EIA WPSR Summary for week ending 12-29-23

When the Taxman Come to the Door, Lord, the House Look like a Rummage Sale

EIA WPSR Summary for week ending 12-29-23

Summary

Neutral report but year-end anomalies make the data appear more bearish than it should.

Crude: -4.4 MMB

SPR: +1.1 MMB

Cushing: +0.7 MMB

Gasoline: +10.9 MMB

Ethanol: +0.1 MMB

Distillate: +10.1 MMB

Jet: +2.0 MMB

Propane: -2.0 MMB

Other Oil: -7.4 MMB

Total: +6.9 MMB

Spot WTI is currently pricing $72. With today’s large product build, this slightly below fair value based on a price model derived from reported EIA inventories.

Crude

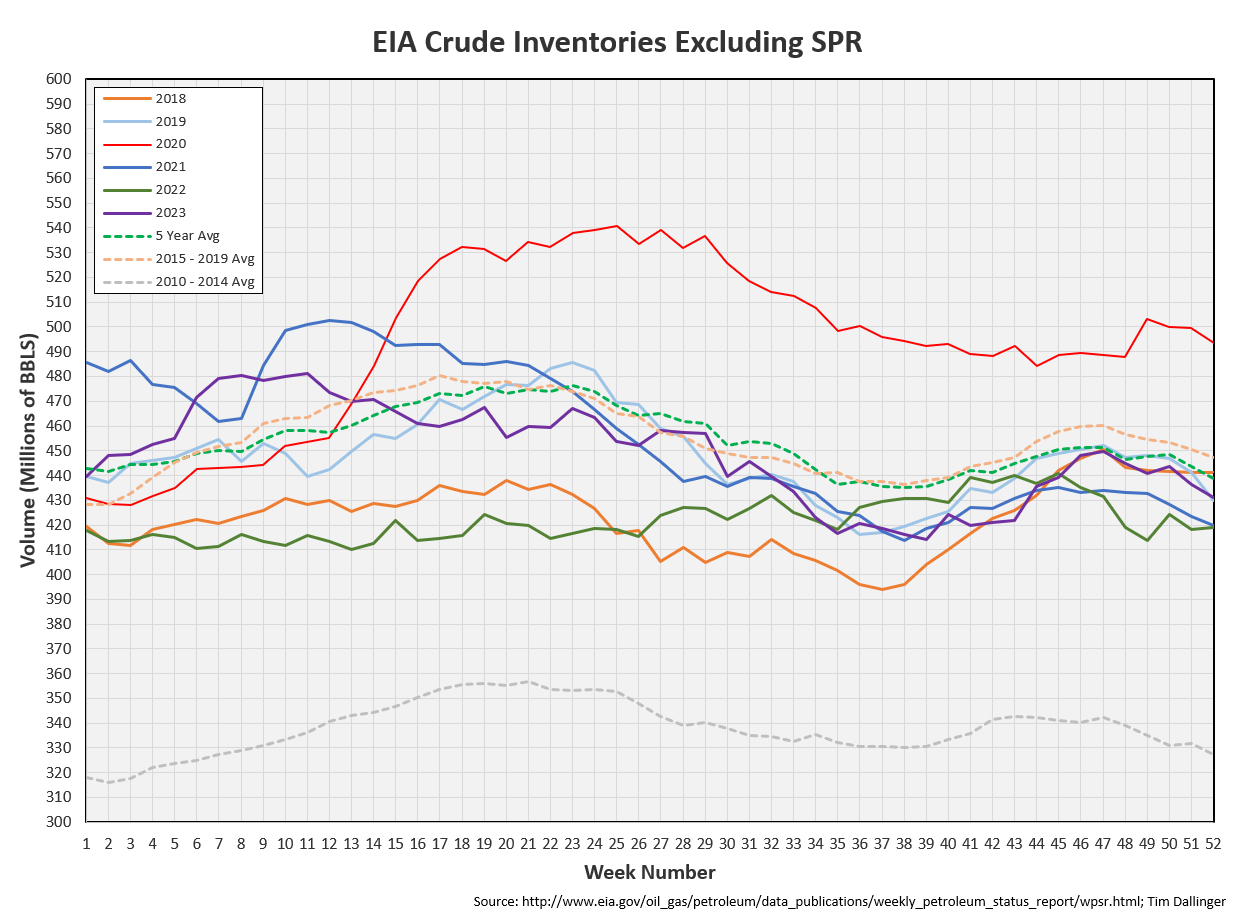

U.S. commercial crude oil inventories decreased by 5.5 MMB from the previous week and are about 2% below the seasonal 5-year average.

