EIA WPSR Summary for week ending 4-4-25

Summary

Crude: +2.6 MMB

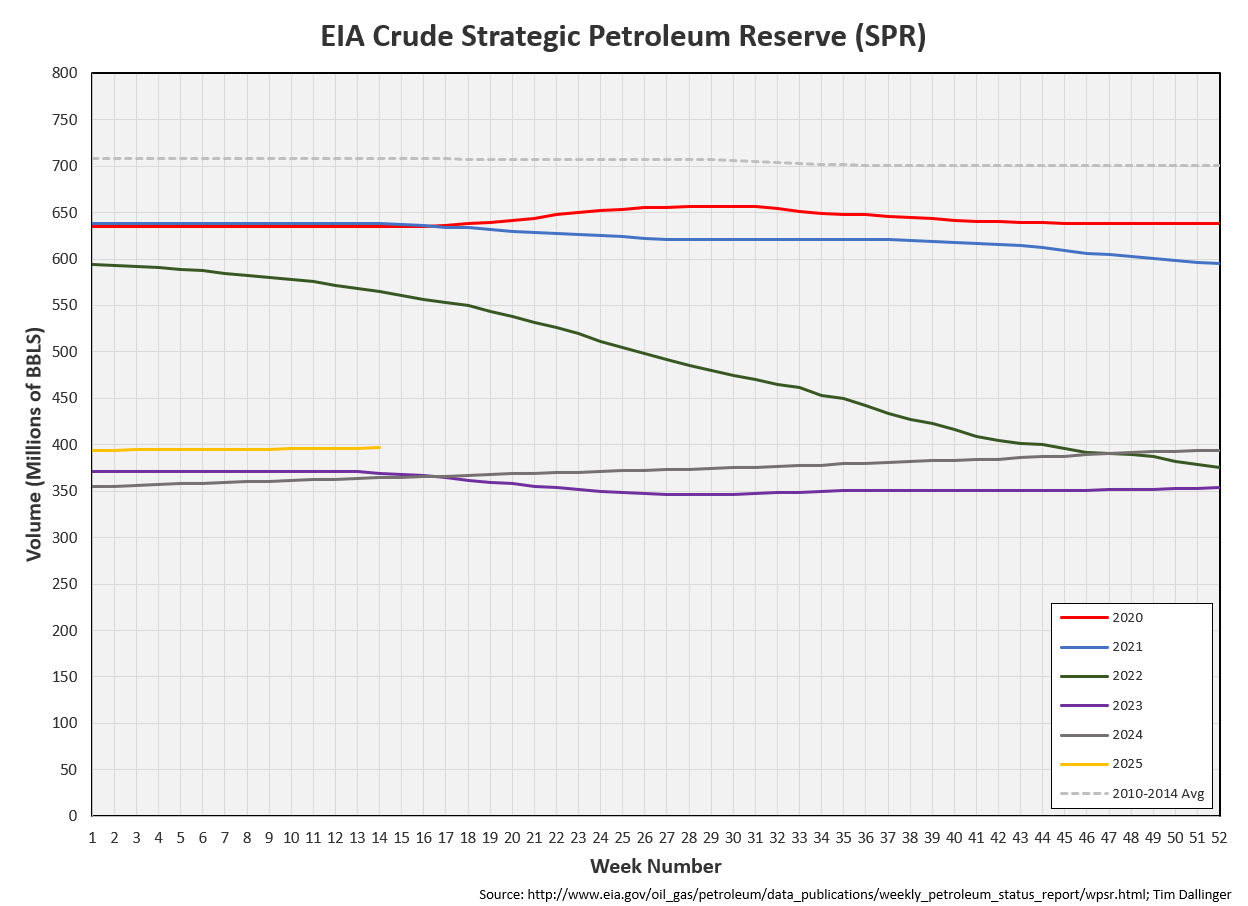

SPR: +0.3 MMB

Cushing: +0.7 MMB

Gasoline: -1.6 MMB

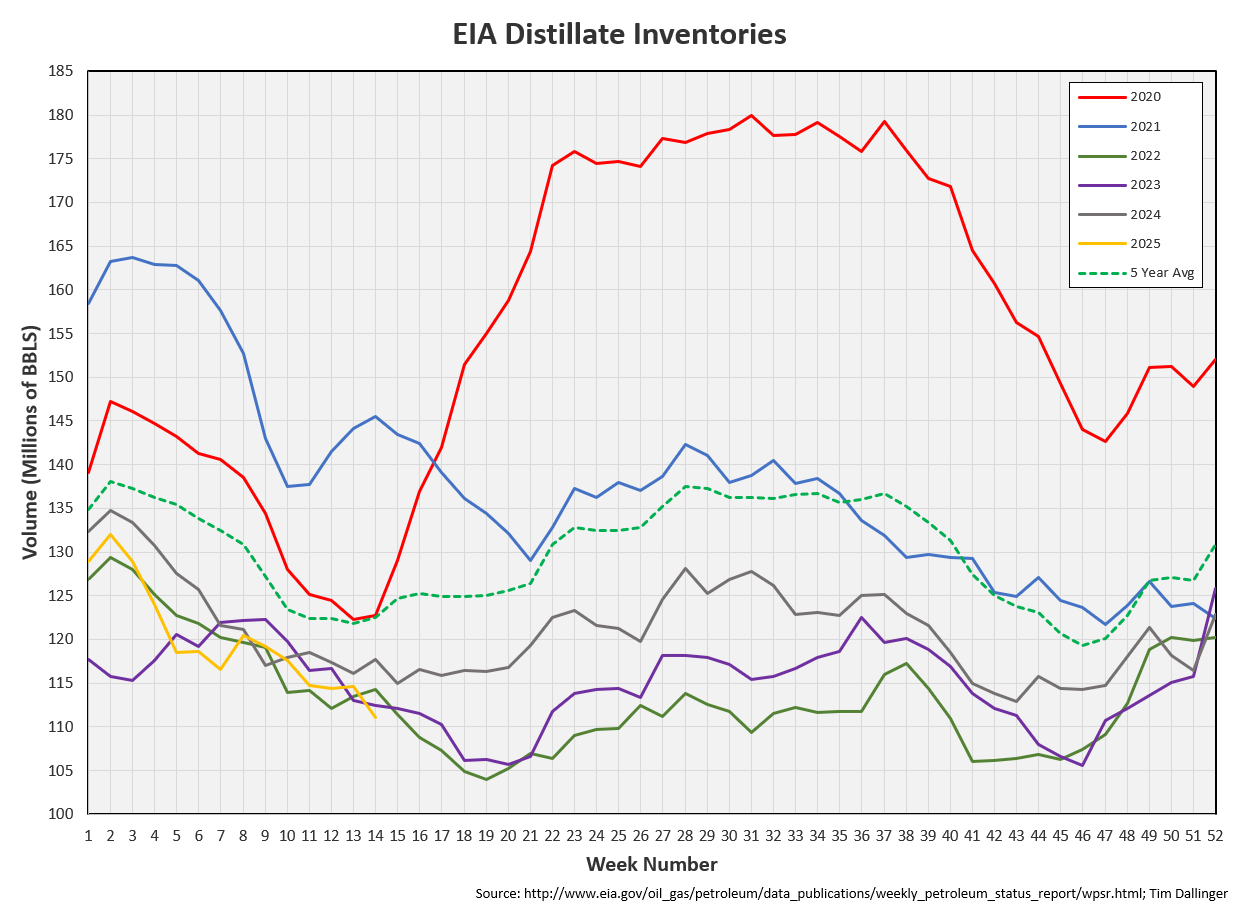

Distillate: -3.5 MMB

Jet: -1.9 MMB

Ethanol: +0.4 MMB

Propane: +1.5 MMB

Other Oil: +2.8 MMB

