EIA WPSR Summary for week ending 4-5-24

Summary

Bearish report.

Crude: +5.8 MMB

SPR: +0.6 MMB

Cushing: -0.2 MMB

Gasoline: +0.7 MMB

Ethanol: -0.2 MMB

Distillate: +1.7 MMB

Jet: +0.3 MMB

Propane: -0.1 MMB

Other Oil: +4.6 MMB

Total: +12.4 MMB

Spot WTI is currently pricing $86. This above fair value based on a price model derived from reported EIA inventories. The market appears to be pricing a geopolitical premium.

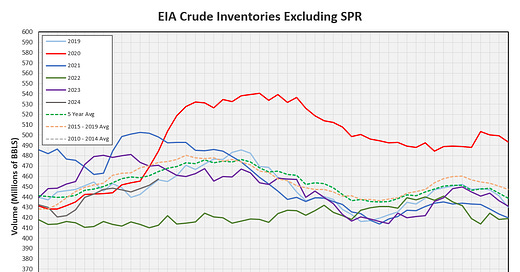

Crude

US Crude oil supply built by 5.8 MMB. Crude inventories are currently 2% below the seasonal average.

0.6 MMB were added to the SPR. 9.2 MMB have been added to the SPR in 2024. SPR addition should run through July.

Crude imports again fell slightly week-on-week.

Crude exports were reported at 2.7 MMBD. Independent ship trackers were showing lower exports this week, but not this low. This is the lowest week of 2024. Global TARS is likely playing a role. Still, exports are expected to be higher with the WTI brent differential.

Unaccounted for oil did correct negative. But it didn’t drop low enough to make up the export barrels that the US customs seems to have missed over March.

Cushing

Crude inventories in Cushing, OK dew by 0.2 MMB. TransMountain Pipeline announced it will begin service May 1, 2024. Some Canadian barrels that would have gone to Cushing will be shipped to the west coast instead.

Gasoline

Total motor gasoline inventories increased by 0.7 MMB and are about 2% below the seasonal 5-year average.

