EIA WPSR Summary for week ending 4-11-25

Summary

Crude: +0.5 MMB

SPR: +0.3 MMB

Cushing: -0.7 MMB

Gasoline: -2.0 MMB

Distillate: -1.9 MMB

Jet: -1.1 MMB

Ethanol: -0.2 MMB

Propane: -1.3 MMB

Other Oil: +4.6 MMB

Total: -2.1 MMB

Spot WTI is currently pricing almost $62. Spot prices remain deeply discounted versus estimated fair value based on a price model derived from reported EIA inventories. The market continues to forecast demand destruction.

Crude

US Crude oil supply built by 0.5 MMB. Crude inventories are currently 6% below the seasonal average.

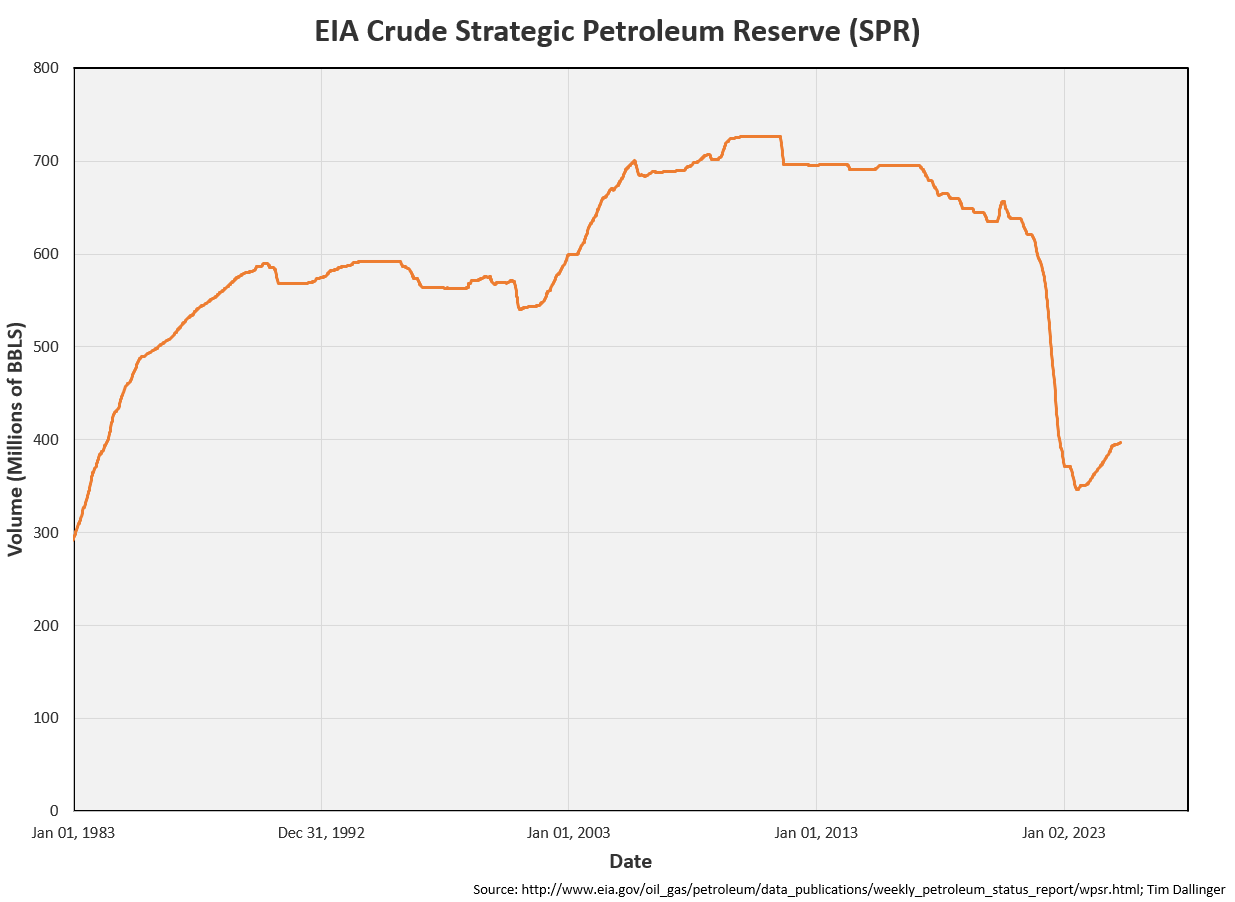

0.3 MMB were added to the SPR.

3.2 MMB have been added to the SPR over 2025.

US crude imports were down. The Keystone pipeline restarted today after being out of service following last week’s spill. Line pressures are limited to 80% of recent highs. Depending on the hydraulics of the pipeline, the operator may be able to make up capacity using more drag-reducing agent. But more than likely, Keystone imports will be lower for some time.