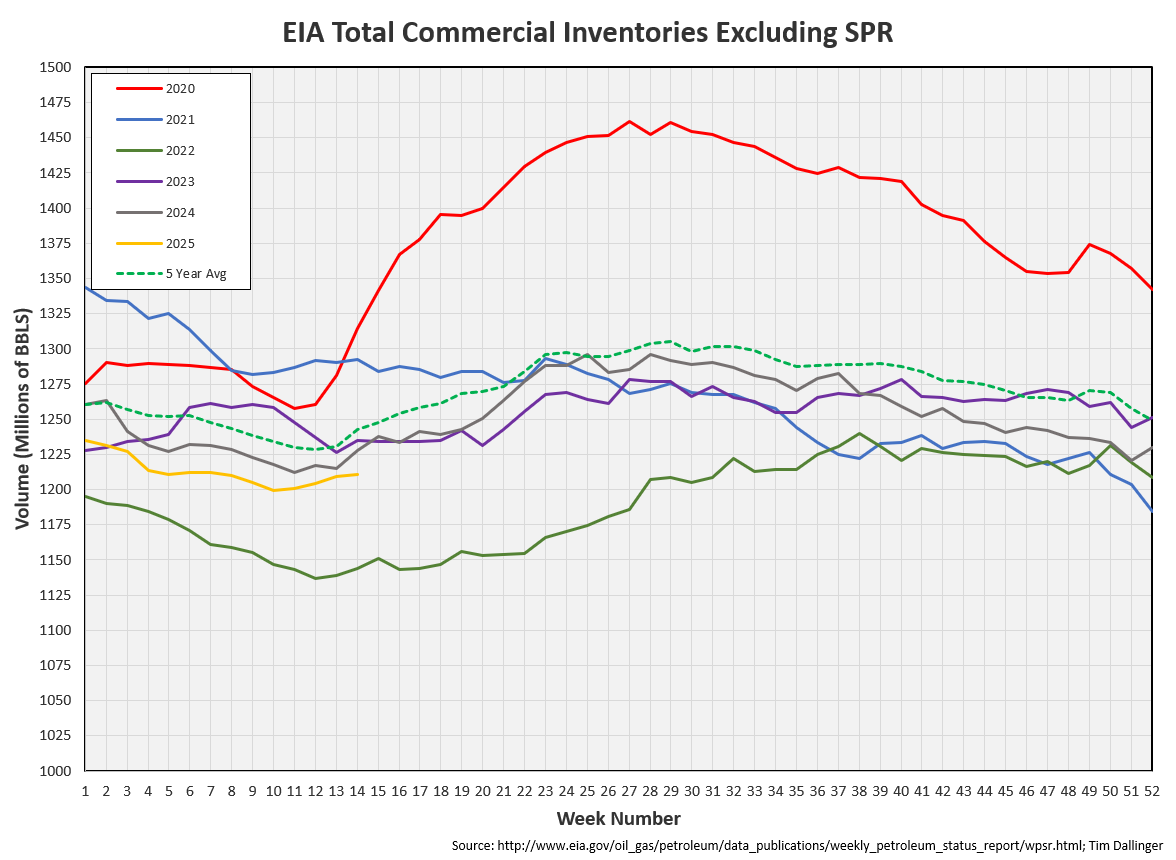

Total: +1.2 MMB

Spot WTI is currently pricing $62, having gained $7 intraday. Even with that jump, this is the most significant price dislocation from estimated fair value since the very beginning of COVID.

Crude

US Crude oil supply built by 2.6 MMB. Crude inventories are currently 5% below the seasonal average.

SPR refill continues slowly. 0.3 MMB were added to the SPR last week.

US crude imports were slightly down week-on-week. Imports are down annually.

Crude exports also fell significantly.

Unaccounted for crude was near record lows.

