EIA WPSR Summary for week ending 12-6-24

Summary

Crude: -1.4 MMB

SPR: +0.7 MMB

Cushing: -1.3 MMB

Gasoline: +5.1 MMB

Distillate: +3.2 MMB

Jet: +0.3 MMB

Ethanol: -0.4 MMB

Propane: -3.0 MMB

Other Oil: -5.5 MMB

Total: -0.9 MMB

Spot WTI is currently pricing $70, rallying over the past week. Prices remain heavily discounted to estimated fair value based on a price model derived from reported EIA inventories. However, this week the differential between spot and estimated fair value narrowed some.

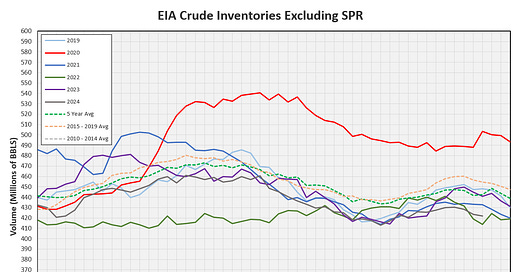

Crude

US Crude oil supply drew by 1.4 MMB. Crude inventories are currently 6% below the seasonal average. Only 2022 was lower in the past 5 years.

0.7 MMB were added to the SPR.

US crude imports were down week-on week.

Crude exports were reported to be extremely low.

