EIA WPSR Summary for week ending 1-12-24

Summary

Neutral, seasonal report.

Crude: -2.5 MMB

SPR: +0.6 MMB

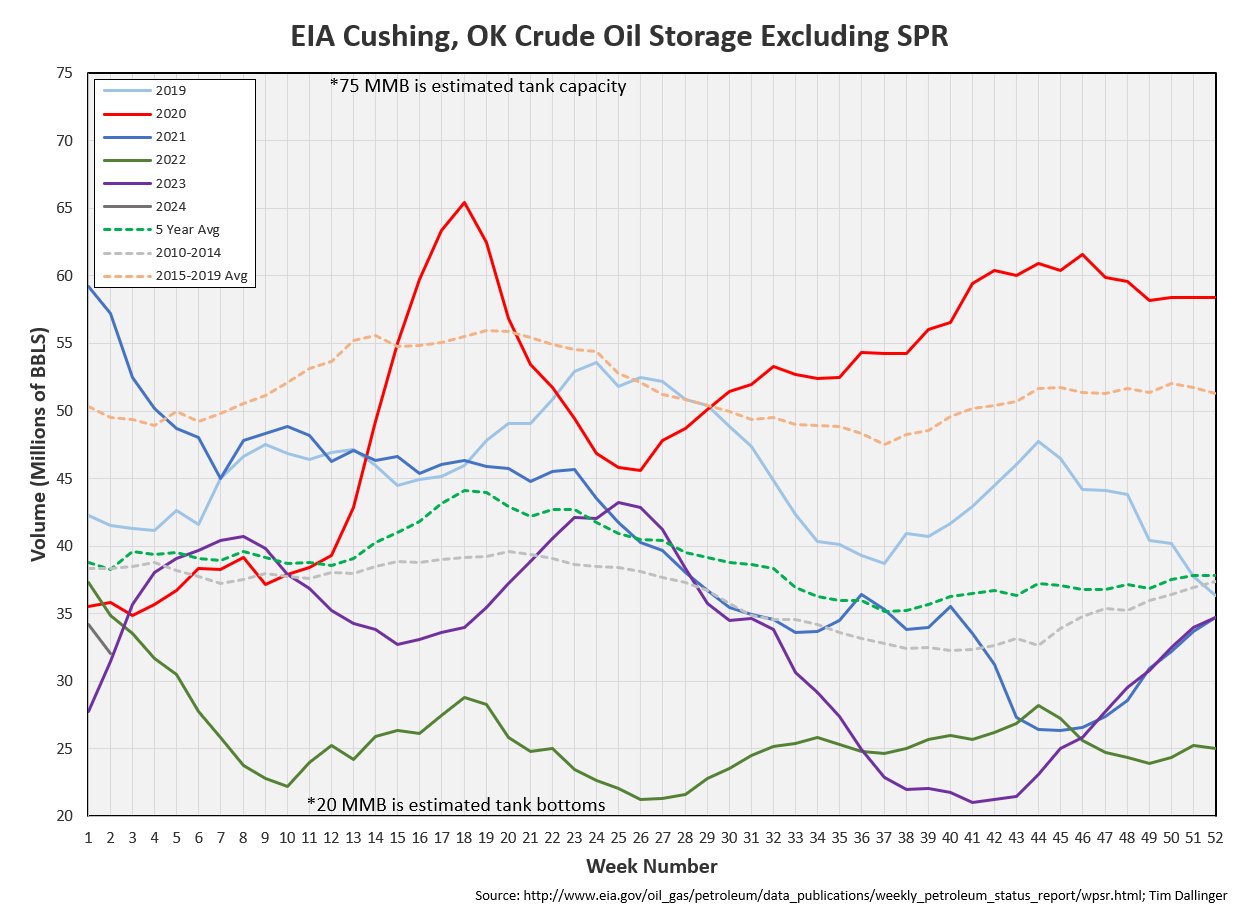

Cushing: -2.1 MMB

Gasoline: +3.1 MMB

Ethanol: +1.3 MMB

Distillate: +2.4 MMB

Jet: +1.6 MMB

Propane: -2.8 MMB

Other Oil: -1.3 MMB

Total: +2.8 MMB

Spot WTI is currently pricing $73. With the recent product builds, this is slightly above fair value based on a price model derived from reported EIA inventories.

Crude

U.S. commercial crude oil inventories decreased by 2.5 MMB from the previous week and are about 3% below the seasonal 5-year average.

0.6 MMB were added to the SPR. This makes 1.9 MMB total of the 12 MMB planned 2024 purchases.

Weekly US crude imports increased, primarily from Canada.

