EIA WPSR Summary for week ending 9-27-24

Summary

Crude: +3.9 MMB

SPR: +0.7 MMB

Cushing: +0.9 MMB

Gasoline: +1.1 MMB

Distillate: -1.3 MMB

Jet: -0.7 MMB

Ethanol: -0.1 MMB

Propane: +0.3 MMB

Other Oil: -3.9 MMB

Total: -0.9 MMB

Spot WTI is currently pricing $71. Prices remain significantly below fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply built by 3.9 MMB. Crude inventories are currently 4% below the seasonal average and near 2023 levels.

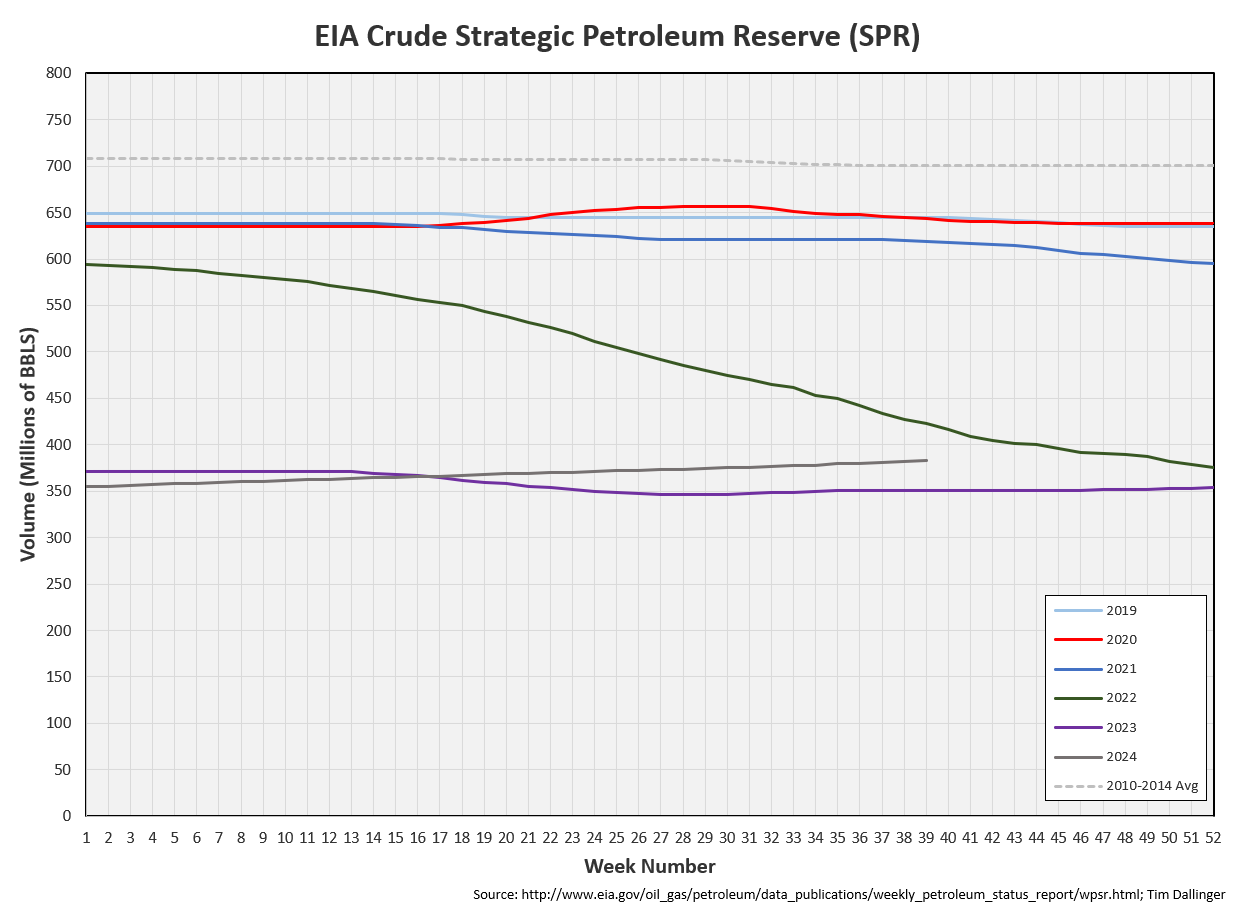

0.7 MMB were added to the SPR.

US crude imports were up on the week, near average levels.

