EIA WPSR Summary for week ending 6-14-24

Summary

Crude: -2.5 MMB

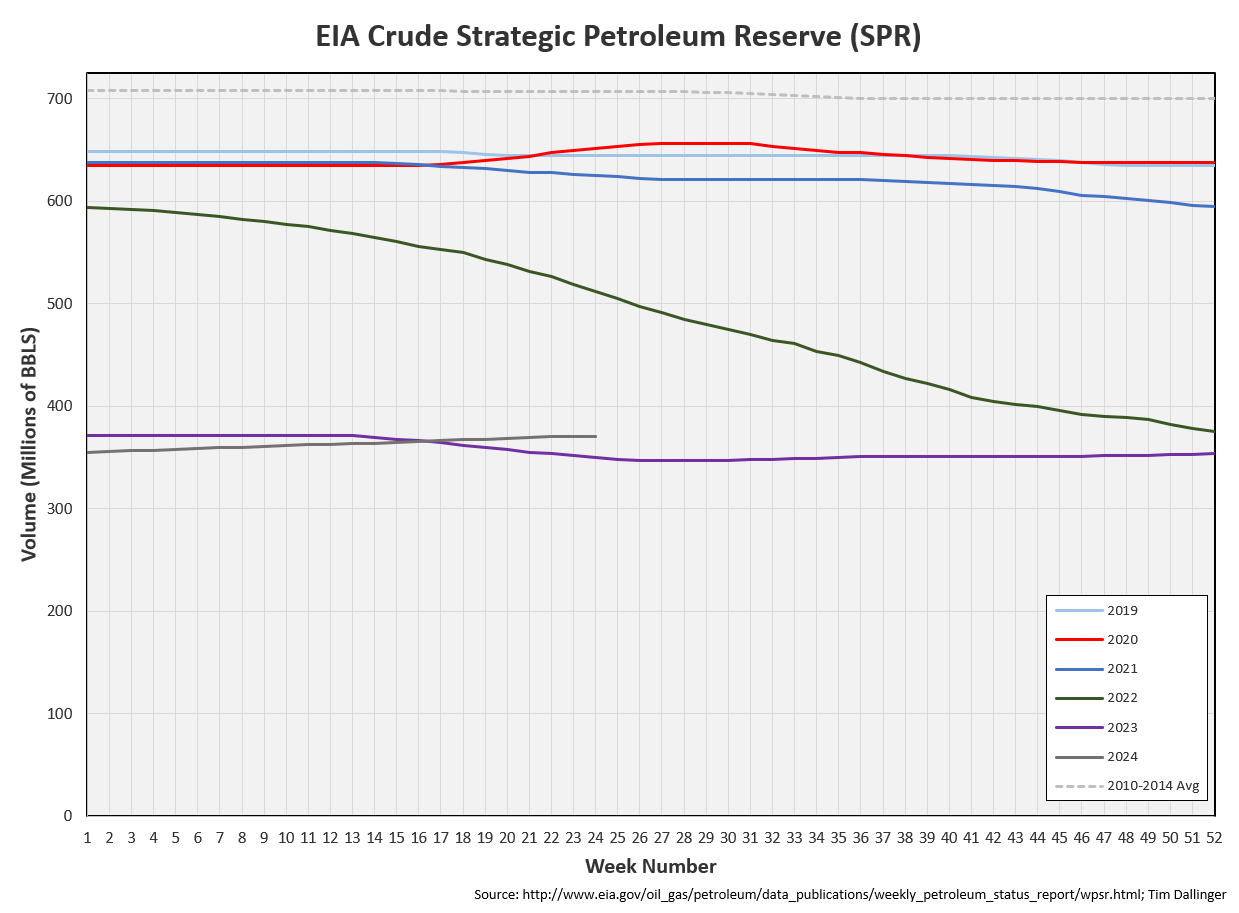

SPR: +0.4 MMB

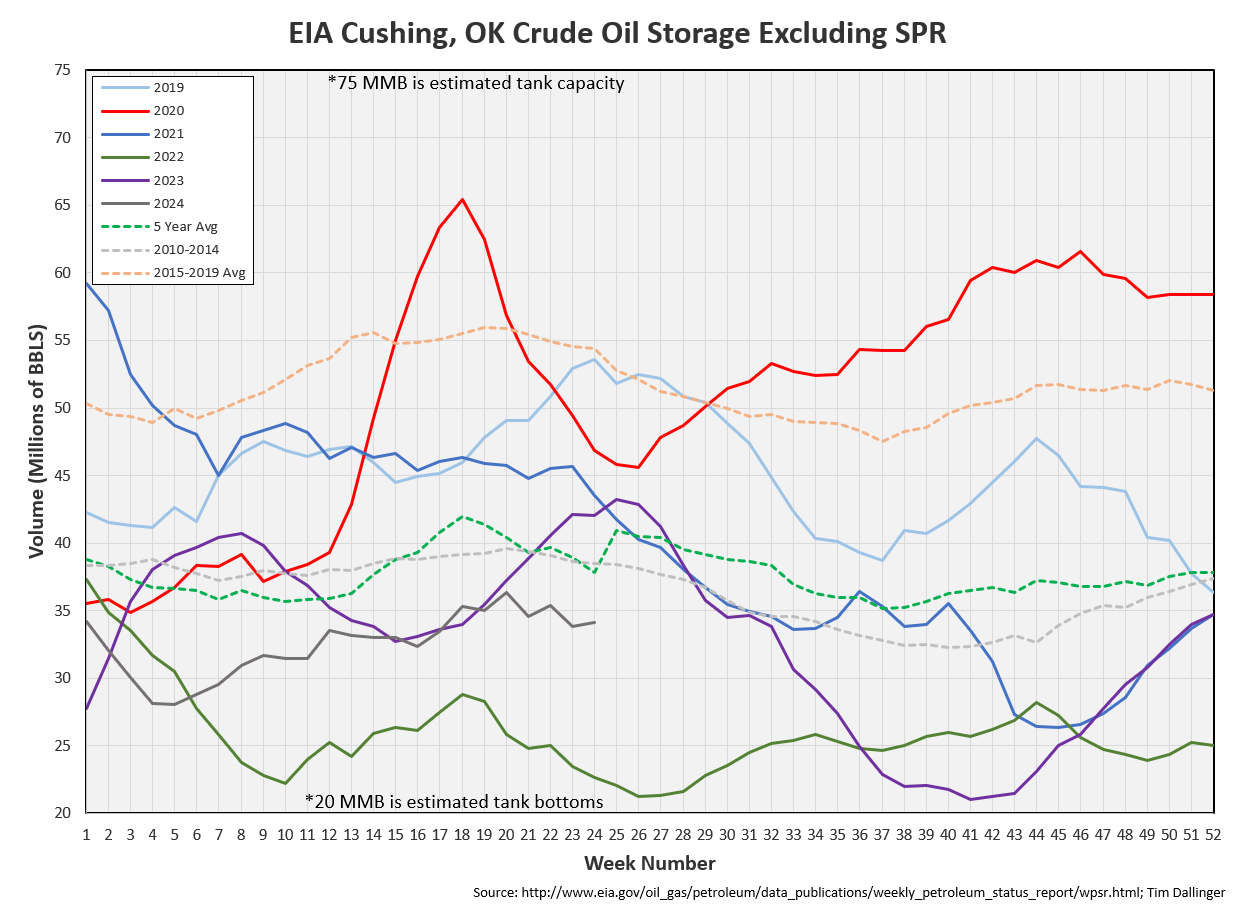

Cushing: +0.3 MMB

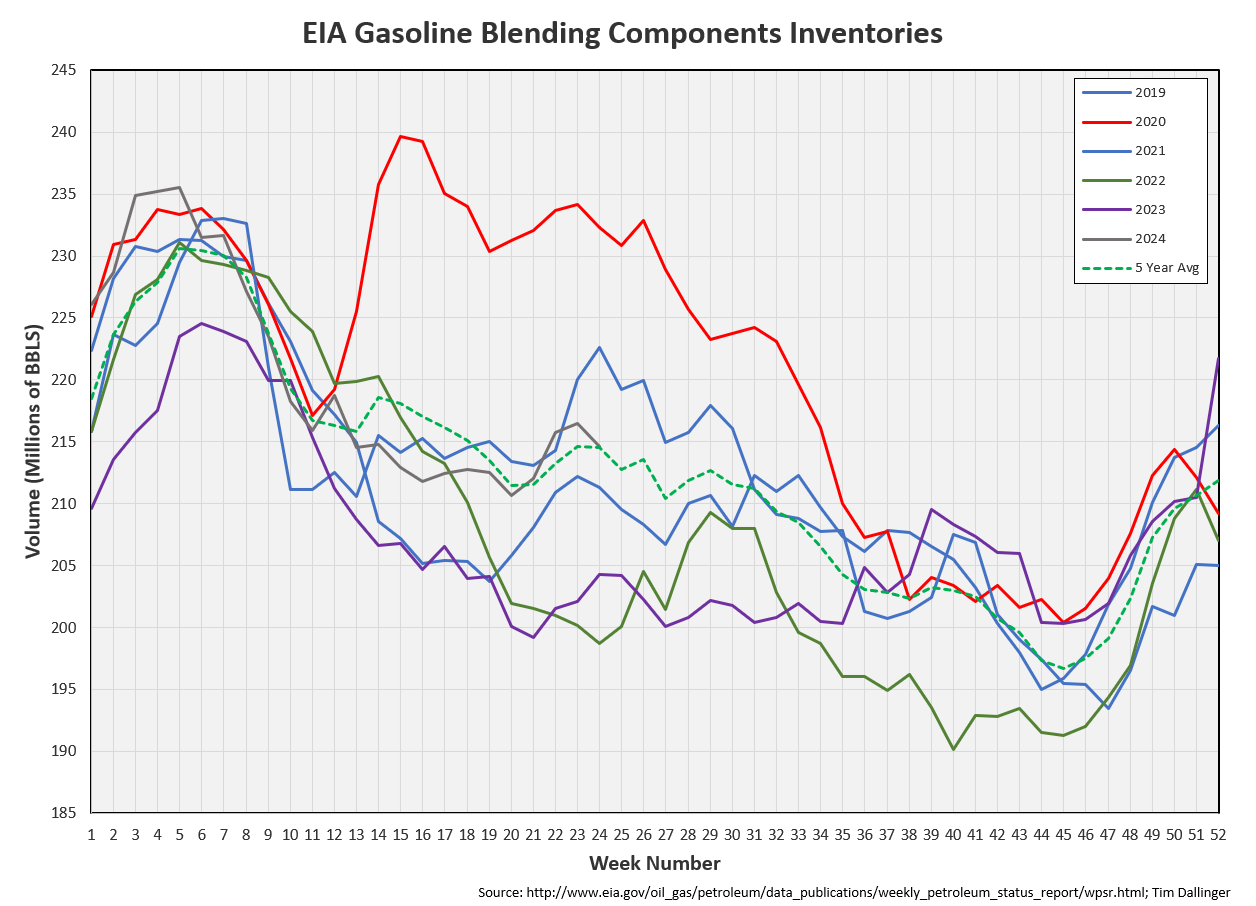

Gasoline: -2.3 MMB

Distillate: -1.7 MMB

Jet: -0.1 MMB

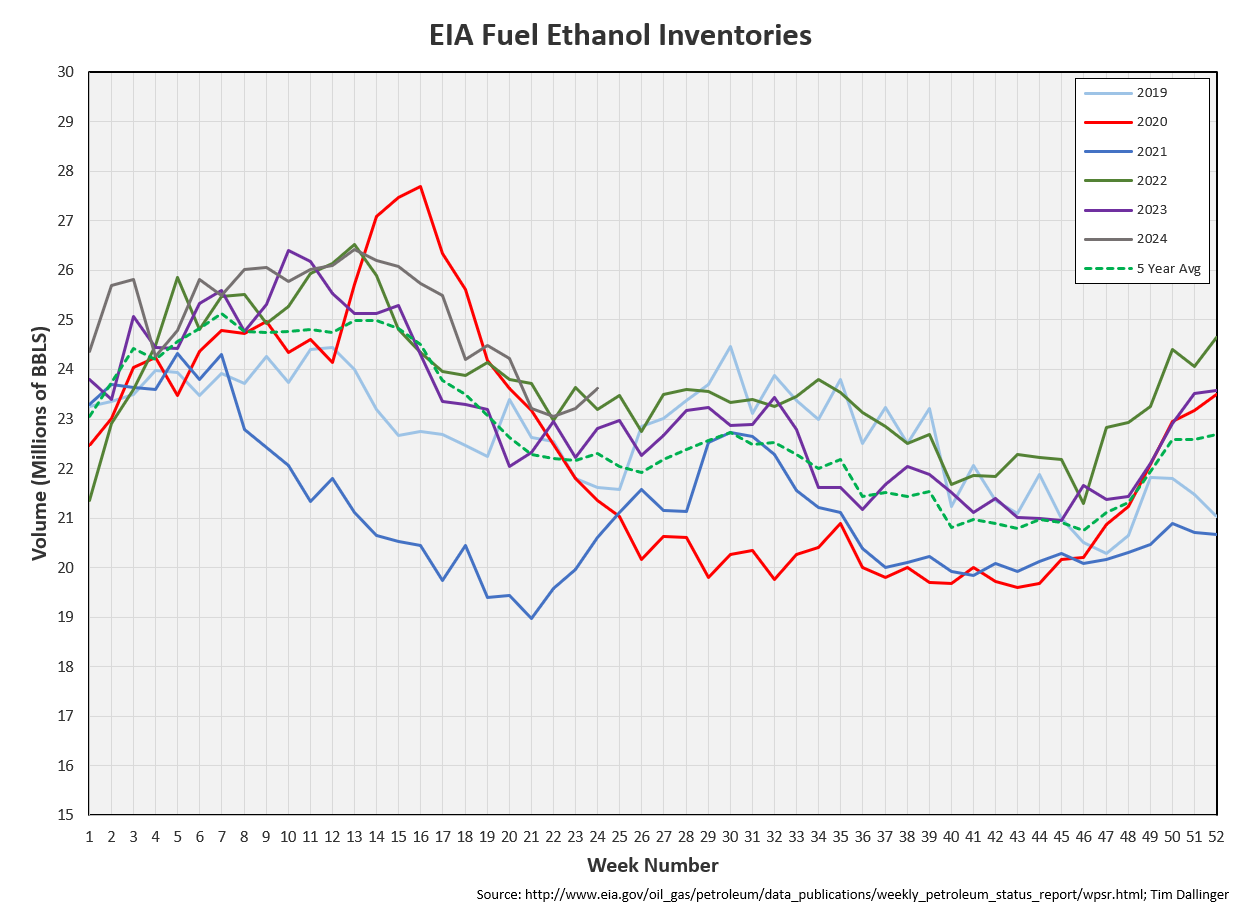

Ethanol: +0.4 MMB

Propane: +1.6 MMB

Other Oil: +4.1 MMB

Total: -0.2 MMB

Bullish report. Spot WTI is currently pricing $81. Prices slightly exceed fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply drew by 2.3 MMB. Crude inventories are currently 4% below the seasonal 5-year average.

0.4 MMB were added to the SPR. 15.9 MMB have been added to the SPR in 2024. A tentative SPR release is again in the news this week. No details have been provided, but the current US Administration suggests another release is an option to try and cool gasoline prices this summer.

US crude imports are still elevated but fell back to a more reasonable level.

Crude exports returned to 4.4 MMB. This is the expected average going forward for the remainder of the summer; elevated but not at record levels.

Unaccounted for crude was near zero. Imports and exports were accurately counted this week, according to independent ship trackers. US Customs still hasn’t corrected some barrels that were overcounted in the previous weeks.

Cushing

Crude storage in Cushing, OK, built by 0.3 MMB week on week. Inventories are lower than average but not at critical levels.

Gasoline

Total motor gasoline inventories decreased by 2.3 MMB and are about 1% below the seasonal 5-year average.

Blending components are at average levels.

Distillate

Distillate fuel inventories decreased by 1.7 MMB last week and are about 8% below the seasonal 5-year average.

Jet

Kerosene type jet fuels decreased by 0.1 MMB. Inventories are at the 5-year average.

Ethanol

Ethanol inventories increased 0.4 MMB week-on-week. Inventories are about 5% above seasonal averages.

