EIA WPSR Summary for week ending 10-27-23

It Would be so Nice if Something Made Sense for a Change

Summary

Neutral report.

Crude: +0.8 MMB

SPR: 0.0 MMB

Cushing: +0.3 MMB

Gasoline: +0.1 MMB

Ethanol: -0.4 MMB

Distillate: -0.8 MMB

Jet: -1.3 MMB

Propane: -1.2 MMB

Other Oil: -0.3 MMB

Total: -3.1 MMB

Spot WTI is currently pricing $82. This is below fair value, based on a price model derived from reported EIA inventories.

Crude

U.S. commercial crude oil increased by 0.8 MMB from the previous week and are about 5% below the seasonal 5-year average. Crude inventories haven’t been this seasonally low since 2014.

SPR was again unchanged this week. Another 1.2 MMB additions are still planned for 2023. Price did fall this week but hasn’t yet hit the DOE’s $79 target for SPR repurchase.

Report US crude exports are high again. WTI – Brent spread is above $4, ensuring the export arbitrage window remains open.

Imports are slightly up this week, mostly from Saudi Arabia and Brazil. Saudi imports should fall back.

Unaccounted for oil falls back below 1 MMBD. It’s still too high considering the re-benchmark of production.

Cushing

Cushing built by 0.3 MMB. Total Cushing volume sits at 21.5 MMB. Drawing to tank bottoms remains a near-term risk.

Gasoline

Total motor gasoline inventories increased by 0.1 MMB and are about 2% above the seasonal 5-year average.

The gasoline build is entirely from blending components.

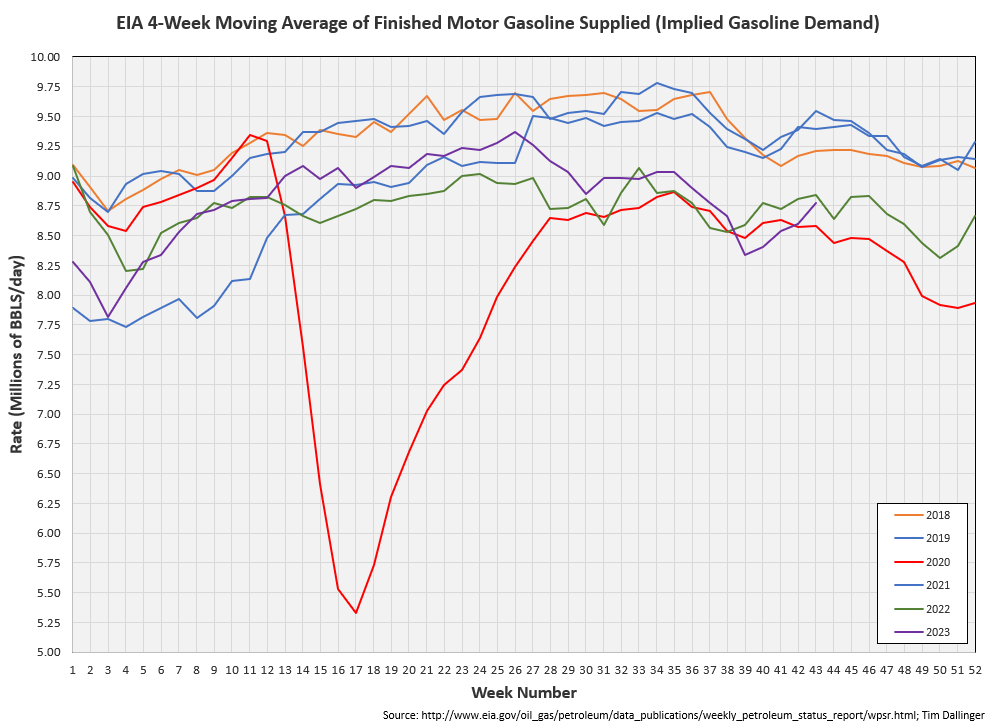

EIA implied gasoline demand increases but is still relatively low.

