EIA WPSR Summary for week ending 3-7-25

Summary

Crude: +1.4 MMB

SPR: +0.3 MMB

Cushing: -1.2 MMB

Gasoline: -5.7 MMB

Distillate: -1.6 MMB

Jet: -1.1 MMB

Ethanol: +0.1 MMB

Propane: -3.4 MMB

Other Oil: +5.0 MMB

Total: -6.0 MMB

Bullish report.

Spot WTI is currently pricing $67. Prices are divorced from estimated fair value based on a price model derived from reported EIA inventories. Global traders are seeing tight physical barrels while spec positioning collapses.

Crude

US Crude oil supply built by 1.4 MMB. Crude inventories are currently 5% below the seasonal average. Only 2022 has had lower crude inventories in the recent past.

0.3 MMB were added to the SPR, after 3 consecutive weeks of no additions. It’s unclear how many barrels will be added.

US crude imports were down, likely impacted by tariff uncertainty.

Crude exports were also down substantially.

Unaccounted for crude flipped negative again. It appears US production is somewhat overstated.

The EIA model is showing US crude production returning to record levels. Connections within the upstream industry are reporting significant light production. There is a demand for light, sweet crude. Although as API gravities trend toward condensate, the barrel becomes less valuable. The more concerning issue is the amount of paraffin wax in some of this production. Dealing with this wax can prove challenging for midstream companies and refiners.

Cushing

Crude storage in Cushing, OK, drew by 1.2 MMB week on week. Cushing inventories remain near seasonal lows.

Gasoline

Total motor gasoline inventories decreased by 5.7 MMB and are about 1% above the seasonal 5-year average. As refiners exit turn-around season and make summer blend gasoline, there are fewer “blending components” that can be counted as gasoline.

Finished gasoline inventories are low.

Distillate

Distillate fuel inventories decreased by 1.6 MMB last week and are about 5% below the seasonal 5-year average. Only 2022 has had lower seasonal inventories in recent history.

