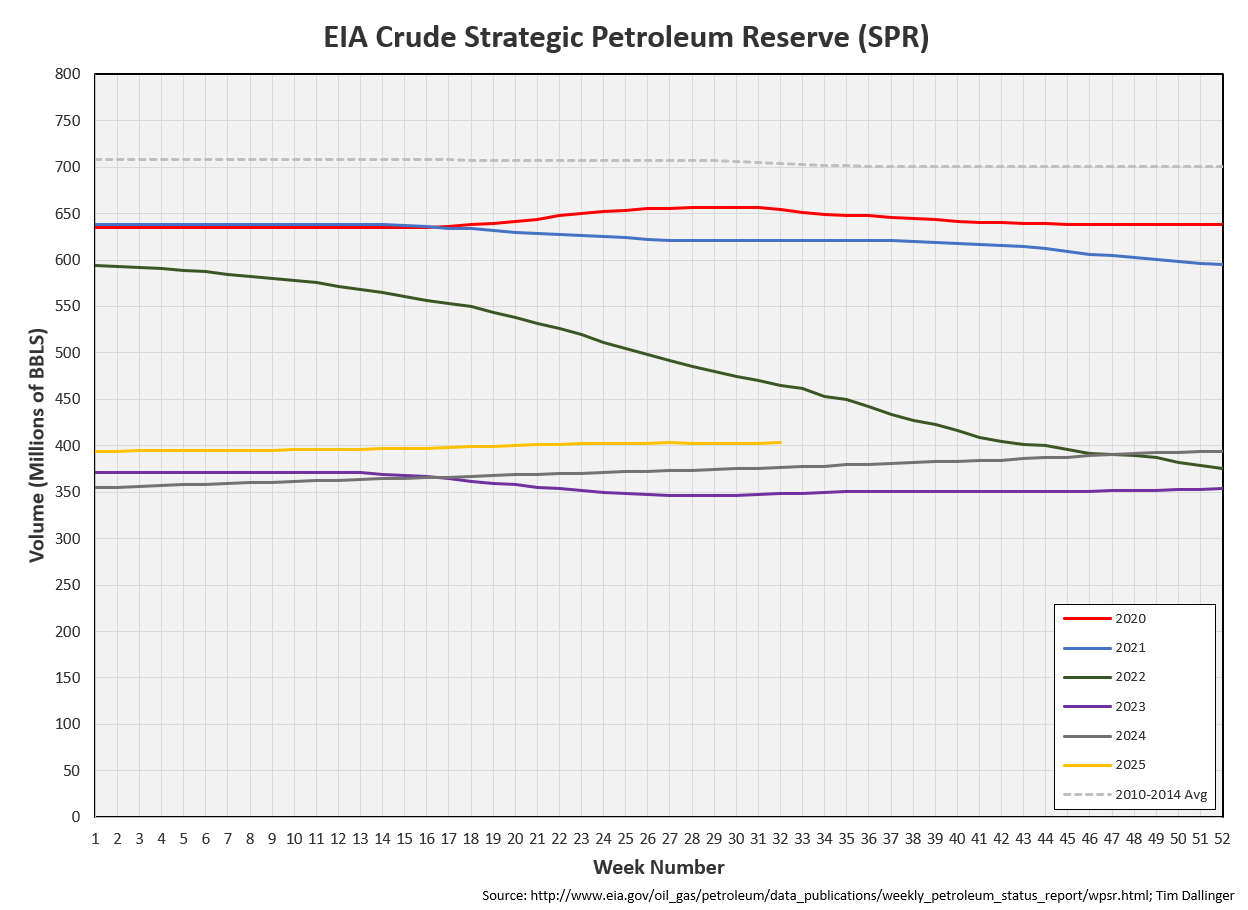

0.2 MMB were added to the SPR.

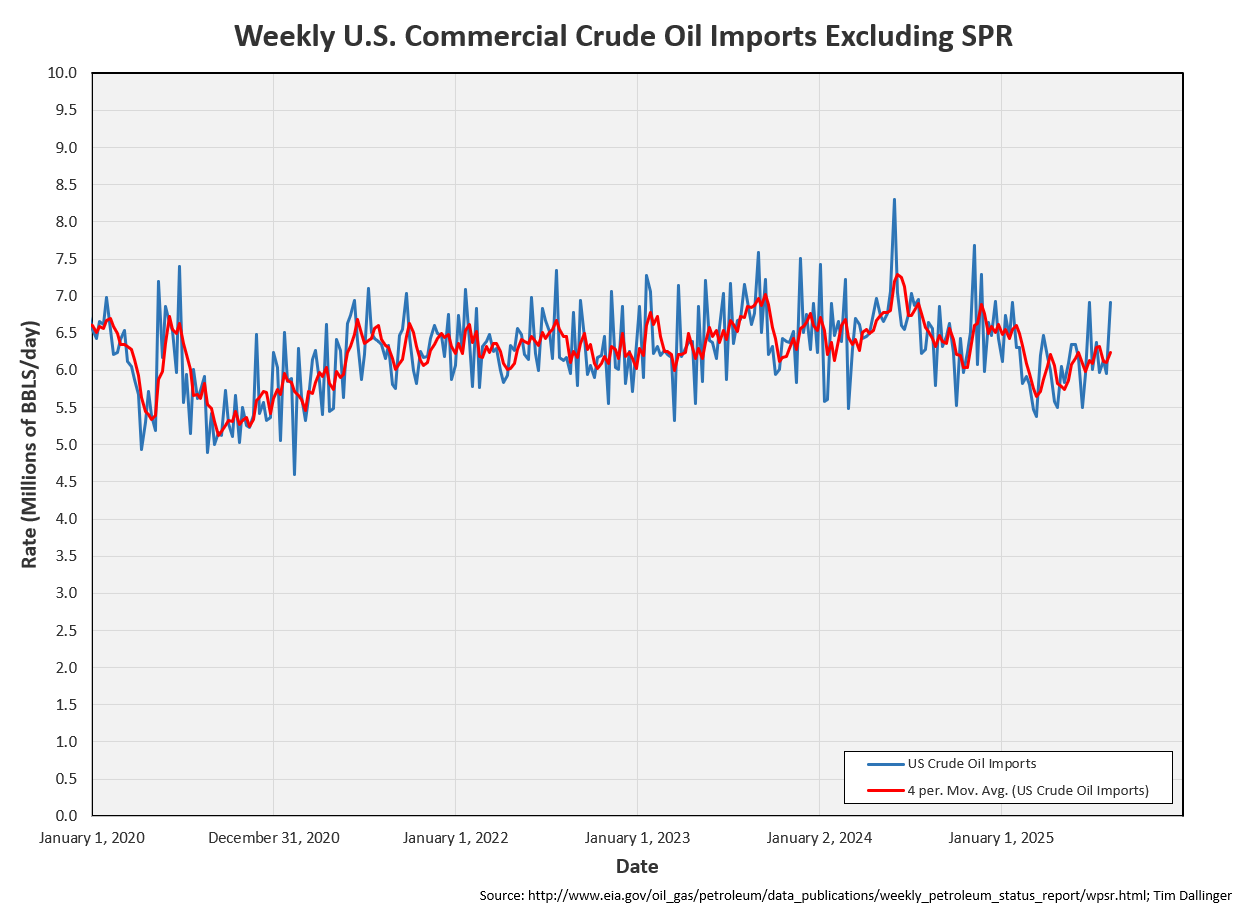

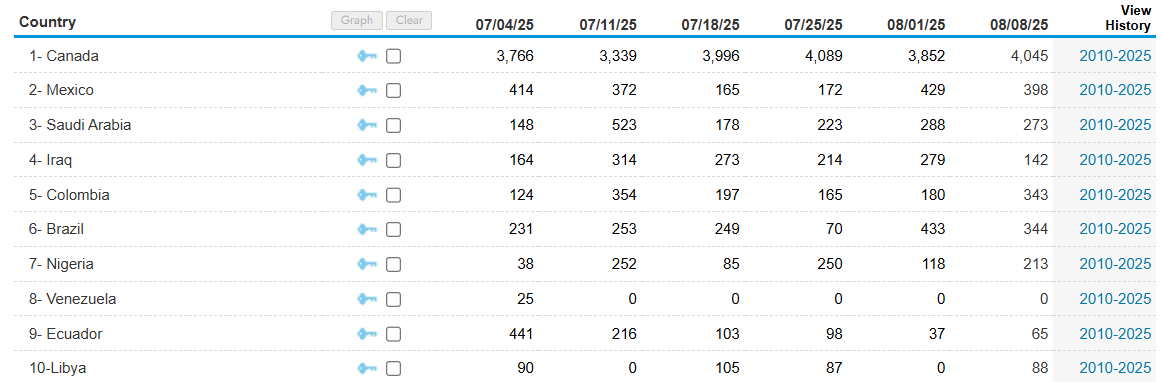

US crude imports spiked week-on-week.