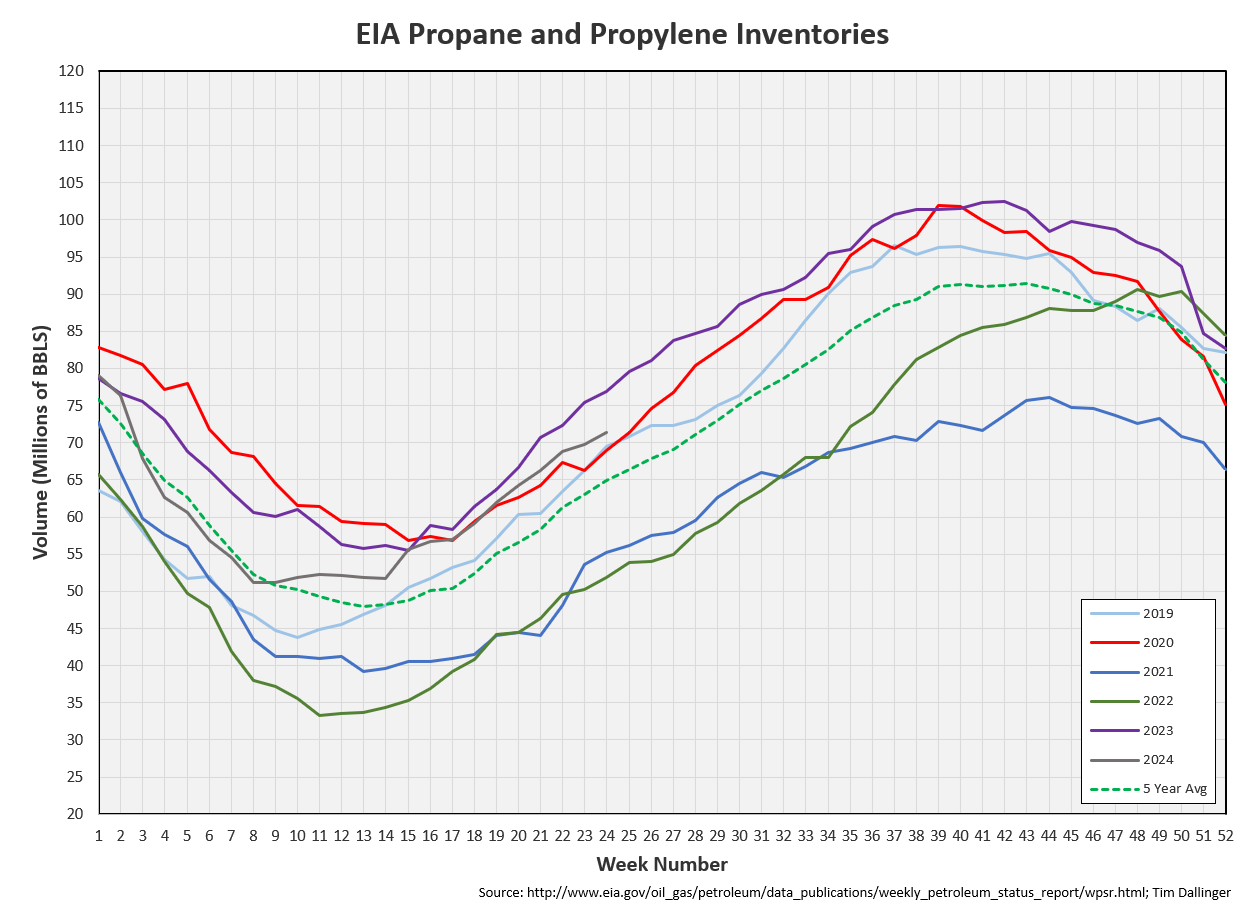

Propane

Propane/propylene inventories increased at 1.6 MMB. The build trajectory has slowed.

Other Oil

Other oil built by 4.1 MMB. Other oil inventories ae elevated.

