EIA WPSR Summary for week ending 2-9-24

Summary

Bearish report.

Crude: +12.8 MMB

SPR: +0.7 MMB

Cushing: +0.7 MMB

Gasoline: -3.7 MMB

Ethanol: +1.0 MMB

Distillate: -1.9 MMB

Jet: +0.1 MMB

Propane: -3.7 MMB

Other Oil: +1.1 MMB

Total: +5.2 MMB

Spot WTI is currently pricing $76. This is slightly above fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply built 12.8 MMB. Crude inventories are currently 2% below the seasonal average.

0.7 MMB were added to the SPR. This makes 5 MMB total of the 12 MMB planned 2024 purchases.

US crude imports returned to seasonal average levels.

US crude exports were also at average levels this week.

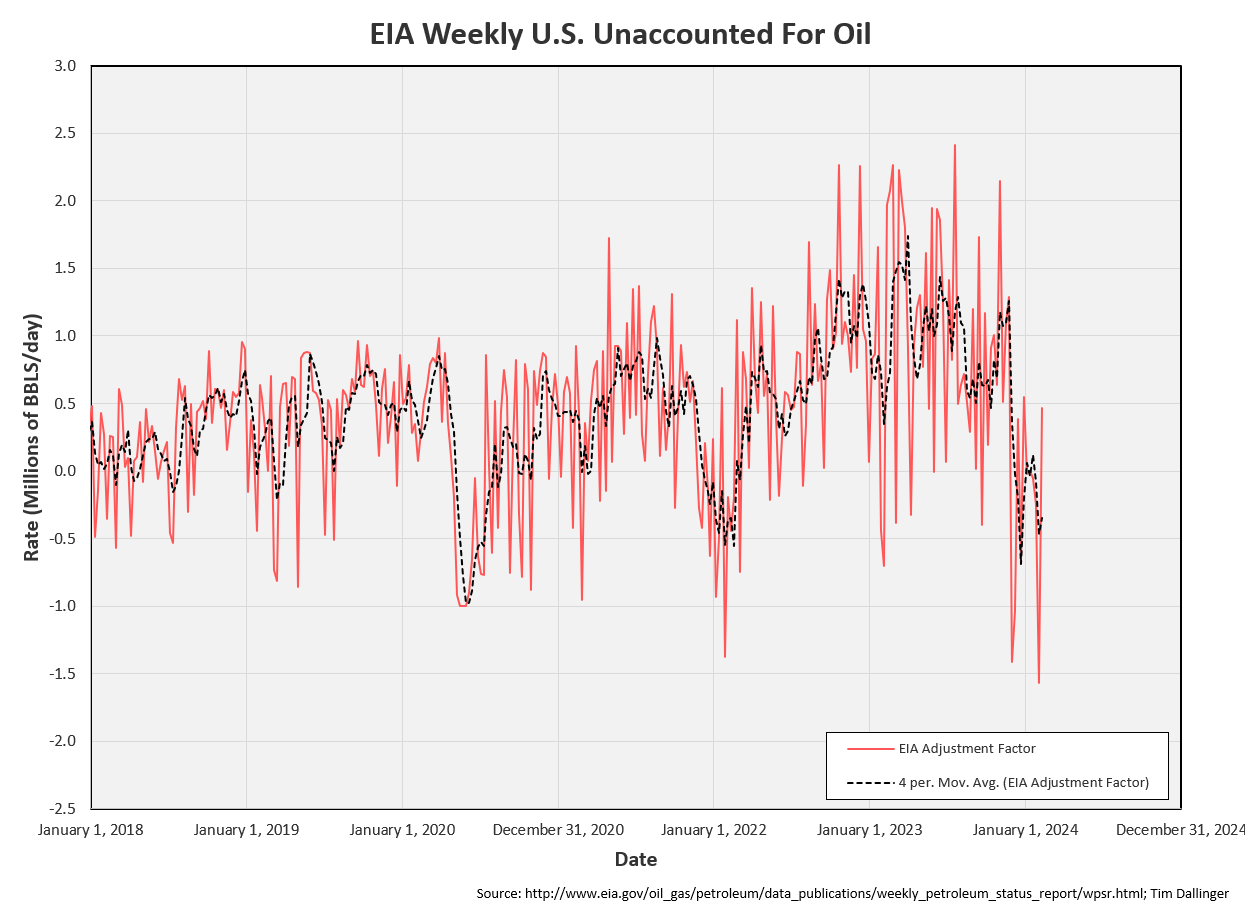

Unaccounted for oil reverted back to positive values. This figure remains noisy.