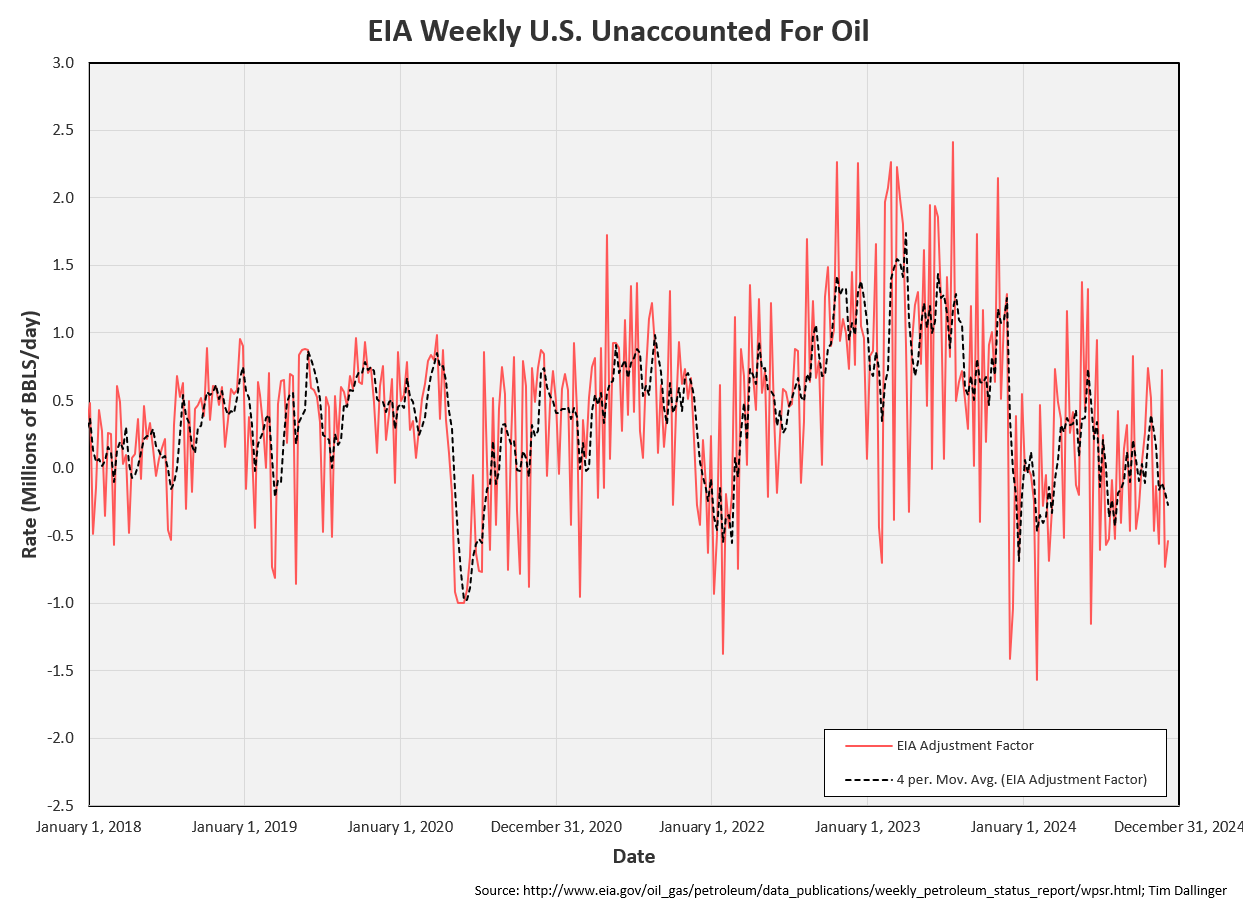

Unaccounted for crude remains negative. It isn’t apparent as to whether production was overcounted or exports were undercounted this week.