The EIA estimates this was primarily due to Columbian imports.

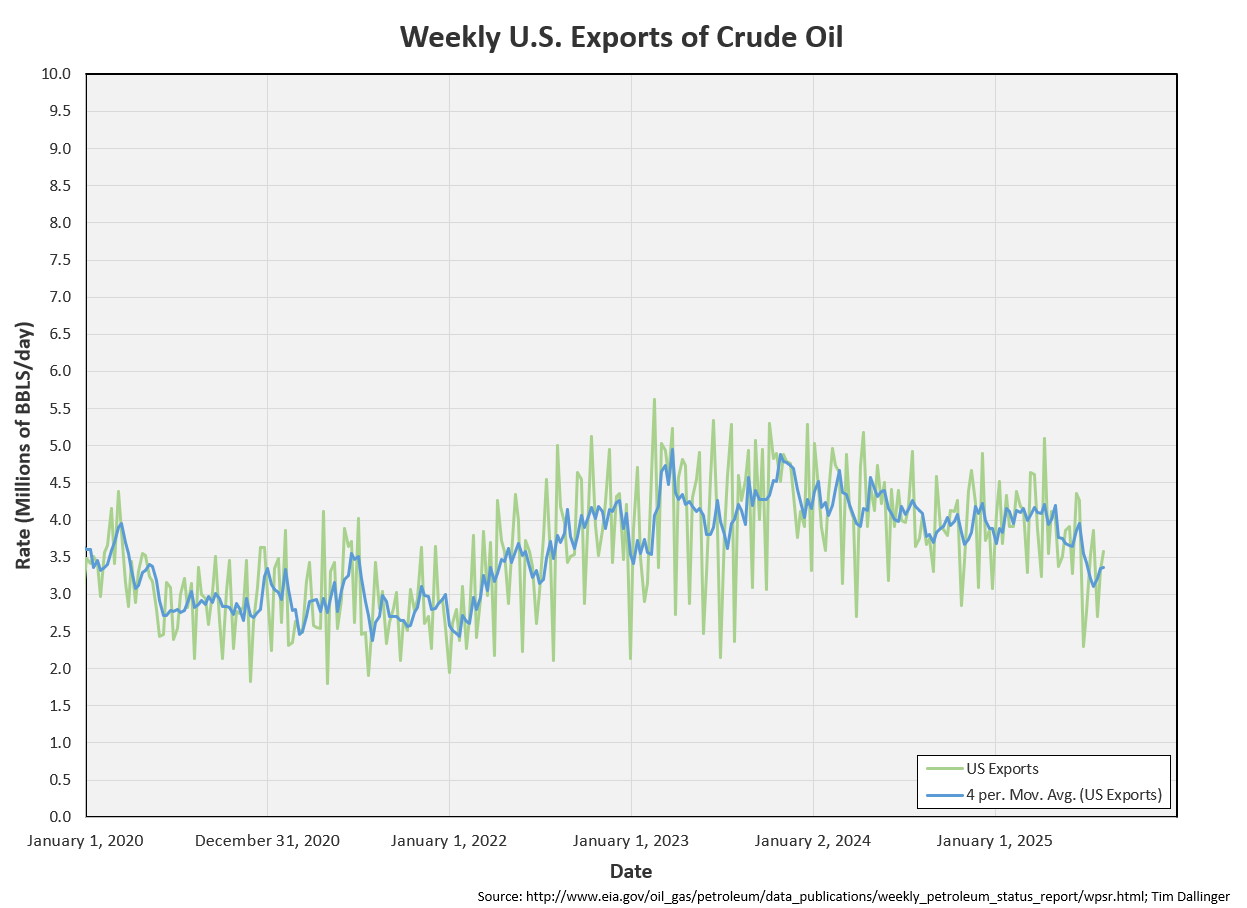

US Crude exports also increased back near the annual average.

