EIA WPSR Summary for week ending 8-23-24

Summary

Crude: -0.8 MMB

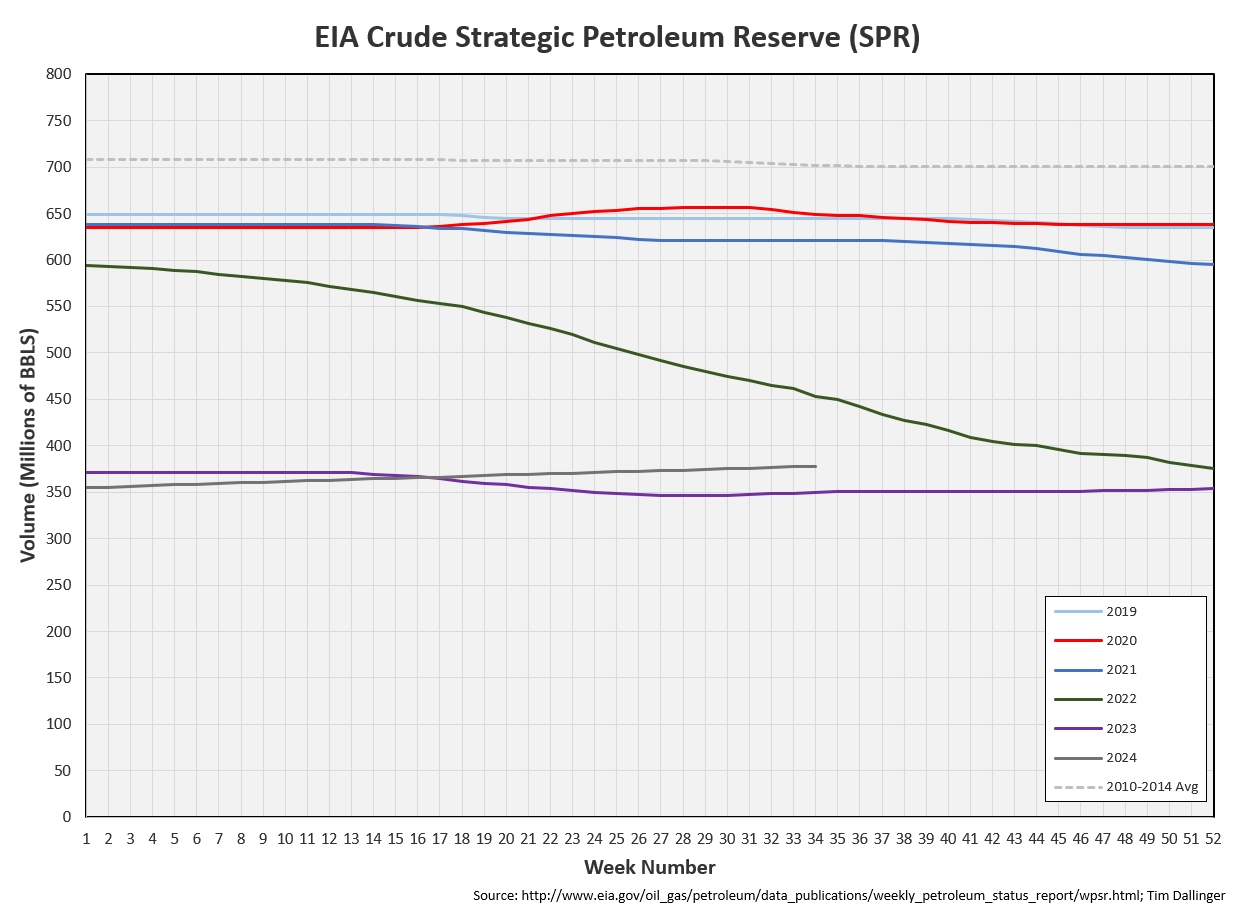

SPR: +0.7 MMB

Cushing: -0.7 MMB

Gasoline: -2.2 MMB

Distillate: +0.3 MMB

Jet: +0.7 MMB

Ethanol: +0.0 MMB

Propane: +1.0 MMB

Other Oil: -1.8 MMB

Total: -3.1 MMB

Neutral report, skewing bullish considering seasonality.

