EIA WPSR Summary for week ending 1-26-24

This Will Not Stand, You Know. This Aggression, Will Not Stand, Man

Summary

Moderately bullish report, considering seasonality.

Crude: +1.2 MMB

SPR: +0.9 MMB

Cushing: -2.0 MMB

Gasoline: +1.2 MMB

Ethanol: -1.5 MMB

Distillate: -2.5 MMB

Jet: -0.7 MMB

Propane: -5.3 MMB

Other Oil: -2.3 MMB

Total: -9.6 MMB

Spot WTI is currently pricing $75. This is fair value based on a price model derived from reported EIA inventories.

Crude

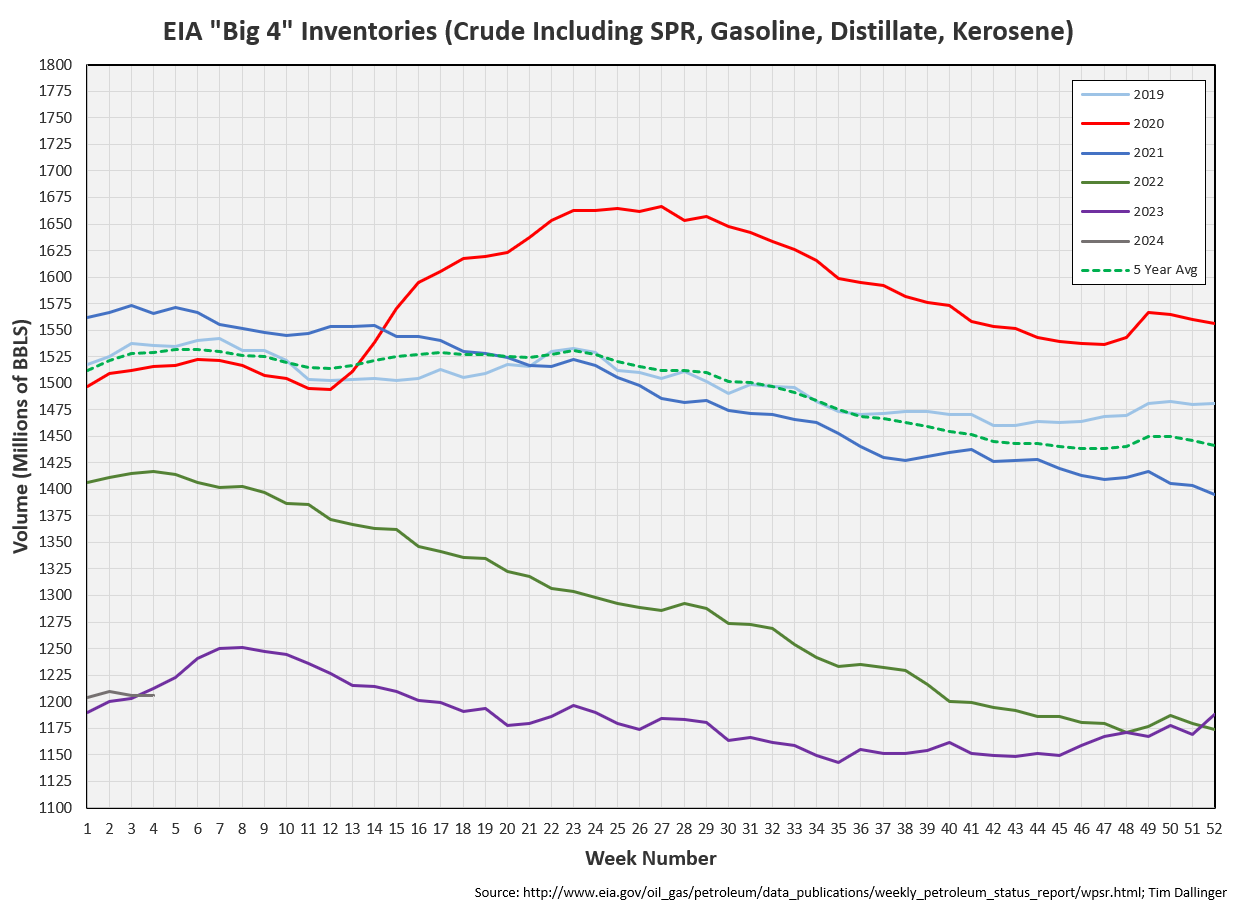

U.S. commercial crude oil inventories increased by 1.2 MMB from the previous week and are about 5% below the seasonal 5-year average.

US production has mostly recovered after the preceding week weather related shut-in’s.

