EIA WPSR Summary for week ending 11-15-24

Summary

Crude: +0.5 MMB

SPR: +1.4 MMB

Cushing: -0.1 MMB

Gasoline: +2.1 MMB

Distillate: +0.1 MMB

Jet: +0.7 MMB

Ethanol: +0.5 MMB

Propane: -0.7 MMB

Other Oil: 0.0 MMB

Total: +3.0 MMB

Seasonally normal report.

Spot WTI is currently pricing $68. Spot crude oil prices remain deeply discounted to the estimated fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply built by 0.5 MMB. Crude inventories are currently 4% below the seasonal average.

1.4 MMB were added to the SPR. SPR inventories hit the 2022 level this week.

US crude imports spiked. This should be anomalous.

US Crude exports recovered back above average but not enough to offset the substantial imports.

Unaccounted for crude was negative, likely due to some over-counted imports.

Cushing

Crude storage in Cushing, OK, drew by 0.1 MMB week on week. Cushing inventories are the lowest they’ve been seasonally in years.

Gasoline

Total motor gasoline inventories built by 2.1 MMB and are about 4% below the seasonal 5-year average.

Distillate

Distillate fuel inventories increased by 0.1 MMB last week and are about 4% below the seasonal 5-year average. The seasonal average is skewed by 2020 though.

Jet

Kerosene type jet fuels built by 0.7 MMB. Jet fuel inventories are higher than normal. It’s not unusual for a slight bump in inventories prior to holiday travel. However, jet fuel didn’t continue to draw down in the fall as it normally does.

Jet fuel demand is robust though.

Global flights and miles traveled returns to record levels.

This was aided by Chinese data which also grew stronger.

https://www.airportia.com/flights-monitor/

Ethanol

Ethanol inventories increased 0.5 MMB week-on-week. Inventories are above seasonal averages. They usually build into year-end; it just appears the build has started a month early.

Propane

Propane/propylene inventories drew by 0.4 MMB.

There is a front moving across the US, which should increase the heating oil, propane and natural gas demand.