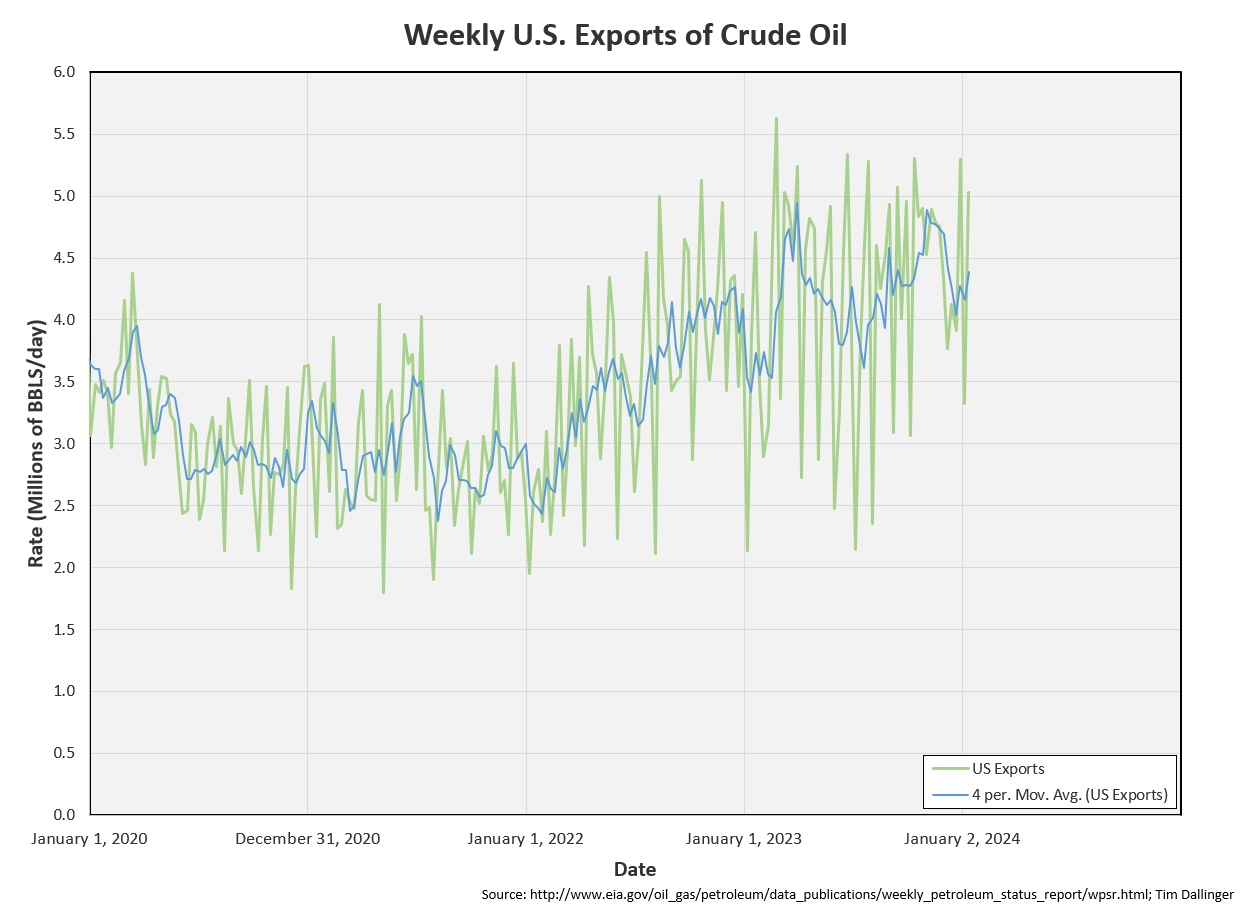

US crude exports surged back above 5 MMBD. Independent ship trackers did not confirm this movement. This appears to be makeup for last week’s missed barrels.

