EIA WPSR Summary for week ending 4-25-25

Summary

Crude: -2.7 MMB

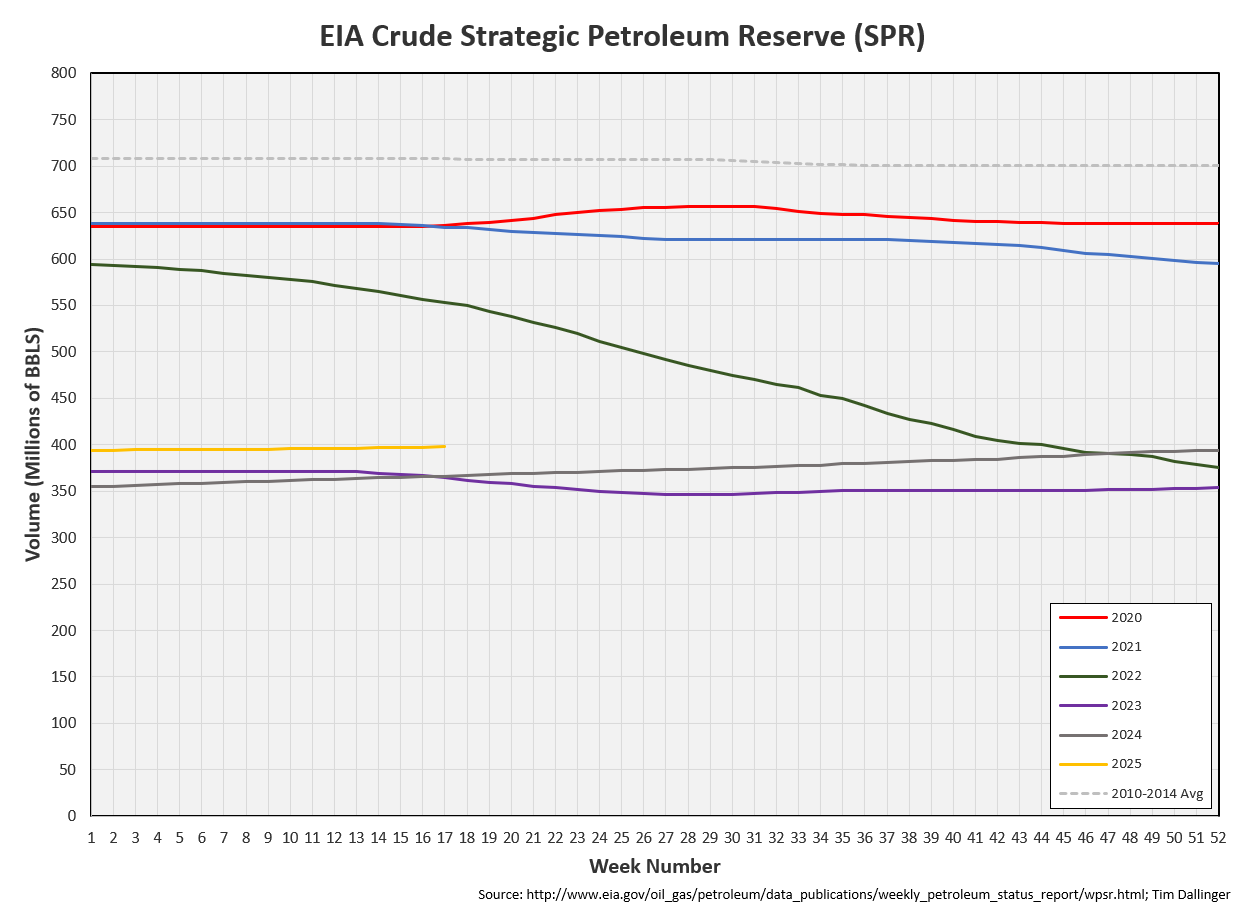

SPR: +1.1 MMB

Cushing: +0.7 MMB

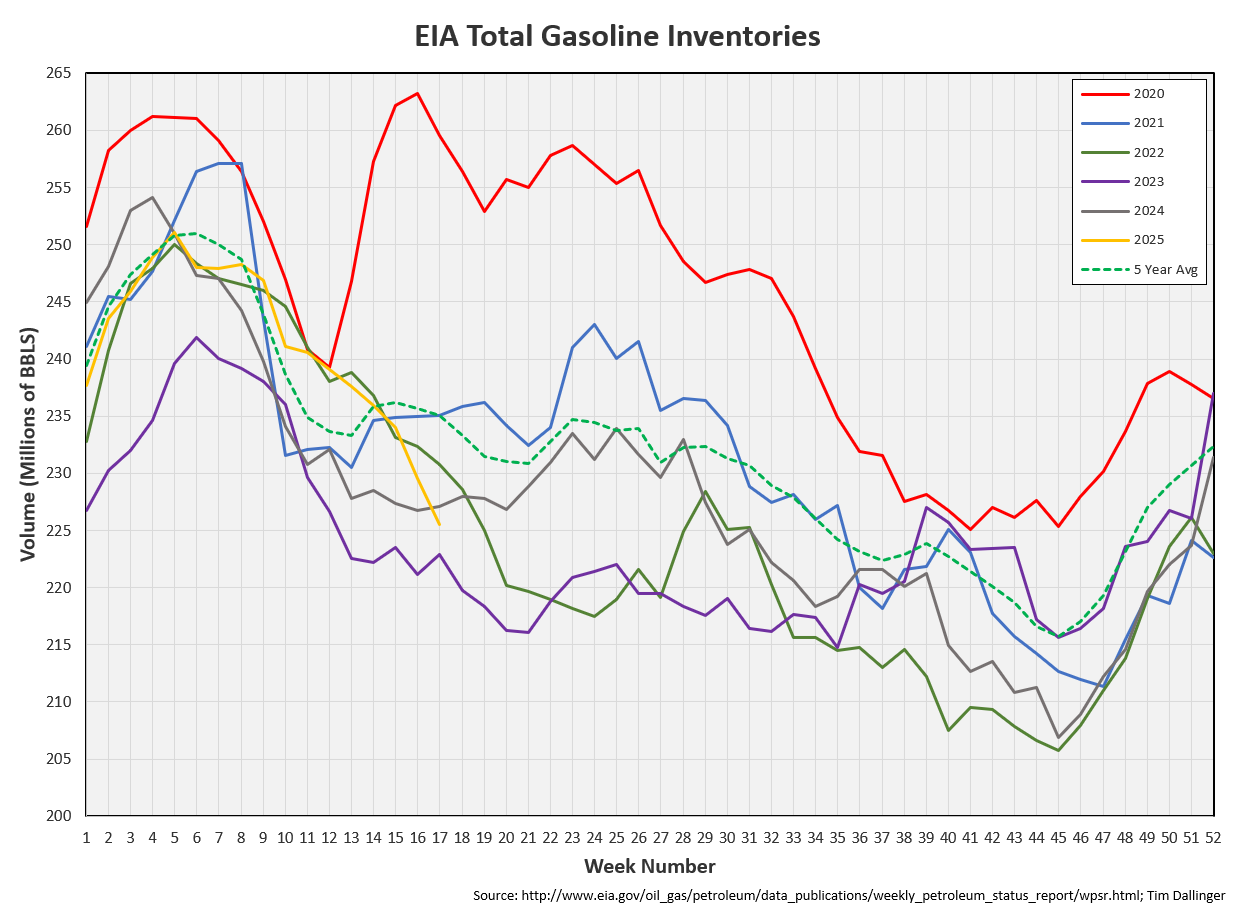

Gasoline: -4.0 MMB

Distillate: +0.9 MMB

