EIA WPSR Summary for week ending 6-7-24

Summary

Crude: +3.7 MMB

SPR: +0.3 MMB

Cushing: -1.6 MMB

Gasoline: +2.6 MMB

Distillate: +0.9 MMB

Jet: -1.1 MMB

Ethanol: +0.2 MMB

Propane: +1.0 MMB

Other Oil: +4.0 MMB

Total: +11.8 MMB

Bearish report.

Spot WTI is currently pricing $78 USD. Prices are above fair value based on a price model derived from reported EIA inventories.

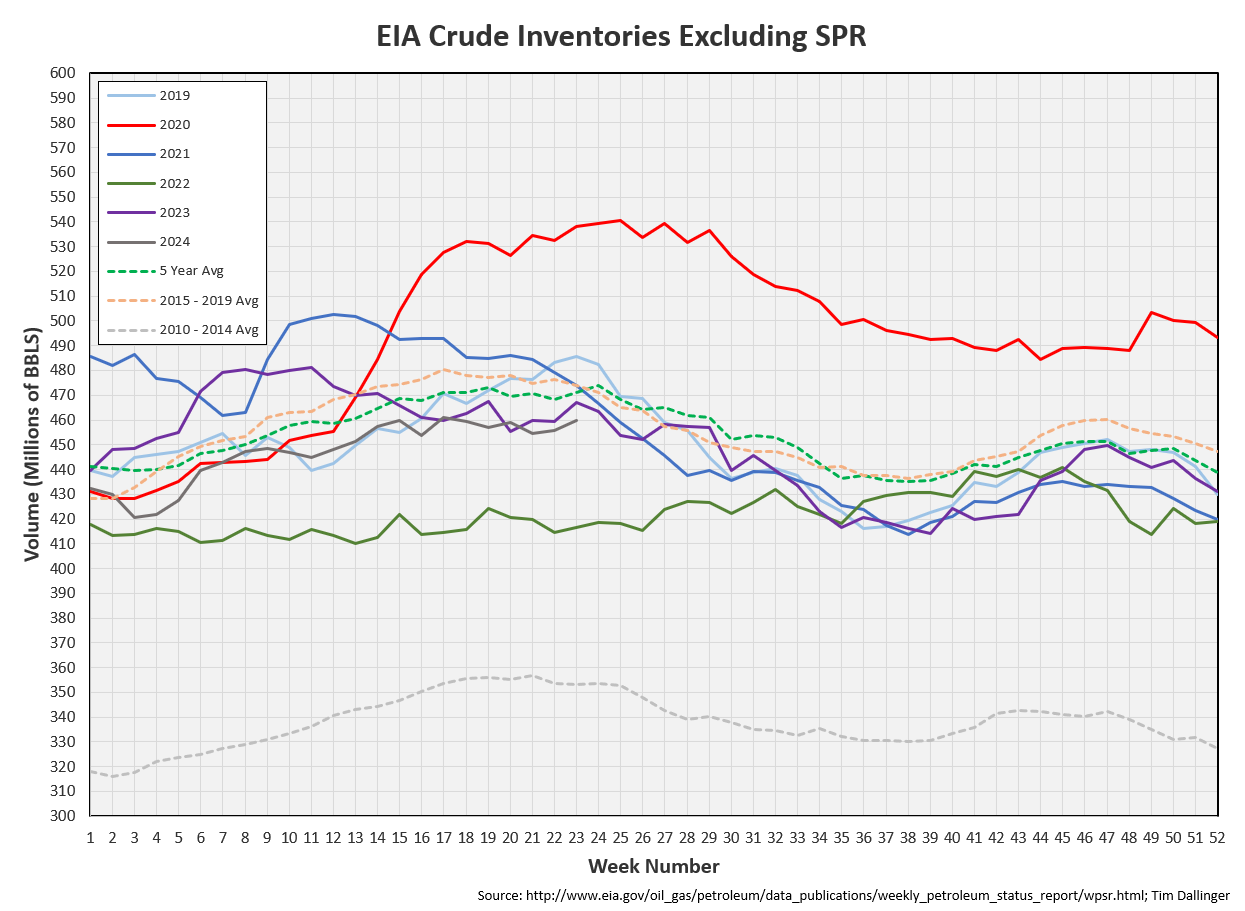

Crude

US Crude oil supply built by 3.7 MMB. Crude inventories are currently 4% below the seasonal average.