Crude exports hit a record high. This was not captured by independent ship-trackers.

Unaccounted for crude spiked positive, due to overcounted export barrels.

The EIA is still showing high production figures. If the Petroleum Supply Monthly comes in low again in two weeks, they need to reassess the short-term energy outlook (STEO).

Cushing

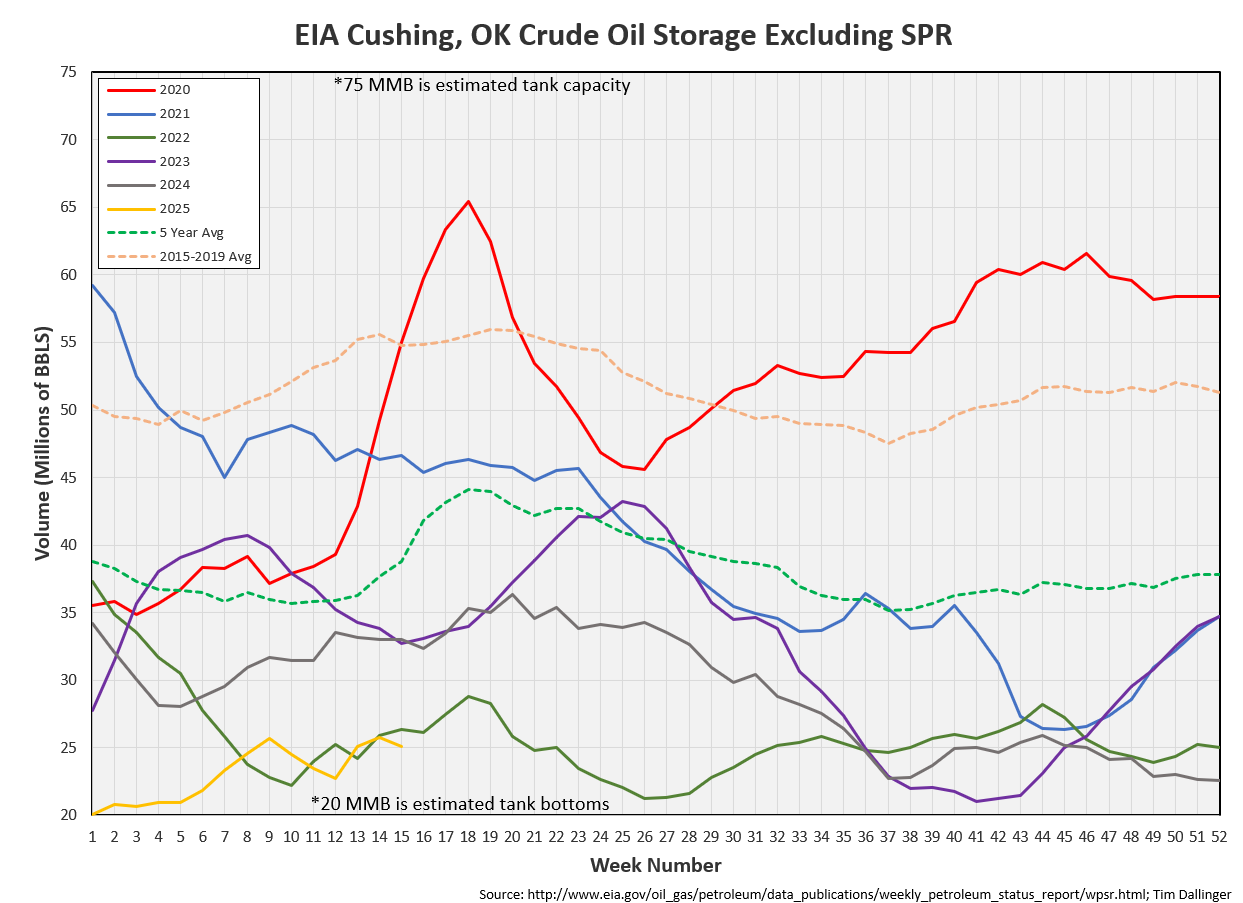

Crude storage in Cushing, OK, drew by 0.7 MMB week on week. These are record low seasonal levels. It’s too early to predict but volumes could reach tank bottoms again this summer.

