EIA WPSR Summary for week ending 6-13-25

Summary

Crude: -11.5 MMB

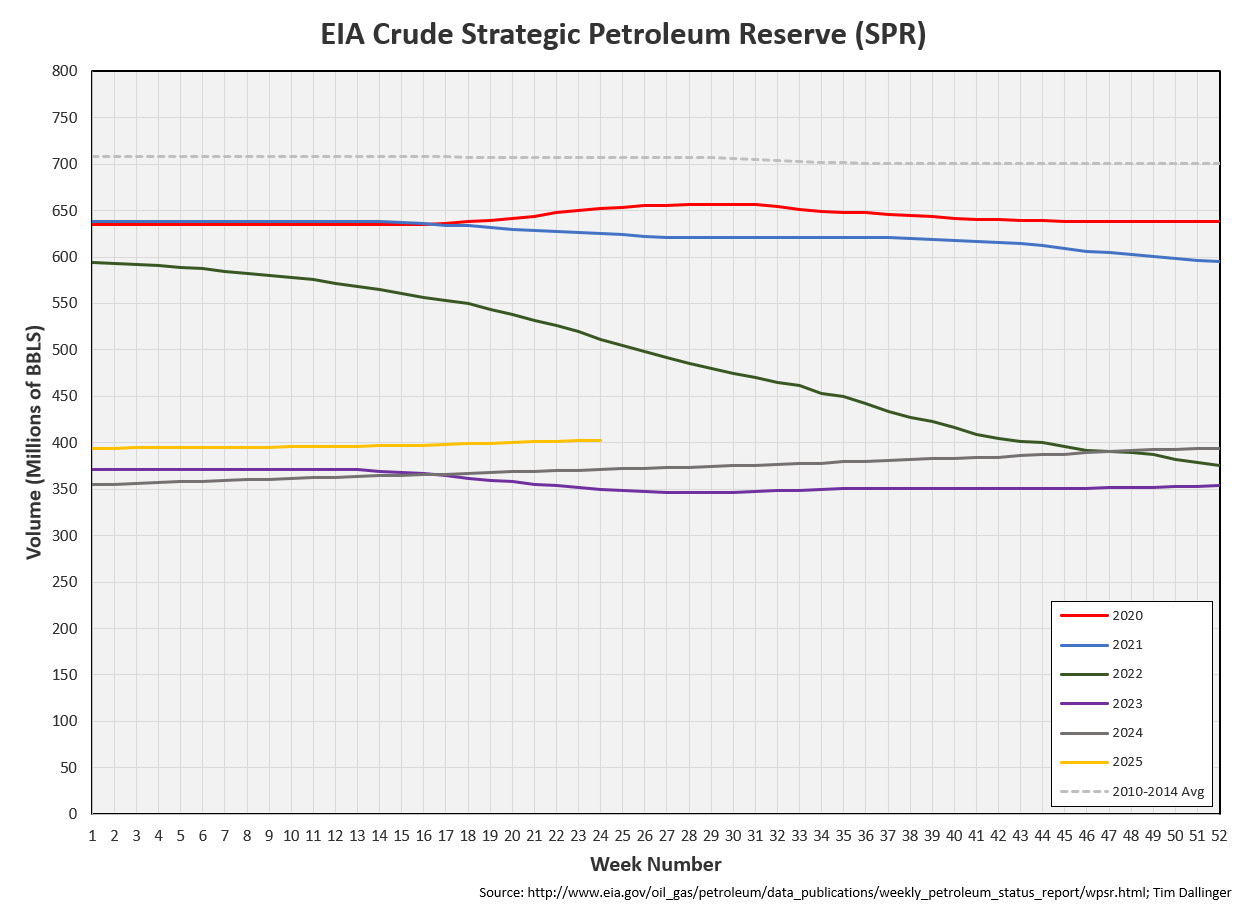

SPR: +0.2 MMB

Cushing: -1.0 MMB

Gasoline: +0.2 MMB

Distillate: +0.5 MMB

Jet: +1.0 MMB

Ethanol: +0.4 MMB

Propane: +1.5 MMB

Other Oil: +1.8 MMB

Total: -6.6 MMB

Spot WTI is currently pricing $73. Even with geopolitical premium added, prices remain discounted versus fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply drew by 11.5 MMB. Crude inventories are currently 10% below the seasonal average.

0.2 MMB were added to the SPR.

Should SPR barrels be needed, there is availability. However, total volume remains diminished compared to historic levels. Also, there continues to be some physical issues with the salt caverns themselves.

Crude inventories including SPR fall back below 2024 levels.

US crude imports fell significantly.

US Crude exports jumped back above average levels after several low weeks.

Unaccounted for crude was near zero.

