EIA WPSR Summary for week ending 10-4-24

Summary

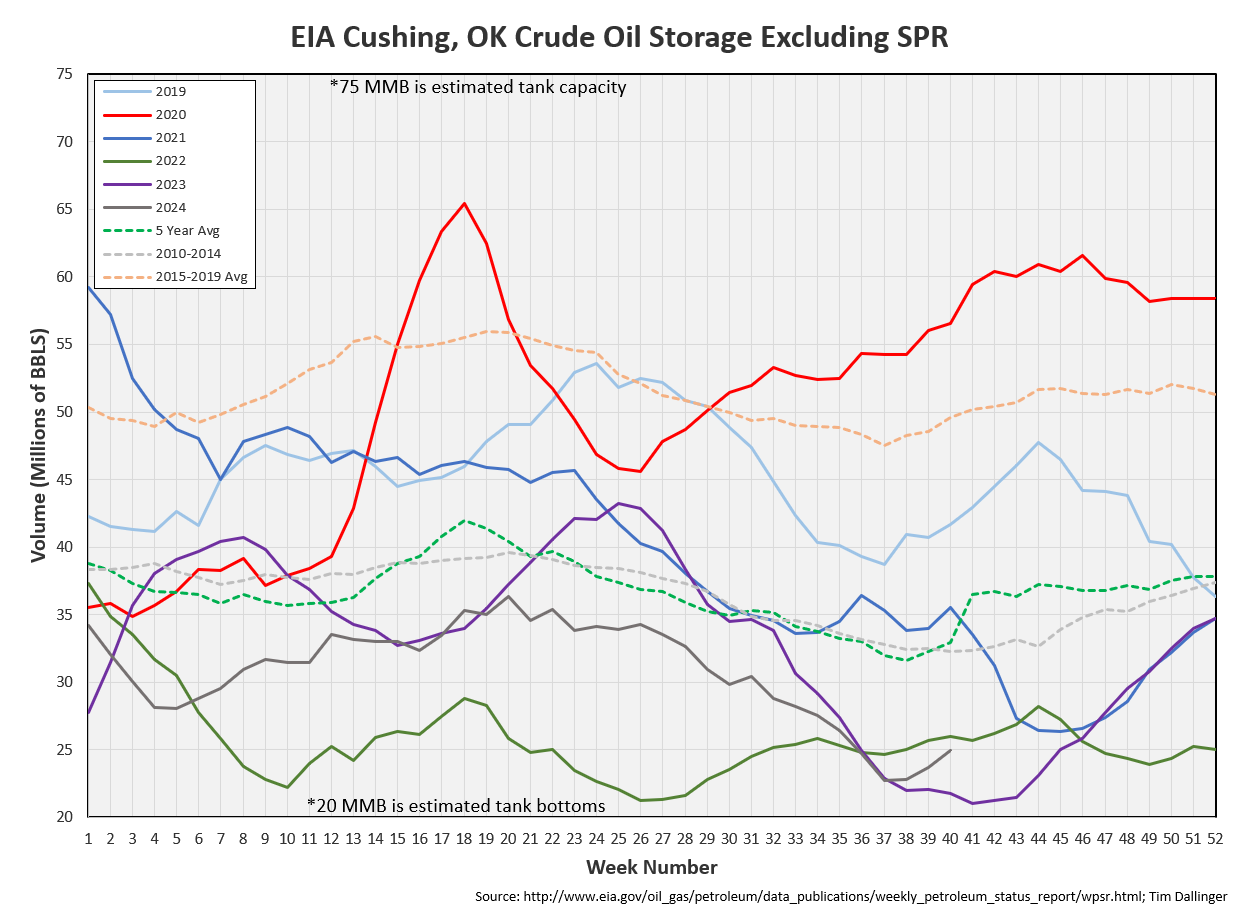

Crude: +5.8 MMB

SPR: +0.4 MMB

Cushing: +1.2 MMB

Gasoline: -6.3 MMB

Distillate: -3.1MMB

Jet: -1.6 MMB

Ethanol: -1.3 MMB

Propane: +1.9 MMB

Other Oil: -3.1 MMB

Total: -8.1 MMB

Spot WTI is currently pricing $72. Prices remain significantly below fair value based on a price model derived from reported EIA inventories.

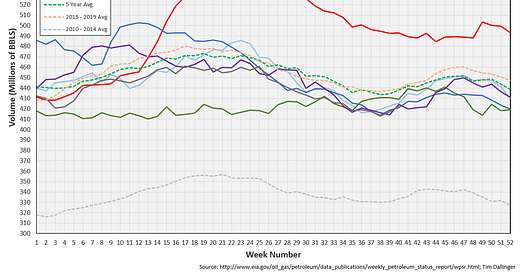

Crude

US Crude oil supply built by 5.8 MMB. Crude inventories are currently 4% below the seasonal average.