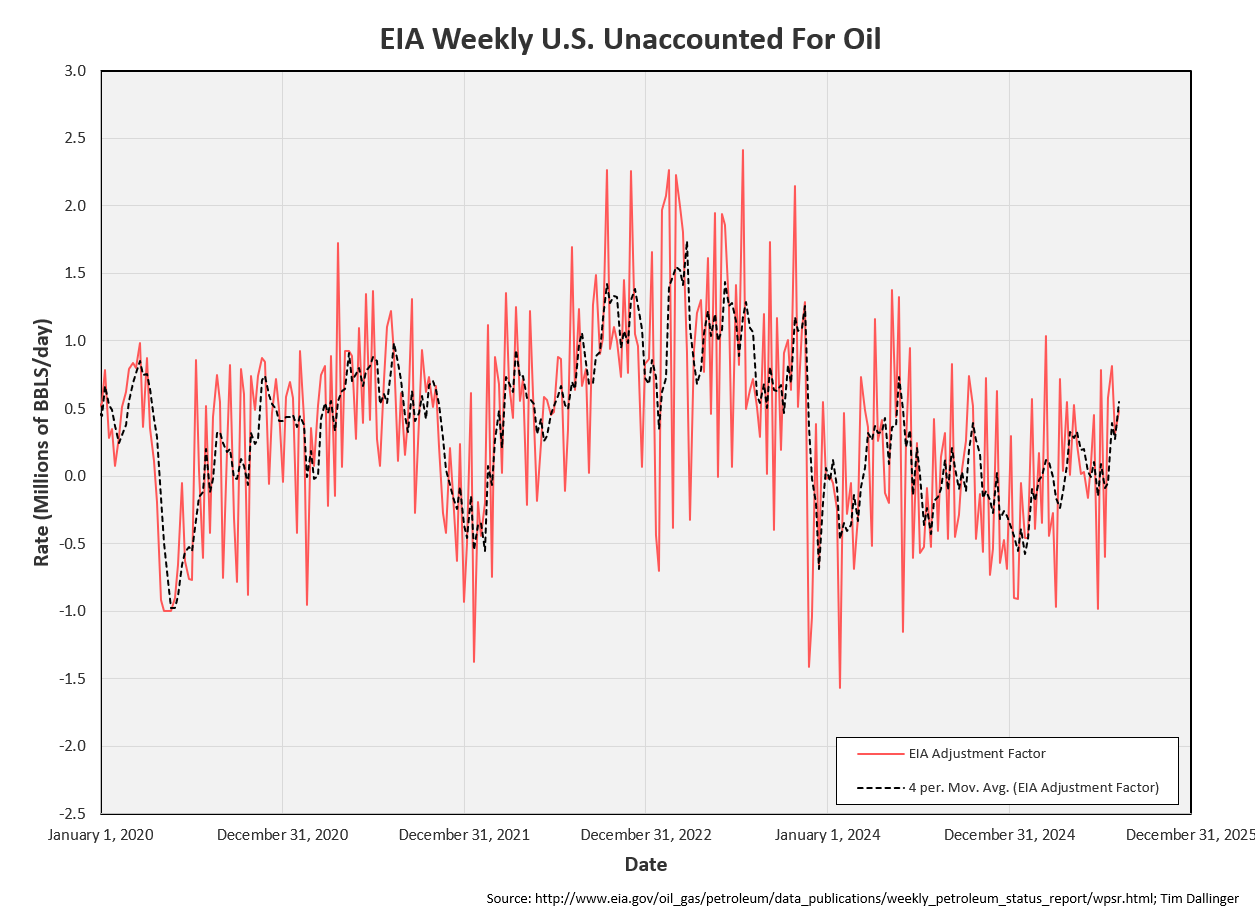

Unaccounted for crude remains high. Blending is an issue and it’s not being captured in the data.