Gasoline

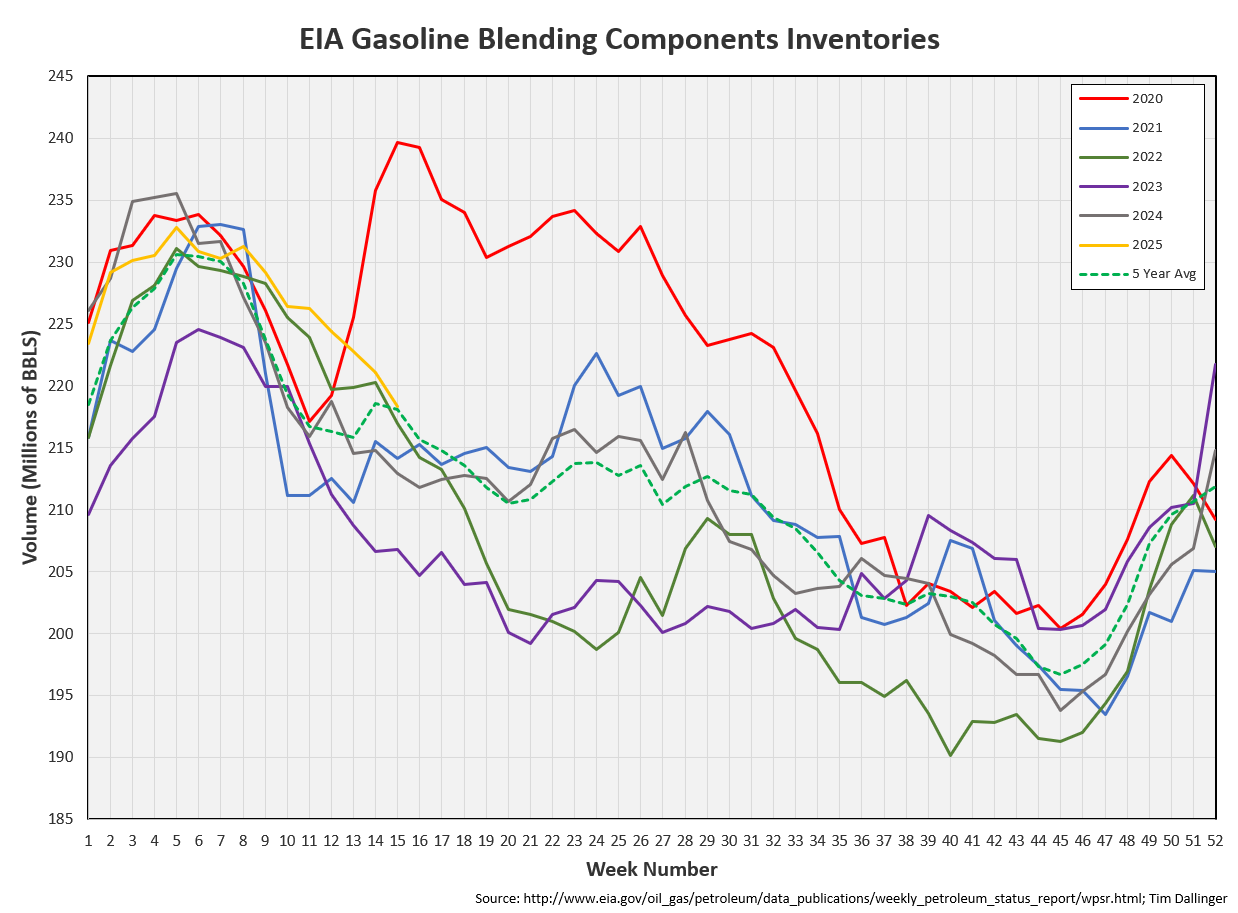

Total motor gasoline inventories decreased by 2.0 MMB, falling back below the seasonal 5-year average.

Finished motor gasoline inventories are below average.

Gasoline blending components are at average levels.

Distillate

Distillate fuel inventories decreased by 1.9 MMB last week and are about 11% below the seasonal 5-year average.

Jet

Kerosene type jet fuels decreased by 1.1 MMB. Jet fuel inventories are still above seasonal averages, but they’ve fallen considerably from record levels over the past month.