0.9 MMB were added to the SPR. This makes 3.7 MMB total of the 12 MMB planned 2024 purchases.

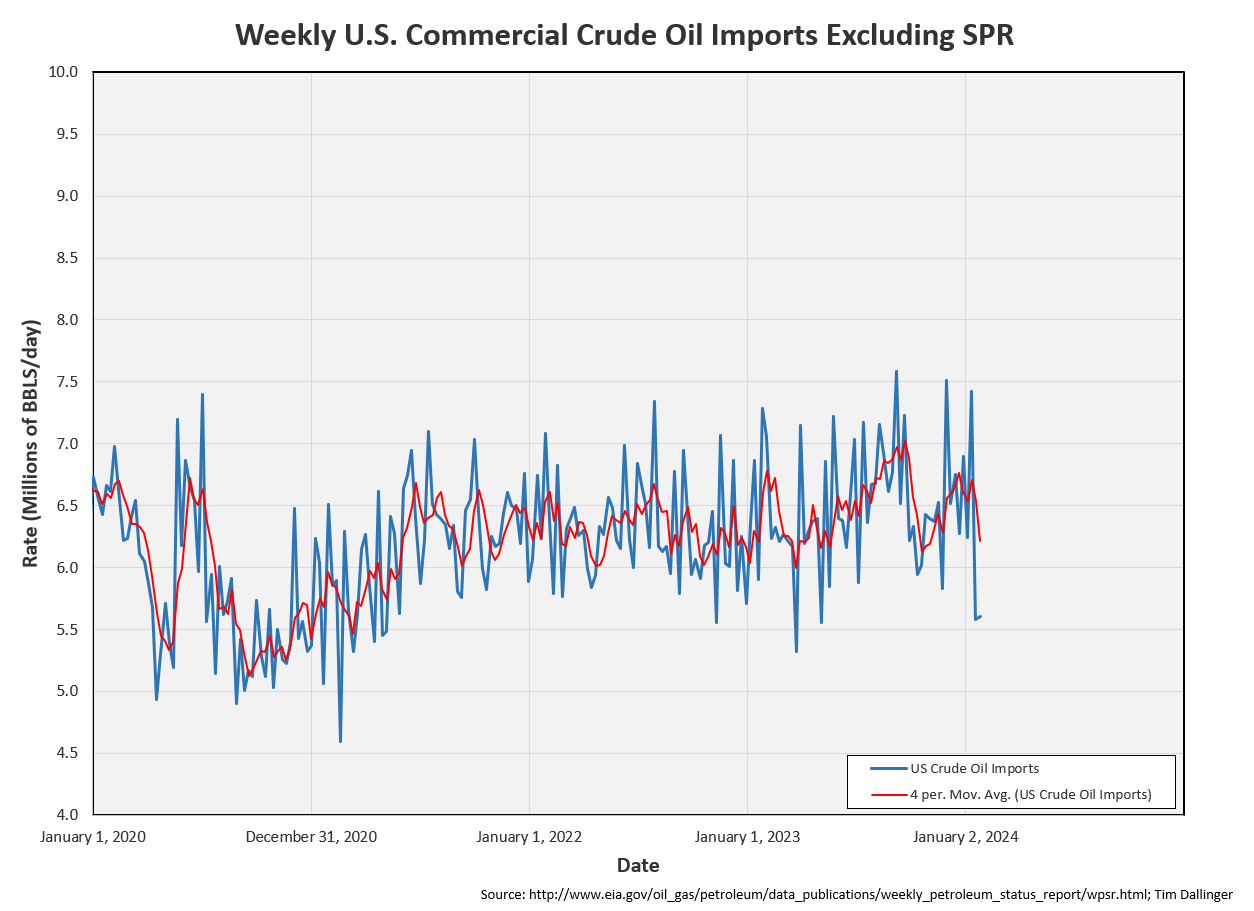

US crude imports remain low.

US crude exports fell some but remain high. US exports should remain resilient. The only potential headwind is that shipping costs have increased recently, globally due higher insurance premiums.

Unaccounted for oil is slightly negative. It appears the EIA has improved this aspect of the model. When they release the condensate analysis in several months, there will be a better understanding of the composition of US production.

Cushing

Cushing drew 2.0 MMB. This seasonal draw looks like it may pressure tank bottoms again over the next two months.

