EIA WPSR Summary for week ending 5-9-25

Summary

Crude: +4.0 MMB

SPR: +0.5 MMB

Cushing: -1.1 MMB

Gasoline: -1.0 MMB

Distillate: -3.2 MMB

Jet: +1.6 MMB

Ethanol: +0.3 MMB

Propane: +2.2 MMB

Other Oil: +2.6 MMB

Total: +4.9 MMB

Spot WTI is currently pricing $62. Prices remain deeply discounted versus estimated fair value based on a price model derived from reported EIA inventories. However, spot price has improved over the past week.

Crude

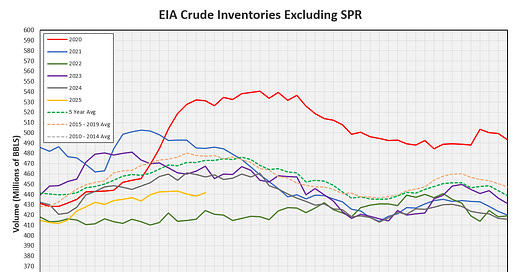

US Crude oil supply built by 4 MMB. Crude inventories are currently 6% below the seasonal average.

0.5 MMB were added to the SPR.

The SPR is at levels experienced October 2022.

US crude imports were down on the week.

US Crude exports were also down significantly.

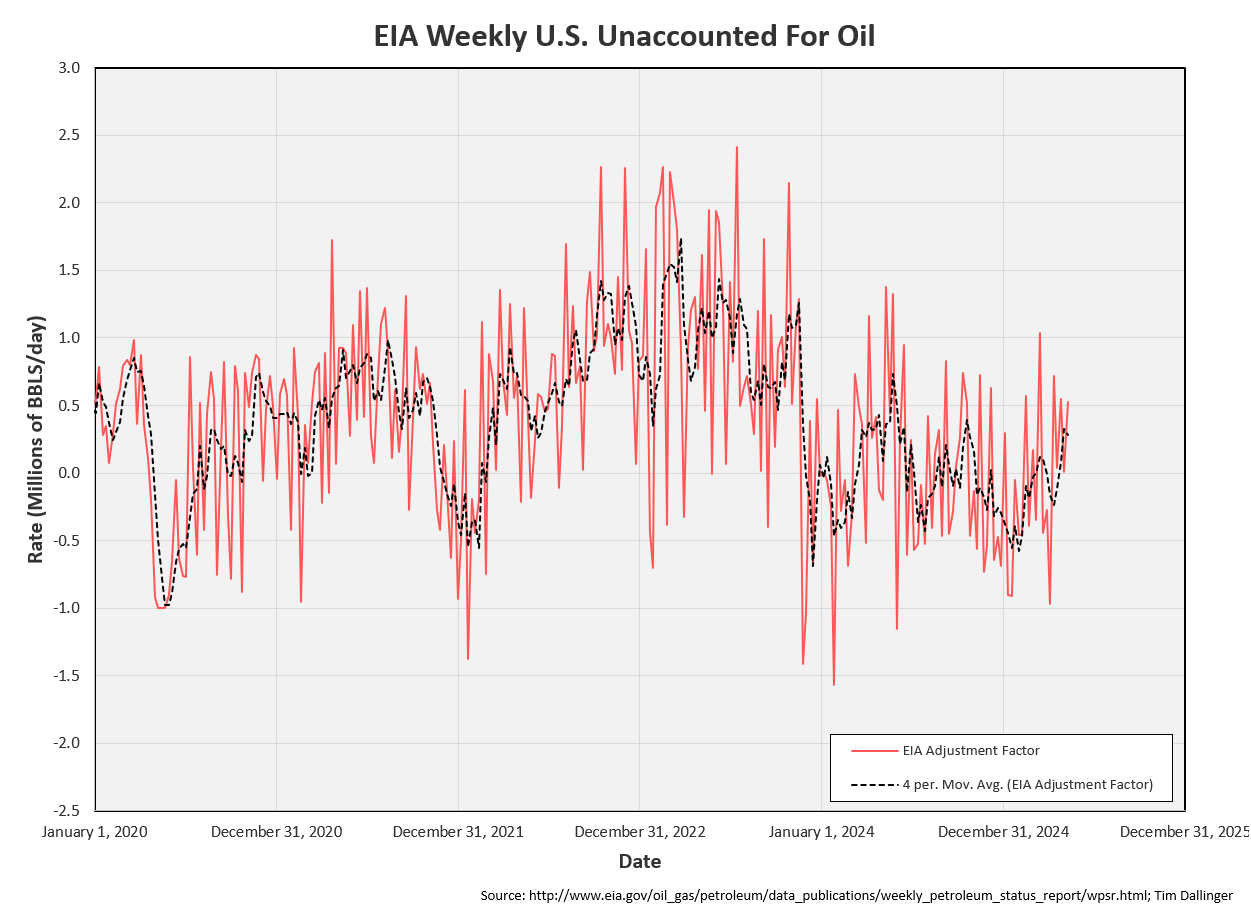

Unaccounted for crude spiked positive, in what appears to be undercounted imports.

