EIA WPSR Summary for week ending 9-20-24

Summary

Crude: -4.5 MMB

SPR: +1.3 MMB

Cushing: +0.1 MMB

Gasoline: -1.5 MMB

Distillate: -2.2 MMB

Jet: -1.1 MMB

Ethanol: -0.3 MMB

Propane: -1.5 MMB

Other Oil: -1.6 MMB

Total: -14.6 MMB

Spot WTI is currently pricing $69. Prices remain significantly undervalued based on a price model derived from reported EIA inventories. The divergence between price and inventories continues.

Crude

US Crude oil supply drew by 4.5 MMB. Crude inventories are currently 5% below the seasonal average. This is the lowest crude inventories since early 2022.

1.3 MMB were added to the SPR. SPR inventories return to December 2022 levels.

The US has made an effort to refill the SPR but levels remain 342 MMB lower than the peak.

US crude imports were about even week-on-week.

US Crude exports fell back slightly. Independent ship trackers expected exports to come in higher this week.

Unaccounted for crude flipped negative. The EIA may have overcounted some Gulf production that was shut-in due to the recent storm. The average is oscillating near zero as it should.

Cushing

Crude storage in Cushing, OK, built by 0.1MMB week on week. Cushing tanks are still on their heels.

Gasoline

Total motor gasoline inventories decreased by 1.5 MMB and are about 1% below the seasonal 5-year average.

Distillate

Distillate fuel inventories decreased by 2.2 MMB last week and are about 9% below the seasonal 5-year average.

Jet

Kerosene type jet fuels drew by 1.1 MMB. Jet fuel inventories are still high but falling. This trajectory should continue through the fall months.

Both global active flights and air miles traveled remains at seasonal records.

China is showing strength in the air travel market.

https://www.airportia.com/flights-monitor/

Ethanol

Ethanol inventories decreased 0.3 MMB week-on-week. Inventories are above seasonal averages.

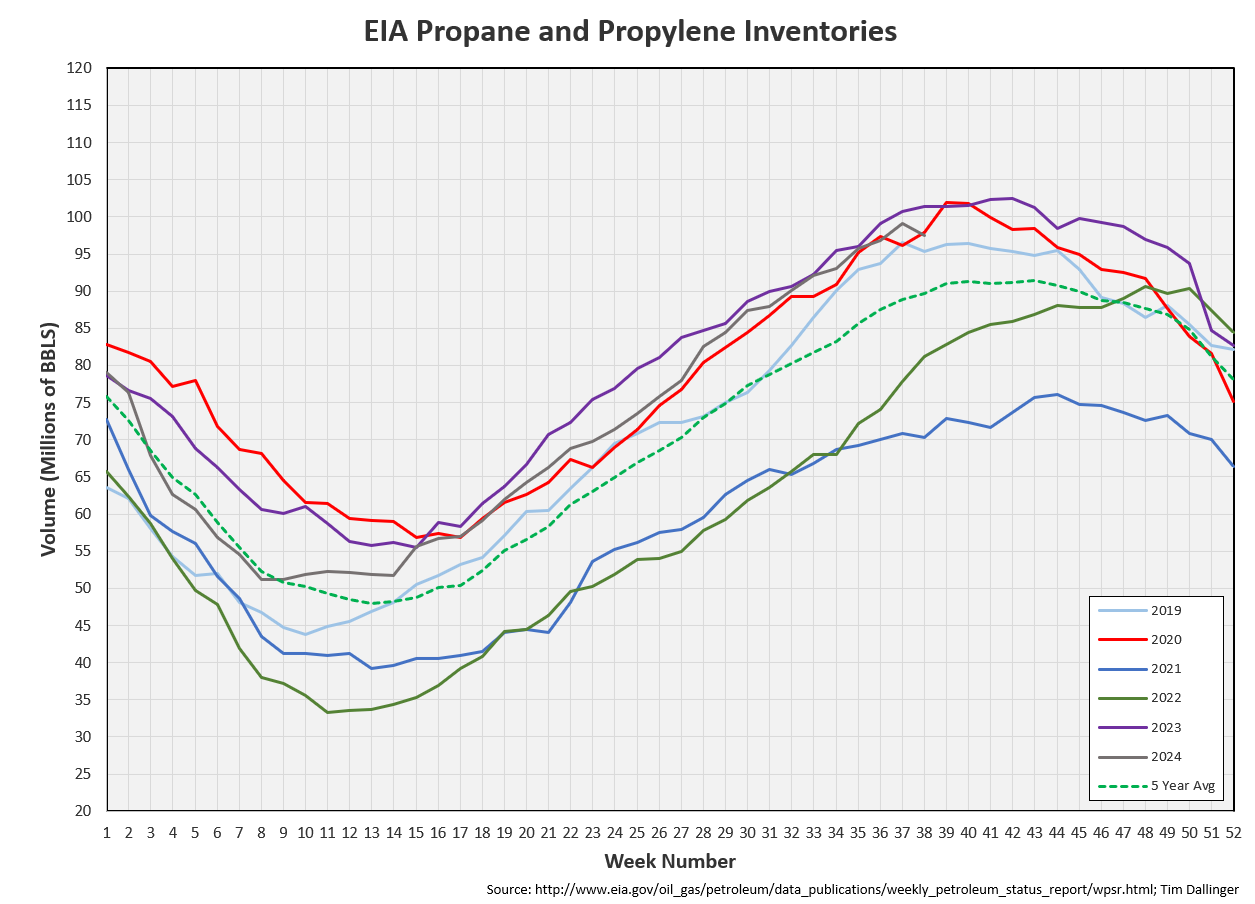

Propane

Propane/propylene inventories decreased 1.5 MMB. It’s a little early for seasonal propane demand to increase. Expect more builds before levels fall into year end.