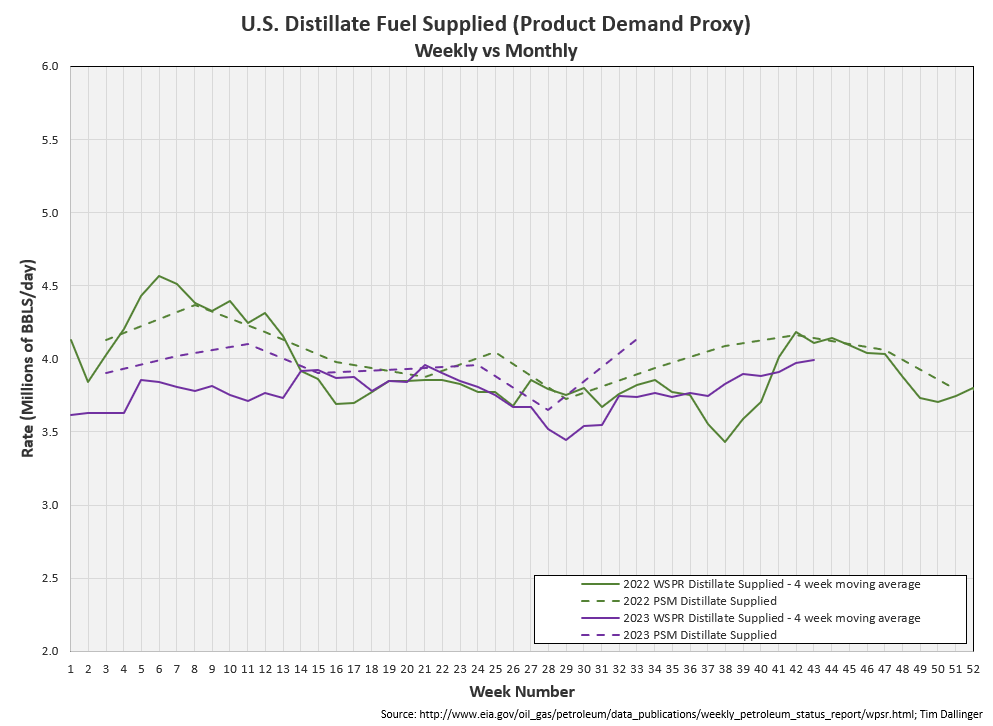

At the end of each month, the EIA corrects the weekly data with a more accurate, “Petroleum Supply Monthly” report. The release is delayed because data takes time to collect. The August report was issued yesterday.

For all the talk of weak demand, it isn’t abundantly apparent in the monthly data. We can see that the monthly report currently shows gasoline demand above the weekly and the 2022 monthly figure.

Ethanol

Ethanol inventories drew 0.3 MMB, resulting in volumes near the seasonal 5-year average.

Distillate

Distillate fuel inventories decreased by 0.8 MMB and are about 12% below the seasonal 5-year average.

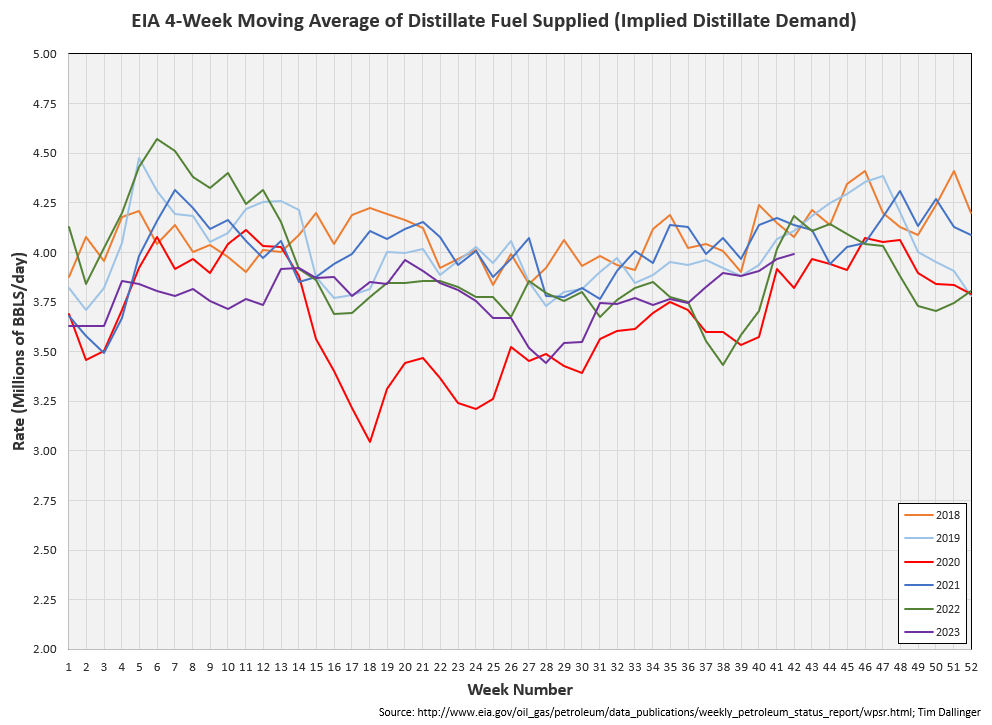

Implied distillate demand shows weakness.

