EIA WPSR Summary for week ending 11-29-24

If You Knew That You Knew Nothing, That Would Be Something, But You Don’t

EIA WPSR Summary for week ending 11-29-24

Summary

Crude: -5.1 MMB

SPR: +1.4 MMB

Cushing: +0.1 MMB

Gasoline: +2.4 MMB

Distillate: +3.4 MMB

Jet: -0.8 MMB

Ethanol: +0.1 MMB

Propane: -0.7 MMB

Other Oil: -3.8 MMB

Total: -4.7 MMB

Bullish seasonal report.

Spot WTI is currently pricing $68. Spot WTI remains deeply discounted versus the estimated fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply drew by 5.1 MMB. Crude inventories are currently 5% below the seasonal average. Only 2022 experienced lower seasonal crude oil inventories in the past 5 years.

1.4 MMB were added to the SPR. SPR inventories are currently just over 2022 levels.

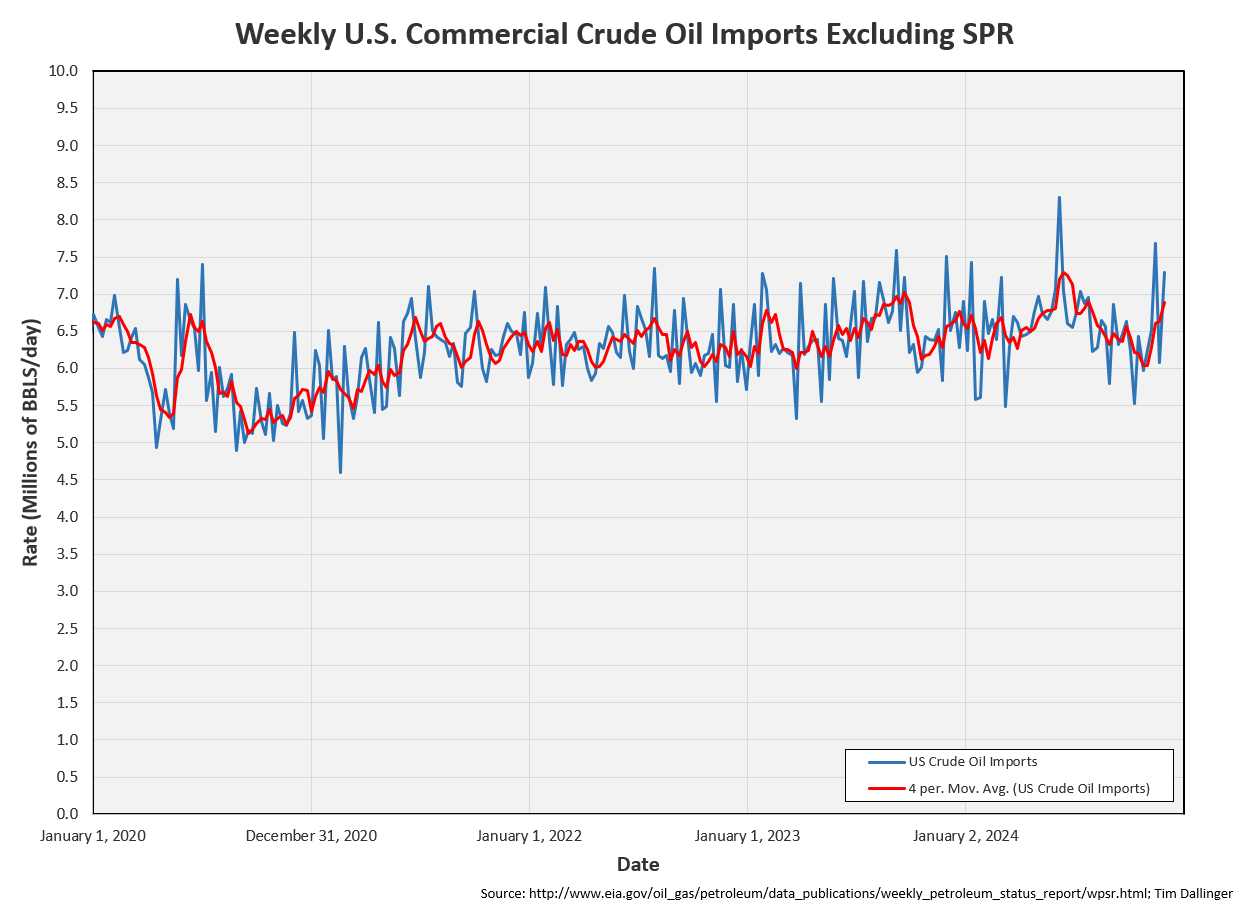

US crude imports remain high. This should be anomalous.

US Crude exports recovered off the lows and are near the annual average.

Unaccounted for crude turned negative.

It isn’t apparent as to whether imports were over-counted this week or US Production is overstated.

