EIA WPSR Summary for week ending 11-8-24

Summary

Crude: +2.1 MMB

SPR: +0.6 MMB

Cushing: -0.7 MMB

Gasoline: -4.4 MMB

Distillate: -1.4 MMB

Jet: -0.7 MMB

Ethanol: +0.0 MMB

Propane: -2.1 MMB

Other Oil: -0.1 MMB

Total: -6.5 MMB

Spot WTI is currently pricing $68. Spot crude prices remain deeply discounted to the estimated fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply increased by 2.1 MMB. Crude inventories are currently 4% below the seasonal average. Crude inventories haven’t been this seasonally low since 2014.

0.6 MMB were added to the SPR. SPR inventories have risen back to December 2022 levels.

US crude imports were back up to average levels.

Crude exports are still down. The reason is unclear.

Unaccounted for crude was slightly negative.

Cushing

Crude storage in Cushing, OK, drew by 0.7 MMB week on week. Cushing inventories match 2023 levels.

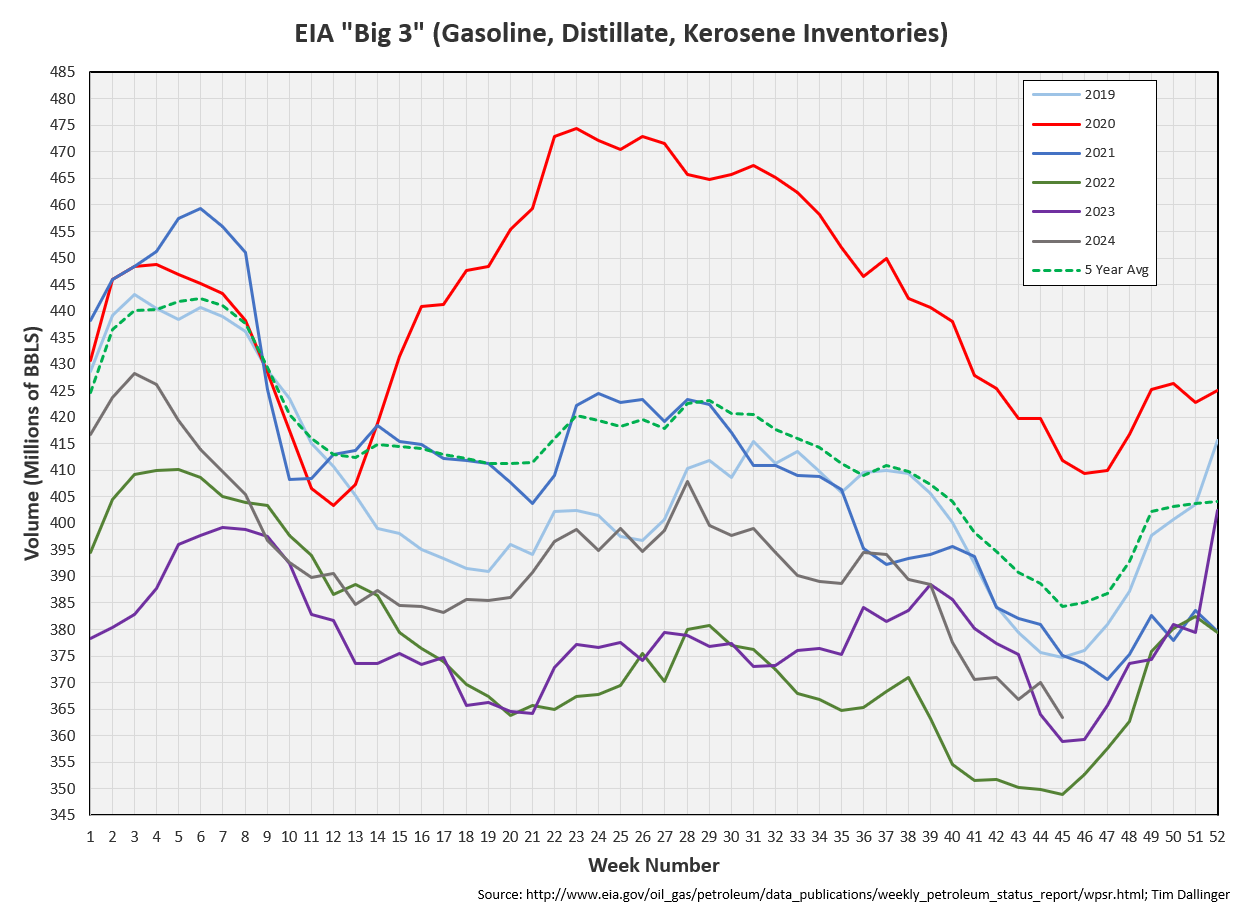

Gasoline

Total motor gasoline inventories decreased by 4.4 MMB and are about 4% below the seasonal 5-year average. Inventories usually build from here into year end.

Finished motor gasoline inventories are at record lows.

