EIA WPSR Summary for week ending 2-2-24

Summary

Slightly bullish report.

Crude: +5.5 MMB

SPR: +0.6 MMB

Cushing: 0.0 MMB

Gasoline: -3.1 MMB

Ethanol: +0.5 MMB

Distillate: -3.2 MMB

Jet: -0.3 MMB

Propane: -2.0 MMB

Other Oil: -2.6 MMB

Total: -4.5 MMB

Spot WTI is currently pricing $74. This is fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply built 5.5 MMB. Crude inventories are currently 4% below the seasonal average.

0.9 MMB were added to the SPR. This makes 4.3 MMB total of the 12 MMB planned 2024 purchases.

US crude imports spiked. Ship trackers did not confirm this movement. Over-counting imports likely contributed to the large negative adjustment this week.

Crude exports fell.

This week saw the largest negative adjustment on record. This is partially due to import/export timing. And US production is also being overcounted.

Cushing

Cushing inventories are flat week-on-week. Inventories are still seasonally low.

Gasoline

Total motor gasoline inventories decreased by 3.1 MMB and are about at the seasonal 5-year average.

Conventional motor gasoline inventories are lower than total gasoline inventories would suggest.

Ethanol

Ethanol inventories built by 0.5 MMB. Inventories are about average.

Distillate

Distillate fuel inventories decreased by 3.2 MMB last week and are about 7% below the seasonal 5-year average.

Jet

Kerosene type jet fuels decreased by 0.3 MMB. Seasonal jet inventories are slightly above average.

Total global airfare miles travels reach an all-time seasonal record, while number of flights still lag 2019.

https://www.airportia.com/flights-monitor/

Propane

Propane/propylene inventories decreased by 2.0 MMB from last week. Inventories have fallen slightly below seasonal averages.

Other Oil

Other oil drew 2.6 MMB. Other oil inventories are at the seasonal average.

Total Commercial Inventory

Total commercial inventories decreased by 4.5 MMB.

Natural Gas

Natural gas experienced another drawdown.