Spot WTI is currently pricing $74 USD. Prices are significantly below fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply drew by 0.8 MMB. Crude inventories are currently 4% below the seasonal average, near both 2022 and 2023 levels.

0.8 MMB were added to the SPR. With current spot prices and only 68 days until the US presidential election, a politically motivated SPR release becomes exceedingly less likely.

US crude imports were down slightly.

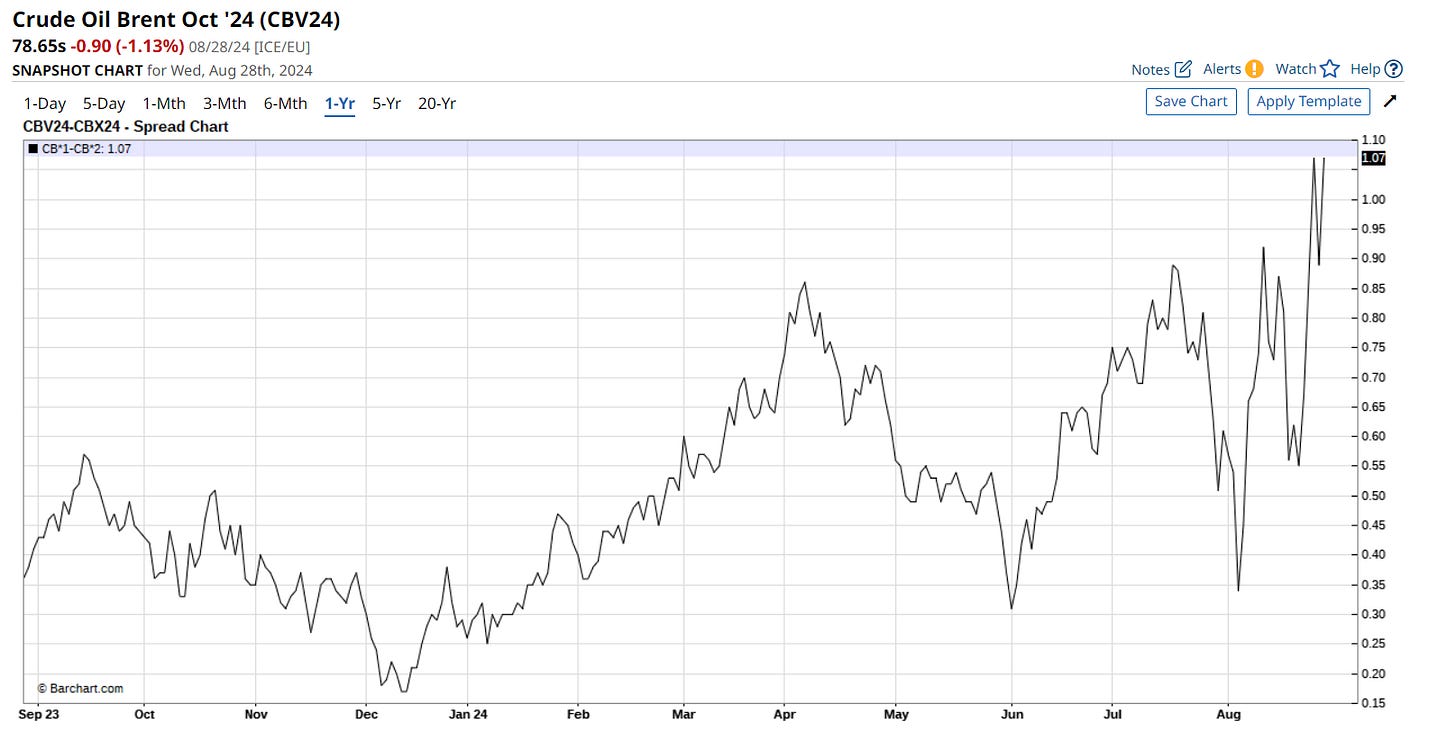

Crude exports were also down slightly. Lower US crude exports may seem odd, especially with the WTI Brent spread. But the reality is US inventories are low. Some light crude grades are fetching a premium to brent pricing for physical delivery to keep them in the US.

