EIA WPSR Summary for week ending 4-12-24

Summary

Neutral report.

Crude: +2.7 MMB

SPR: +0.6 MMB

Cushing: 0.0 MMB

Gasoline: -1.2 MMB

Ethanol: -0.1 MMB

Distillate: -2.8 MMB

Jet: +1.0 MMB

Propane: +4.0 MMB

Other Oil: +7.5 MMB

Total: +10.0 MMB

Spot WTI is currently pricing $82. Prices slid after this report. However, this still slightly above fair value based on a price model derived from reported EIA inventories. The market appears to have sold geopolitical premium.

Crude

US Crude oil supply built by 2.7 MMB. Crude inventories are currently 2% below the seasonal average.

0.6 MMB were added to the SPR. 9.8 MMB have been added to the SPR in 2024.

This week senior White House advisor, John Podesta, reiterated that low gasoline prices were of the upmost priority to the Administration and an SPR release may be considered for this summer. US energy policy continues to be misguided and blatantly political.

US crude imports were about flat week-on-week.

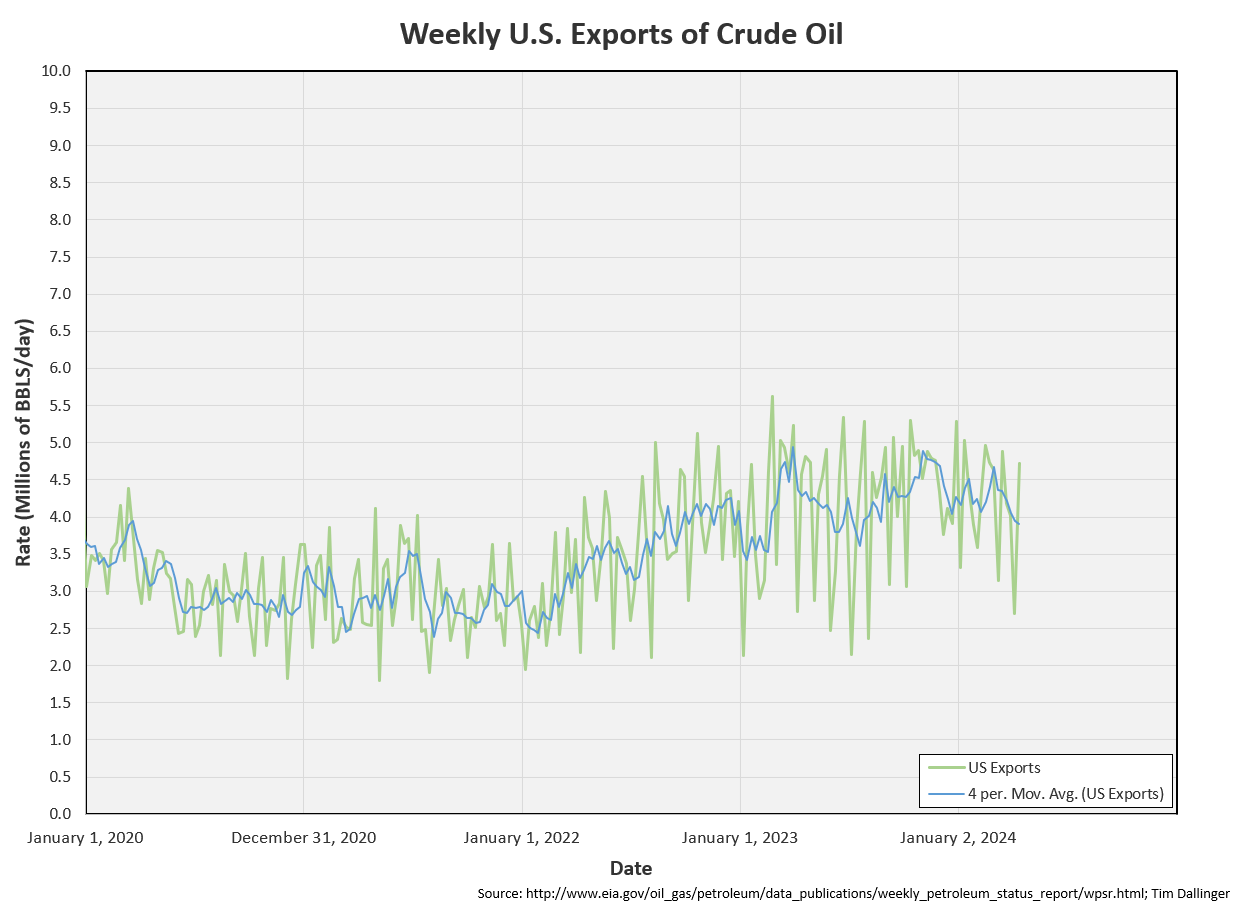

Crude exports were reported at 4.7 MMBD, a significant jump from last week. However, independent ship trackers showed low exports again. It could be surmised that US Customs was catching up for the miscounted barrels over April.

Unaccounted for oil increased to a 2024 high of 1.16 MMBPD. This was about the amount of overcounted exports this week. The US customs and EIA are still reporting inflated crude inventories due to undercounting crude exports in March.

