EIA WPSR Summary for week ending 12-1-23

Summary

Neutral report. Bullish crude. Bearish implied demand. Messy details.

Crude: -4.3 MMB

SPR: +0.3 MMB

Cushing: +2.2 MMB

Gasoline: +5.4 MMB

Ethanol: +0.1 MMB

Distillate: +1.3 MMB

Jet: +1.3 MMB

Other Oil: -3.5 MMB

Total: -1.7 MMB

Spot WTI is currently pricing $69. This below fair value, based on a price model derived from reported EIA inventories.

Crude

U.S. commercial crude oil inventories decreased by 4.3 MMB from the previous week and are just below the seasonal 5-year average.

0.3 MMB of crude oil was transferred from commercial inventories to the SPR. Another 0.6 MMB additions are still planned for the remainder 2023. Additional purchases are tentatively planned for 2024 but Deputy Energy Secretary, David Turk, said physical constraints and maintenance on the network of underground caverns on the U.S. Gulf Coast limits the purchase 3 MMB per month currently.

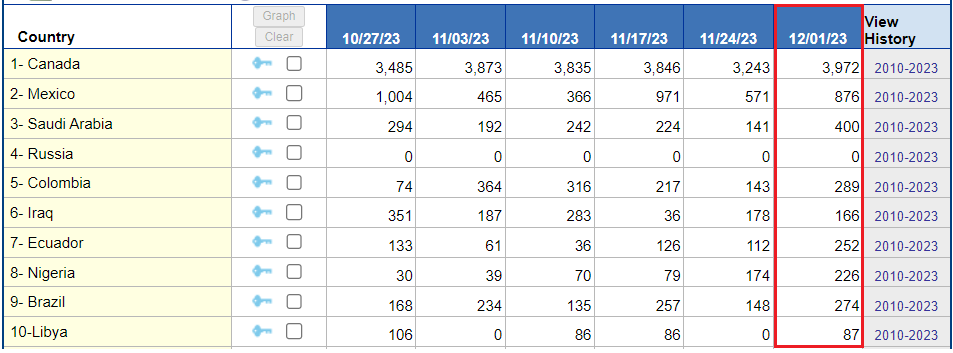

US crude imports soared to the second highest recorded week. There is no apparent reason that explains this swing.

EIA tentatively reports that 9 of the 10 importing countries showed significant increases week-on-week.

Meanwhile, US crude exports fell 400 kbd. Independent ship trackers show that last week had record crude exports. US Customs did not confirm that trend. Its unclear if exports were miscounted or missed.

Unaccounted for oil posted the largest negative adjustment on record. This indicates that imports and exports were miscounted. It also further supports the assertion that the EIA’s attempt to improve their inventory modeling with the “transfer to crude oil category,” has made the data worse. To say that the data is a messy is an understatement.

