EIA WPSR Summary for week ending 10-17-25

EIA WPSR Summary for week ending 10-17-25

Summary

Crude: -1.0 MMB

SPR: +0.8 MMB

Cushing: -0.8 MMB

Gasoline: -2.1 MMB

Distillate: -1.5 MMB

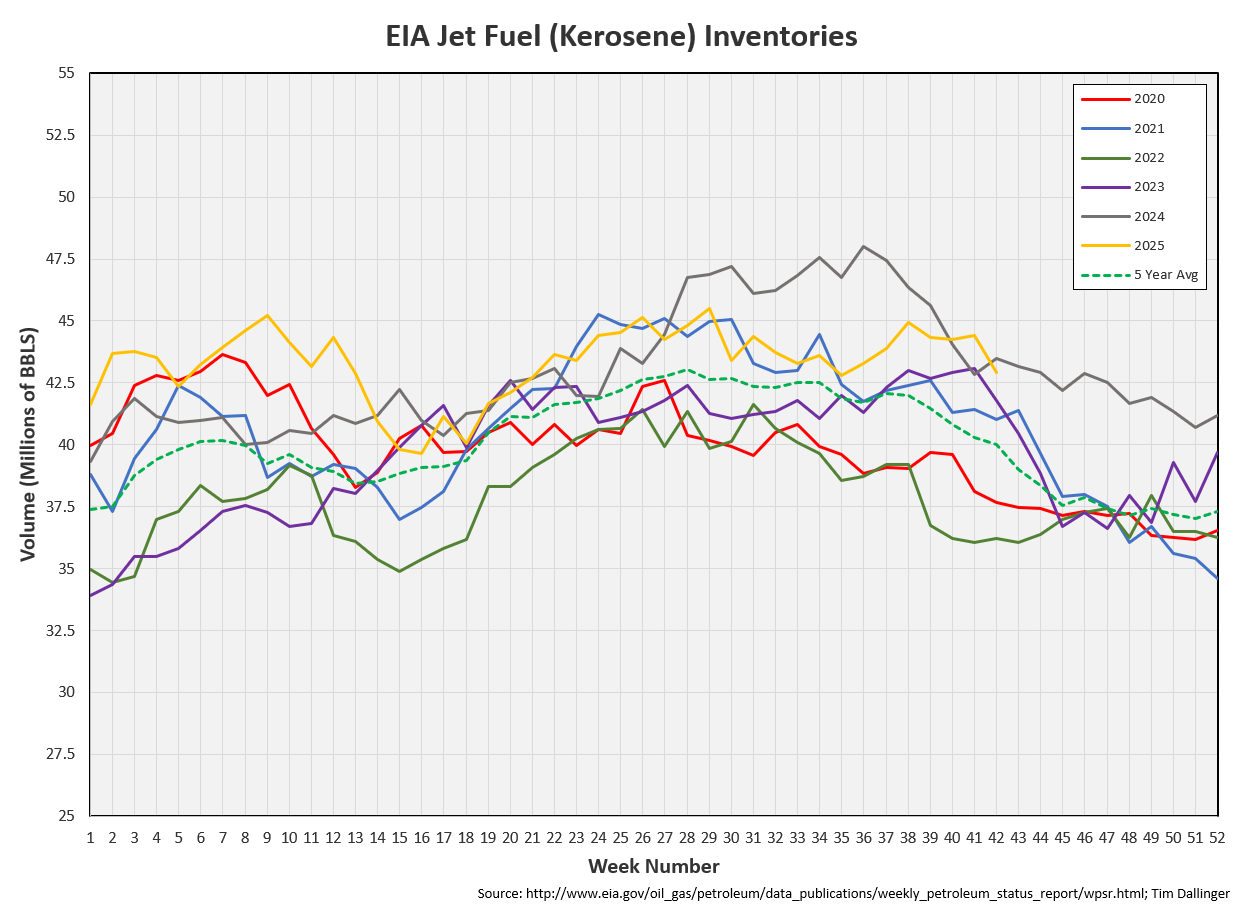

Jet: -1.5 MMB

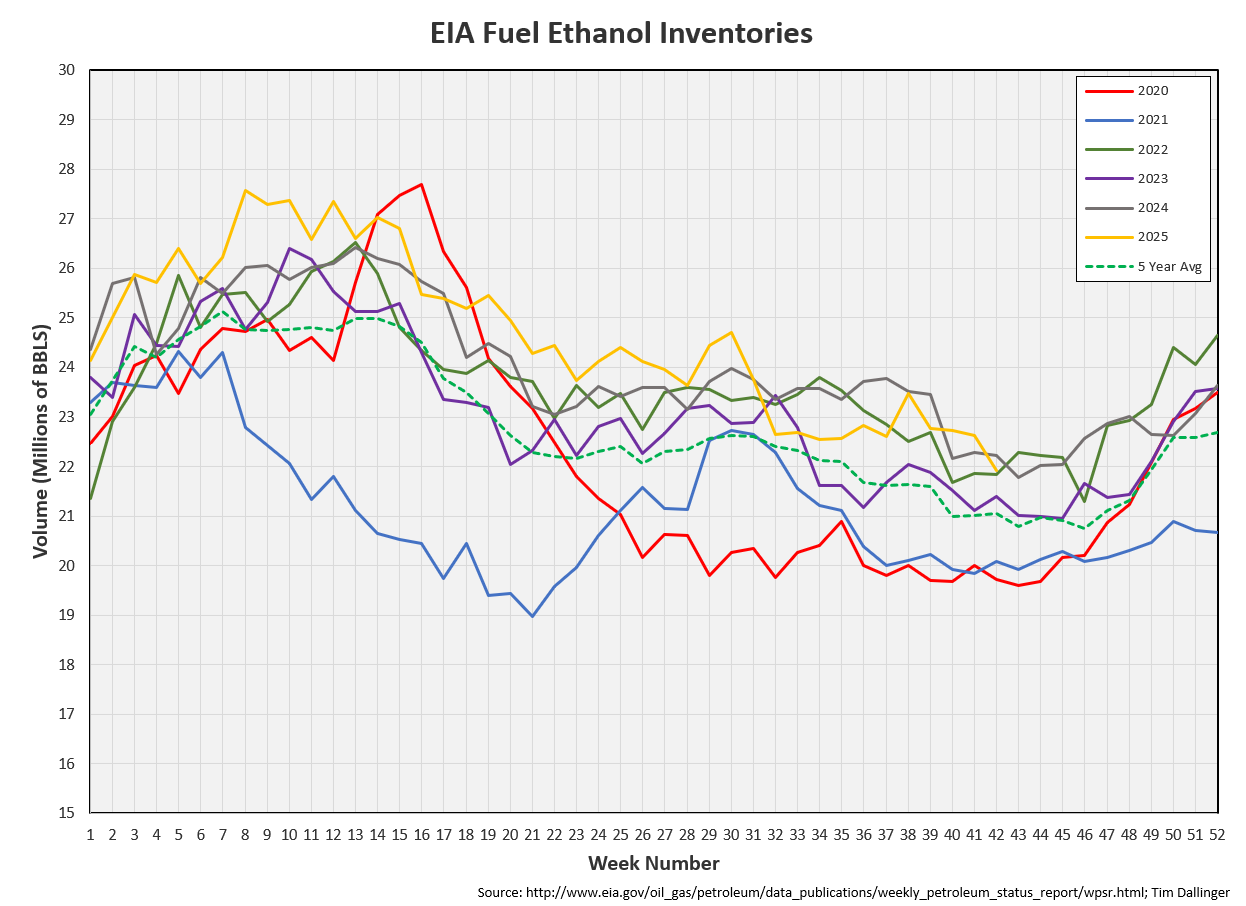

Ethanol: -0.7 MMB

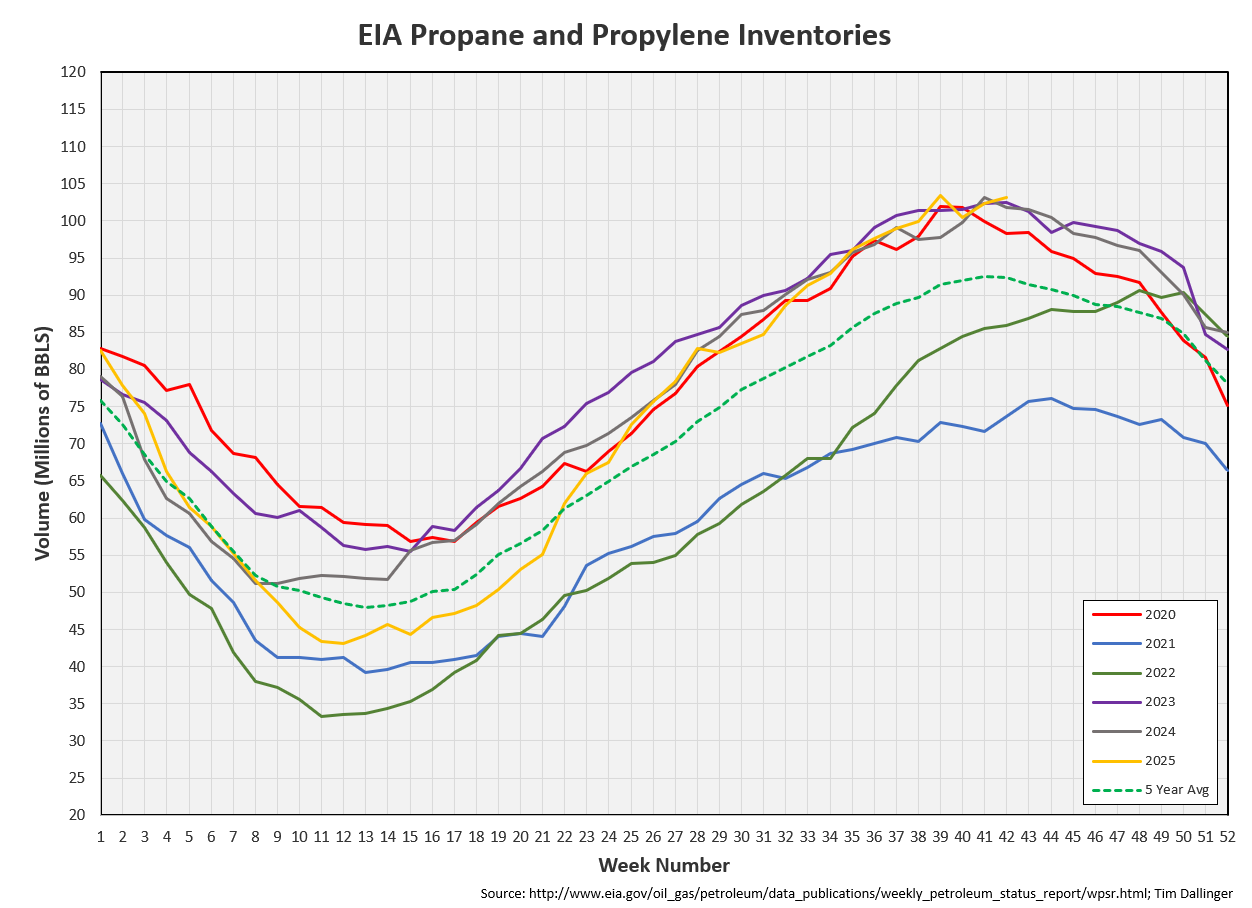

Propane: +0.8 MMB

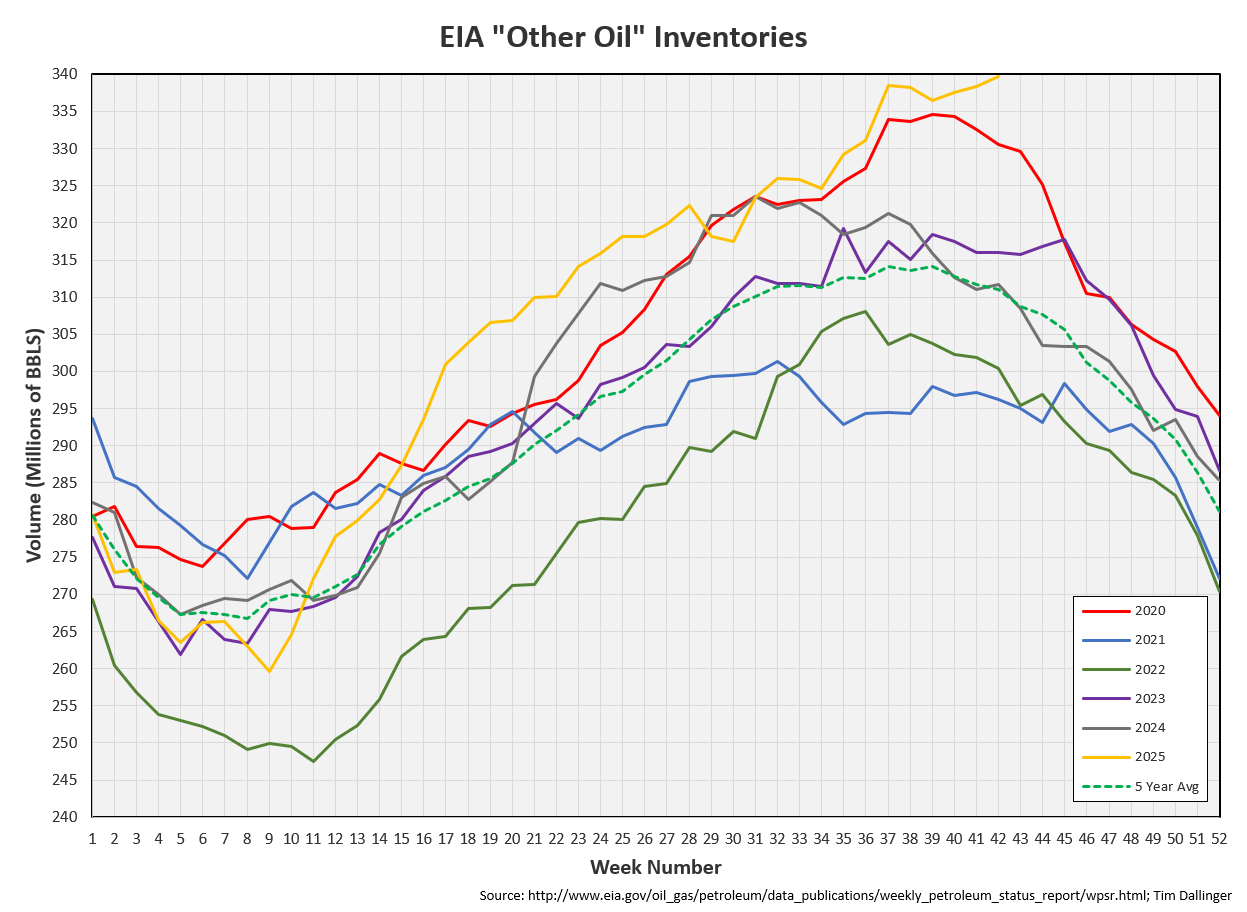