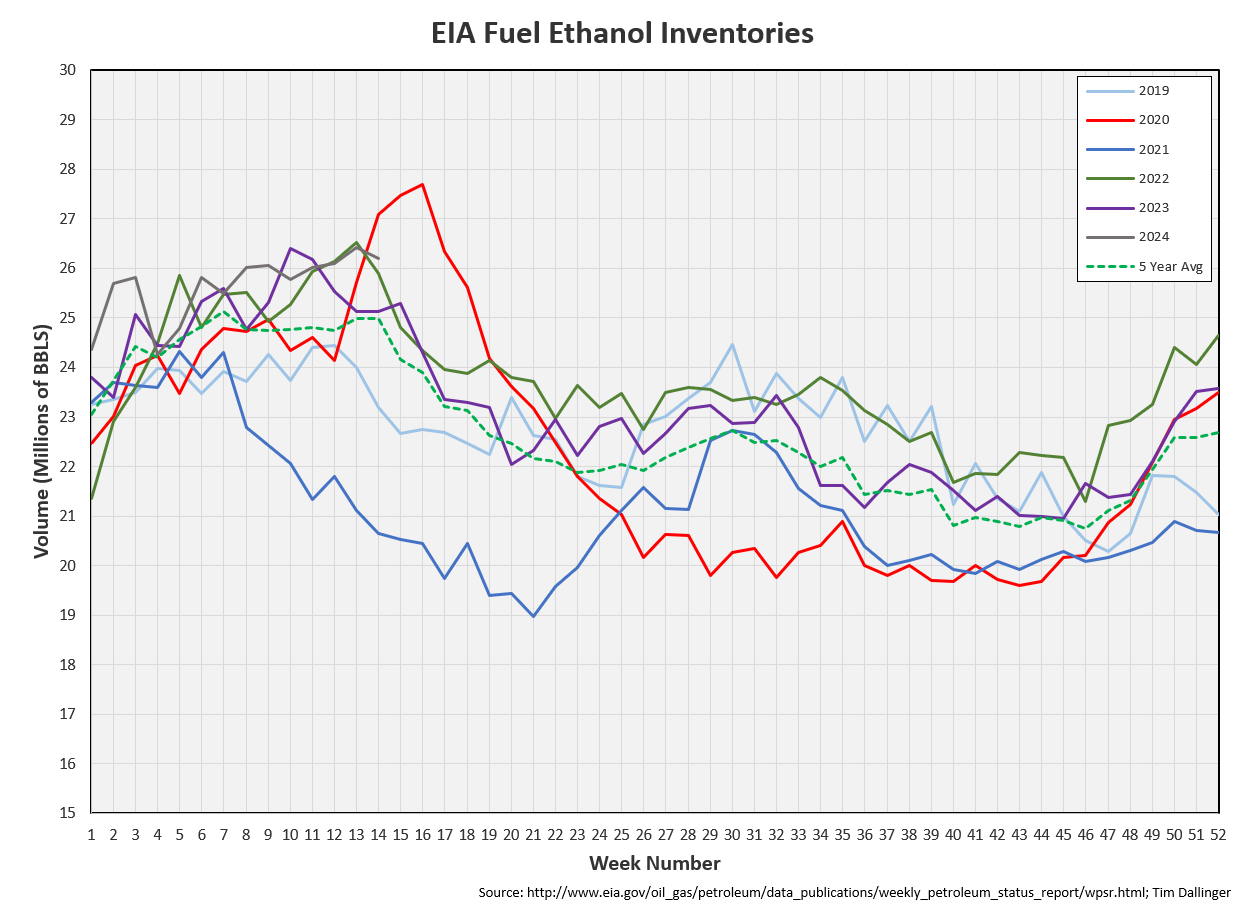

Ethanol

Ethanol inventories are just above 2022 high levels, about 5% above the seasonal 5-year average.

Distillate

Distillate fuel inventories increased by 1.7 MMB last week and are about 5% below the seasonal 5-year average.

Jet

Kerosene type jet fuels increased by 0.3 MMB. Seasonal jet inventories are about 10% above the 5-year average.

Global flights are still at record levels.

https://www.airportia.com/flights-monitor/

Propane

Propane/propylene inventories decreased 0.1 MMB week-on-week. Inventories are above seasonal averages.

Other Oil

Other oil increased by 4.6 MMB. The build was large but seasonally normal. “Other oil” inventories are just below seasonal average.

Total Commercial Inventory

Total commercial inventories increase by 12.4 MMB, bringing them to 2019 levels.