Ethanol

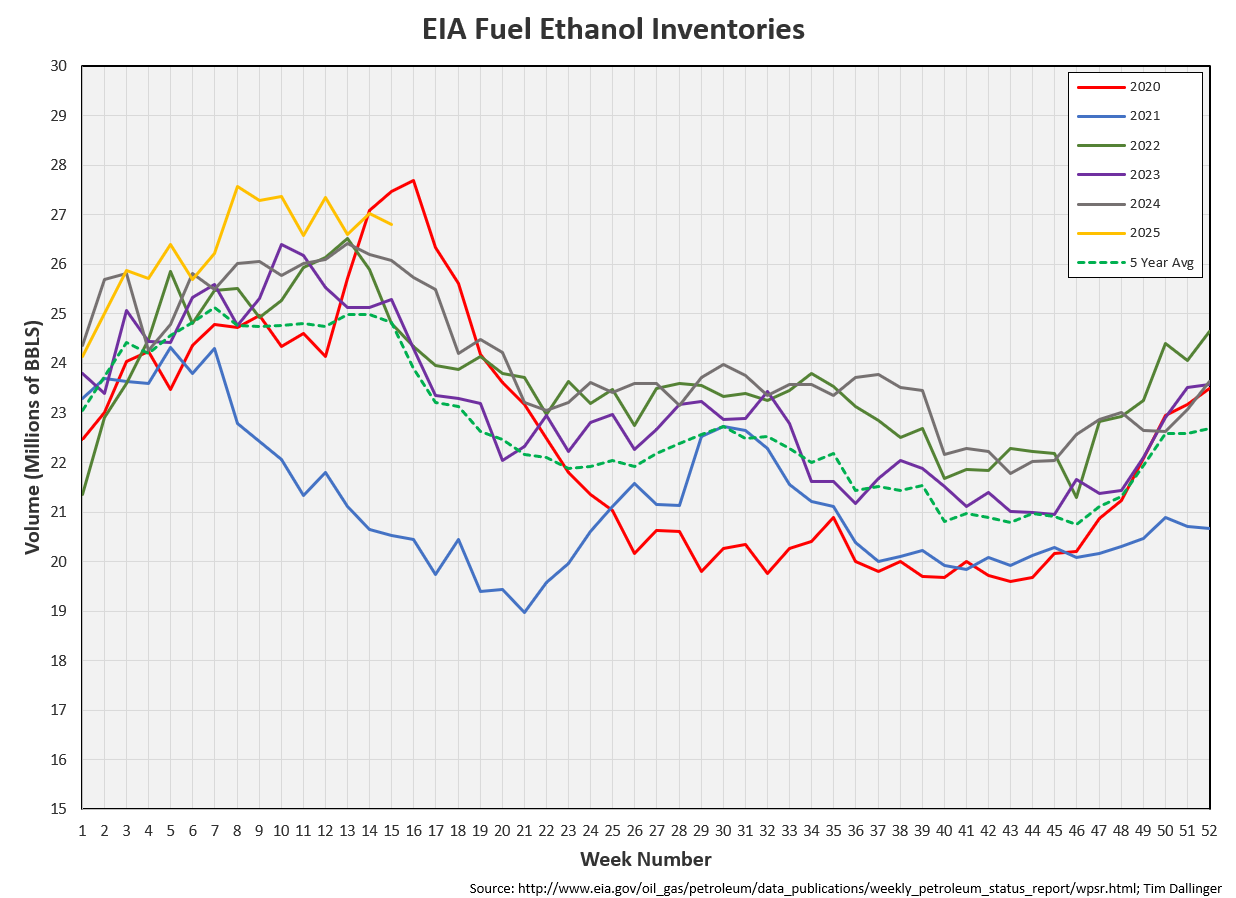

Ethanol inventories decreased 0.2 MMB week-on-week. Inventories are still above seasonal averages.