Other Oil: +1.3 MMB

Total: -4.2 MMB

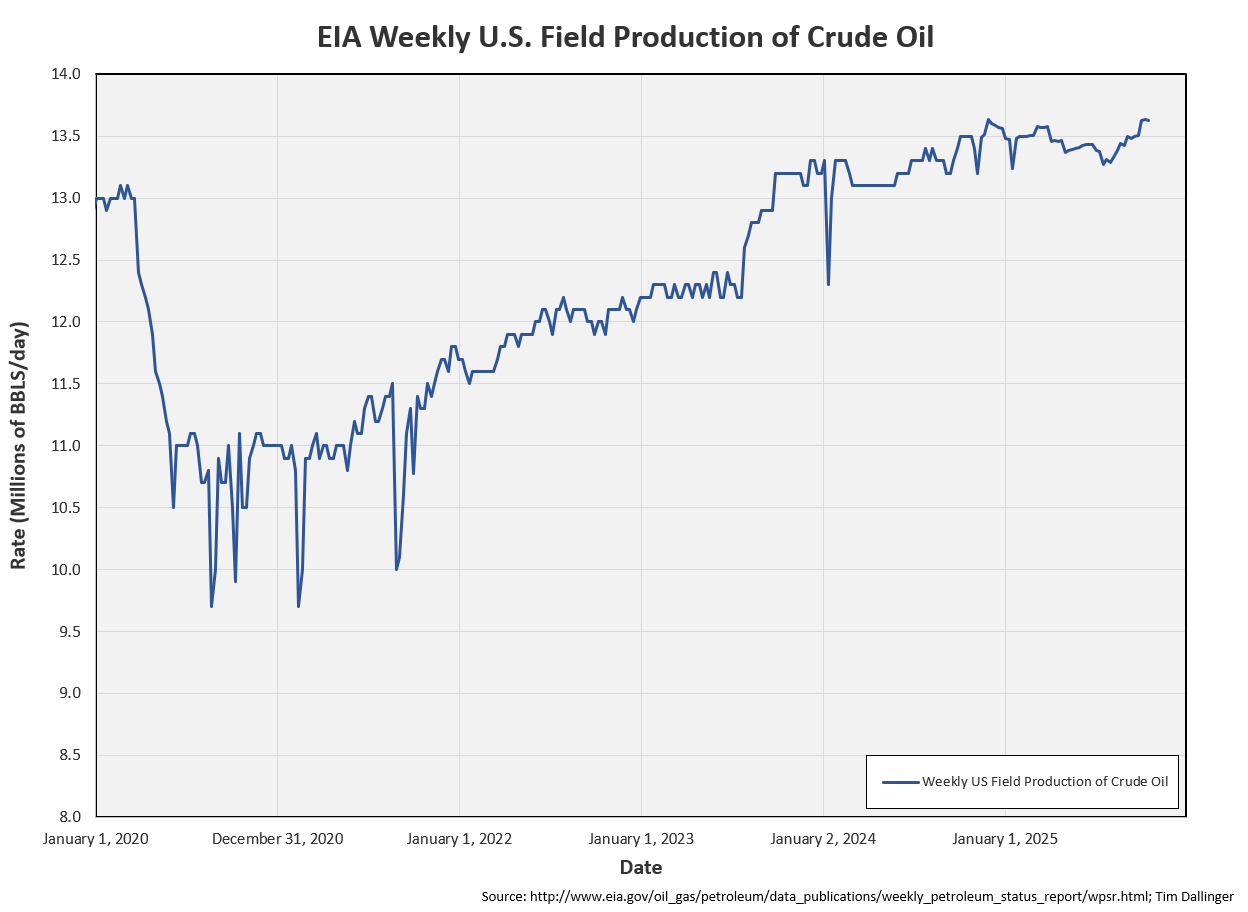

Bullish report. Refining is still down due to turnaround, but utilization increased on the week. BP’s Whiting facility is still experiencing outages after a fire, driving up gasoline prices in the Midwest. Both imports and exports returned to average levels. The EIA is modeling US production near record levels but there was a slight negative adjustment. Production is overcounted.

