Summary

Bullish report.

Crude: -4.3 MMB

SPR: +0.0 MMB

Cushing: +1.2 MMB

Gasoline: +0.4 MMB

Ethanol: +0.7 MMB

Distillate: +1.5 MMB

Jet: -1.1 MMB

Propane: -1.0 MMB

Other Oil: -6.7 MMB

Total: -10.0 MMB

Spot WTI is currently pricing $69. This is below fair value, based on a price model derived from reported EIA inventories.

Crude

U.S. commercial crude oil inventories decreased by 4.3 MMB from the previous week and are 2% the seasonal 5-year average.

SPR remained unchanged this week. 0.6 MMB additions are still planned for the remainder 2023.

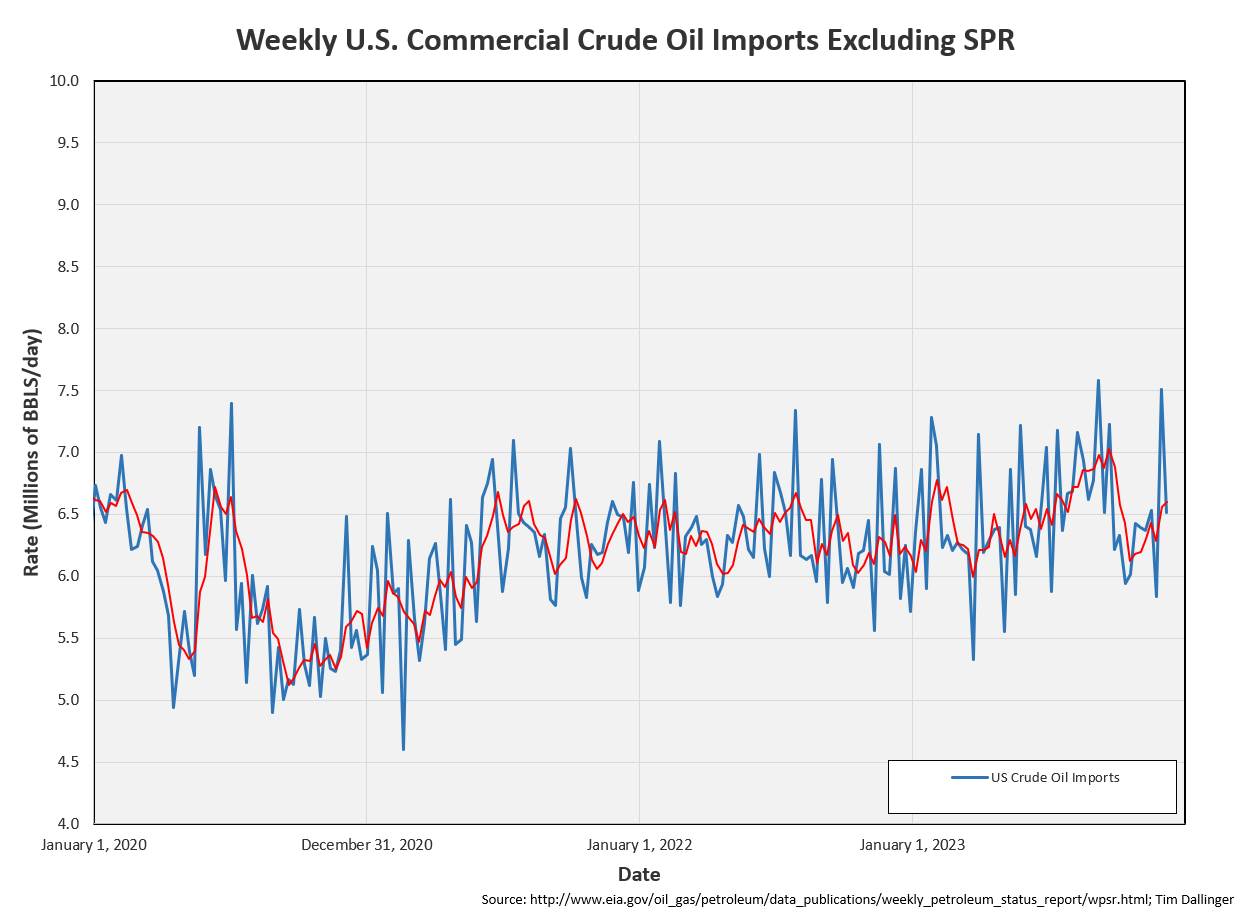

US crude imports returned to normal levels, showing last week’s surge was anomalous.

US crude exports also fell. Independent ship trackers show that these were undercounted.

Undercounting exports for two consecutive weeks has contributed to negative adjustments.

Cushing

Cushing built by 1.2 MMB, in-line with expected seasonal behavior. Cushing builds should continue through year end.

