EIA WPSR Summary for week ending 5-30-25

Summary

Crude: -4.3 MMB

SPR: +0.5 MMB

Cushing: +0.6 MMB

Gasoline: +5.2 MMB

Distillate: +4.2 MMB

Jet: +0.9 MMB

Ethanol: +0.2MMB

Propane: +6.8 MMB

Other Oil: +0.1 MMB

Total: +12.9 MMB

Bearish report, although not completely uncommon spike in products, early in demand season.

Spot WTI is currently pricing $62. Prices remain below estimated fair value based on a price model derived from reported EIA inventories.

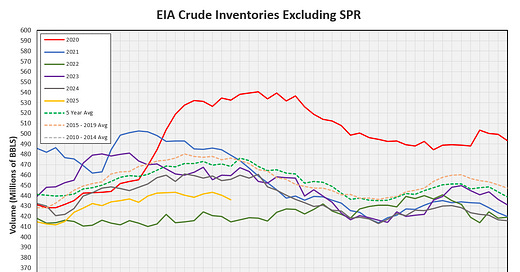

Crude

US Crude oil supply drew by 4.3 MMB. Crude inventories are currently 7% below the seasonal average.

0.5 MMB were added to the SPR.

US crude imports were flat week-on-week.

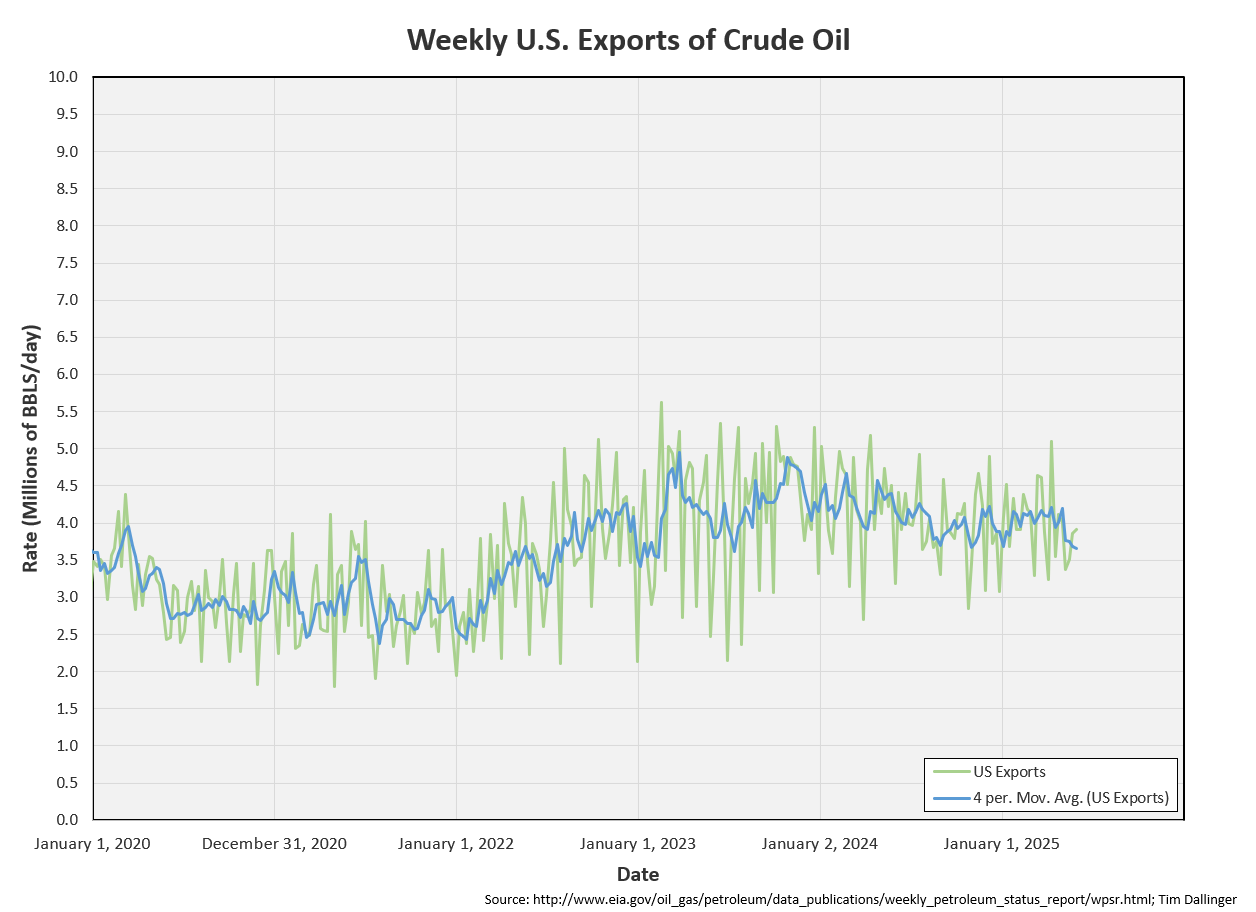

Crude exports were up but still below average levels.