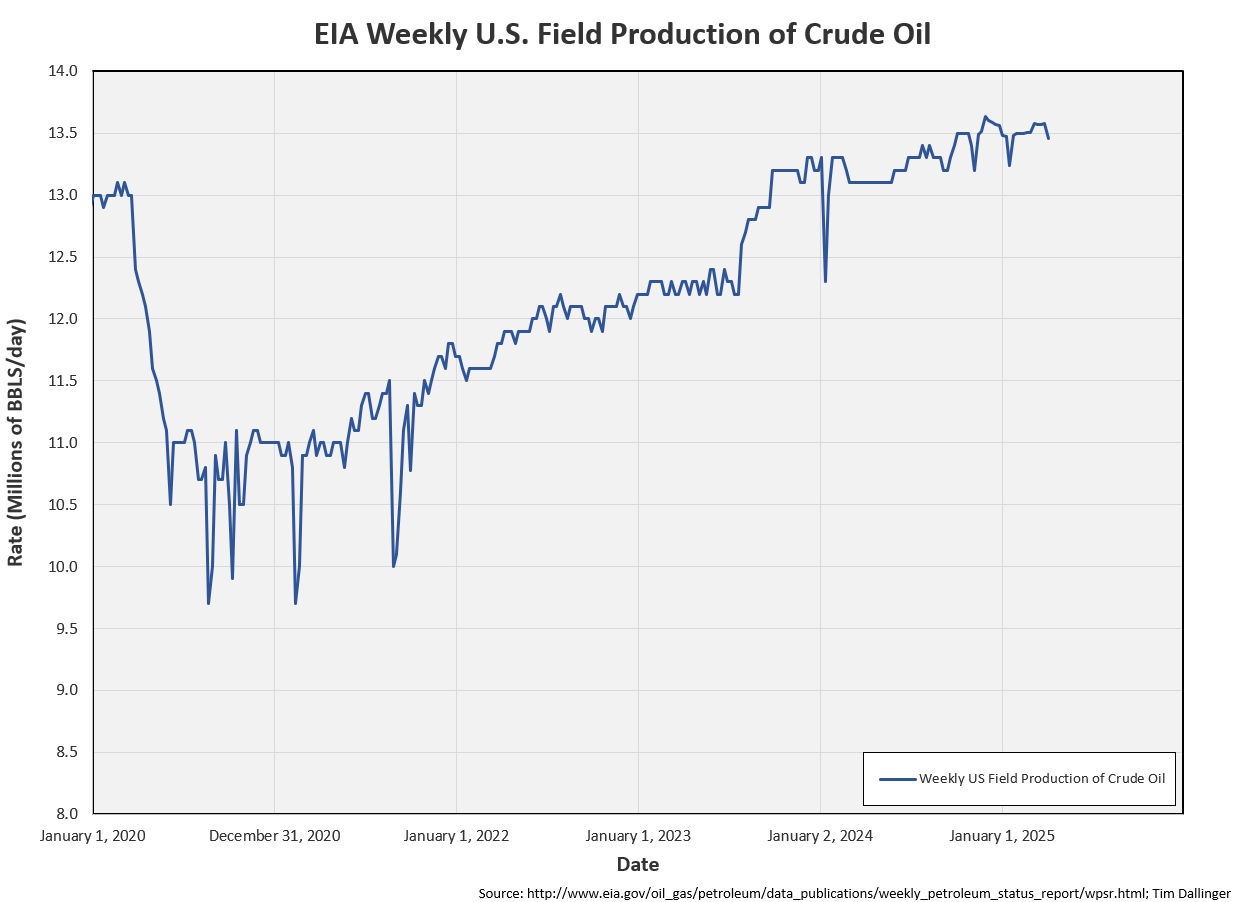

The EIA appears to have considered last week’s Petroleum supply monthly. They’ve revised their production model down slightly. They’re still over-counting US production, as evidenced by the large negative adjustment.

Cushing

Crude storage in Cushing, OK, built by 0.7 MMB week on week. Cushing storage levels match the 2022 seasonal lows.

