EIA WPSR Summary for week ending 2-7-25

Summary

Crude: +4.0 MMB

SPR: +0.2 MMB

Cushing: +0.9 MMB

Gasoline: -3.0 MMB

Distillate: +0.1 MMB

Jet: +0.9 MMB

Ethanol: -0.7 MMB

Propane: -2.6 MMB

Other Oil: +2.6 MMB

Total: +1.2 MMB

Neutral seasonal report although the headlines appear bearish as the product draw didn’t offset the crude build. Spot WTI is currently pricing $71. Spot price is below estimated fair value based on a price model derived from reported EIA inventories.

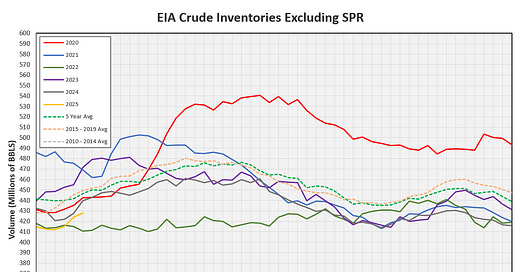

Crude

US Crude oil supply built by 4.0 MMB. Crude inventories are currently 4% below the seasonal average.

0.2 MMB were added to the SPR. SPR fill rate has slowed substantially.

US crude imports were down, week-on-week.

Crude exports also fell.

Unaccounted for crude returned to negative values.

With the continuous negative adjustment, even after accounting for Customs import and export timing issues, US crude oil production appears to be overcounted.

Cushing

Crude storage in Cushing, OK, built by 0.9 MMB week on week. This is counter-seasonal build, but volumes couldn’t have gone lower than the beginning of 2025.

Gasoline

Total motor gasoline inventories decreased by 3 MMB. Inventories fell back below the seasonal 5-year average this week. There may be anomalous weeks, but the trend should be down from here until June.

Distillate

Distillate fuel inventories increased by 0.1 MMB last week and are about 11% below the seasonal 5-year average. With the cold weather returning, increasing heating oil demand, draws should return next week.

Jet

Kerosene type jet fuels built by 0.9 MMB. Inventories are high but not unreasonable. They match pre-COVID levels.

Ethanol

Ethanol inventories decreased 0.7 MMB week-on-week. Inventories are near 2024 levels.

Propane

Propane/propylene inventories decreased by 2.6 MMB, returning to seasonal averages. Next week should show a considerable draw to weather.

Other Oil

Other oil built 2.6 MMB. It’s a little early for builds due to changes in summer gasoline blending stock. But that will occur after turn-around season.

Total Commercial Inventory

Total commercial inventory built by 1.2 MMB.

Natural Gas

The amount of crude oil refiners processed by refiners picked up slightly. Maintenance season is beginning and crude demand will be impact temporarily.

Refiners

The amount of crude oil refiners processed by refiners picked up slightly. Maintenance season is beginning, and crude demand will be impact temporarily.