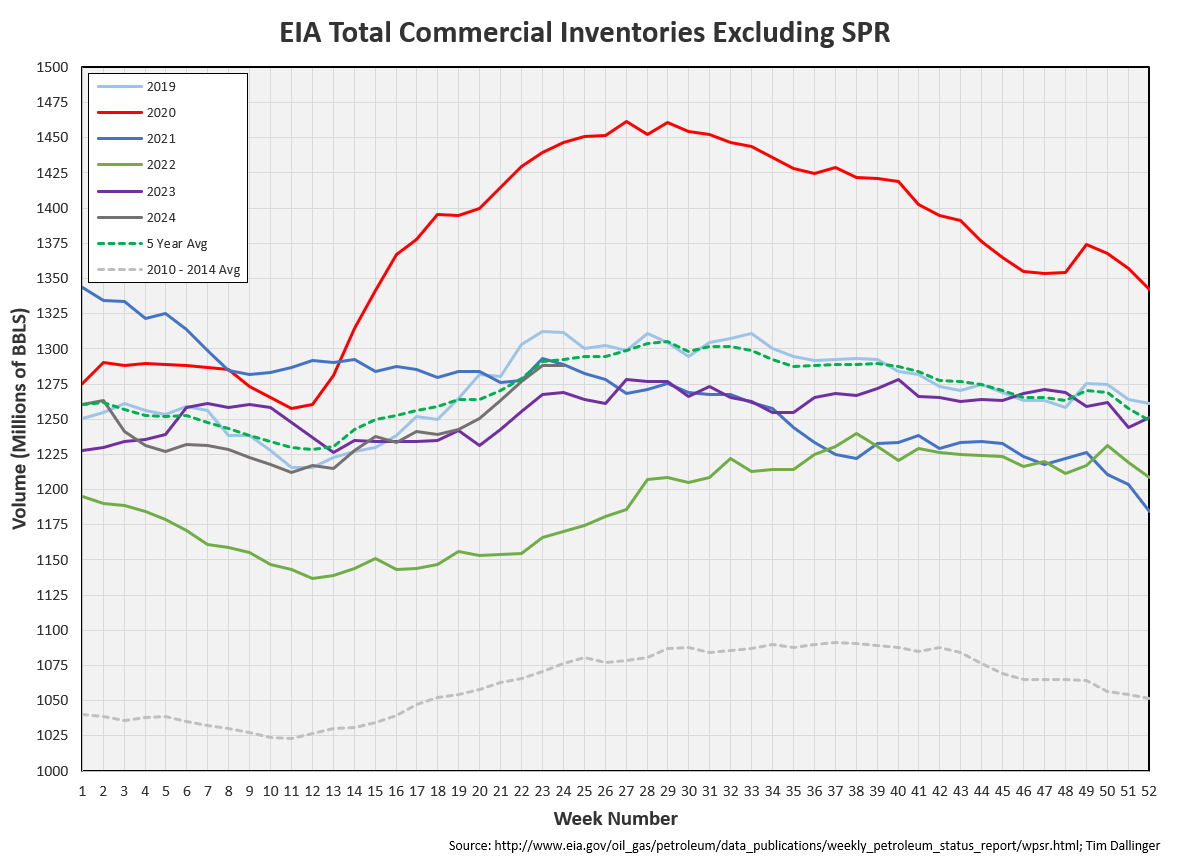

Total Commercial Inventory

Total commercial inventory drew by 0.2 MMB. Total inventories are near the seasonal average.

Natural Gas

Natural gas inventories remain at seasonal records.

