EIA WPSR Summary for week ending 10-25-24

Summary

Crude: -0.5 MMB

SPR: +1.2 MMB

Cushing: +0.7 MMB

Gasoline: -2.7 MMB

Distillate: -1.0 MMB

Jet: -0.3 MMB

Ethanol: -0.5 MMB

Propane: -0.2 MMB

Other Oil: -3.3 MMB

Total: -9.5 MMB

Spot WTI is currently pricing $68. Spot crude price has, once again, dislocated from the modeled fair value by the largest magnitude in nearly in a decade.

Crude

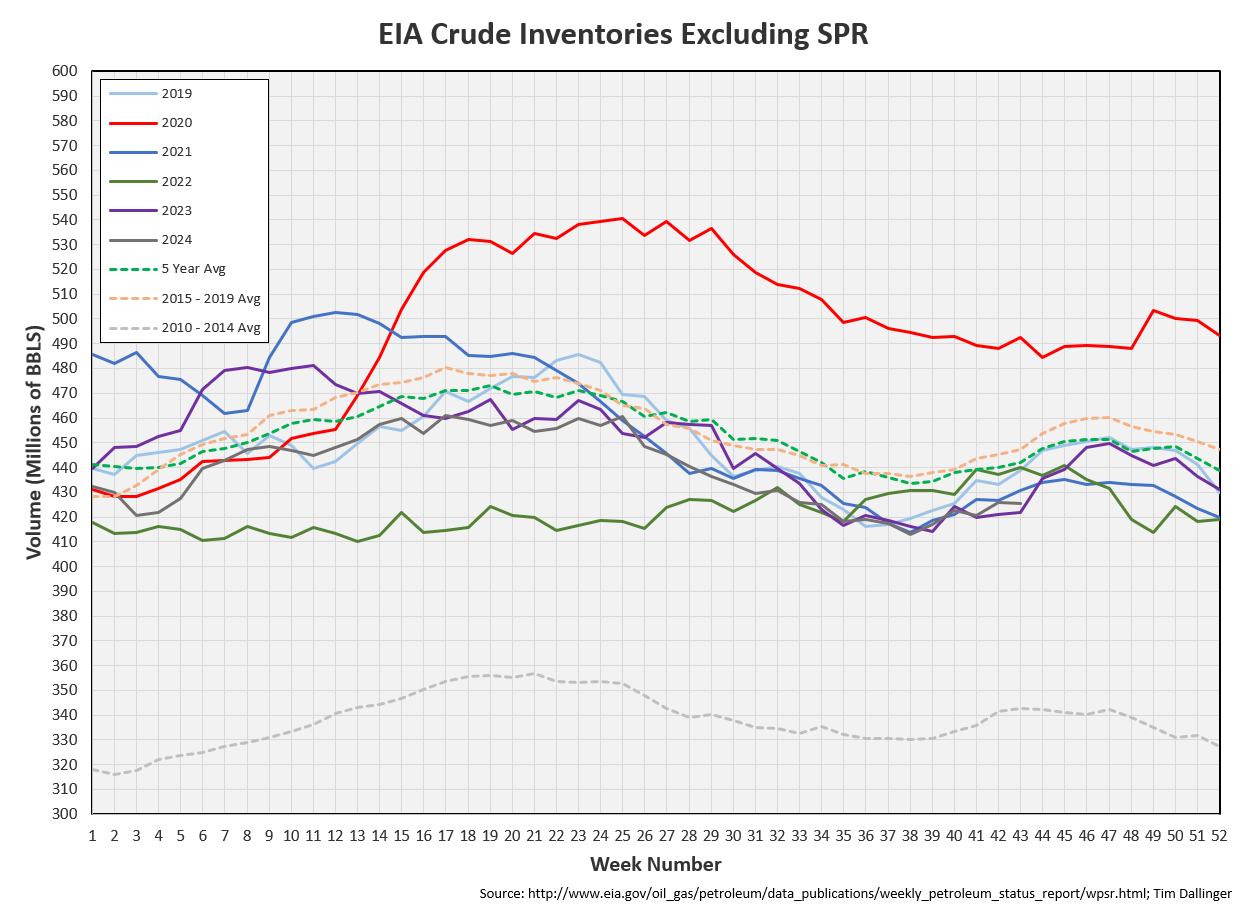

US Crude oil supply drew by 0.5 MMB. This was significantly below the consensus estimate of a 5 MMB build. Crude inventories are currently 4% below the seasonal average. They are on pace to reach a multi-year low in the coming weeks.

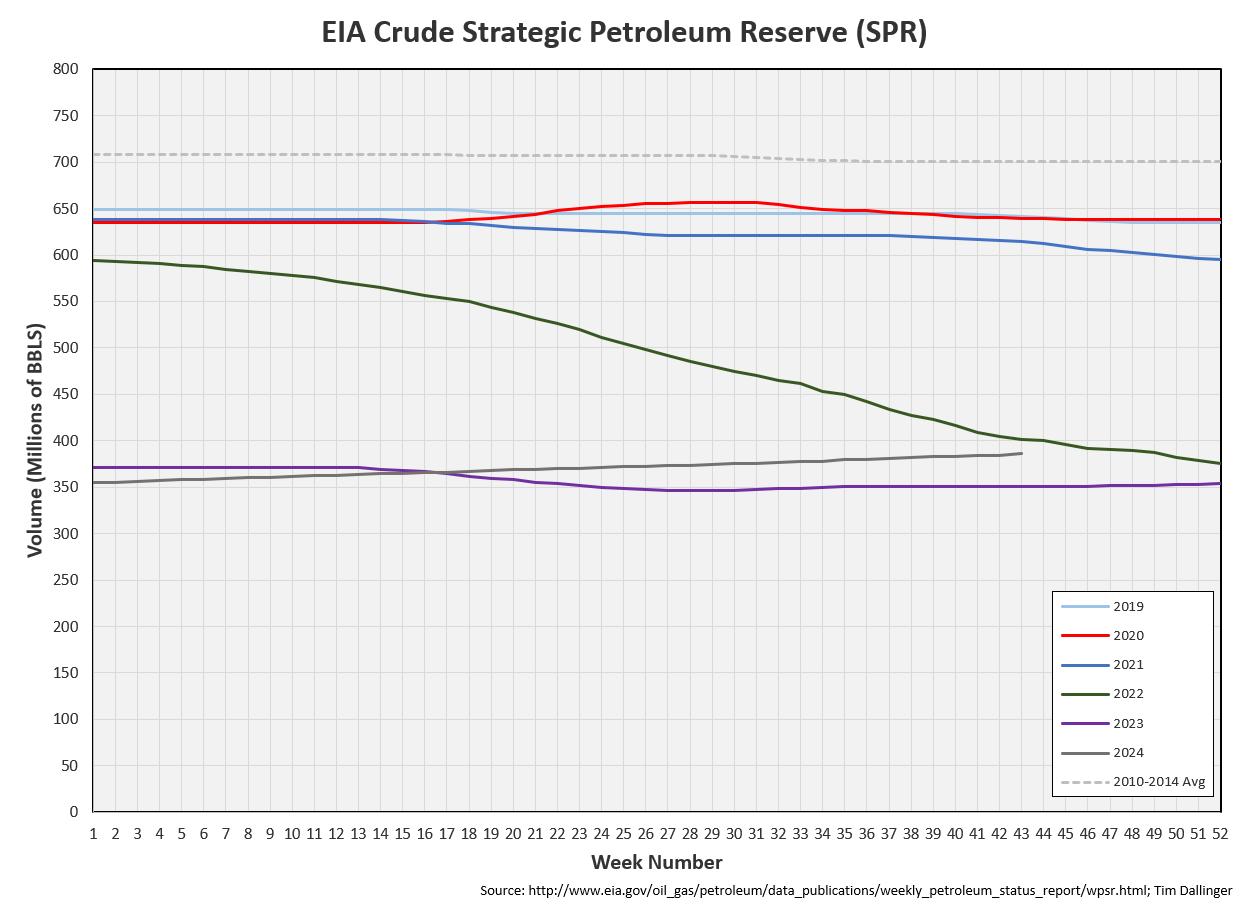

1.2 MMB were added to the SPR.

US crude imports were down week-on-week.

