EIA WPSR Summary for week ending 5-10-24

Summary

Fairly neutral report.

Crude: -2.5 MMB

SPR: +0.6 MMB

Cushing: -0.3 MMB

Gasoline: +0.2 MMB

Distillate: +0.0 MMB

Jet: +0.1 MMB

Ethanol: +0.3 MMB

Propane: +2.9 MMB

Other Oil: +2.4 MMB

Total: +3.5 MMB

Spot WTI is currently pricing almost $79. Prices are fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply drew by 2.5 MMB. Crude inventories are currently 4% below the seasonal average. 2024 crude inventories are currently 10 MMB lower than 2023 levels for this week.

0.6 MMB were added to the SPR.

12.7 MMB have been added to the SPR in 2024. SPR inventories still remain near 40-year lows.

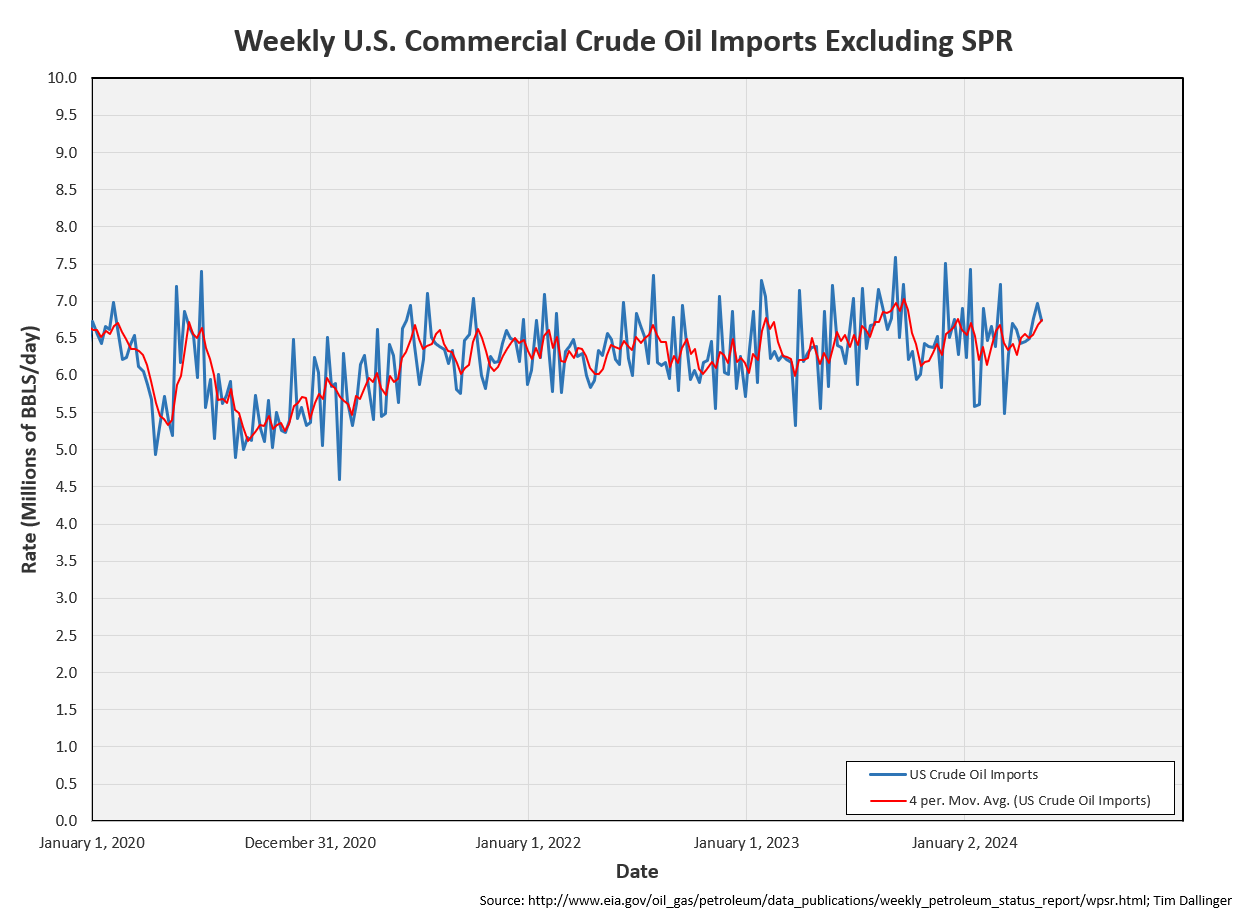

US crude imports were down week-on-week. They are still at the higher than the 2024 average.