0.4 MMB were added to the SPR.

US crude imports were down slightly week-on-week.

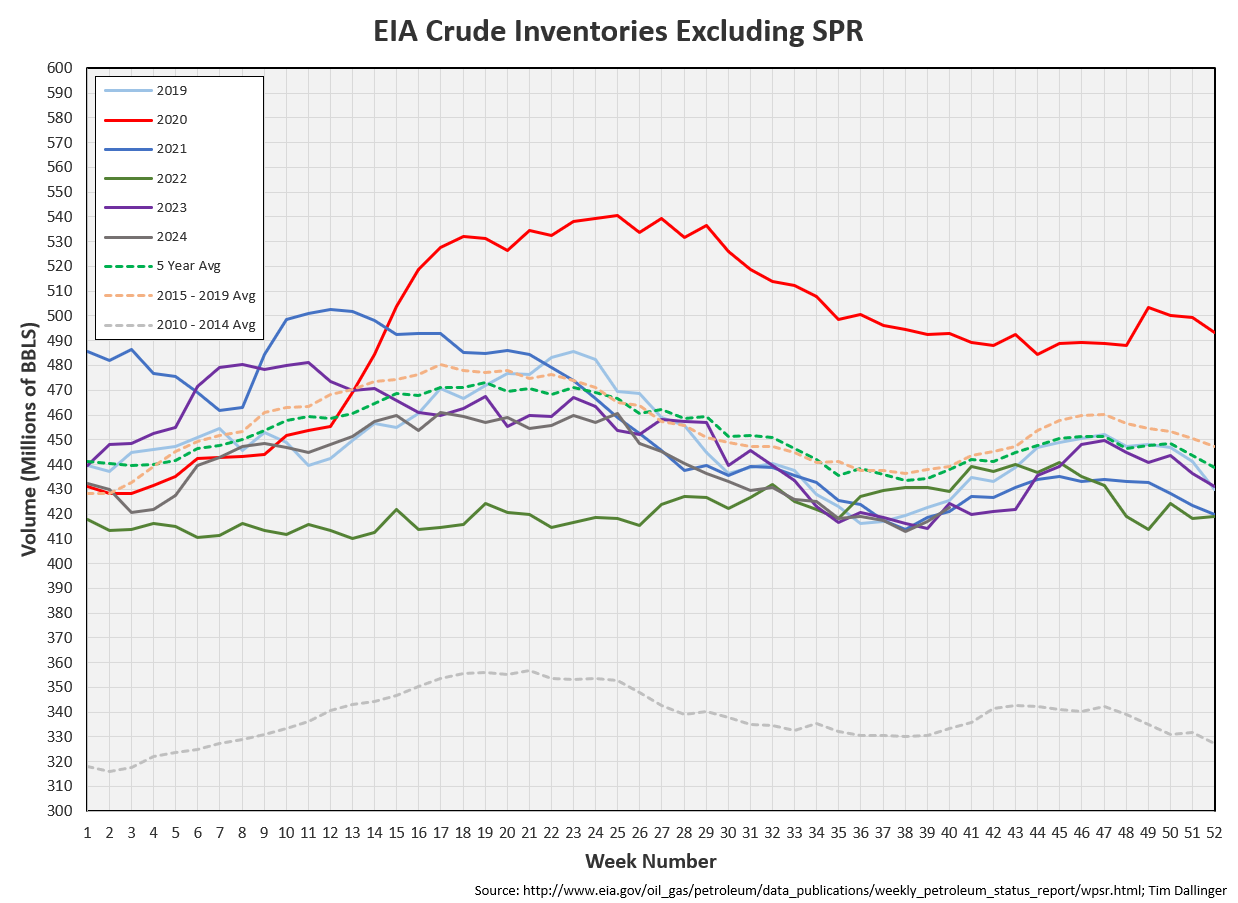

US Crude exports were also low.

Unaccounted for crude was about flat. One might infer that the EIA storage model is improving. However, instead of high uaccounted for crude figures, the weekly EIA reports state that US production is growing.

This seems unlikely with current crude future pricing, wastewater disposal cost and continued weakness in associated natural gas pricing. The more accurate monthly data demonstrates that the weekly figures are overstated.