Gasoline

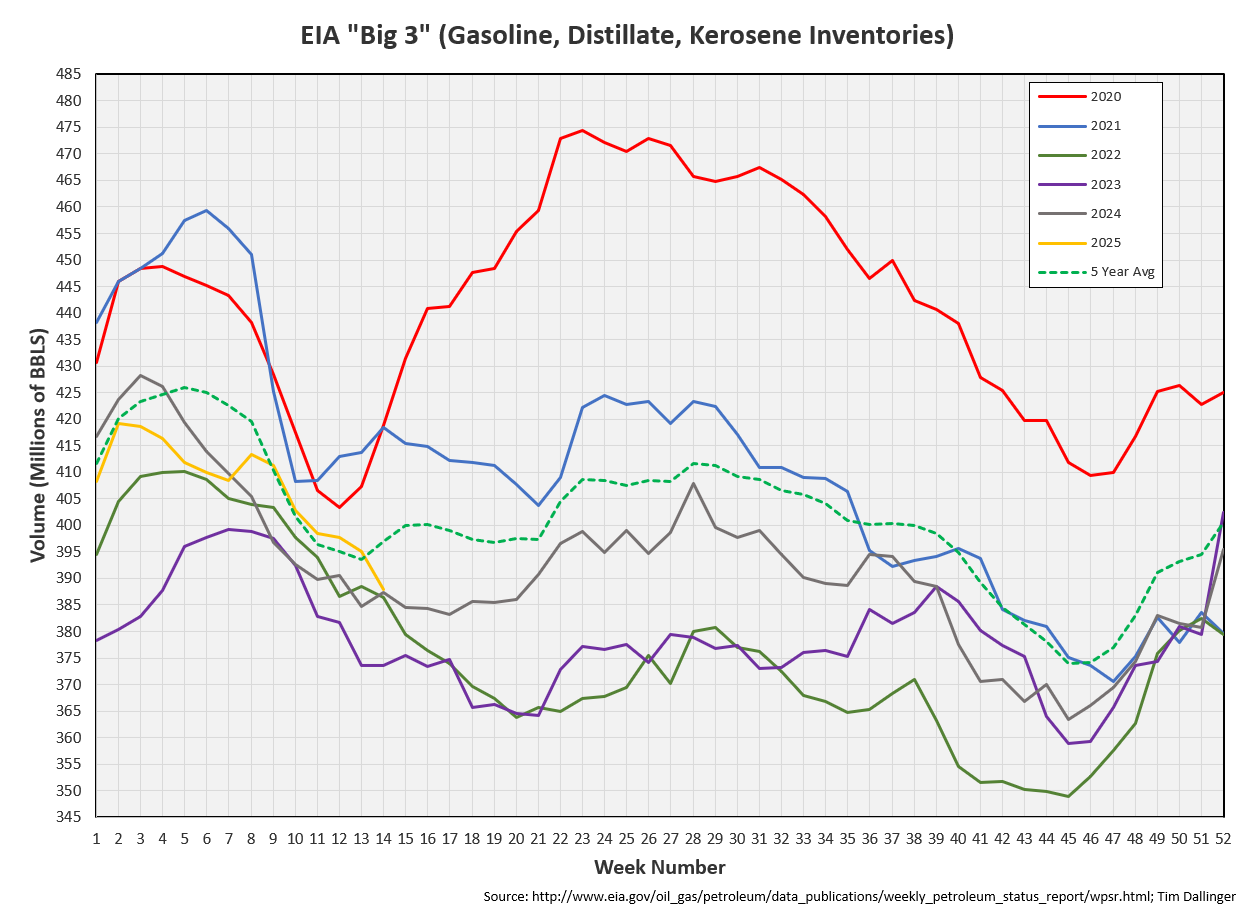

Total motor gasoline inventories decreased by 1.6 MMB and are near the seasonal 5-year average.

Distillate

Distillate fuel inventories decreased by 3.5 MMB last week and are about 9% below the seasonal 5-year average. Distillate inventories are at record low levels.

Jet

Kerosene type jet fuels fell by 1.9 MMB, finally falling below 2024 levels. Jet fuel inventories are still above the seasonal average.

Ethanol

Ethanol inventories increased 0.4 MMB week-on-week. Seasonal ethanol inventories are near record highs.

Propane

Propane/propylene inventories increased 1.5 MMB. Propane inventories are 5% below the seasonal 5-year average.

Other Oil

Other oil built by 1.2 MMB. Other oil inventories are above average.

Total Commercial Inventory

Total commercial inventory built by 1.2 MMB. Total inventories remain below seasonal averages.

