EIA WPSR Summary for week ending 2-14-25

(Turn around) Every Now and Then I Get a Little Bit Nervous

EIA WPSR Summary for week ending 2-14-25

Summary

Crude: +4.6 MMB

SPR: +0.0 MMB

Cushing: +1.5 MMB

Gasoline: -0.2 MMB

Distillate: -2.1 MMB

Jet: +0.7 MMB

Ethanol: +0.5 MMB

Propane: -3.6 MMB

Other Oil: +0.2 MMB

Total: +0.2 MMB

Spot WTI is currently pricing $72. Prices are still slightly below estimated fair value based on a price model derived from reported EIA inventories. Despite the difference narrowing, a bullish setup is developing.

Crude

US Crude oil supply built by 4.6 MMB. Crude inventories are currently 3% below the seasonal average.

No barrels were added to the SPR.

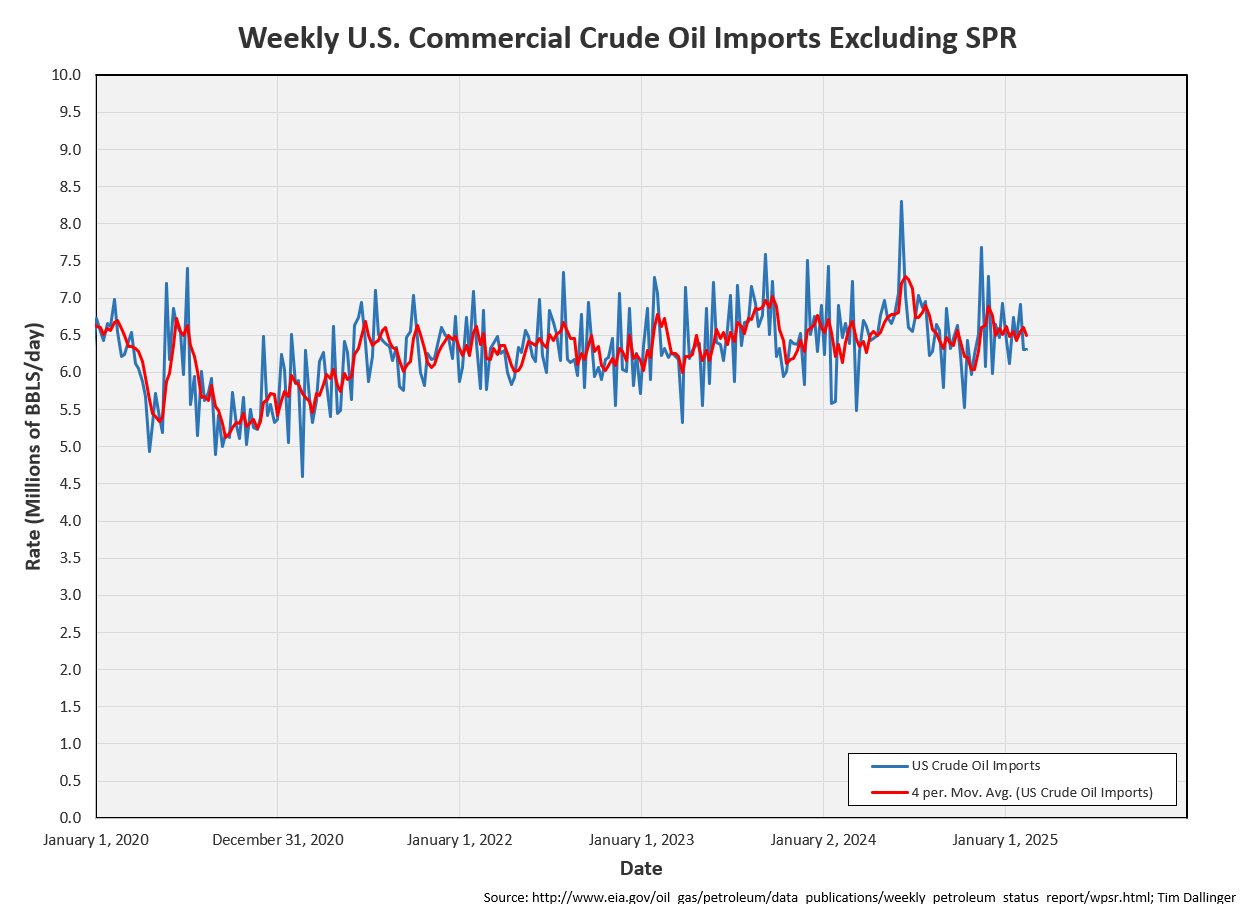

US crude imports fell week-on-week.

Crude exports increased slightly.

Unaccounted for crude remains slightly positive.

Cushing

Crude storage in Cushing, OK, built by 1.5 MMB week on week. Cushing inventories remain at record seasonal lows but have built from tank bottoms.