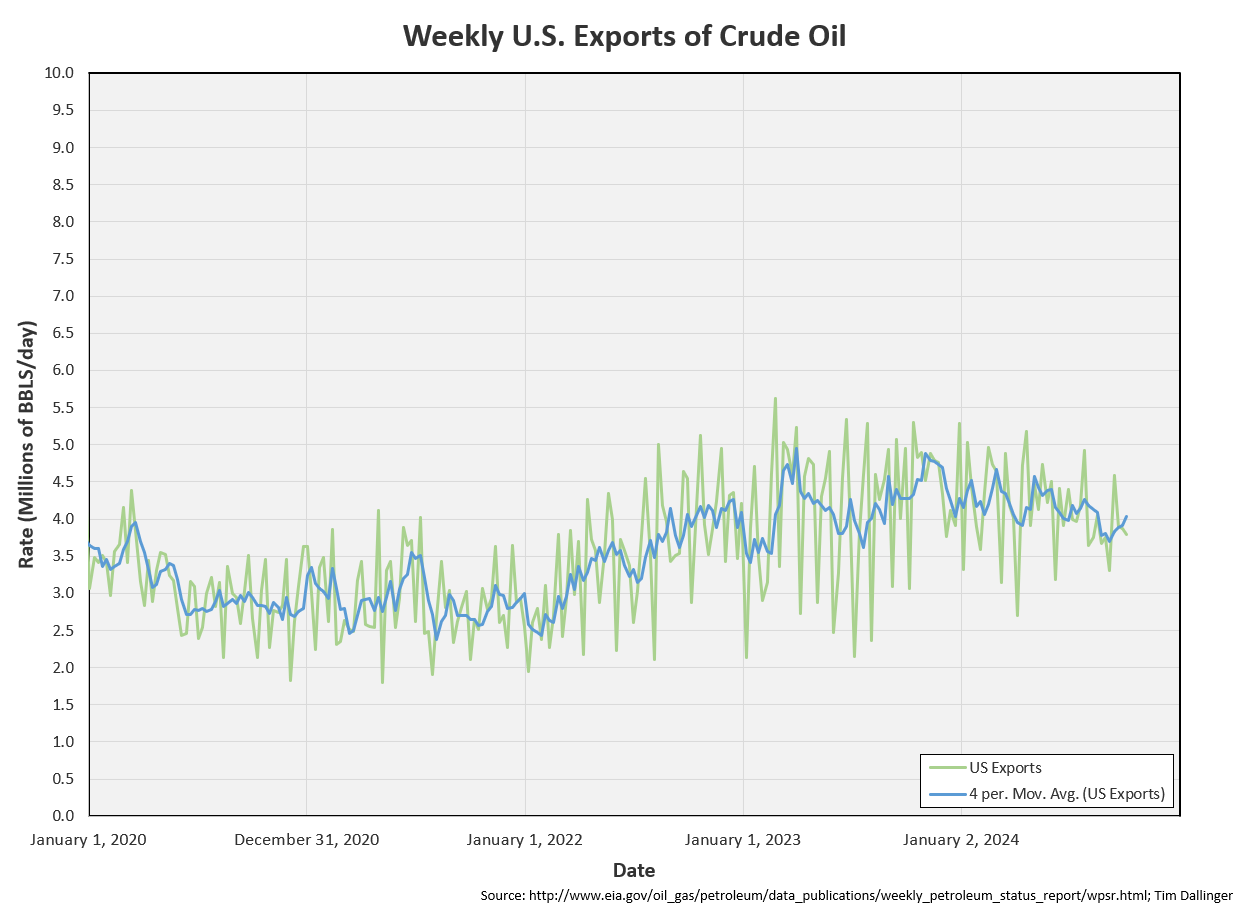

Cushing

Crude storage in Cushing, OK, built by 1.2 MMB week on week. Inventories are still low but there is now enough crude in storage for more normal tank farm operation. Hitting tank bottoms is less likely.

Gasoline

Total motor gasoline inventories decreased by 6.3MMB and are about 4% below the seasonal 5-year average. This is a significant gasoline draw. Some of this is likely due to hurricane noise. But it also appears demand is healthy.

Even gasoline blending components have dropped below average as refiners switch to winter blend.

The EIA gasoline demand proxy has rebounded and approaches seasonal historic highs.

Distillate

Distillate fuel inventories decreased by 3.1 MMB last week and are about 9% below the seasonal 5-year average.