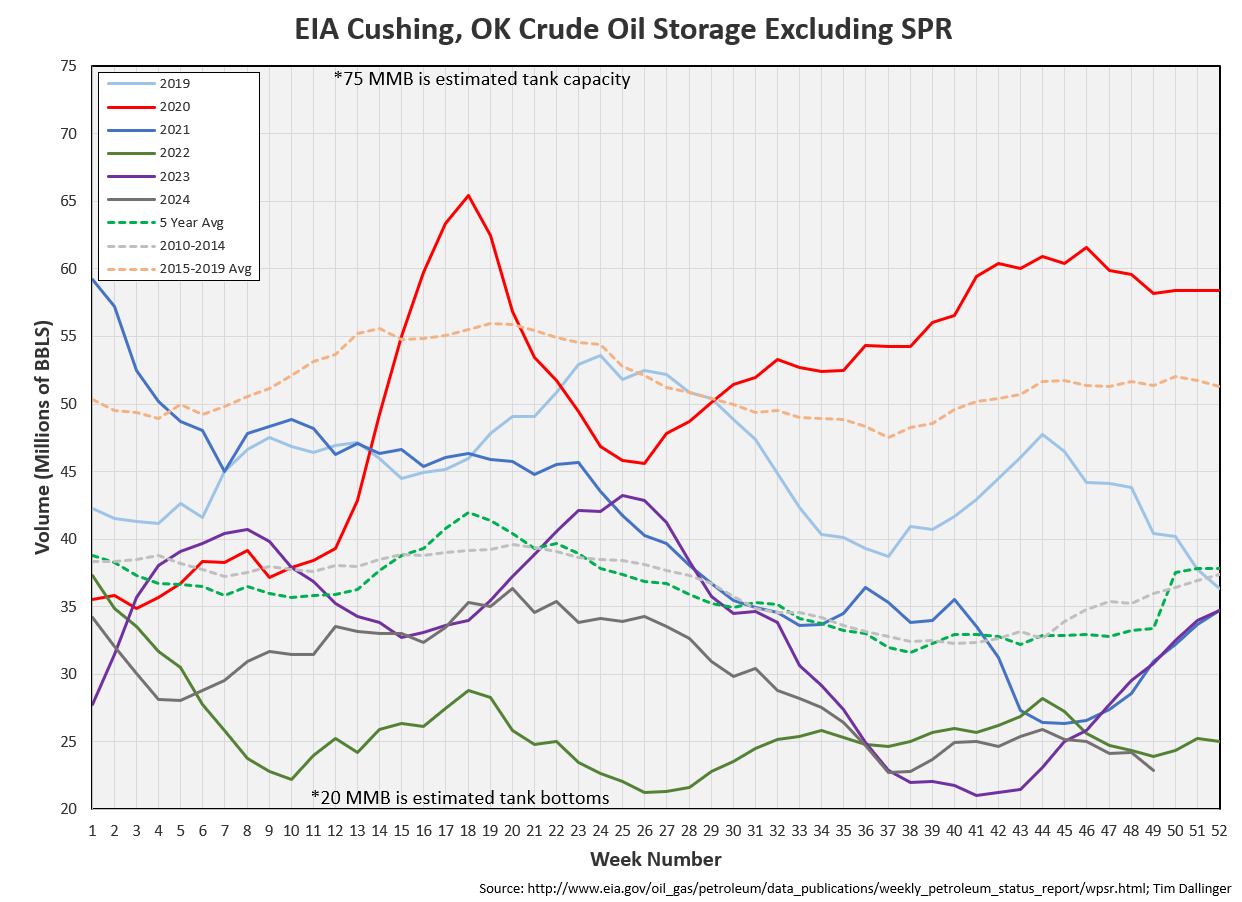

Cushing

Crude storage in Cushing, OK, drew by 1.3 MMB week on week. Cushing storage hasn’t been this seasonally low in a decade.

