EIA WPSR Summary for week ending 7-5-24

Summary

Crude: -3.4 MMB

SPR: +0.5 MMB

Cushing: -0.7 MMB

Gasoline: -2.0 MMB

Distillate: +4.9 MMB

Jet: +1.2 MMB

Ethanol: 0.0 MMB

Propane: +2.2 MMB

Other Oil: +0.5 MMB

Total: +2.6 MMB

Bullish report.

Spot WTI is currently pricing $82. Prices are slightly above approach fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply drew by 3.4 MMB. Crude inventories are currently 4% below the seasonal average.

0.5 MMB were added to the SPR. 17.9 MMB have been added to the SPR in 2024. This nears the reported contracted 20 MMB addition planned for 2024. The DOE just solicited an additional 4.5 MMB of sour barrels.

US crude imports increased slightly and hover near the 2024 average.

Crude exports fell back to just blow 4.0 MMBD. Storm Beryl likely affected imports and exports and will have an effect again on next week’s report too.

Unaccounted for crude was slightly elevated.

Cushing

Crude storage in Cushing, OK, drew by 0.7 MMB week on week. Inventories are lower than every year except 2022. They aren’t currently at critical levels though.

Gasoline

Distillate fuel inventories increased by4.9 MMB last week and are about 8% below the seasonal 5-year average.

Distillate

Distillate fuel inventories increased by4.9 MMB last week and are about 8% below the seasonal 5-year average.