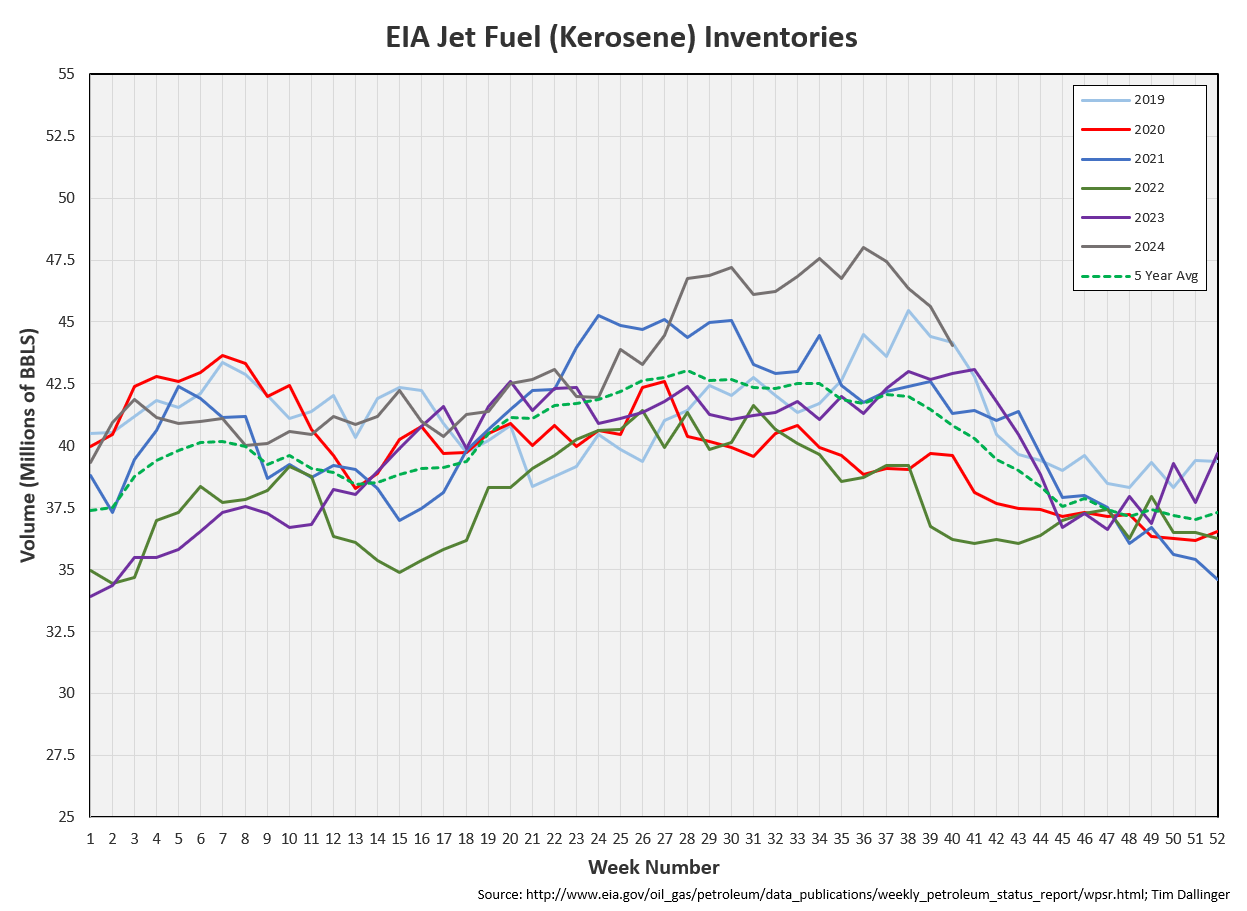

Jet

Kerosene type jet fuels drew by 1.6 MMB. Jet fuel inventories remain high but are falling.

Average jet fuel implied demand is at all-time records.

This seems reasonable as both global flight and miles traveled by air remain at seasonally record levels.

https://www.airportia.com/flights-monitor/

Ethanol

Ethanol inventories decreased 1.3 MMB week-on-week. Inventories are above seasonal averages but falling.

Propane

Propane/propylene inventories increased by 1.9 MMB. Seasonal draw season approaches.

Other Oil

Other oil drew by 3.1 MMB and returns to average levels.

Total Commercial Inventory

Total commercial inventories are below average.