Gasoline

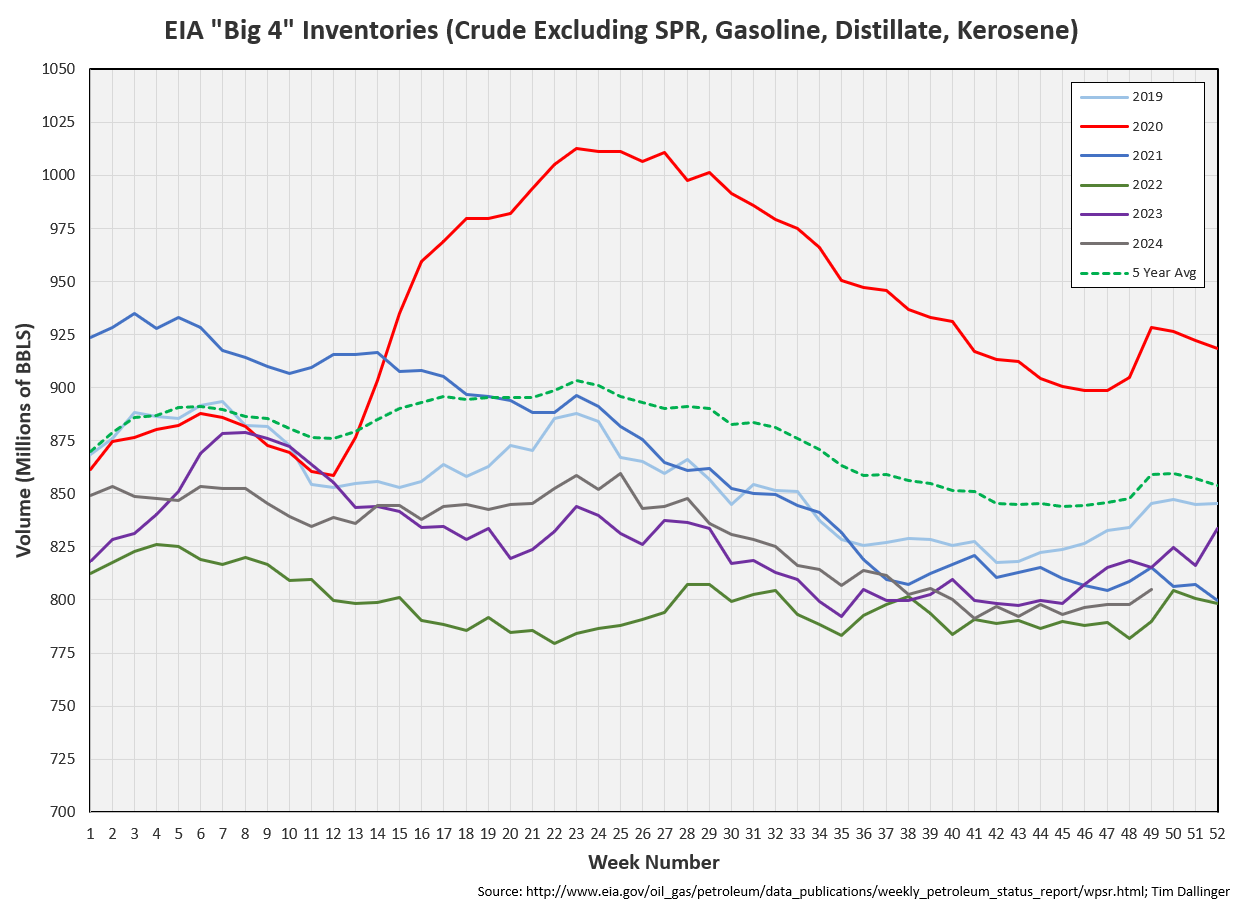

Total motor gasoline inventories increased by 5.1 MMB and are about 4% below the seasonal 5-year average. Both blending components and finished gasoline built.

Distillate

Distillate fuel inventories increased by 3.2 MMB last week and are about 4% below the seasonal 5-year average.

Jet

Kerosene type jet fuels built by 0.3 MMB.

Average number of global flights falls slightly below 2019 but total air miles traveled remains significantly higher. Fewer flights must be traveling longer distances.