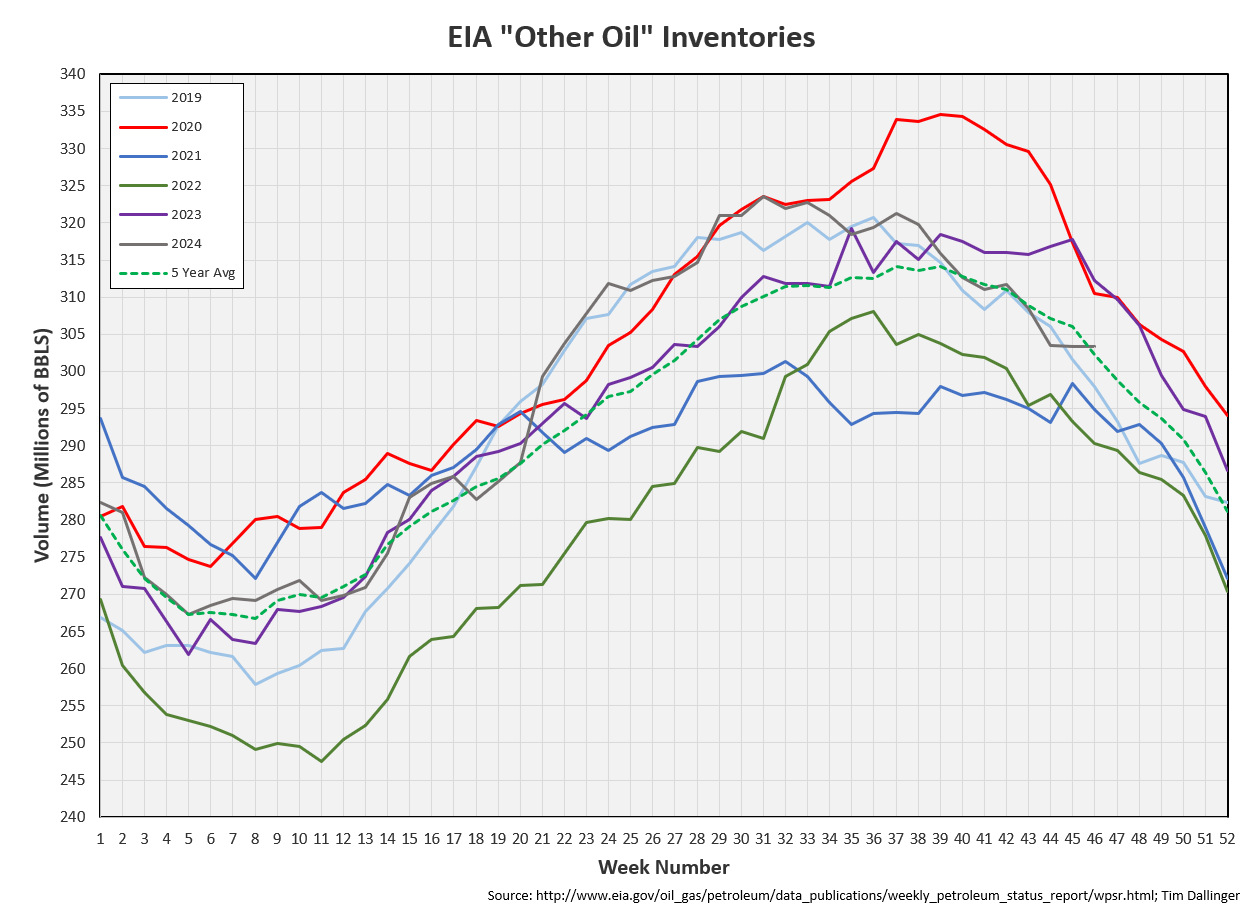

Other Oil

Other oil is flat week-on-week. Draws should resume next week.

Total Commercial Inventory

Total commercial inventory built by 3 MMB but remains below average.