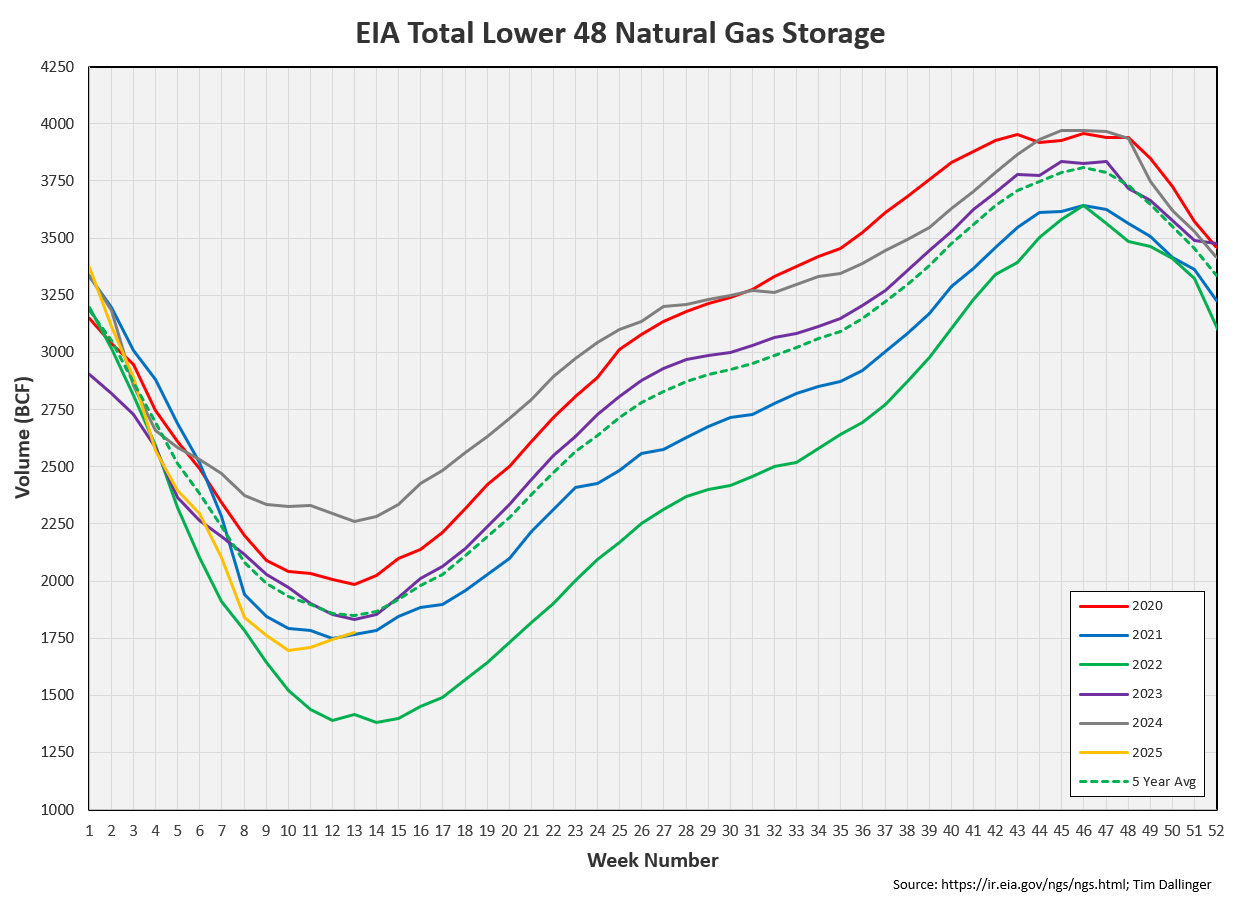

Natural Gas

Natural gas inventories are below average but building. There is reported to be both record natural gas demand and production.

Refiners

The amount of crude oil refiners processes last week increased slightly. Utilization should continue to increase from here.

The EIA’s product demand proxy fell. It deserves more scrutiny.

The implied demand for transportation products is healthy.

Implied demand for “other oil” is bringing down total demand.

When considering product supplied, generally 4-week moving averages are considered because the data is volatile. Breaking down “other oil” supplied into discreet weeks, it’s apparent that one single week of poor implied other oil demand is bringing down the average. The 4-week moving average will roll past this week soon and implied demand should increase.

Transportation inventories are below average. They are identical to 2024 seasonal levels.

Including crude oil in the aggregate shows only 2022 was lower. Consider then that oil prices were double today’s spot price.

Simple cracks cratered since yesterday. This is not an accurate reflection of the market.