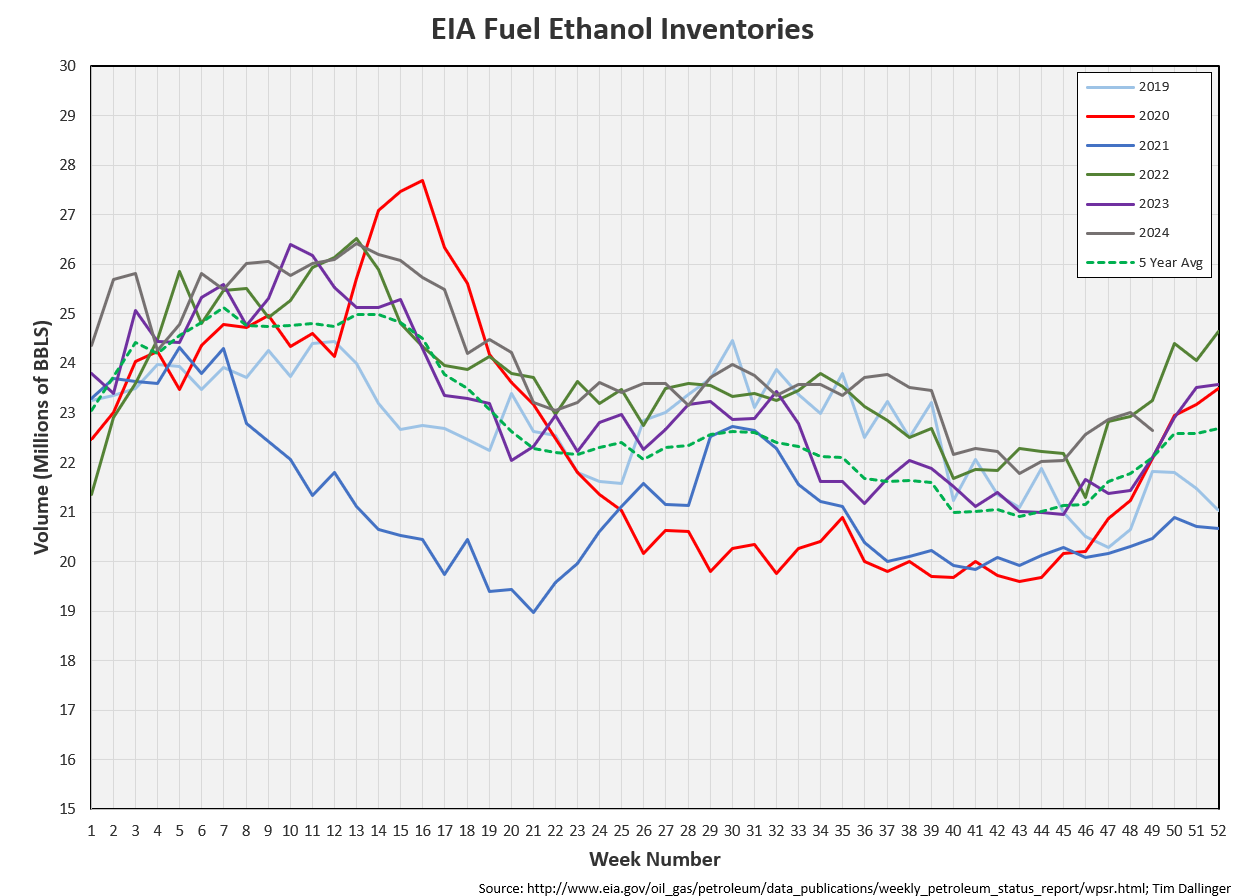

Ethanol

Ethanol inventories decreased 0.4 MMB week-on-week. Ethanol inventories approach seasonal averages.

Propane

Propane/propylene inventories drew by 3 MMB and are slightly above seasonal averages.

The National Weather Service is showing warmer weather, especially in the northeast. This will likely hamper propane and natural gas demand in the near term.

Other Oil

Other oil drew by 5.5 MMB. Other oil inventories are below average levels.