Unaccounted for crude was about flat.

Cushing

Crude storage in Cushing, OK, drew by 0.7 MMB week on week. Cushing has about 7 MMB of working volume remaining. These figures will become more critical over the next two months.

Gasoline

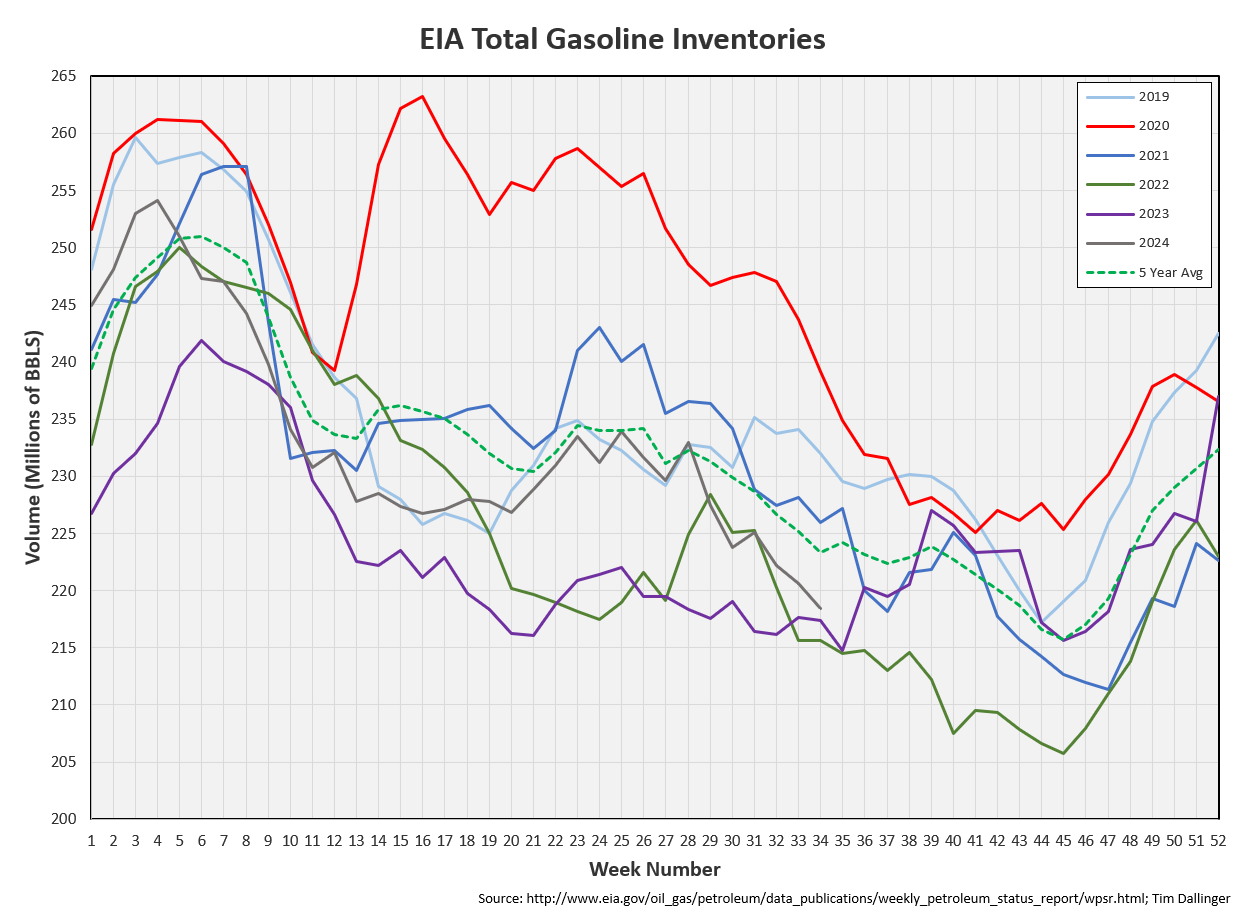

Total motor gasoline inventories decreased by 2.2 MMB and are about 4% below the seasonal 5-year average.