Cushing

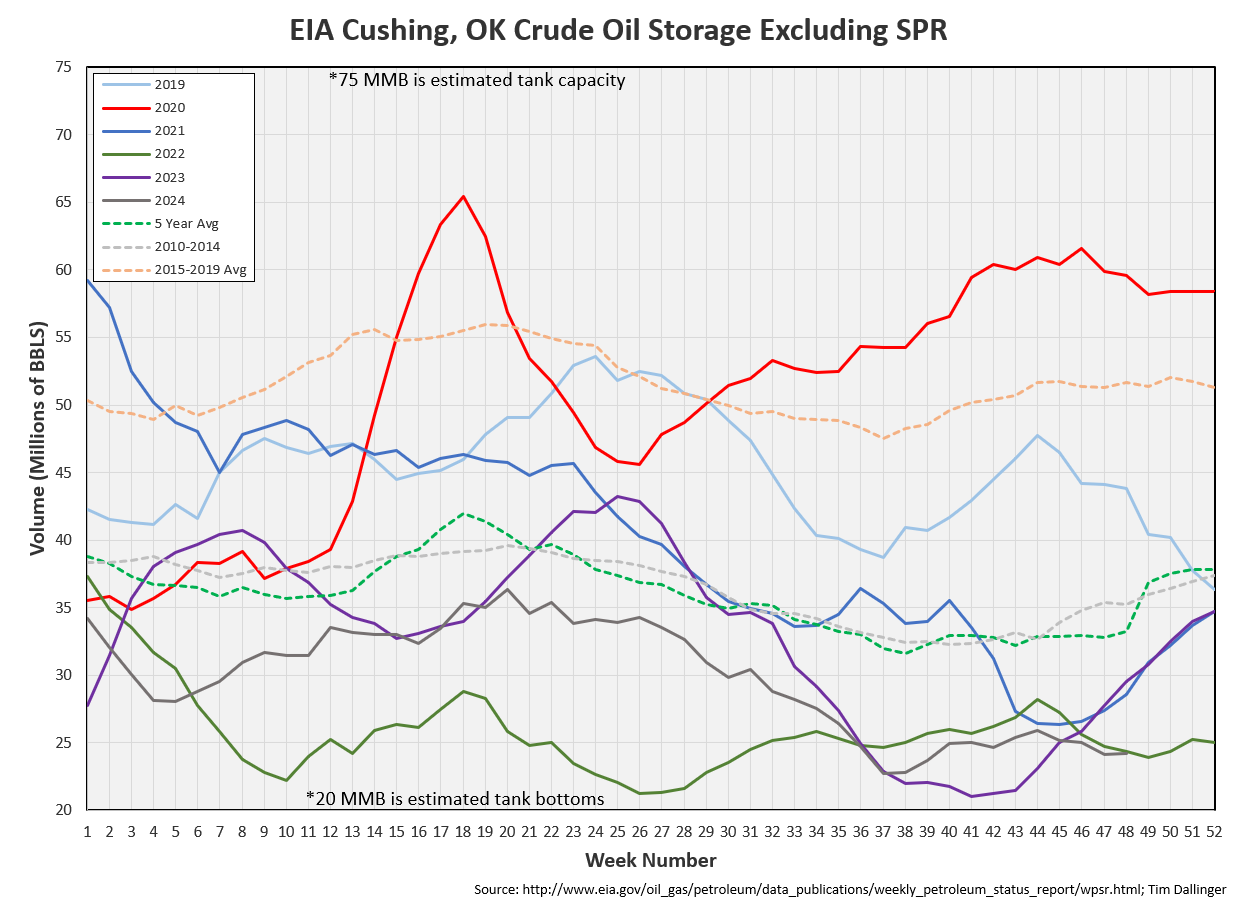

Crude storage in Cushing, OK, built by 0.1 MMB week on week. Cushing inventories are at the lowest seasonal level they have been in a decade.

Gasoline

Total motor gasoline inventories increased by 2.4 MMB and are about 4% below the seasonal 5-year average. Gasoline seasonal inventories are currently near record lows. They will build into year end.

Distillate

Distillate fuel inventories increased by 3.4 MMB last week and are about 5% below the seasonal 5-year average.

Jet

Kerosene type jet fuels decreased by 0.8 MMB.