Gasoline

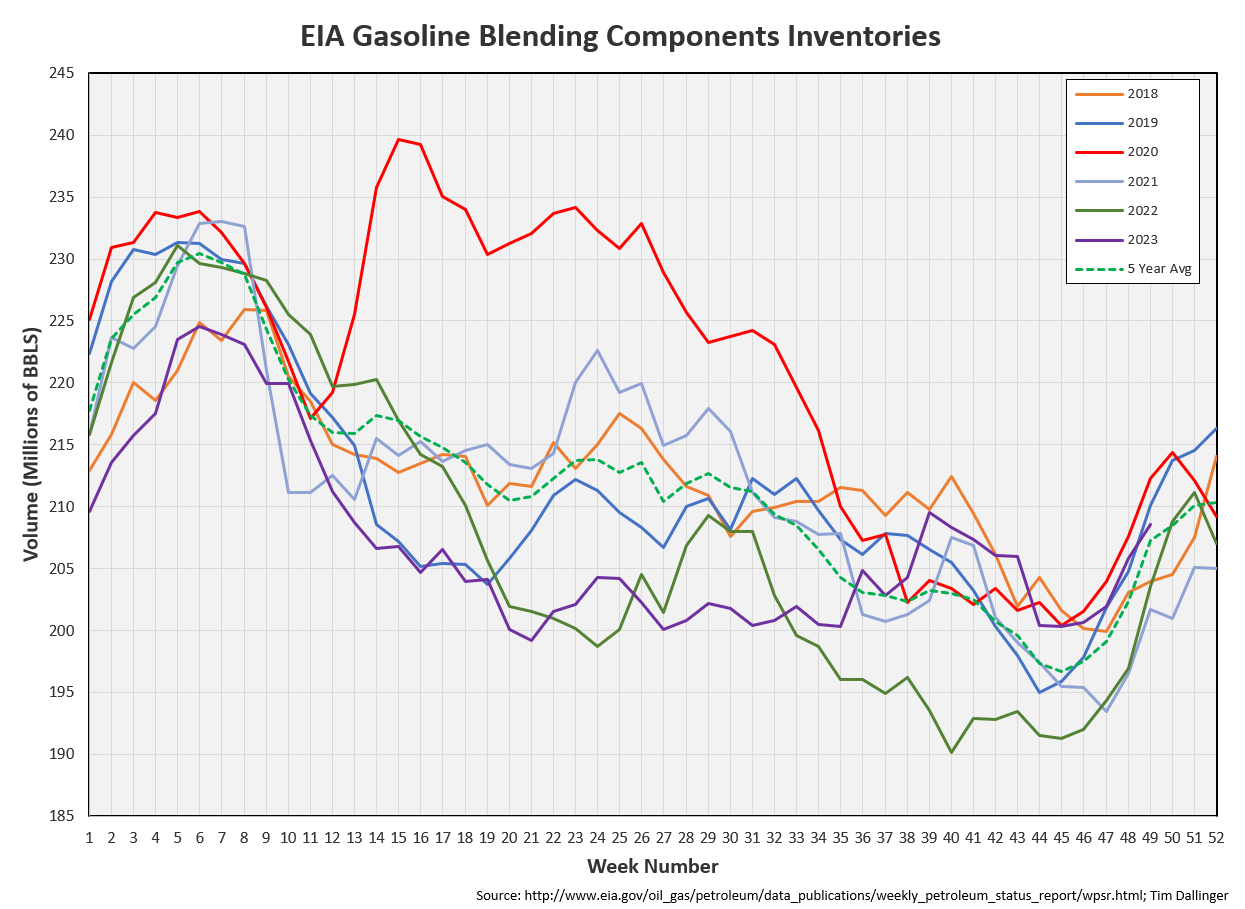

Total motor gasoline inventories decreased by 0.4 MMB and are 2% below the seasonal 5-year average.

Finished gasoline is at the same level as last year.

Blending components are above average.

When the EIA reports gasoline inventories, they simply add finished gasoline and blending components. Blending components are naphthas which can be derived from crude oil or natural gas liquids (NGL’s).

Ethanol

Ethanol inventories built by 0.7 MMB, resulting in volumes near the seasonal 5-year average.