Implied demand is strong.

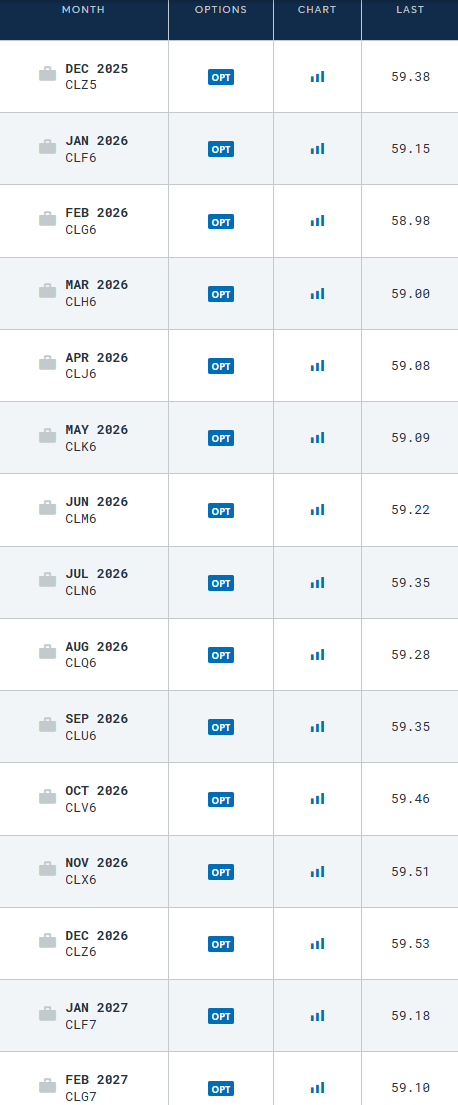

Spot WTI is currently pricing $59. Prices have rebounded slightly on the week but remain extremely dislocated from estimated fair value based on a price model derived from reported EIA inventories. The market is expecting a significant supply glut. There is no sign of oversupply yet in the US inventories.