Gasoline

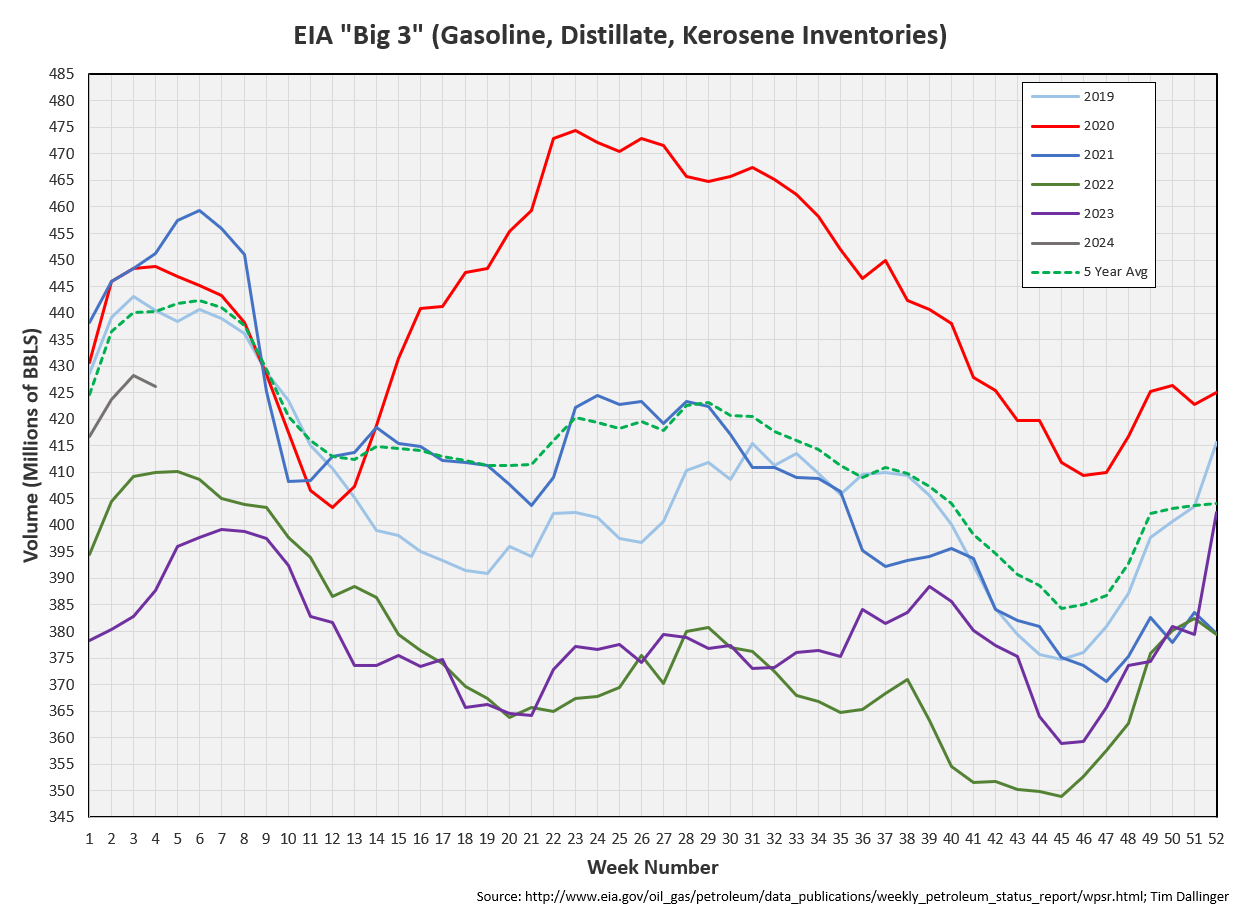

Total motor gasoline inventories increased by 1.2 MMB and are about 1% above the seasonal 5-year average. Gasoline’s seasonal build should end soon when February refinery maintenance season begins.

Ethanol

Ethanol inventories built by 1.5 MMB. Inventories approach average.

Distillate

Distillate fuel inventories decreased by 2.5 MMB last week and are about 5% below the season 5-year average.

Jet

Kerosene type jet fuels decreased by 0.7 MMB. Seasonal jet inventories are above average.

Propane

Propane/propylene inventories decreased by 5.3 MMB from last week. With the previous 2 weeks draws, inventories have fallen below seasonal averages.

Other Oil

Other oil drew 2.3 MMB. Other oil inventories are at the seasonal average.

Total Commercial Inventory

Total commercial inventories decreased by 9.6 MMB and are now below 2023.