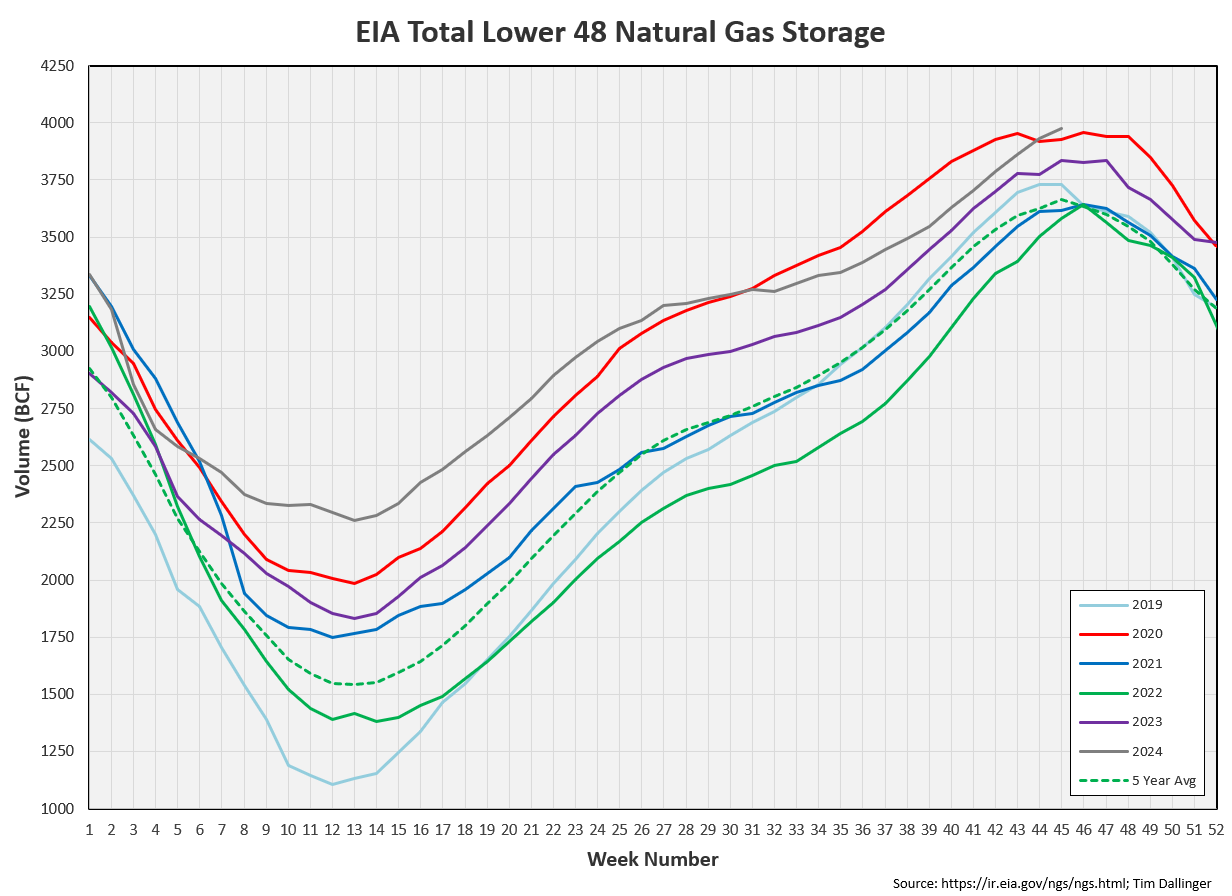

Natural Gas

The natural gas graph presented below is the same as the one in last week’s report. Natural gas inventories are updated on Thursdays. Last week’s EIA WSPR was delayed due to holiday, so it included the latest gas update.

Refiners

The amount of crude oil refiners processed fell last week. The BP Whiting facility has not yet started their distillation unit and coker, boosting gasoline prices in the Chicago area.

The EIA’s product demand proxy also fell back slightly. It’s still in the upper range.

Transportation inventories built.

Yet simple cracks still soared.

Time structures have come in on WTI but remain backwarded.

Discussion

As guided, this was the first week the EIA published the WPSR production number without rounding. Interestingly, they also re-benchmarked production. While the market doesn’t seem to care, this is interesting. If this holds, and it should at least until the next Petroleum Supply Monthly, the EIA is showing that US production has not grown in 2024. The consensus was for 500 – 700 KBD of US production growth. If there was no US growth, US inventories are lower than reported. This may seem counterintuitive. After all, the EIA publishes inventories every week. It’s important to remember that the WPSR is all modeled and surveyed and that the EIA does not revise previous reports.

The EIA and IEA both expected a surplus in late 2024. This has not materialized, and global inventories continue to fall. Could US shale finally be rolling over? If so, that has implications on 2025 projections.

Then why does crude spot oil price remain under pressure? That’s a valid question. Many energy analysts and physical oil traders have been trying to highlight that the crude market has been acting anomalously for months.

Chinese oil demand is often cited for price weakness. Chinese demand has disappointed. Although, visible Chinese inventories have drawn during this period of lower imports. Now, according to tracker KPLR, November Chinese loadings are at all-time record levels.

There’s another chart circulating in financial markets, showing the divergence in US 10-year treasury bond and crude prices. Energy bears claim this is misleading and must instead look at the dollar strength.

WTI and DXY haven’t been strongly correlated since early 2023.

The divergence in my own undisclosed proprietary price model started in July and continues to grow larger.

What is the market seeing that those who are counting barrels are not? Ghosts?

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Cole Sear, played by Haley Joel Osment, confesses the infamous quote in the 1999 American thriller, The 6th Sense.

Looking forward to your next report, especially with all the (quite scary)geopolitical implications.

Also, great movie. H J Osmont should have won the Oscar that year.