EIA WPSR Summary for week ending 9-6-24

Summary

Crude: +0.8 MMB

SPR: +0.3 MMB

Cushing: -1.7 MMB

Gasoline: +2.3 MMB

Distillate: +2.3 MMB

Jet: +1.2 MMB

Ethanol: +0.4 MMB

Propane: +1.1 MMB

Other Oil: +0.9 MMB

Total: +9.0 MMB

Bearish report.

Spot WTI is currently pricing $67. Prices remain substantially below estimated fair value based on a price model derived from reported EIA inventories.

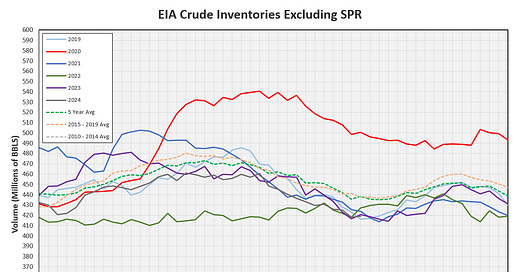

Crude

US Crude oil supply built by 0.8 MMB. Crude inventories are currently 4% below the seasonal average.

0.3 MMB were added to the SPR. Almost 25 MMB have been added to the SPR in 2024.

US crude imports were jumped over 1 MMBD higher than the previous week. This is above average 2024 import levels.

Crude exports fell. Inventories are tight. There aren’t as many available barrels for export.

Unaccounted for crude flipped negative. Exports may have been slightly higher production is lower than reported.