Crude exports were down slightly.

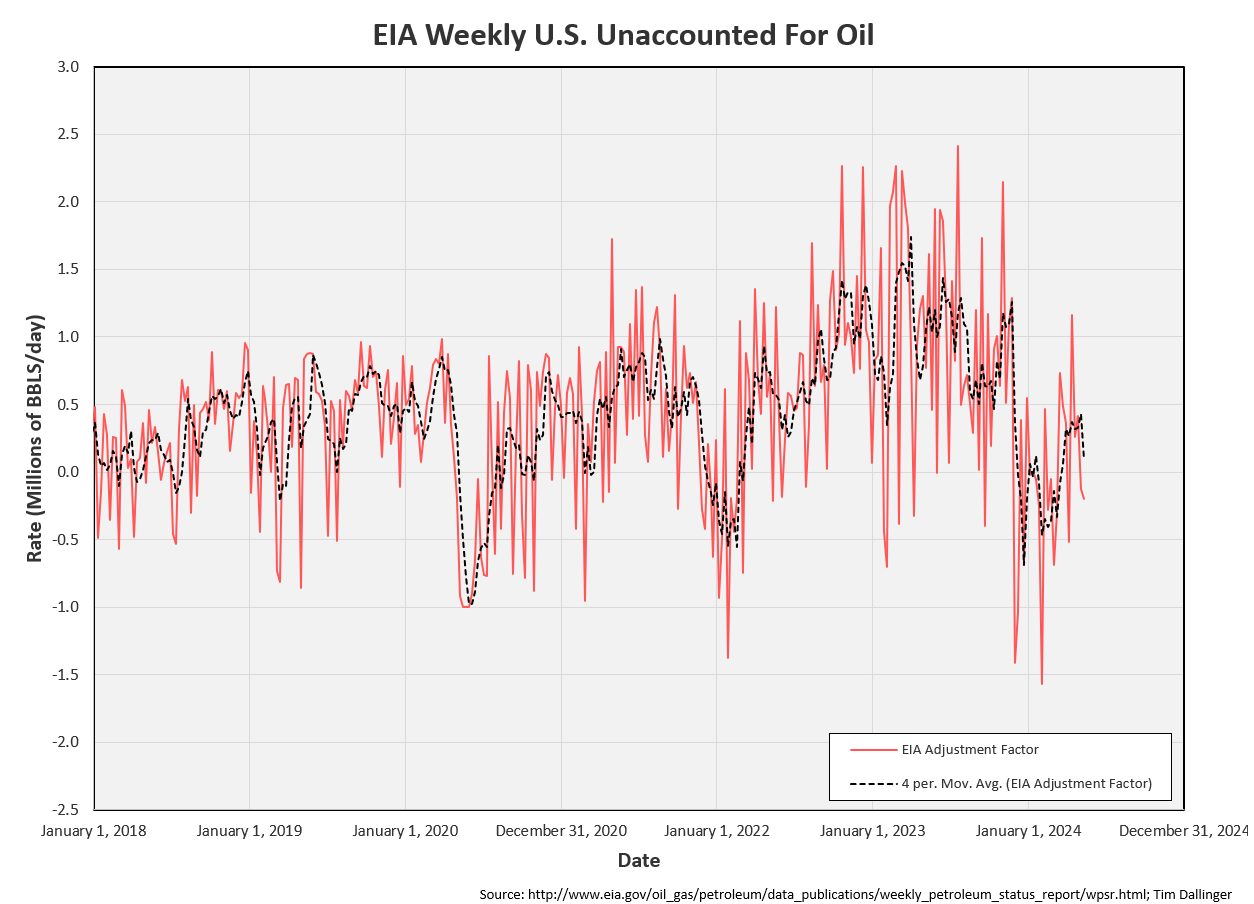

Unaccounted for crude was again slightly negative.

Cushing

Crude storage in Cushing, OK, drew by 0.3 MMB week on week. Cushing inventories fall below last year’s level.