1.1 MMB were added to the SPR. All of the 2023 SPR fillings were completed. Perhaps this is a head start on the barrels purchased for 2024 delivery.

Weekly US crude imports were slightly elevated.

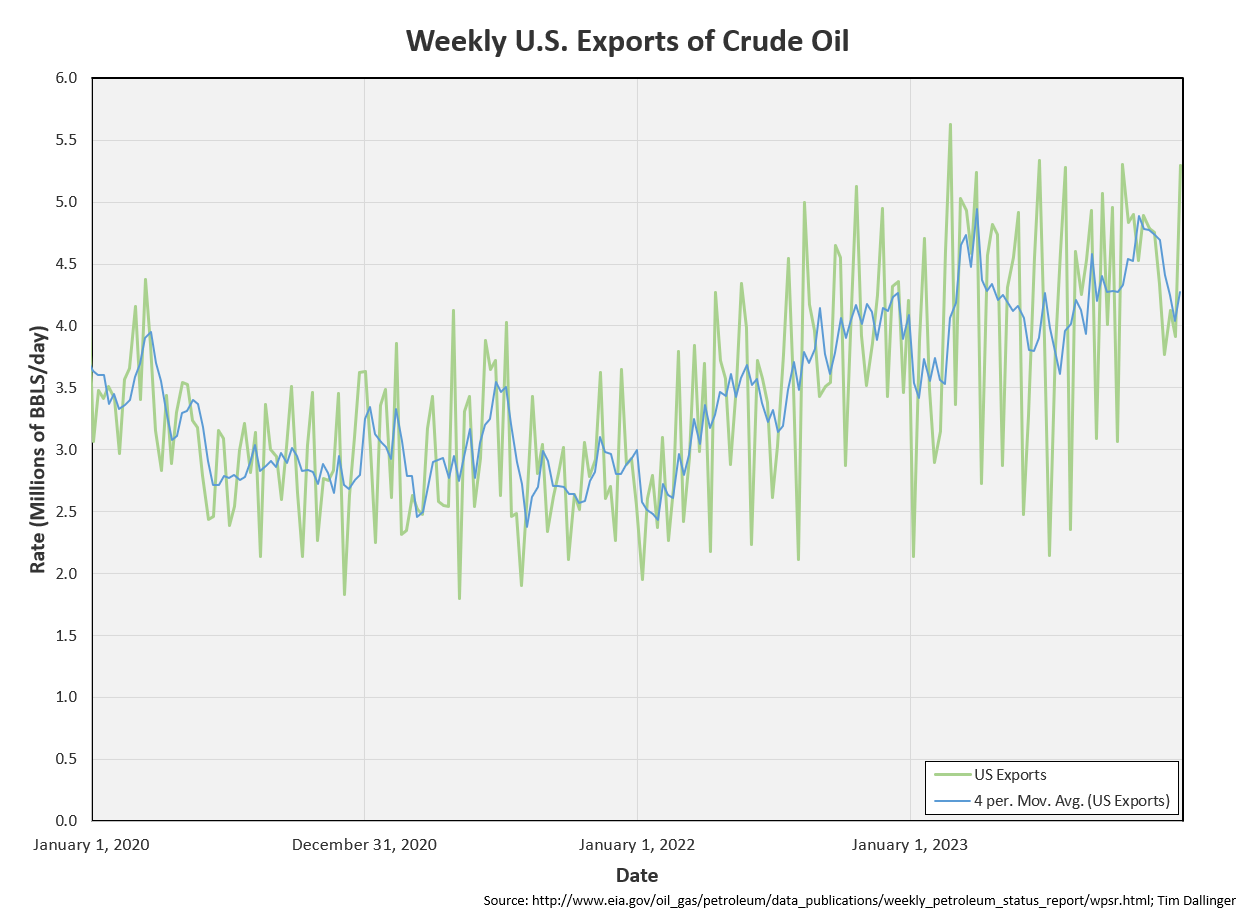

US crude exports were reported to be near record levels. Independent ship trackers did not confirm this movement. This appears to be make-up barrels that the customs didn’t count over the past several weeks.