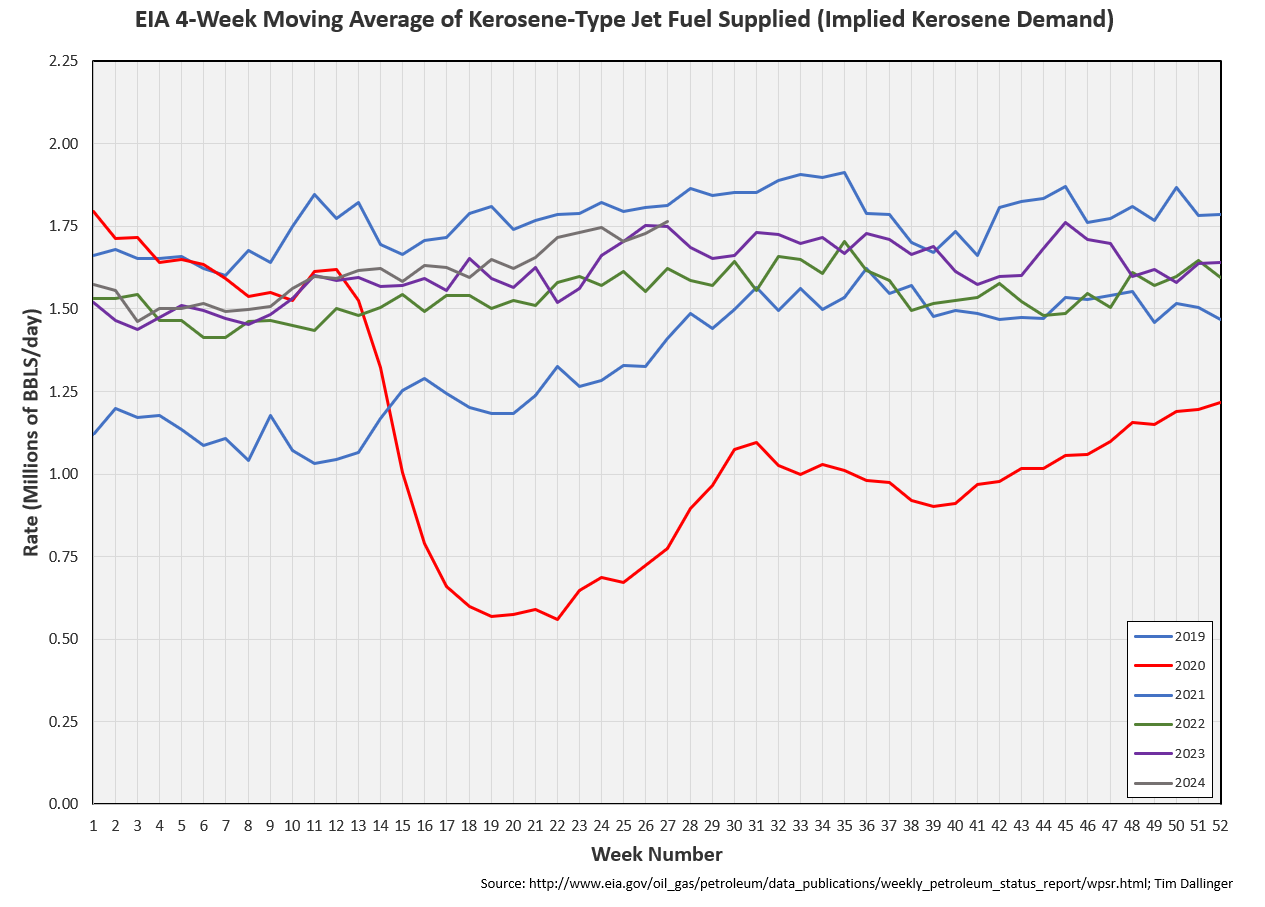

Jet

Kerosene type jet fuels built by1.2 MMB. Inventories are rising to meet demand.

The EIA jet fuel demand proxy is showing strength. Although, it’s likely understating actual demand.

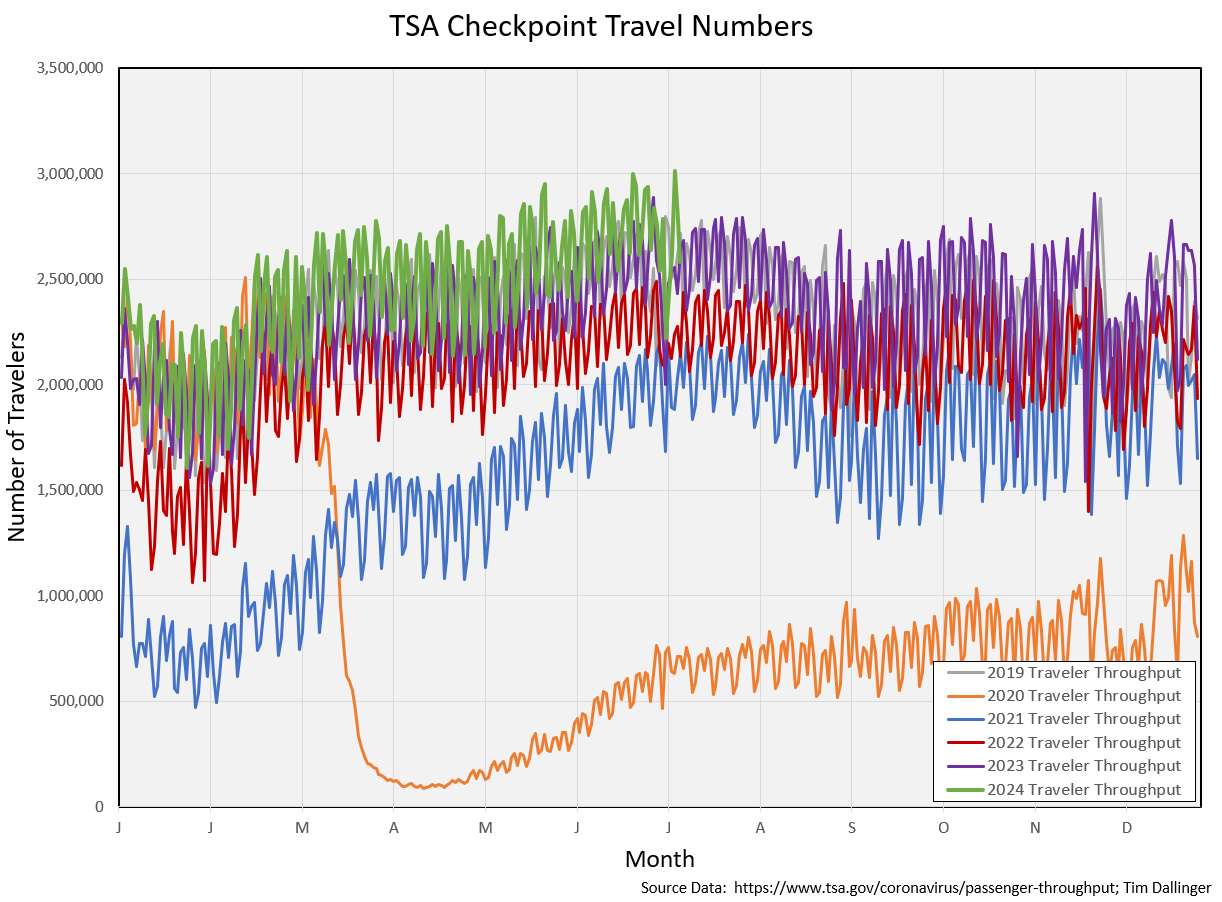

TSA checkpoint figures hit an all-time high over the holiday travel week.