Cushing

Storage in Cushing, OK, is flat week on week. Draws should return soon, especially with Canada’s TransMountain (TMX) line scheduled to start May 1, 2024. It’s reported that TMX linefill has started and wet commissioning has been completed. Planned startup appears on-schedule.

Gasoline

Total motor gasoline inventories decreased by 1.2 MMB and are about 5% below the seasonal 5-year average.

Distillate

Distillate fuel inventories decreased by 2.8 MMB last week and are about 7% below the seasonal 5-year average.

Jet

Kerosene type jet fuels increased by 1.0 MMB. Seasonal jet inventories are about 10% above the 5-year average.

Global flights and miles traveled continues to reach new seasonal highs.

https://www.airportia.com/flights-monitor/

Ethanol

Ethanol inventories decreased 0.1 MMB week-on-week. Inventories are about 5% above seasonal averages.

Propane

Propane/propylene inventories surged 4.0 MMB week-on-week. Inventories are above seasonal averages. Builds will continue until fall.

Other Oil

There was a large, 7.4 MMB build of other oil. This is the building season for this category, but the magnitude was larger than expected. Inventories are elevated above the seasonal 5-year average.

Total Commercial Inventory

Total commercial inventories built by 10 MMB. Total commercial inventories are 1% below the seasonal 5-year average. This includes the significant build in propane and other oil, less critical petroleum categories.