0.3 MMB were added to the SPR. 15.3 MMB have been added to the SPR in 2024 but inventories remain below the level at the start of 2023.

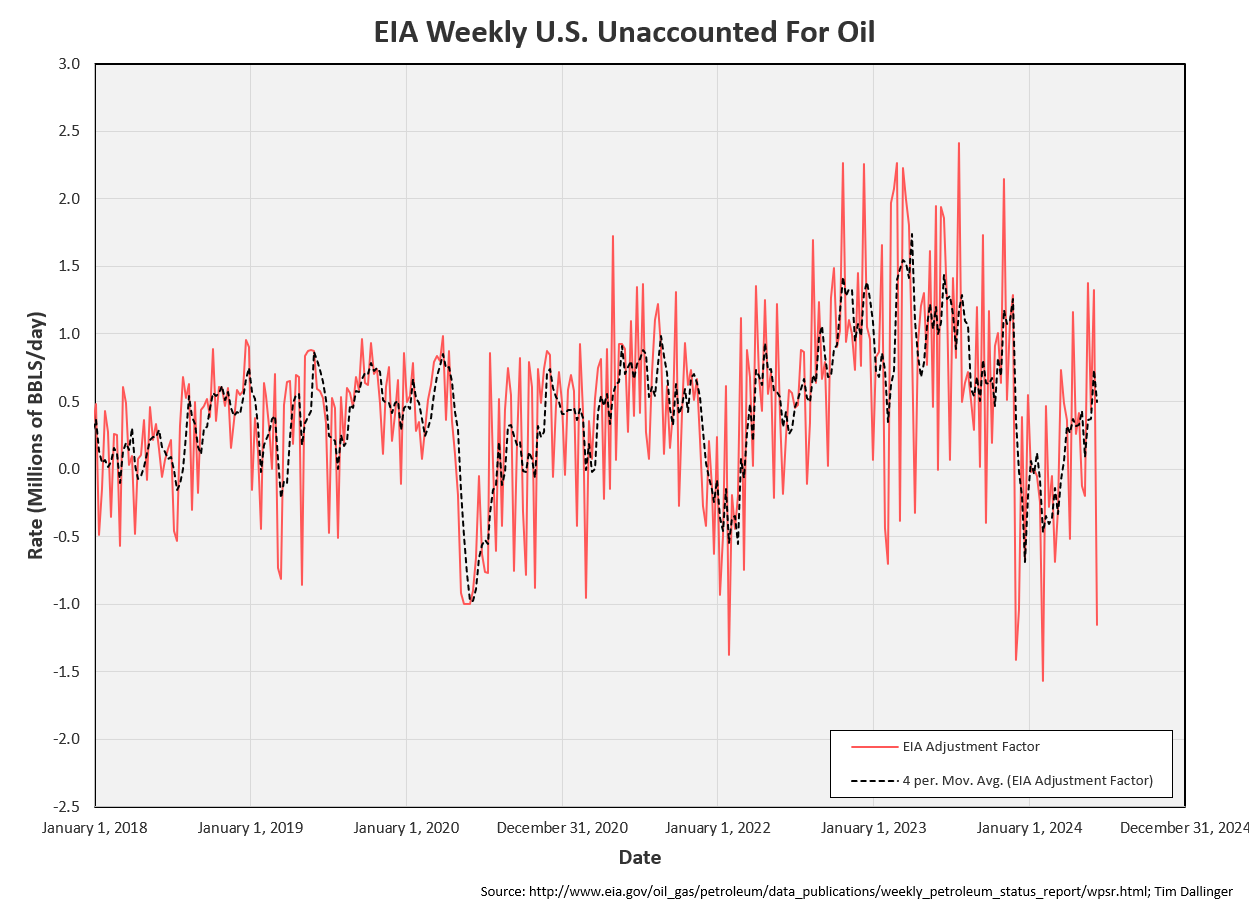

US crude imports were surged to a rate not witnessed since 2018. This highly unusual and suspect.

Preliminary figures show that import from Canada and Mexico are the culprit. There is no apparent reason for this increase. It’s possible that barrels exported to the Canadian west coast on TMX are landing in California. But the increase is too large to be just that. It’s more likely that US Customs miscounted barrels.

Crude exports simultaneously dropped to the 3rd lowest of 2024. Independent ship trackers did show impacted exports but no that low. Again, Customs appear to have miscounted barrels.

Unaccounted for crude flipped negative to try and correct for the questionable import and exports figures.