Distillate

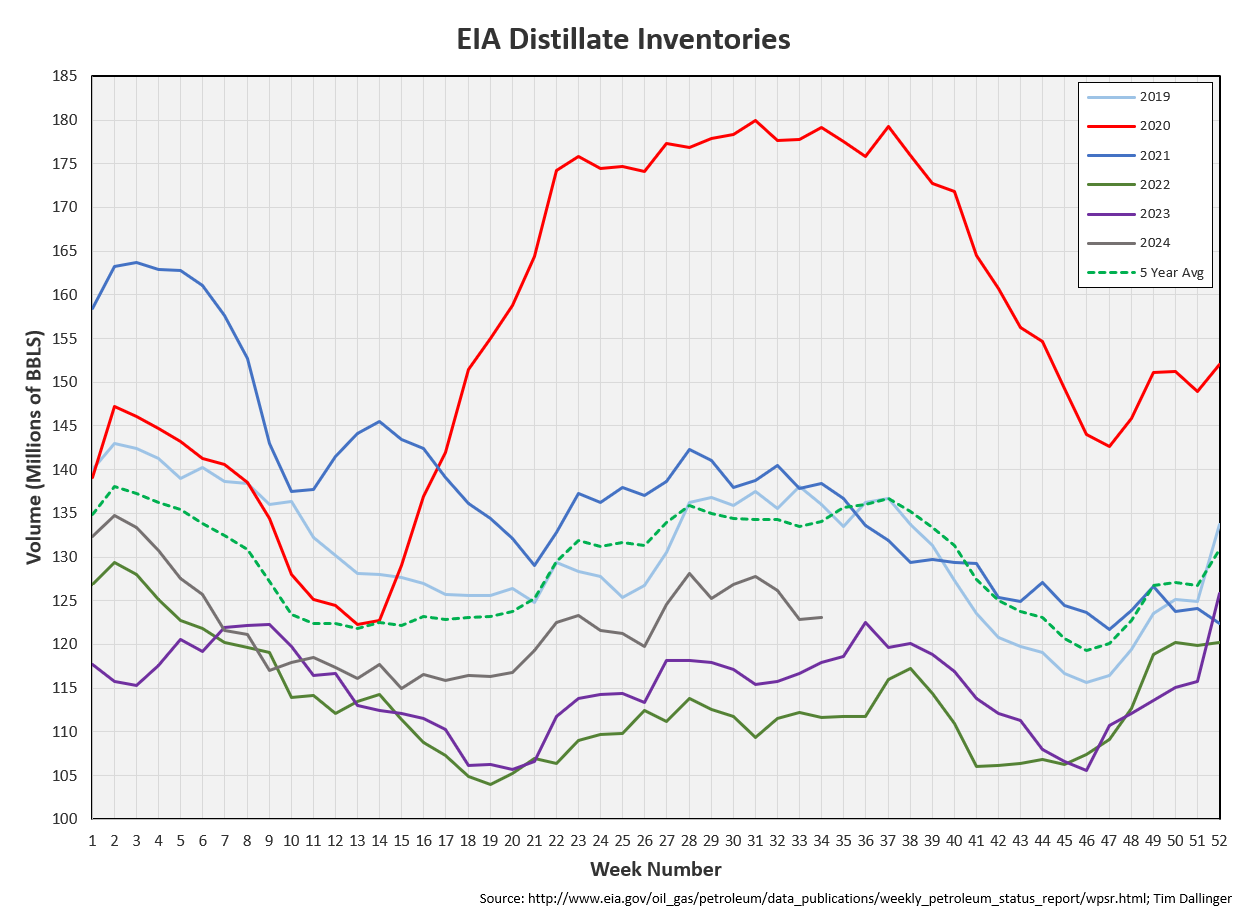

Distillate fuel inventories increased by 0.3 MMB last week and are about 10% below the seasonal 5-year average.