Cushing

Crude storage at Cushing, OK built by 0.7 MMB. Levels are now just above 2022. Unanticipated refinery outages likely led to the build.

Gasoline

Total motor gasoline inventories decreased by 3.7 MMB and are 2% below the seasonal 5-year average.

Ethanol

Ethanol inventories built by 1.0 MMB. Inventories are 1.5% above average.

Distillate

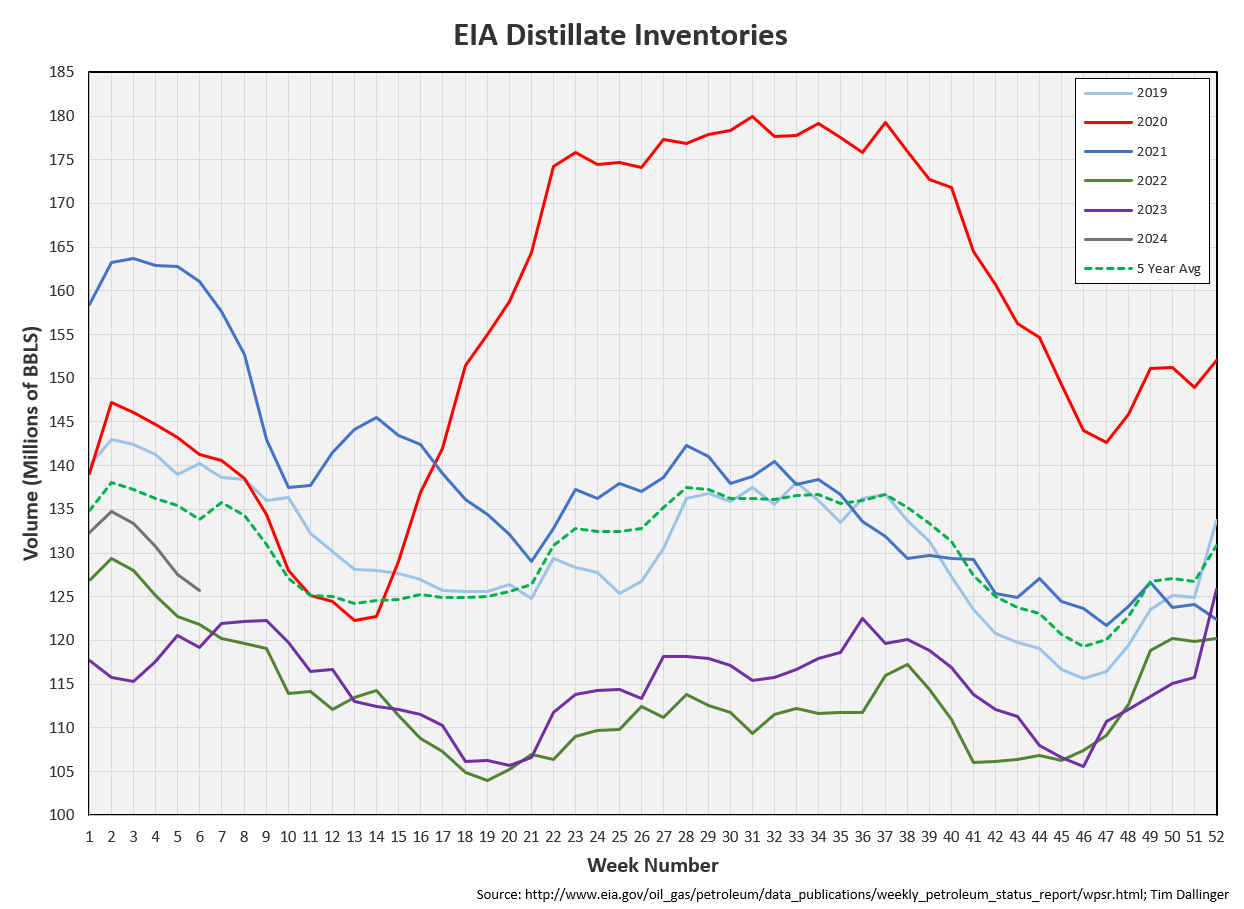

Distillate fuel inventories decreased by 1.9 MMB last week and are about 7% below the seasonal 5-year average.