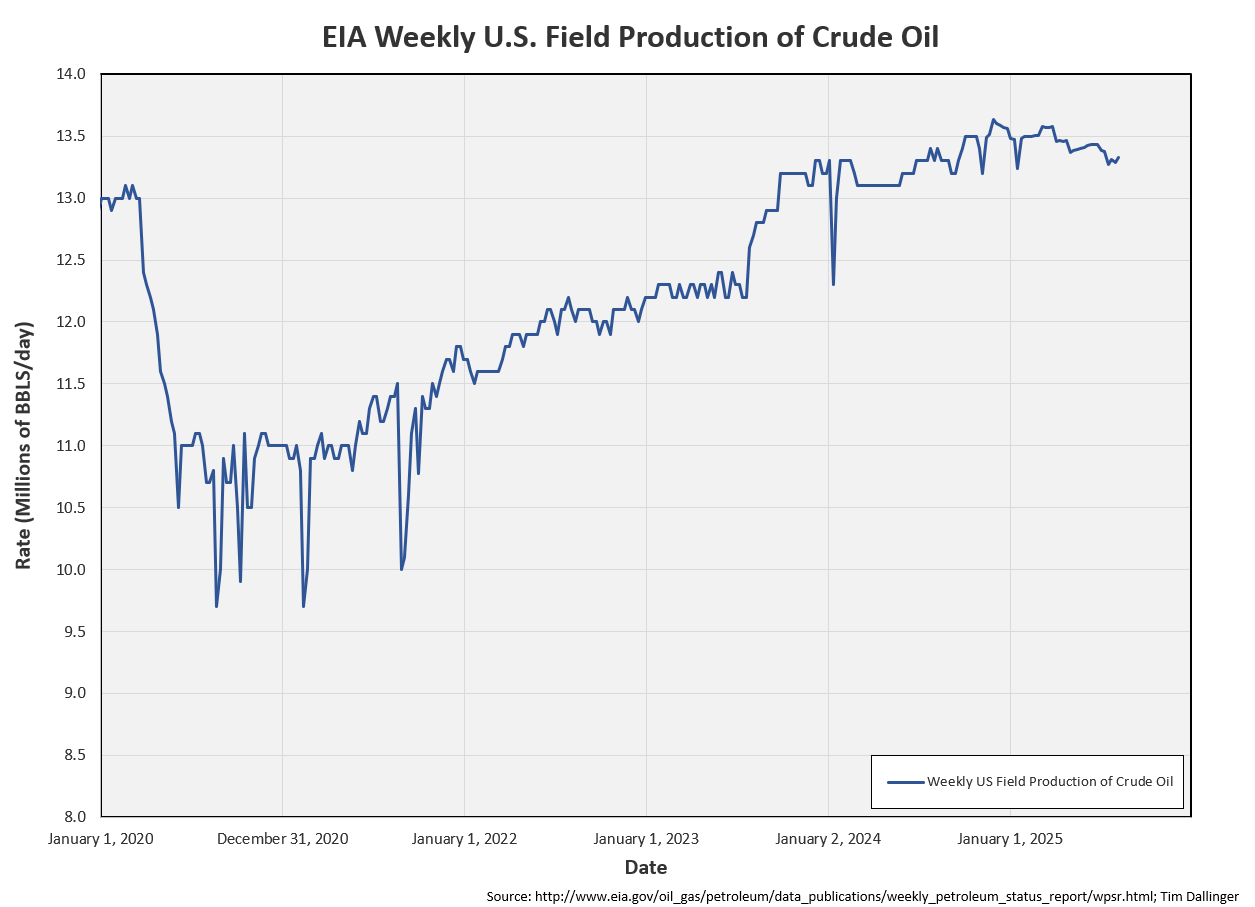

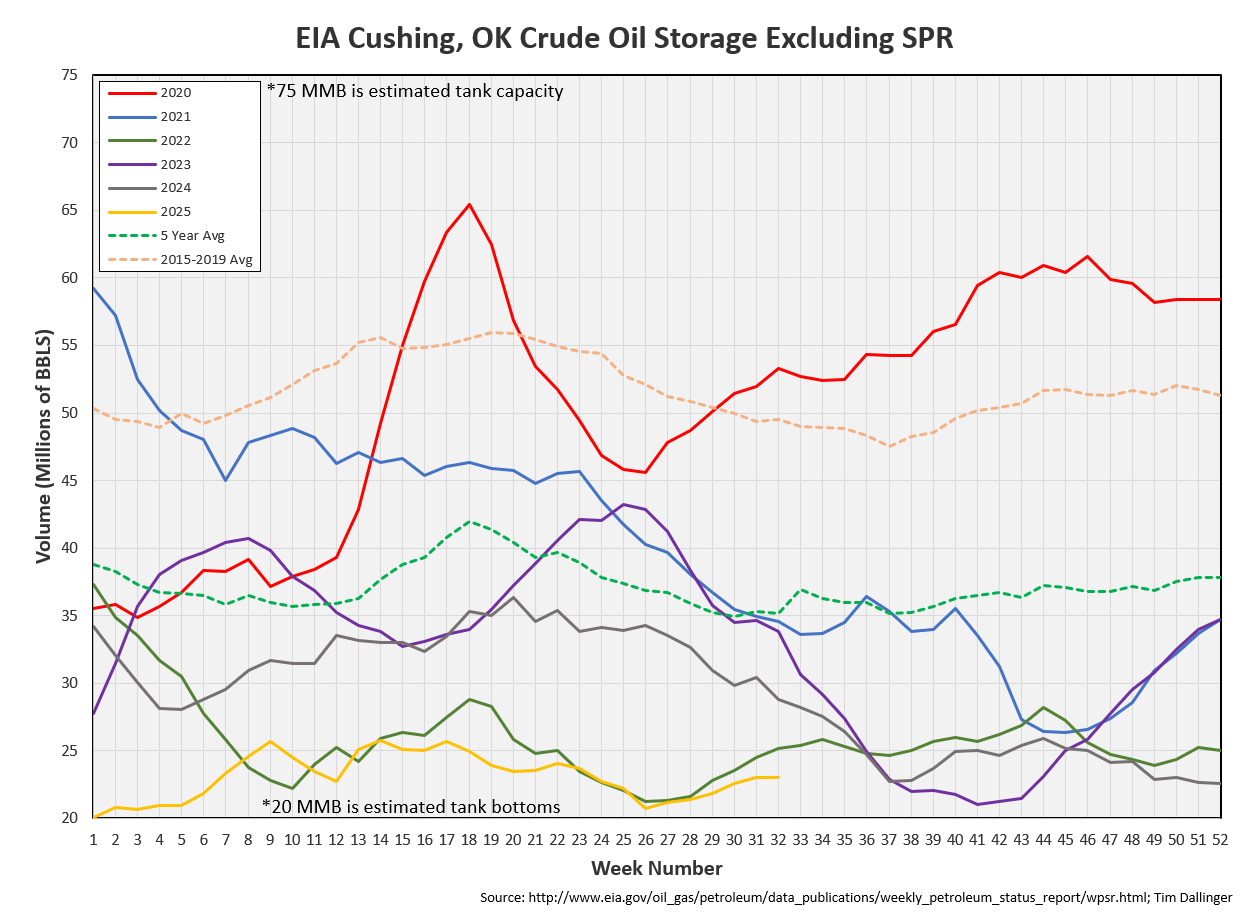

The EIA is modeling US production growth again.

In the latest STEO, the EIA claims this is due to increases in well productivity. This conflicts with shale producer guidance.

The EIA also expects prices to fall significantly.

This would put most US production below break-even pricing without the ability to have hedged production out. Therefor, the EIA is over-estimating the inventory builds.

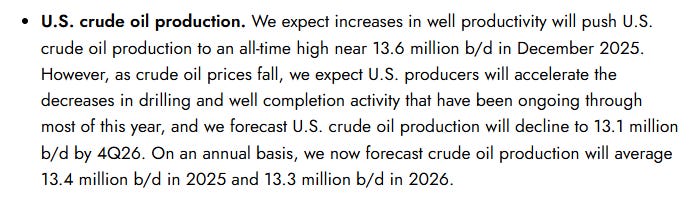

Cushing

Crude storage in Cushing, OK, increased by 0.1 MMB week-on-week. Cushing inventories remain low.