Jet

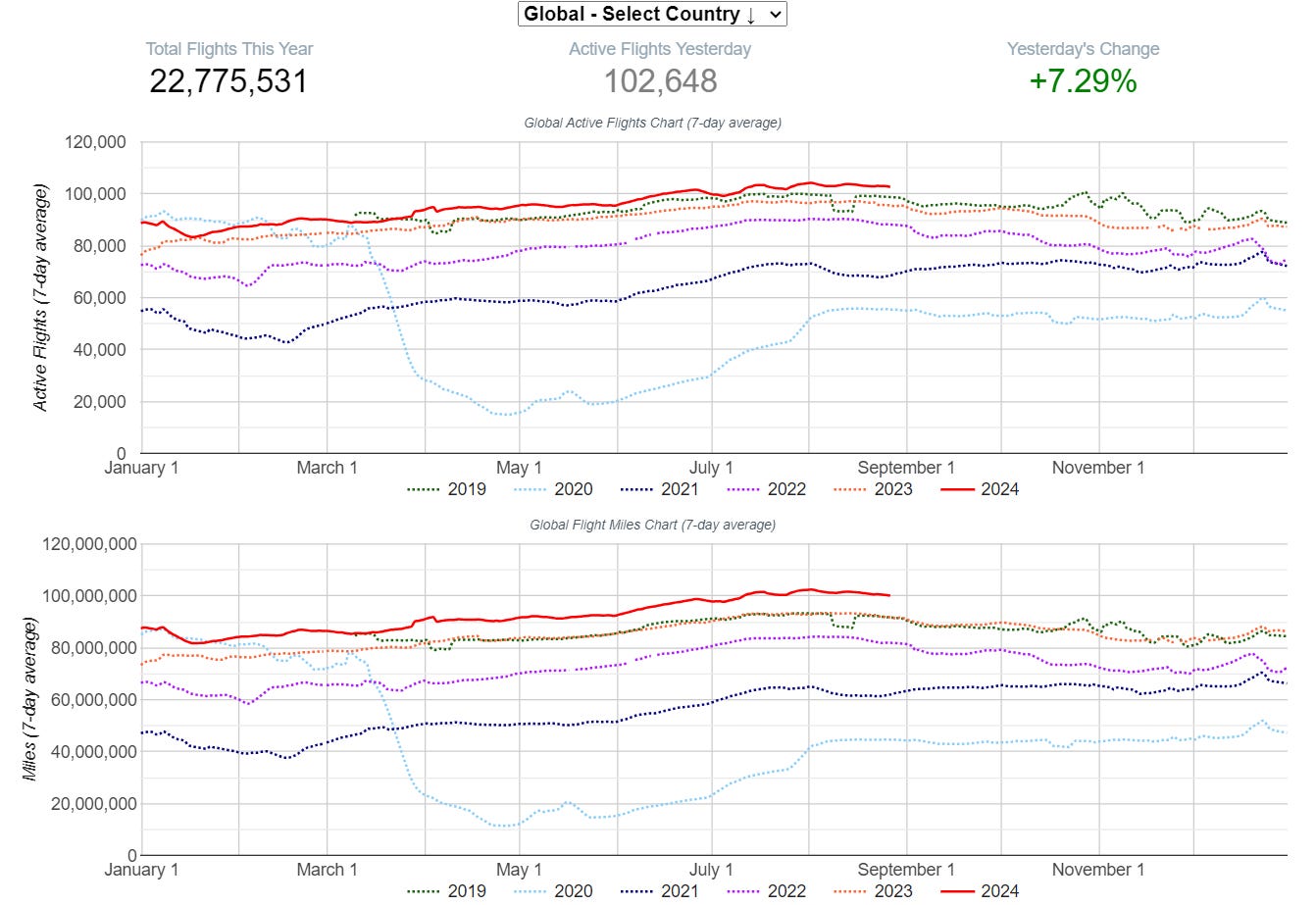

Kerosene type jet fuels increased by 0.7 MMB. Jet fuel inventories are at record highs. This is odd because jet fuel demand is also high.