However, the bulk of gasoline inventories are actually the blending components. Blending components are low but remain above record lows.

Distillate

Distillate fuel inventories decreased by 1.4 MMB last week and are about 5% below the seasonal 5-year average.

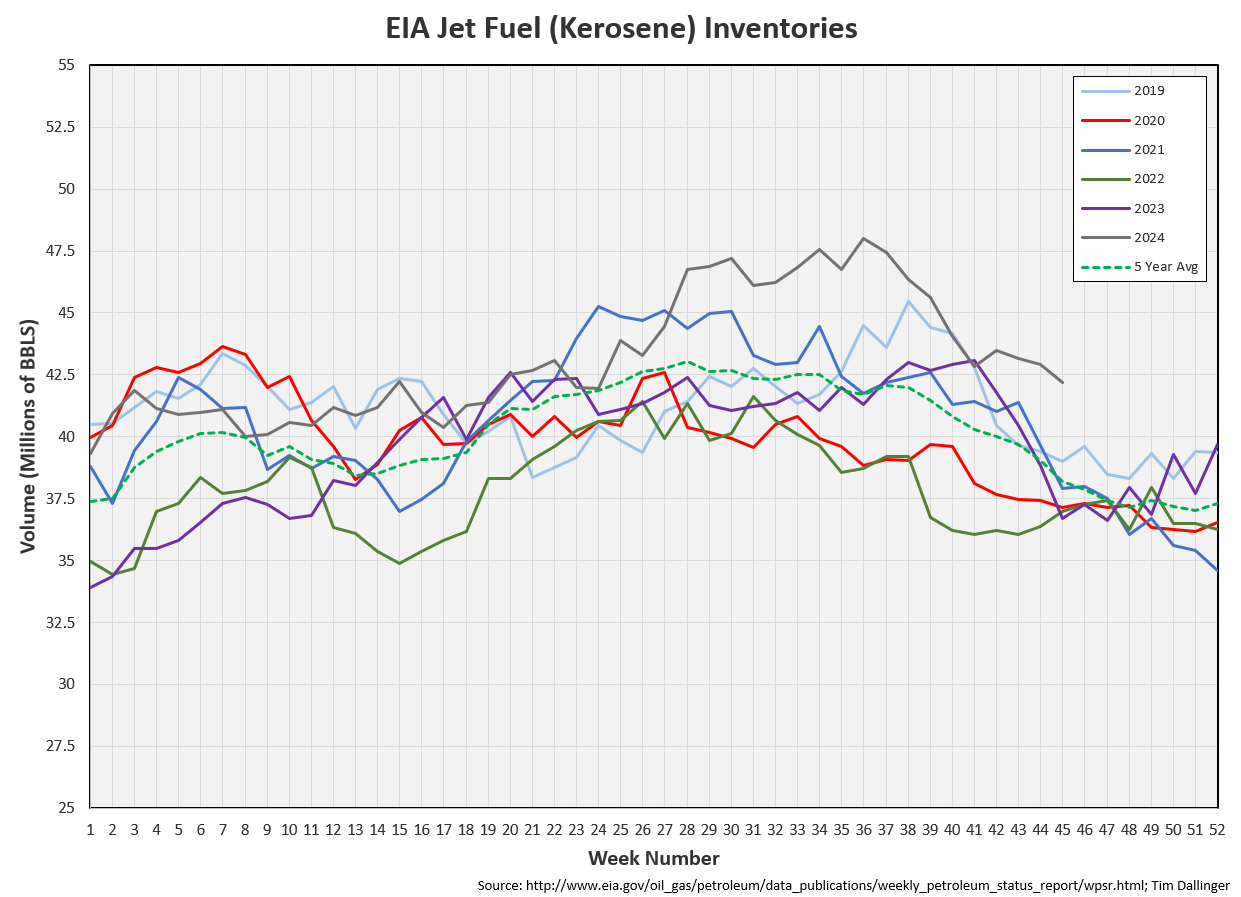

Jet

Kerosene type jet fuels drew by 0.7 MMB. Jet fuel stores are high.

Total global flights have fallen below 2019 levels but airfare miles remain at record levels.

Chinese flights rebounded.

https://www.airportia.com/flights-monitor/

Ethanol

Ethanol inventories were flat, week-on-week. Inventories remain above seasonal averages.

Propane

Propane/propylene inventories decreased by 2.1 MMB as winter heating demand picks up. Propane inventories are still higher than average though.

