EIA WPSR Summary for week ending 7-19-24

Summary

Crude: -3.7 MMB

SPR: +0.6 MMB

Cushing: -1.7 MMB

Gasoline: -5.6 MMB

Distillate: -2.8 MMB

Jet: +0.1 MMB

Ethanol: +0.66 MMB

Propane: +1.8 MMB

Other Oil: +6.3 MMB

Total: -4.6 MMB

Extremely bullish report.

Spot WTI is currently pricing $77. Price is below fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply drew by 3.7 MMB. Crude inventories are currently 5% below the seasonal average.

0.6 MMB of crude oil were added to the SPR. 19.2 MMB have been added to the SPR in 2024.

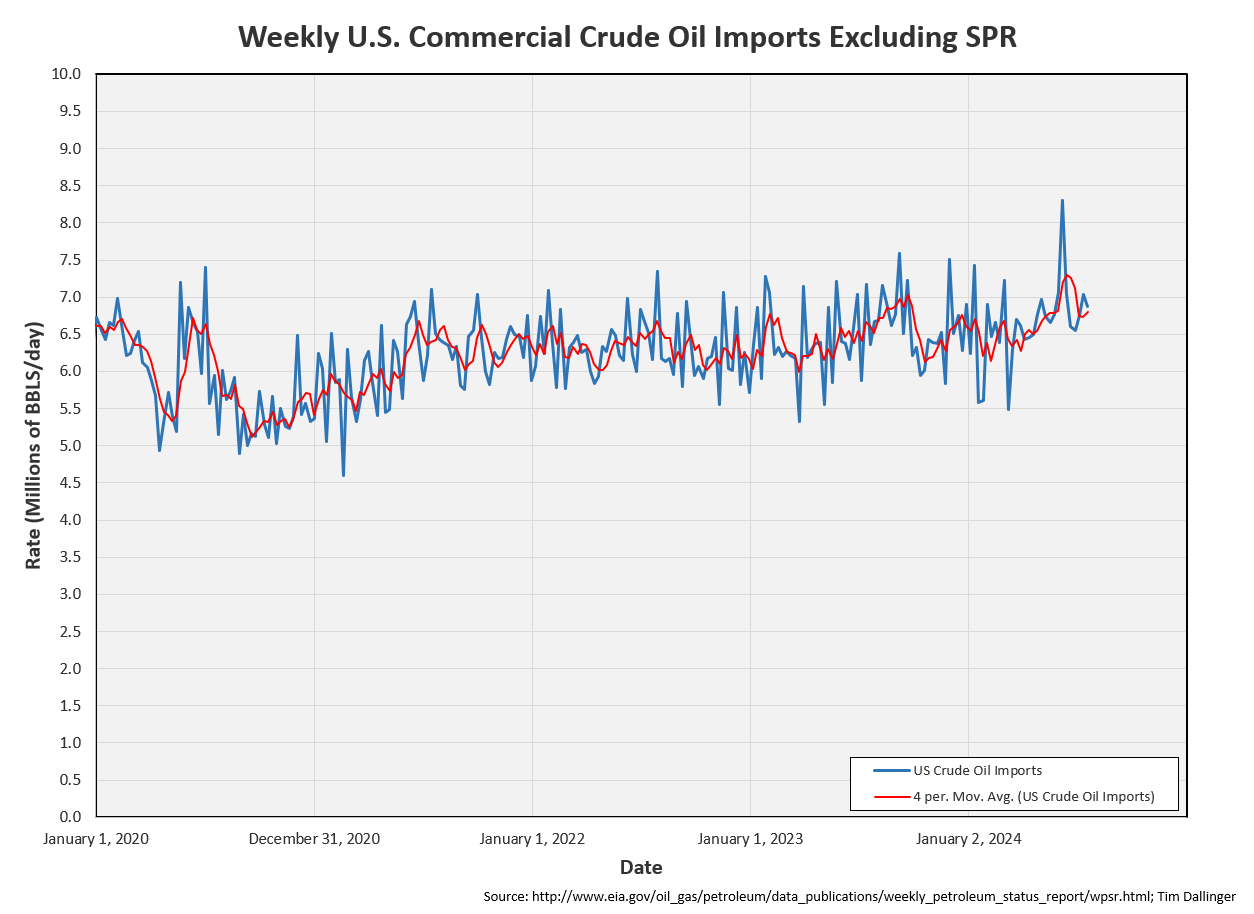

US crude imports were down slightly.