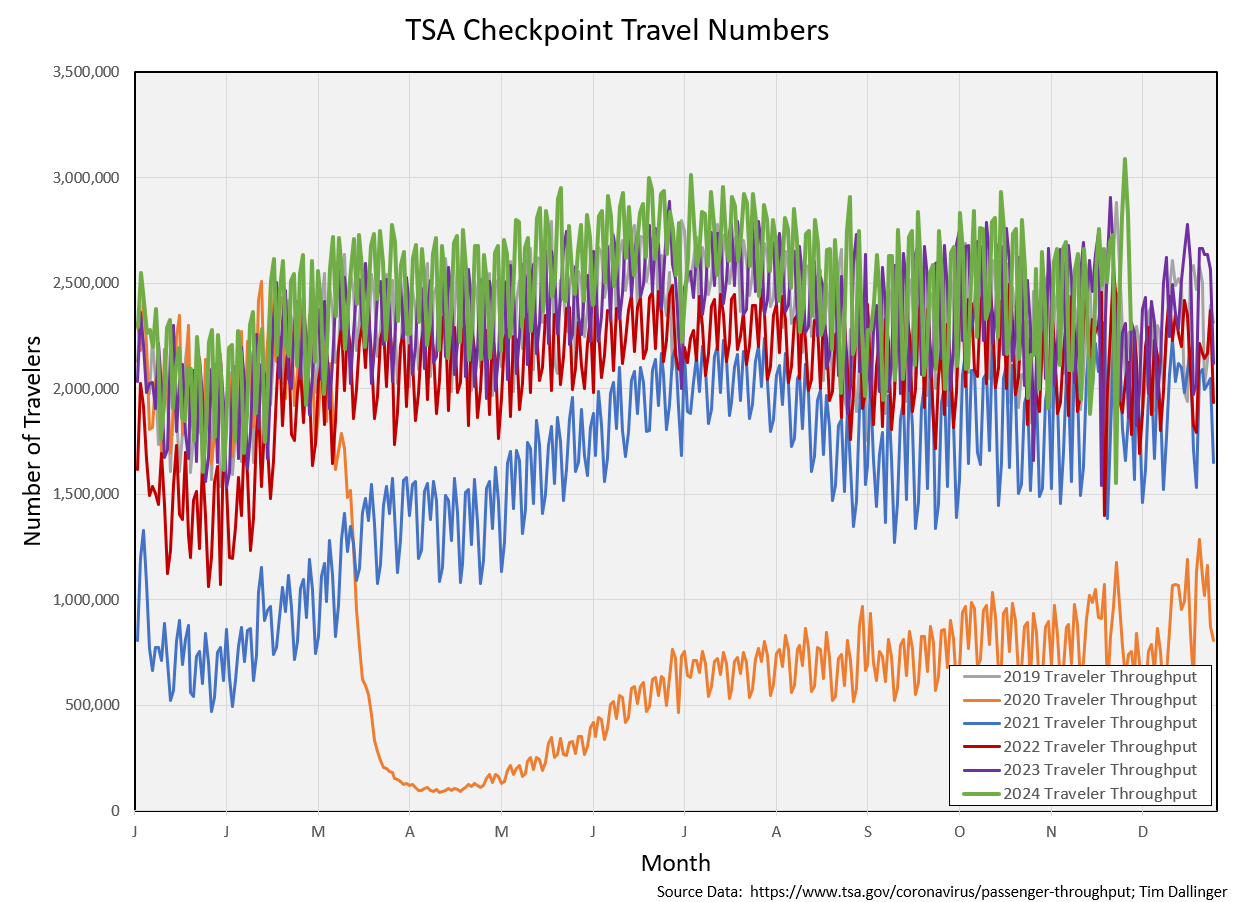

The number of travelers passing through TSA hit a record on Sunday, 12-1-24.