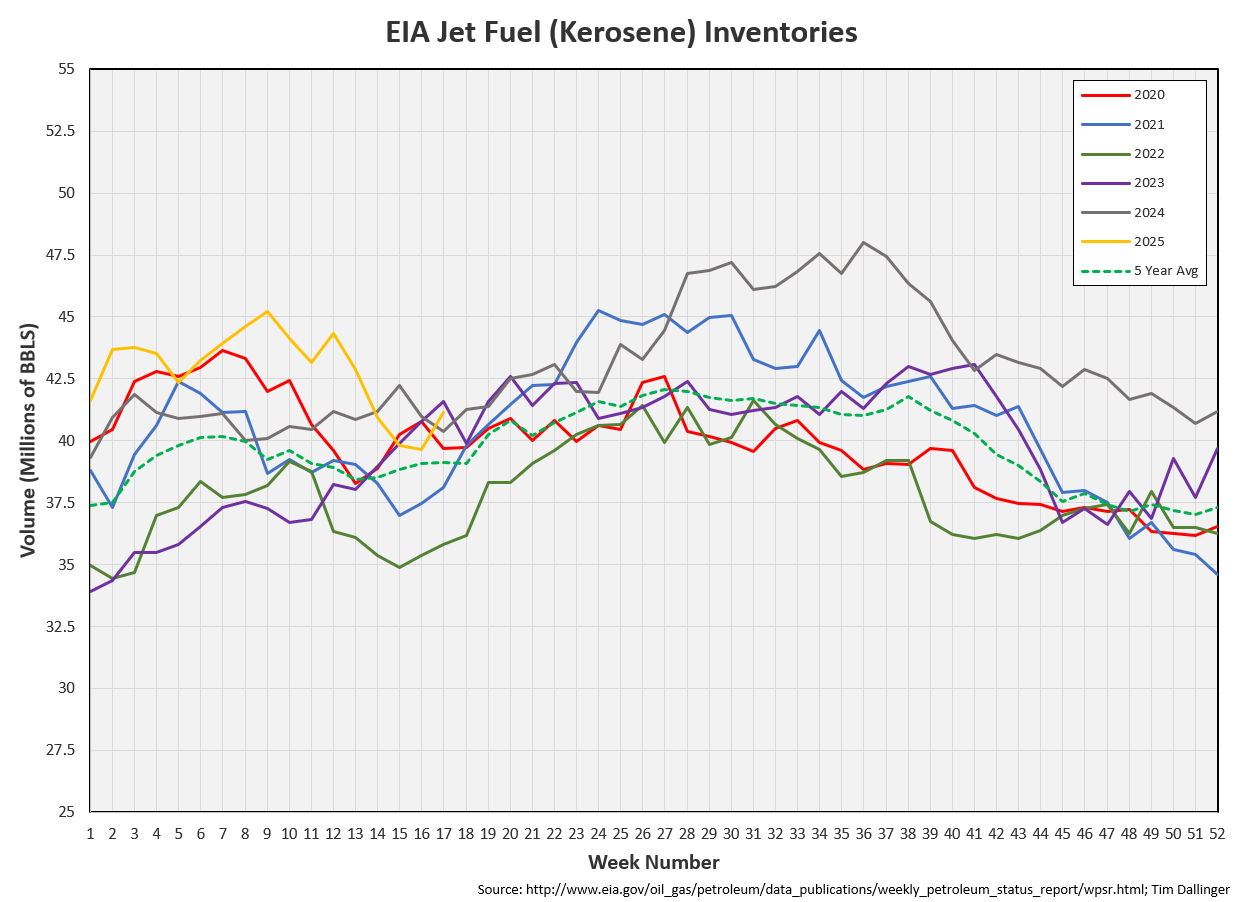

Jet: +1.5 MMB

Ethanol: -0.1 MMB

Propane: +0.6 MMB

Other Oil: +7.3 MMB

Total: +4.2 MMB

Spot WTI is currently pricing $58. This was a bullish report, yet the market remains fixated on broader economic measure. Prices are severely discounted in relation to estimated fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply drew by 2.7 MMB. Crude inventories are currently 6% below the seasonal average.

1.1 MMB were added to the SPR.

US crude imports were down.