Gasoline

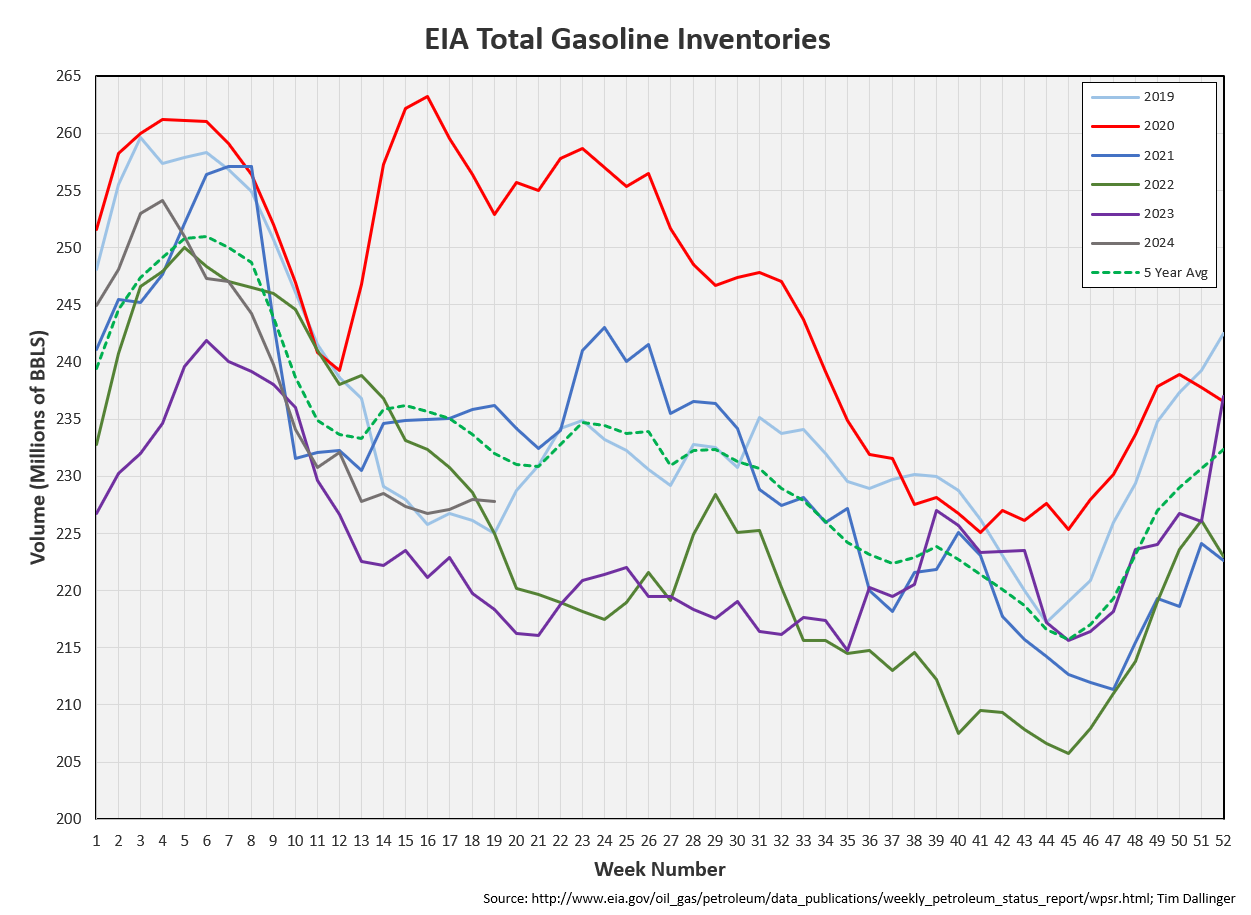

Total motor gasoline inventories decreased by 0.2 MMB and are about 4% below the seasonal 5-year average.

There’s been considerable focus on product inventories, alleged demand weakness and struggling prices. Gasoline is currently priced higher than last year.

Total motor gasoline inventories are slightly above 2024.