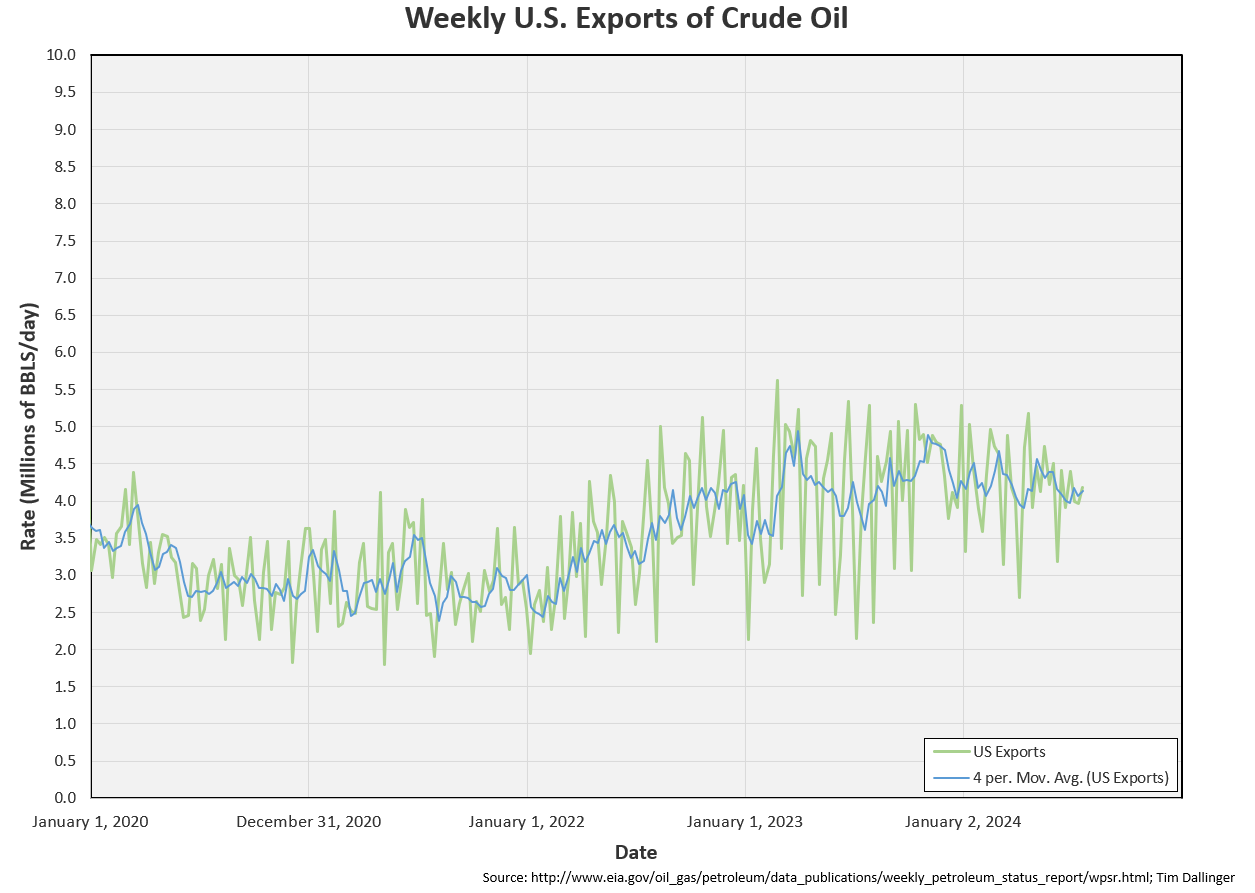

Crude exports slightly up.

Storm related import and exports issues should now be resolved.

Unaccounted for crude was again negative. It appears this figure is making up for US Customs recent under-counting.

Cushing

Crude storage in Cushing, OK, drew by 1.7 MMB week on week. Inventories are falling hard. Refiners are using what light, sweet crude that they can and rest is getting sucked out to the rest of the world in elevated exports. This should support WTI.

Gasoline

Total motor gasoline inventories decreased by a staggering 5.6 MMB and are about 4% below the seasonal 5-year average.