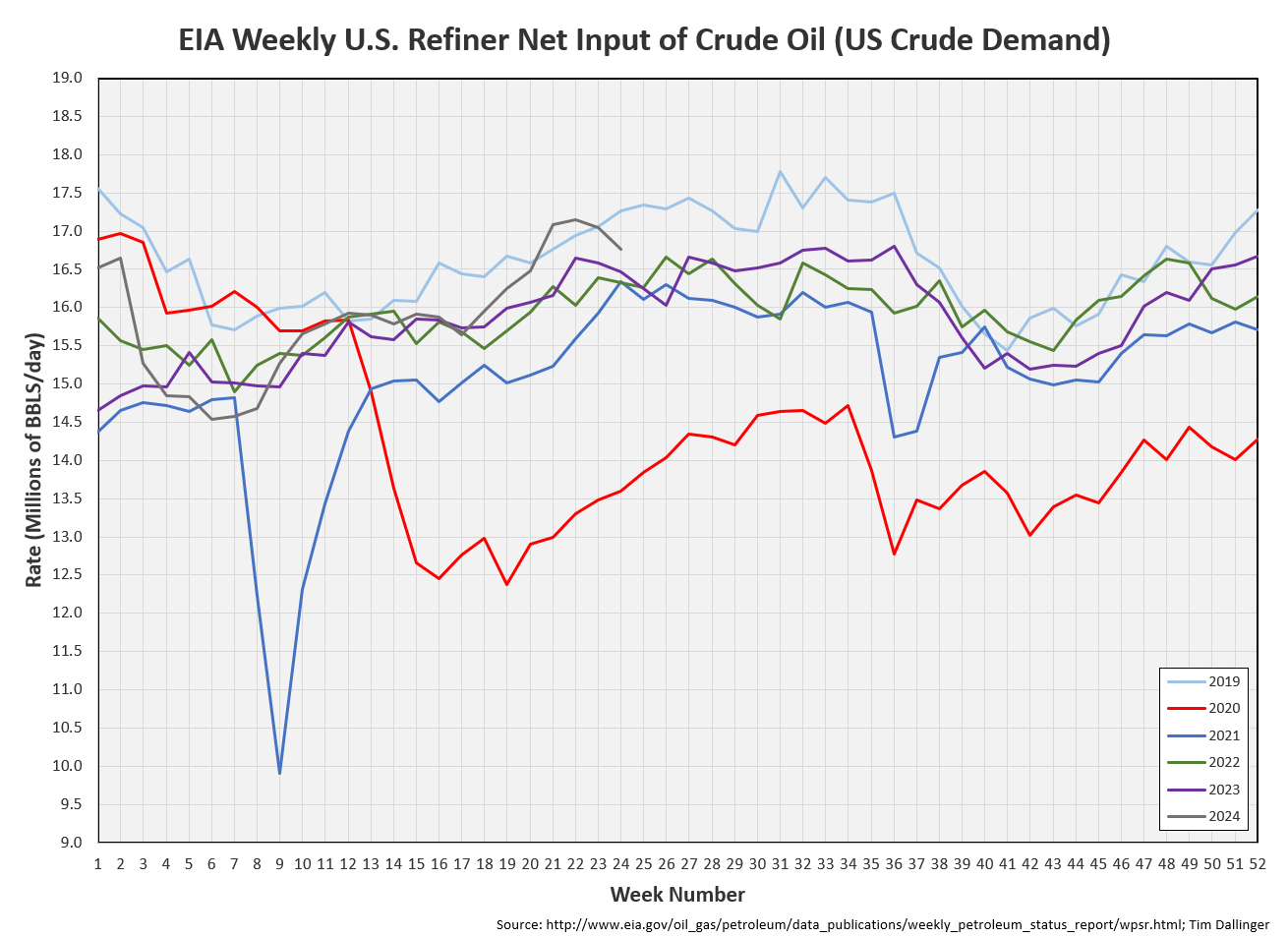

Refiners

The amount of crude oil refiners processed last week fell back from record levels. Utilization is still high.

The EIA’s product demand proxy showed strength last week but is slightly down on a moving average basis.

Transportation inventories drew with increased demand and decreased refiner production.

Simple cracks would have responded more if crude wouldn’t have jumped so much.

Discussion

Timespreads show physical crude is tightening again.

Ship tracking service Kpler is showing a drastic reduction in Saudi Arabian crude exports this month. KSA appears motivated to keep prices elevated.

The recent financial position washout was overdone and prices have bounced back higher as speculators must contend with the realities of improving physical markets.

Economic data is starting to show some weakness and yet, energy demand is not. The Statistical Review of World Energy released a report this week that showed global fossil fuel consumption hit an all-time high in 2023. That shouldn’t be a surprise for those following this report, especially those weeks that highlight comments from the refiner quarterly conference calls.

Despite several weeks of soft EIA data, the bull thesis remerges this week. One must continue to watch for recessionary pressures. But petroleum inventories look to trend down over the summer, supporting higher prices.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

“Break my Stride” was a 1983 high single by American recording artist Matthew Wilder.

🙏🏻