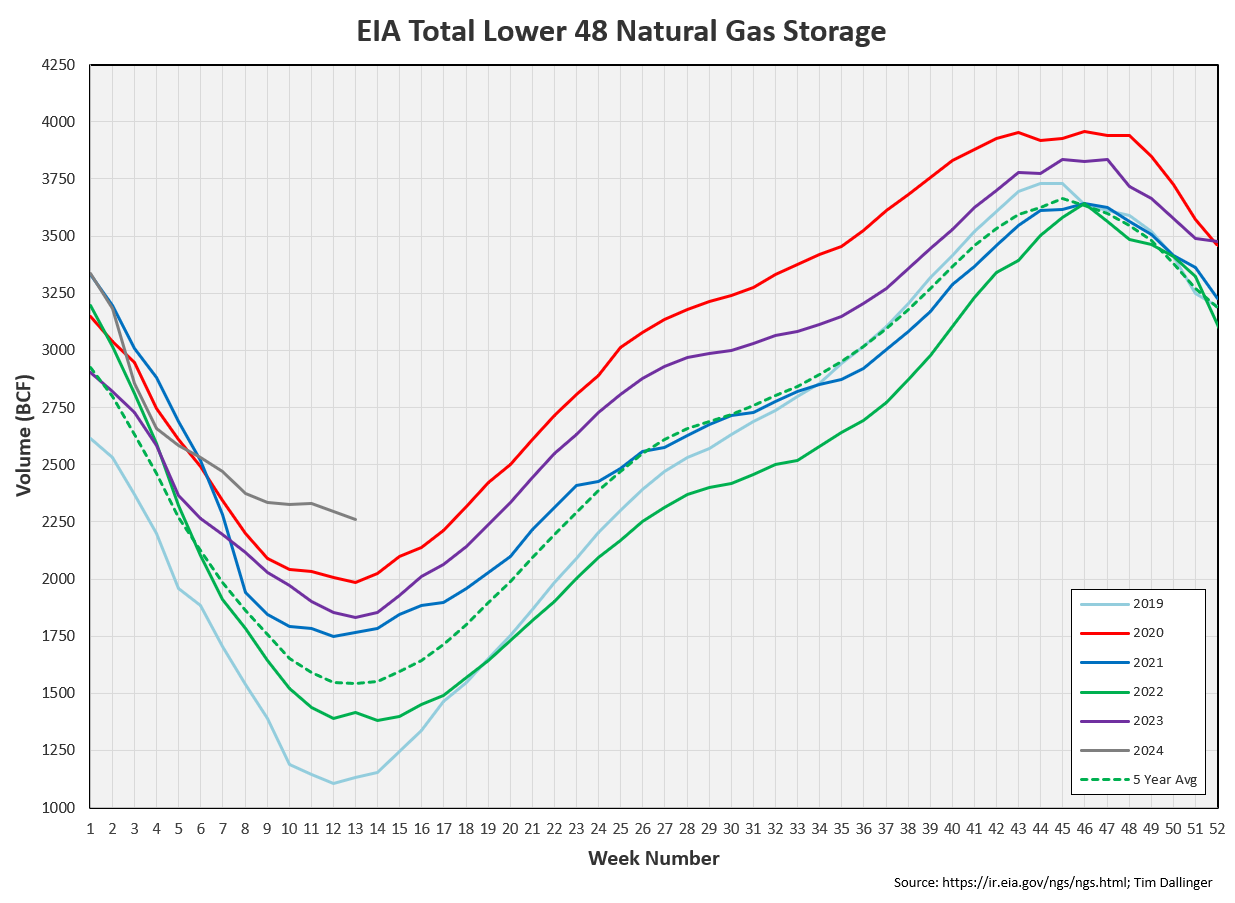

Natural Gas

Natural gas inventories remain at seasonal record highs.

Refiners

US refiner weekly crude input again fell slightly week on week. Crude oil processing is still near record seasonal highs.

EIA’s consumer demand proxy fell significantly, week-on-week. There’s no clear reason.

Transportation inventories are near 2022 levels. Only 2023 was lower.

The 3-2-1 crack spread has retraced back near the critical $30 level. Gasoline prices will be higher at the pump this summer.

Timespreads remain constructive. The market remains backwarded, expressing physical tightness.

The brent market appears stronger than WTI.

Discussion

The EIA is reporting weekly US production to be 13.1 MMB. If one considers the trend of US production + adjustment, it appears the EIA is overcounting US production in the weekly figures.

The January Petroleum Supply Monthly production figure of 12.533 MMB is gaining some attention among analysts as questions about shale growth remain front and center.

Shale growth does appear to be stalling. But the latest US monthly production figures include the significant freeze event that occurred in January 2024. There were shut-ins across all the shale basins. The next Petroleum Supply Monthly should be more illustrative on weather-related incidents vs basin declines.

Associated natural gas production is also be a headwind for the Permian. Waha gas prices are currently negative. Producers are at their flaring limits, takeaway capacity is full and thus associated natural gas is now a cost.

The EIA revised their global demand projections higher yesterday in the latest short-term energy outlook (STEO).

The March CPI printed higher than expected. Inflation is not tamed. The Federal Reserve has little reason to cut interest rates. The broad market sold off on the news. Commodities seem to be a safe haven as investors look to protect value from inflationary pressure.

Despite the bearish report, oil prices held. Reports were published intra day that the US was expecting imminent Iranian retaliations against Israel. Last week Ukraine attacked a Russian product export pipeline. Global tensions remain high.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

“Danger Zone,” is a 1980’s American rock song by artist Kenny Loggins, released in 1986 on the Top Gun soundtrack.