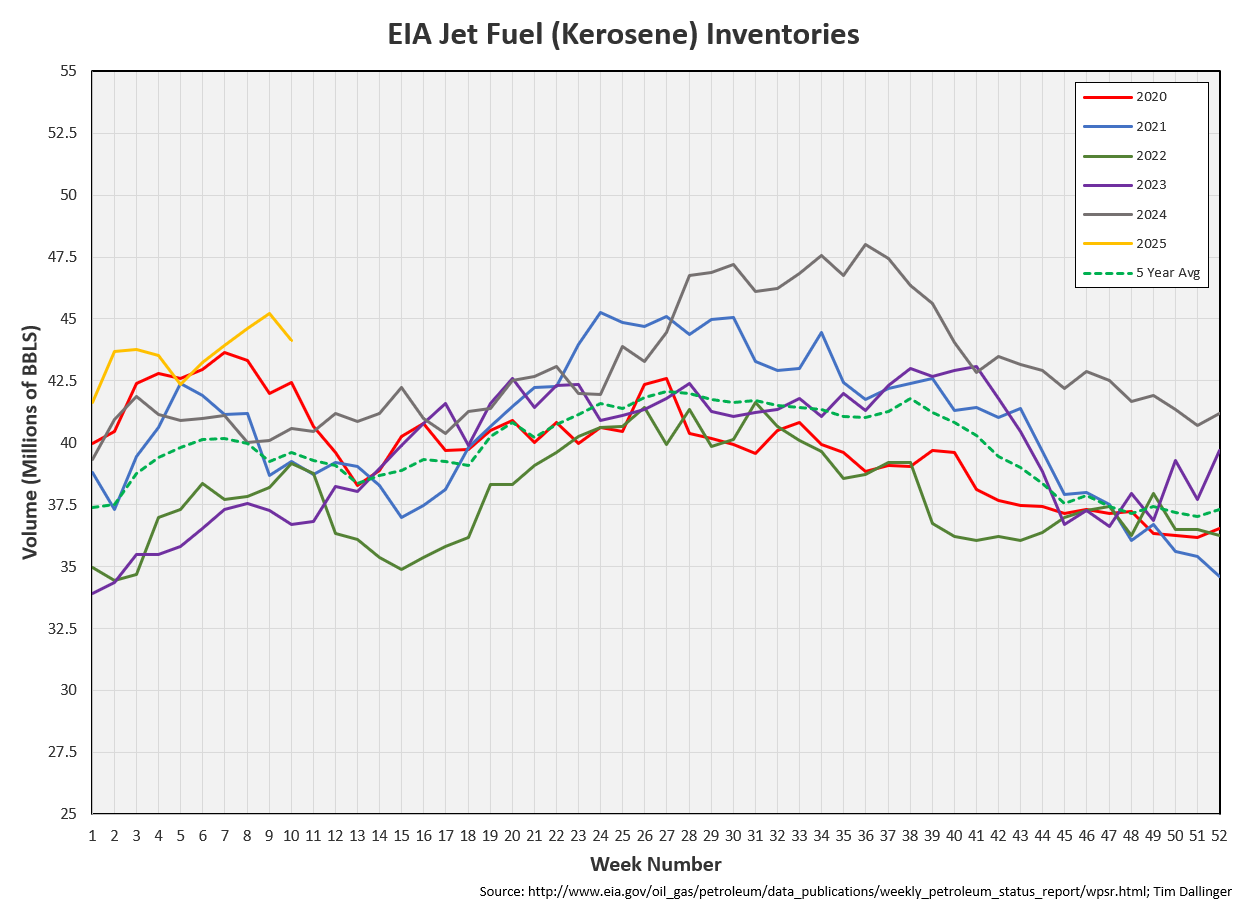

Jet

Kerosene type jet fuels drew by 1.1 MMB. Jet fuel demand remains strong, going into normal US spring break periods.