The adjustment factor is back within a reasonable level.

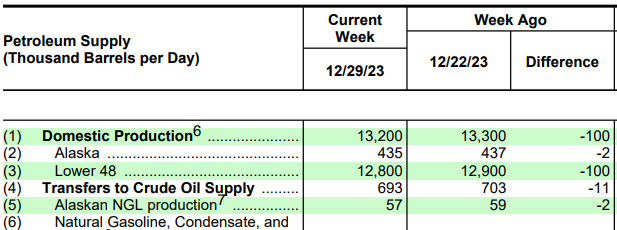

The reduction in the adjustment factor is entirely due to new “transfers to crude oil supply.”

Cushing

Cushing built by 0.7 MMB, in-line with expected seasonal behavior. As expected, Cushing inventory built into year-end. Cushing experienced builds at the beginning of 2023. It’s unclear if that will repeat in 2024 or if draws will return as is the case in most other years.

Gasoline

Total motor gasoline inventories increased by 10.9 MMB and are slightly above the seasonal 5-year average. There’s usually anomalous behavior that occurs near end due to tax liabilities. Refiners don’t wish to pay taxes on end-of-the-year crude storage and commercial retail locations avoid refilling products for similar reasons. This makes for sizeable crude draws and product builds.

It’s highly unlikely that consumer demand fell as much as the demand proxies indicate.

The gasoline build was entirely in blending components. Blending components are at the seasonally highest level in history. This is due to the production of all the condensate that being counted as crude oil.

Implied gasoline demand plummeted. This is not corroborated by any other metric.

Ethanol

Ethanol inventories built by 1.0 MMB.

Distillate

Distillate fuel inventories increased by 10.1 MMB last week and are about 6% below the season 5-year average. Again, this appears should correct in the following two weeks.

Jet

Kerosene type jet fuels increased by 2.0 MMB.

TSA shows record Christmas travel.

Flight trackers are showing air travel has nearly returned to 2019 levels.