Crude

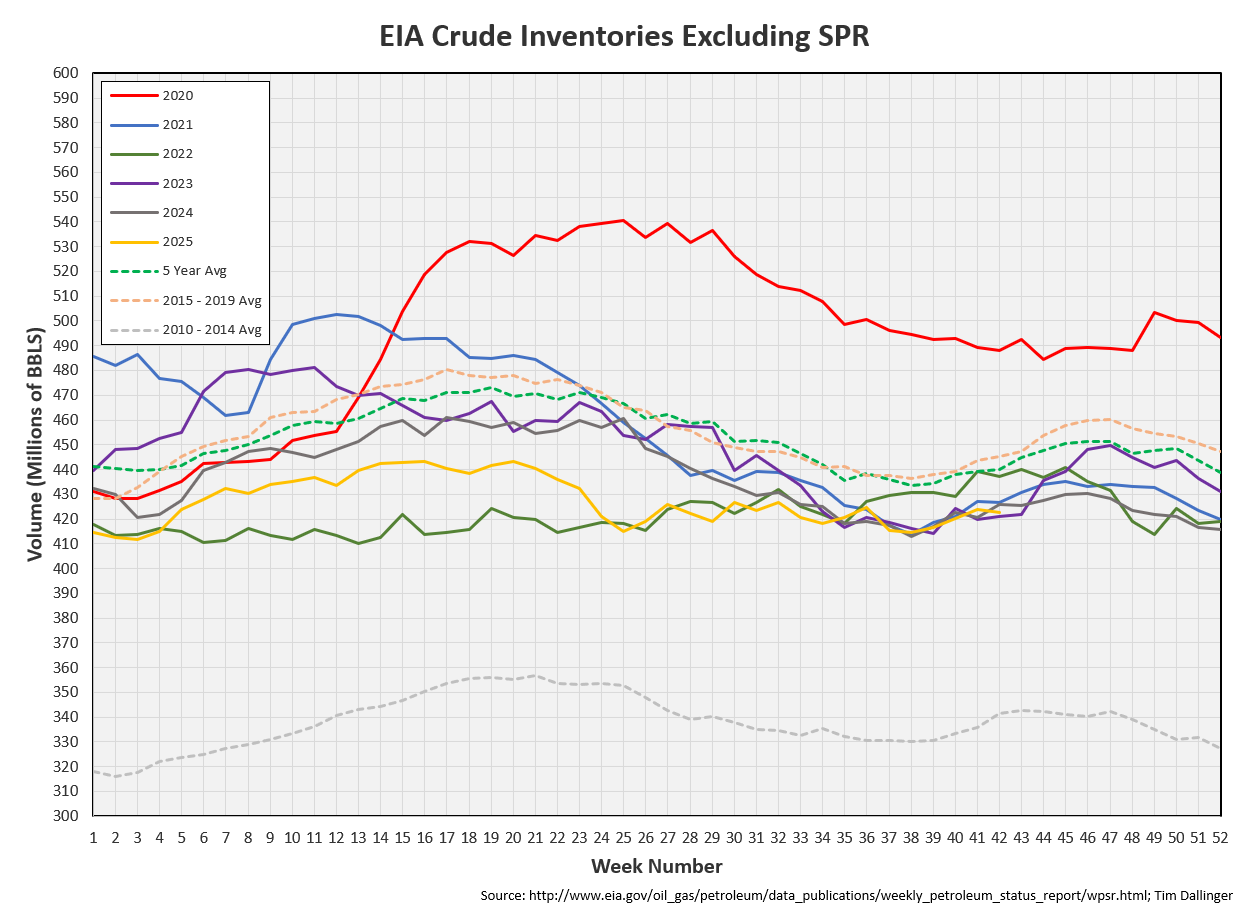

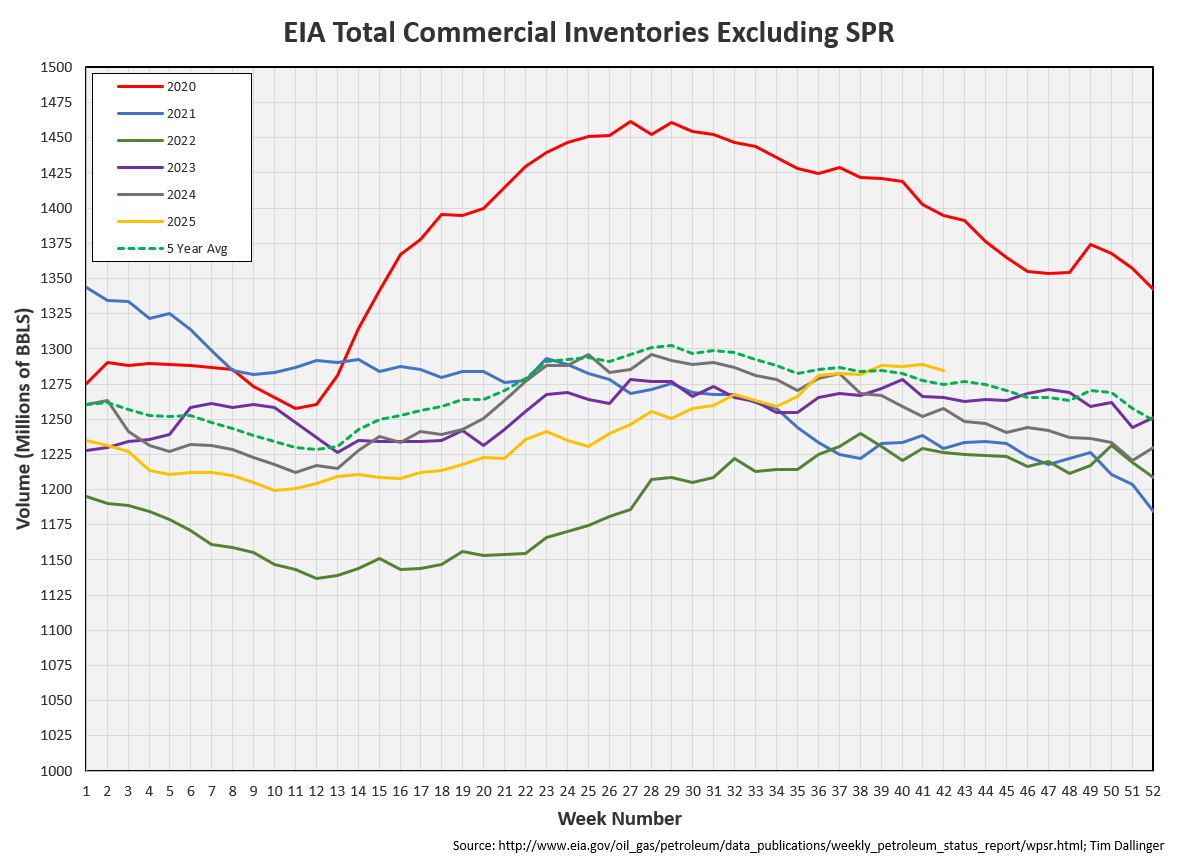

US Crude oil supply drew by 1.0 MMB. Crude inventories are currently 4% below the seasonal average. Only 2023 seasonal crude inventories have be lower in recent times and only by a marginal amount.