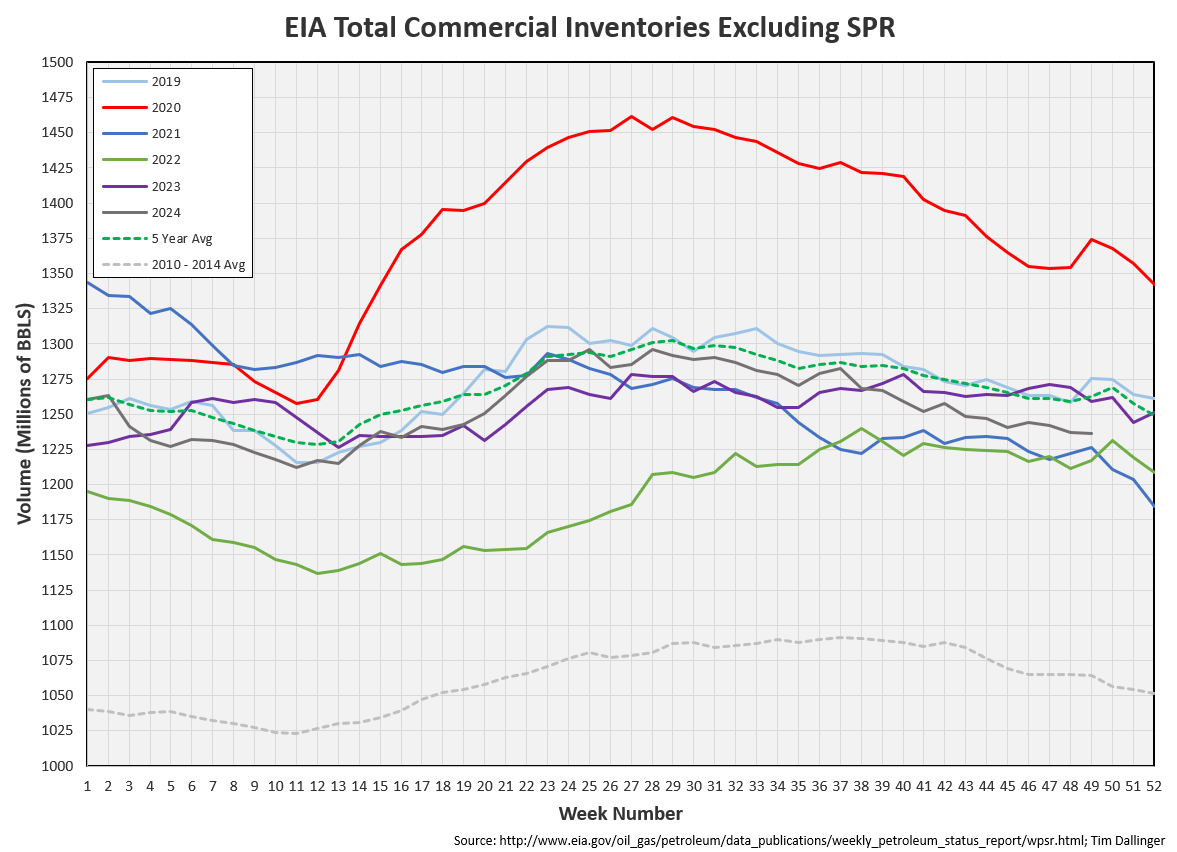

Total Commercial Inventory

Total commercial inventory drew by 0.9 MMB.

Natural Gas

Natural gas inventories are still at record storage levels. The weather hasn’t been cold enough to offset the increased associated gas production from US tight oil.