Jet

Kerosene type jet fuels increased by 0.1 MMB. Seasonal jet inventories are slightly above average.

Total global airfare miles travels and total number of flights reach an all-time seasonal record.

https://www.airportia.com/flights-monitor/

Propane

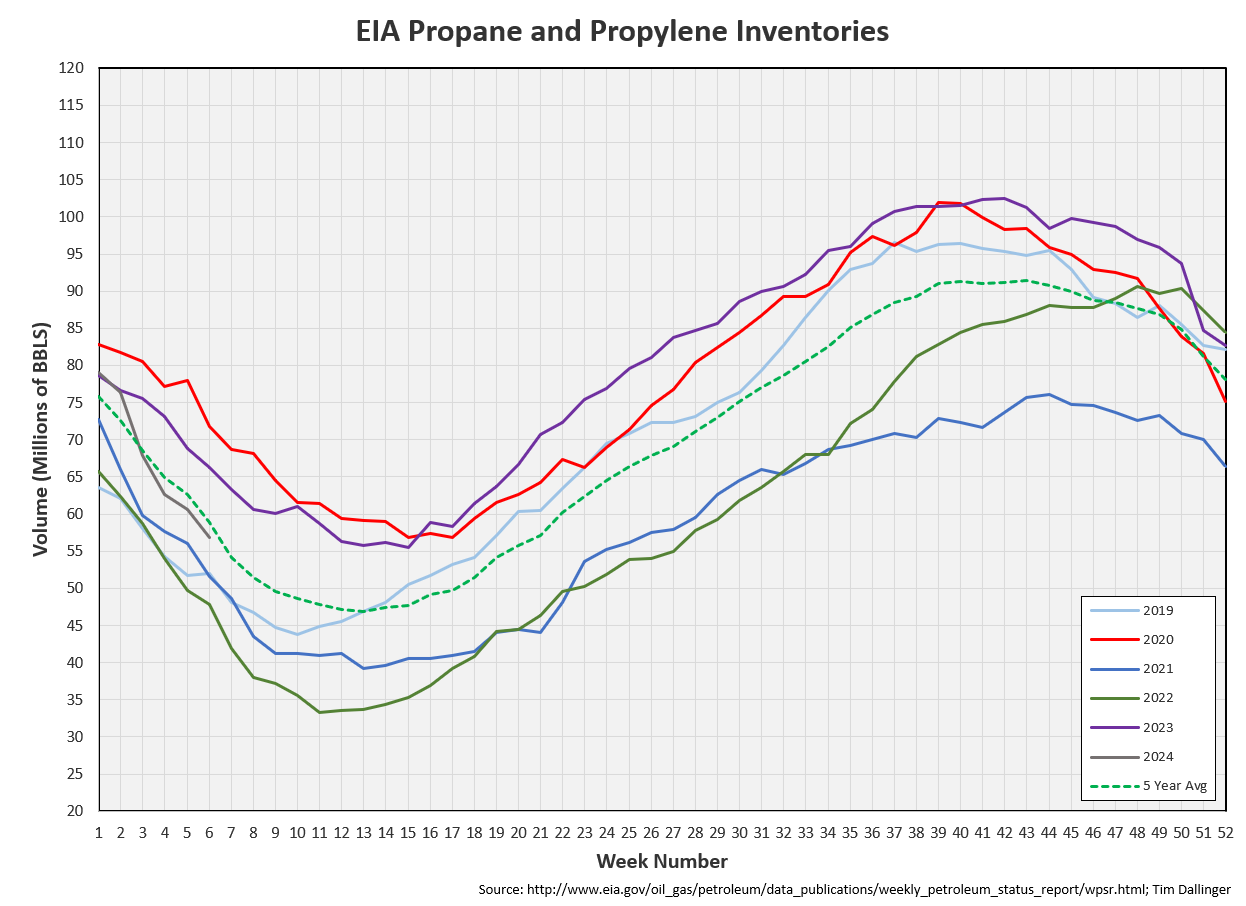

Propane/propylene inventories decreased by 3.7 MMB from last week. Inventories have fallen slightly below seasonal averages.

Other Oil

Other oil increased by 1.1 MMB. Other oil inventories are just above seasonal average.