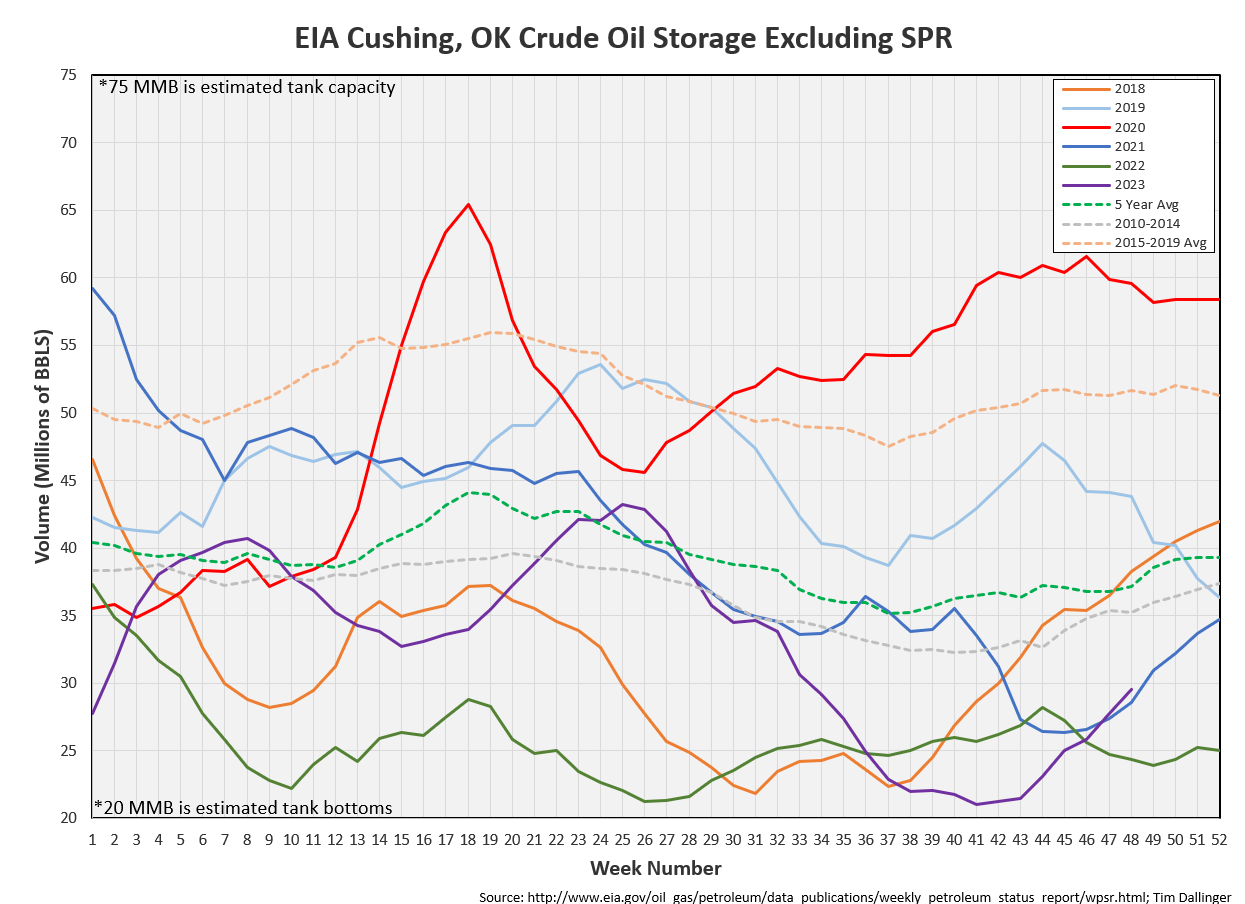

Cushing

Cushing built by 2.2 MMB, in-line with expected seasonal behavior. Cushing looks to build into year end.

Gasoline

Total motor gasoline inventories increased by 5.4 MMB and are about at the seasonal 5-year average. Gasoline inventories should continue to build over the next month.

The EIA is showing implied gasoline demand is lower than 2022.

Ethanol

Ethanol inventories built by 0.1 MMB, resulting in volumes near the seasonal 5-year average.

Distillate

Distillate fuel inventories increased by 1.3 MMB last week and are about 11% below the season 5-year average. Inventories are near 2022 levels.

Jet

Kerosene type jet built 1.3 MMB. Inventories are 2% above the seasonal 5-year average. Flights have fallen back from Thanksgiving week records.

Global Chinese flight miles are just above 2019 records but the number of flights still lag.

https://www.airportia.com/flights-monitor/

Propane

Propane/propylene inventories decreased by 1.8 MMB from last week and are 18% above the seasonal 5-year average.

Other Oil

Other oil decreased by 3.5 MMB

Total Commercial Inventory

Total commercial inventories drew by 1.7 MMB.

Natural Gas

Natural gas built slightly.

Associated gas production is hitting record amounts as Permian oil plays become more gassy. This much gas is leading to complications with EIA modeling as additional NGL components cloud many categories. Unfortunately, this trend will continue as the Permian well GOR increases.

Discussion

Refiners increased production slightly.

The EIA continues to show diminishing implied demand figures. Perhaps demand is as poor as the EIA is showing. Price action seems to indicate that.

Transportation inventories have built off their bottom, following maintenance season. Volumes are still below average, mainly due to distillate figures.

For those following these weekly notes, there was a mistake in the “Big 3” implied demand last week. The corrected graph is as follows:

Implied transportation demand is still low but it’s not below COVID levels as reported last week.

Crack spreads have recovered.

But time-spreads weaken.

OPEC met late last week and increased their cuts through Q1 2024. The cuts are voluntary. The market is pricing crude like it doesn’t believe OPEC. Selling has lead to more selling. Computer trading algorithms push crude prices lower. This seems overdone but there also appears little reason for traders go long here.

The crude market is struggling. Contango, although slight, is concerning. There isn’t incentive to store in the current interest rate environment. But the physical market isn’t tight. It’s certainly not strong enough to fight an aggressively short paper market.

OPEC+ needs to deliver as guided if they wish to halt the falling prices.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

“Sons of the Desert” is a 1993 American comedy film staring Laurel and Hardy.