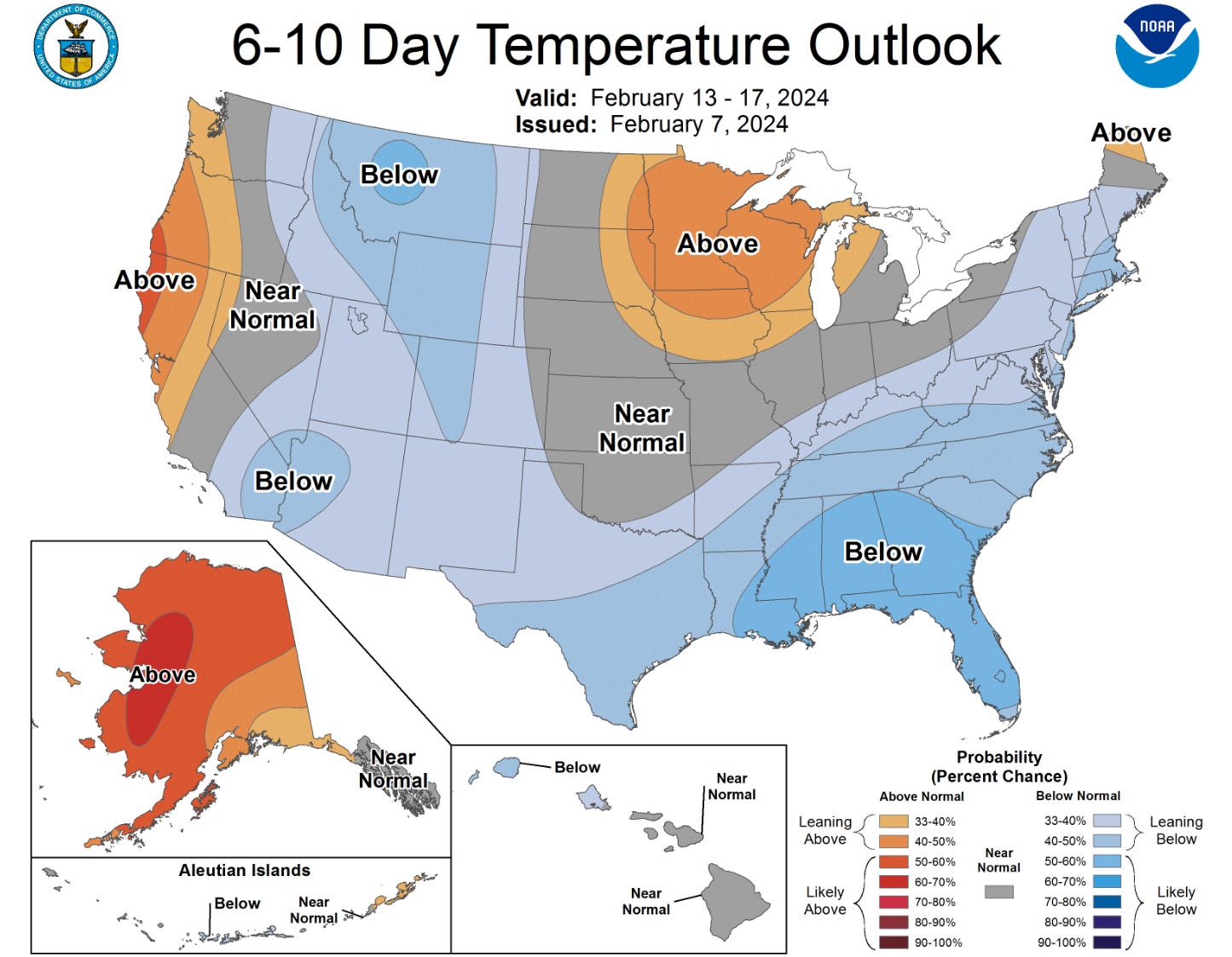

The short-term outlook looks cold but natural gas still can’t catch a bid.

Discussion

BP’s Whiting refinery was down for part of last week due to power outage. Crude processed reflects this outage. Maintenance should be starting now but it isn’t expected to be extensive this season.

The EIA consumer demand proxy increased. An independent demand tracker showed even higher figures. However, that market analyst keeps their model proprietary so input cannot be corroborated.

Transportation inventories drew significantly.

The simple 3-2-1 crack spread responded in turn. Refiners will want to exit maintenance season as soon as possible.

Transportation fuel plus crude inventories have now drawn below 2023.

Tracking the sum of the adjustment factor and production suggested that production hadn’t surged. It does appear that there was a spike late 2023. This was likely due to smaller firms working in burst capacity to appear like quality acquisition targets.

The November 914 seems to confirm this behavior.

Consider the latest Petroleum Supply Monthly (PSM):

399,227 / 30 = 13,307.56 kbd

The PSM now includes tranfers to crude supply, which is meant to capture NGL and condensate blending. Notice that the monthly adjustment is negative. That suggests production isn’t as high as reported or there’s less transfers into crude supply. However, industry insiders are reporting significant blendstock in crude.

The EIA doesn’t confirm that production is over-counted. But it now admits that no further 2024 US growth is expected. The unlimited shale growth narrative approaches its conclusion.

The US struck targets in Iraq, Syria and Yemen, in retaliation for last week’s drone strike.

Russian refineries and other energy infrastructure are under attack by Ukrainian drones this week.

Tensions are high and yet the market is not pricing any geopolitical premium into crude prices.

Bearish sentiment remains across the energy sector and spec positioning still shows near record short interest.

If US production falters and demand holds or any middle eastern/Russian supplies are significantly compromised, this is ripe for a squeeze.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Colonel Sam Trautman tries to convince John Rambo to end the standoff in the 1982 American action film, “Rambo 1 – First Blood.”