https://www.airportia.com/flights-monitor/

Propane

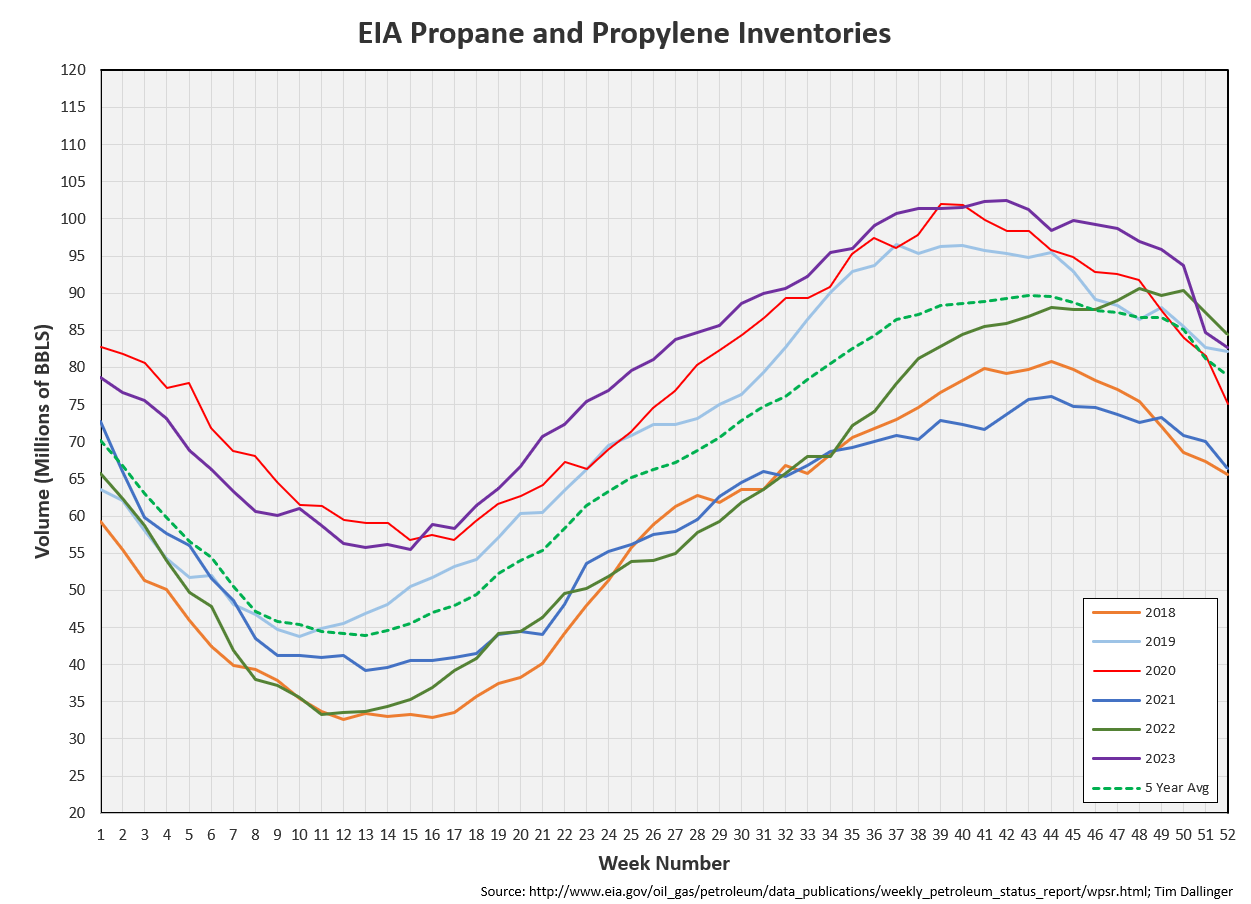

Propane/propylene inventories decreased by 2.0 MMB from last week and are 13% above the seasonal 5-year average. Propane inventories remain high but they’ve now finished below 2022 levels.

Other Oil

Other oil drew 7.4 MMB, nearing seasonal averages.

Total Commercial Inventory

Total commercial inventories built by 6.9 MMB and finish the year at the seasonal average. This includes higher propane and other oil inventories than previous years though.

Natural Gas

Natural gas finishes the year at 2020 levels.

Cold weather is forecasted for much of the US so the outlook isn’t completely bearish. Still, natural gas inventories are high.