Other Oil

Other oil inventories drew by 1.6 MMB. Inventories are above average but it appears the late years draws have started.

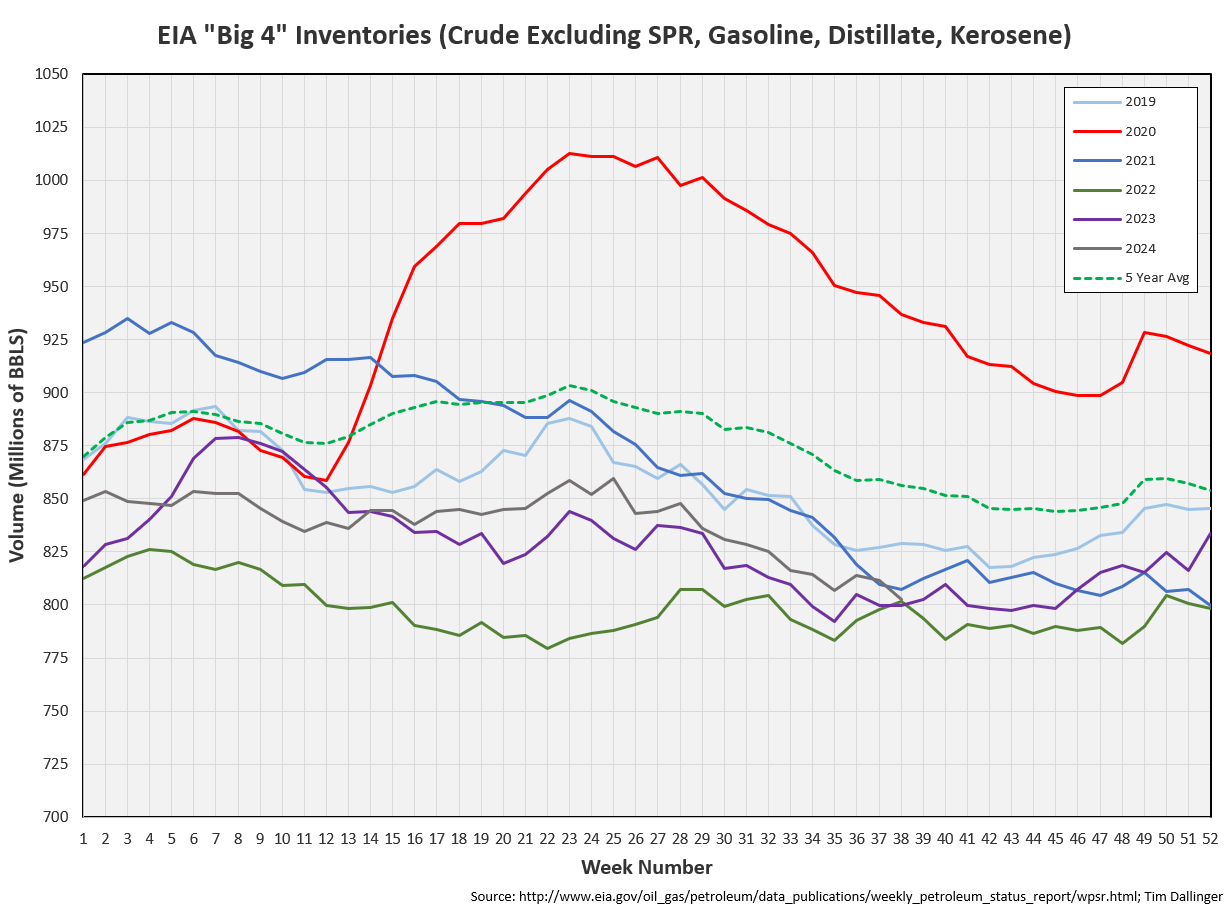

Total Commercial Inventory

Total commercial inventory fell by 14.6 MMB. Total commercial inventories are below seasonal averages.

Natural Gas

Natural gas inventories built last week, as expected.

Refiners

Refining fell slightly. Refiners continue to show strength in the face of weak crack spreads. Only 2019 has shown higher seasonal throughput.

The moving average for EIA’s product demand proxy does not convey strength. However, actual inventories are much more important than the calculated proxy.

Transportation demand proxy is higher than the previous 2 years though.

Transportation inventories are below average but above the previous 2 years.

Including crude though and inventories match the lowest seasonal levels in years.

Simple cracks appear to have bottomed, just prior to maintenance season.

Discussion

Both the WTI and Brent futures curve remain backwarded.

WTI backwardation extends until the end of next year.

The divergence between price and inventories continues. Crude rallied earlier this week, only to be sold off again, despite bullish API and EIA figures. Short interest continues to remain near record levels.

OPEC+ exports are low. Even previous non-compliant countries have fallen in line. Despite headlines, Chinese is still importing substantial crude. Physical markets tighten and inventories draw.

Something must give.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Dr. Hannibal Lector, portrayed by Anthony Hopkins, taughts Clarice, Jodie Foster in the 1991 award-winning American thriller Silence of the Lambs.

Special thanks to

for the inspiration for the title of this week’s publication.

Excellent. Keep up the good work.

Appreciated!!!!