The EIA continues model US production as growing after it benchmarked volumes lower earlier this year. No field data confirms this growth.

Cushing

Crude storage in Cushing, OK, drew by 1.0 MMB week on week. Cushing inventories return to 2022 levels and tank bottoms are again a summer risk.

Gasoline

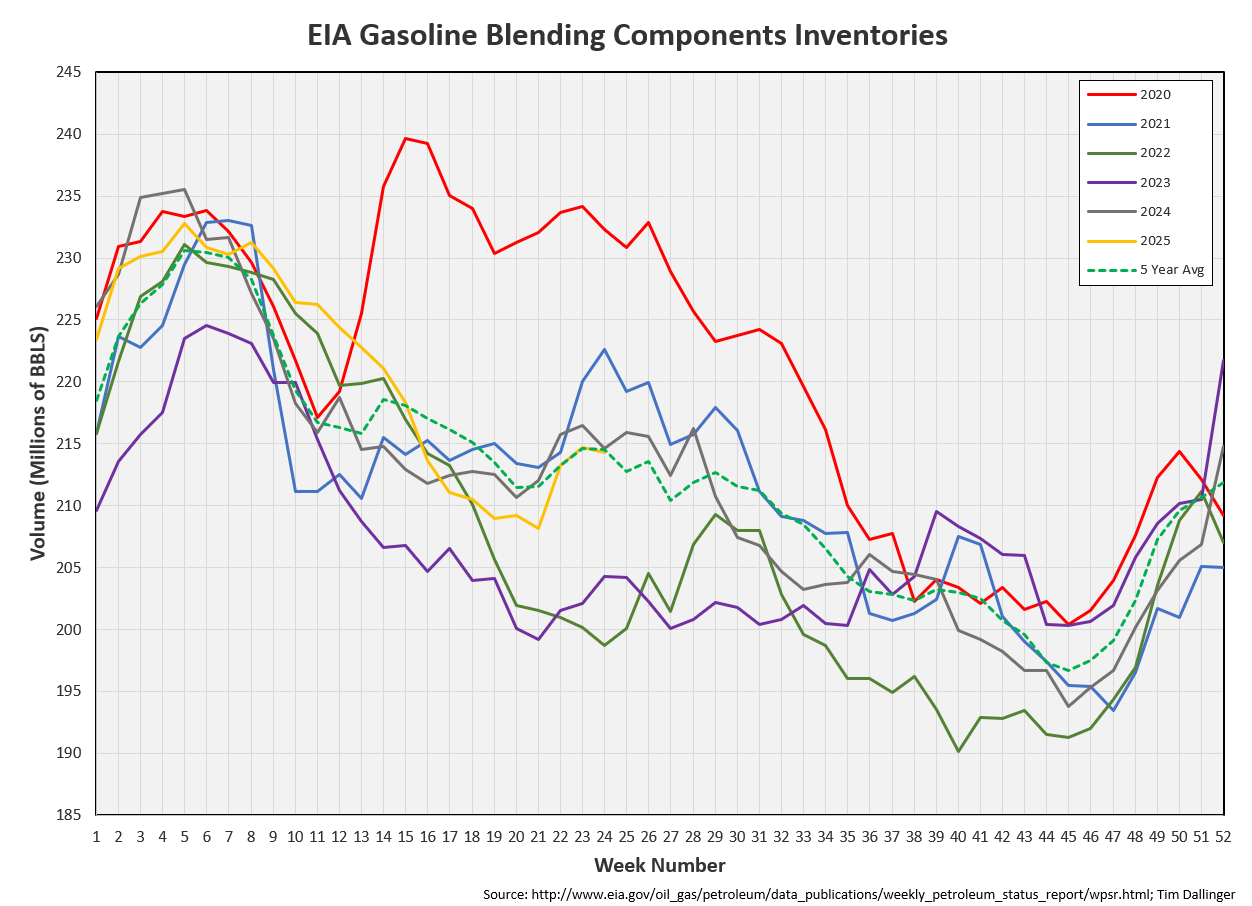

Total motor gasoline inventories increased by 0.2 MMB and are about 2% below the seasonal 5-year average.

Finished gasoline inventories are below average.

Gasoline blending components are at average levels.

Distillate

Distillate fuel inventories increased by 0.5 MMB last week and are 17% below the seasonal 5-year average, hitting a new seasonal low.

Jet

Kerosene type jet fuels built by 1.0 MMB. Jet fuel inventories are above average, but air travel demand remains robust.

Ethanol

Ethanol inventories increased by 0.4 MMB week-on-week. Inventories are at seasonal record levels.