Cushing

Crude storage in Cushing, OK, drew by 1.3 MMB week on week. Inventories are below average but above critical levels.

Gasoline

Total motor gasoline inventories increased 2.6 MMB and are slightly below the seasonal 5-year average.

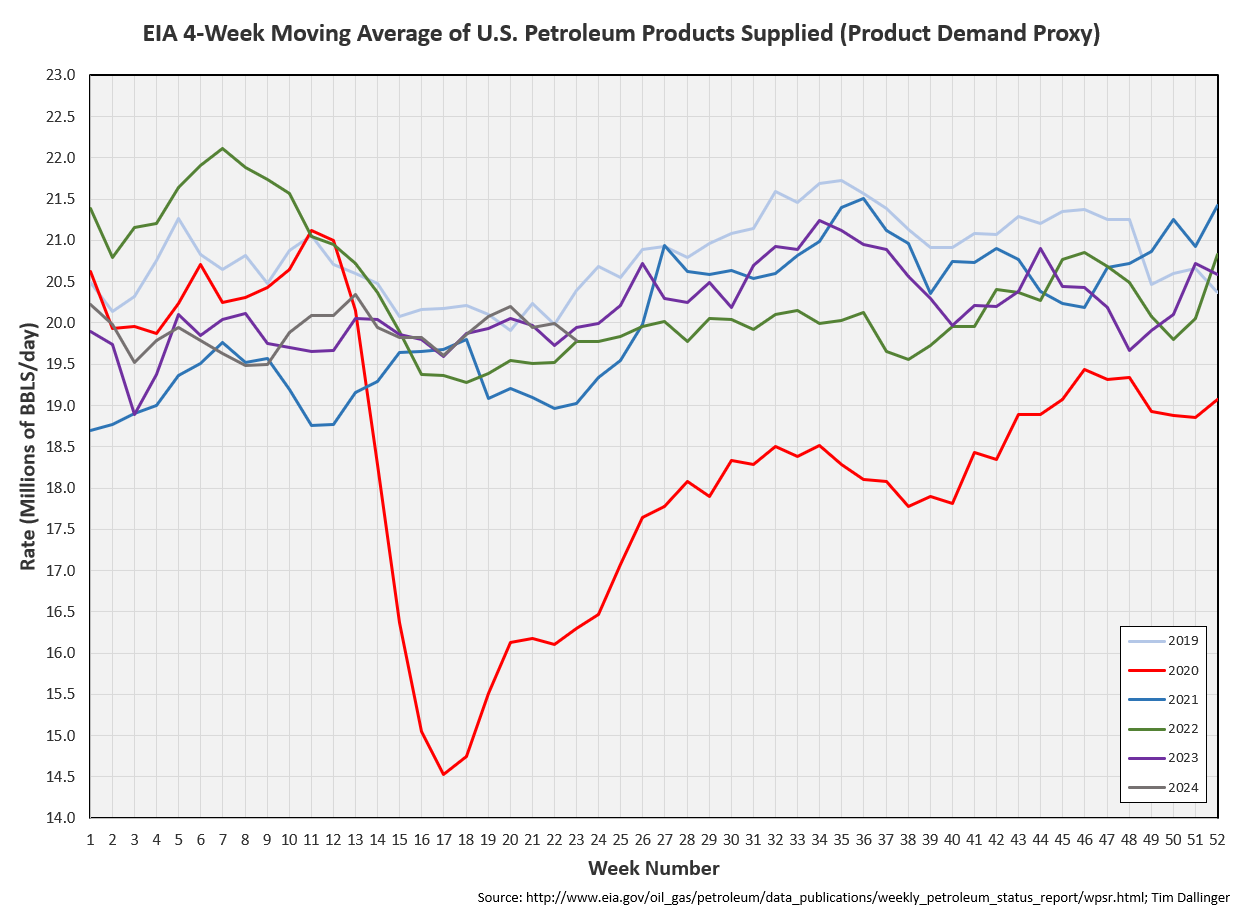

Yet the moving average for the EIA’s gasoline demand proxy continues to improve. Only 2023 and 2019 have been higher.

Distillate

Distillate fuel inventories increased by 0.9 MMB last week and are about 7% below the seasonal 5-year average.

Jet

Kerosene type jet fuels drew by 1.1 MMB. Inventories are near average levels.