Natural Gas

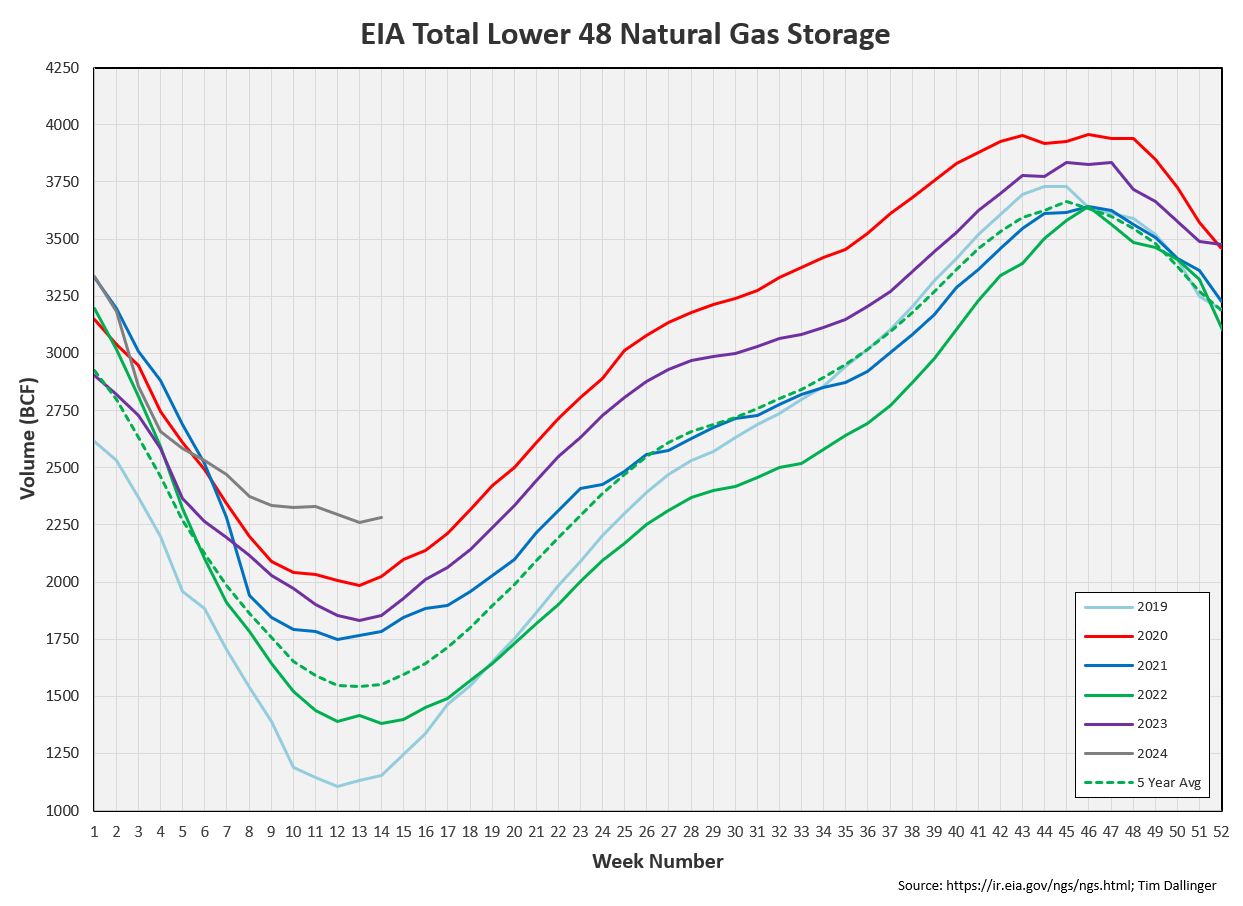

Natural gas inventories remain at seasonal record highs. Natural gas is priced negative at the WAHA hub. Associated gas from shale oil production is now a cost.

Refiners

US refineries picked up this week. Only 2019 has seen higher run rates in the recent past.