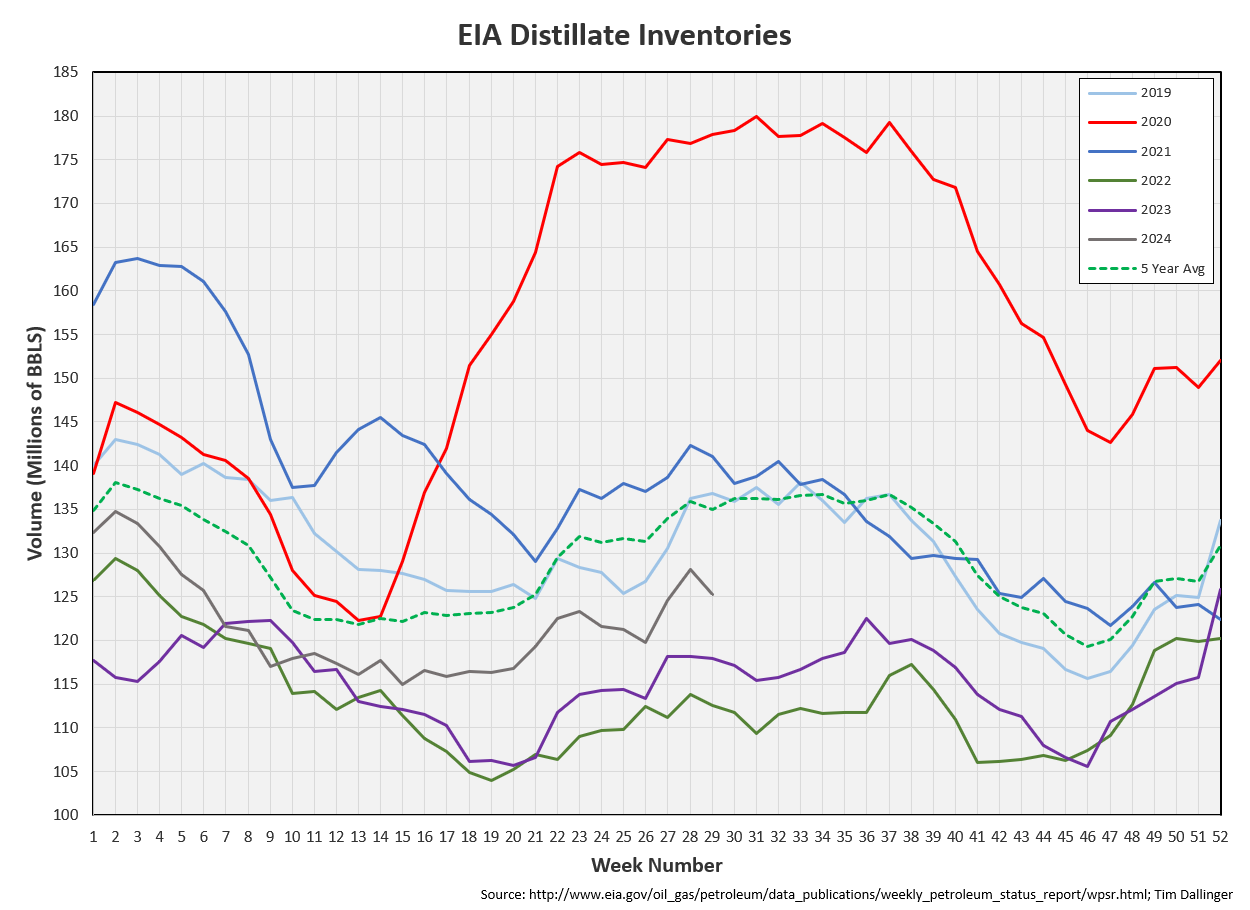

Distillate

Distillate fuel inventories also decreased by 2.8 MMB last week and are about 9% below the seasonal 5-year average.