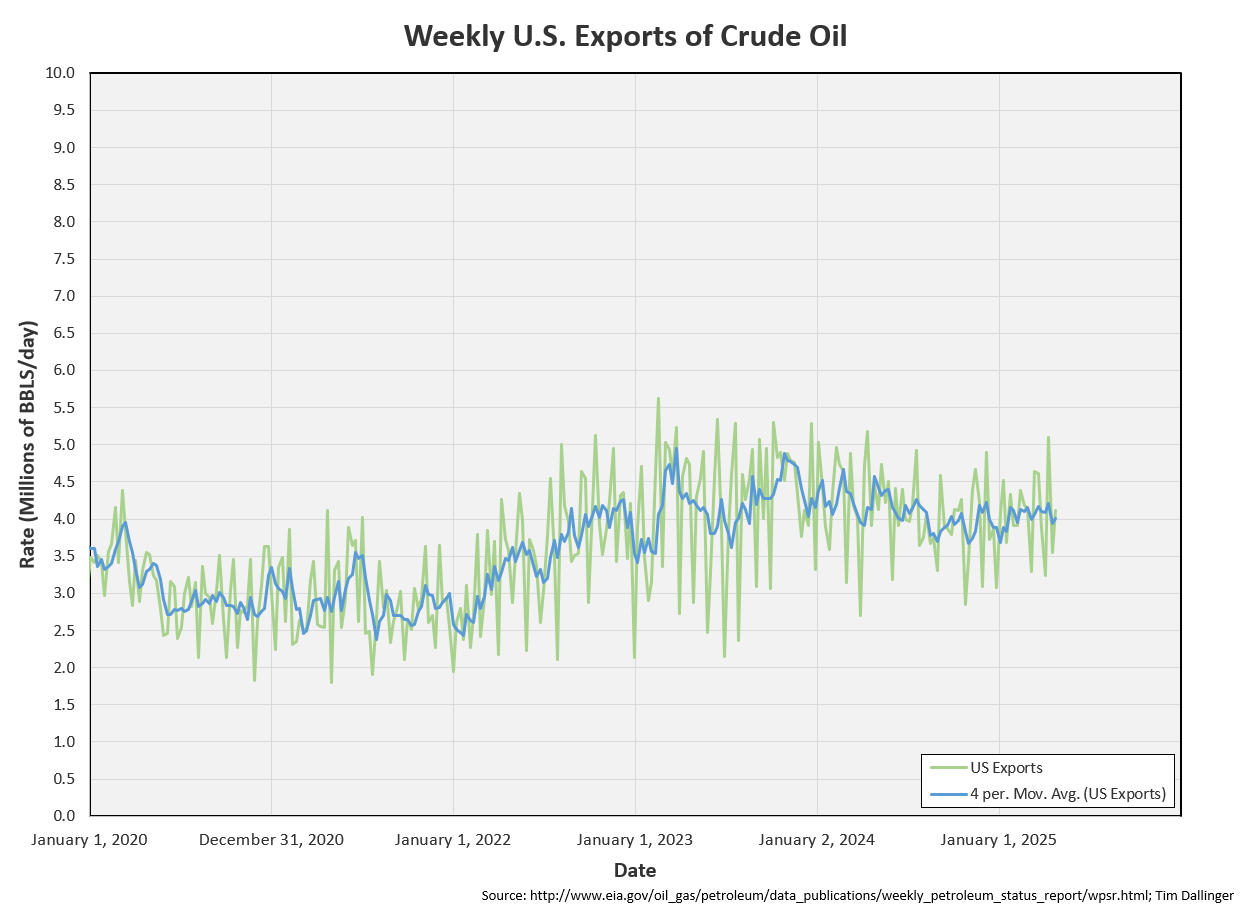

Crude exports increased although they appear to be over-counted.

Unaccounted for crude was positive because of overcounted exports.

The EIA continues to model US production well above 13.0 MMB. Tomorrow, the February PSM data will be released, and it should that US production continues to be overcounted.

Cushing

Crude storage in Cushing, OK, built by 0.7 MMB week on week. Cushing inventories remain at seasonal record lows.

Gasoline

Total motor gasoline inventories decreased by 4.0 MMB and are about 4% below the seasonal 5-year average.

Finished motor gasoline inventories are at record lows.

Distillate

Distillate fuel inventories increased by 0.9 MMB last week and are about 8% below the seasonal 5-year average. Distillate volumes ticked just higher than the 2022 low.

Jet

Kerosene type jet fuels increased by 1.5 MMB.

Ethanol

Ethanol inventories decreased 0.1 MMB week-on-week. Inventories are above seasonal averages.

Propane

Propane/propylene inventories increased by 0.6 million barrels and are 8% below the seasonal 5-year average.

