EIA WPSR Summary for week ending 9-1-23

Summary

Bullish report.

Crude: -6.3 MMB

SPR: +0.8 MMB

Cushing: -1.9 MMB

Gasoline: -2.7 MMB

Ethanol: 0.0 MMB

Distillate: +0.7 MMB

Jet: +0.9 MMB

Other Oil: +7.9 MMB

Total: +1.2 MMB

“Other oil” is the only bearish component of this report. Spot WTI is pricing $86. This approaches fair price, based on modeled value derived from reported EIA inventories.

Crude

Crude oil drew by 6.3 MMB.

The US has now added 3.6 MMB back to the SPR. Another 2.4 MMB addition are planned for 2023.

Even with that addition, the SPR will be have been drained down by 45% since 2021.

Strong export numbers continue. The exports that appear to have been missed last week were counted this week.

Unaccounted for oil jumped back above 1 MMBD.

The EIA has included a new category in their monthly reports called transfers to crude oil supply. This should include barrels of unfinished oils (refinery feedstocks) and natural gas liquids that have been blended into the crude oil supply. The WPSR publication does not yet include this addition. When it’s added, it should reduce unaccounted for oil significantly.

Cushing

Cushing drew 1.8 MMB and sits at 27 MMB of inventory. At this draw rate, hitting tank bottoms become a risk in early October.

Gasoline

Total motor gasoline inventories drew 2.7 MMB and are about 5% below the seasonal five-year average. Next week, gasoline inventories are poised to fall below 2022 seasonal levels.

Ethanol

Ethanol inventories were flat. They are about 2% below the five-year average.

Distillate

Distillate fuel inventories increased by 0.7 MMB and are about 14% below the seasonal five year average.

Jet

Kerosene type jet fuel built 0.9 MMB. Jet fuel inventories historically build over the next month.

Global miles flown are at all-time seasonal records.

This has occurred without the contribution of China. It’s unclear if Chinese demand will continue to recover further into year end or stall here.

https://www.airportia.com/flights-monitor/

Propane

Propane inventories increased by 0.5 million barrels last week and are about 18% above the five year average. Historically, propane inventories reach their peak in September and then draw with increased heating demand into fall and winter.

Other Oil

A significant 7.9 MMB jump in Other oil inventories. There’s no clear explanation for the anomalous behavior.

Total Commercial Inventory

Total commercial inventories built 0.4 MMB. This week, other oil interfered with their apparent downward trajectory. Seasonally record low levels are still expected in late September.

Natural Gas

Excess natural gas inventories have eases slightly.

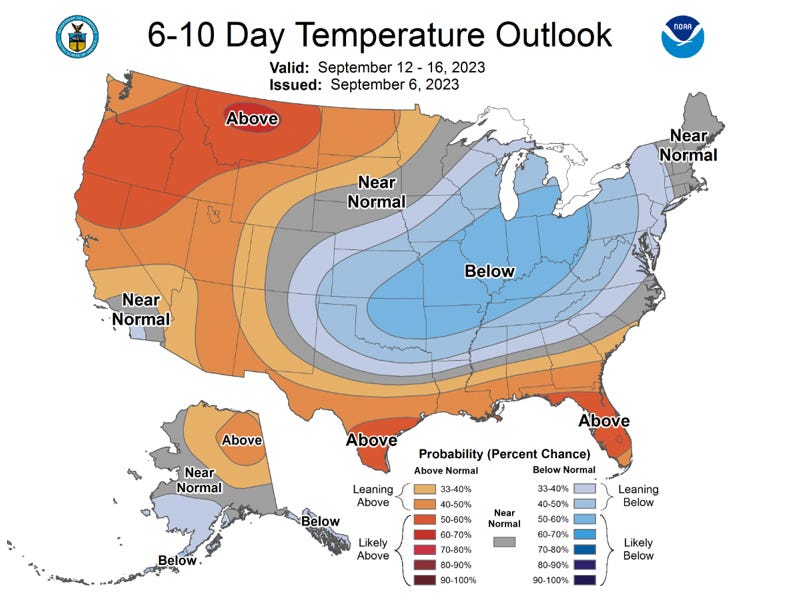

Natural gas inventories in the southern region are under pressure with continued power demand due hot weather.