Refiners

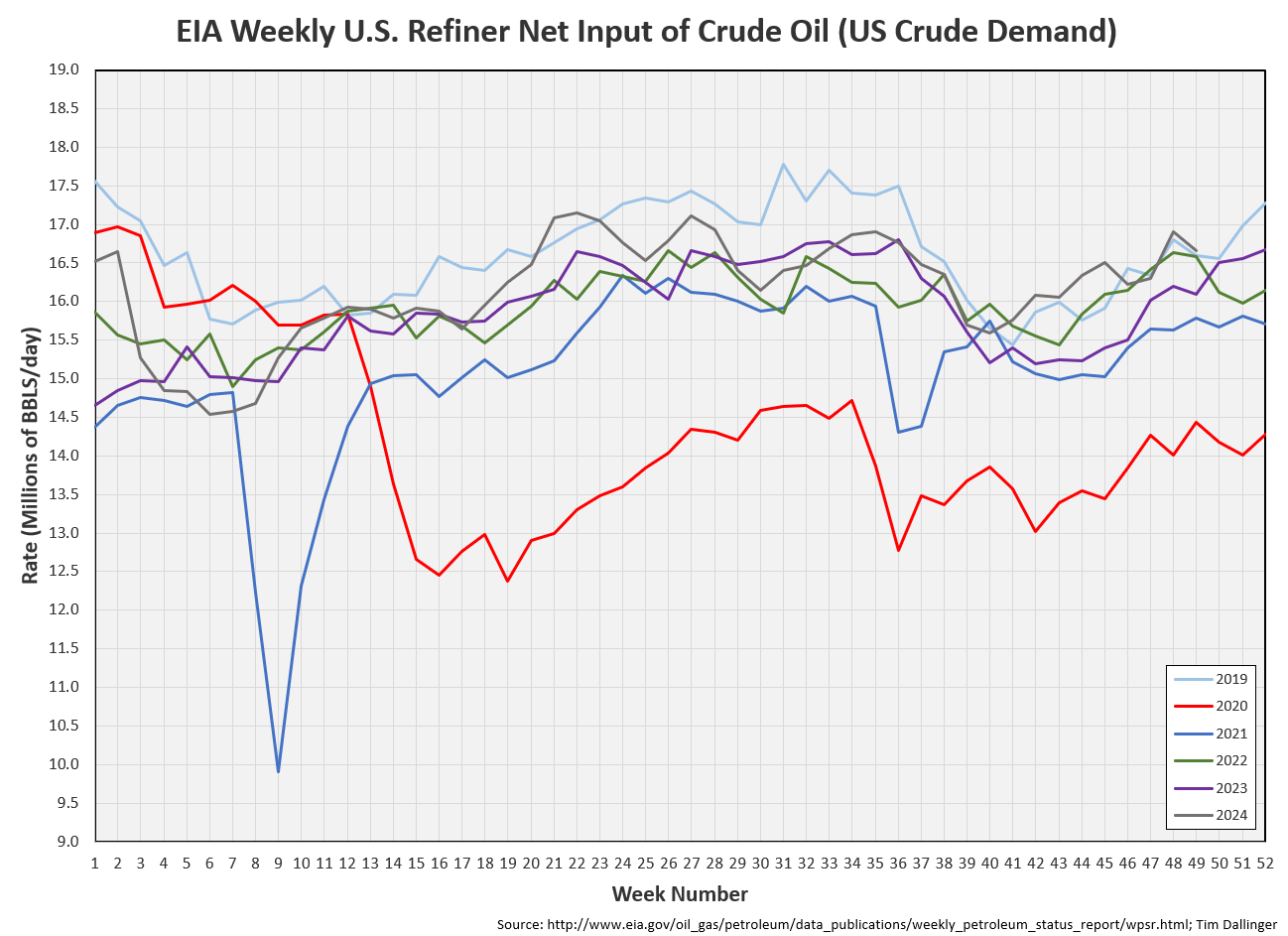

US refiners again processed a seasonal record amount of crude oil last week.

The EIA’s product demand proxy shows implied demand equivalent to 2022 levels. Implied product demand is less than 1 MMBD off the peak.

Transportation inventories built to 2021 levels. History suggest the next several will be flat.

Including crude oil with transportation inventories shows only 2022 was lower.

Simple cracks are still struggling but remain above the recent lows.