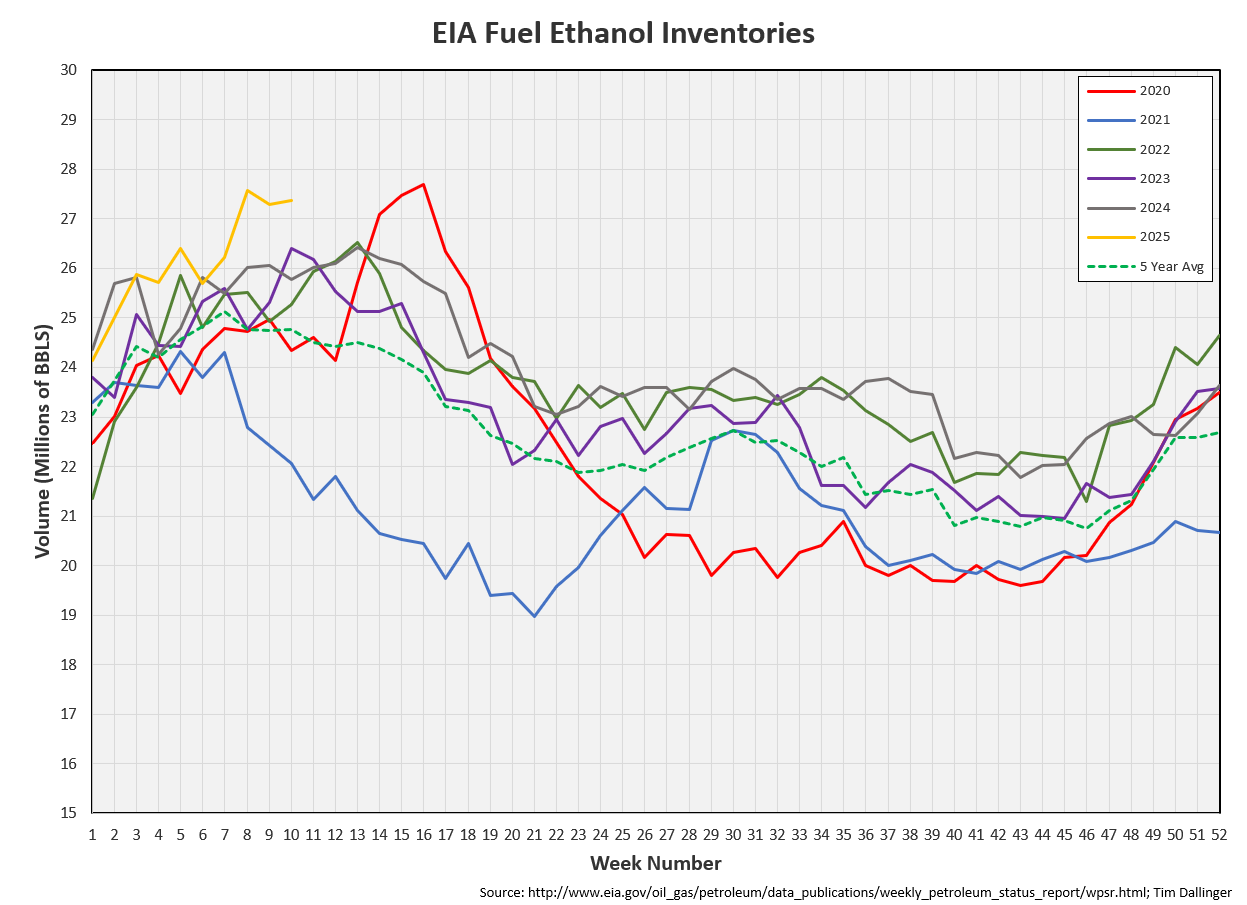

Ethanol

Ethanol inventories increased 0.1 MMB week-on-week. Inventories are above seasonal averages.

Propane

Propane/propylene inventories drew by 3.4 MMB. Propane is now 10% below the seasonal average.

Other Oil

Other oil jumped 5.0 MMB. As mentioned in the gasoline segment above, components such as butane that are used as blending component in winter, cannot be used to make summer blend gasoline.

Total Commercial Inventory

Total commercial inventory drew by 6.0 MMB. Only 2022 has shown lower inventories in recent history.

Natural Gas

Natural gas inventories fell although the trajectory eased with more moderate US temperatures. Natural gas inventories aren’t yet at the annual low. But they should approach the trough in the next few weeks.

There is inclement weather expected this weekend but it’s expected to be limited to high winds, not cold temperatures.

Refiners

The amount of crude oil refiners processed last week increased to tie a seasonal record. Stated differently, US crude oil demand matched seasonal records. Maintenance season is wrapping up and refiners are getting ready for driving season.

