EIA WPSR Summary for week ending 5-31-24

Summary

Crude: +1.2 MMB

SPR: +0.9 MMB

Cushing: +0.8 MMB

Gasoline: +2.1 MMB

Distillate: +3.2 MMB

Jet: +0.4 MMB

Ethanol: -0.2 MMB

Propane: +2.5 MMB

Other Oil: +4.5 MMB

Total: +13.5 MMB

Spot WTI is currently pricing $74. Prices are below fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply built by 1.2 MMB. Crude inventories are currently 4% below the seasonal 5-year average.

0.9 MMB were added to the SPR. 15 MMB have been added to the SPR in 2024.

US crude imports were up week-on-week.

Canada, Columbia and Brazil account for the increase. There’s no apparent reason for this increase.

Crude exports were also up slightly, back to average levels.

Unaccounted for crude surged. Anecdotal accounts suggest that crude blending is increasing again. If that’s the case, all of the liquid being counted as crude oil isn’t crude oil. But that only matters to market when there’s a shortage.

Cushing

Crude storage in Cushing, OK, built by 0.8 MMB week on week. Cushing inventories are lower than previous years, excluding 2022, but they are no where near critical levels currently.

Gasoline

Total motor gasoline inventories increased by 2.1 MMB and are about 1% below the seasonal 5-year average.

Finished motor gasoline inventories remain low while blending components continue to build.

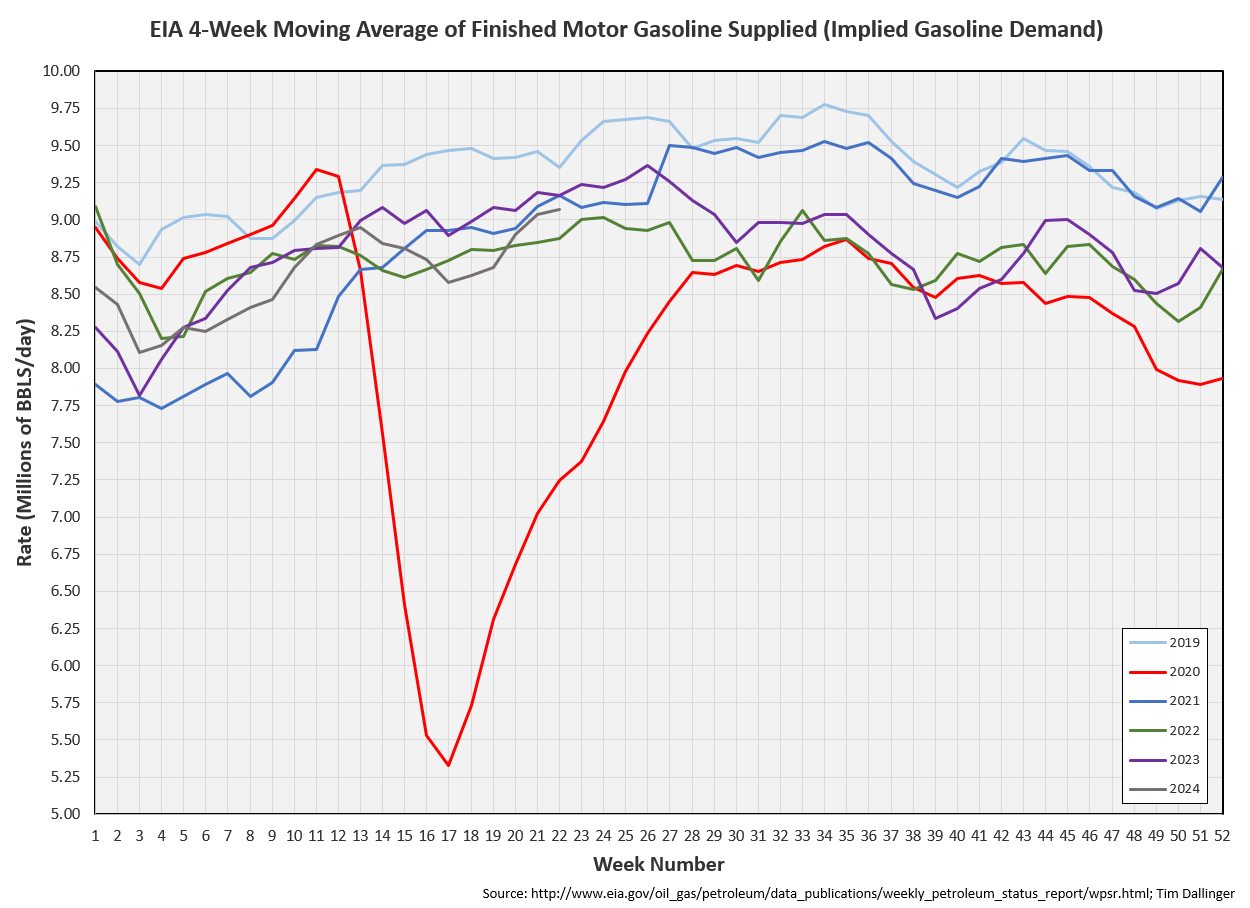

There’s been recent press suggesting poor demand. Using a 4-week moving average for the EIA’s gasoline demand proxy, demand is down 0.28 MMB off its seasonal record. AAA is showing gasoline demand figures higher than the EIA.

