EIA WPSR Summary for week ending 4-26-24

Summary

Bearish report.

Crude: +7.3 MMB

SPR: +0.6 MMB

Cushing: +1.1 MMB

Gasoline: +0.3 MMB

Ethanol: -0.2 MMB

Distillate: -0.7 MMB

Jet: -0.6 MMB

Propane: +0.2 MMB

Other Oil: +0.9 MMB

Total: +7.9 MMB

Spot WTI is currently pricing $79, experiencing pressure all week. Prices are near fair value based on a price model derived from reported EIA inventories.

Crude

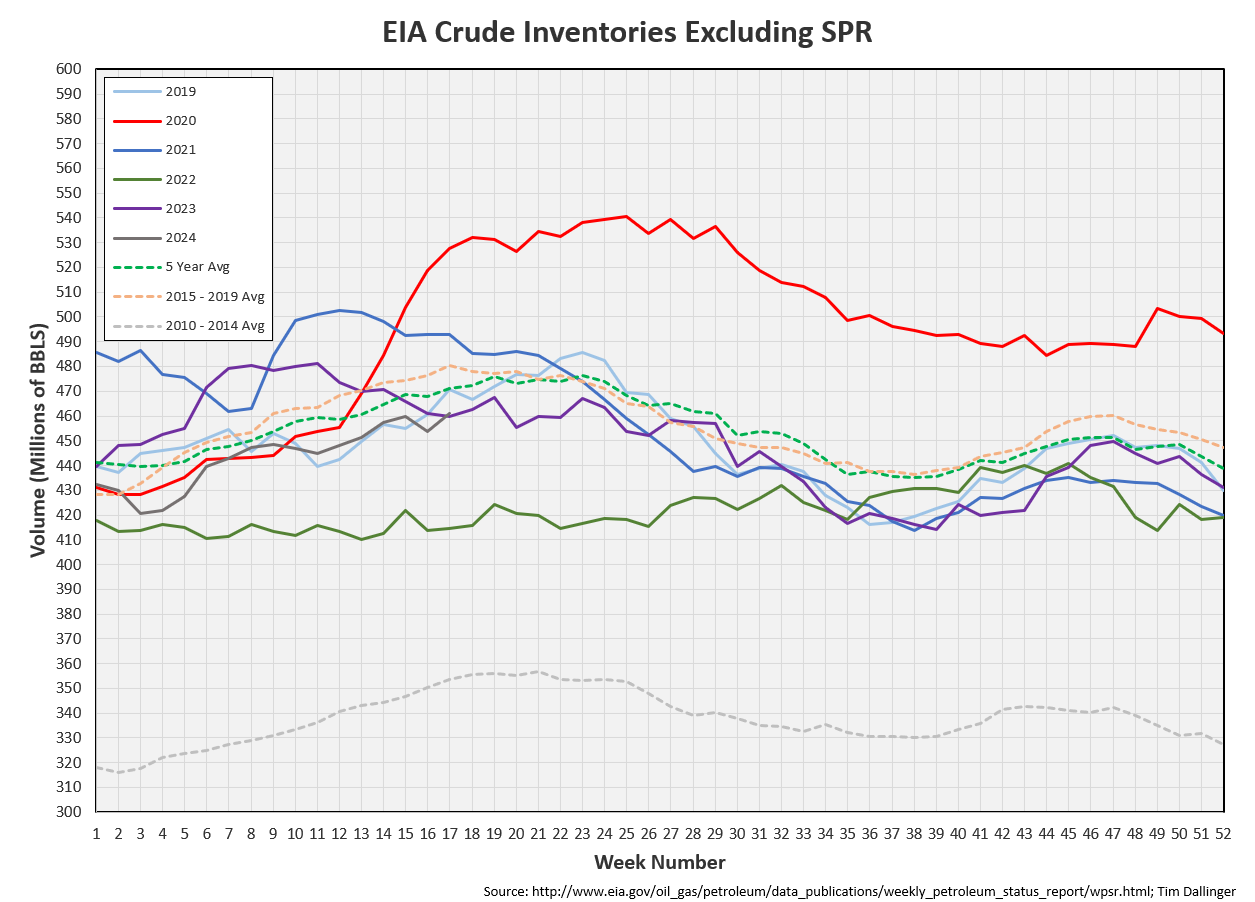

US Crude oil supply built by 7.3MMB. Crude inventories are currently 3% below the seasonal average. They closely match 2023 levels.