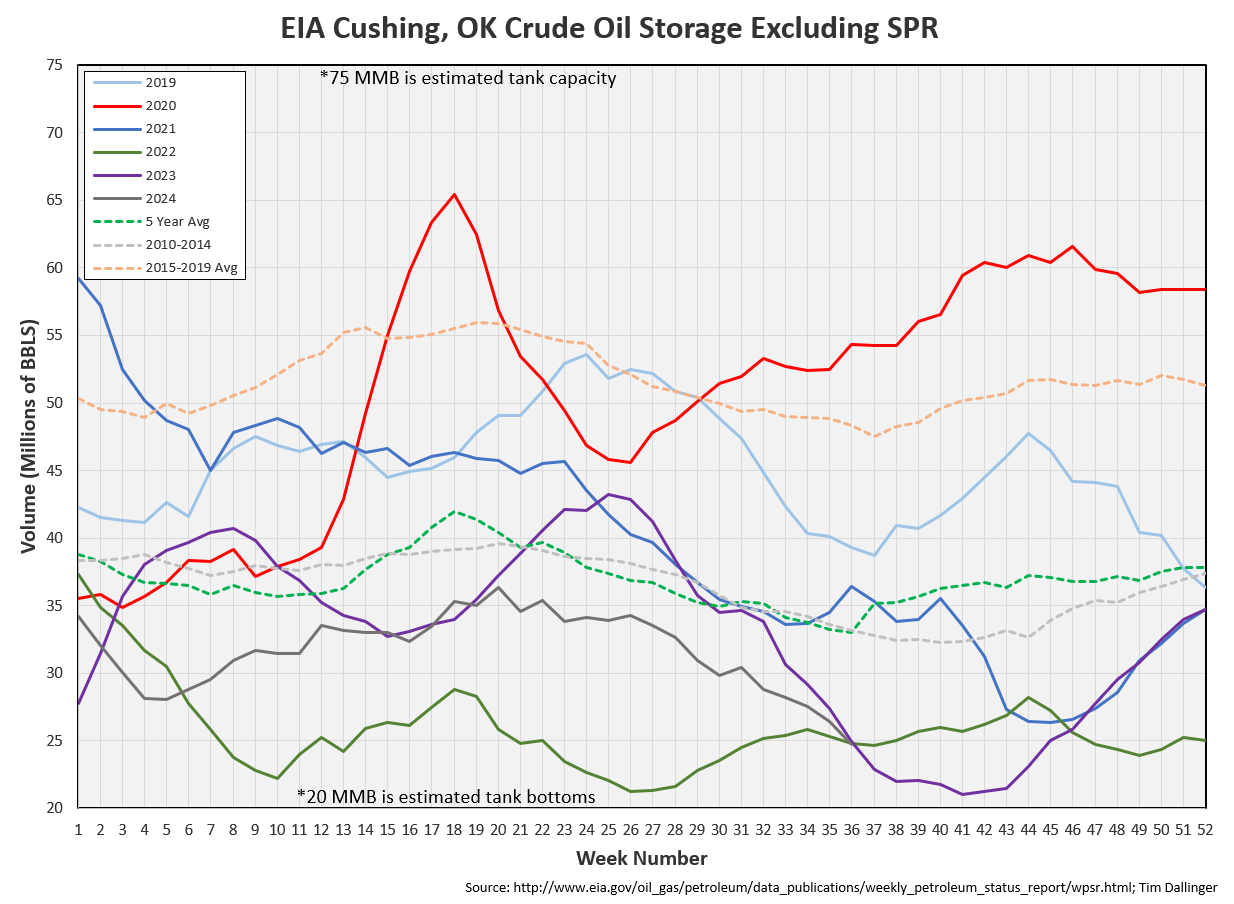

Cushing

Crude storage in Cushing, OK, drew by 1.7 MMB week on week. Cushing inventories stand at 24.7 MMB. Tank bottoms are approaching. This opens a squeeze potential as the current future contract approaches expiration.

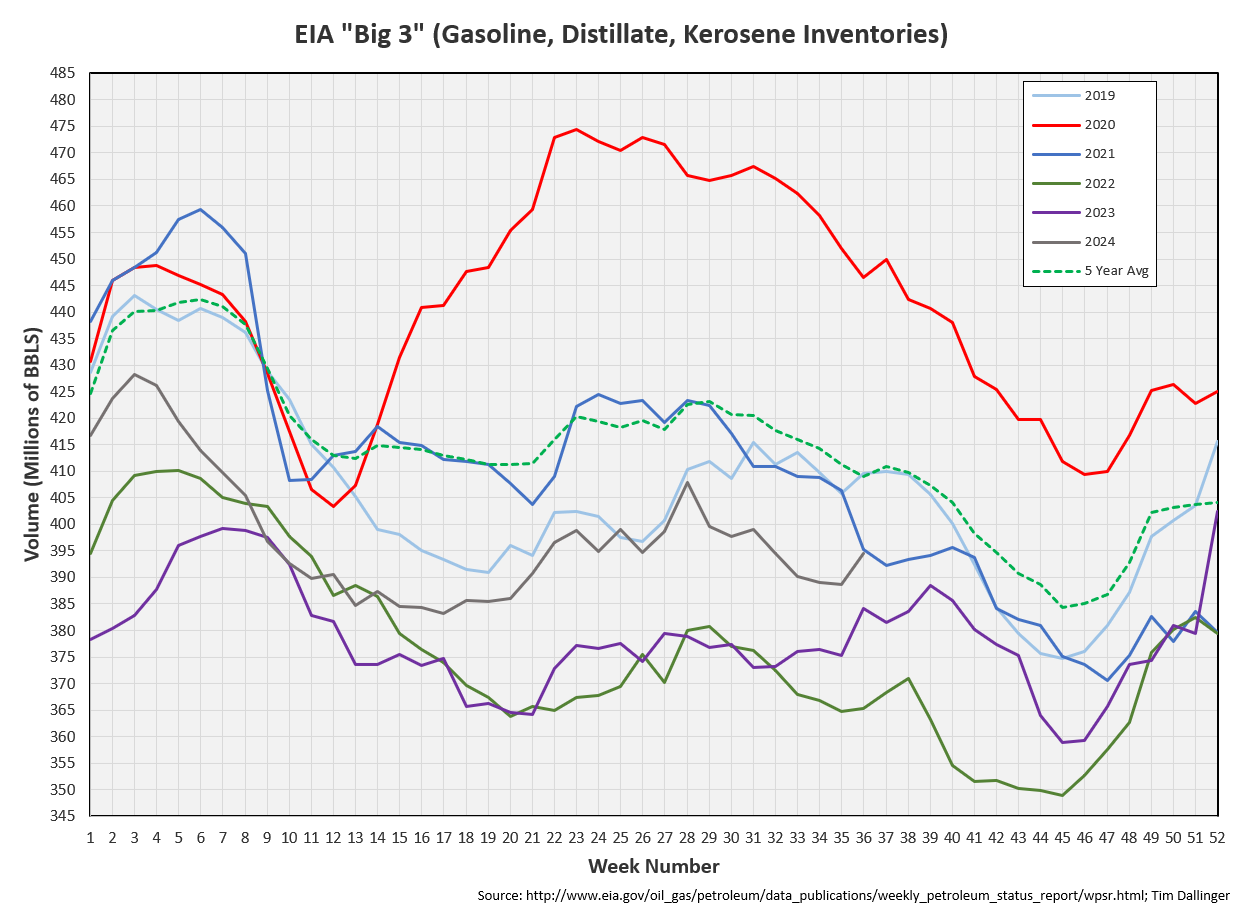

Gasoline

Total motor gasoline inventories increased by 2.3 MMB and are now near the seasonal 5-year average. Gasoline will draw again when Fall maintenance begins at the end of the month.

Finished gasoline inventories are lower than average and blending components are higher.