Distillate

Distillate fuel inventories increased by 3.2 MMB last week and are about 7% below the seasonal 5-year average.

Again, news coverage is highlighting multi-decade low distillate demand. Again, using moving averages, the EIA demand proxy is only off 0.356 MMB from the seasonal-record. Distillate demand isn’t stellar but it’s not at panic-inducing levels.

Jet

Kerosene type jet fuels increase 0.4 MMB.

Moving averages of the EIA jet fuel demand proxy only lag 2019.

Global flights are at seasonal records and approach all-time records. Global miles traveled are at all-time records already.

Ethanol

Ethanol inventories decreased 0.2 MMB week-on-week.

Propane

Propane/propylene inventories increase 2.5 MMB, in-line with normal seasonal behavior.

Other Oil

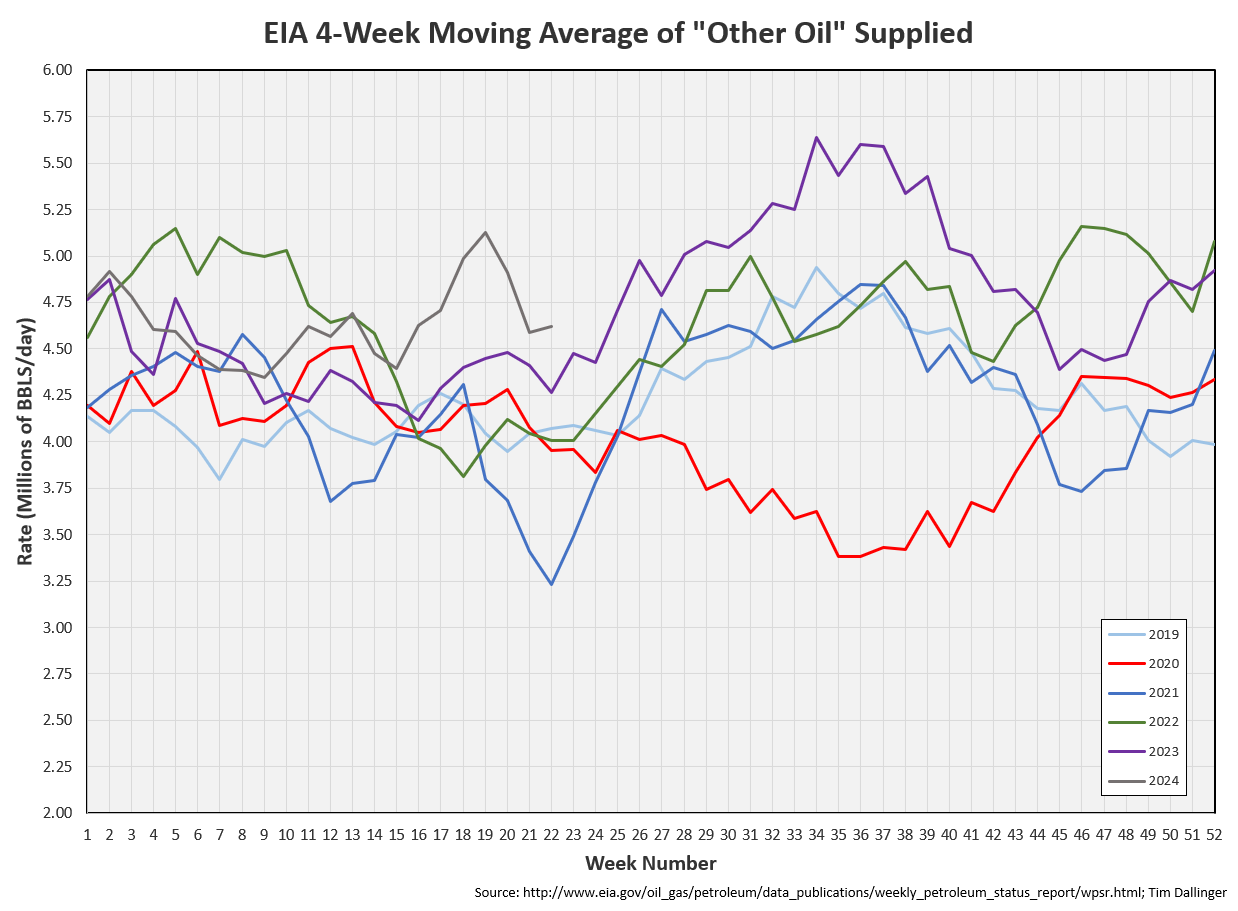

Other oil built by 4.5 MMB. Inventories are at record levels.

And yet, the EIA still shows record seasonal “other oil” demand. These figures don’t add up.

Total Commercial Inventory

Total commercial inventory built 13.5 MMB. Total commercial inventories are at seasonally average levels.