Global miles traveled and number of flights hit all-time records.

https://www.airportia.com/flights-monitor/

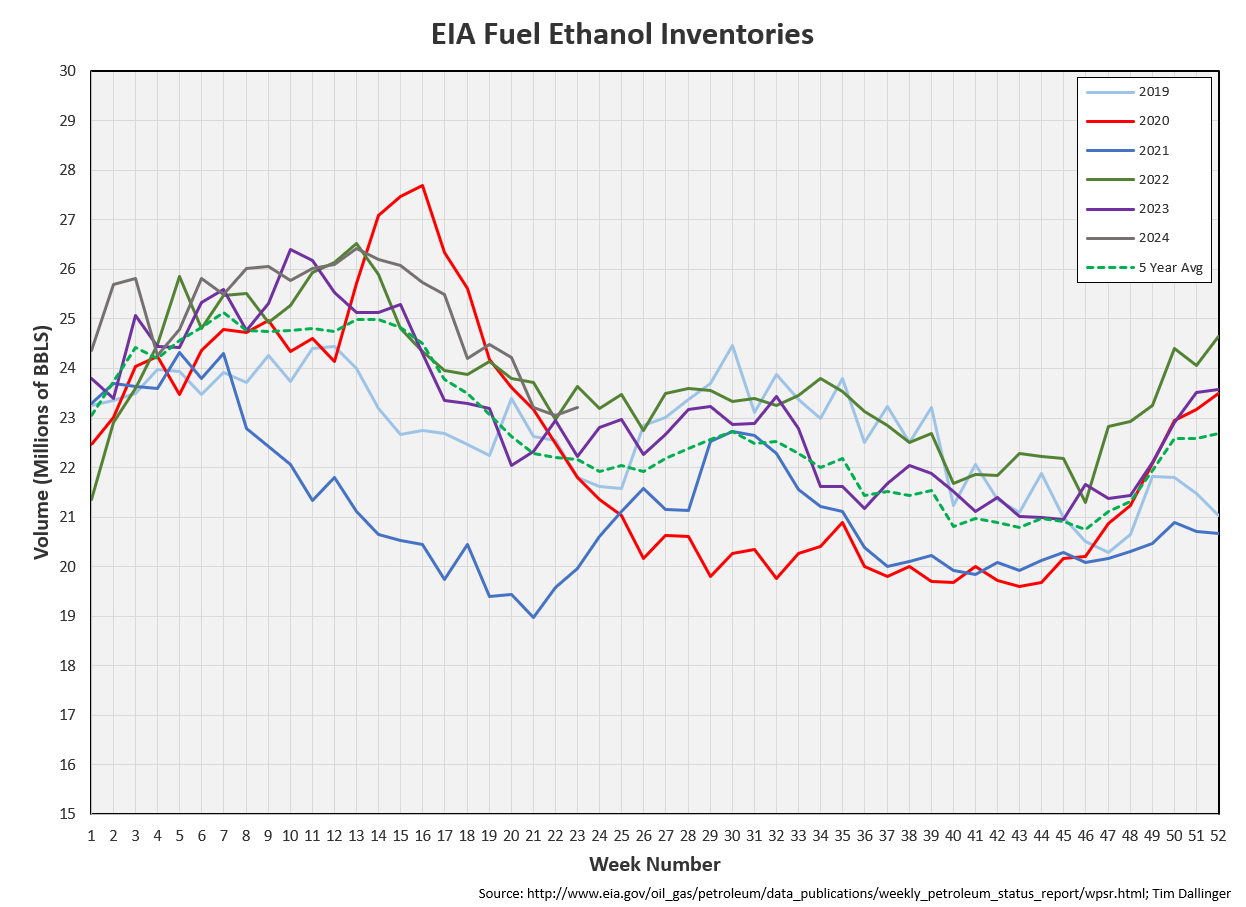

Ethanol

Ethanol inventories increased 0.2 MMB week-on-week. Inventories are above seasonal averages.

Propane

Propane/propylene inventories increased by 1 MMB. This rate of increase is near the seasonal 5-year average but lower than recent years.

Other Oil

Other oil built by 4 MMB. This category continues to act oddly.

The EIA other oil demand proxy has crated almost 1 MMBD off its recent record.

Total Commercial Inventory

Total commercial inventories increased by 11.8 MMB.

Natural Gas

Natural gas inventories remain high.

Refiners

The amount of crude oil refiners tied another seasonal record for amount of crude oil processed. Any demand weakness is not being demonstrated in crude oil demand.