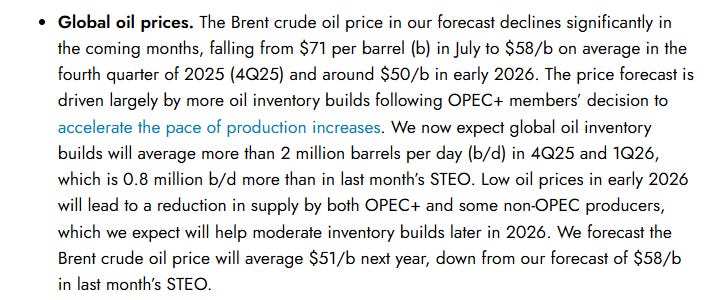

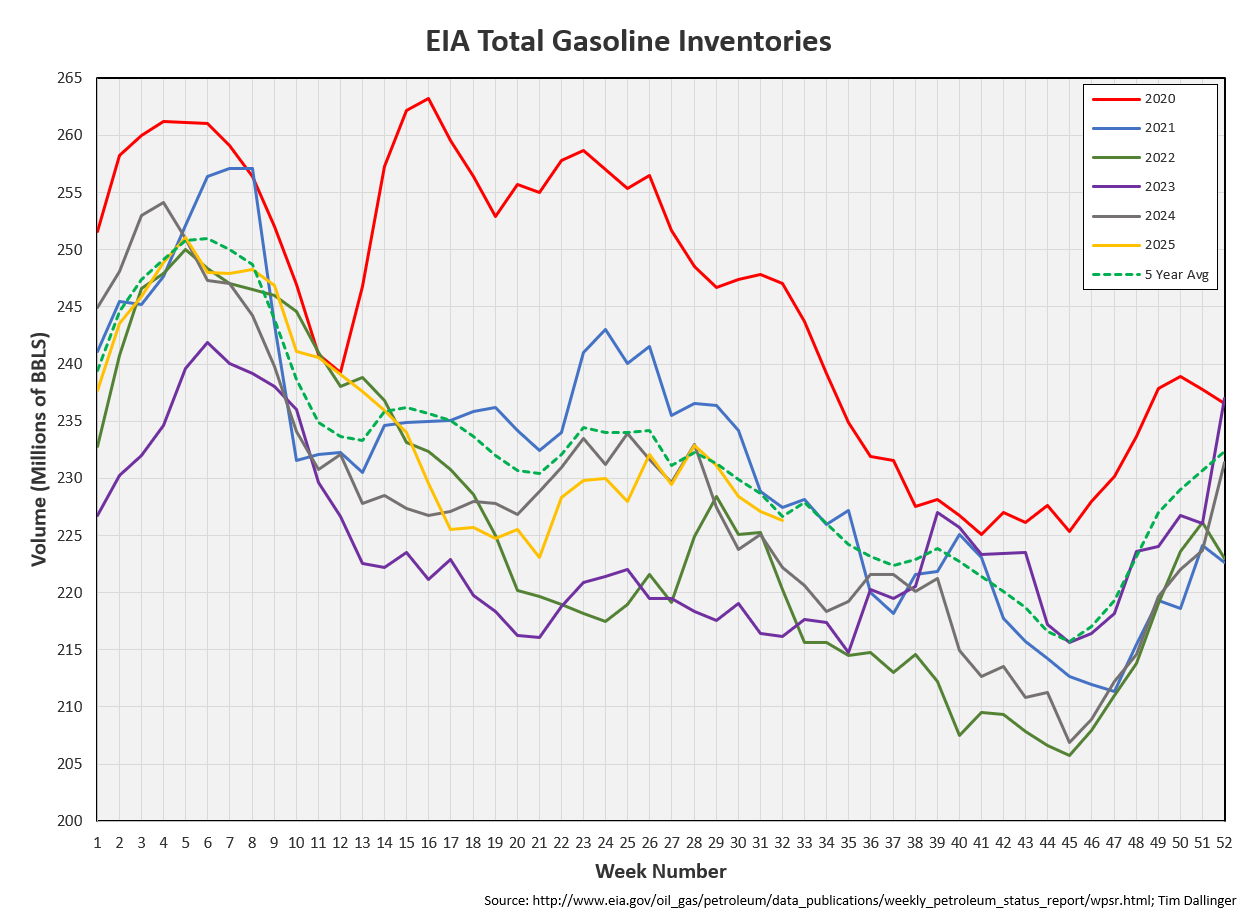

Gasoline

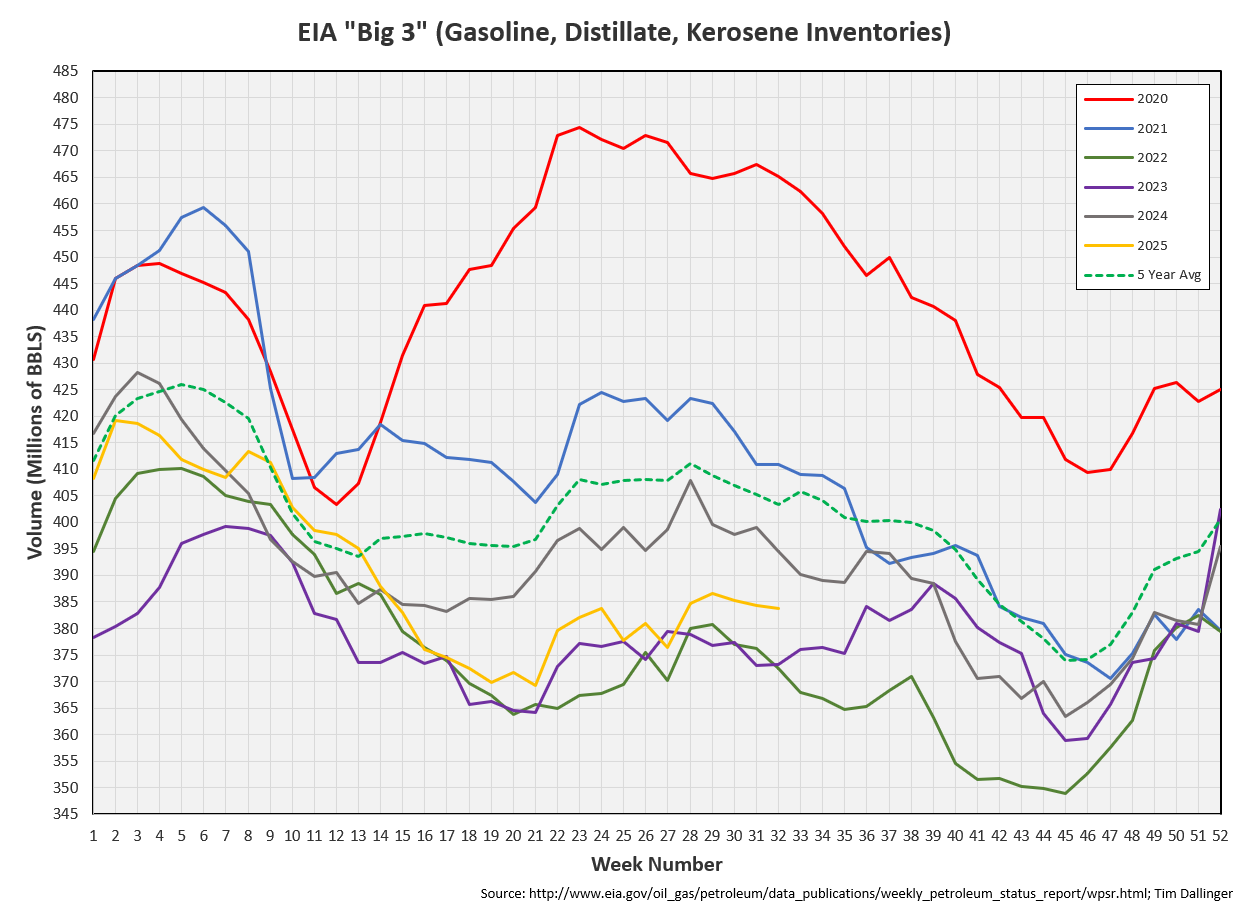

Total motor gasoline inventories decreased by 0.8 MMB and are near the seasonal 5-year average.

Distillate

Distillate fuel inventories increased by 0.7 MMB last week and are about 15% below the seasonal 5-year average.

Jet

Kerosene type jet fuels decreased by 0.6 MMB.

Ethanol

Ethanol inventories decreased 1.1 MMB week-on-week. Inventories are approach the seasonal averages, having worked off the recent surplus.

Propane

Propane/propylene inventories increased by 3.9 million barrels and are 11% above the seasonal 5-year average.