Crude exports fell to slightly below average levels.

Unaccounted for crude was again negative.

Weekly production was revised higher but the monthlies are not confirming that trend.

Cushing

Crude storage in Cushing, OK, built by 0.9 MMB week on week. Storage volumes have recovered off tank heels but remain seasonally and absolutely low.

Gasoline

Total motor gasoline inventories increased by 1.1 MMB and are about just below the seasonal 5-year average. Draws are expected to resume in after next week.

Distillate

Distillate fuel inventories decreased by 1.3 MMB last week and are about 7% below the seasonal 5-year average.

Jet

Kerosene type jet fuels drew by 0.7 MMB and inventories remain above average.

Average Chinese flights and airfare miles are again on the rise, setting fresh seasonal records.

Average global flights and airfare miles are again are also at record seasonal levels but the trend appears more uniform.

https://www.airportia.com/flights-monitor/

Ethanol

Ethanol inventories decreased by 0.1 MMB week-on-week. Inventories are above seasonal averages.

Propane

Propane/propylene inventories built by 0.3 MMB. Seasonal draws begin soon.

Other Oil

Other oil drew by 3.9 MMB. Inventories are slightly above seasonal average but falling. Draws should continue into early spring.

Total Commercial Inventory

Total commercial inventory drew by 0.9 MMB. Inventories are below average and also below 2023.

Natural Gas

Natural gas inventories are high. Only during COVID have they been seasonally higher.

Refiners

The amount of crude oil refiners processes last week fell. There’s often one more bump next week before maintenance season goes into full swing. Refiners have guided that a light maintenance season is planned this year.

The EIA’s average product demand proxy also fell.

Even with the gasoline build, transportation inventories drew, supporting cracks.

Simple cracks are still low but have bounced from their recent bottom.