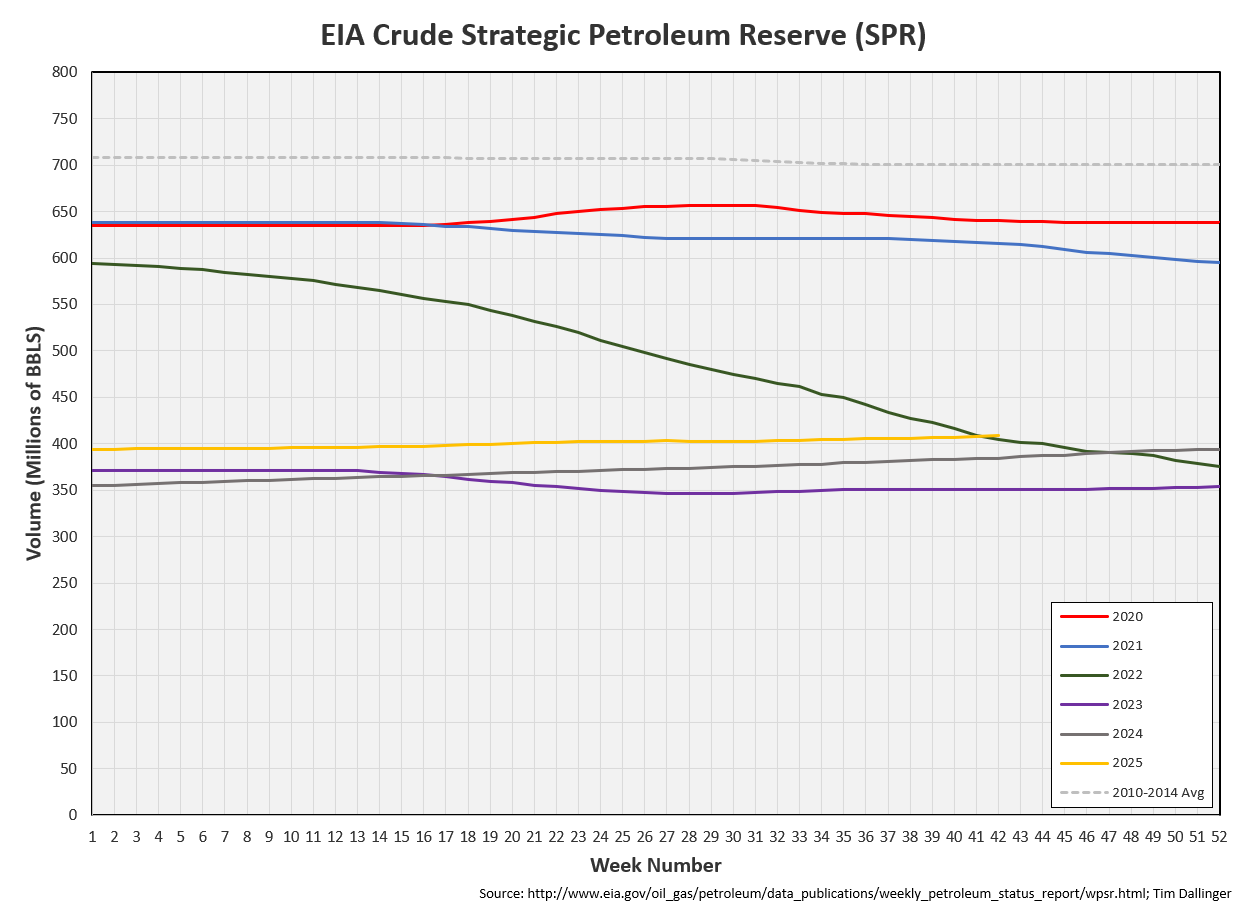

0.8 MMB were added to the SPR.

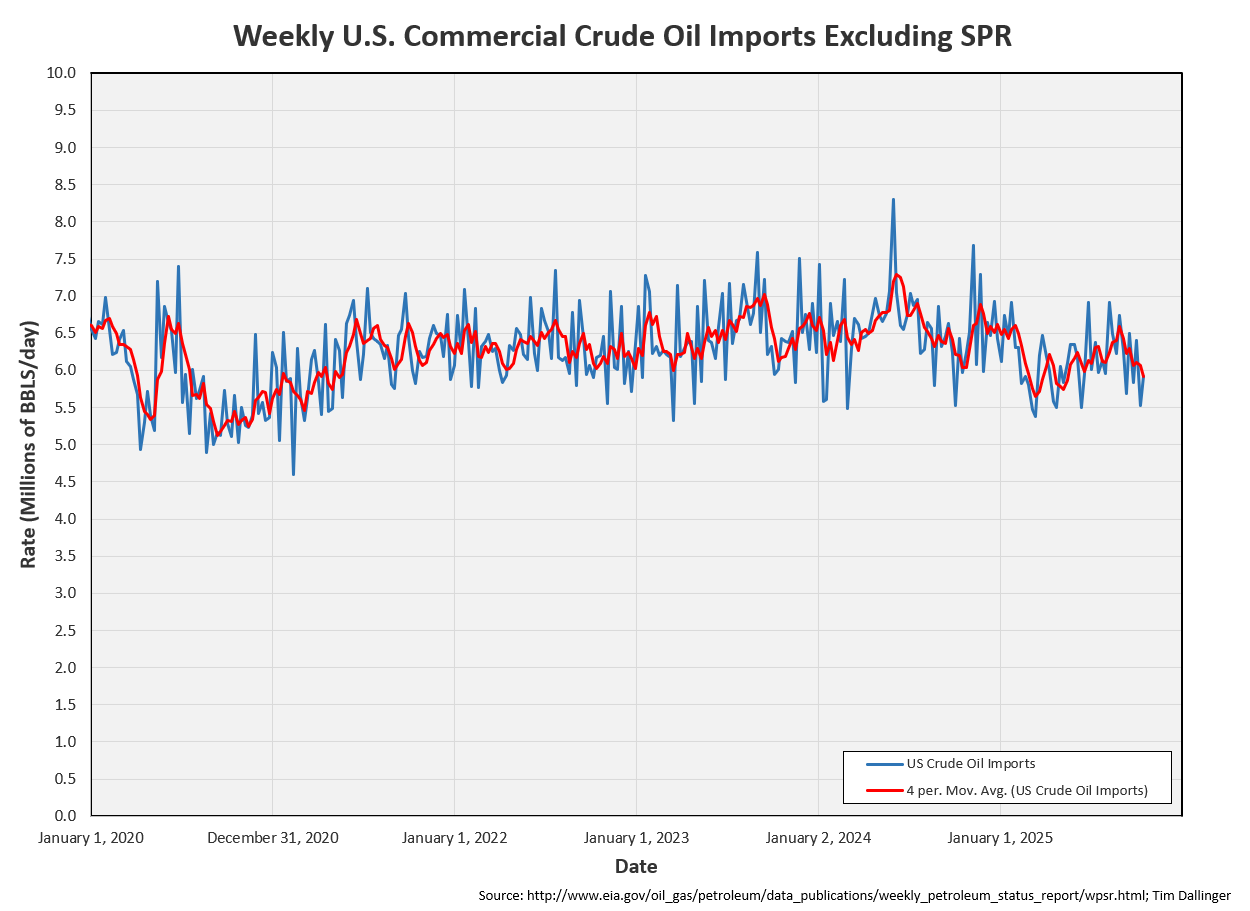

US crude imports increased weekly, back to average levels.

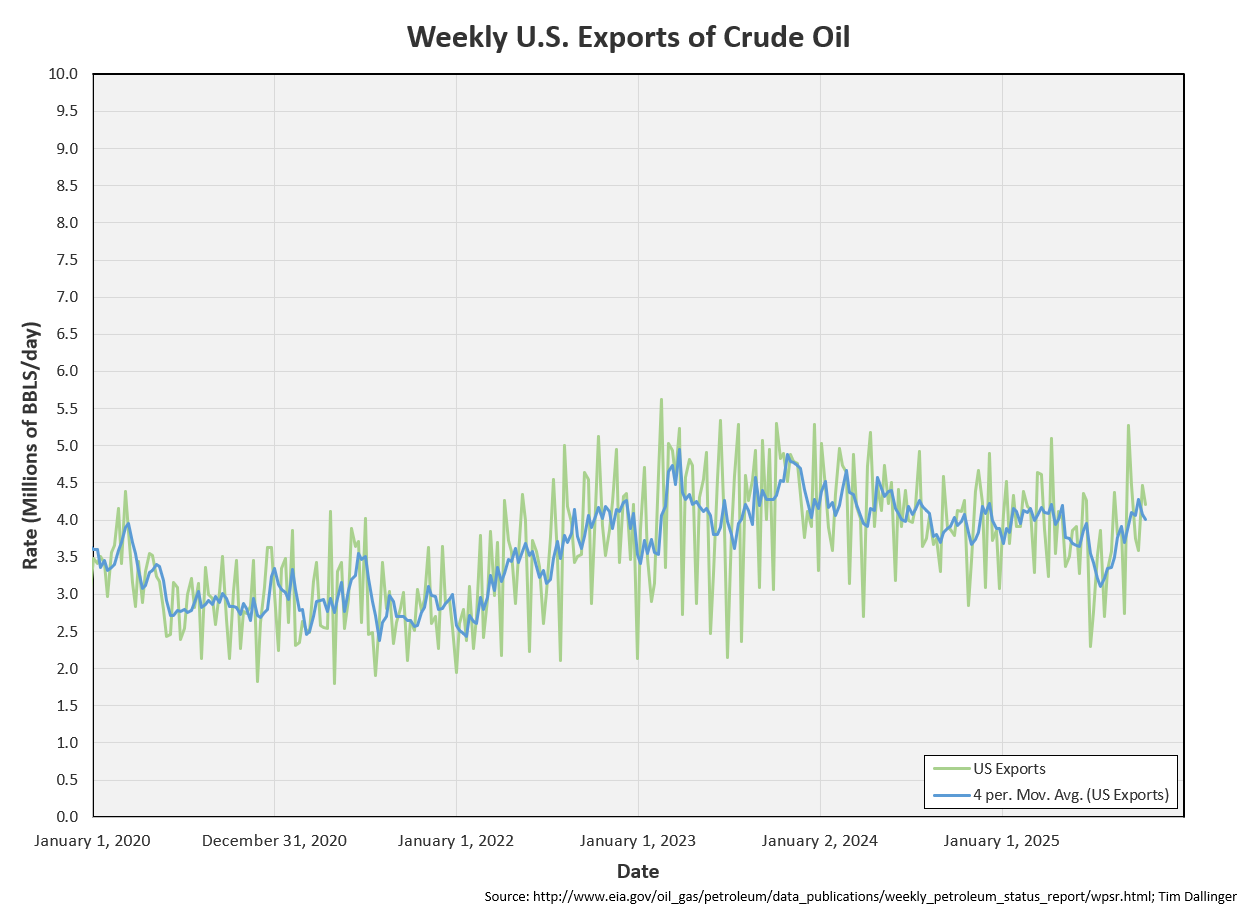

Crude exports decreased from last week’s overcounted figures. US crude exports remain healthy demonstrating there is still global physical demand for light barrels.

Unaccounted for crude retreated into slightly negative territory.

The EIA is still modeling US crude production near record levels. Crude production is over-counted.