Distillate

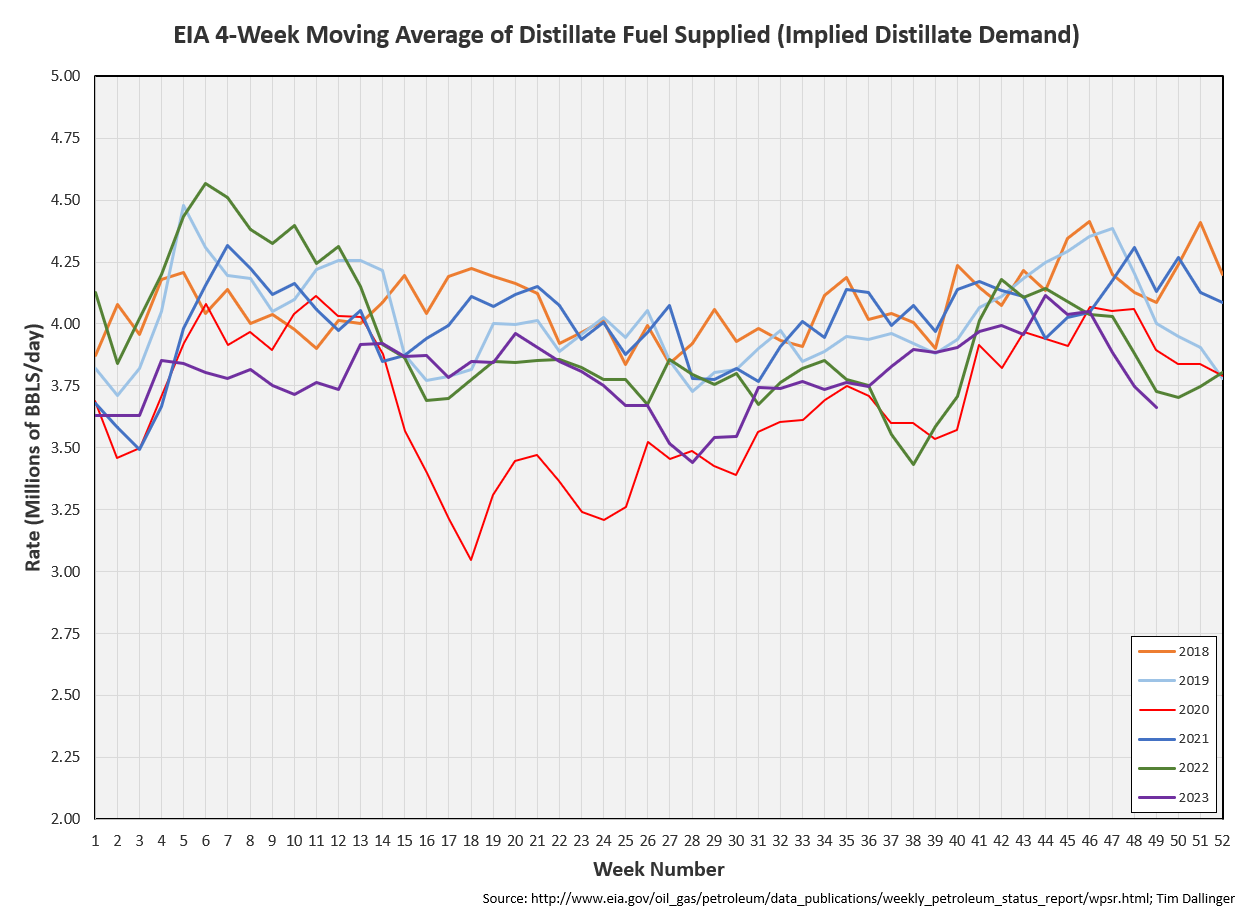

Distillate fuel inventories increased by 1.5 MMB last week and are about 12% below the season 5-year average.

This is the lowest weekly seasonal distillate inventory level on record and yet the EIA product supplied implies demand is lower than COVID.

Jet

Kerosene type jet drew 1.1 MMB. Inventories are slightly below the seasonal 5-year average.

Global miles travels are back at seasonal record levels. Total global flights still lag 2019.

https://www.airportia.com/flights-monitor/

Propane

Propane/propylene inventories decreased by 1.0 MMB from last week and are 18% above the seasonal 5-year average.

Other Oil

Other oil decreased by 6.7 MMB. Other oil inventories are still above average.

Total Commercial Inventory

Total commercial inventories drew by 10.0 MMB.

Natural Gas

Natural gas showed a significant draw last week.

The upcoming weather forecast shows warmer temperatures. That doesn’t bode well for natural gas demand in the short-term.

Discussion

Refiner input of crude oil fell slightly.

The EIA product demand proxy showed an uptick.

Transportation inventories remain low.

The simple 321 crack spread is healthy again.

Timespreads remain weak over the next 3 months.

There is no geopolitical premium in pricing even as the Palestinian-Israel-Iran quagmire continues. Houthis in Yemen have fired rockets at several merchant ships, including tankers. No significant damage has been reported.

Venezuela and Guyana are currently in dispute over borders, including off-shore oil-rich maritime territory. XOM reiterates their intention to remain in Guyana despite the increasing hostilities and maintain production.

Oil bulls have had a rough several weeks, although fundamentals have not been as weak as price action suggests. Today’s report was extremely supportive. The market response is muted though. Managed money positioning still skews bearish. If the next several EIA reports echo this one and the physical market tightens, sending the front months back into backwardation, that would demonstrate that the bull thesis still has legs. The market is anticipating builds in Q1 so flat or slightly falling inventories should drive some short covering.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Eternal optimist, Lloyd Christmas, portrayed by actor Jim Carrey, positively interprets a rejection from Mary Swanson in the 1994 American comedy film, “Dumb and Dumber.”