Propane

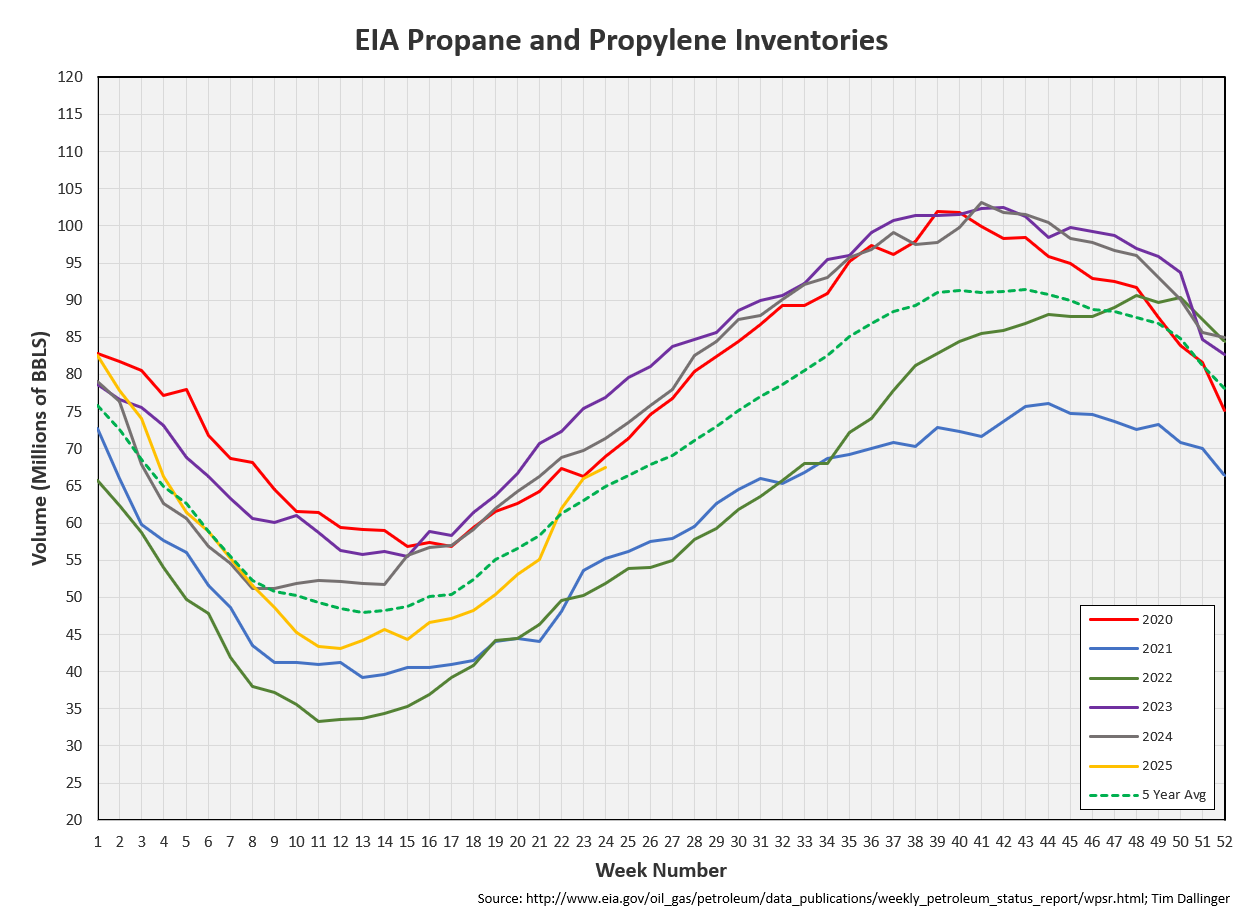

Propane/propylene inventories increased by 1.5 million barrels from last week and are 5% above the seasonal 5-year average.

Other Oil

Other oil increased 1.8 MMB and inventories are at record seasonal levels.

Total Commercial Inventory

Total commercial inventories decreased by 6.6 MMB.

Natural Gas

Natural gas inventories are above average. Their rate of build is slightly higher than normal.