Discussion

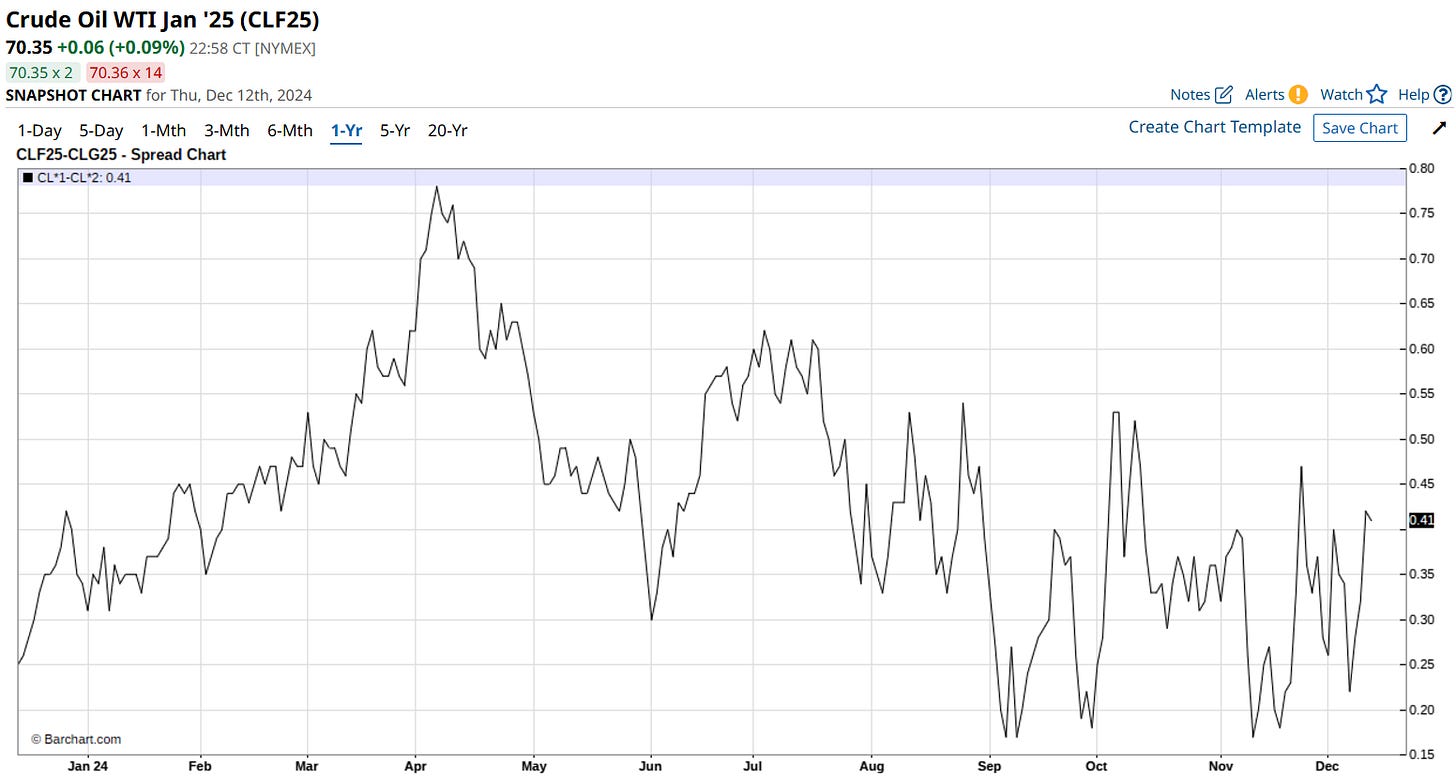

The bearish narrative continues. And yet both WTI and Brent timespreads remain backwarded, indicating that there is no supply glut. Crude markets have remained in backwardation all year with the brief exceptions of anomalous movements expiration days.

The EIA quietly updated their 2025 supply and demand forecasts. They don’t expect over-supply until Q3 2024 and the summation of the entire year is actually in a slight deficit.

Notice the 2024 consumption numbers. Global demand is at all-time high. The world has been in a supply deficit all year. Where’s the demand weakness?

The EIA also updated US production.

For the sake of this discussion, assume that the WPSR production number of 13.631 MMB is accurate. The EIA expects no 2025 US production growth.

Remember, all the projected global production growth was limited to essentially the US, Canada, Brazil, Guyana. That narrative is changing.

Instead of running the EIA headlines, publications have reported OPEC+ revised their projections lower. Read those articles carefully. OPEC+ revised their demand “growth” down. They still expect continued record demand.

Energy bulls are currently exceedingly rare. They must be dead or hibernating. And yet the underlying data does not suggest that the energy market should be this weak. Sentiment follows price and price has been hammered. Equity investors also appear to have thrown in the towel. Tax loss selling compounds the issue. Growth names selling at 50x earnings apparently are more appealing than cash flow positive energy stocks, paying dividends and buying back shares.

Chinese demand has disappointed over 2024. However, India and African demand have filled that hole. What happens if China gets aggressive with their economic growth plan as they are guiding for 2025? What happens if US production growth finally ends? What happens if the OPEC+ agreement doesn’t falter? What if the Russian Ukraine conflict ends and the world realizes that Russia didn’t lose any production?

I may be one of the last bulls still standing. Is there anyone remaining with me?

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Conan the Barbarian prays to Crom as the hoard descends upon him and his friend and ally, Subotai.

I've had some pushback from readers that there aren't bullish indicators and the market is currently well-supplied. Global crude stocks have drawn 100 MMB over 2025. That means that the market is in a deficit. If supply growth doesn't materialize, drawdown will continue until the physical market overwhelms the paper.

I don't expect $100 oil in 2025 but my model suggests ~$89 is currently fair price. If oil can get back to the $80 to 85 range, that significant upside especially for energy equities.

Yes, still bullish but goddamn