EIA WPSR Summary for week ending 10-20-23

Summary

Neutral report. Bearish implied demand.

Crude: +1.4 MMB

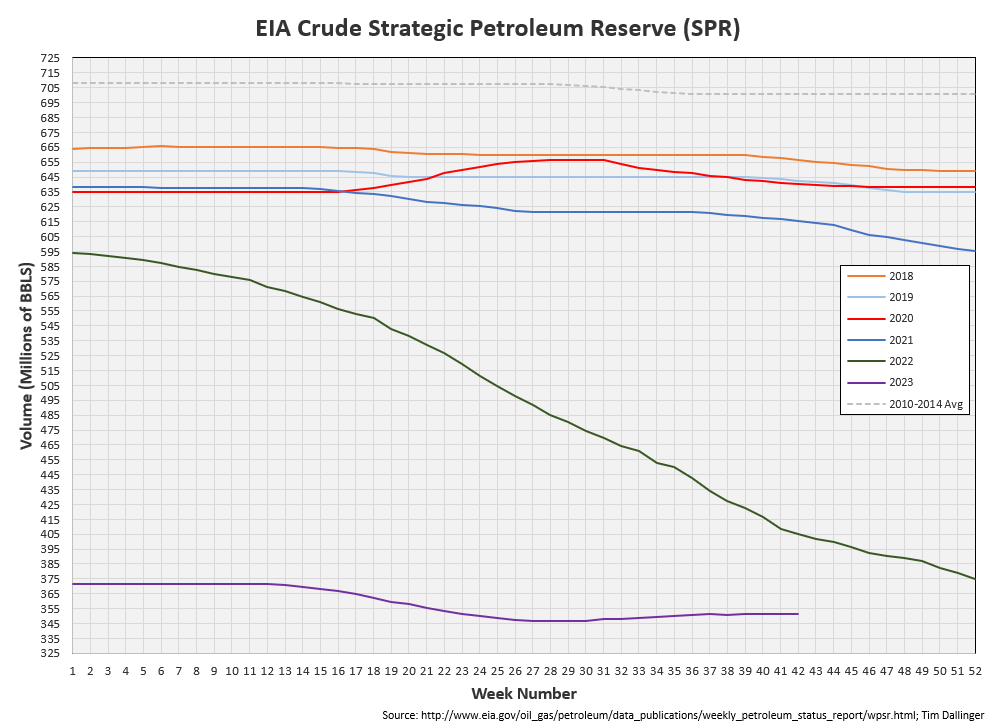

SPR: 0.0 MMB

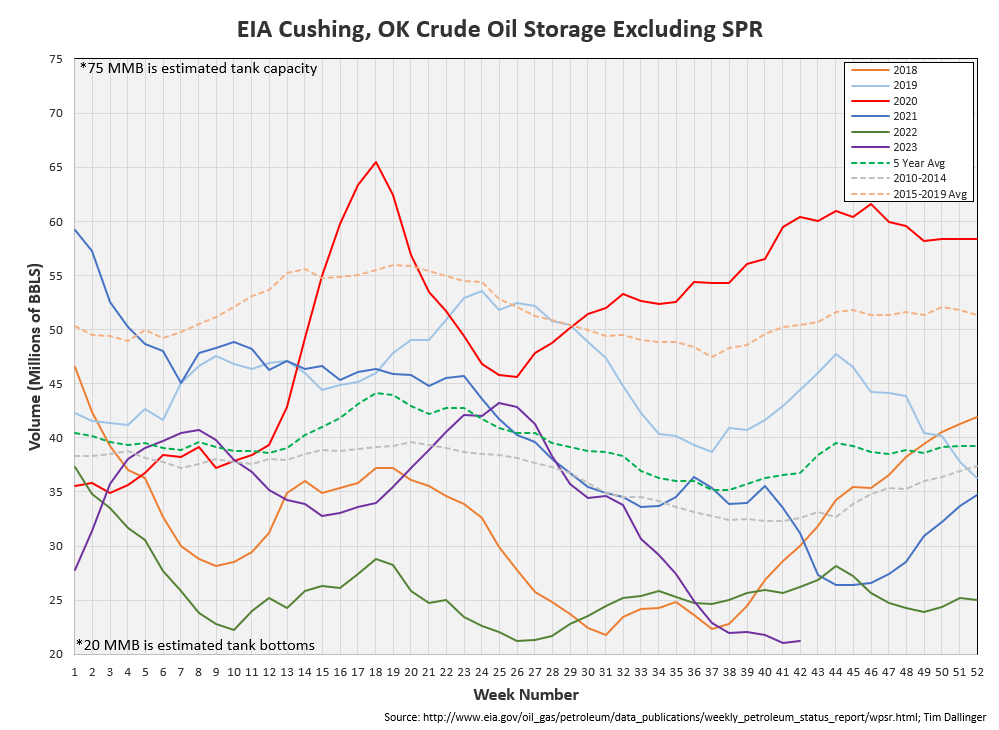

Cushing: +0.2 MMB

Gasoline: +0.2 MMB

Ethanol: +0.3 MMB

Distillate: -1.7 MMB

Jet: -1.3 MMB

Other Oil: 0.0 MMB

Total: -0.5 MMB

Spot WTI is currently pricing $85. This is slightly below fair value, based on a price model derived from reported EIA inventories. Price sold off immediately after this report and then climbed back to finish positive on the day.

Crude

U.S. commercial crude oil inventories increased by 1.4 MMB. U.S. crude oil inventories are about 5% below the seasonal 5-year average.

SPR was again unchanged this week. Another 1.2 MMB additions are still planned for 2023.

US crude exports remain high. Several weeks ago, it appeared the arbitrage window was closing. At the time of this report, the WTI – Brent spread has widened again to $4. This should be enough to incent continued exports.