Refiners

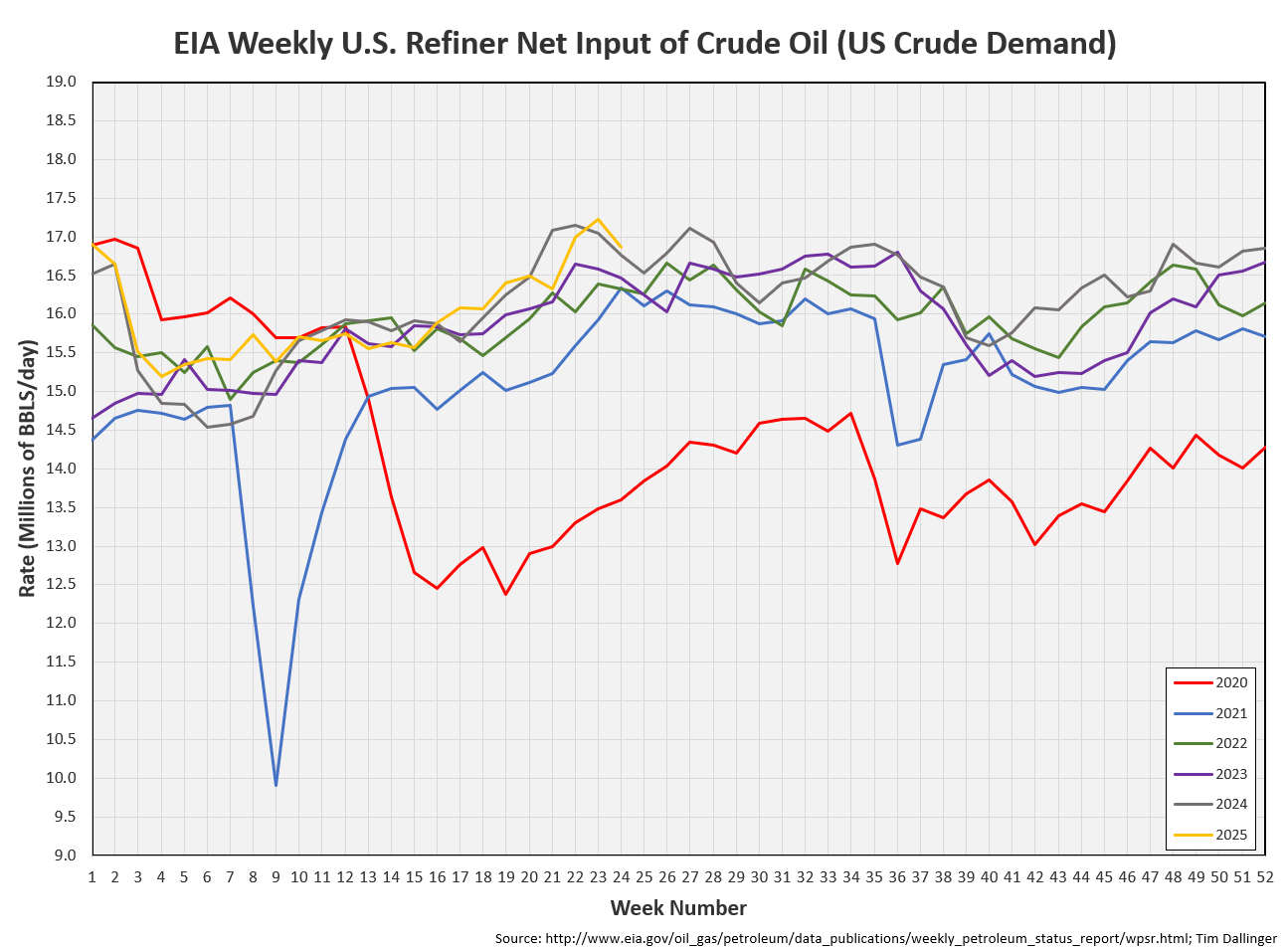

US refiners processed high amounts of crude again. The seasonal peak is about a month away.

The EIA’s product demand proxy is back to high levels.

Implied demand for transportation inventories slightly lags record levels but it has bounced back from recent lows.

Transportation inventories remain below average.

Including crude oil, only 2022 has been lower.

Simple cracks are healthy, even with the recent price action in crude.

Discussion

As most readers should already be aware, Israel preemptively attacked Iran at the end of last week. Strikes included military personnel, nuclear scientists, and energy infrastructure. Crude prices increased in response as short interest decreased.

The US is reported to have aided Israel with equipment and defense but deny providing direct support. US assets have moved into the region and there’s mixed messaging as to whether the US will join the offensive. This is a fluid situation and de-escalation currently seems distant.

Crude prices have been volatile. The prevailing narrative though is to fade price action driven by geopolitics. While this does have some historic precedence, it hasn’t always been a winning strategy. The Russian Ukrainian conflict almost doubled crude prices with just the threat of lost production.

No significant production has been lost yet so the market is hesitant to buy up crude. Should there be a supply outage, this is an interesting time. US production growth has been halted and many signals show its actually falling. Should the US need SPR, caverns have damage and maintenance and volumes have not been refilled significantly after the last deposition. OPEC has increased production on paper, but those barrels have not materialized on the physical market.

Timespreads remain backwarded.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Black Sabbath released the classic anti-war protest song, War Pigs, on the 1970 album Paranoid.