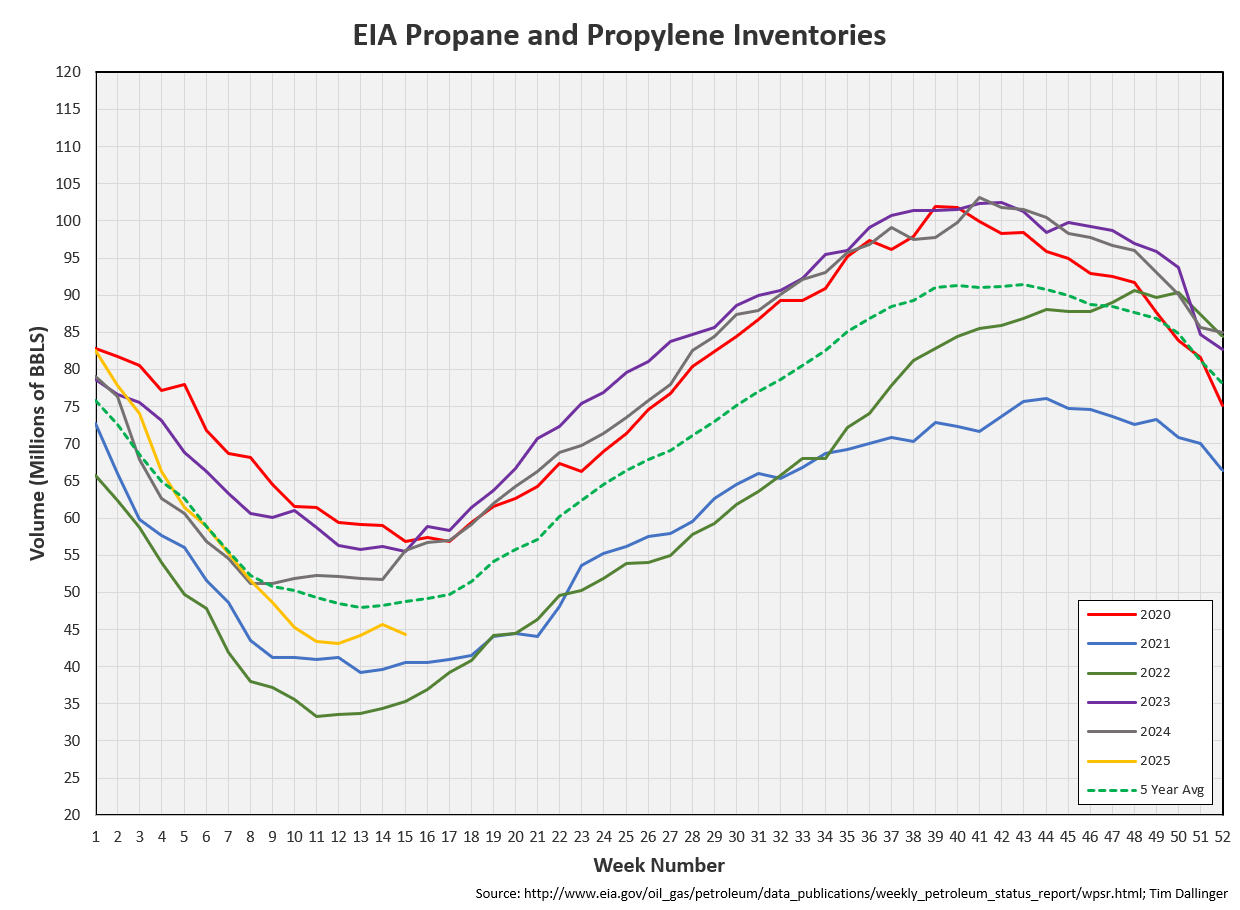

Propane

Propane/propylene inventories decreased counter-seasonally by 1.3 MMB. Propane inventories are 9% below the seasonal average.

Other Oil

Other oil increased by 4.6 MMB, nearing a seasonal high.

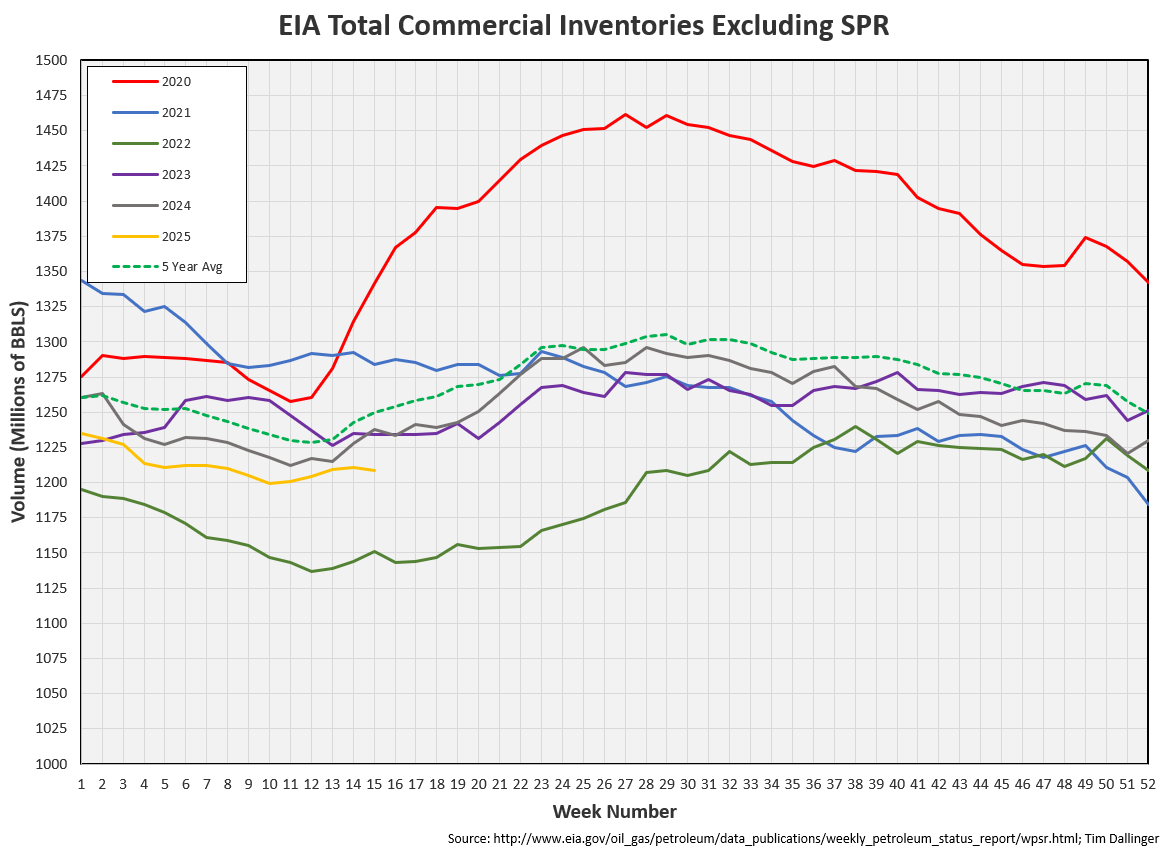

Total Commercial Inventory

Total commercial inventory fell by 2.1 MMB. Total commercial inventories are below the seasonal average even with high levels of “other oil.”