Natural Gas

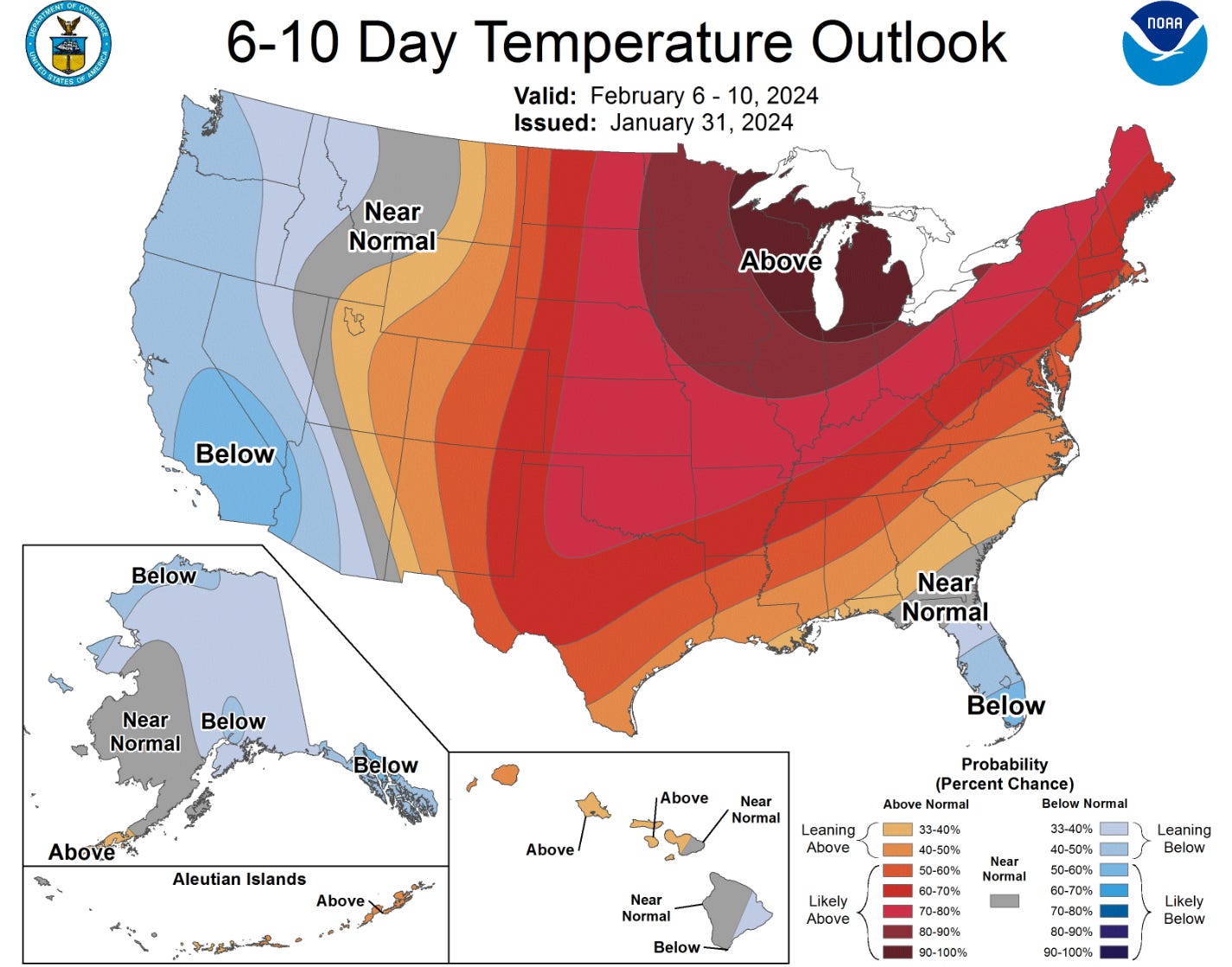

Natural gas drew considerably during the domestic cold snap.

The near-term weather though appears to be warm so it appears that increased demand was only temporary.

Discussion

US refineries were down again. This is likely still weather related. Spring maintenance approaches but it should not have started yet.

US product demand proxies are up week-on-week.

Transportation inventories appear to be near annual peaks. Draws should begin again shortly.

Cracks are healthy.

Crude and transportation inventories look to fall below 2023 levels next week.

Including SPR, inventories are quite low. This can be misleading though as the market doesn’t seem to price SPR as inventory.

Saudi Aramco announces plans to abandon their oil production expansion program. Instead, the focus will be on maintaining the 12 MMBD capacity.

Reimposing Venezuelan oil sanctions is being considered after the Maduro regime blocked candidacy for his leading opposition in presidential election.

Conflict in the middle east rages. Red Sea harassment continues. Russian vessels appear to be allowed to pass.

An unmanned drone strike in Northeastern Jordan killed 3 US servicemen and wounded 12 others. American casualties were previously the red line. The US Administration has guided that it will address those responsible at time and manner of their choosing. No retaliatory strikes have occurred yet.

Iran has denied any link to the attack, claiming this was a reciprocal response to the US military exercises in Syria and Iraq.

Expect escalation to continue.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

The Dude, portrayed by Jeff Bridges, in the 1998 American crime comedy written and produced by the Coen brothers, channels George H.W. Bush’s rhetoric from Operation Desert Storm.