Crude exports increased above the annual average.

Unaccounted for crude was positive. This was likely due to imports being under-counted.

Cushing

Crude storage in Cushing, OK, built by 0.7 MMB week-on-week. Cushing inventories are low but no longer in danger of hitting tank bottoms. Only 2023 experienced lower seasonal volume.

Gasoline

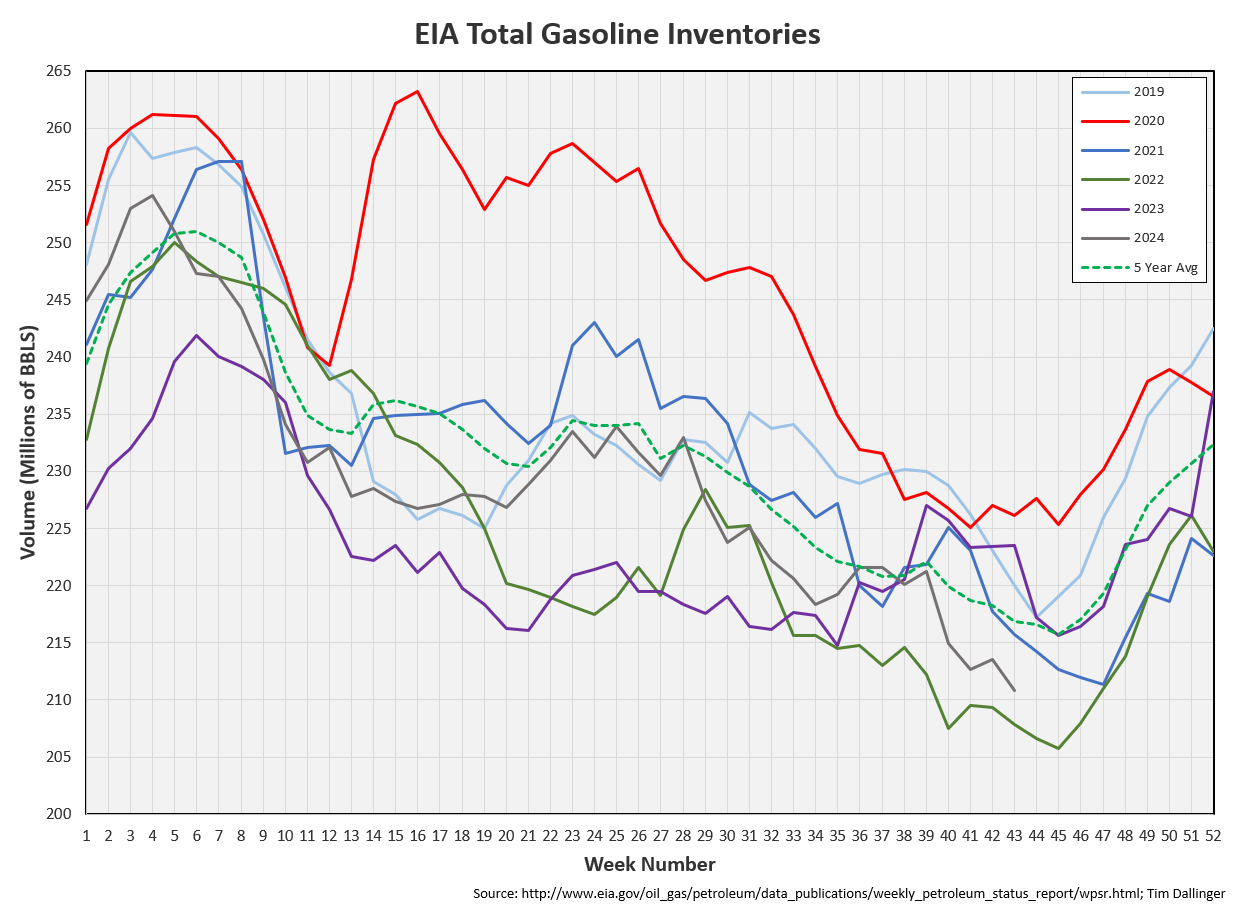

Total motor gasoline inventories decreased by 2.7 MMB and are about 4% below the seasonal 5-year average.

Conventional gasoline inventories are at record low levels.

Blending components drew too as refiners make more winter-blend gasoline.

Distillate

Distillate fuel inventories decreased by 1.0 MMB last week and are about 9% below the seasonal 5-year average.

Jet

Kerosene type jet fuels drew by 0.3 MMB. Jet fuel inventories are above the seasonal average although appear poised to fall into holiday travel season.

Ethanol

Ethanol inventories decreased 0.5 MMB week-on-week. Inventories are about 4% above seasonal averages.

Propane

Propane/propylene inventories decreased by 0.2 million barrels from last week and are 11% above the five-year average for this time of year.

There’s a cold weather system developing that should drive some additional propane and natural gas heating demand.

Other Oil

Other oil inventories decreased by 3.3 MMB and are just below the seasonal average.

Total Commercial Inventory

Total commercial inventory drew by 9.5 MMB.

Natural Gas

Natural gas inventories remain high.