Some argue that airlines are simply flying fuller now. That may be the case but total US airline miles traveled has been at record levels since April 1.

China total flights and airfare miles are at all-time records.

Global numbers of flights have declined slightly from their peak but total miles traveled remains at record levels.

Ethanol

Ethanol inventories were flat week-on-week. Inventories are above seasonal averages.

Propane

Propane/propylene inventories built by 2.2 MMB.

Other Oil

Other oil built by 2.6 MMB.

The EIA other oil demand proxy has rebounded back to record levels. This is still anomalous, unexplained behavior.

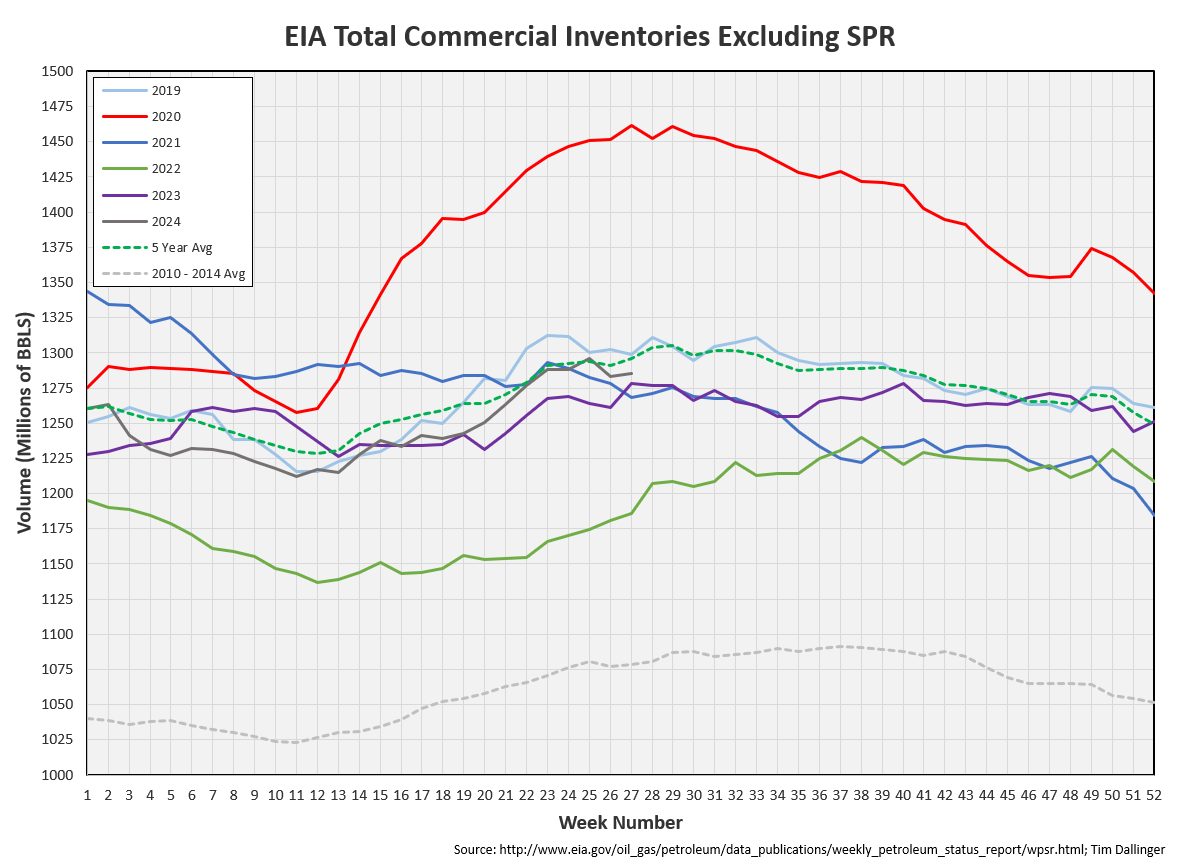

Total Commercial Inventory

Total commercial inventory built by 2.6 and are slightly below the seasonal 5-year average.