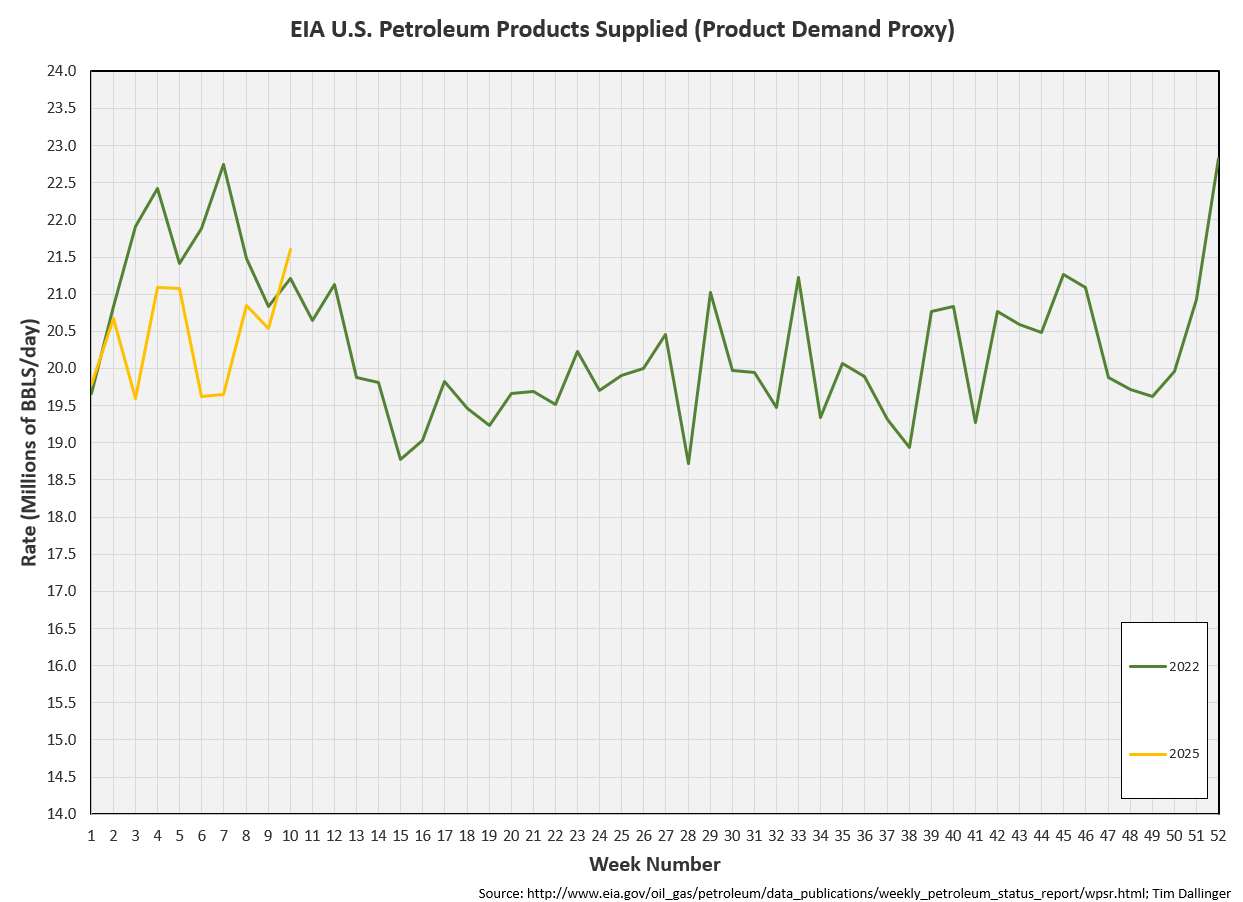

The EIA’s product demand proxy also increased. Because the weekly figures fluctuate so significantly, a moving average is usually used to track this category.

Looking at the individual week, last week was just below the seasonal record.

As 2025 and 2022 have been compared in several other earlier categories, here is that graph with only those 2 years included. Remember, this only a proxy but the data illustrates product demand is higher today than 2022.

Transportation inventories are at seasonal levels. This may worry some who are only watching inventories. But recall, implied product demand is higher than average.

Adding crude to transportation inventories show again, only 2022 was lower.

Readers following closely may notice that 5-year average line changed versus last week’s chart for the Big 3 and Big 4. A mistake was identified in my calculations and 5 year average had not yet rolled to include 2025. It is corrected now.