Refiners

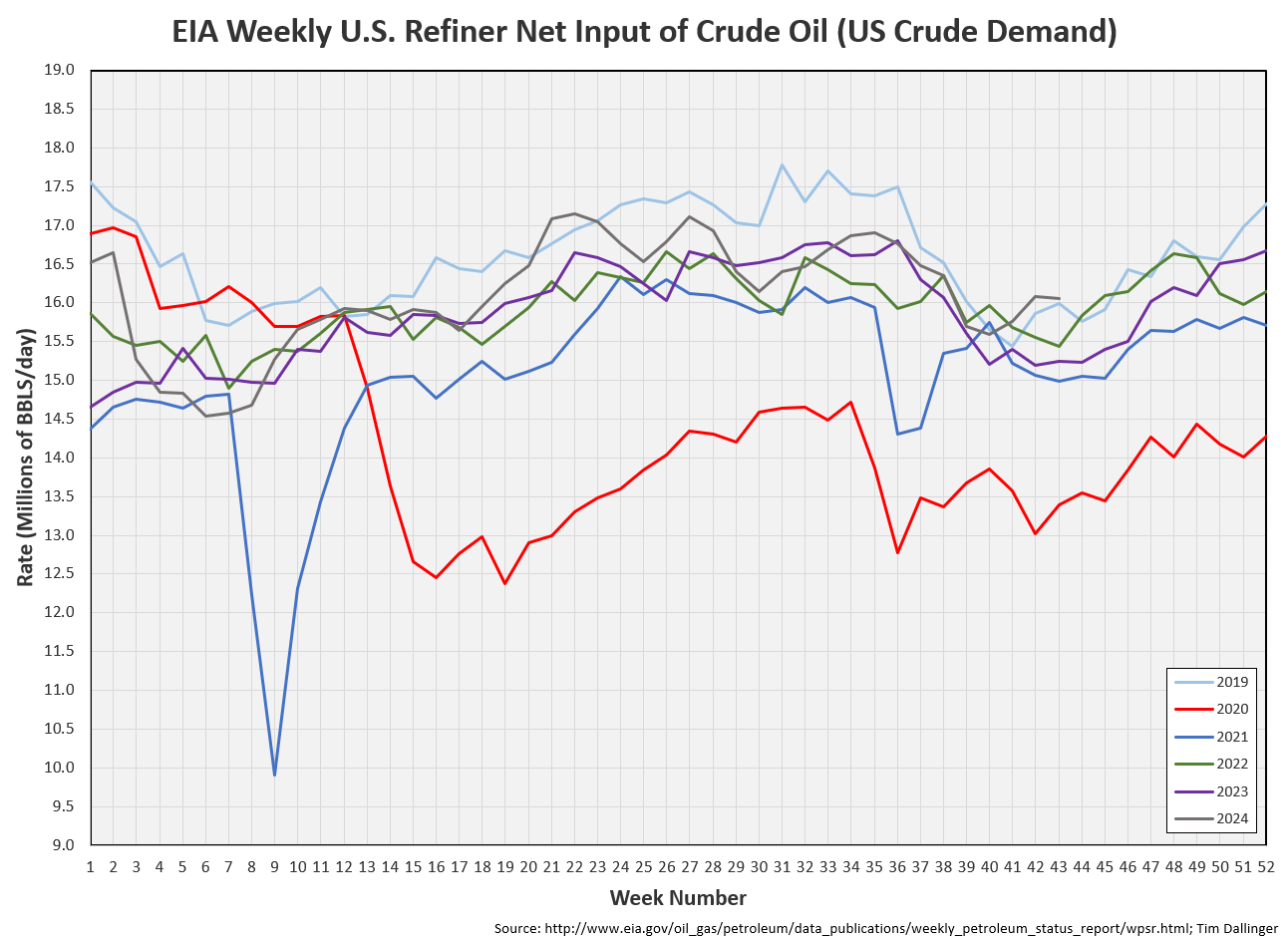

Refiners again processed a seasonal record amount of crude oil last week. It appears turn-around season is ending a bit early. Crude oil demand should remain strong.

The EIA’s product demand proxy is also showing strength.

Transportation inventories are drawing, with only 2022 showing lower levels.

If crude is included in this category, critical inventories are near record lows.

Simple cracks are finally showing some life.

Discussion

Time structures remain backward, meaning there is no incentive to store crude oil. The market is demanding physical barrels now, even as the financial market whips around with extreme volatility.

The US Presential election is next Tuesday. If elected, Trump has promised to “drill, baby, drill.” Should this happen, the market may be surprised to learn that the US government hasn’t been restricting US production in any significant manner. Producers are finally operating within cash flow and that behavior is expected to continue.

Over the weekend, Iran directly struck Iranian military assets and Hezbollah forces in Lebanon. Although there was significant damage to defense systems and at least 4 Iranian casualties, Iran down-played the efficacy of the strike. Media reported that Iranian officials, through back-channel communications, expressed their desire for no further escalation. However, the deputy coordinator of the Islamic Revolutionary guard has directly refuted this claim, calling for retaliation to occur in the next few days. Hezbollah officials have claimed responsibility for a drone attack on Netanyahu’s home residence and pledge for further action. Yet, since no Iranian energy or nuclear facilities were targeted, crude oil sold off at the open on Monday.

There is currently no geopolitical premium included in crude prices. Crude prices have diverged even further from their historic correlation with commercial inventories.

Market bears continue to celebrate negative price action as mainstream media sources report that the world is awash in crude. Those tracking global inventories know that this is a false narrative. Chinese demand isn’t strong but Indian demand has made up for the fall. Either the market is accurately predicting global recession or there will be a reckoning on this critical mispriced commodity.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Doc Holiday describes Wyatt Earp’s motivation in the 1993 cult classic American Western film, Tombstone.

Geopolitical risks are not priced in. And the markets are foolish to believe that Trump can just turn on the spigots. It doesn’t work that way in oil, mining or agriculture.

"Over the weekend, Iran directly struck Iranian military assets..." I believe you meant Israel where you have Iran.