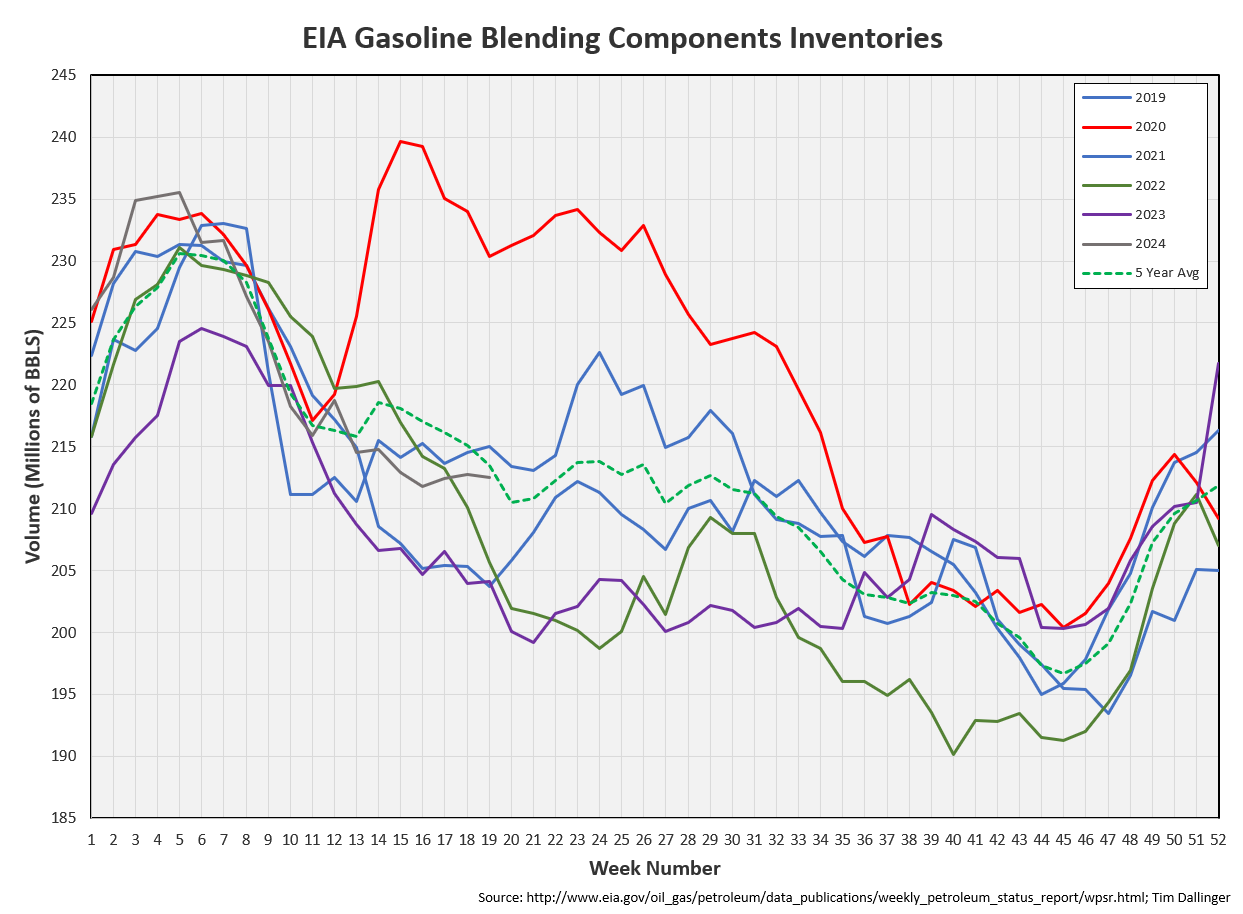

The increased gasoline inventory is from blending components. The EIA doesn’t break this category down further so it’s not possible to tell which components are contributing the most.

Distillate

Distillate fuel inventories decreased slight last week and are about 7% below the seasonal 5-year average.

Jet

Kerosene type jet fuels increased by 0.1 MMB.

Ethanol

Ethanol inventories increased by 0.3 MMB week-on-week.

Propane

Propane/propylene inventories increased by 2.9 MMB, in line with seasonal expectations.