Natural Gas

Natural gas inventories continue their seasonal increase, nearing average levels.

Refiners

US refiners haven’t ramped for driving season yet. That should occur in about 3 weeks.

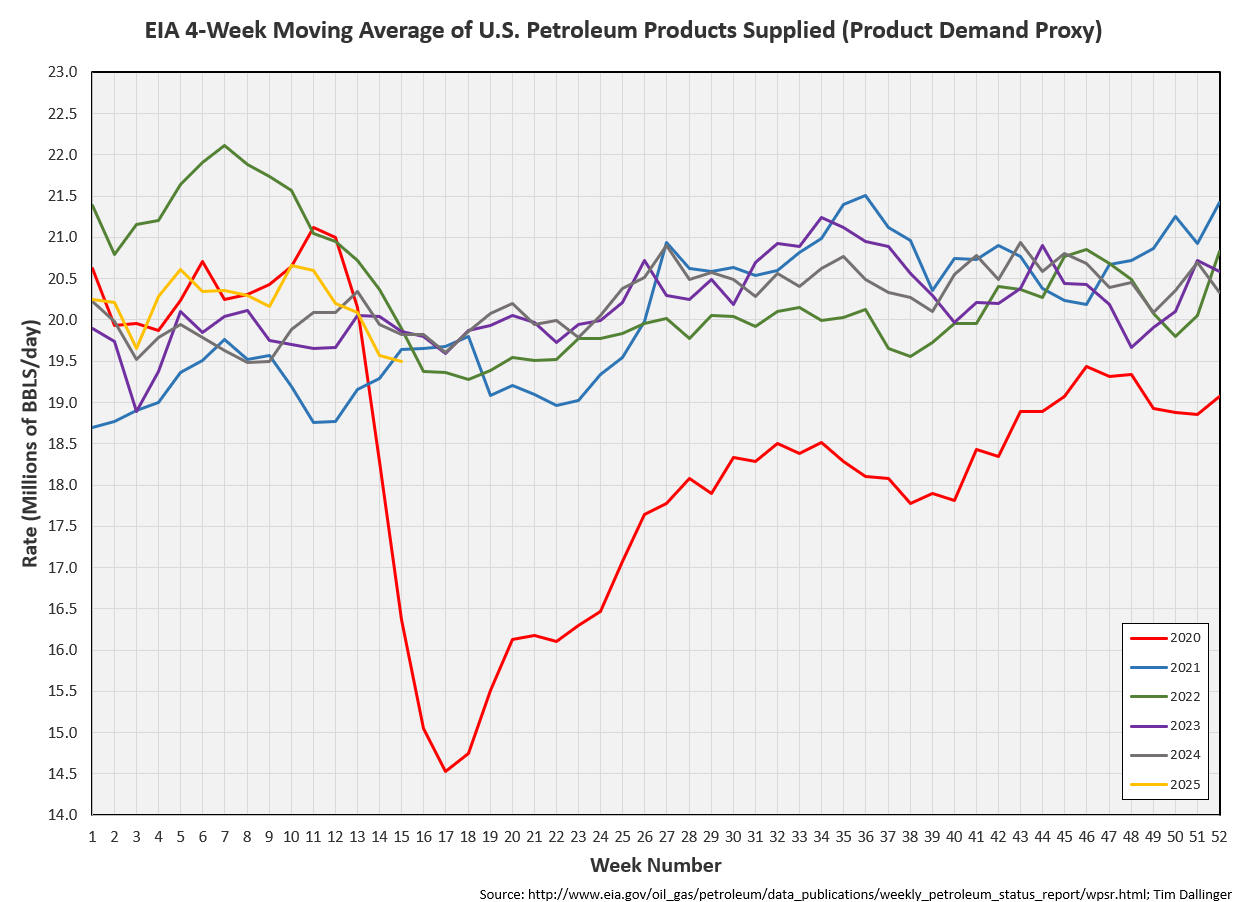

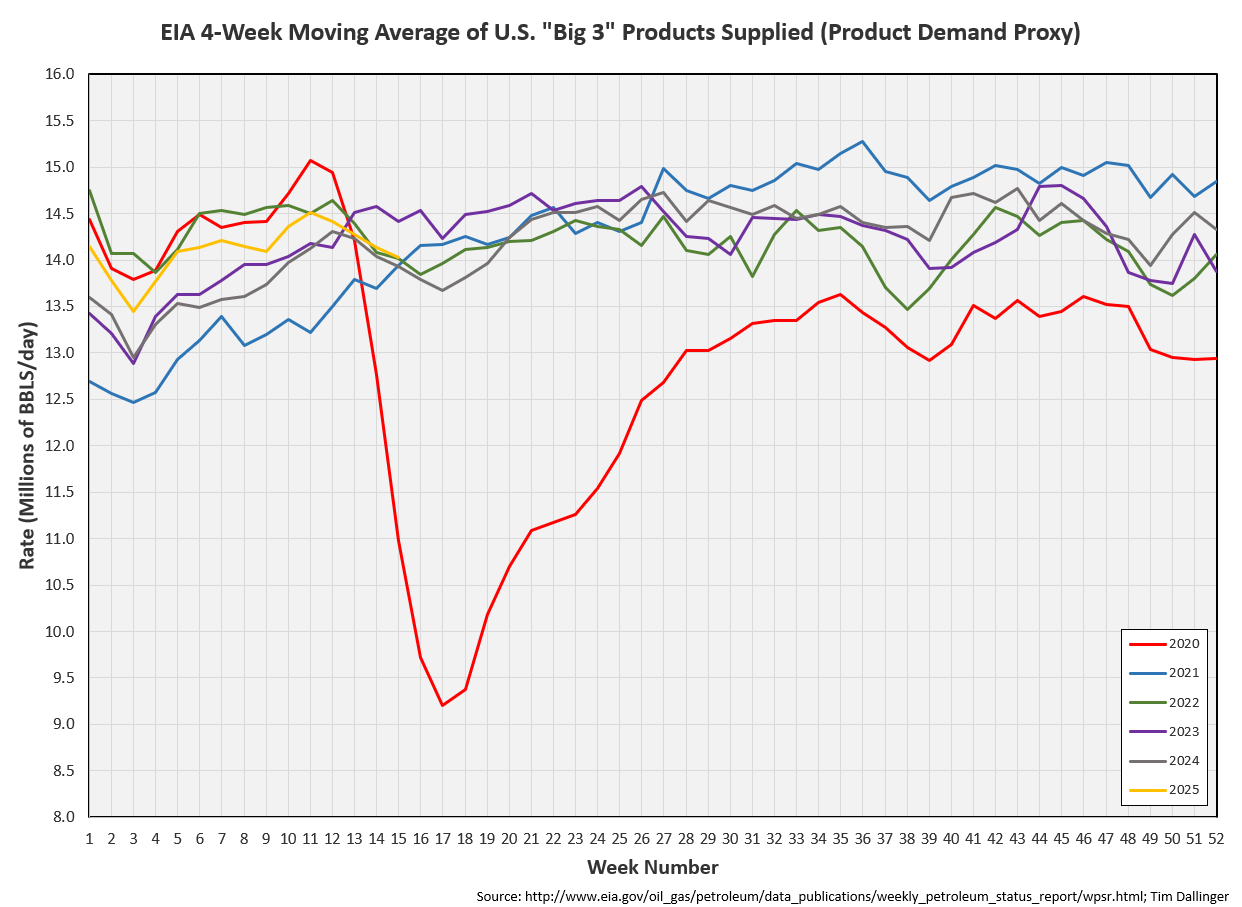

The EIA’s product demand proxy remains under pressure.

However, the demand proxy for transportation inventories remains average.

However, the demand proxy for transportation inventories remains average.

The simply 321 crack spread recovered from last week’s decline.

Discussion

The futures curve has flattened out. Slight contango occurs further down the curve. While contango is normally bearish, crude storage costs for a year are greater than $1. While this is not a bullish development, there’s still no incentive to store.

The paper market continues to dominate the physical.