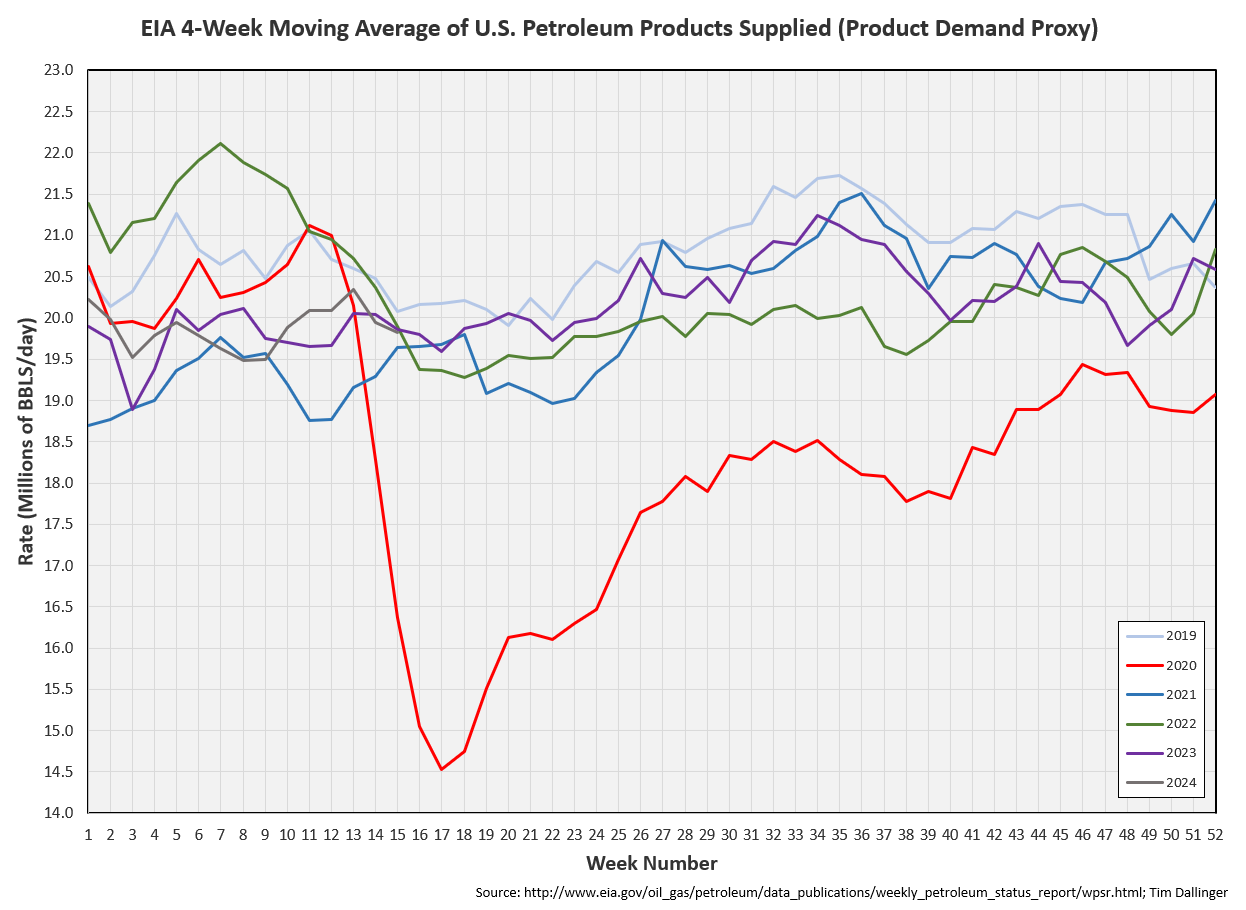

Yet the EIA demand proxy shows weakness. If refiners are running at near record levels and products are still drawing, how can consumer demand be weak? Speculators watch this measure but it has limited utility describing actual markets.

Transportation inventories continue their downward trajectory.

Simple crack-spreads are holding near a healthy $30.

Discussion

Graphs showing declining DUC’s, like the one below, are garnering attention online.

The data depicted is accurate, but it seems be being presented in a misleading way. Bulls argue that the lack of US rig growth and declining DUC’s are finally showing in US production numbers. By all accounts, US shale production is struggling for those reasons and the lack to natural gas takeaway capacity. However, the January monthly decline was driven significantly by weather impacts.

The weekly figures do appear to be over-counting US production. But February production figure will be reported higher than 12.5 MMB. 13 MMB is a reasonable expectation.

The weeklies are based on a model, rife with issues. But it seems unlikely that the weekly production numbers are off by 0.5 MMBD.

Over the weekend Iran attacked Israel with drones, rockets, and missiles. The Iron Dome defense with the assistance of the US and UK airforce, were able to shoot down most of the projectiles. There was only limited damage to the Nevatim Airbase. Iran claims this attack was in accordance with international agreement, under article 51 of the UN charter pertaining to legitimate defense. It was in response to the airstrike on the Iranian consulate in Damascus, Syria that killed 5 high ranking Iranian officials.

The US is trying to convince Israel that the successful defense was a win, and no further escalation is required. Israeli officials disagree. The Israeli War Cabinet remains divided on the appropriate response. Geopolitical risk is being discounted but that appears premature. Middle East- Northern Africa tensions remain high.

The US Administration will reimpose sanctions on Venezuela as Maduro failed to allow free and fair elections. The US is providing companies until May 31 to wind-down their business with state-owned PdVSA. If sanctions are imposed as announced, the US gulf coast is going to have difficulty locating heavy barrels.

The bullish commodity thesis continues. The summer is still projected to be tight. The pullback today is reasonable as spec positioning had skewed bullish. The physical market needs to tighten a bit more or geopolitical conflict escalate to drive the next crude leg higher.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

🙏🏻