Global flights and global miles flown both remain at seasonal record levels.

Ethanol

Ethanol inventories were flat week-on-week. Inventories are above seasonal averages.

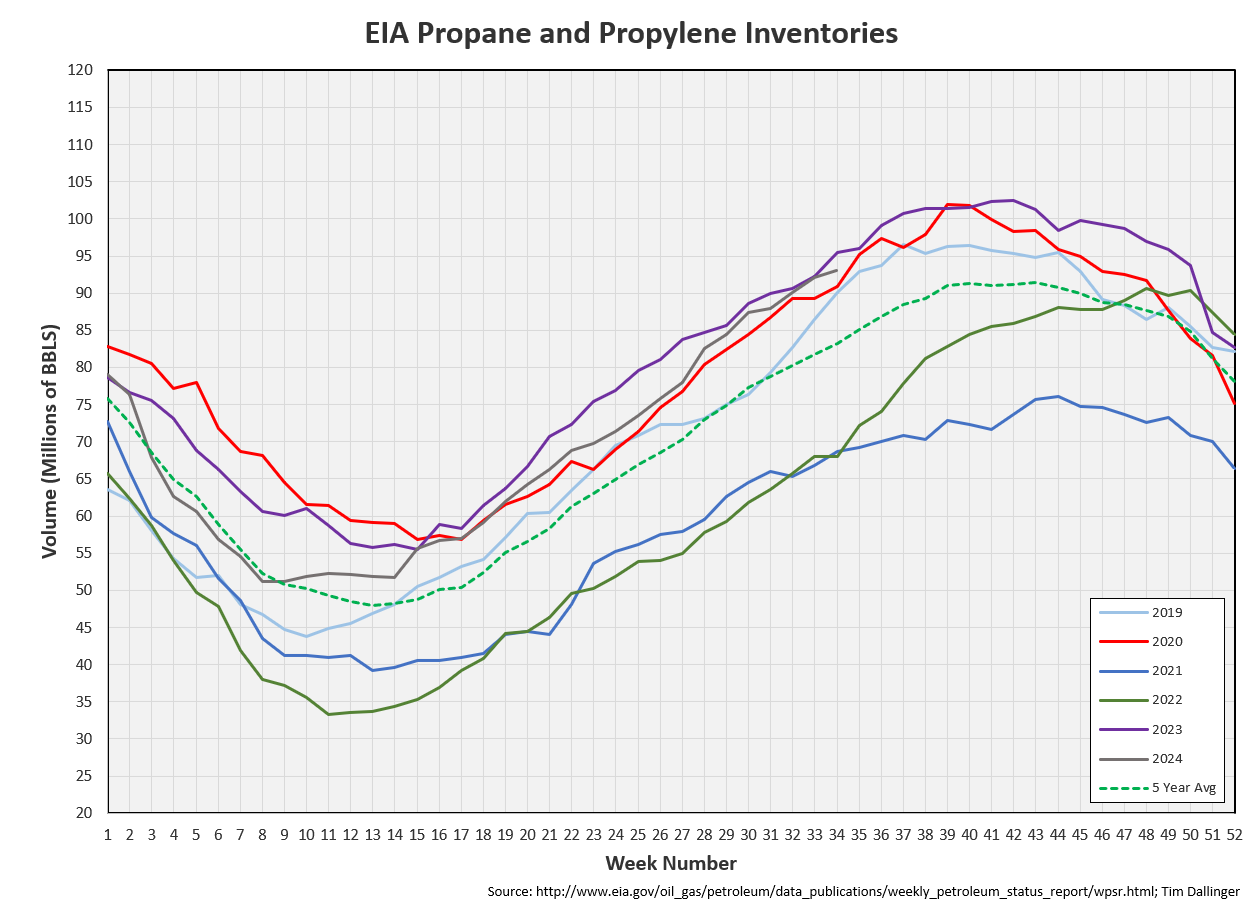

Propane

Propane/propylene inventories increased by 1.0 MMB. The rate of builds has moderated recently.