Cushing

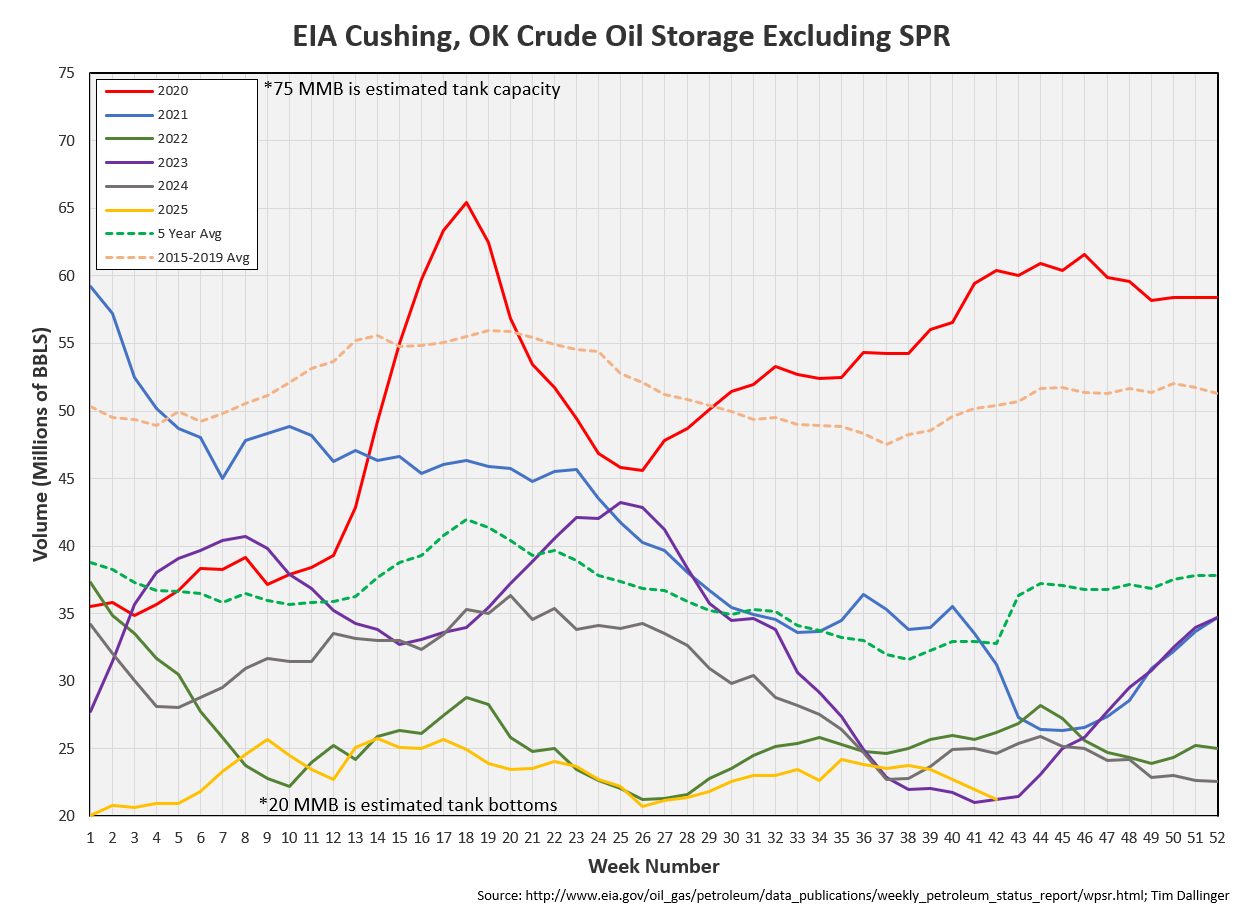

Crude storage in Cushing, OK, drew by 0.8 MMB week on week. Cushing tanks are once again near their minimum levels. This should be the low but if inventories fall further, Cushing operability becomes challenging.