Total Commercial Inventory

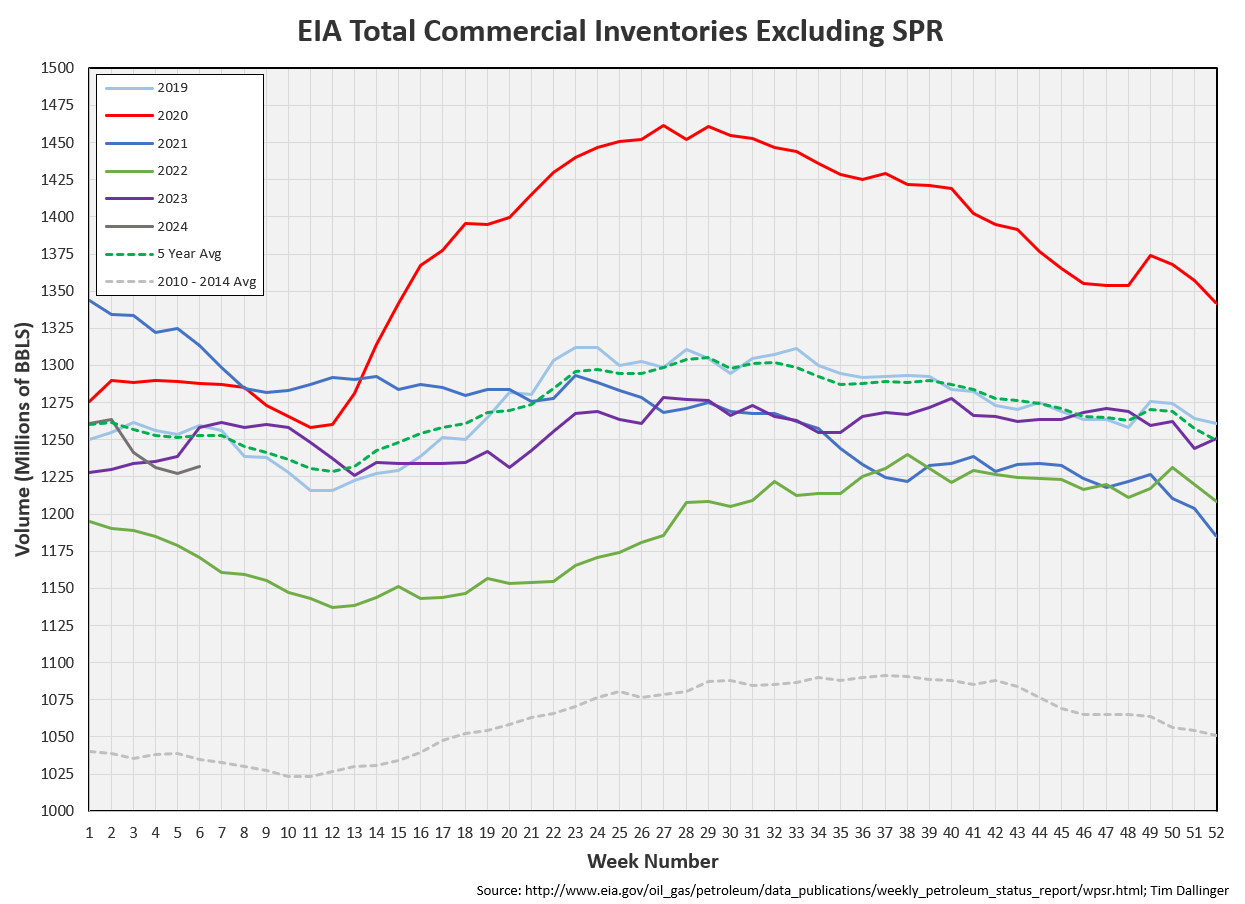

Total commercial inventories built by 5.2 MMB.