Independent ship trackers showed exports were counted correctly this week. With the STEO still showing US production at 13.2 MMBD, it’s unclear as to why unaccounted for oil has tracked back to 1 MMBD. This should fall back to 0.5 MMBD.

Cushing

Cushing built by 0.2 MMB. Total Cushing volume sits at 21.2 MMB. Drawing to tank bottoms remains a near-term risk.

Gasoline

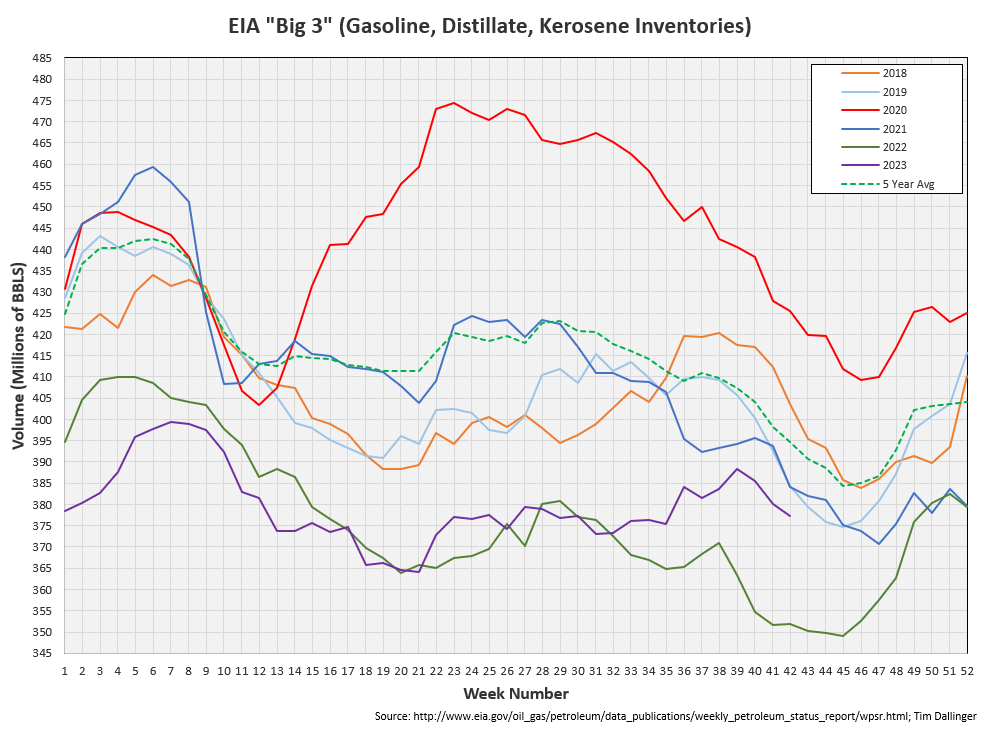

Total motor gasoline inventories increased by 0.2 MMB and are about 1% above the seasonal 5-year average.

Further draws were expected. The EIA implied gasoline demand shows considerable weakness. Implied demand on a 4-week moving average basis is at pandemic levels. Secondary sources are not confirming these low figures. US Refiners report earnings this week and next. Conference calls will be monitored to determine if their internal demand figures match the EIA.

Ethanol

Ethanol inventories built 0.3 MMB, resulting in volumes near the seasonal 5-year average.

Distillate

Distillate fuel inventories decreased by 1.7 MMB and are about 12% below the seasonal 5-year average.