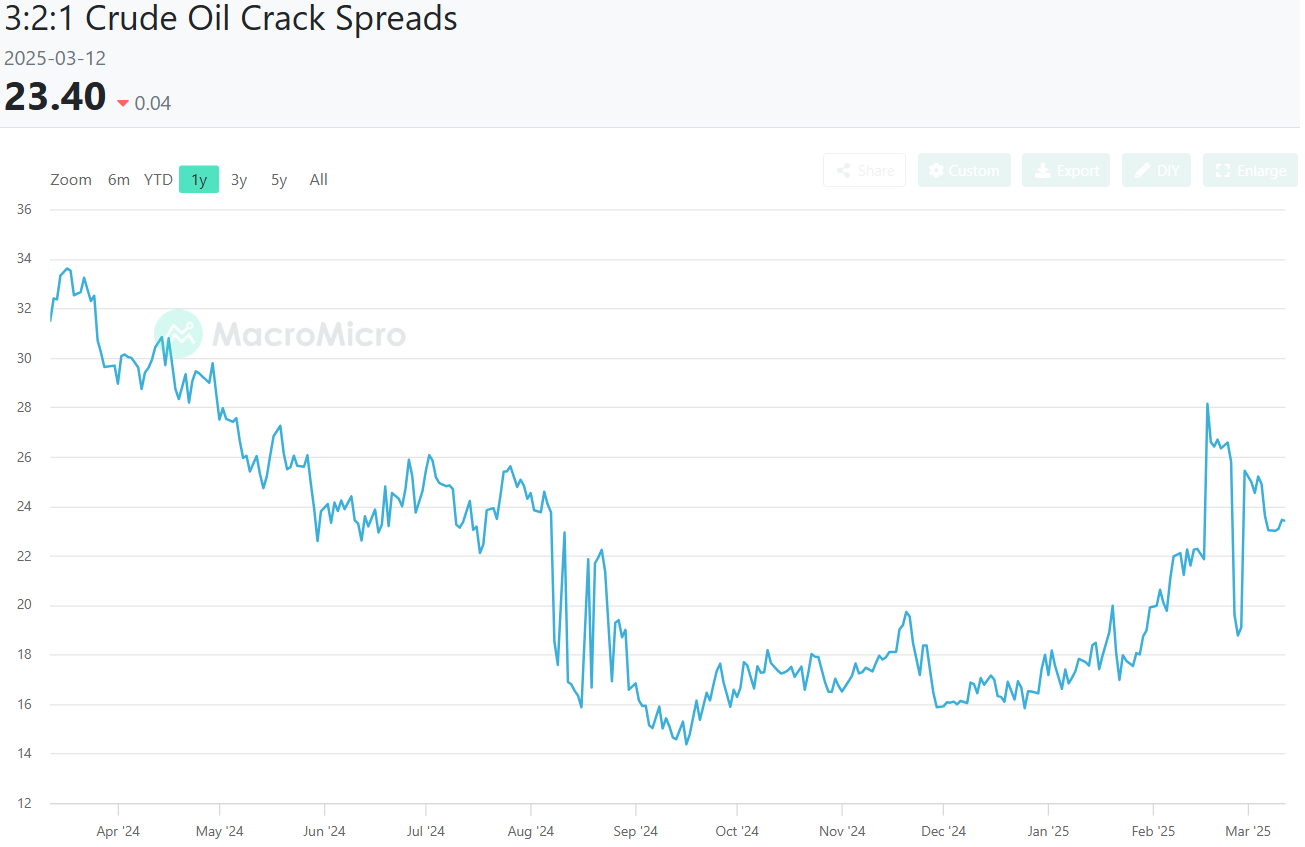

Simple cracks remain healthy, above $20. When monitoring simple cracks, its important not to use the shape of the graph. Barchart does not accurately reflect historic figures. For instance, 3 weeks ago, simple cracks were $18. Cracks collapsed to $15 prior to that. Those figures are not represented in the chart below.

The barchart graph will not be presented in future reports to eliminate this potential confusion. It appears the EIA provides daily closing prices for CL, RBOB and HO. A new graph will be created soon.

For now, this source appears accurate.

https://en.macromicro.me/series/4934/crude-oil-cracking-spread

Discussion

Upon further review Barchart is also not tracking historic futures correctly either. WTI and Brent both currently remain in backwardation. New sources will be located for these charts. Again, apologies for any previous confusion.

This is CERAWeek where global energy professional meet in Houston to discuss issues facing the industry.

The newly appointed Secretary of Energy, Chris Wright, gave the keynote speech. Wright stressed the importance of energy for modern life. This is a stark contrast to the previous Energy secretary’s remarks.

Although this Administration seems to understand the significance all forms of energy play in daily life, there has been some mixed messaging. The Trump administration remains adamant that inflation can be eased with lower energy prices. While this may be the case, it ignores incentives. Should crude oil prices fall to their desired $50 price, much of US production becomes uneconomical. It seems highly unlikely that producers will drill at a loss.

Perhaps the Trump administration is hoping for bankruptcies and the Super Majors will buy competitor’s assets for deeply discounted prices. But no producers are guiding for increased spending. Capital discipline remains the mantra. “Drill, baby, drill” is a simple slogan, not an economic plan.

OPEC has shown no intention to flood the market and NON-OPEC growth is disappointing. Global recession would impact demand but how significantly?

Even the EIA acknowledges that physical markets are tight. The latest STEO:

Remember that EIA and IEA previously both predicted a significantly oversupplied market for all of 2025.

In personal news, my parents are celebrating their 50th wedding anniversary. I will be vacationing with them next week, celebrating and there will be no summary report. Reports will resume the following week on the normal schedule. Thank you for your understanding.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Secretary of Energy, Chris Wright’s keynote speech:

Happy Anniversary to your parents!

Good point on EIA’s revision to prior forecasted surplus. Wonder if the regime change had something to do with that.