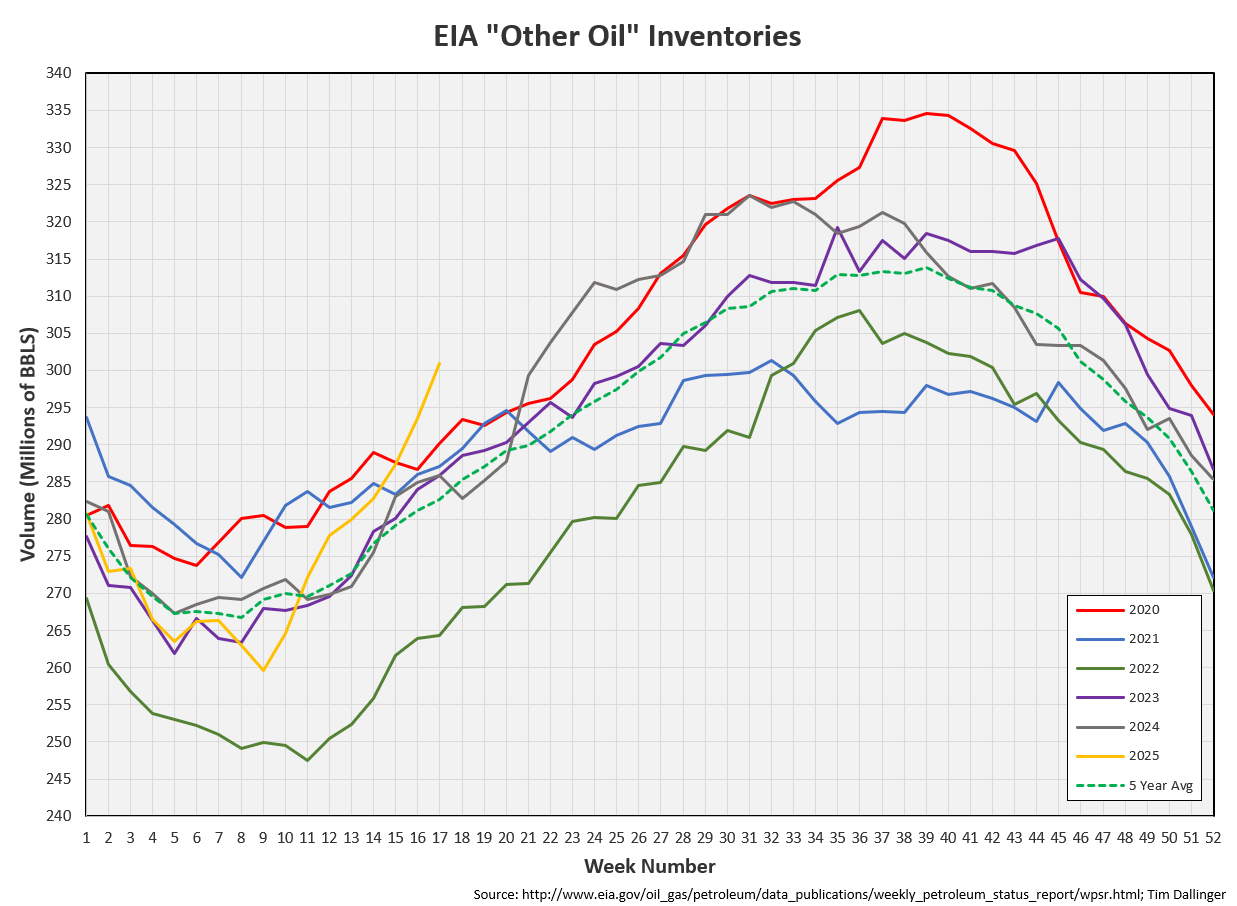

Other Oil

Other oil increased by 7.3 MMB. Other oil inventories are above average and trending higher.

Total Commercial Inventory

Total commercial inventory increased by 4.2 MMB.

Natural Gas

Natural gas inventories are again tracking toward average levels.

Refiners

US refinery utilization jumped. The increase is a little early considering seasonal trends, but cracks are enticing.