Distillate

Distillate fuel inventories increased by 2.3 MMB last week and are about 8% below the seasonal 5-year average. The anomalous 2020 year obscures normal trends. 2015 to 2019 average is also included below. Current inventories are still below average but not staggeringly so.

Jet

Kerosene type jet fuel built by 1.2 MMB. Inventories are above average.

Global flights are still tracking at seasonal record levels.

Chinese flights are still at record levels but have pulled back from the peak.

https://www.airportia.com/flights-monitor/

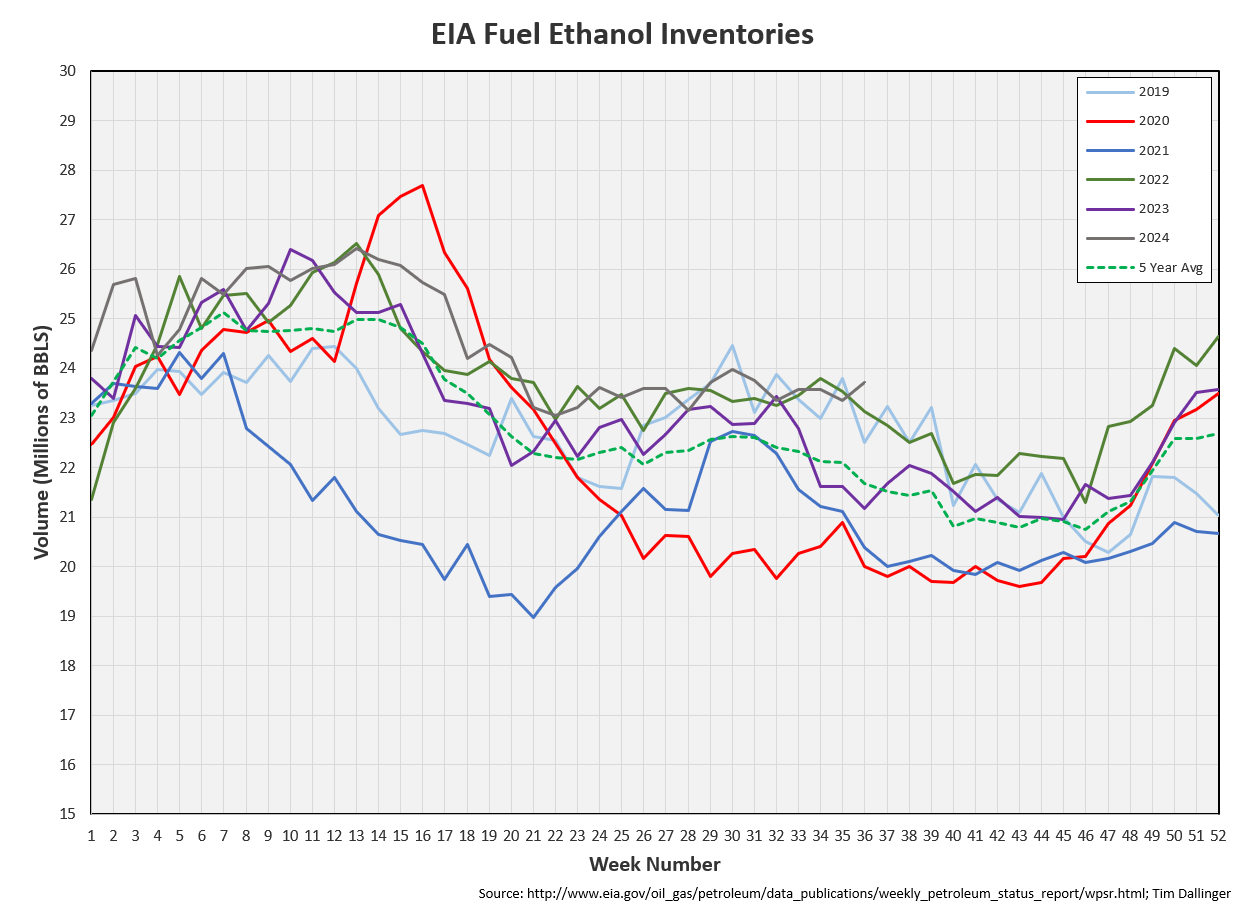

Ethanol

Ethanol inventories increased 0.4 MMB week-on-week. Inventories are above seasonal averages.

Propane

Propane/propylene inventories increased by 1.1 MMB, nearing seasonal records.

Other Oil

Other oil increased by 0.9 MMB. Significant draws are not expected in this category for another month.

Total Commercial Inventory

Total commercial inventory increased by 9 MMB. Inventories are slightly below average.