This weakness is not corroborated in the PSM

Jet

Kerosene type jet drew 1.3 MMB. Inventories are near seasonal averages.

Monthly jet demand figures have outpaced weekly reports nearly all year.

Total flights are down but miles flown again approach all-time seasonal records.

https://www.airportia.com/flights-monitor/

Propane

Propane/propylene inventories decreased by 1.2 MMB and are 16% above the seasonal 5-year average. Inventory draws into year-end appear to have started.

Other Oil

Other oil drew 0.3 MMB week-on-week.

Weekly demand appears strong. The PSM doesn’t break out “other oil” so it’s difficult to confirm with other sources.

Total Commercial Inventory

Total commercial petroleum inventories decreased by 3.1 MMB last week.

Natural Gas

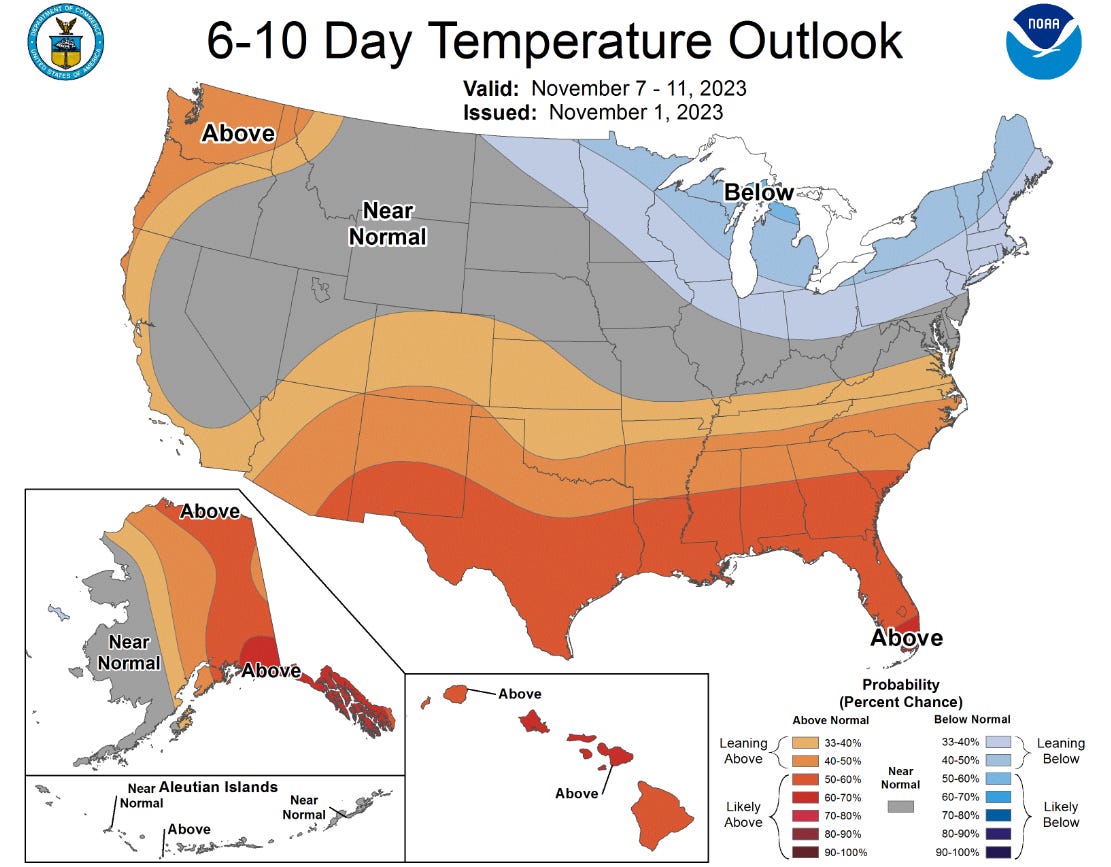

Natural gas continues its seasonal build.

Last week’s cold front appears short-lived.

