EIA WPSR Summary for week ending 4-1-24

Summary

Bullish report.

Crude: +1.4 MMB

SPR: +0.7 MMB

Cushing: +0.7 MMB

Gasoline: -4.5 MMB

Ethanol: 0.0 MMB

Distillate: -4.1 MMB

Jet: +0.1 MMB

Propane: +0.0 MMB

Other Oil: +1.5 MMB

Total: -5.5 MMB

Spot WTI is currently pricing $79. This is fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply built 1.4 MMB. Crude inventories are currently 1% below the seasonal average. Crude has only built 16 MMB on the year. Draws should resume in the next 2 weeks.

0.7 MMB were added to the SPR. 5.9 MMB have been added to the SPR in 2024.

US crude exports spiked this week.

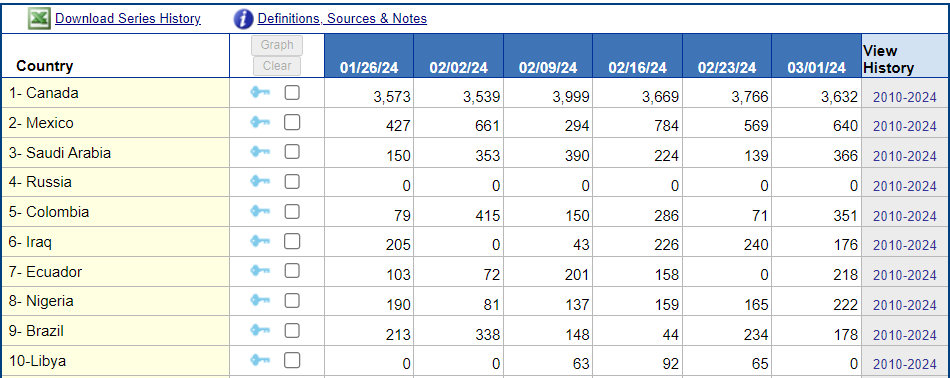

Higher imports from Saudi Arabia should be temporary. It’s unclear as to why Columbia volume was so high.

US crude exports were again at the high end of normal. Independent ship trackers confirmed this export volume.

Unaccounted for oil nears zero. In another month, there should be better data as to how much of the US production is actual crude production.

Cushing

Crude storage at Cushing, OK built by 0.7 MMB. Draws are expected to resume shortly as we near driving season.

Gasoline

Total motor gasoline inventories decreased by 24.5 MMB and are 2% below the seasonal 5-year average. This significant gasoline draw should ease some of the demand fears.