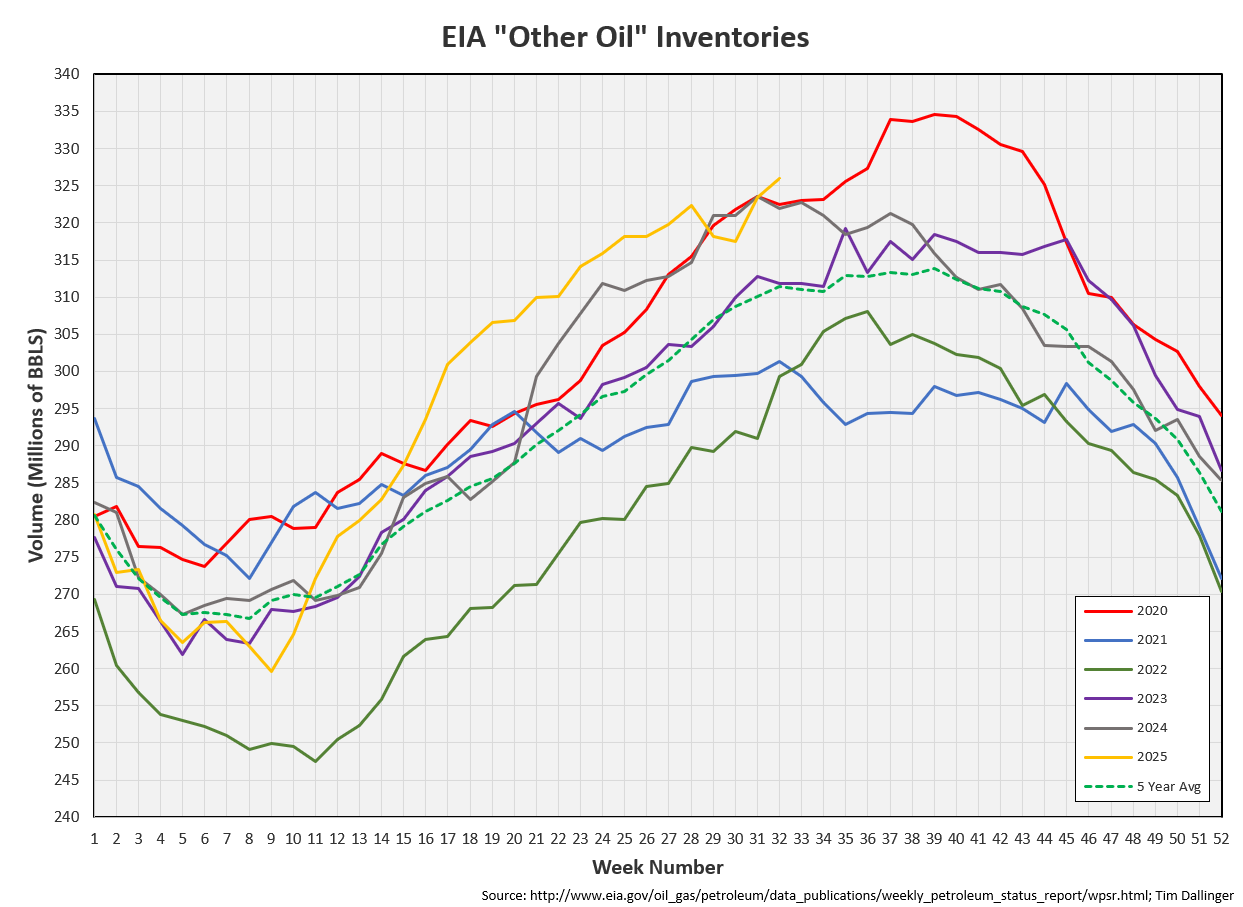

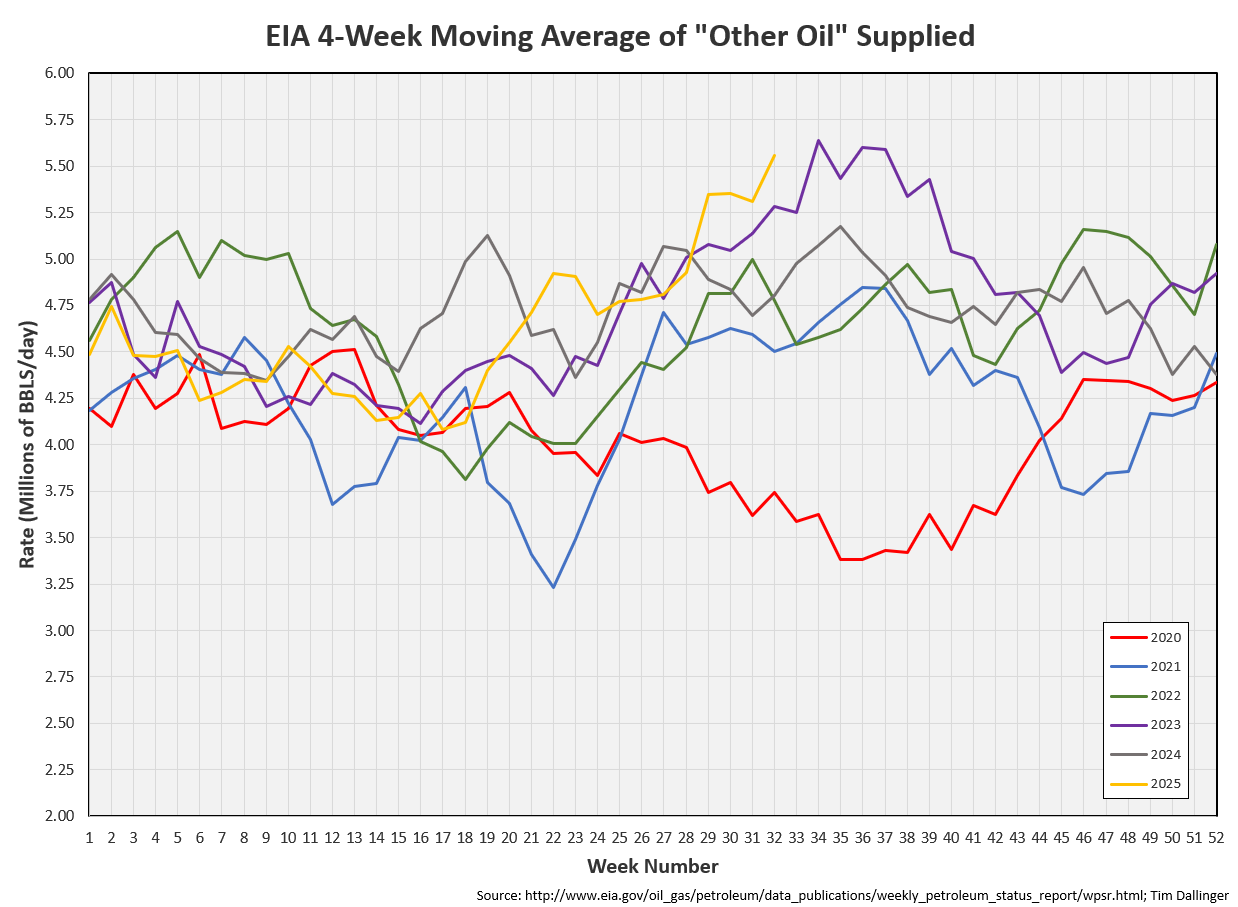

Other Oil

Other oil built by 2.5 MMB.

This is driven much by “other oil.” That would be concerning but the EIA accounting categories appear off.