Natural Gas

Natural gas inventories remain high.

Incoming weather should increase demand. But nat gas bulls shouldn’t celebrate yet. US producers are reducing their voluntary gas drilling curtailment. They lack the discipline of OPEC.

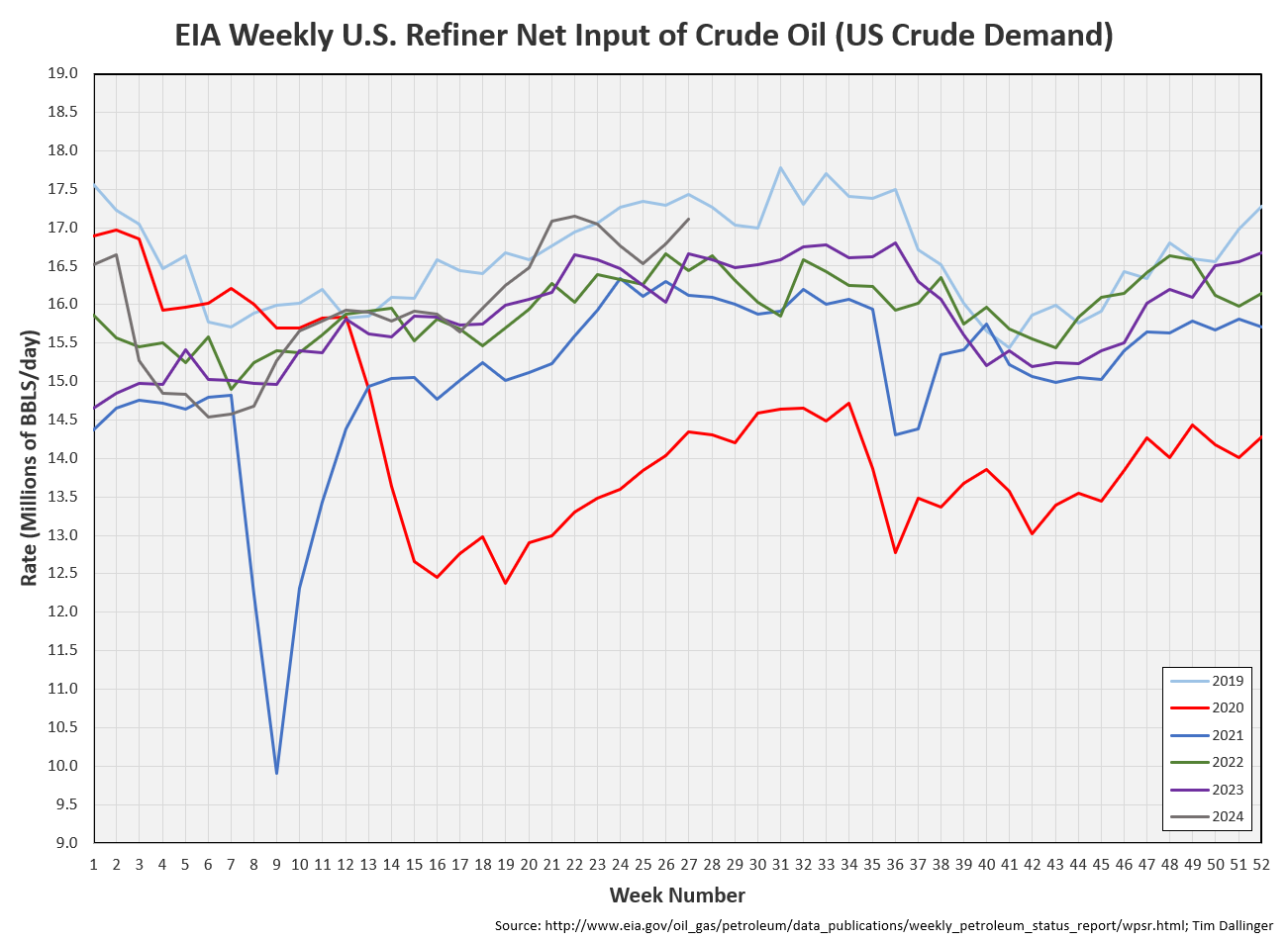

Refiners

The amount of crude oil refiners processing rebounding again last week. Crude demand is strong. Weather related refinery shutdowns in the gulf will likely lead to a crude build next week but products should draw instead.