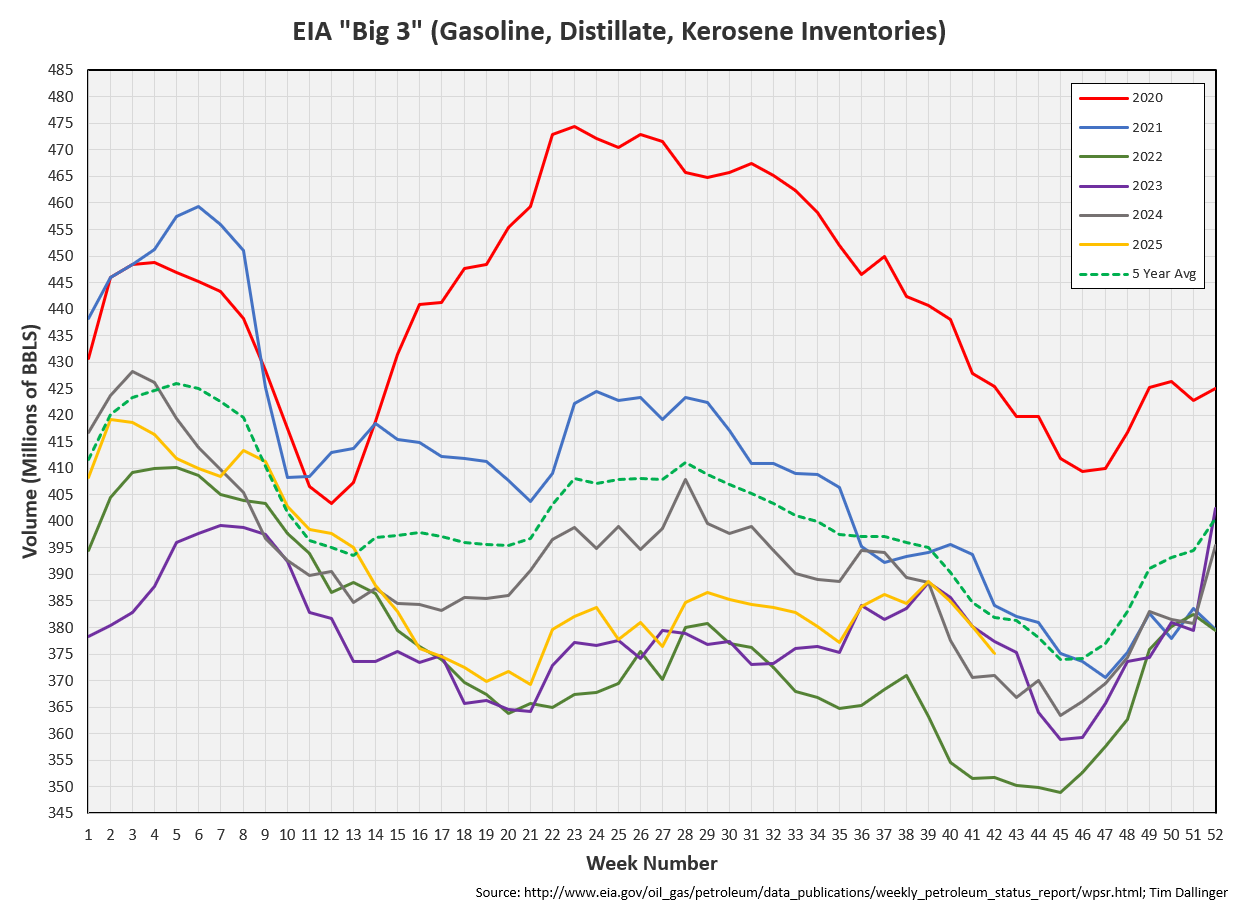

Gasoline

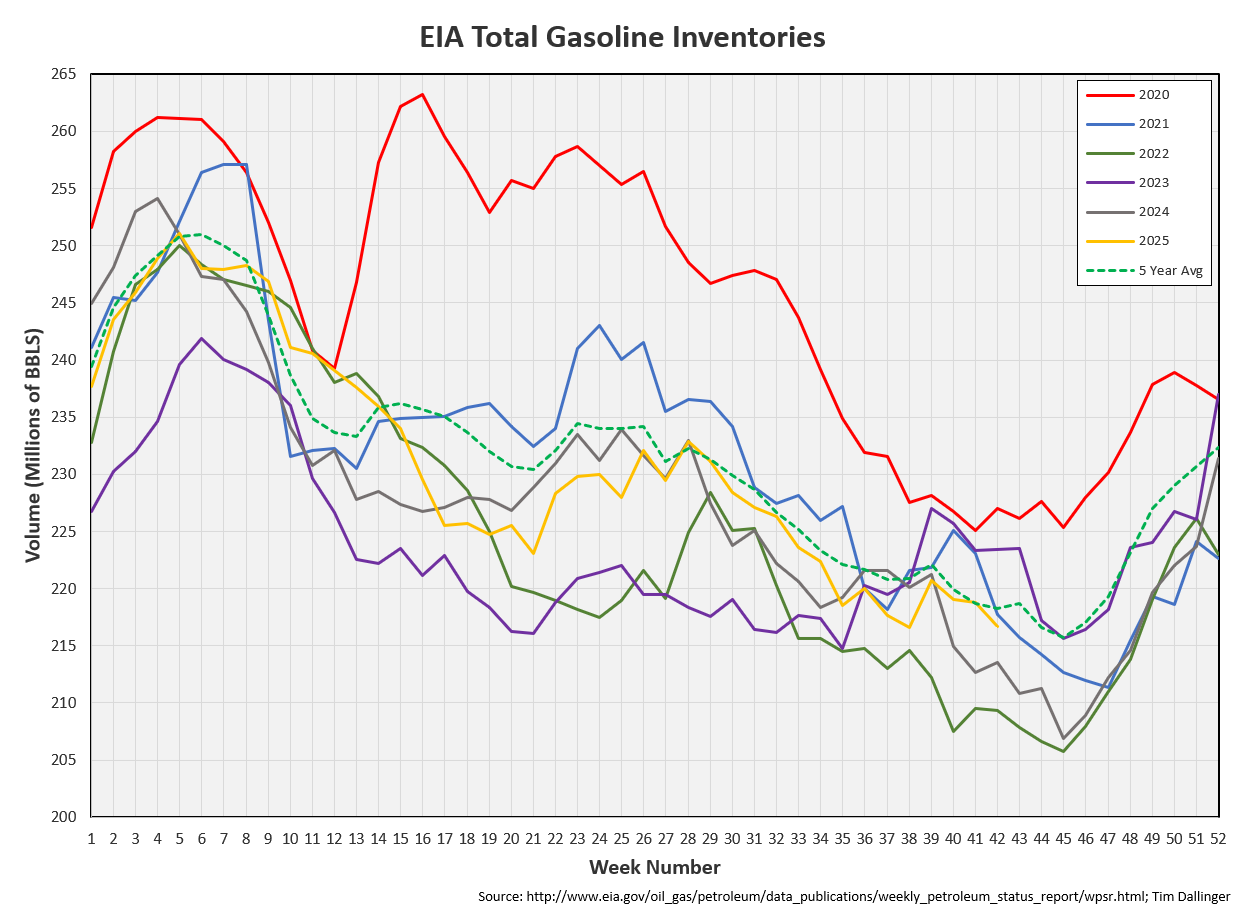

Total motor gasoline inventories decreased by 2.1 MMB and are again below the seasonal 5-year average.

Distillate

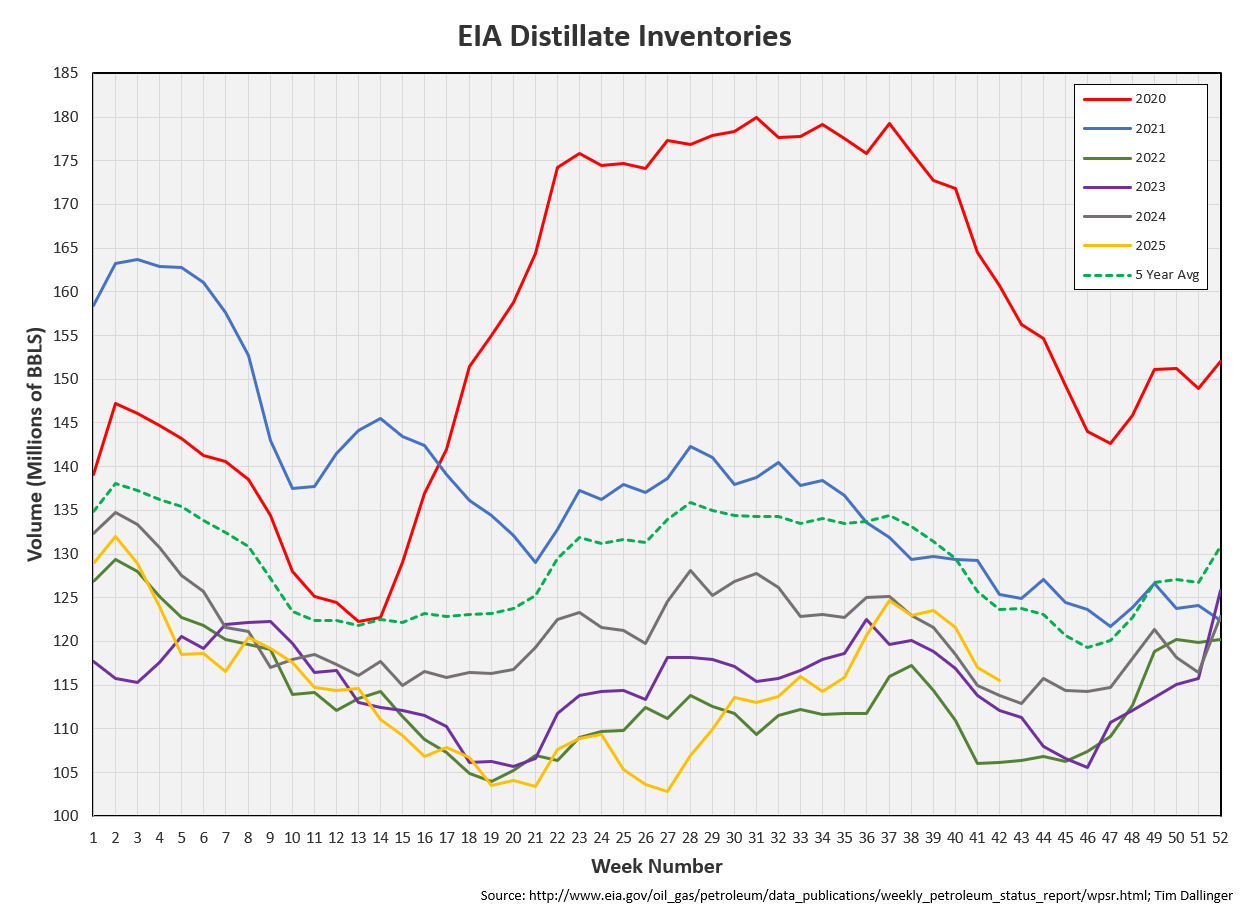

Distillate fuel inventories decreased by 1.5 MMB last week and are about 7% below the seasonal 5-year average.

Jet

Kerosene type jet fuels drew by 1.5 MMB. Seasonal inventories just fell below 2024 levels.

Ethanol

Ethanol inventories decreased 0.7 MMB week-on-week. Inventories are above seasonal averages but have been trending lower.

Propane

Propane/propylene inventories are slightly above seasonal records and just shy of the all-time record set a month ago. The only surplus in the US is in the hydrocarbon gas liquids.

Other Oil

Other oil is also at all-time records. Again, this is due to miscategorized “crude oil” production.

Total Commercial Inventory

Total commercial inventories are above average but these included the bloated condensates and high carbon chain liquids.