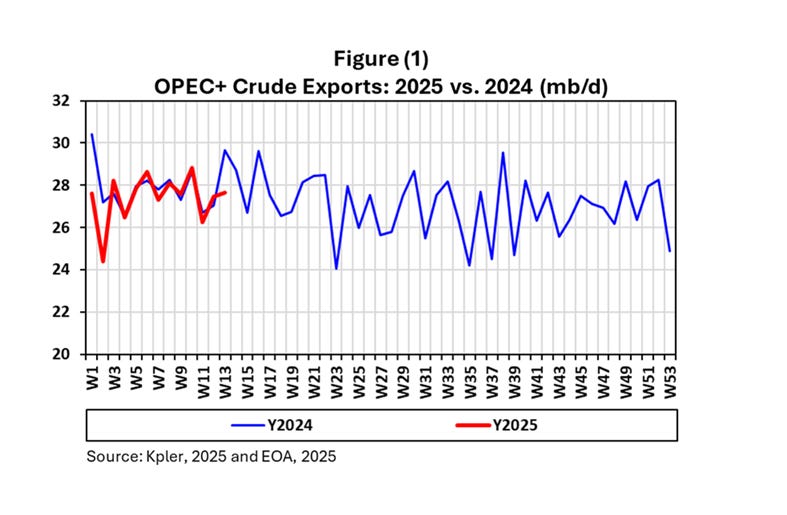

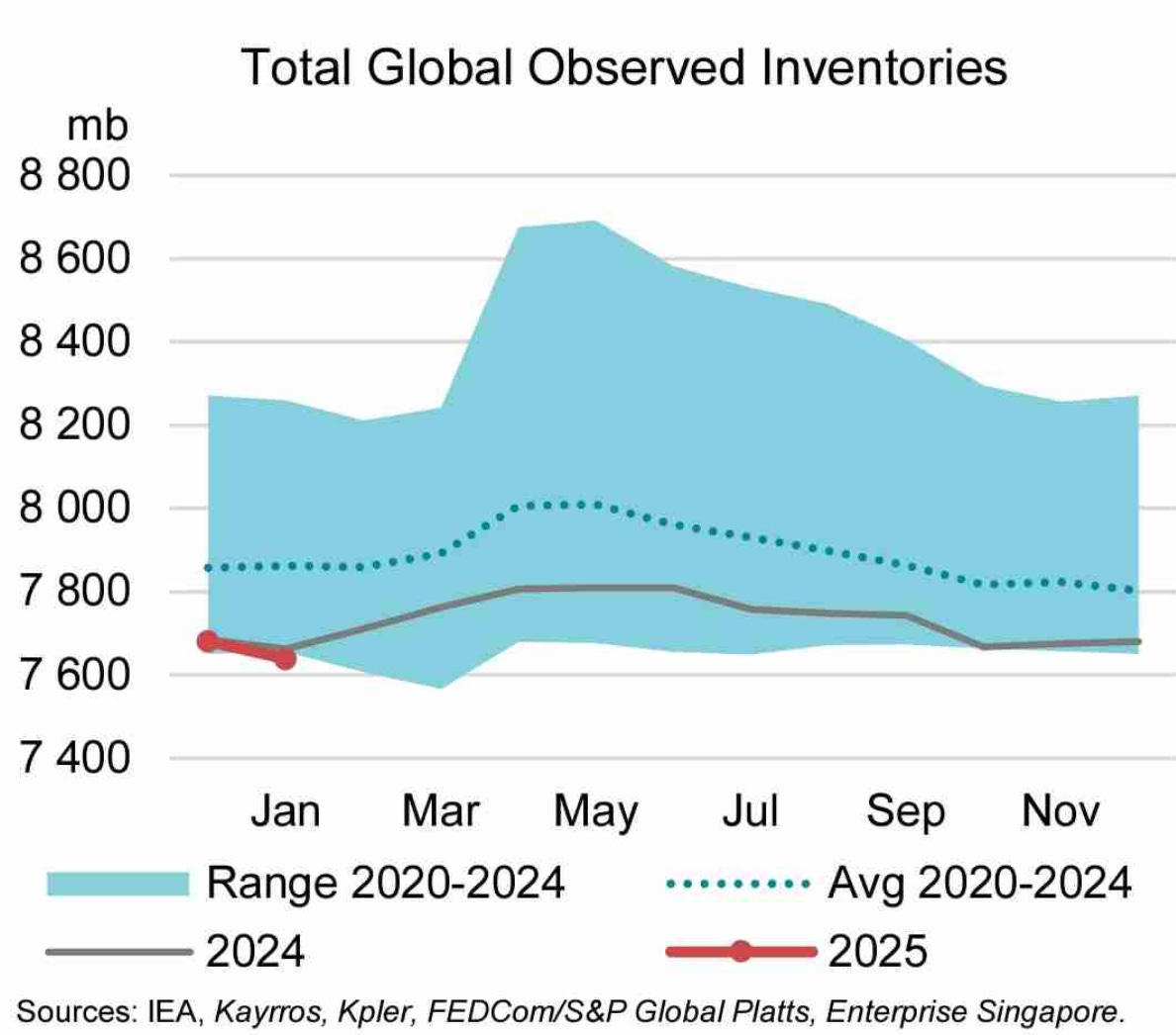

A F Alhajji shared the following graph in his recent post.

A F Alhajji Daily Energy Report

Despite OPEC’s easing of voluntary production cuts, OPEC exports still remain below 2024 levels.

Total observed global inventories are at low levels. Is anyone paying attention?

With today’s strong price movement, perhaps the market is finally starting to notice some of the physical tightness. Or more likely, price action was influenced by the announcement that the US imposed sanctions on Chinese refineries for purchasing Iranian crude.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Doc Brown reassures Marty Mcfly in the 1985 sci-fi classic film, Back to the Future.