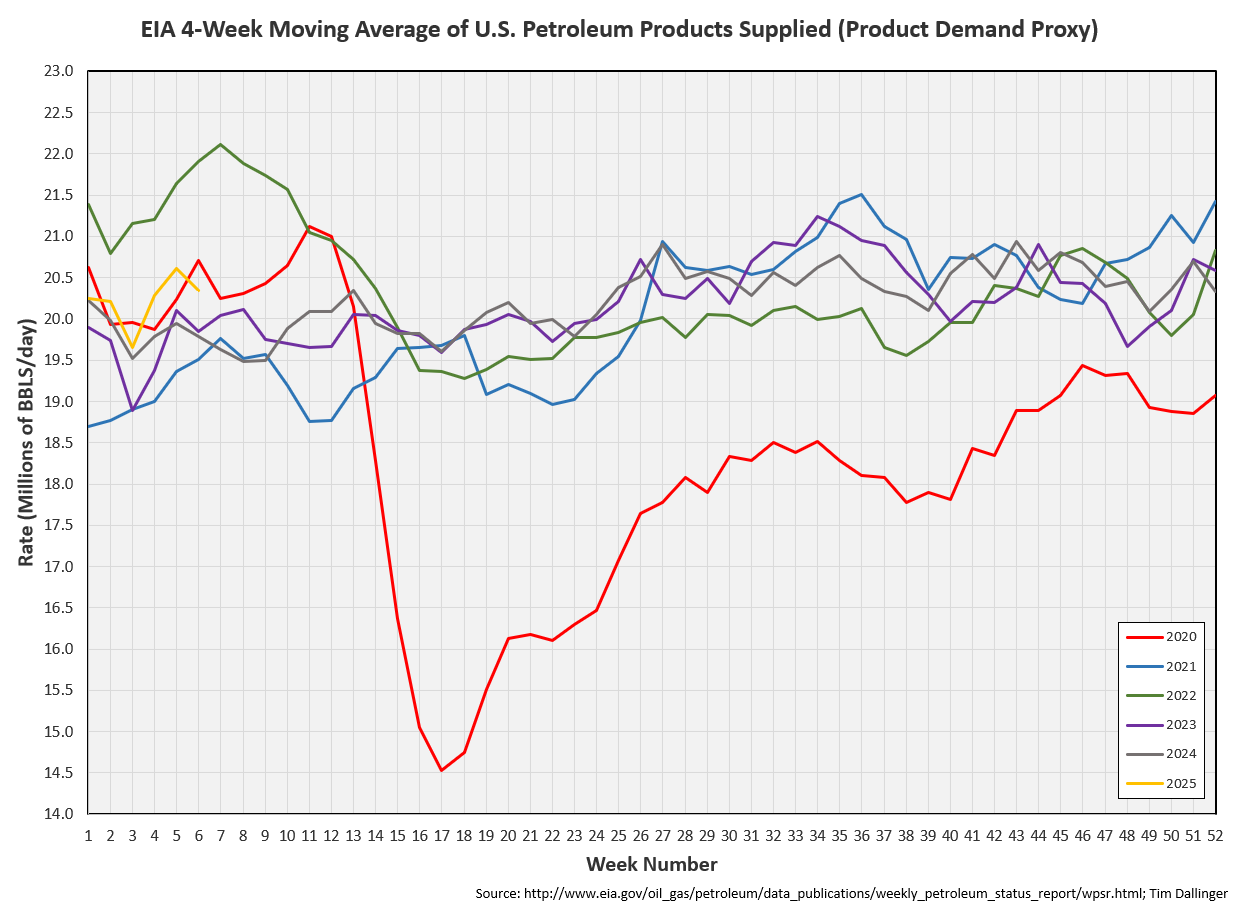

The EIA’s product demand proxy fell. This is seasonal fluctuations in a noisy environment proxy.

Transportation inventories fell.

Simple cracks are finally strengthening in a meaningful way.

Discussion

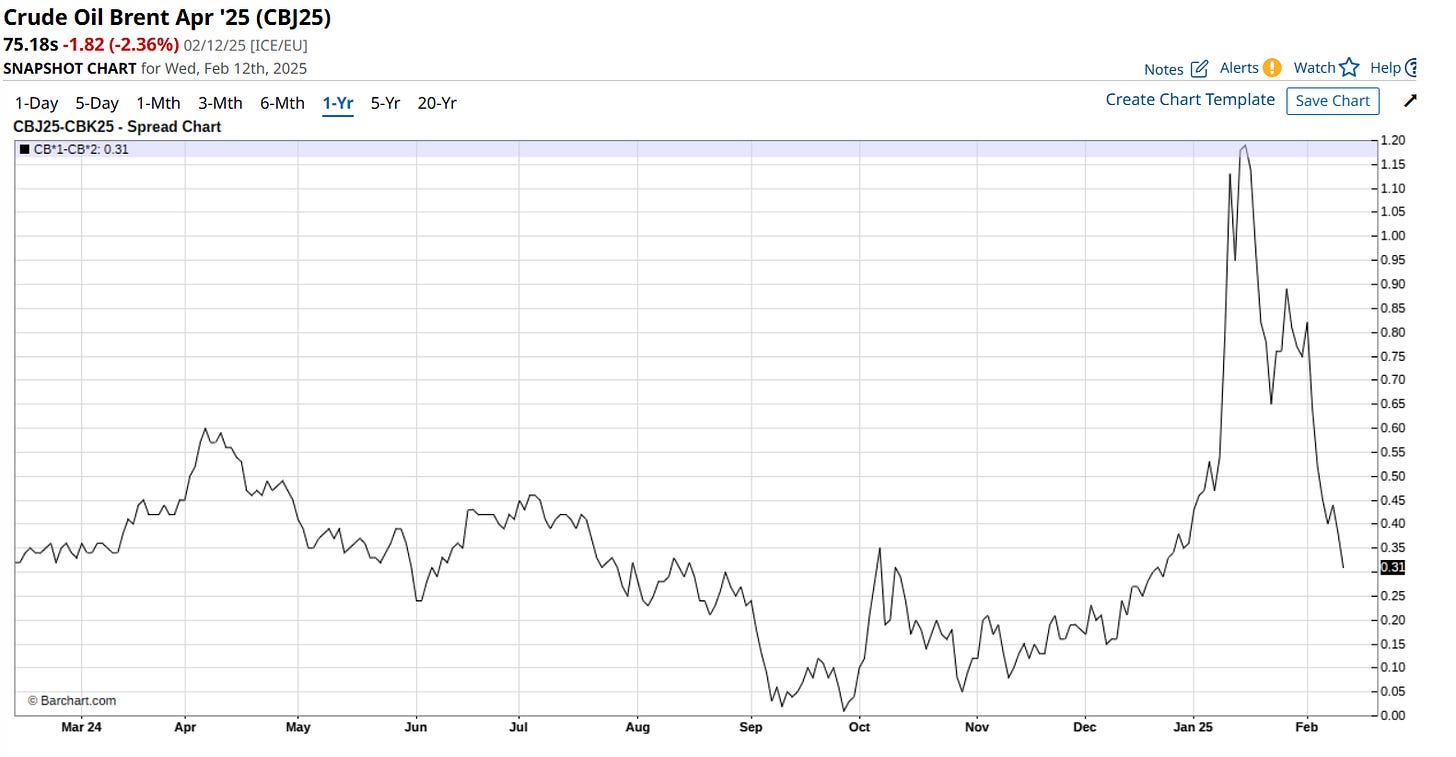

WTI backwardation has diminished in the front month.

Brent timespreads are stronger.

Last week, Saudi hiked the official selling price (OSP) of Arab light to Asia to the highest relative price in over a year. It appears they want to China to purchase WTI barrels to increase US exports and draw visible inventories.

The EIA released their latest STEO, expecting inventories to increase starting in April when OPEC production increases and continue through the remainder of 2025. This is nearly identical to their 2024 outlook which proved to be incorrect. Current prices don’t suggest OPEC will increase production. The EIA also continues to expect record US production. This is possible. However, service companies are currently laying off staff.

Besides that, it’s been a relatively quite week with rangebound prices. There appears to be little appetite to increase spec length. There’s still some misguided fear about Canadian crude tariffs. However, global inventories are tight enough that shorts aren’t pressing either.

Summer driving season still appears bullish but there’s usually a lull here in late winter for energy markets.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

“Crying, Waiting, Hoping” is a classic American rock song by Buddy Holly, released in 1959.