A slight reprieve in the recent heat is expected.

Discussion

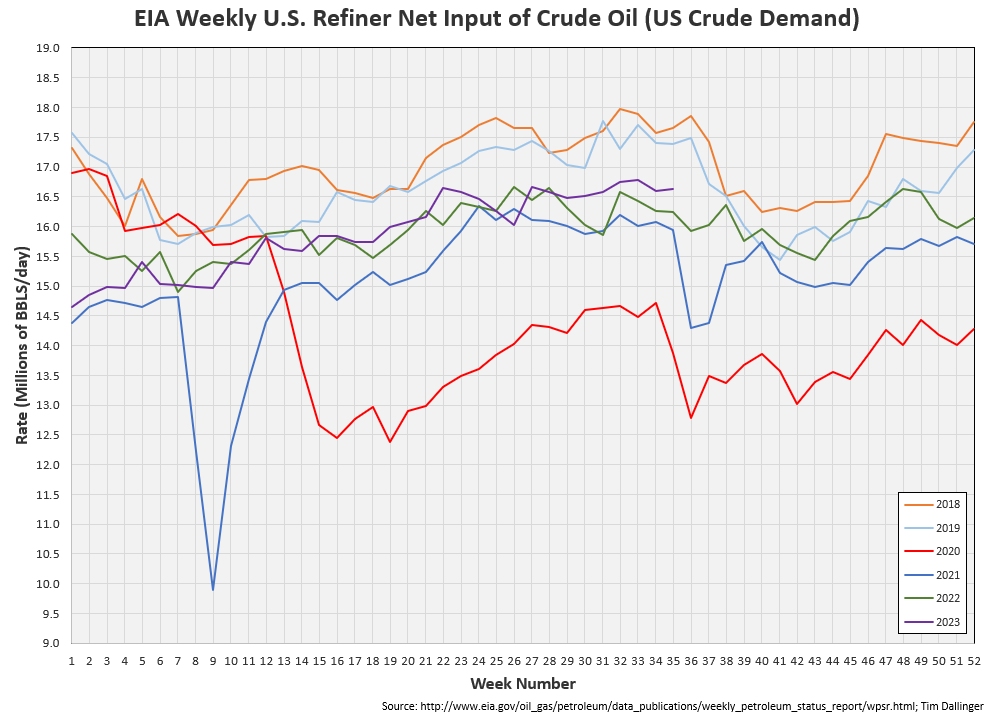

US refiner turn-around season approaches. However, utilization is still holding up currently. The Marathon Garyville facility is reported to back to full capacity after last week’s fire.

Although the EIA end user demand proxy remains below seasonal record, it still appears healthy.

Transportation inventories are above 2022 levels, mostly due to more distillate.

Including crude oil inventories with transportation inventories shows levels approaching seasonal record lows.

Cracks have come off record levels but remain high.

As mentioned last week, Saudi Arabia announced extension of their “lollipop” 1 MMBD cut. The surprise was they preemptively announced that the extension would remain in place through the end of year. Russia also announced an additional 300 kbd cut. Russia is finally losing export barrels. One might infer that Russia production is finally being impacted and their “cut” was necessary to obscure this reality.

Saudi Arabia also released their October Official Selling Price (OSP). Prices increased for both the US and Asian refiners desiring KSA crude oil. It appears Saudi Arabia is trying to restrict US purchases and incent China to buy US grades. This would cause lower US imports and higher exports, continuing to pressure US inventories. Being the most transparent inventories in the world, US inventory draws support higher global prices.

Saudi Arabia remains committed to decreasing global storage supplies. Tanker traffic will be monitored to see whether China increases US loading or instead chooses to draw their own strategic petroleum reserves.

E&P equities have not followed the recent crude price rally. Though inventories do support the recent price action, investors don’t seem to believe its sustainable. If price consolidates near here, producers will generate significant free-cash-flow. Should the market not recognize the value, companies can use those funds to pay down debt, repurchase shares or increase dividends.

The bullish thesis remains intact.