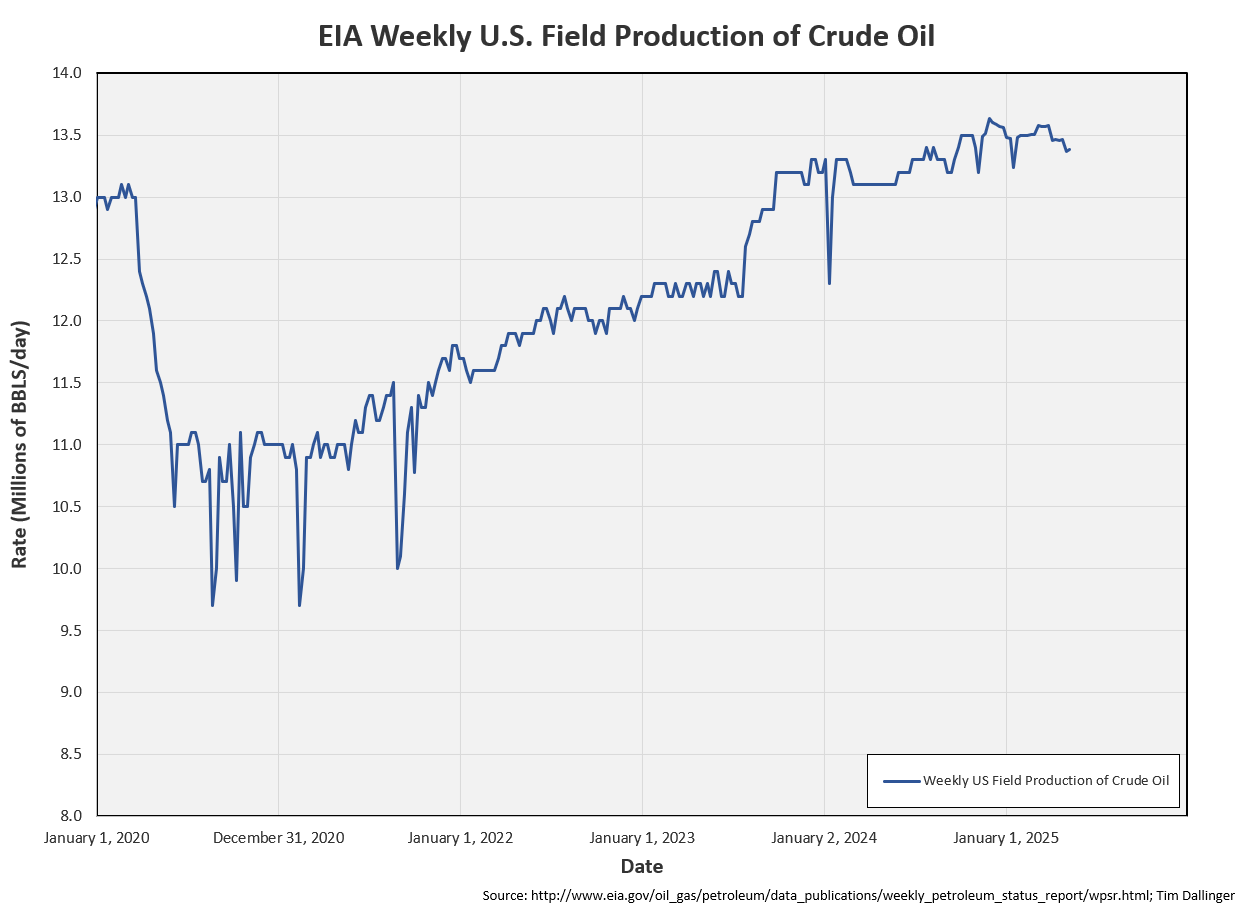

Even with the recent downward revision in the STEO, the EIA still models US production at almost 13.4 MMBD.