Unaccounted for crude is near zero.

The EIA monthly production report released at the end of last week, did show the weekly figures are overcounted. But the surplus is not as significant as it was previously. Monthly production will fall from here.

Cushing

Crude storage in Cushing, OK, built by 0.6 MMB week on week. Cushing inventories remain low but have built slightly from the recent trough.

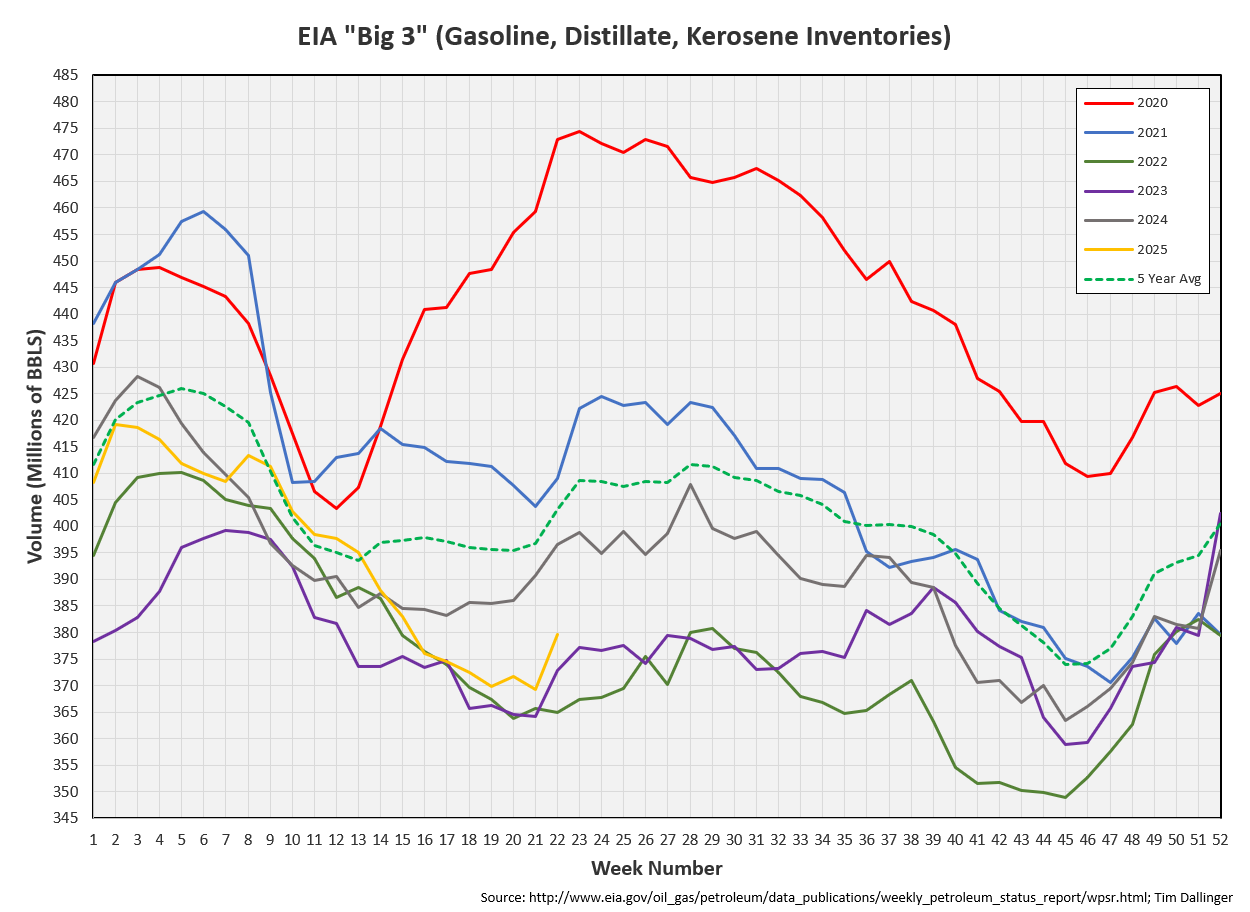

Gasoline

Total motor gasoline inventories increased by5.2 MMB and are about 1% below the seasonal 5-year average. There is usually one significant build week when refiners initially ramp. In the past, that has been an anomalous week. If trends persist, next week’s gasoline movement will be muted.