Discussion

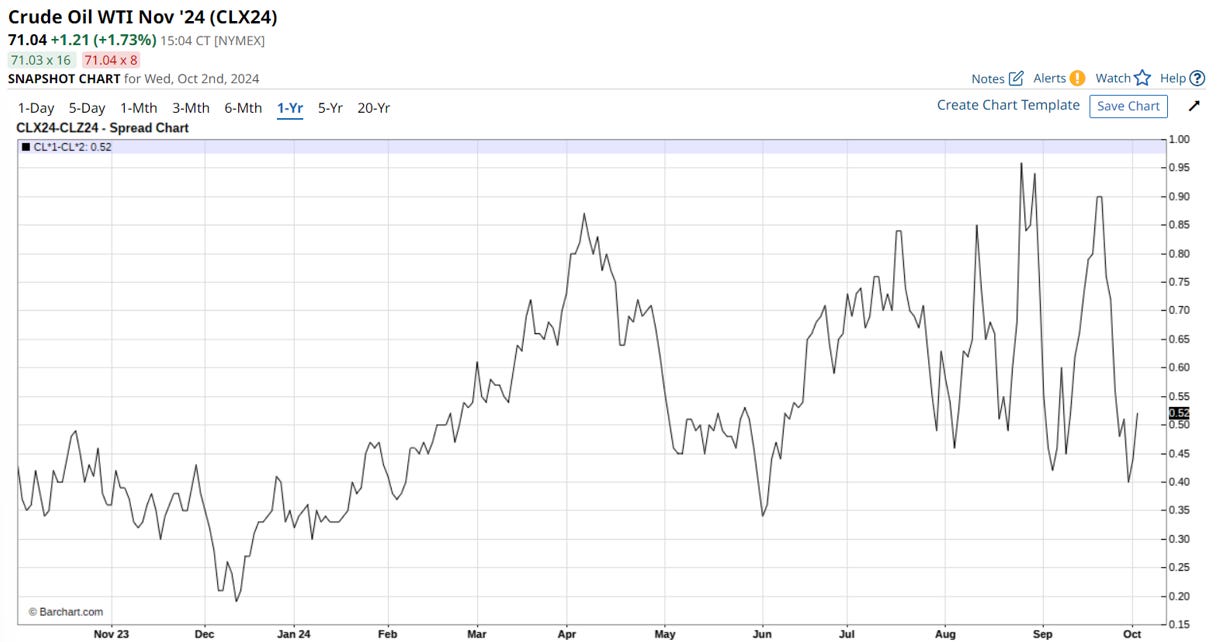

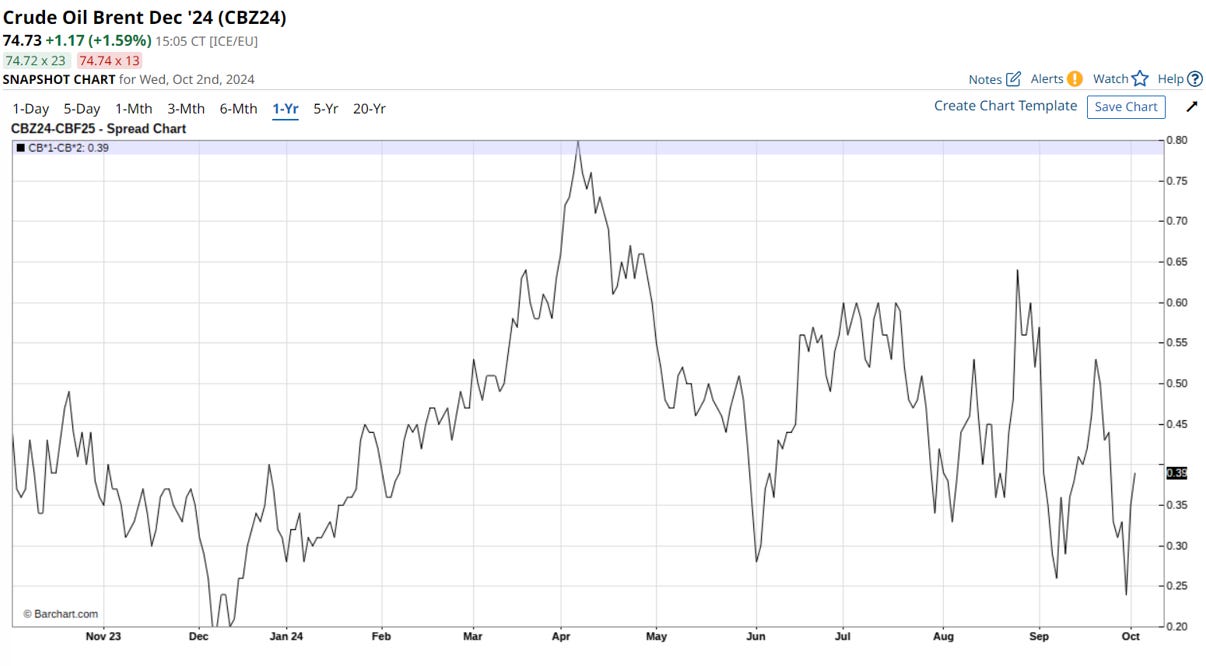

Although, crude and WTI time structures remain backwarded, there is little focus on fundamentals this week.

Yesterday, Iran struck Israel with a barrage of missiles, in retaliation to a recent offensive in Lebanon which killed the secretary general of Hezbollah. No civilians or soldiers were harmed. However, the IDF has still promised a swift and devasting response. The US has urged Israel not to target nuclear sites in retaliation.

Iran currently produces just over 3 MMBD of crude oil. It exports about half of that through the crude export terminal, located on Kharg Island. If Israel were to target critical oil infrastructure like Kharg Island, there isn’t enough spare capacity anywhere in the world to fill that supply gap.

There was a brief short-covering rally in prices. Geopolitical unrest has been mostly faded this year and many are expecting similar behavior here. However, the conflict has escalated, and physical markets are tighter than they’ve previously been. Any actual supply interruption can initiate a short squeeze in futures.

The market awaits the Israeli response.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Denzel Washington plays narcotics Detective Alonzo Harris, the 2001 American crime thriller, “Training Day.”

Refinery runs my friend