Discussion

This was one of the most volatile weeks in the history of energy markets. Energy investors cannot catch a break.

OPEC+ announced that they were pulling forward some return to production due to improved demand outlook. An additional 135 kbd of production was expected. OPEC+ increased that to 400 kbd. There’s conflicting ideas about why this occurred. Some expect that it was a nod to the Trump administration who has been adamant that they want lower energy prices. This doesn’t seem to make much sense for Saudi Arabia though unless it’s in exchange for something like defense support. Perhaps it gives Trump room to increase sanctions on Iran. However, this seems unlikely as Trump reneged a similar agreement in October 2018 when he granted waivers on Iranian sanctions, last minute, after Saudi had increased exports to keep the world market well-supplied.

A more likely scenario seems that there’s internal strife among OPEC members. Several countries including Kazakhstan has been over-producing their quota. Increasing supply hurts all members and acts a warning that there can be dire consequences for noncompliance. Saudi has enough storage to drive prices significantly lower. Saudi also lowered their OSP (official selling price) to allegedly undercut cheaters.

Despite all the bearish headlines, it still seems unlikely that OPEC+ is flooding the market. Did OPEC work this hard to manage a market, just to throw-in-the-towel when US shales finally seems to be showing signs of fatigue?

The market was already selling crude when Trump announced global sweeping tariffs. Financial markets fell. Banks increased their likelihood of a recession. Panic and hedging caused paper markets to sell crude hard. Benchmark crude oil fell almost $20 in a week. Recessionary fears are warranted but this was overdone. Physical markets are still trading strongly. Barrels are moving globally in a normal manner.

There are energy analysists that claim price will have no effect on supply for the remainder of the year. These individuals fail to recognize the amount of production that is unhedged and true break-even pricing. Chevron announced today that they will “triple frac” half of their Permian production this year to save costs. That means re-fracking wells where production has fallen due to natural decline. There is some cost-savings because it doesn’t require additional rigs. But those wells won’t produce what that did in their peak.

Oil did jump $7 today when a 90-day tariff pause on most countries was announced. Still, with this much economic uncertainty, management teams aren’t keen on committing additional capital on growth projects.

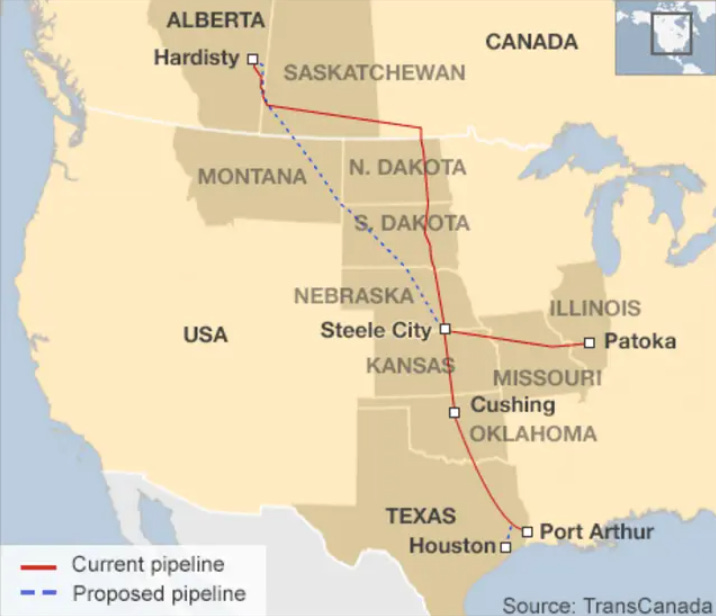

Keystone pipeline is shutdown following a rupture yesterday in North Dakota yesterday. That means ~500kbd of Canadian crude will not be landing in Cushing until the system is repaired and restarted (the blue dotted line in the figure below is Keystone XL which was never built). This should show up, starting next week in the crude import figures. Additional Details are awaited from regulators on restart.

While oil is still underpriced due to current underlying supply and demand fundamentals, one should exercise caution with investment and trading decisions. This volatility is the playground for algorithms. Paper barrels exceed physical barrels by an order of magnitude.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Joe Exotic bemoans his misfortune in the 2020 Netflix documentary, Tiger King.