Ethanol

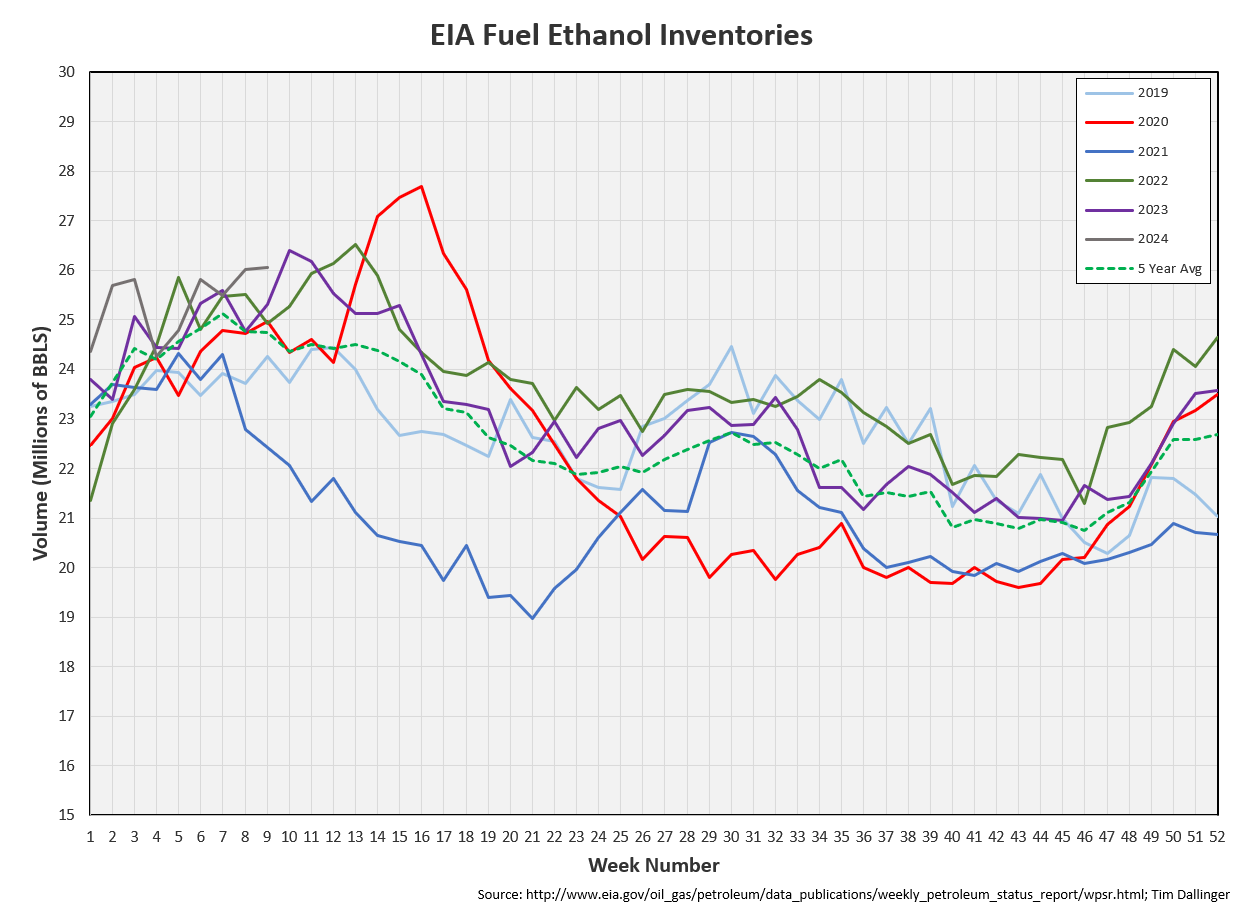

Ethanol inventories are flat week-on-week.

Distillate

Distillate fuel inventories decreased by 4.1 MMB last week and are about 10% below the seasonal 5-year average. Distillate volumes fall below 2022 levels.

Jet

Kerosene type jet fuels increased by 0.1 MMB. Seasonal jet inventories are just above the 5-year average.

Global flights remain at record levels but have come down slightly following the Chinse New Year.

https://www.airportia.com/flights-monitor/

Propane

Propane/propylene inventories are flat week-on-week.. Inventories are at seasonal averages.

Other Oil

Other oil increased by 1.5 MMB. Other oil inventories are just above seasonal average.

Total Commercial Inventory

Total commercial inventories drew by 5.5 MMB.

Natural Gas

Natural gas inventories are still oversupplied due to increasing volumes of associated gas in tight oil production.

Natural gas demand won’t get any additional boost from the weather. However, this warm spring weather should be bullish gasoline demand as spring breaks begin nation-wide.

EQT corporation joins Chesapeake Energy in voluntarily curtailing gas production. This gave natural gas prices a slight boost.

Discussion

Crude input jumps almost 600 kbd as refiners start to exit maintenance season. This should continue to ramp into summer.

The EIA’s demand proxy is still showing impacted product demand. No other metric confirms this behavior.

In fact, transportation inventories fall to record seasonal lows.

The simple 321 crack spread remains healthy. It’s higher than all Q4 2023.

Both brent and WTI are firmly backwarded. Timespreads continue to gain strength. Some are concerned that the back months are not moving up as quickly as the front. This suggests the physical market tightens and refiners and marketers are willing to pay a premium for prompt delivery.

The bearish narrative is that the timespread rally is a facade. As tankers reroute to avoid the Red Sea, transit time increases. This results in more oil-on-water.

Oil-on-water is up but one cannot view that metric in isolation. Swiss commodity trader Kim Benni, posted the following:

https://twitter.com/BenniKim/status/1764578495491969124

Global inventories, including oil-on-water, are down on the year. This is counter-seasonal movement and bodes well for the second quarter, when demand increases.