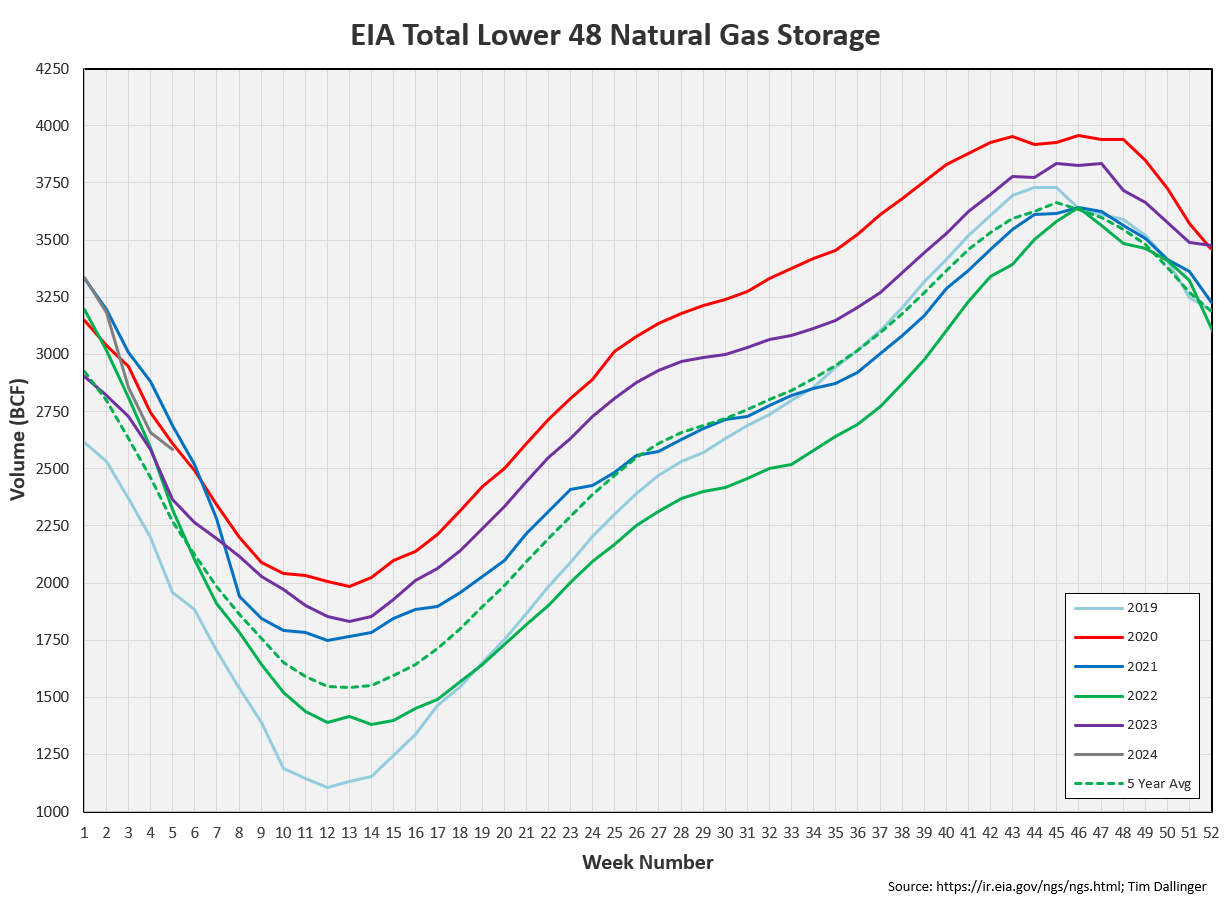

Natural Gas

Natural gas drew but not at a steep enough rate to impress the market.

Warm weather will hamper natural gas demand.

Discussion

Crude oil input to refineries fell again. Whiting is still down. Several units in the Gulf coast region are experiencing similar unplanned outages. And spring maintenance season is now in full swing.

The EIA demand proxy demonstrates further weakness. While no 3rd party services are reporting impacted demand, the lack of significant product draws this week makes this plausible. Demand should bounce back.

Transportation inventgories are still relatively low, leading to healthy cracks.

Cracks have pulled back off their recent highs but remain elevated.

WTI timespreads have returned to backwardation.

Brent backwardation is even steeper.

The global physical market is tighter than the US. This should drive US crude exports back up.

Products need to draw enough over the next 3 weeks to offset the crude builds due to refinery maintenance.

This was decidedly a bearish report. There really is no bright spot. However, if this week’s product demand figure is a one-off, significant product draw will return. Crude exports should remain high, offsetting some of the expected US crude build. Bullish sentiment can return quickly.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Lieutenant Arcot "Thorny" Ramathorn’s shooting accuracy is nearly perfect, in the 2001 American comedy film, “Supertroopers.”