Cushing

Crude storage in Cushing, OK, drew by 1.1 MMB week on week. Cushing inventories are at record seasonal lows, early in the higher demand season.

Gasoline

Total motor gasoline inventories decreased by 1.0 MMB and are about 3% below the seasonal 5-year average.

Finished gasoline inventories ticked up slightly although they remain below average levels.

Gasoline blending components drew. Blending component inventories are also below average levels.

Distillate

Distillate fuel inventories decreased by 3.2 MMB last week and are about 16% below the seasonal 5-year average.

Distillate inventories are the lowest they’ve been since April 2005.

Jet

Kerosene type jet fuel increased by 1.6 MMBD. Inventories are above average but near recent seasonal levels.

Ethanol

Ethanol inventories increased 0.3 MMB week-on-week. Inventories are above seasonal averages.

Propane

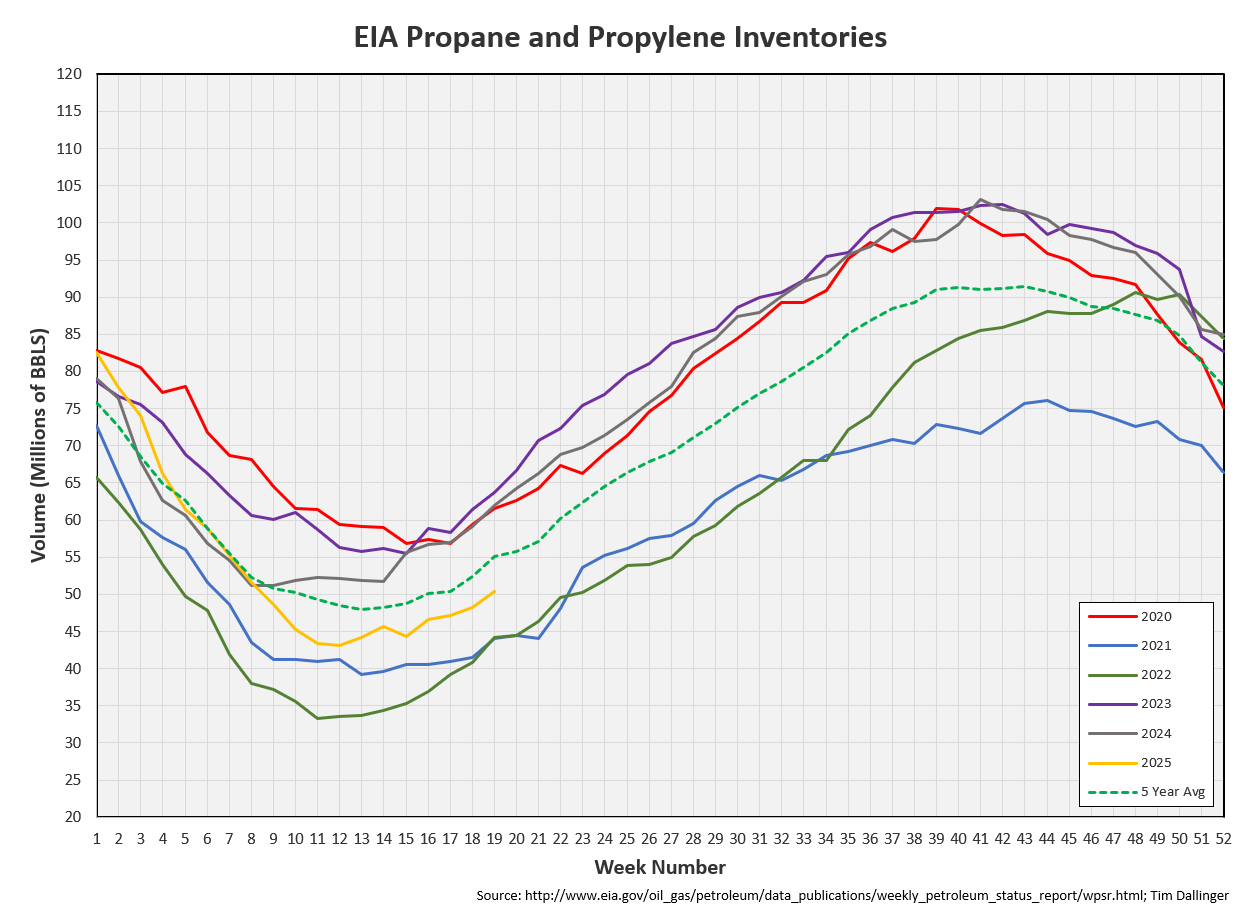

Propane/propylene inventories increased 2.2 MMB, in-line with normal seasonal trends. Propane inventories are below seasonal averages.