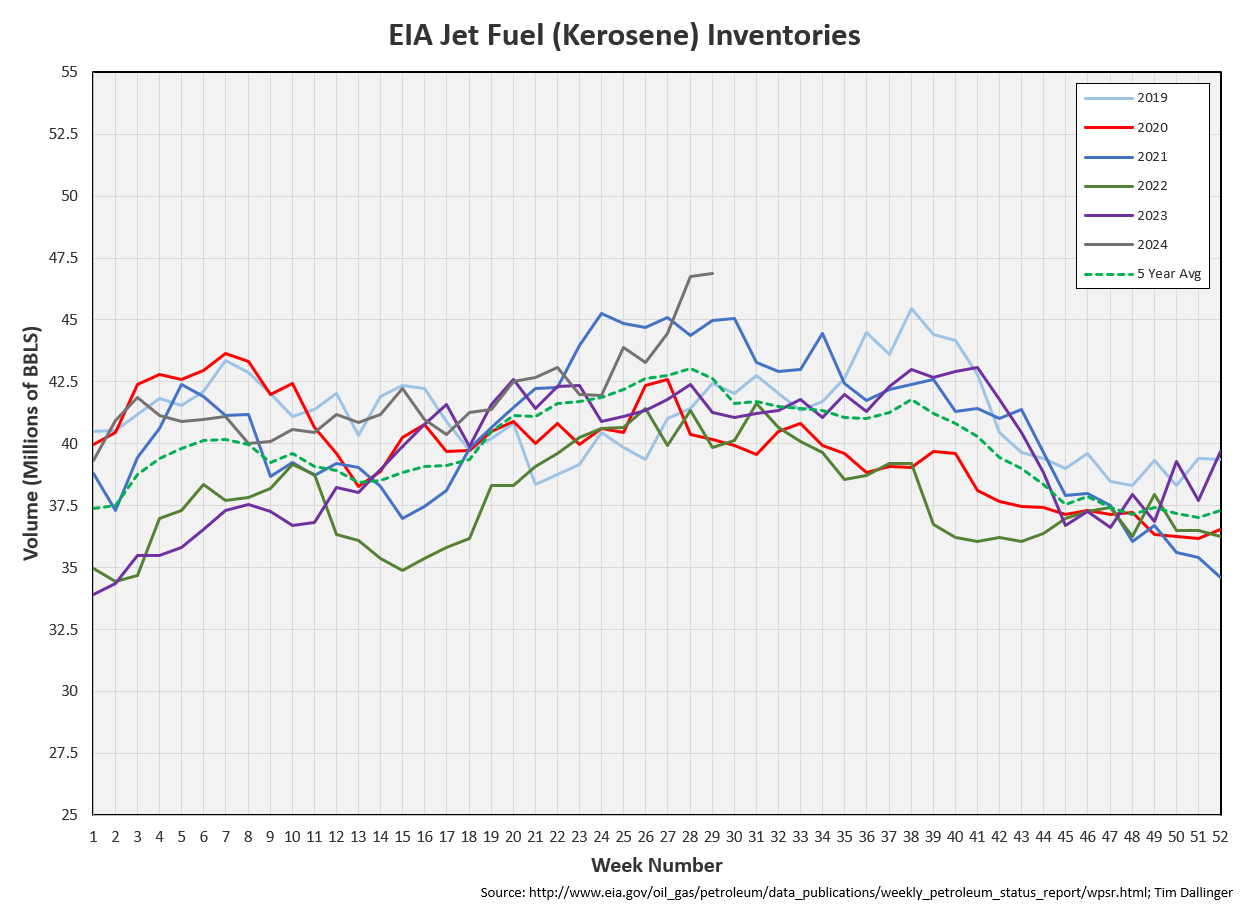

Jet

Kerosene type jet fuel increased by 0.1 MMB.

The number of flights and global miles flown have fallen back slightly from all-time highs. They still are both at seasonal records though. Jet fuel demand is strong, regardless of the value of the EIA proxy.

Ethanol

Ethanol inventories built slightly. Inventories are about above seasonal averages.

Propane

Propane/propylene inventories built 1.8 MMB, in-line with seasonal expectations.

Other Oil

Other oil built by 6.3 MMB, hitting a seasonal storage record.

Total Commercial Inventory

Total commercial inventories drew by 4.6 MMB. Inventories are just below seasonal averages. That figure includes the record other oil and bloated propane category.