Discussion

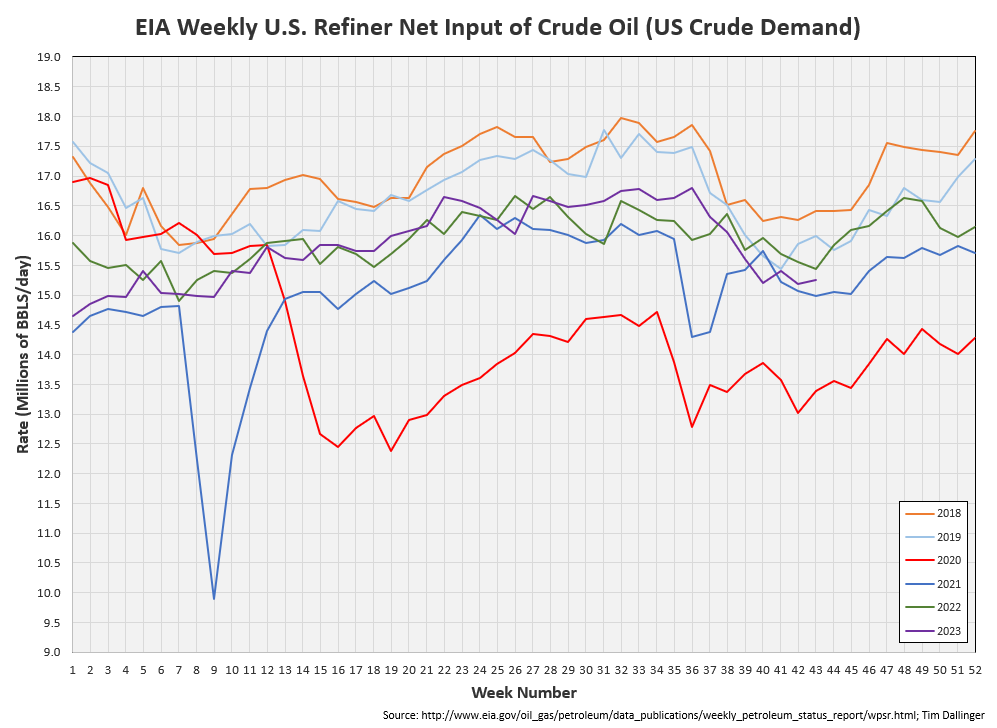

Refiners should exit turn-around season now. Net input of crude oil should meaningfully build into year-end. There are talks of run cuts. This may occur globally but if US refiners cut runs, low levels of distillate will reach critical levels.

The EIA still shows weak product demand.

Through August, 2023 implied demand outpaces 2022.

Many Q3 energy earnings reports have been released. Here are some excerpts from various refiner conference calls:

“The strength in demand was evident in our U.S. wholesale system, which matched the second quarter record of over 1 million barrels per day of sales volume. Our refineries operated well and achieved 95% throughput capacity utilization in the third quarter.”

Lane Riggs, VLO

“We saw strong demand and global supply tightness supporting refining margins. Diesel cracks led the barrels inventories remain tight and European distillate production ran below capacity.

Globally, oil demand is at a record high as the need for affordable and reliable energy increases throughout the world. In our system, both domestically and within our export business, we are seeing steady demand year-over-year across the gasoline and diesel and demand for jet fuel continues to grow. Global supply remains constrained and global capacity additions have progressed at a slow pace.”

Mike Hennigan, MPC

“In energy products, we achieved the highest third quarter refinery throughput on record, driven by our Beaumont refinery expansion. At a time of strong demand and low inventories.”

Darren Woods, XOM

“We are seeing stable to growing demand for our products at our refinery gates, thereby continuing the call for high utilization from our assets. demand. We continue to hear calls for higher refining utilization, and see a market supported by low inventories and sustained customer demand.”

Thomas Nimbley, PBF Energy

“We are seeing distillate demand globally at about 2% higher than last year.

On the demand side, we are seeing global gasoline 2% year-over-year and particularly strong, Asia and Middle East, Europe, about flat. U.S. demand seems to be about flat, too. Latin America has been really strong, about 5% over last year.”

-Brian Mandell, PSX

The crack spreads are indicating that there are some demand issues. But despite pessimistic sentiment, various broad scale economic data and the EIA WSPR product supplied proxies, monthly demand metrics and refiner outlook suggest health.

The conflict in the middle east continues. To date, no supply has been disrupted. The market isn’t assigning any geopolitical price premium to crude.

The EIA will be doing maintenance on systems next week. No WSPR report is expected so no summary will be necessary.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Alice in Wonderland is a 1951 American animated fantasy film based on Lewis Carroll’s 1865 novel, Alice’s Adventure in Wonderland.