Natural Gas

Natural gas inventories are released weekly on Thursdays. As last week’s WPRS was delayed until Thursday due to the holiday, the graph presented below was already provided last week. The EIA will update natural gas inventories as normal, tomorrow.

Refiners

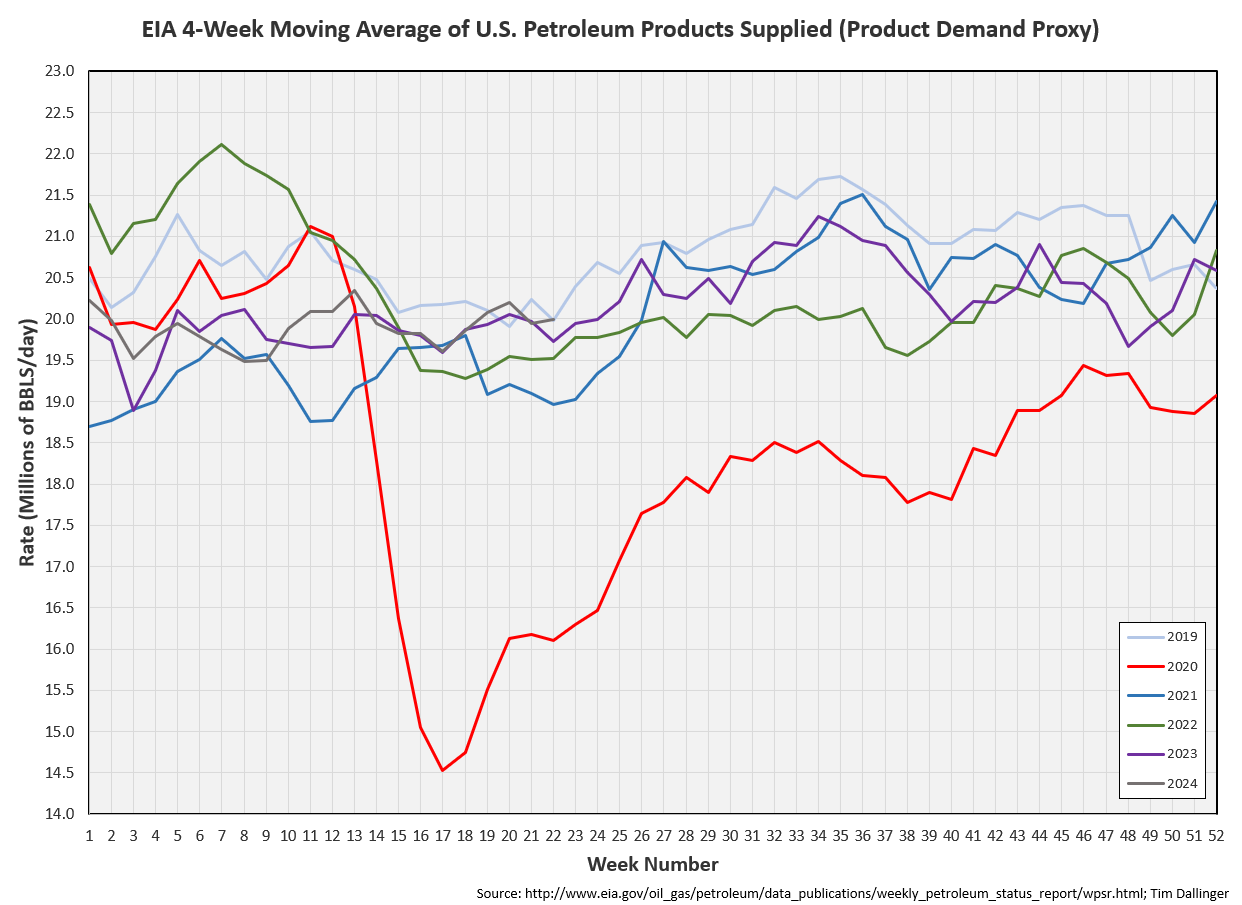

US refiners again processed a seasonally record amount of crude oil. This is record crude demand.

The moving average for the EIA’s product demand proxy matches the 2019 record.

The moving average for transportation inventories only lags 2019.

Transportation inventories have built but remain well below average levels.

Simple cracks are still down but they have rebounded a bit.

Discussion

Brent roared back into backwarded time structure.

WTI remains backwarded.

OPEC met over the weekend and the result was bearish in the short-term. They agreed to maintain their cuts through Q3 but then to start to phase them out, pending market conditions. The physical market had already loosened recently, and financial positioning collapsed on the news. Prices fell almost 10% as banks report that CTA’s flip negative.

It appears the market overreacted, and many are using price action to extrapolate poor demand. The numbers simply don’t seem to confirm that though. Inventories do need to draw over the next several months. If they do, bullish sentiment will return. If they don’t, then demand has been impacted by global slowdown.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

The Dude, portrayed by Jeff Bridges in the cult-classic 1998 film The Big Lebowski, puzzles over conflicting information.

The Dude abides...