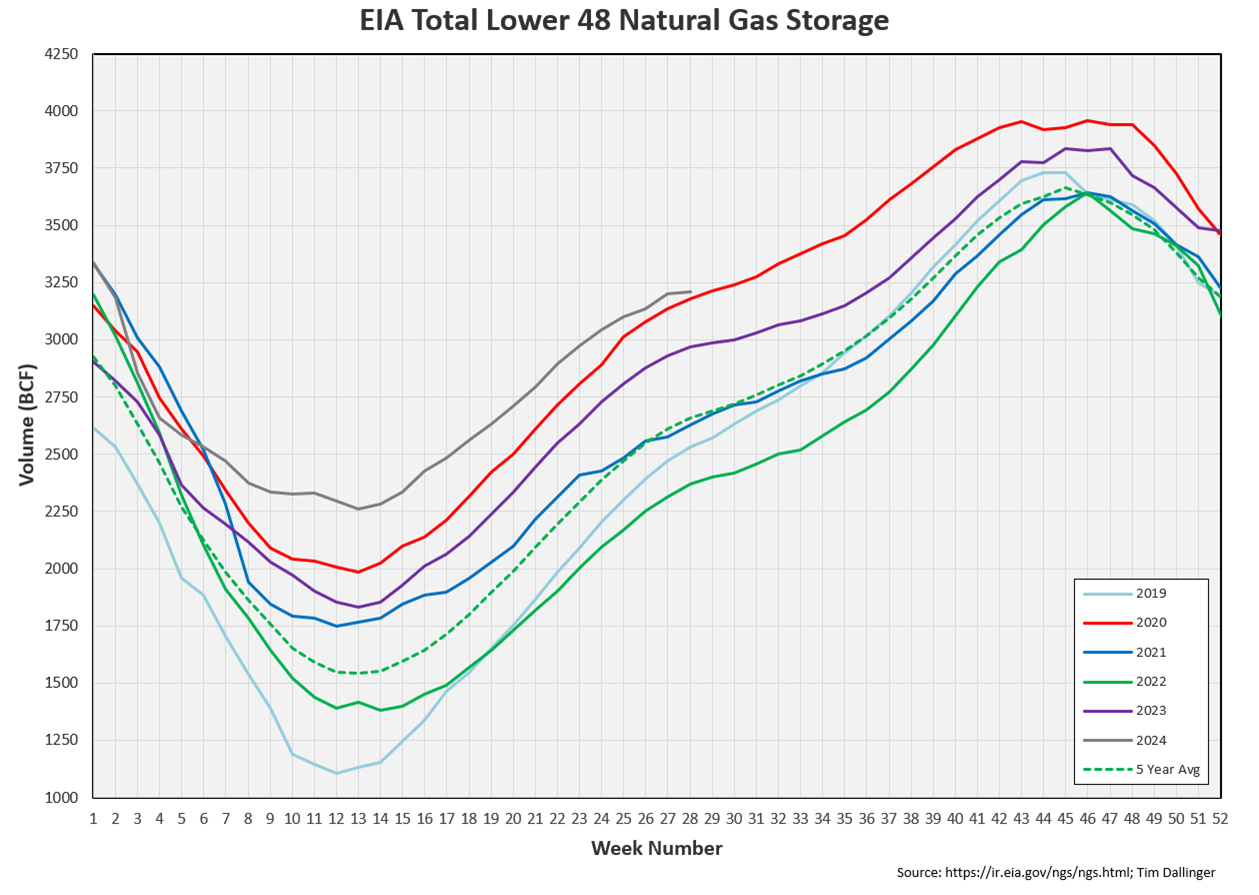

Natural Gas

Natural gas inventories remain elevated.

Refiners

Refiner utilization dropped. Refiners processed 05 MMBD less the previous week. Runs appear to have been cut. Cracks behaved favorably in response.