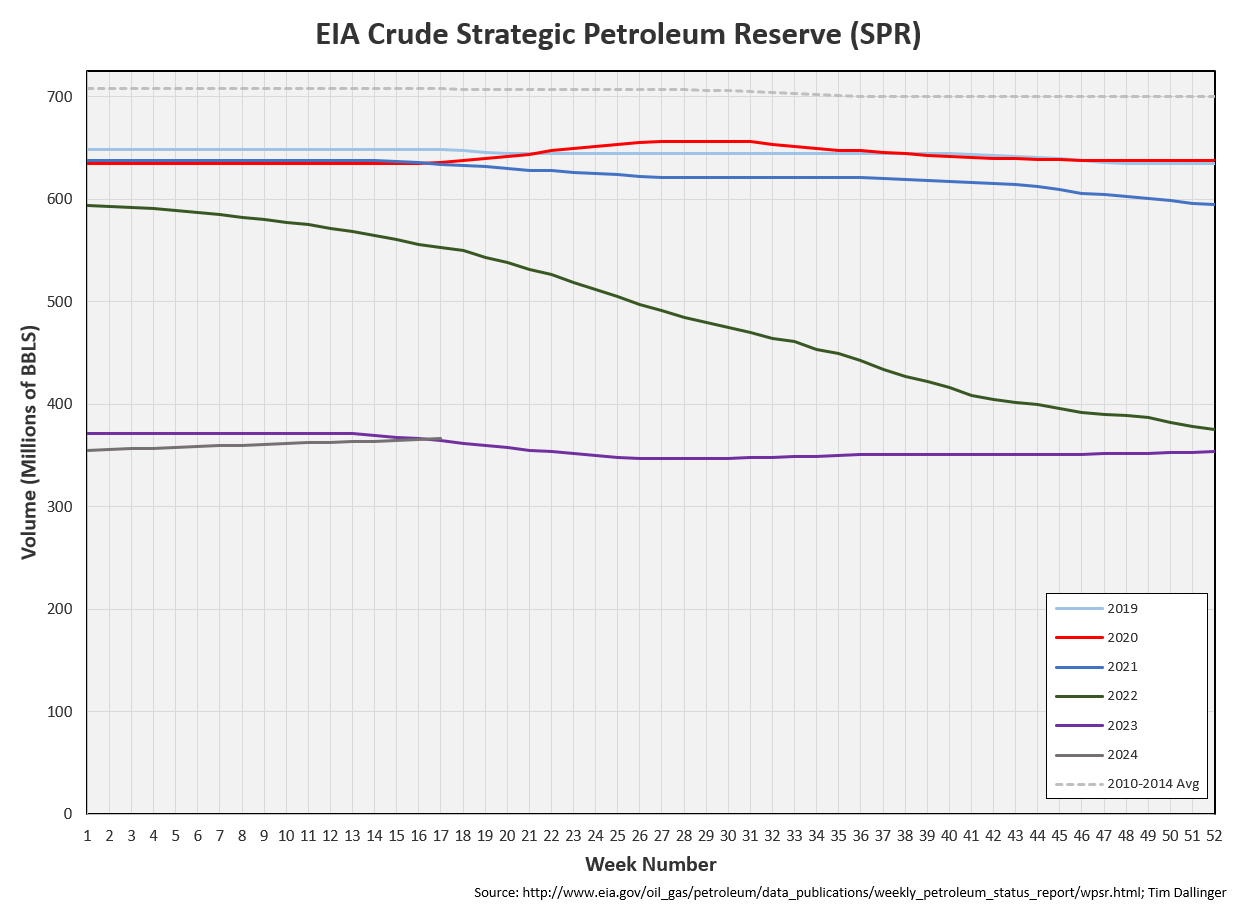

0.6 MMB were added to the SPR. 11.2 MMB have been added to the SPR in 2024. SPR has just surpassed the level held one year ago.