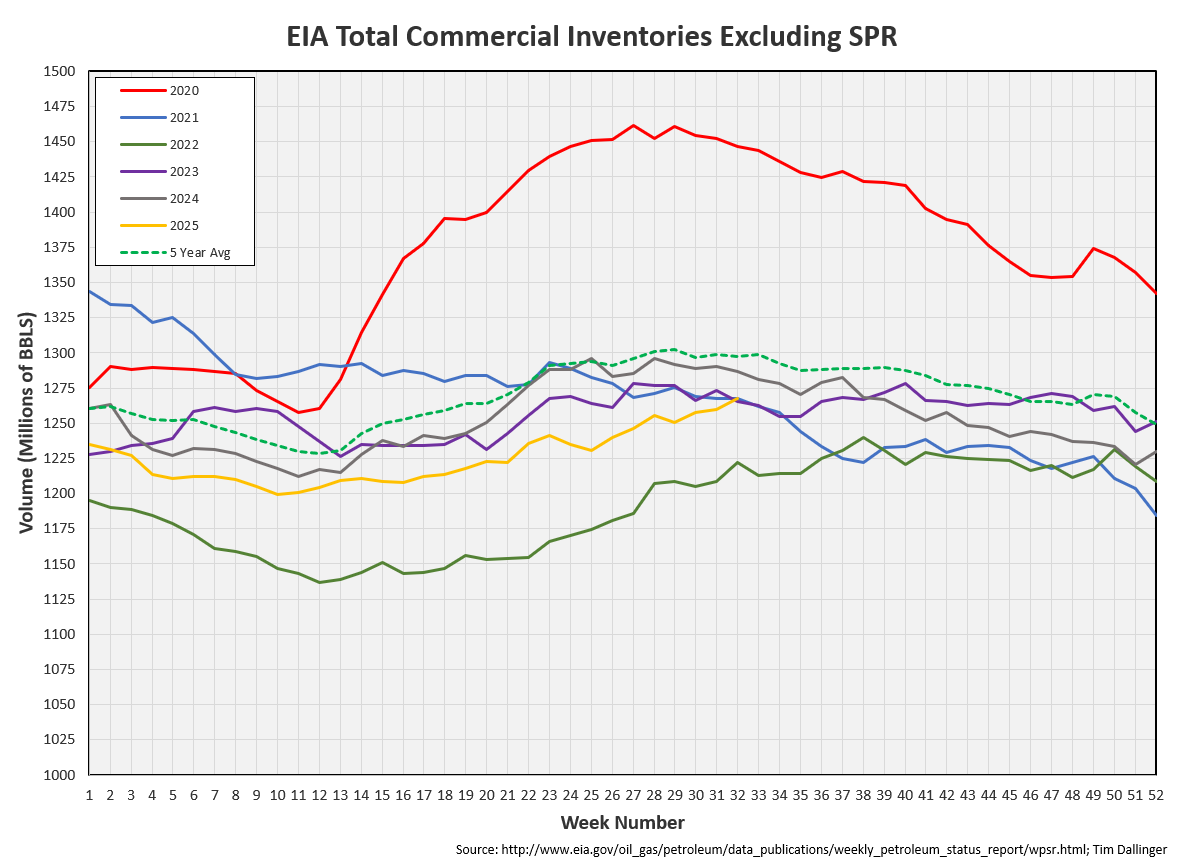

Total Commercial Inventory

Total commercial inventory built by 7.5 due to crude, propane and other oil. The light ends that are being miscategorized as crude are inflating inventories.

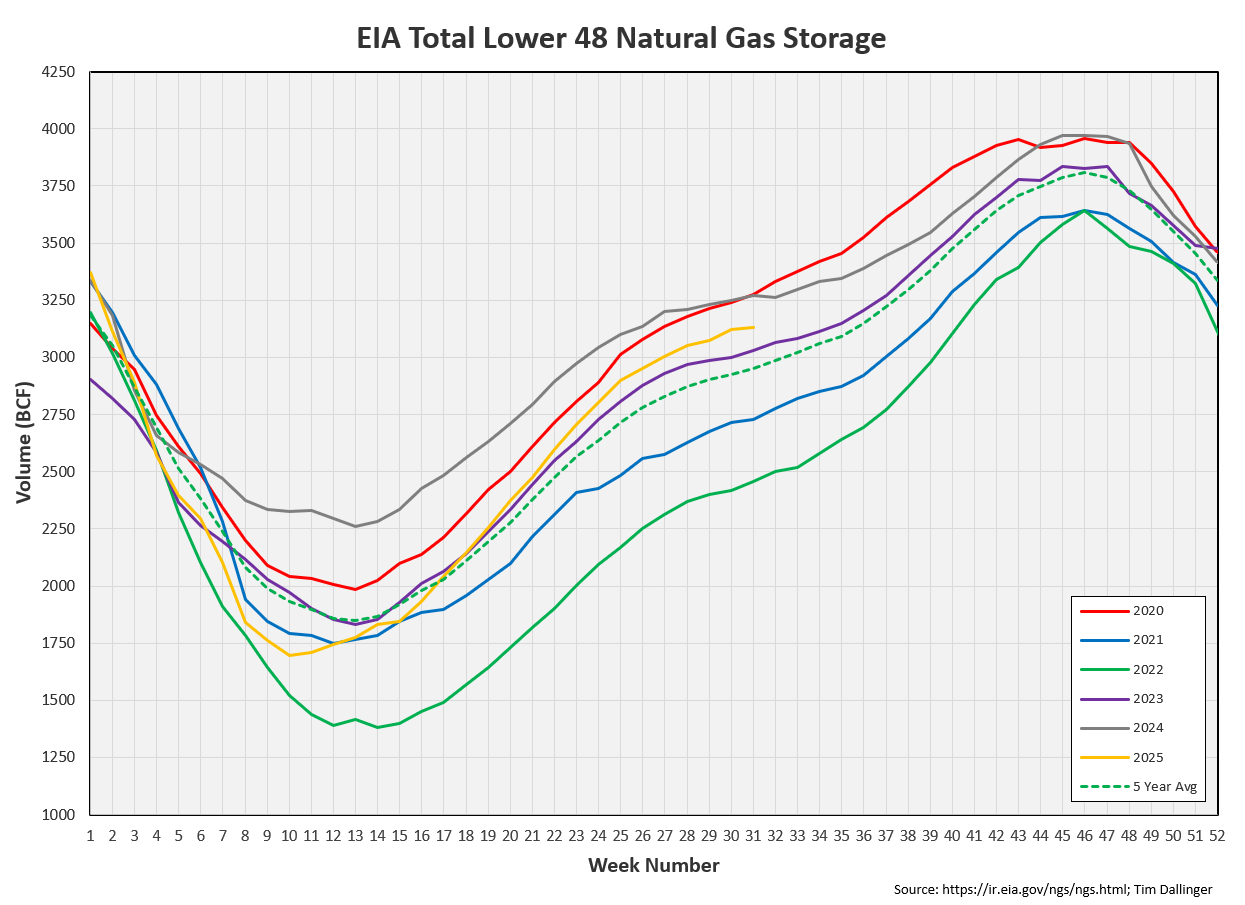

Natural Gas

Natural gas inventories are above average but following normal seasonal trends.