Natural Gas

The graph for natural gas inventories is identical to the one presented last week. Due to the holiday delay, the petroleum and natural gas report were released on the same day. There will be new gas data available tomorrow.

Refiners

The amount of crude oil refiners processes fell slightly last week but remains near seasonal high levels.

The EIA’s product demand proxy fell.

Transportation inventories increased unexpectedly.

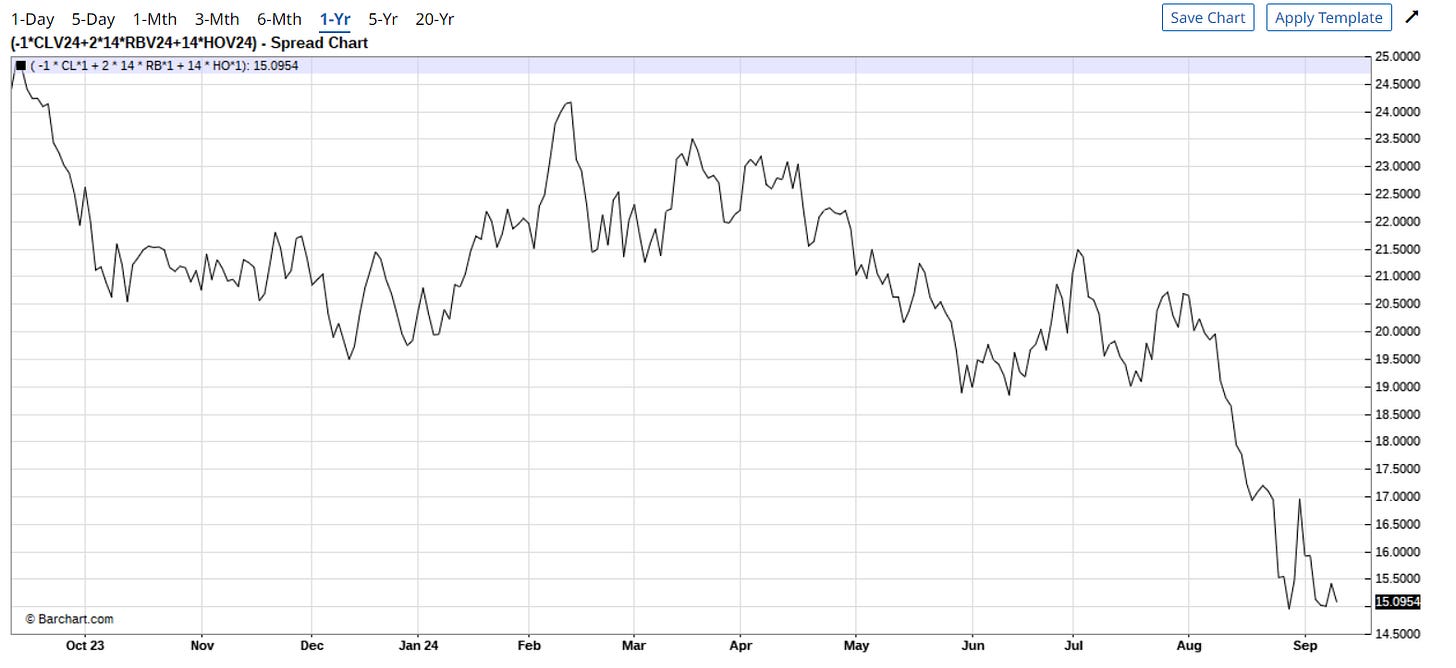

Simple cracks are extremely low. Run cuts haven’t occurred though.

Discussion

The selloff in crude oil continued this week. OPEC revised their demand forecast down slightly and the market responded negatively. It would appear that this revision was made to give the organization cover not to raise production in Q4.

This was a bearish report but it still cannot explain the discrepancy between global inventories and crude oil spot prices.

Short interest in crude contracts is higher than that during the Global Financial Crisis. This pessimism makes little sense. Credit markets are suggesting some recessionary pressure but not enough to warrant this price action. There is little sign of significant demand destruction.

Media articles rationalize the selloff with reasons like China weakness, supply out-pacing demand and internal OPEC strife. The Chinese economy is struggling but not at the magnitude being reported. Non-OPEC supply growth is also being blamed for falling prices. Forward projections show growth from US, Canada, Brazil, Guyana and Norway. But this growth hasn’t emerged yet. OPEC appears committed to the cooperative effort to balance the market and ensure future global energy production investment continues.

Considering current global inventories, one must ask, where’s the glut?

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Mack and Dennis express similar sentiment as those watching energy markets in the American sitcom, “It’s Always Sunny in Philadelphia”

Stocks doesn't matter anymore. Barrels are either on a tank or on a ship.

Makes me feel better that someone who knows WAY more than I do is also confused.