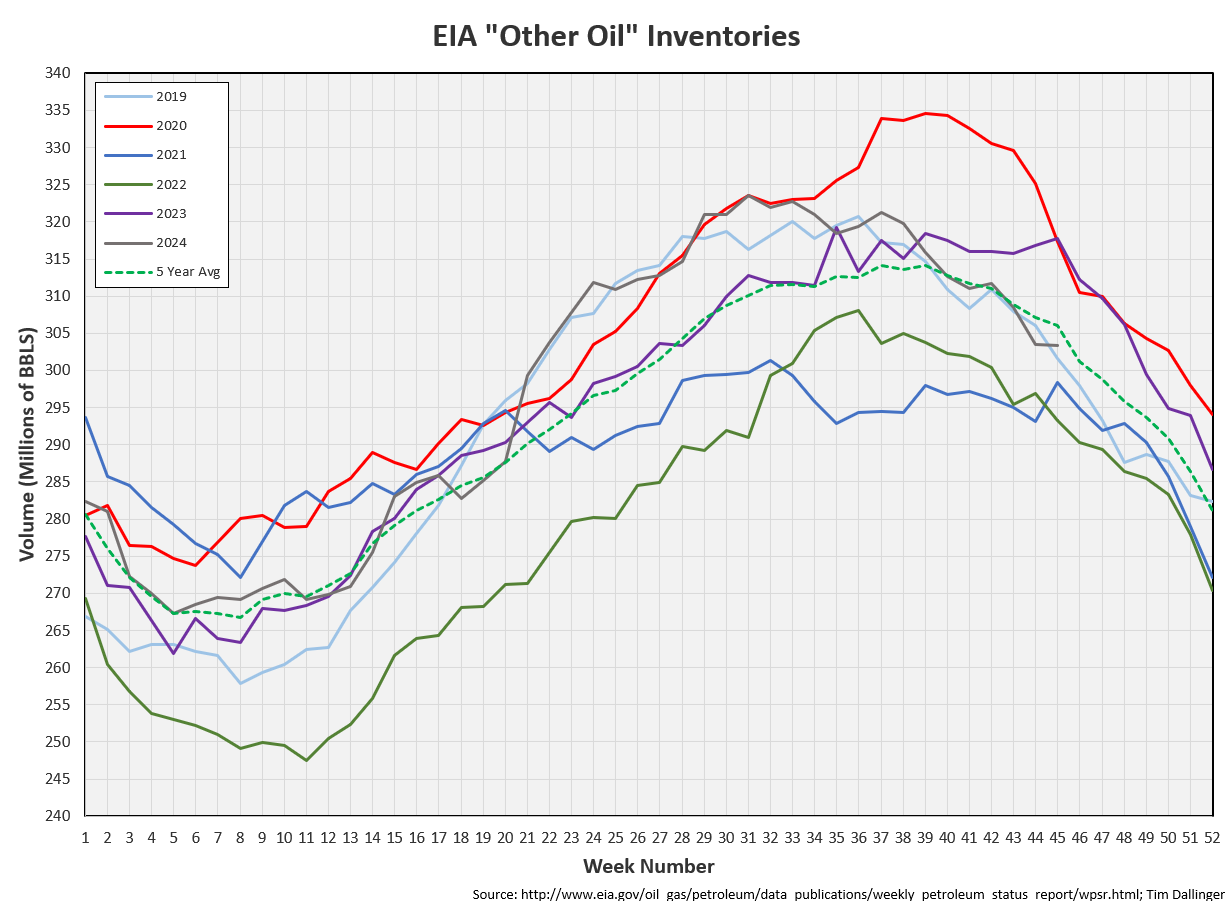

Other Oil

Other oil drew by 0.1 MMB. Other oil inventories are slightly below the seasonal average.

Total Commercial Inventory

Total commercial inventory decreased by 6.1 MMB.

Natural Gas

Natural gas inventories are at record highs.

Refiners

US refiners again set a seasonal record for the amount of crude oil processed weekly.

The EIA’s product demand proxy only lags 2019.

Transportation inventories fall.

If crude oil is included with transportation inventories, only 2023 demonstrated lower levels in the recent past.

Simple cracks continue to rally.

Backwardation remains in both WTI and Brent.

Discussion

It’s been a frustrating year for oil bulls. Even as physical data has been largely constructive over 2024, price has not followed.

Analysts are now turning toward 2025 and the bearish sentiment continues.

Morgan Stanley released their 2025 global energy projections. They expect 1.3 MMB global surplus. But consider the details:

MS expects all-time record demand. Yet, they expect production growth to outpace demand. They project US liquid production to grow by 600 kbd. While this is possible, it seems unlikely. Especially when one considers that they expected 700 kbd of production growth in 2024. That has not materialized.

The most significant recent “growth” has been due to the EIA changing accounting methods in mid-2023 to include NGL’s blended in the crude stream. All shale production is showing higher GOR.

On top of US growth, MS expects an additional 1 MMBD of growth from other Non-OPEC sources. Even the most ambitious Guyana guidance shows only 250 kbd of growth. Canada and Brazil will make up the remainder?

Take the under.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Randle P. McMurphy, portrayed by Jack Nicholson in the film adaption of Ken Kesey’s novel, One Flew Over the Cuckoo’s Nest, is a rebellious red-headed logger, veteran, backroom boxer and fanatic gambler, always interested in action.