Ethanol

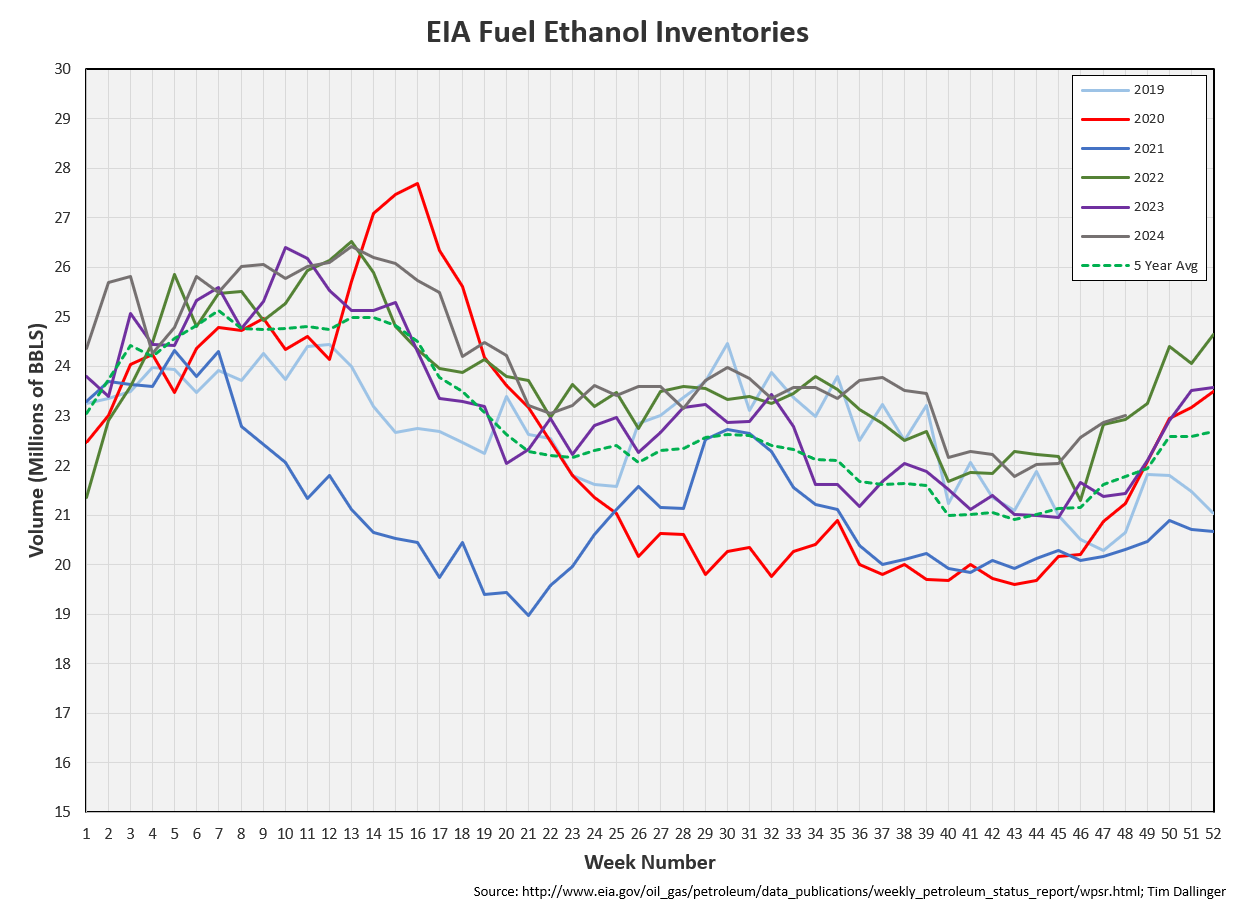

Ethanol inventories increased by 0.1 MMB week-on-week. Inventories are above seasonal averages, just above the 2022 high.

Propane