Gasoline

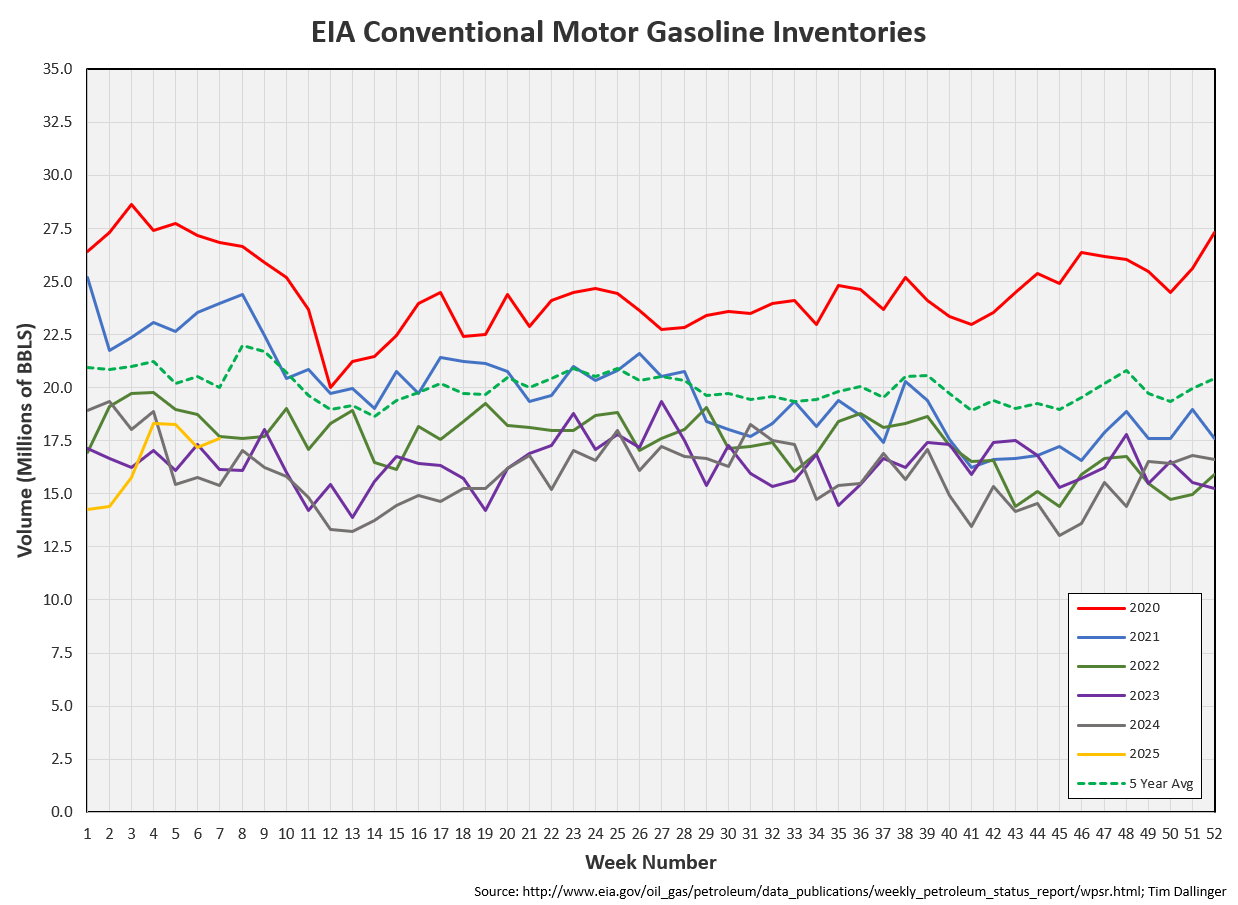

Total motor gasoline inventories decreased by 0.2 MMB and are about 1% below the seasonal 5-year average. There appears to be one more soft week ahead and then draws will pick up substantially.

Finished gasoline is below average.

Gasoline blending components are slightly above average.

Distillate

Distillate fuel inventories decreased by 2.1 MMB last week and are about 12% below the seasonal 5-year average. The lack of Russian heating oil is showing up in distillate inventories.

Jet

Kerosene type jet fuels increased 0.7 MMB. Global jet demand is at seasonal record levels.

Ethanol

Ethanol inventories increased 0.5 MMB week-on-week. Inventories are above seasonal averages.

Propane

Propane/propylene inventories drew by 3.6 MMB. Inventories are at average levels. Next week’s report should show another sizeable draw due to weather induced demand.

Other Oil

Other oil built by 0.2 MMB. Other oil inventories are just below average.

Total Commercial Inventory

Total commercial inventory built by 0.2 MMB. Total commercial inventories are below average. Only 2022 was lower.

Natural Gas

Natural gas inventories had a significant drawdown due to inclement weather across the US. Projections are for weather to heat up next week.