US crude imports were above the annual average, at 6.772 MMBD.

Preliminary data shows that Canadian and Mexican imports were up. TMX starts operation today so it will be interesting to see if that affects Canadian crude imports. Mexico is expected to limit its crude exports as it ramps up domestic refining.

No Brazilian imports is strange behavior.

Crude exports fell to 3.918 MMB. This is just below the annual average.

Unaccounted for crude was slightly up. With recent values being positive and natural gas prices so depressed, one must wonder if more blending is occurring.

Cushing

Crude storage in Cushing, OK, built by 1.2 MMB week on week. Cushing inventories are near 2023 levels.

Gasoline

Total motor gasoline inventories increased by 0.3 MMB and are about 3% below the seasonal 5-year average.

Distillate

Distillate fuel inventories decreased by 0.7 MMB last week and are about 7% below the seasonal 5-year average.

Jet

Kerosene type jet fuels drew by 0.6 MMB.

Global air travel continues to be at seasonally record levels.

https://www.airportia.com/flights-monitor/

Ethanol

Ethanol inventories decreased 0.2 MMB week-on-week. Inventories are about 7% above seasonal averages.

Propane

Propane/propylene inventories increased by 0.2 MMB. Inventories are about 10% above seasonal averages.

Other Oil

Other oil increased by 0.9 MMB. Other oil inventories are about 1% above seasonal averages.

Total Commercial Inventory

Total commercial inventory built by 7.9 MMB, mostly due to crude oil. Inventories are slightly below seasonal averages.

Natural Gas

Natural gas inventories continue to build. Negative pricing continues at the WAHA hub.

Refiners

The amount of crude oil refiners processed last week 15.6 MMB, down 0.23 MMB on the week. Refiners should ramp over the next month.

The EIA’s product demand proxy increased slightly. The moving average is tracking near 2023 levels.

Transportation inventories fell slightly.

Simple cracks really sold off today. Wholesale gasoline dropped significantly. While this isn’t reassuring, it is just one day. Cracks were just under $30 yesterday.

There is little reason to suspect demand weakness. The following quotes were pulled from Q1 2024 conference calls that occurred within the past week:

“Product demand was strong across our wholesale system, with diesel demand higher and gasoline demand about the same as last year.”

Lane Rigs

Valero

“Currently, our assets are running near historical highs, and we are ready to meet peak summer demand.”

Mark Lashier

Phillips 66

“As for the macro-refining environment, we remain constructive in our view. Oil demand is at a record high globally, and we expect oil demand to continue to set records into the foreseeable future. Forecasted outlooks for this year estimate 1.2 million to 2 million barrels per day of incremental demand over 2023, primarily driven by the growing need for transportation fuels.”

Mike Hennigan

Marathon Petroleum

“Frankly, we're continuing to see growth in demand, not as high as we've seen historically, but continued good growth and frankly in the first quarter saw some of that pick up.”

Darren Wood

ExxonMobil

Discussion

The EIA released their monthly report yesterday, which is regarded as more accurate than the weekly publications.

Consumer demand is tracking higher than 2024.

US production rebounded, demonstrating that the production decline in January was significantly weather induced. The monthly figures were lower than the weekly though.

The market has faded geopolitical risk even as the Houthis have returned to harassing tankers in the Red Sea.

This was a bearish week for sentiment, commodity pricing, and energy fundamentals.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Private the Penguin accurately captures the mood of energy bulls this week in the 2005 animated film, “Madagascar.”

Perhaps this is primarily crude stockpiling at the tail end of refinery maintenance season

Perhaps this is primarily crude stockpiling at the tail end of refinery maintenance season