Low PADD 1 distillate inventories remains a concern, especially with colder weather approaching.

Jet

Kerosene type jet drew 1.3 MMB. Inventories are near seasonal averages.

Global air miles have fallen back from all-time seasonal records.

https://www.airportia.com/flights-monitor/

Propane

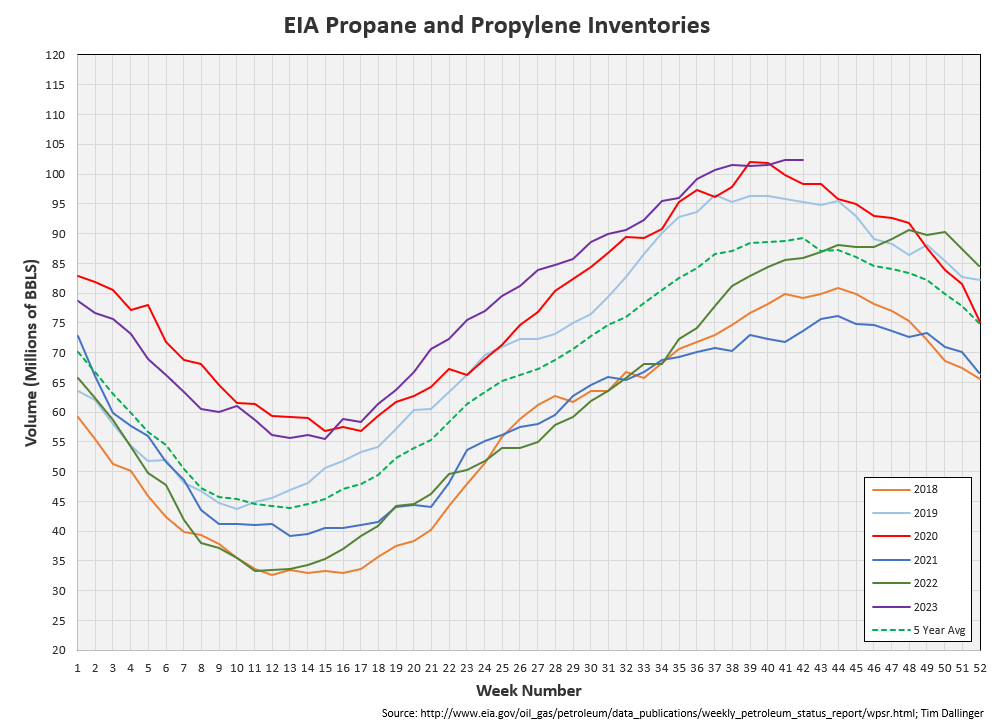

Propane/propylene inventories increased by 0.1 MMB and are 18% above the seasonal 5-year average. The cold weather should lead to draws into year end.

Other Oil

Other oil is flat week-on-week. Draws are expected to return next week.

Total Commercial Inventory

Total commercial petroleum inventories decreased by 0.5 MMB last week.

Natural Gas

Natural gas inventories are about 5% above the seasonal 5-year average.

Discussion

This was another week of refiner maintenance. One more week should remain.

The EIA demand proxy again demonstrates product weakeness.

Yet, transportation inventories remain lower than every recent year except 2022.

The DOE announced that it would consider strategically purchasing more barrels to refill the SPR at $79. With current backwarded timespreads, the DOE would have to purchase September 2024 delivery to obtain their desired price.

However, the DOE does not want WTI. They are interested in US produced sour barrels. There is very little of this type of oil produced in the US. It can be found in the Gulf.

The US eased sanctions on Venezuelan oil to get more barrels similar to this grade. Venezuelan fields are in poor shape due to a lack of investment. It’s unclear if they can boost production and by how much.

Israel has delayed initiation of the Gaza ground invasion. The Wall Street Journal is reporting that is to allow the US to move weapon systems into position to protect US assets in the region. Iran has warned of regional escalation should the ground invasion occur. There has been no official communication from the US as to the grounds for which the US will officially join the conflict. US bases in Syria and Iraq are sustaining rocket attacks daily.

No energy infrastructure has been targeted or damaged yet. The market isn’t currently adding any geopolitical premium to pricing.

While geopolitical conflict and weakening economic data garners the mainstream attention, the oil market remains in deficit. Global inventories continue to quietly draw. BBG energy columnist, Javier Blas, highlights the recent drawdown in global floating storage.

https://twitter.com/JavierBlas/status/1716352819698061767

The bullish thesis appears shaky on the surface but the underlying fundamentals remains supportive.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Happy Gilmore is a 1996 American comedy film, staring Adam Sandler as a failed hockey player turned golfer.