Other Oil

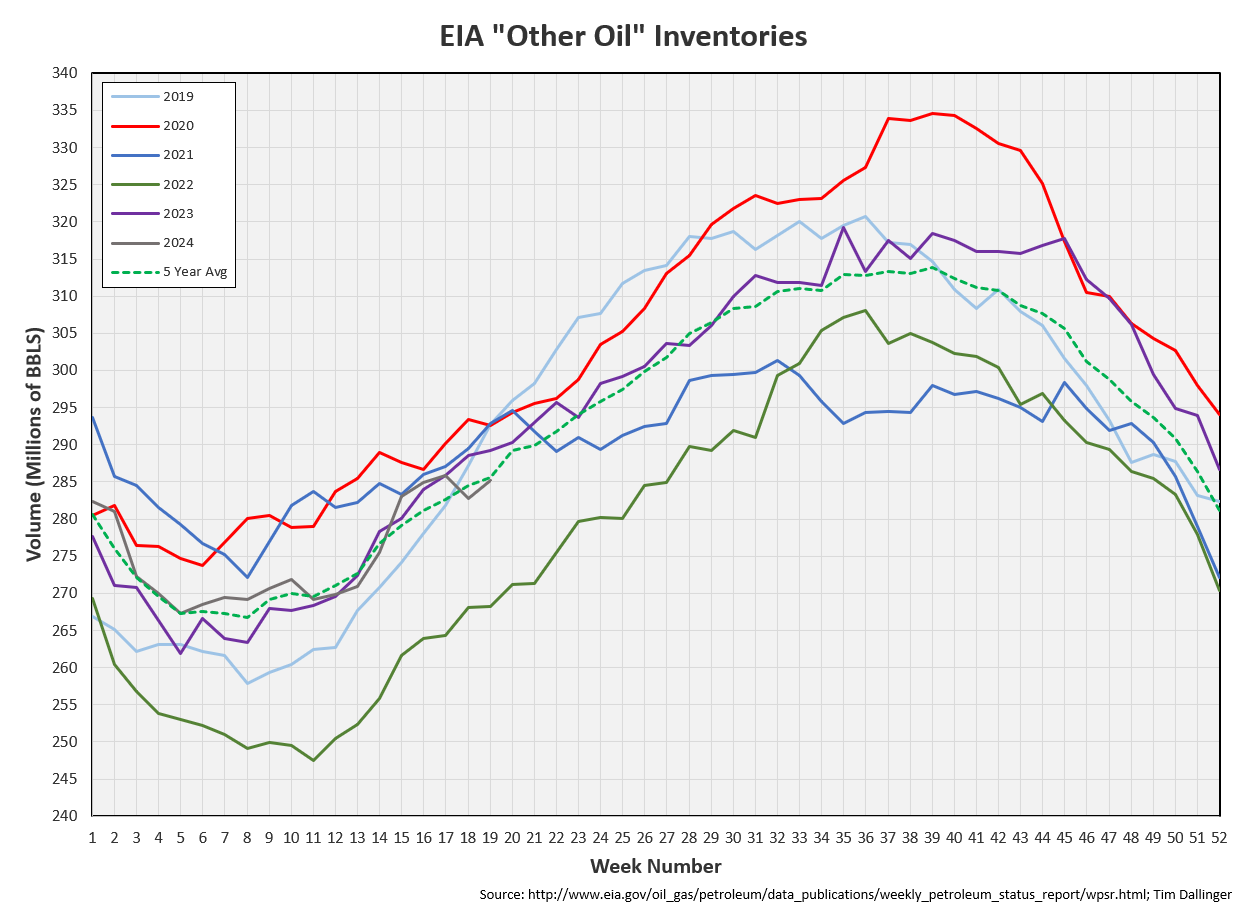

Other oil built by 2.4 MMB and is at the 5-year seasonal average.