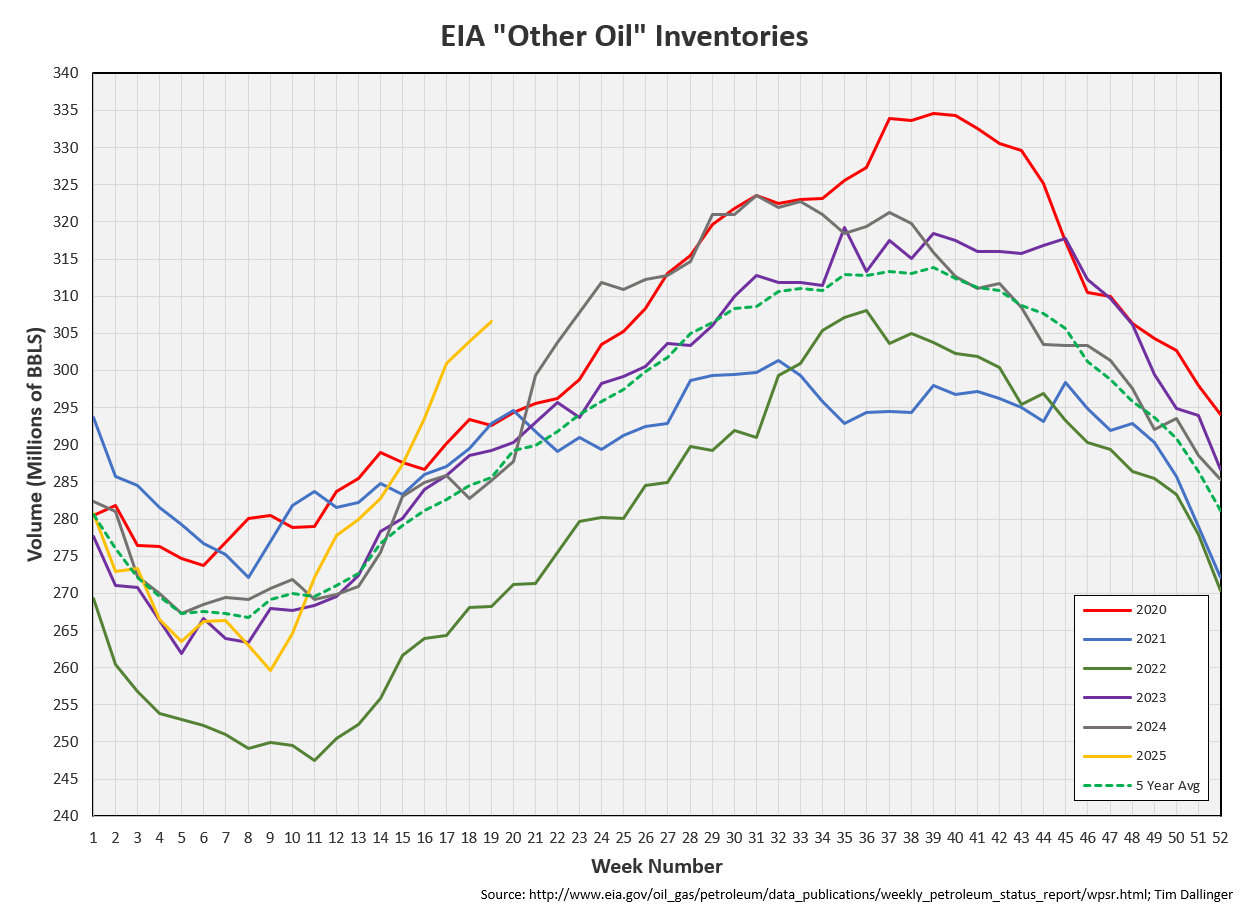

Other Oil

Other oil built by 2.6 MMBD. Other oil inventories are above average.

Total Commercial Inventory

Total commercial inventory increased 4.9 MMBD.