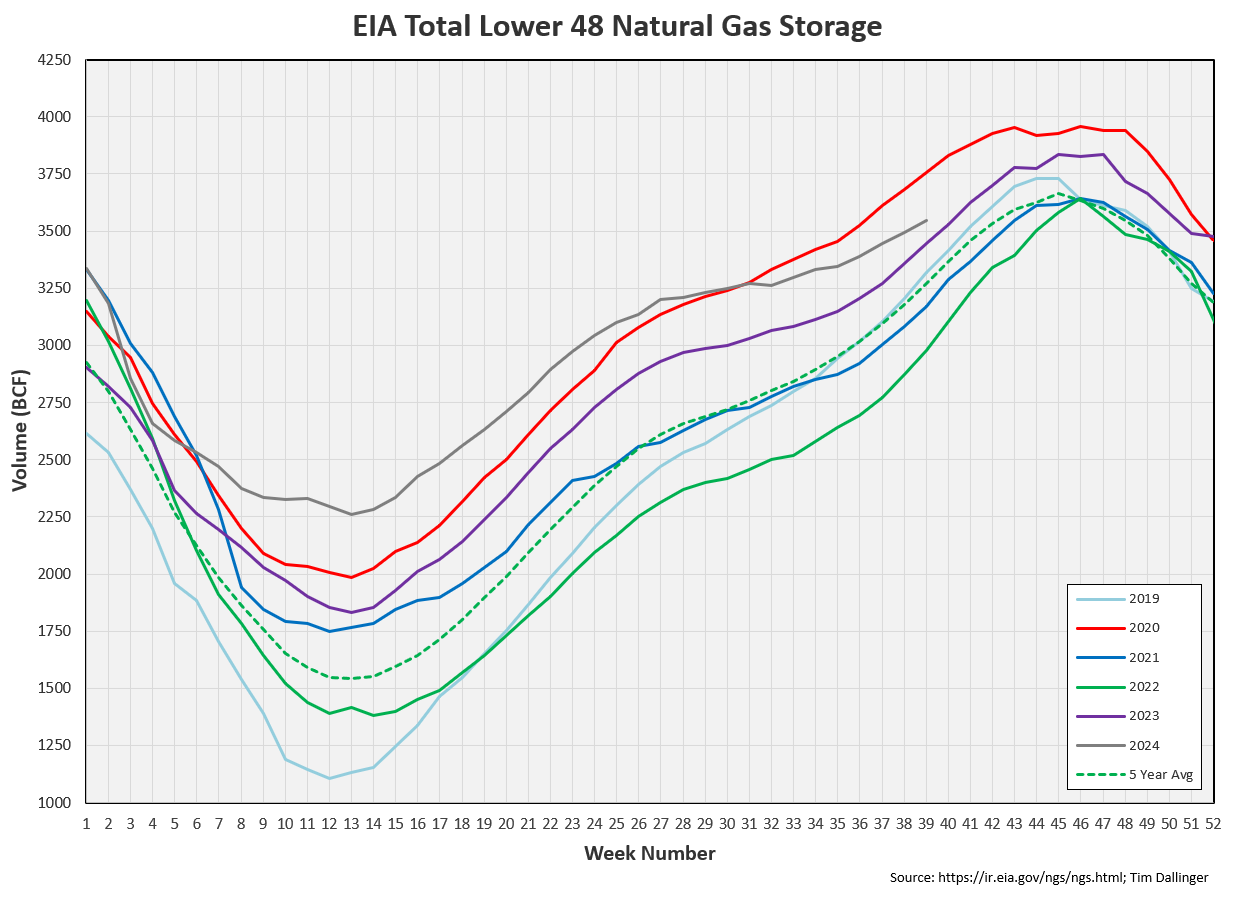

Natural Gas

Natural gas inventories continue to build but the trajectory has slowed, giving prices some support.

Refiners

The amount of crude oil refiners processes last week fell as turnaround begins. Refinery net input of crude will likely remain low over the next month. However, this will put pressure on product storage and should boost crack spreads.

The EIA’s petroleum product demand proxy is showing strength.

Average implied demand of transportation inventories has recovered signficantly.

In turn, transportation inventories fall. Only 2022 showed lower volumes in recent history.

The same assertion can be said if crude is included.

Discussion

Crude prices rallied into the end of last week as the market tried to assess middle east geopolitical risk. Short interest was previously at record levels. Several mainstream publications declared the rapid price increase to be a result of a short squeeze. While some short positions were closed, open interest remained about flat.

Prices are falling again as the market seems to discount the possibility of supply disruption. This publication continues to highlight that the crude market is not functioning in a manner consistent with historic behavior. Speculators are driving price much more than fundamentals. While I will not disclose the fair pricing model I have derived as it is not sensitive enough to provide accurate trading signals, I continue to highlight that petroleum inventories and price divergence continues. Some even claim that inventories no longer matter. This is a mistake. While price volatility can be significantly influenced by external factors such as macroeconomic trends and geopolitical unrest, commodities always return to simple supply and demand fundamentals.

Regardless of any middle east escalation, the world remains in a crude oil deficit and inventories are drawing.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Scotty Smalls’ dad tries to teach him the fundamentals of baseball in the 1993 American comedy classic, The Sandlot.