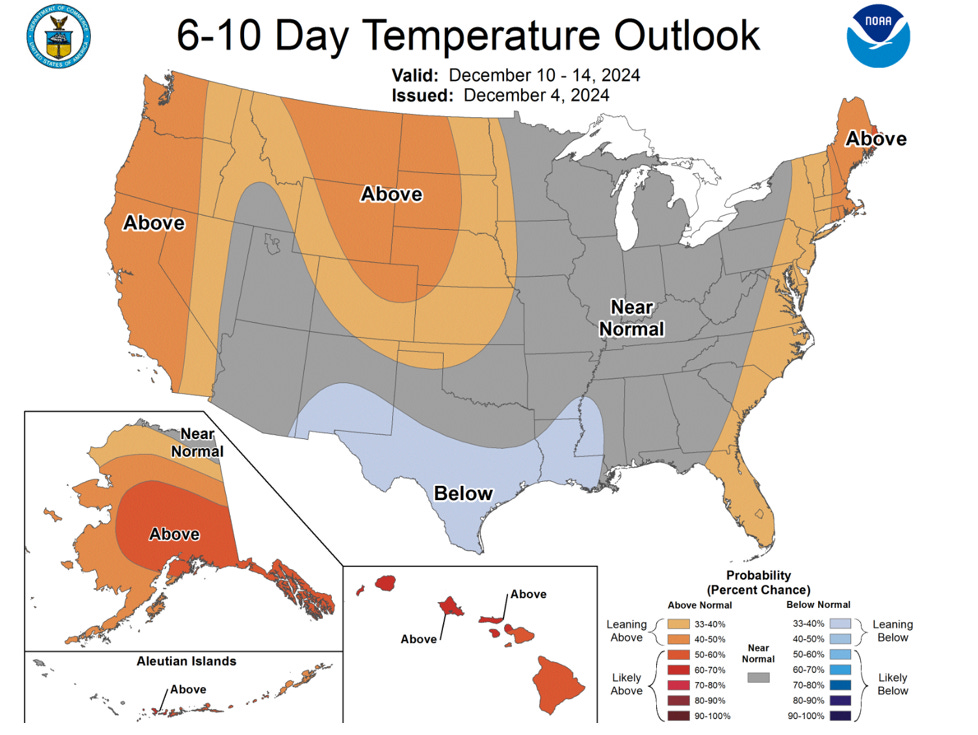

Propane/propylene inventories drew by 0.7 MMB as heating demand increases.

Weather appears to be mild next week. That won’t help heating demand.