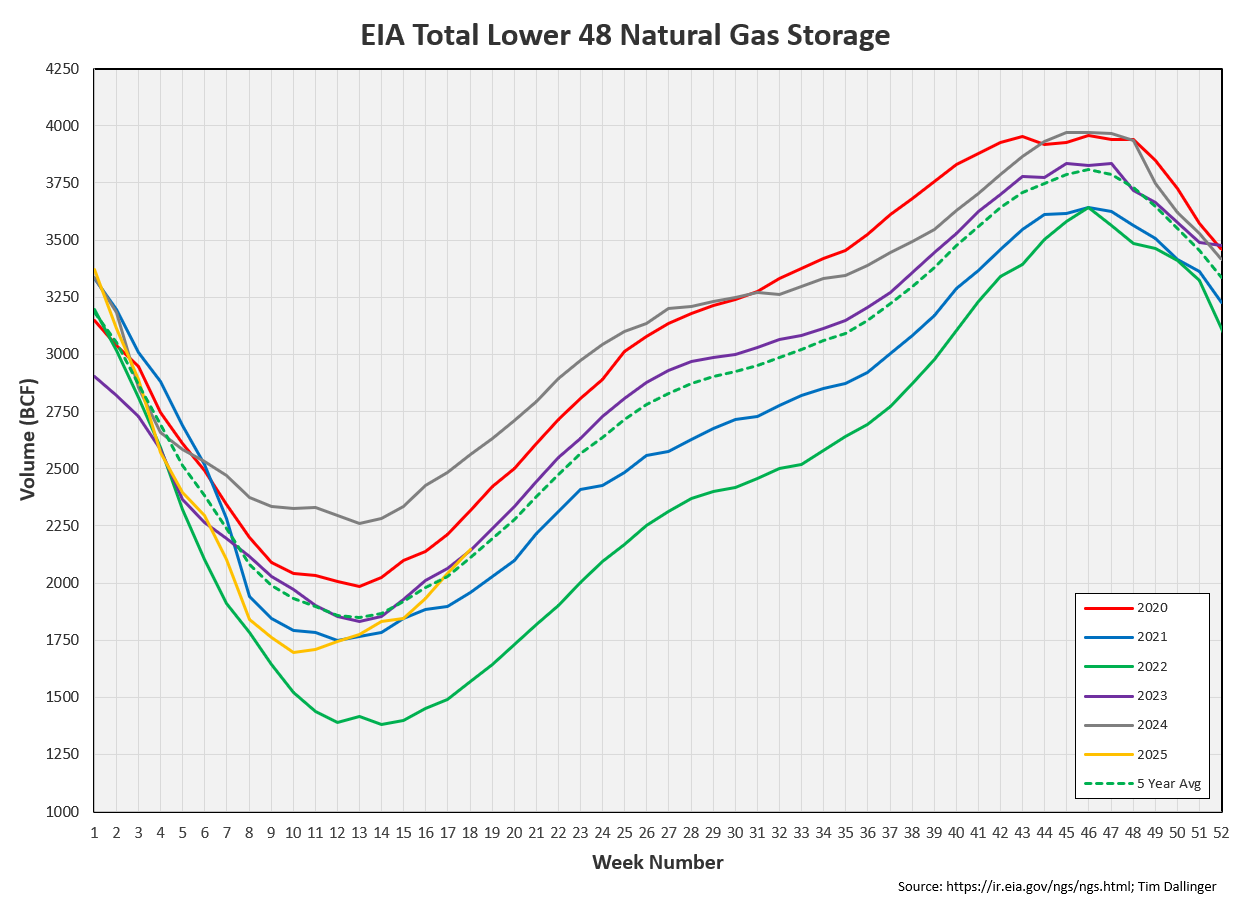

Natural Gas

Natural gas inventories cross above seasonal average levels. Even though US crude production is struggling, associated natural gas production remains high due to well inefficiencies.

Refiners

The amount of crude oil refiners processes last week hit a seasonal record. Refiners are running hard.

The moving average for EIA’s product demand proxy increased slightly. The demand proxy lags 2023 and 2024 but only slightly.

The demand proxy for transportation inventories is just below 2024.

Transportation inventories are seasonally low.

If crude is included with transportation inventories, only 2023 has been lower in recent years.

Simple crack spread strength continues, approaching record levels. Refiners will continue to run hard try to capture this value, especially as summer demand season approaches.

Discussion

Libya’s Government declares a state of emergency, warning citizens that escalating conflict appears imminent. No crude production has been lost yet.

Apparent crude inventories are rising but the increase is concentrated to China. Chinese product inventories are low but it appears refineries are holding off on increasing utilization.

Timespreads remain backwarded, suggesting there is no physical glut.

Spec positioning in crude remains extremely low as traders still grapple with the global economic uncertainty associated with tariffs.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

In one of George Straight’s classic ballads “Run,” the narrator begs a partner to travel to meet him by any available means.

Always love these Tim, thank you!