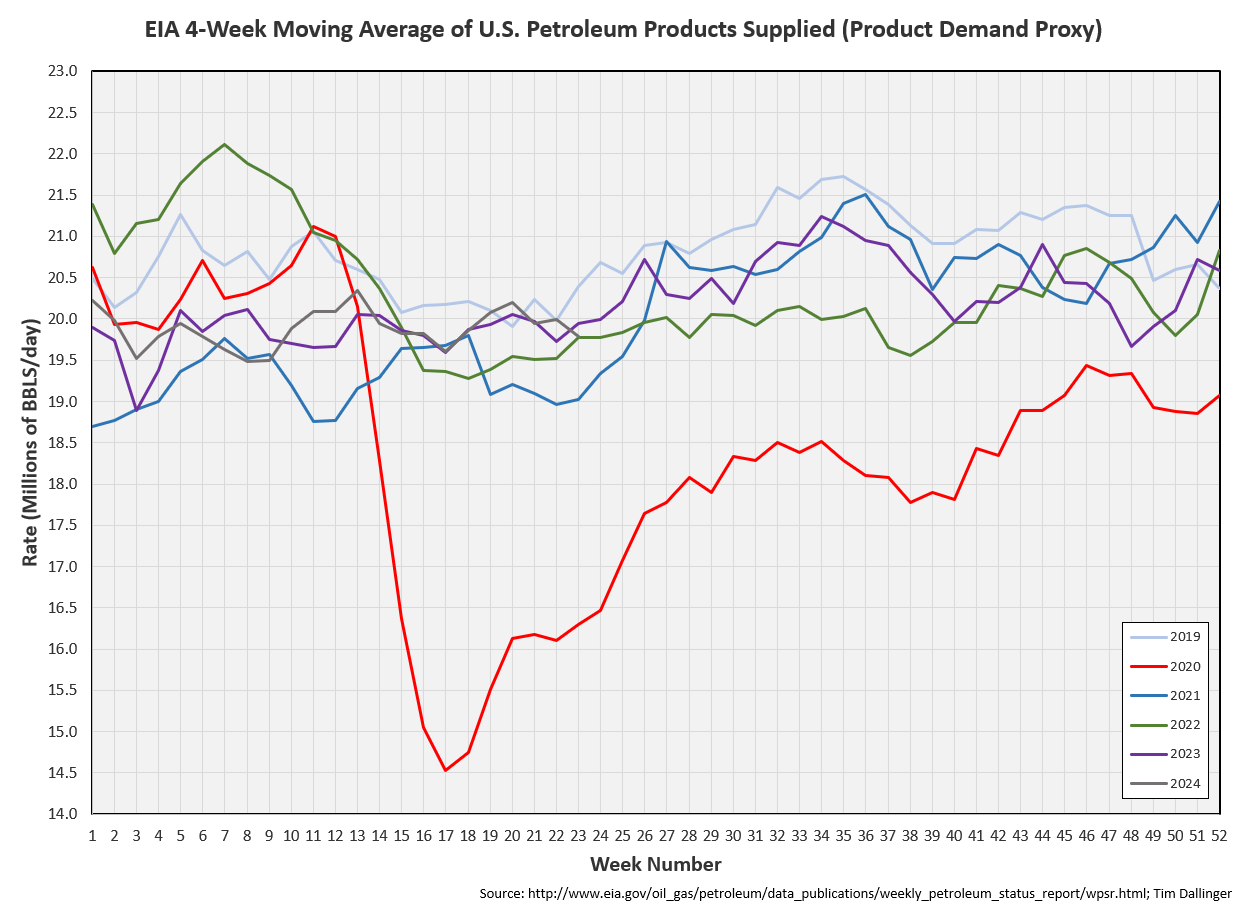

The EIA’s product demand proxy shows some weakness.

Transportation inventories fell considerably, giving cracks a needed boost.

Reviewing the EIA implied demand more closely, the average implied demand for just transportation inventories matches 2021 and only lags 2019.

Simple cracks received a needed boost.

Discussion

Pessimism has overtaken energy markets. Fund spec positioning has washed out. Retail has also abandoned the sector.

Yet, the data is showing a significantly different picture. OPEC exports have fallen to multi-year lows. It appears that they trying to squeeze the physical market. It’s working. WTI and Brent both remain in steep backwardation, signaling that the physical market is tight.

What could be causing such poor outlook? One potential source for the negative outlook is recent developments in US politics. Following a failed assassination attempt, former president Trump is showing a substantial lead in polling for November success. Though details remain murky, President Biden has announced through written communication that he will not be seeking reelection.

Analysts expect a Trump presidency to be bearish for energy. He’s fond of the slogan, “drill, baby, drill” and has a history of taking to Twitter when he feels the price of oil is too high. While Trump can move markets with his statements, he can’t tweet more oil out of the ground. US production continues to struggle with increased associated gas as GOR (gas to oil ratio) increases. While US production has not declined, it also is not growing. The rig count continues to fall. Companies are drilling horseshoe patterns on their existing best acreage. This increases production in the short-term and decreases drilling cost. But the land produces less total oil over the life-cycle of the well. This will be a future issue in West Texas.

The market is also not pricing any geopolitical premium in crude markets. Yet, the middle east and Russia both remain tumultuous places.

Russia is over-complying with OPEC cuts for a change. They also appear to be eyeing November. A Trump presidency likely means less Ukrainian aid, bringing that conflict to a conclusion. High oil prices are usually bearish for the current administration during an election cycle as it has knock-on effects across the economy. Saudi is acting similarly. Saudi Arabia had a much warmer relationship with President Trump and Jarid Kushner than with the Biden Administration.

Saudi Arabia may also be hoping Trump will enforce Iranian sanctions, taking Iranian barrels back off the market.

Iran is reported to have made advancements in their uranium enrichment program. If that’s the case, will Israel strike pre-eminently?

Iranian backed Houthis continue to harass tankers in the Red Sea.

This appears to be a bullish setup, at least into the election. If one believes US production is not currently constrained by the government, then a Trump presidency should have little effect on the physical market. Expect volatily. But at the end of the day, energy market operate on simple supply and demand fundamentals.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Iconic professional wrestler, Hulk Hogan, gives an impassioned speech, supporting former president Trump, at the 2024 Republican National Convention.