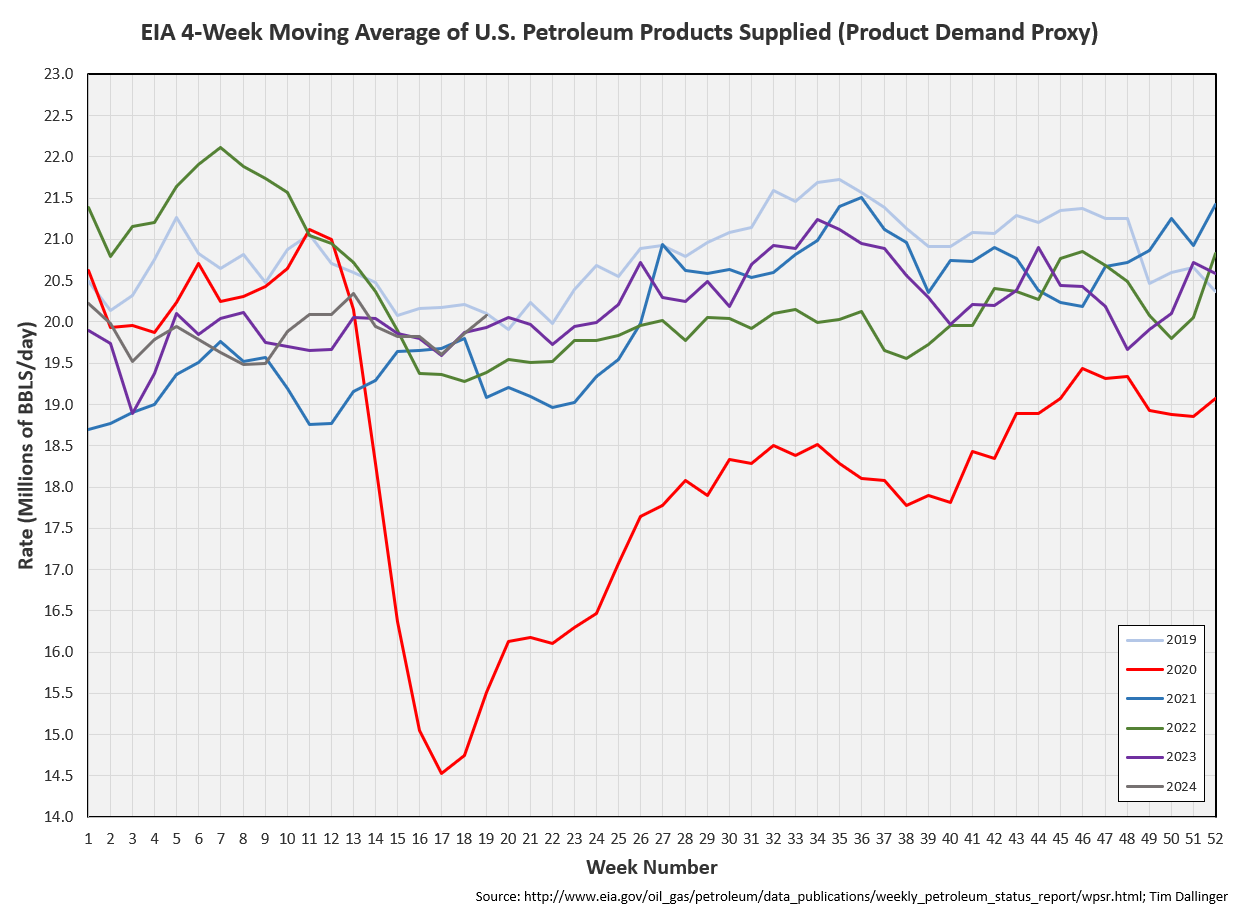

Interestingly, the other oil demand proxy continues to hit seasonal records and is making grounds on all-time records.

Total Commercial Inventory

Total commercial inventory increased by 3.5 MMB and match 2023 figures.

Natural Gas

Natural gas inventories remain stubbornly seasonally high.

Refiners

The amount of crude oil refiners processes last week increased by 307 kbd. Only 2019 had higher run rates in recent years.

The EIA’s product demand proxy is at seasonal records.

However, the demand proxies for transportation inventories are down. The EIA is showing impacted gasoline and distillate demand but record other oil demand. This is odd behavior with no apparent explanation. It will be interesting to see if this demand data is corrected higher, later in the monthly figures. These anomalies with later corrections, are the type of patterns that make people accuse the EIA of tampering with the data. While politically motivated manipulation is possible, it seems more like that the EIA’s weekly model continues to have significant limitations.

Transportation inventories are flat on the week but higher than 2023 and 2024.

Simple cracks bounced today but remain under pressure.

Time spreads have come in but crude futures remain backwarded.

Discussion

Over the weekend, the Iraq oil minister said, “Iraq has reduced enough and will not agree to any new cuts.” It isn’t apparent if he meant additional cuts or extension of current cuts. Bears have taken this to mean that the OPEC deal is concluding. In reality, Iraq doesn’t matter much. Despite the headline, they aren’t currently cutting production. Saudi continue to bear the brunt of the voluntary cuts. The June meeting is two weeks away and while there will likely be heated conversations over quotas, the base case assumption is for extension of the current cuts.

The crude market seems to have gotten over-extended early due to geopolitical risk. Prices have since come back down. Demand fears, especially regarding diesel, remain. But signs indicate this soft patch is concluding as summer driving starts to ramp now.

Global refining should be picking up too.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Fillmore is a conspiratorial hippie VW van, originally voiced by George Carlin, in the 2006 animated Disney film, Cars.