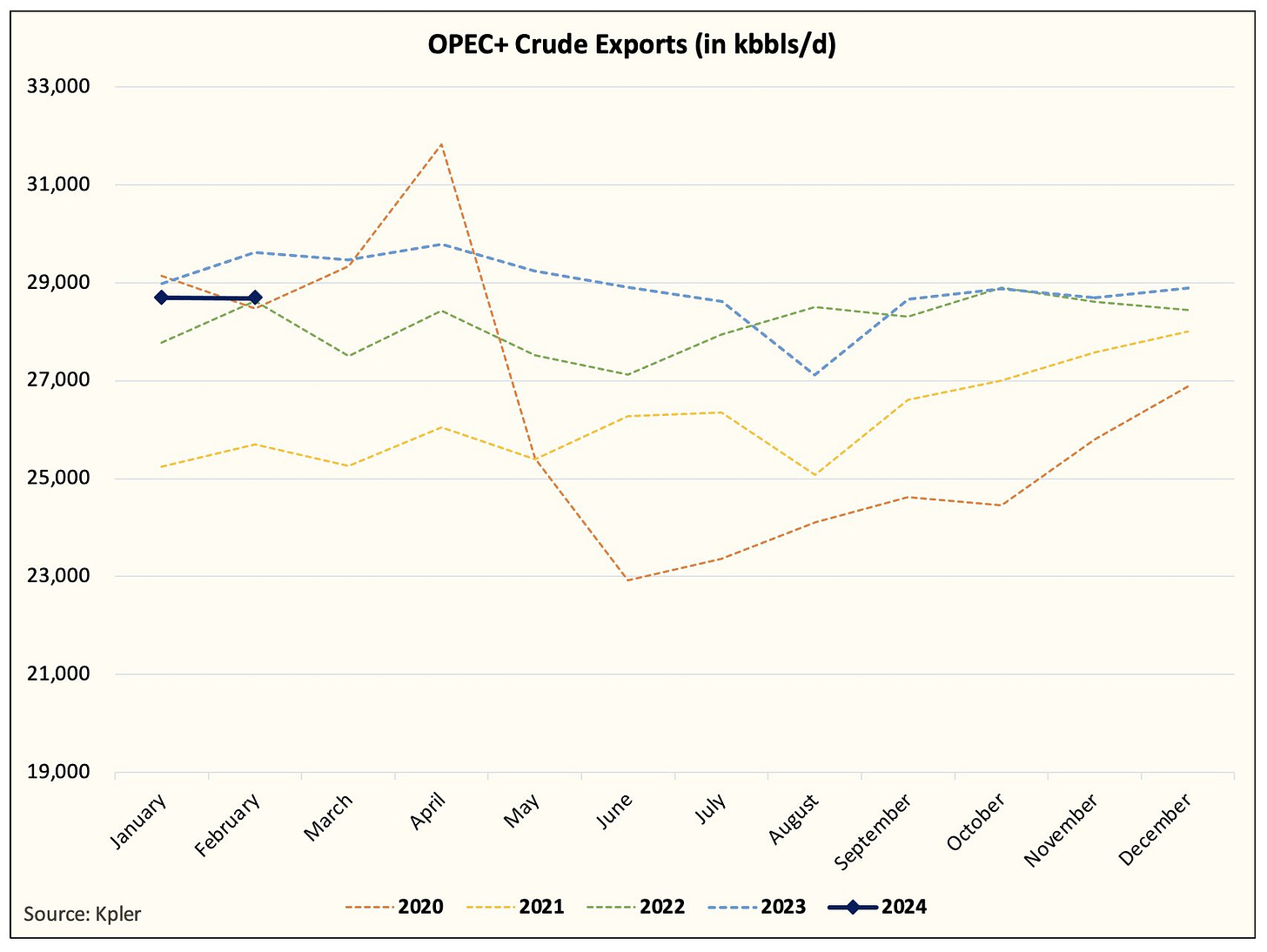

Energy investment research firm, HFIR, posted the following OPEC export graph. It doesn’t appear that OPEC+ is cutting exports.

https://twitter.com/HFI_Research/status/1765132878541918633

OPEC extended their voluntary cuts for another quarter.

Does this mean that demand is weak? If that were the case, KSA would need to discount their crude instead of raising prices.

Asian refiners will look to the US for cheaper light crude. US crude export strength should continue.

Signals seem to indicate that demand is healthy. Even though OPEC exports remain elevated, spot price and timespreads continue their rally.

The bullish thesis proceeds forward into the highest demand season.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Bob Marley and Wailers released their reggae hit “Sun is Shining” in 1978 on the album Kaya. While it’s a popular track today, it was largely overlooked when it was first released.