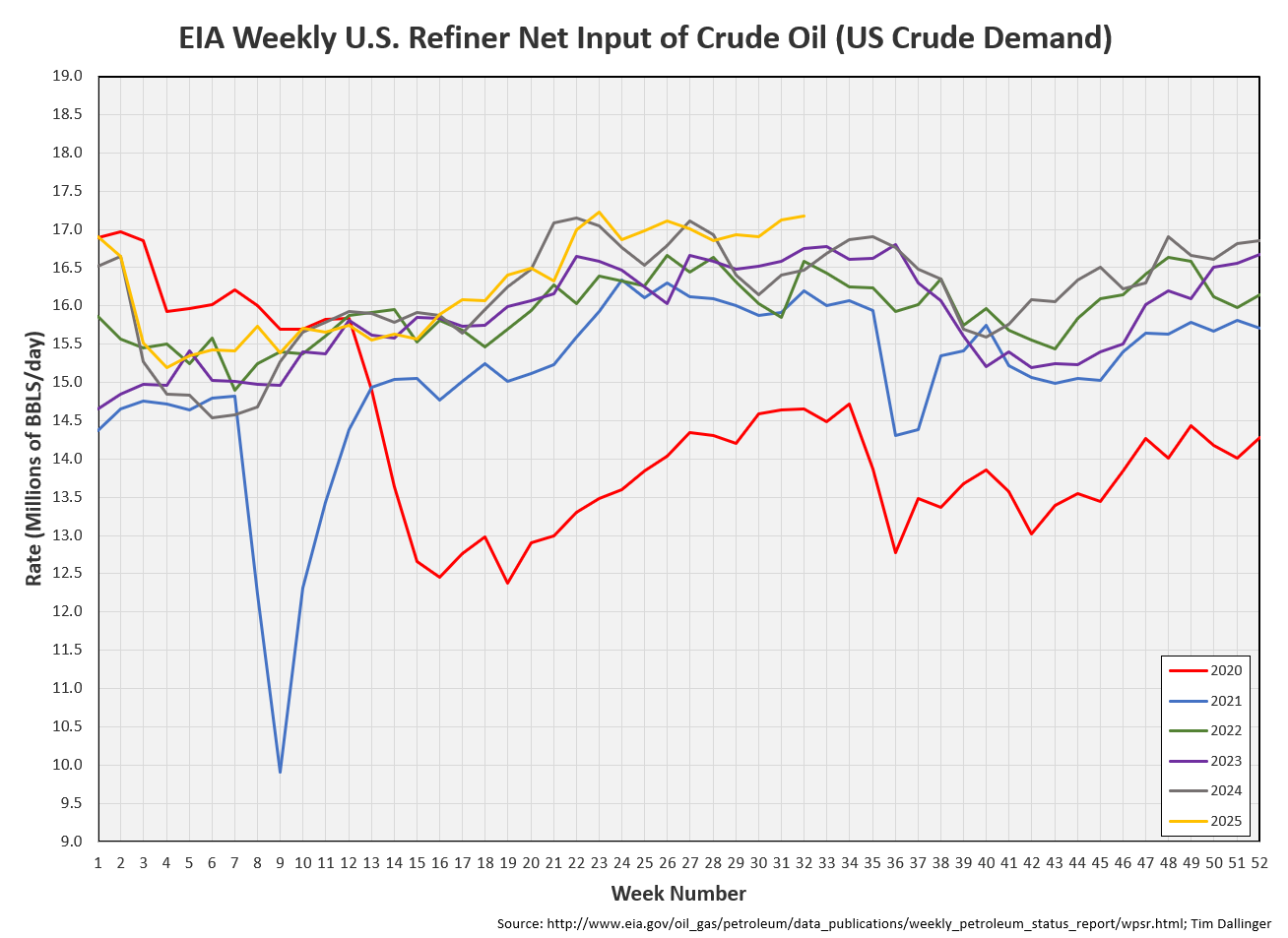

Refiners

The amount of crude oil refiners processed last week increased. The is second highest weekly output of 2025.

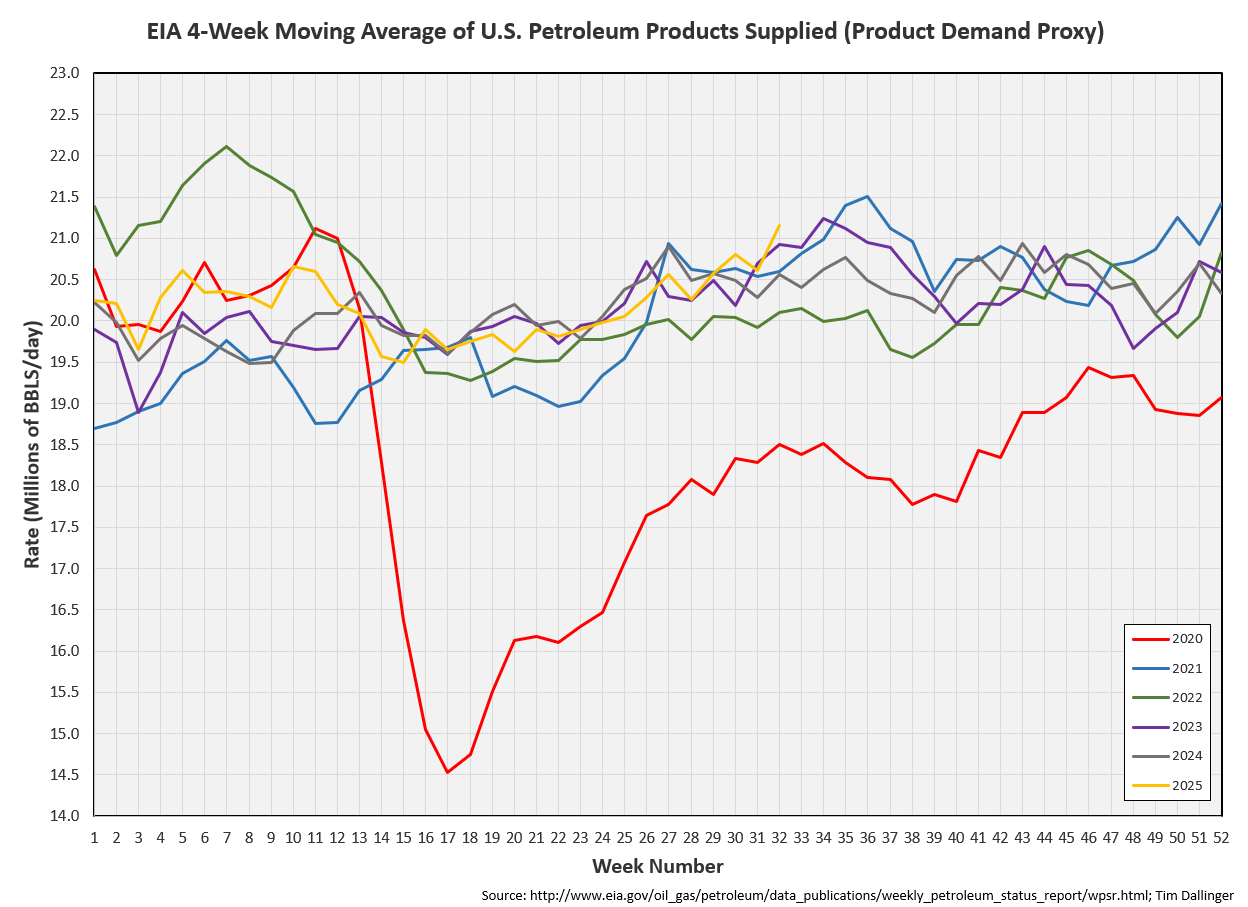

The rolling average for the EIA’s product demand proxy clocks a 2025 record.

Transportation inventories are still low.

When crude is included, inventories approach 2022 levels.

Simple cracks are high. Demand is strong.

Discussion

Regular readers may recognize the challenges inherent in reporting inventories accurately. The EIA is the most transparent agency in the world. However, there is still issue with data validity. Nearly all of the data released weekly is based on modeling from industry survey and internal calculations. When components of the model don’t balance, a correction factor called the adjustment factor, or unaccounted-for oil, is applied. While there have been accusations of manipulation from skeptics for years, the only thing that the adjustment factor absolutely demonstrates is that the model is inaccurate. The aphorism attributed to George E. P. Pox fits; “all models are wrong, but some are useful.”

Without 3rd party auditing, there will always be questions about the validity of data.

For the past several months, this publication has been drawing attention to data that appears odd. As previously described, some of the EIA categories have overlap. How products are counted will skew the perception of the market. It would appear that US crude oil is being overcounted due to blending of light ends. It also seems likely that these high carbon-chain molecules are eventually being counted as propane, gasoline blending components and other oil. The product market is a mess, leading some analysts to claim demand is poor. However, crack spreads continue to improve. A physical commodity market can be inefficient for some duration. However, commodities should approach efficiency with time.

The outlook isn’t particularly bullish until signs of declines become more apparent. But the bearish sentiment seems overdone here as well.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Cosmo, portrayed by Ben Kingsley, describes the state of the emerging digital world in the 1992 film, “Sneakers.”