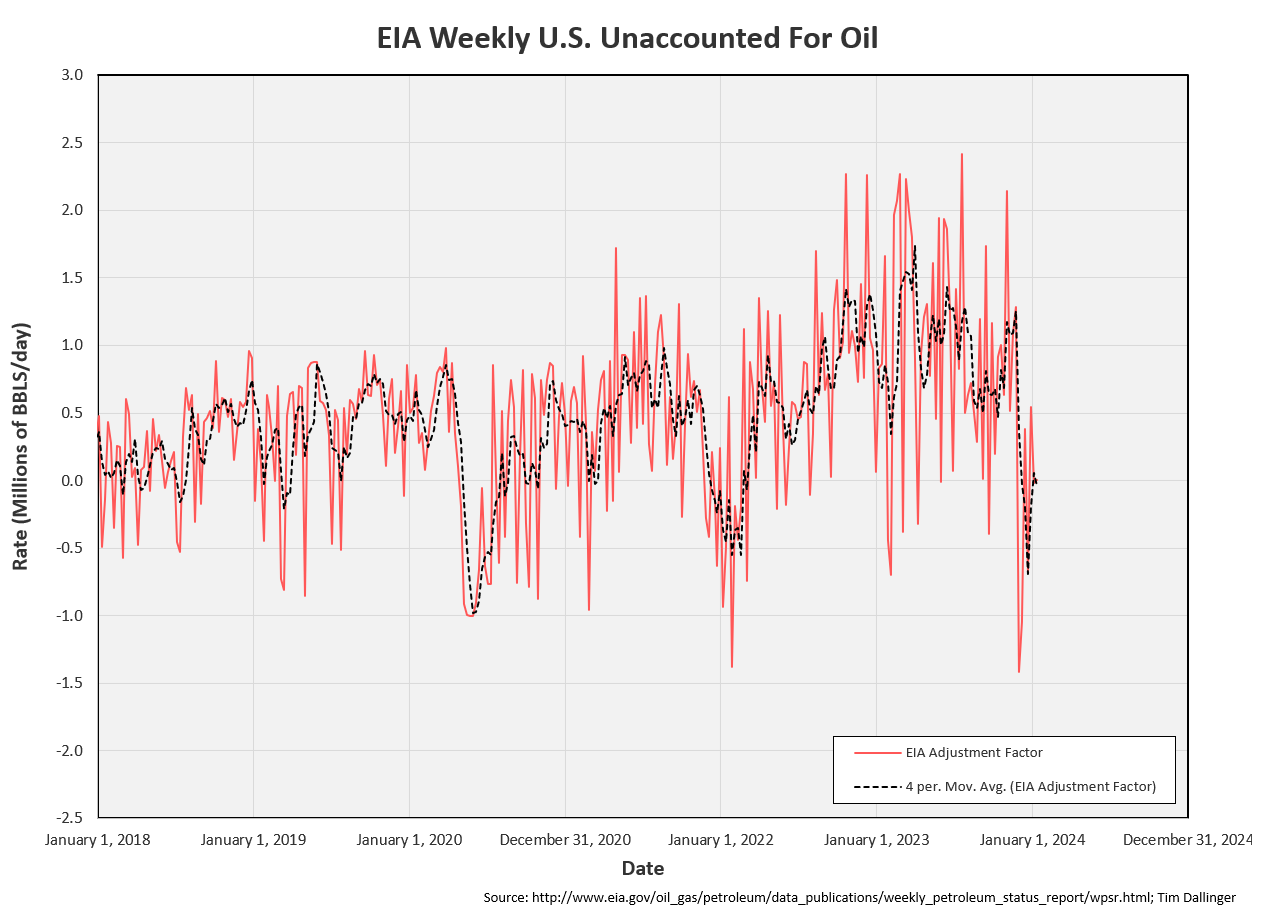

Unaccounted for oil is again near zero.

Cushing

Cushing drew 2.1 MMB. While this isn’t abnormal seasonal behavior, the quantity was significant. This is the most bullish aspect of this week’s report.

Gasoline

Total motor gasoline inventories increased by 3.1 MMB and are about 1% above the seasonal 5-year average. Gasoline continues its seasonal build.

Ethanol

Ethanol inventories built by 1.3 MMB. Inventories are above average.

Distillate

Distillate fuel inventories increased by 2.4 MMB last week and are about 3% below the season 5-year average. A significant diesel draw is expected next week due to increased heating oil demand.

Jet

Kerosene type jet fuels increased by 1.6 MMB. Seasonal jet inventories are above average.

Propane

Propane/propylene inventories decreased by 2.8 MMB from last week and are 10% above the seasonal 5-year average. Propane should also draw considerably next week.

Other oil drew 1.3 MMB. Other oil inventories near seasonal averages.

Other Oil

Other oil drew 1.3 MMB. Other oil inventories near seasonal averages.

Total Commercial Inventory

Total commercial inventories increased by 2.8 MMB. Total commercial inventories are at the seasonal average.

Natural Gas

Natural gas drew but not nearly as much as expected. There’s another week of colder temperatures ahead.