Other Oil

Other oil drew by 3.1 MMB. This is early for the normal seasonal trend.

Total Commercial Inventory

Total commercial inventory drew by 3.1 MMB.

Natural Gas

Natural gas inventories have moderated. Gas producers appear to be finally exercising discipline.

Refiners

The amount of crude oil refiners processed last week 16.86 MMB, up on the week. Only 2019 has been seasonally higher.

The EIA’s product demand proxy also increased. This should peak in the next 3 weeks.

Transportation inventories remain under pressure.

And yet simple cracks continue to struggle.

Discussion

Timespreads are extremely strong. This indicates that the physical market is tight, as well as reports that specific grades are selling significantly above spot. The paper market continues to behave oddly.

Ninepoint Energy fund shows that the sum of US inventories and oil-on-water are at all-time lows (for the duration of time that the oil-on-water dataset has been available).

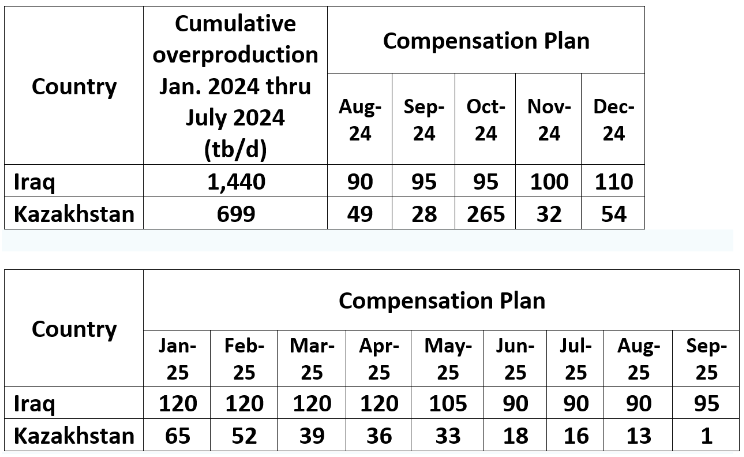

Yes, despite cratering inventories, the EIA, the IEA and several banks have all soured on the outlook for crude oil. They expect a crude glut as OPEC increases production. OPEC did guide that they would taper off their cuts but that was subject to change based on market conditions. It seems unlikely OPEC will maintain the increased production plan in the face of falling prices.

OPEC just received commitments from Iraq and Kazakhstan on how they would compensate for their over-production during the initial 7 months of 2024. That seems like an unlikely response from an organization allegedly on the verge of flooding the world with supply.

Articles continue to trumpet Chinese oil demand weakness. Yet, despite all poor press, analysts at Energy Intelligence shows\ Chinese demand was only down 284 kbd in the second quarter. To put that into perspective, that is only slightly above 1% of total US demand. On a global scale, it’s a rounding error.

The market is not pricing crude according to current inventories so its completely ignoring any geopolitical risk. The Greek tanker struck by Houthis last week is now leaking oil. Oil tanks near the Iran Iraq exploded in an incident Iraqi sources are calling an unfortunate accident. Conflict in Libya again takes production offline. This current outage is expected to continue for months. This afternoon, sources are reporting that the US Defense department has warned countries in the region that a large-scale Iranian attack against Isreal is expected within the next 48 to 72 hours.

These issue impact physical barrels in an already-tight market. Yet spot benchmark oil price continues to slide.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Ron Burgandy, portrayed by Will Ferrell, questions Brian Fantana’s, Paul Rudd, cologne statistics in the 2004 US comedy film, “Anchorman: The Legend of Ron Burgundy.”

It’s enough to make one crazy…

Exasperated with jet fuel inventories among other things