The EIA’s product demand proxy fell, matching 2022.

Transportation inventories continue to build. They should reach a local peak soon.

The EIA’s demand proxy for transportation only meaningfully lags 2019.

Simple cracks remain under pressure.

Backwardation remains in both WTI and Brent.

Discussion

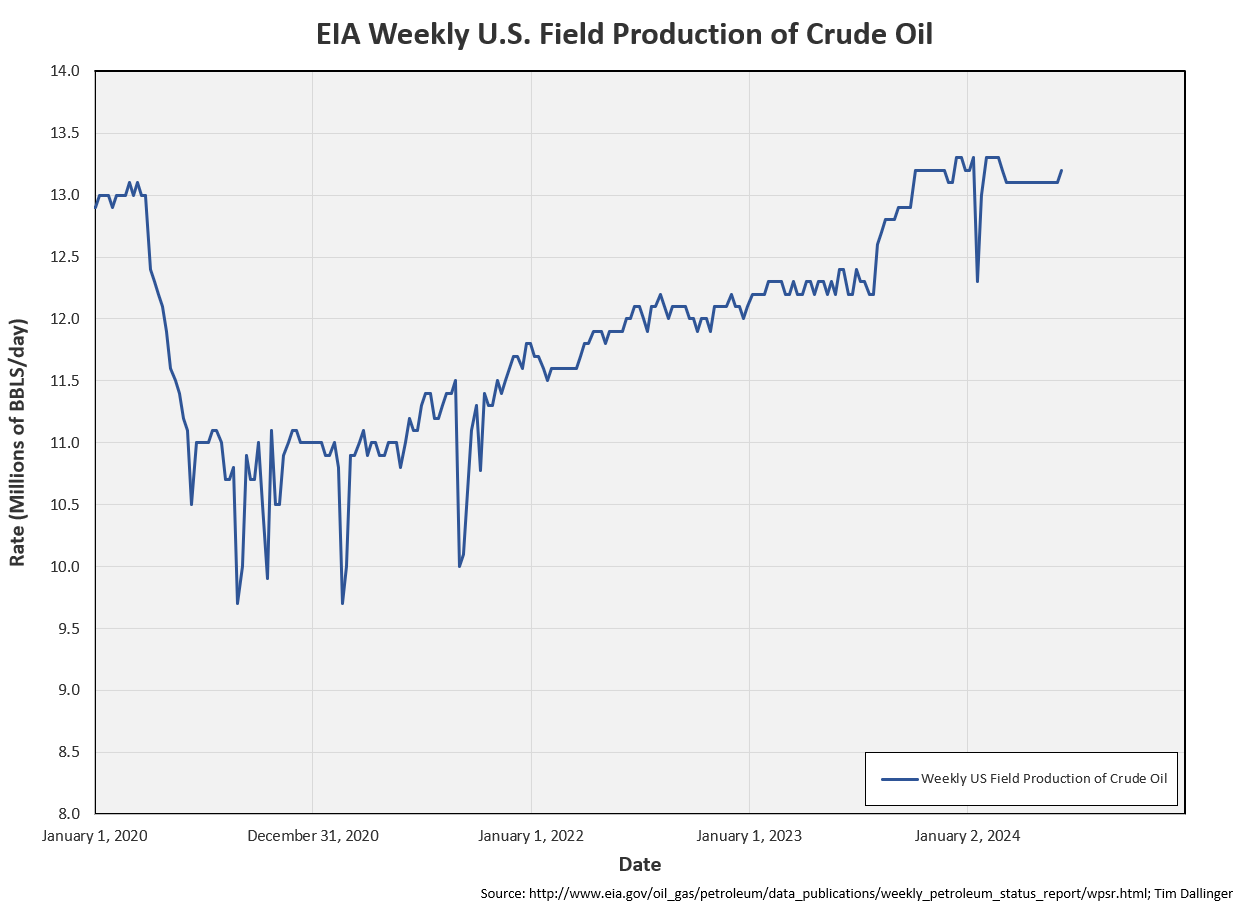

The WPSR showed a slight uptick in production. No other data is corroborating this trend.

Inventory draws should have materialized this week. Yesterday’s API report was quite bullish. The EIA WSPR did not echo the sentiment. This week was plagued with odd data. If inventories don’t start to draw soon, the bullish thesis must be revisited.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

In Samuel Beckett’s classic play, Vladimir and Estragon engage in discussion while awaiting a friend who never arrives.