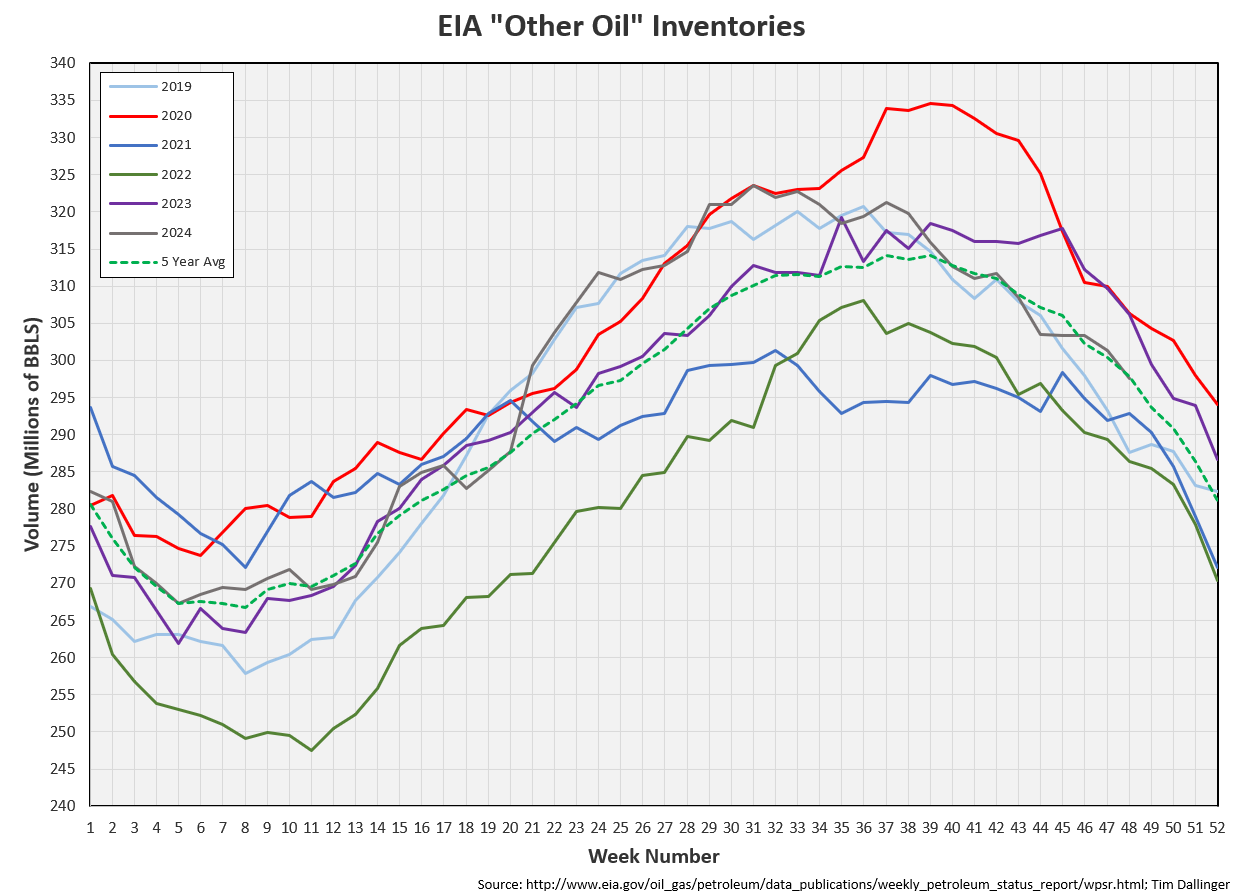

Other Oil

Other oil decreased by 3.8 MMB. Inventories are at the seasonal average.

Total Commercial Inventory

Total commercial inventory drew by 4.7 MMB.

Natural Gas

Natural gas inventories are at record levels, surpassing COVID. US production continues to experience increased associated gas.

Refiners

Us refiners again processed a record amount of crude. This is a seasonal demand record.

The EIA’s product demand proxy matches 2022 levels.

Transportation inventories are near the 2023 lows.

If crude oil is included, only 2022 was had lower inventories in the past 5 years.

Simple cracks retreat as refiners come back online.

