EIA WPSR Summary for week ending 4-18-25

Summary

Crude: +0.2 MMB

SPR: +0.5 MMB

Cushing: -0.1 MMB

Gasoline: -4.5 MMB

Distillate: -2.4 MMB

Jet: -0.2 MMB

Ethanol: -1.3 MMB

Propane: +2.3 MMB

Other Oil: +6.3 MMB

Total: -0.7 MMB

Spot WTI is currently pricing $62. Spot prices are discounted the most since COVID, when compared to an estimated fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply built by 0.2 MMB. Crude inventories are currently 5% below the seasonal average.

0.5 MMB were added to the SPR.

The SPR was previously at this level in November 2022 and May 1984.

US crude imports were down. Keystone pipeline has restarted after its spill but it’s currently reported to be running at reduced capacity.

Crude exports also fell. Exports seem low but last week’s volumes were overcounted according to independent ship trackers.

Unaccounted for crude returned near zero.

The EIA continues to model US crude production high. The next Petroleum Supply Monthly will be available on May 1. Then will be more apparent if shale growth has stalled or January’s lower figures were due to inclement weather.

Cushing

Crude storage in Cushing, OK, drew by 0.1 MMB week on week, to a seasonal low.

Gasoline

Total motor gasoline inventories decreased by 4.5 MMB and are about 5% below the seasonal 5-year average.

Gasoline blending components have fallen below average too.

Distillate

Distillate fuel inventories decreased by 2.4 MMB last week. Distillate inventories are at a seasonal low, about 13% below the seasonal 5-year average.

Distillate inventories also approach historic low levels.

Jet

Kerosene type jet fuels drew by 0.2 MMB.

Ethanol

Ethanol inventories decreased 1.3 MMB week-on-week. Inventories are still above seasonal averages but declining at a normal rate.

Propane

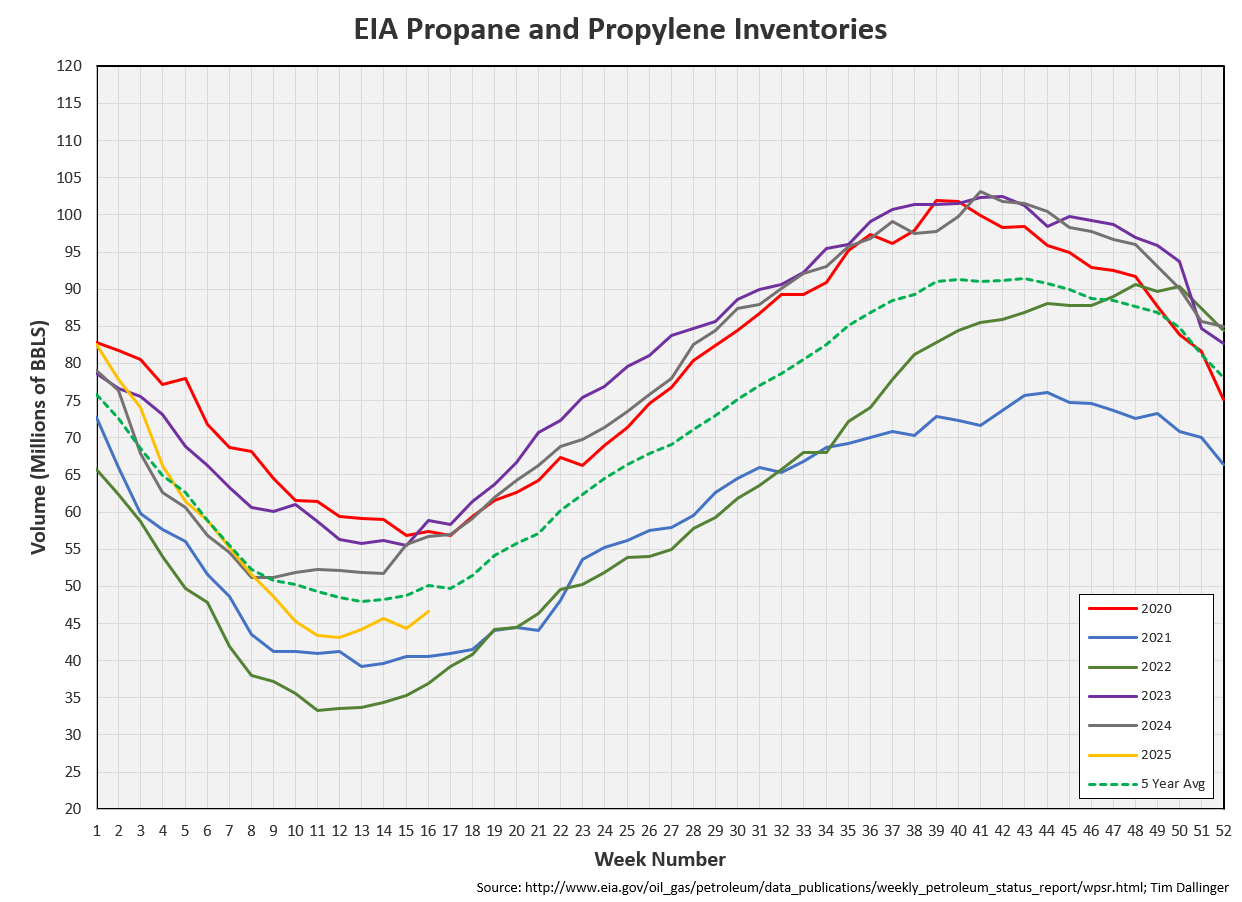

Propane/propylene inventories built seasonally by 2.3 MMB. Propane inventories are 7% below the seasonal average.

Other Oil

Other oil built by 6.3 MMB to a seasonal record.

Interestingly though, the implied demand for other oil has only been seasonally higher than once.

Total Commercial Inventory

Total commercial inventory drew by 0.7 MMB with the product draw being offset primarily by other oil build.

Natural Gas

It was a supportive natural gas report as inventories didn’t rise significantly, even though build season has begun.

Refiners

US refiners processed near seasonal record levels of crude oil last week. This is stark denial of the prevailing narrative that oil demand is weak.

The EIA’s product demand proxy also is at seasonal record levels, on an average basis.

Transportation inventories approach 2023 lows.

Implied demand for transportation inventories approaches seasonal record levels.

This is aided by all-time record level implied jet fuel demand.

Simple cracks are very constructive. Refiners will continue to run hard.

Discussion

Futures remain backwarded. Volume is thin on the back end of the curve.

Crude oil prices continue to struggle even though physical market flow and inventories continue to be supportive of higher prices.

Reuters reported that sources have described internal strife within OPEC as some members want higher increases to their quotas. The Saudi Arabian oil minister has refuted that Reuters has accurate sources in the past. However, the market took this report as serious risk, selling off after the announcement.

The newly appointed Kazakhstan energy minister offered conflicting statements, pledging commitment to the OPEC+ agreements but also stating that they would act in accordance with national interests with all the ensuing consequences. Kazakhstan had previously vowed to make-up for its previous production which exceeded quota. Now it claims it cannot control the Western companies which produce Kazakhstan oil.

OPEC meets again on May 5.

Short interest remains high.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Anakin Skywalker confronts Obi Wan in the 2005 sci-fi film, Star Wars: Episode III – Revenge of the Sith.