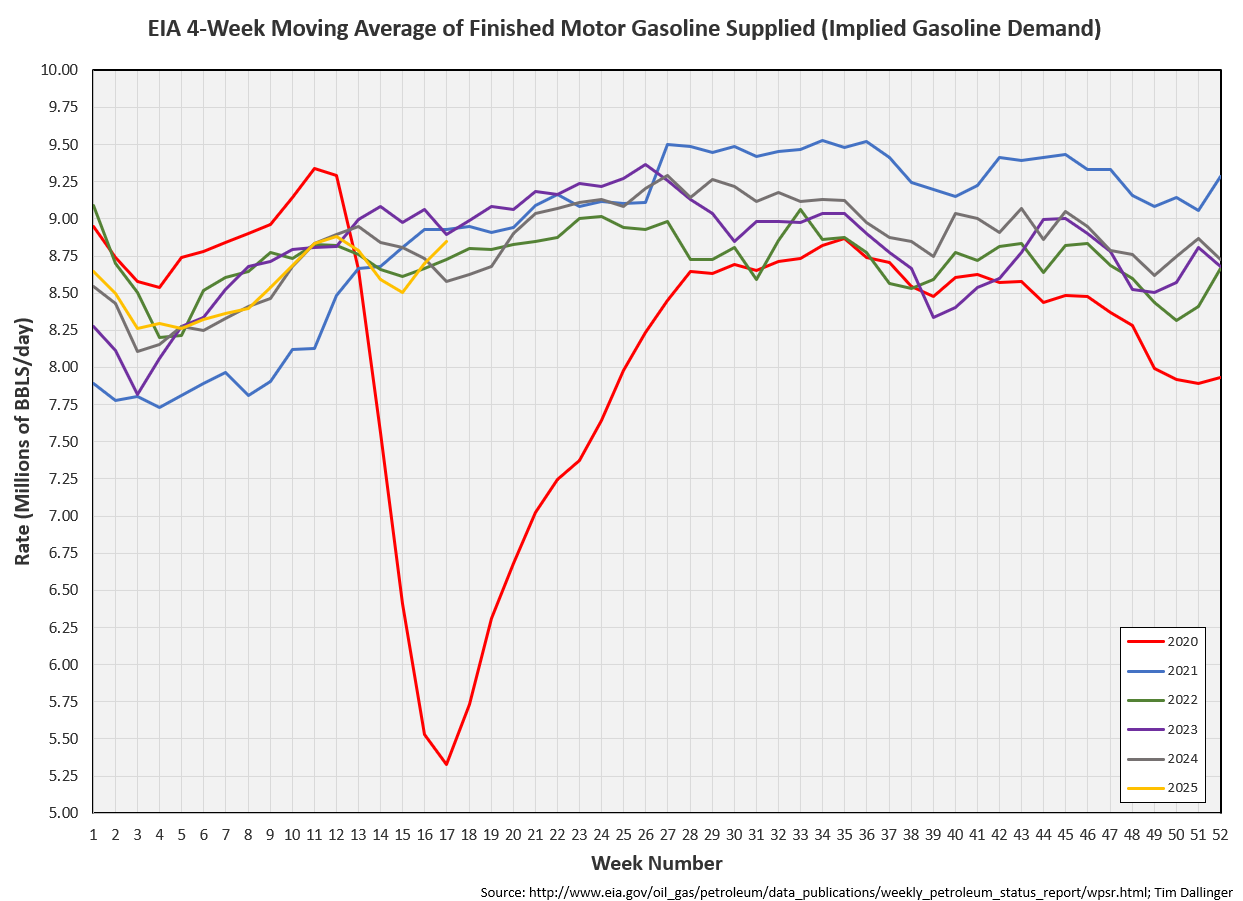

The EIA’s product demand proxy fell on the week but moving averages remain near seasonal records.

Transportation inventories match record seasonal lows.

Implied demand for transportation inventories is at record levels.

Implied gasoline demand is just below record levels.

Implied jet fuel demand remains at records levels.

Simple cracks are strong.

Discussion

The first quarter of 2025 closes today, and reports are that the US economy contracted. Crude oil abruptly sold off. Some appear to be hedging recession risk by shorting crude. Global economic conditions are worth watching but they do not warrant a $20+ discount in crude oil prices. The last time inventories were near this level, crude oil was well above $100.

Although analysts claimed that producers were hedged and price wouldn’t affect production in 2025, this is proving to be incorrect. US shale production growth was already slowing before the price decline.

While he didn’t explicitly admit that he was wrong, energy secretary Chris Wright is trying to walk back his previous claim that growth can occur at even at $50. At $58, very few wells are profitable, considering full-cycle dynamics.

Chris Wright says that SPR refill will continue but the refill rate cannot be increased currently due to repair work. The reserves were damaged during the rapid drawdown. I have filed a FOIA request with the DOE to obtain the recent cavern reports to assess the reported damage.

Various news outlets are reporting that Saudi Arabia is on the verge of initiating a price war due to Kazakhstan’s inability or unwillingness to reign in Chevron production. It seems more likely that KSA simply will not further cut production unilaterally.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Happy apologizes to Chubbs Petersen, in the 1996 American comedy, Happy Gilmore.

Very curious what your FOIA request reveals!