Discussion

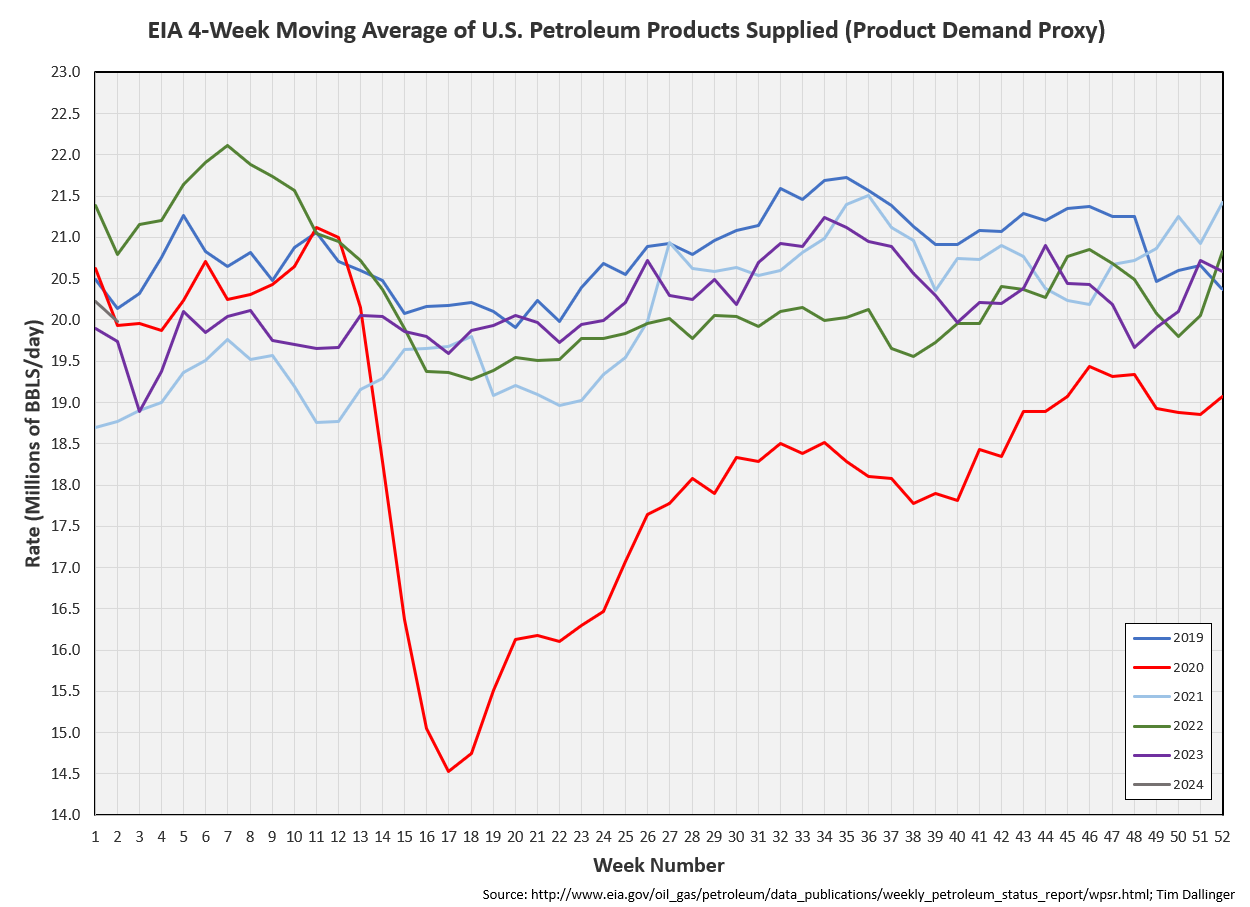

US refiners processed nearly as much crude oil last week as the 2023 peak, showing high crude oil demand.

At the same time, the EIA demand proxy suggests weakening product demand.

Transportation inventories are below seasonal averages.

Crack spreads are healthy.

These are in direct conflict with the EIA product demand proxy.

The market remains bearish on oil and even on energy equities. Yet, the timespreads have reverted again into backwardation. The physical market is tightening.

The broad market improved with indexes recovering off the Q3 2023 slump to finish the year higher. The Federal Reserve has suggested that interest rate tightening cycle is complete. Speculators are eyeing late 2024 cuts.

Conflict escalated further in the middle east this week. Fighting intensifies in Gaza, despite the EU parliament calling for a ceasefire. Houthi rebels continue to harass container ships and tankers in the Red Sea. A coalition of US and UK forces attacked Houthi positions in Yemen. Iran struck targets in Syria, Iraq and Pakistan. In Davos, Iran’s foreign minister claimed attacks by its “Axis of Resistance” would end with peace in Gaza. While it’s well-known, this is a clear declaration that Iran is behind these militant groups causing conflict through the region. While no red lines appear to have been crossed, the US and Iran rhetoric intensifies.

The energy market remains on the sidelines, waiting for supply loss before pricing any geopolitical premium.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Leslie Nielsen stars in the 1998 American comedy film, “The Naked Gun: From the Files of Police Squad!”