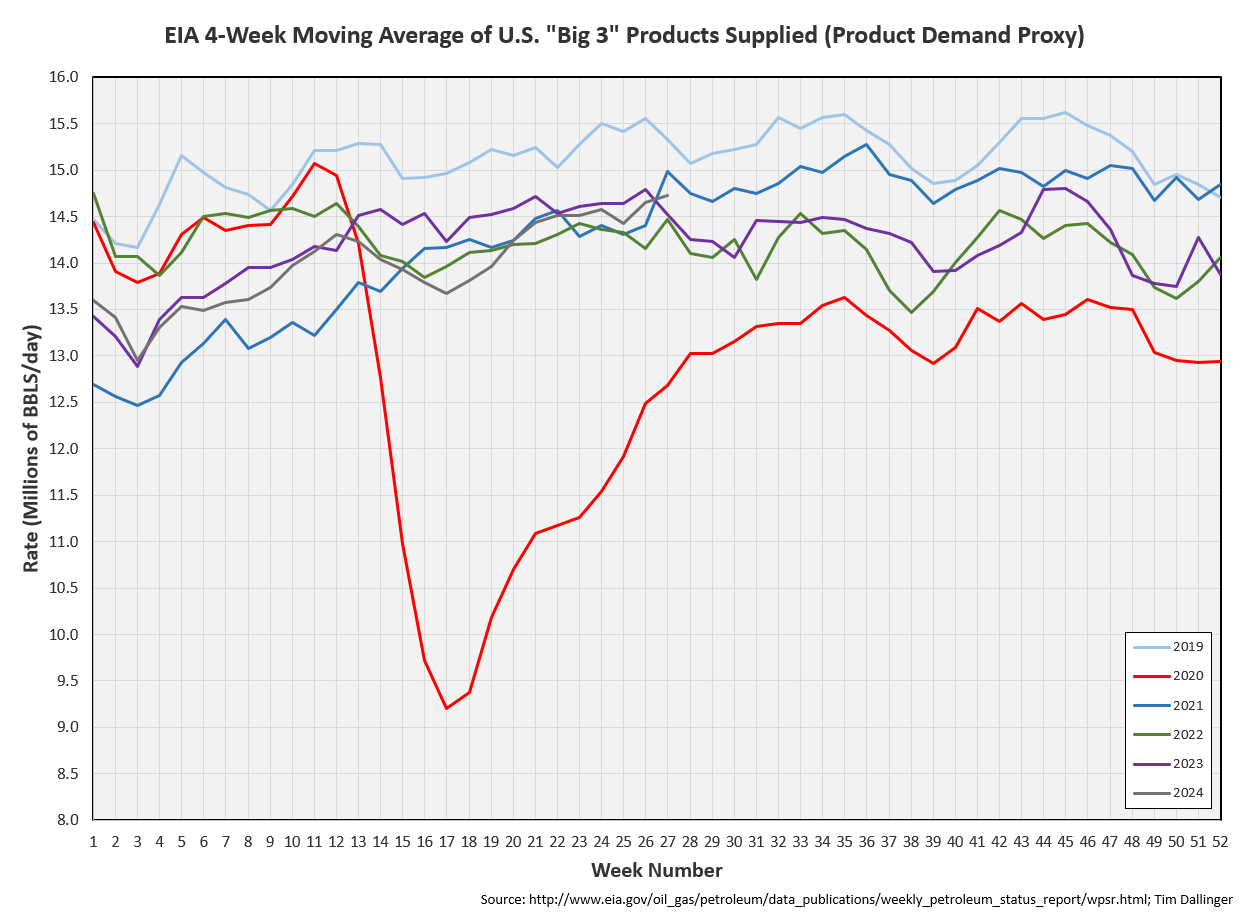

The EIA’s product demand proxy is still showing slight weakness.

Product supplied figures for transportation inventories continue to build though.

Transportation inventories remain below average.

Simple cracks took a hit today. They should rebound next week with anticipated product draws.

Discussion

Although the report was bullish, this was again a relatively uneventful week. Hurricane beryl did cause damage to the Houston era. Power is currently being restored and clean-up starting. This should increase distillate demand in the near-term. But next week’s report will likely be odd.

On a personal note, I will be on vacation next week. Expect a week pause in these publications unless something substantial occurs across energy markets.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Officer Kimble, played by Arnold Schwarzenegger, in the 1990 American action comedy “Kindergarten Cop,” accurately describes US natural gas producers.