Discussion

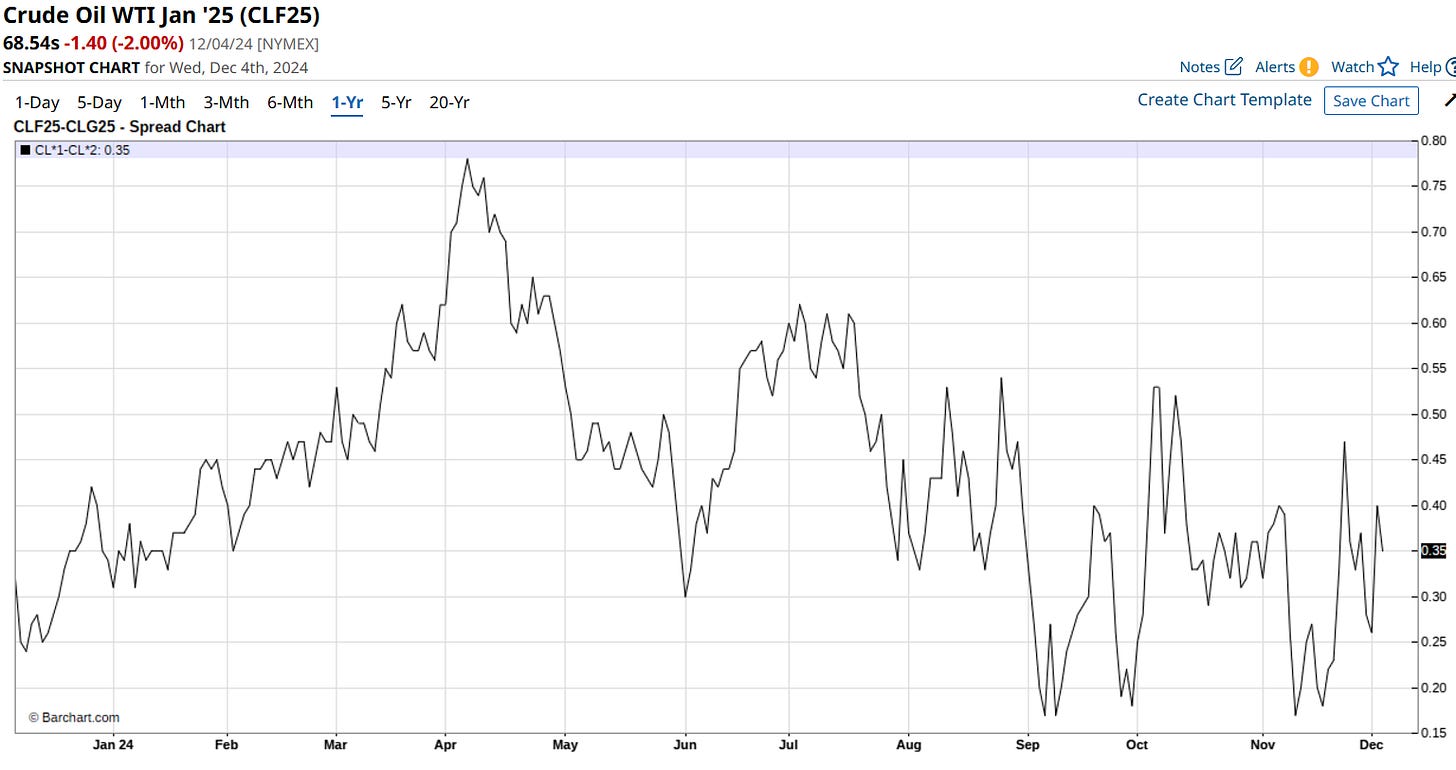

Backwardation remains across the term structure.

Some readers have questioned whether there really are bullish signals in these graphs as pricing continues to struggle. Good-faith criticism is always welcomed and perhaps warranted. Maybe global inventories aren’t showing similar trends?

Morgan Stanely has access to some non-public datasets. These are the inventory graphs from last week:

Source: Morgan Stanely Oil Data Digest

Both crude and products are near the 5 year-low for the monitored global inventories.

OPEC+ met over the weekend and agreed to maintain the current cuts longer. Subsequently, energy agencies are cutting their 2025 surplus expectations.

There continues to be significant discrepancy between historical prices and physical market signals. Anecdotally, crude traders, experienced energy analysts and production management teams haven’t seen a market behave in this manner for an extended period of time. One should expect prices will rebound or physical data will start to turn bearish.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Ben Harp, played by John C McGinley, gives special agent Johnny Utah, Kenau Reeves, a warm welcome to the FBI in the 1991 action crime thriller, “Point Break.”