Distillate

Distillate fuel inventories increased by 4.2 MMB last week and are about 16% below the seasonal 5-year average. Distillate inventories also often jump initially when refiners ramp.

Jet

Kerosene type jet fuels increase by 0.9 MMB. Jet fuel inventories are above average.

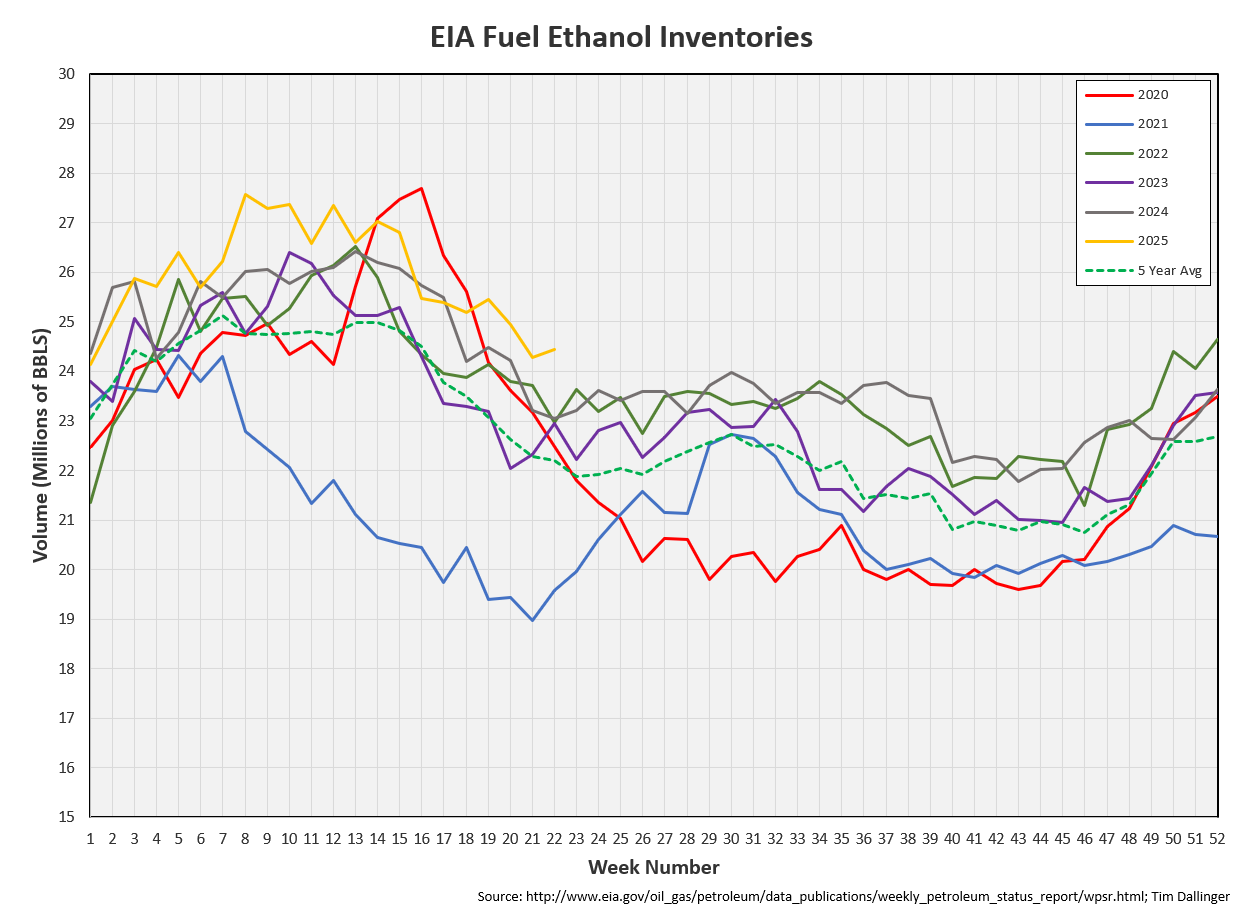

Ethanol

Ethanol inventories increased 0.2 MMB week-on-week. This is an odd build during the normal draw trend. Inventories are above seasonal averages.

Propane

Propane/propylene inventories built by 6.8 MMB, just exceeding seasonal averages. This is an unexpected, significant build. This behavior should not persist.