Refiners

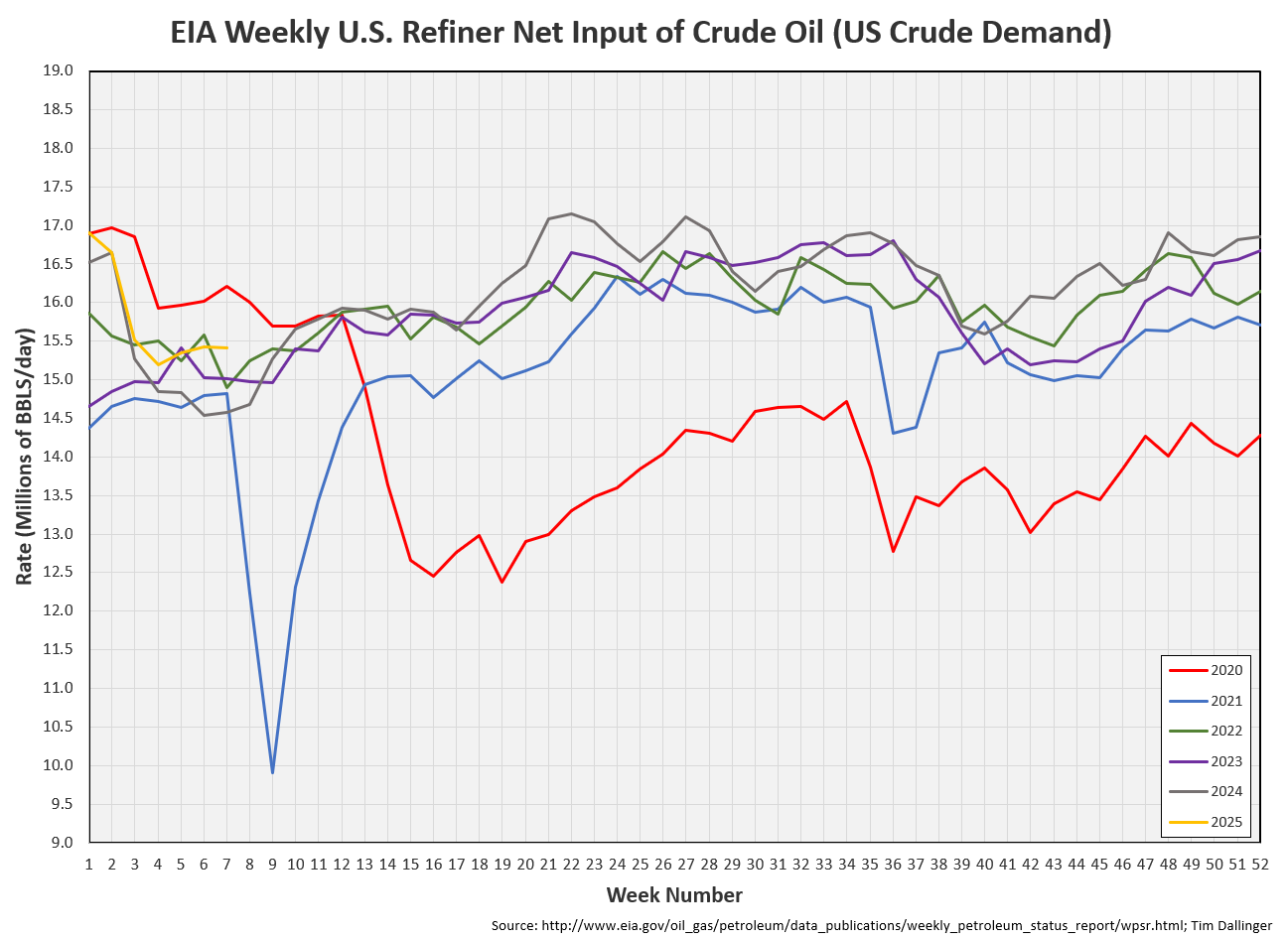

The amount of crude oil refiners processed was nearly identical to the previous week. Turnaround season has been light so far.

The EIA’s product demand proxy is lower than the peak. But only 2022 has been seasonally higher.

Transportation inventories are drawing.

Simple cracks continue to strengthen.

Discussion

There’s a little pressure WTI futures. The term structure remains in backwardation but the magnitude decreases. Refiners are not currently scrambling for April WTI barrels.

The brent market is currently stronger.

The energy market has been focused on geopolitical turmoil for the past several years. Yet the underlying fundamentals have quietly improved. Demand remains robust despite financial media reports claiming the converse. At the end of the day, this is still a commodity market. Supply and demand will be reflected in price eventually.

The IEA has refined their global supply balance, reducing their modeled oversupply. Every agency still predicts US growth. But for all the fanfare about increased production efficiencies, US production growth has not yet materialized.

Q1 is typically the weakest demand period. Crude builds continue but they are offset by product draws. Crude demand is a little soft while product demand remains robust. This continues to add strength to cracks. Refiners will look to capitalize on these attractive spreads, refining more barrels. After turn-around, refiners will ramp to prepare for summer driving season. Crude inventories will fall. Prices should rise.

The market will soon be forced to consider inventories versus projections.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Bonnie Taylor released the pop hit, “Total Eclipse of the Heart,” in 1983.