Discussion

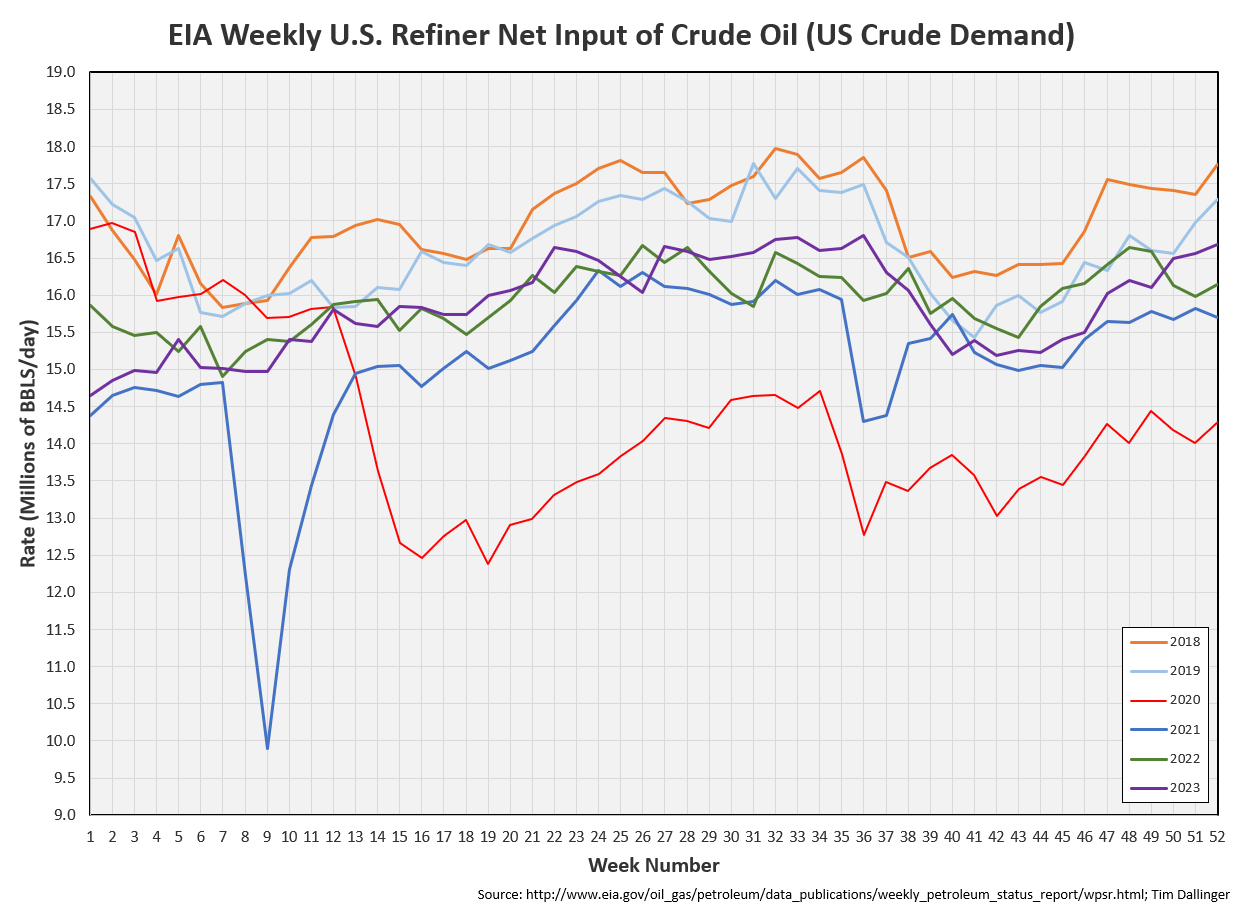

US refiner utilization finishes the year near the annual high. Crud input will fall from here into February maintenance season.

Despite this week’s substantial fall in product supplied, moving averages remain robust.

Transportation inventories jump but again, that’s most likely due to year-end tax implications.

If consumer demand was as bad as reported, cracks spreads would be collapsing. That isn’t the case. Cracks aren’t at record levels but they are healthy.

There’s slight contango on the front-end of the futures. The physical market needs to tighten more.

While Israel continues bombing of Hamas positions in the Gaza strip, conflict in the middle east doesn’t appear to remain isolated.

Lebanese armed group, Hezbollah, condones the Israeli military action, threatening that they will not remain silent.

Houthi rebels continue aggression in the Red Sea, off the coast of Yemen. The US Navy sunk 3 Houthi ships. The US, Britain and other key allies have issued a final warning to cease attacks. Houthis responded by detonating one of their drone boats today. This doesn’t appear to be over.

International shipping firms continue to reroute tankers and shipping container ships.

Hamas, Hezbollah and Houthi groups are all backed by Iran.

Libyan protests shutdown the 300kbd production, Sharara oilfield.

Additional OPEC cuts started this week and secondary sources are reported the effect is already apparent in the physical market.

Even with spreading conflict, there is no geopolitical price premium. The market is focusing on demand fears and ignoring supply risk. With next week’s report being the first containing 2024 data, we’ll wait until then to look at annual projections from the EIA, IEA and OPEC.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

“Fortunate Son” is a song by the Classic American rock band, Creedance Clearwater Revival. It’s included on their fourth studio album, Willy and the Poor boys, released in November 1969.