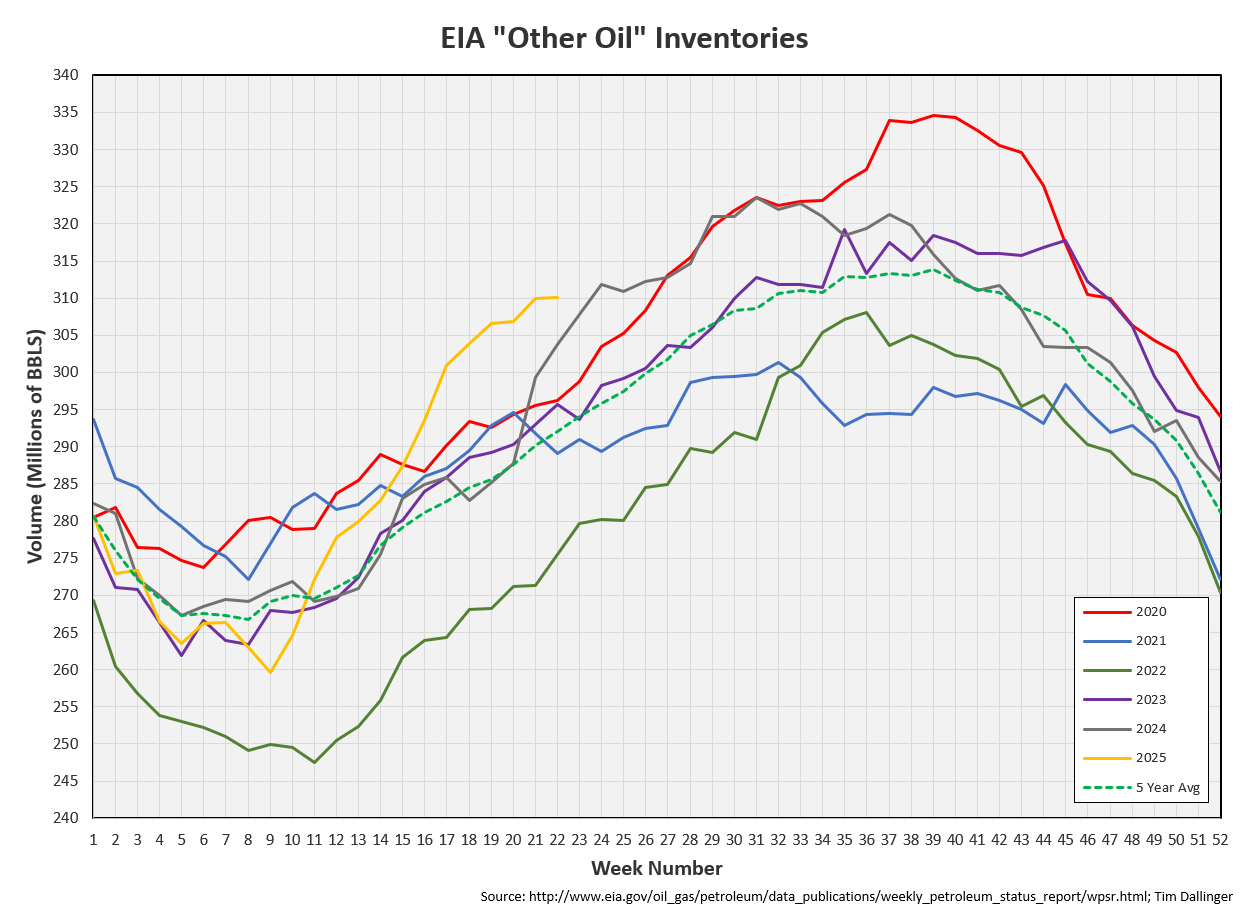

Other Oil

Other oil is essentially flat. This is not normal although the rapid builds through spring weren’t normal either.

Total Commercial Inventory

Total commercial inventories increased by 12.9 MMB. Seasonal builds here are normal but the rate is slightly above average.