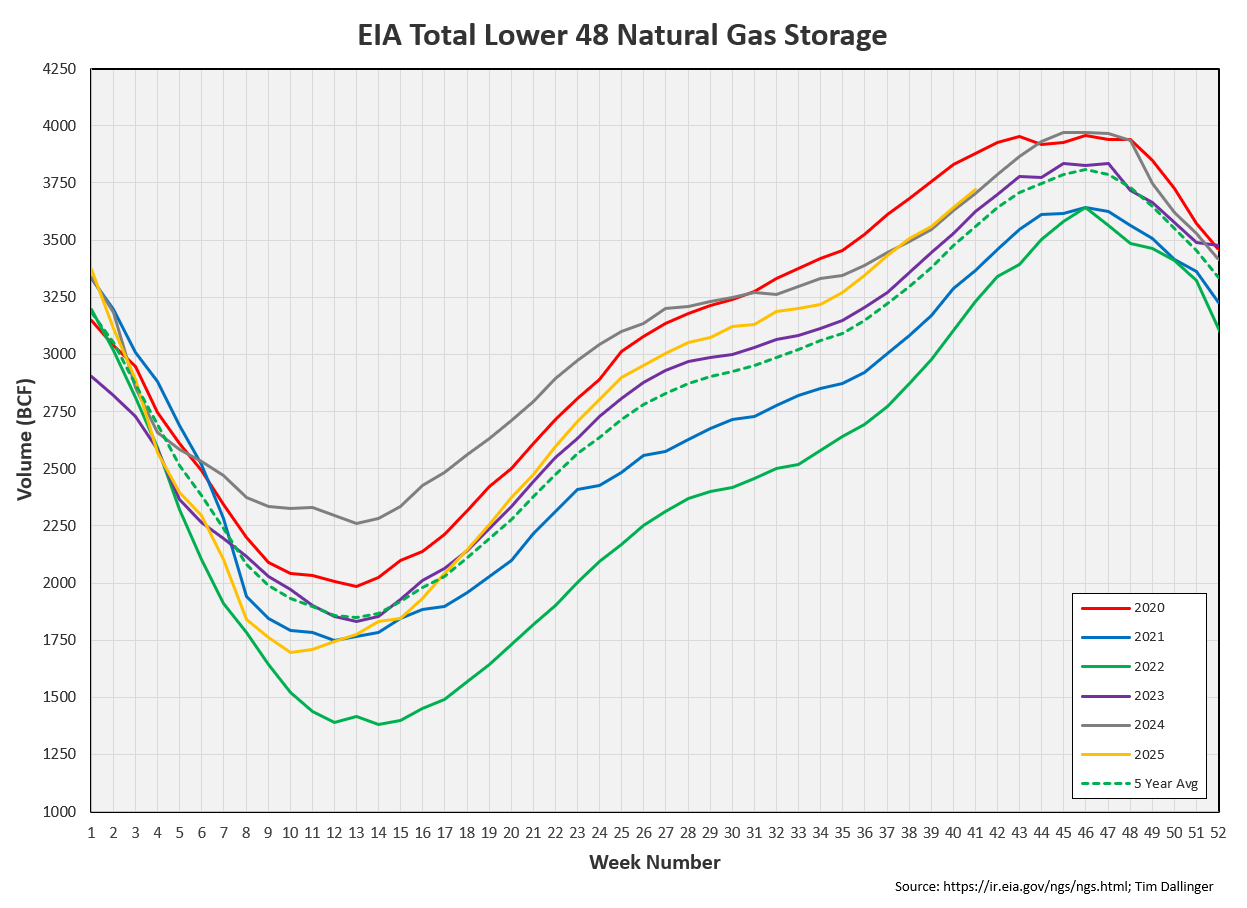

Natural Gas

The natural gas inventory chart below is the same as last week due to the EIA petroleum and gas reports being released on the same day due to government holiday. The updated gas inventory model will be available from the EIA tomorrow.

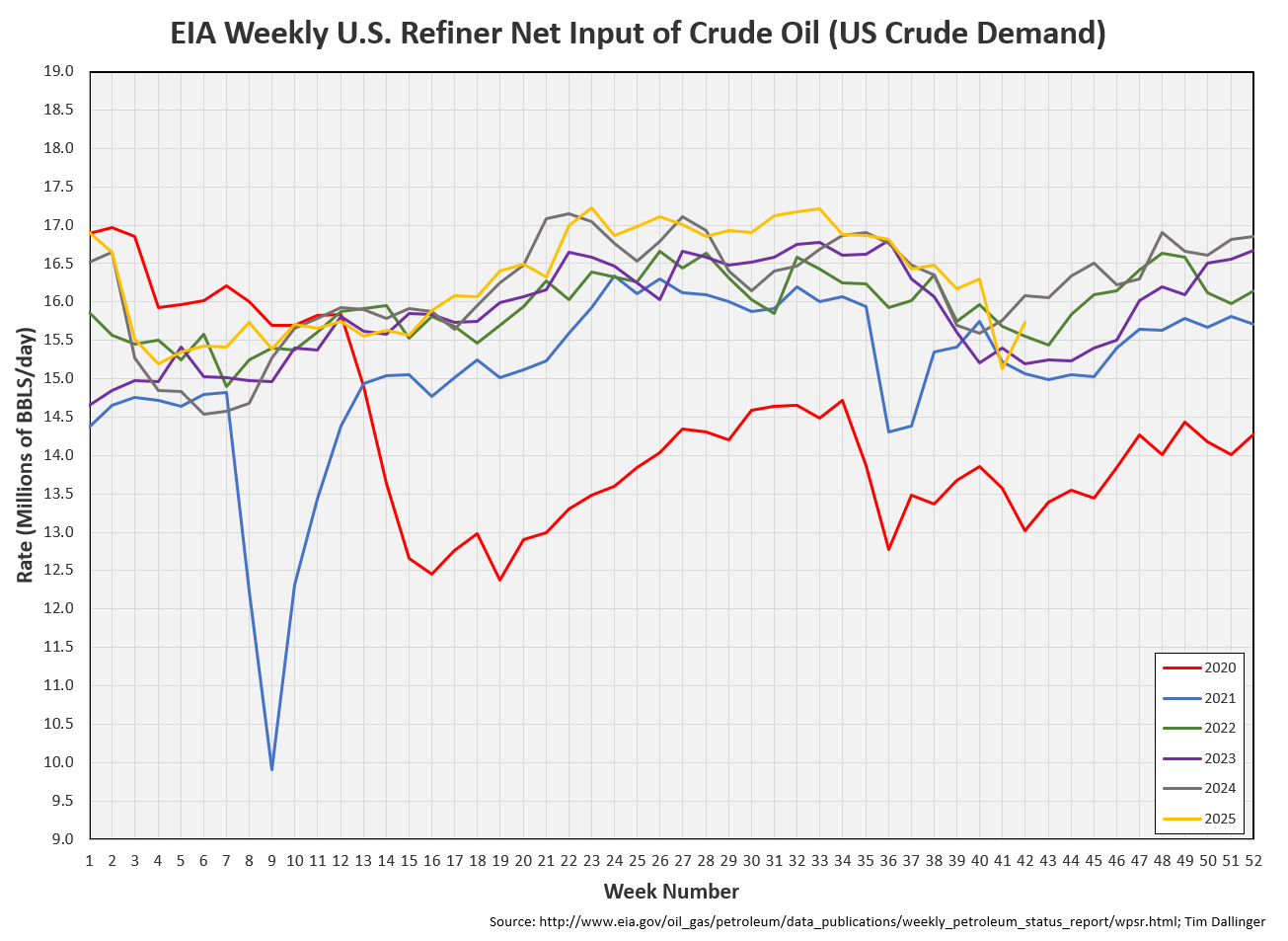

Refiners

Refining jumped from last week’s low. Last week’s figure appears anomalous. Part of that is due to units at the BP Whiting facility being offline following a fire. But Whiting is still struggling to restart those assets so those outages should be included this week too. With that impacted refinery activity and utilization still jumped, it seems maintenance season is ending sooner than expected. Crude demand is poised to rise imminently.

The EIA’s product demand proxy is up week-on-week. The moving average is down but it’s near normal high seasonal levels. Consumer demand is healthy.

Transportation inventories draw.

Simple cracks hover near $25. Refiners have plenty of incentive to run hard.

Discussion

Bearish sentiment prevails. The oversupply narrative persists. Reported oil-on-water figures remain high, leading to fear of glut. Yet for all the publicity, these barrels have not landed in onshore inventories. Even China is now drawing inventory.

The futures structure has flipped into slight contango. While this is not a bullish development, consider the magnitude.

Contango is the futures curve structure where prices are higher in the future. This is usually bearish because there is incentive to store. If a producer or trader can sell a contract today, for delivery in the future at a higher price, they often will. But the difference in the spot price and the contract price must be large enough to pay the storage fee for this duration. Otherwise, this physical arbitrage does not make financial sense. The degree is contango is not large enough to carry this trade profitably.

It isn’t bullish because it means refiners aren’t willing to pay up for immediate spot delivery. But most refiners aren’t buying spot crude anyway though. Refinery activity is planned months in advance.

These prices are not high enough to incent additional capital expenditure. Some analysts are suggesting shale break-even prices are below current levels. This is an incomplete analysis. They are pricing crude at the wellhead and not accounting for delivery tariffs and storage fees. This also doesn’t account for cost of capital and debt service. Full cycle price dynamics are higher than these excel calculations suggest. This is why the rig count is falling, and the majors and service companies are laying off staff.

Capital expenditure is required just to maintain current production levels due to natural declines. Additional capital would be required to grow production. Without production growth, the legacy well declines become more apparent. Earnings are poised to start in about a week. These dynamics will be more apparent then. Expect lower guidance especially as hedges are rolling off.

As the world focuses on the expected oversupply, they often overlook demand growth. Global demand has accelerated to 107+ MMBD, if one takes into account the “missing barrels.” OPEC spare capacity dwindles.

Net shorts in crude contracts have increased. Longs have all been but eliminated. The entire global financial system is expecting massive oversupply. That isn’t to say that they are all incorrect. But this trade is extremely lopsided. If the glut doesn’t materialize in a more meaningful manner than ship counting or there are any significant geopolitical outages, this can get unwound quickly. Perhaps that’s why energy equities are holding up much better than crude.

For the energy bull, it’s more waiting.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Jim Carrey plays an animated animal sleuth in the 1994 American slapstick comedy, Ace Ventura: Pet Detective.

To what do you attribute the recent spike in implied US production?