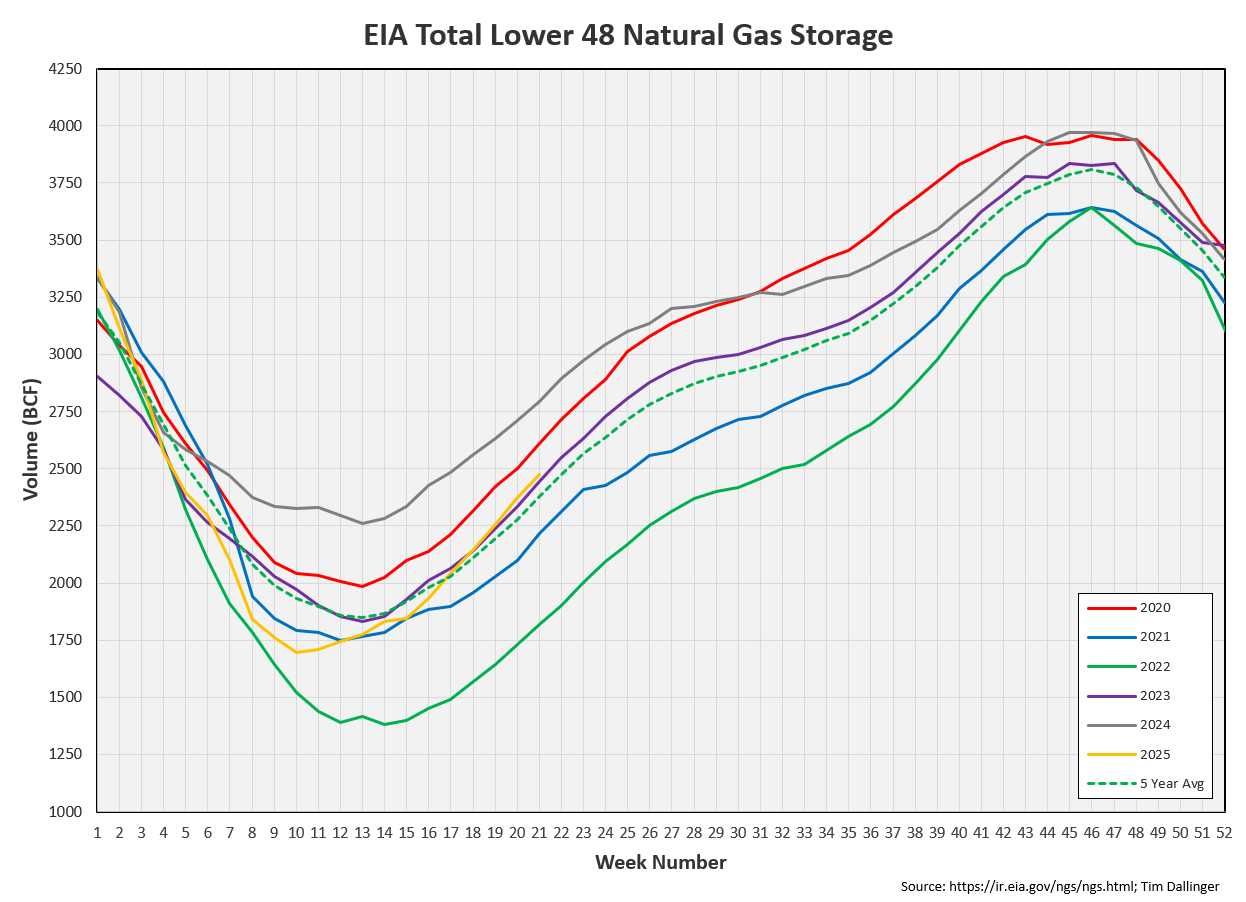

Natural Gas

Natural gas inventories remain above average. The chart below is the same presented last week. As last week’s crude report was delayed due to holiday, the crude and gas report were released on the same day. There will be a new gas report tomorrow.

Refiners

Use crude refiners jump to processing just below 17 MMBD. Refiners have only exceeded a weekly 17 MMBD of crude processed figure, 4 times. Next week should come in lower.

The EIA’s product demand proxy demand fell but the weekly moving average remains in-line with highs.

Transportation inventories spiked.

When the crude draw is included, the trend is normal.

Simple cracks fell with the product inventory increase. Cracks above $20 are still healthy.

Discussion

OPEC+ continued with their scheduled monthly increase in crude production. Crude actually jumped after the news. The market is realizing that Saudi has no appetite for a price-war and that increased production doesn’t necessarily mean increased crude exports as OPEC countries increase internal crude oil usage during summer months for cooling.

Backwardation increased as the front months moved up. There is no supply glut.

Ukraine drone attacked Russia’s fleet of war planes. President Trump continues to seek de-escalation but Russia vows retaliation for the bold attack.

Trump also reiterated that Iran is running out of time to reach a nuclear deal. It is unclear what another round of failed negotiations could bring but sanction enforcement seems a likely outcome.

Some Canadian production is shut-in due to seasonal wildfires.

Yet the market is not pricing any geopolitical premium. No barrels have been lost yet but the physical market remains tight, and any supply interruption could be significant.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Doctor Otternschlag, played by Greta Garbo, concludes the 1932 classic film, The Grand Hotel.