EIA WPSR Summary for week ending 9-15-23

Summary

Bullish report.

Crude: -2.1 MMB

SPR: +0.6 MMB

Cushing: -3.1 MMB

Gasoline: -0.8 MMB

Ethanol: +0.5 MMB

Distillate: -2.9 MMB

Jet: +1.0 MMB

Other Oil: +4.1 MMB

Total: +3.0 MMB

Spot WTI is pricing $90. This is slightly above fair value, based on price model derived from reported EIA inventories. Manage risk accordingly.

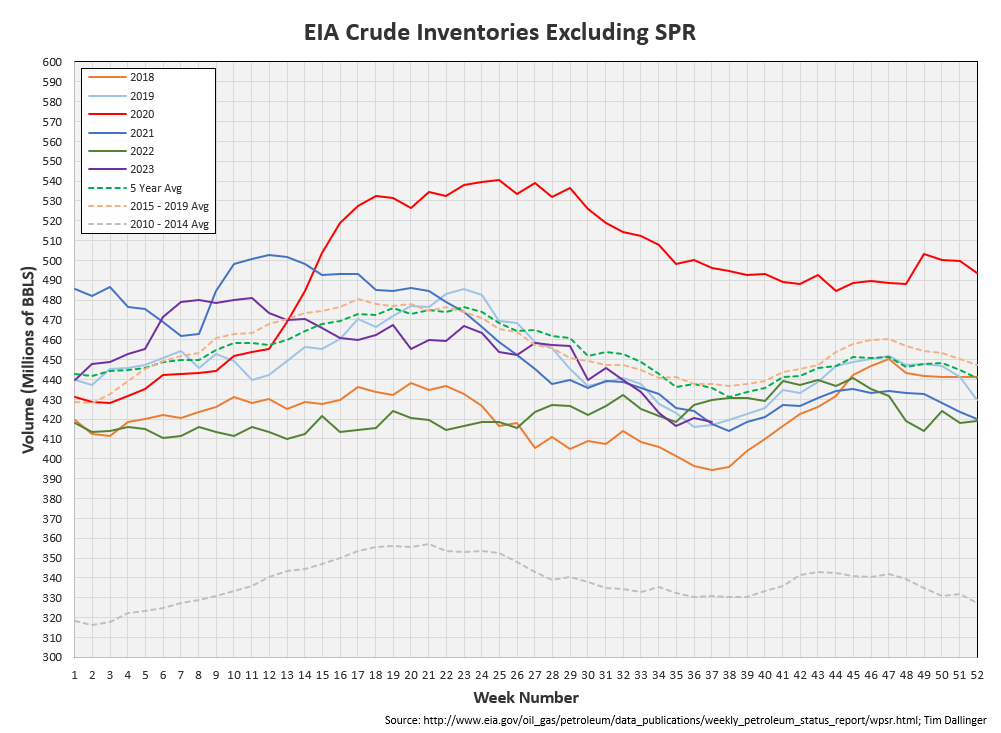

Crude

Crude oil drew by 2.1 MMB. At 418.5 million barrels, U.S. crude oil inventories are about 3% below the seasonal 5-year average. Crude builds are expected begin within the next two weeks as maintenance season ramps but exports currently appear robust. Crude inventories shouldn’t build substantially. The market will focus more on product inventories during October.

SPR built by 0.3 MMB. The US has now added 4.2 MMB back to the SPR. Another 1.8 MMB addition are planned for 2023.

US crude imports fall back normal levels.

US exports surged back above 5 MMBD. Independent ship trackers show exports did rebound but not that much. There appears to be overcounting this week.

Unaccounted for oil also jumped back to significant levels. Some of this can be explained by the overcounted exports. But that cannot account for all 1.7 MMB of unaccounted for oil.

Cushing

Another staggering draw at Cushing. 3.1 MMB weekly disposition leaves Cushing at 22.9 MMB. Cushing is testing tank bottoms. Seasonally, Cushing should start to rebound next week. If not, something unique is happening and some shippers may fail to deliver on physical contracts.

20 MMB may seem like significant volume but one must remember that includes tank bottoms and pipeline linefill.

Tank bottoms contain an oily sludge made up of water, heavier hydrocarbon and solid particulates.

Gasoline

Gasoline inventories drew 0.8 MMB and are about 3% below the seasonal five-year average. As mentioned last week, the jump was likely due to switching to winter blend. Gasoline should resume its seasonal drawing pattern.

Ethanol

Ethanol inventories built 0.5 MMB. They are about 1% above the five-year average.

Distillate

Distillate fuel inventories decreased by 2.9 MMB and are about 14% below the seasonal five-year average.

The EIA product demand proxy for distillate is showing strength versus last year’s weakness.

Jet

Kerosene type jet fuel built by 1 MMB. Inventories are about average.

Global flights lag 2019 but total miles flown are at record seasonal high’s.

Chinese flights have rebounded.

https://www.airportia.com/flights-monitor/

Propane

Propane inventories increased by 1.6 million barrels last week and are about 20% above the five-year average. The propane glut shows little sign of easing.

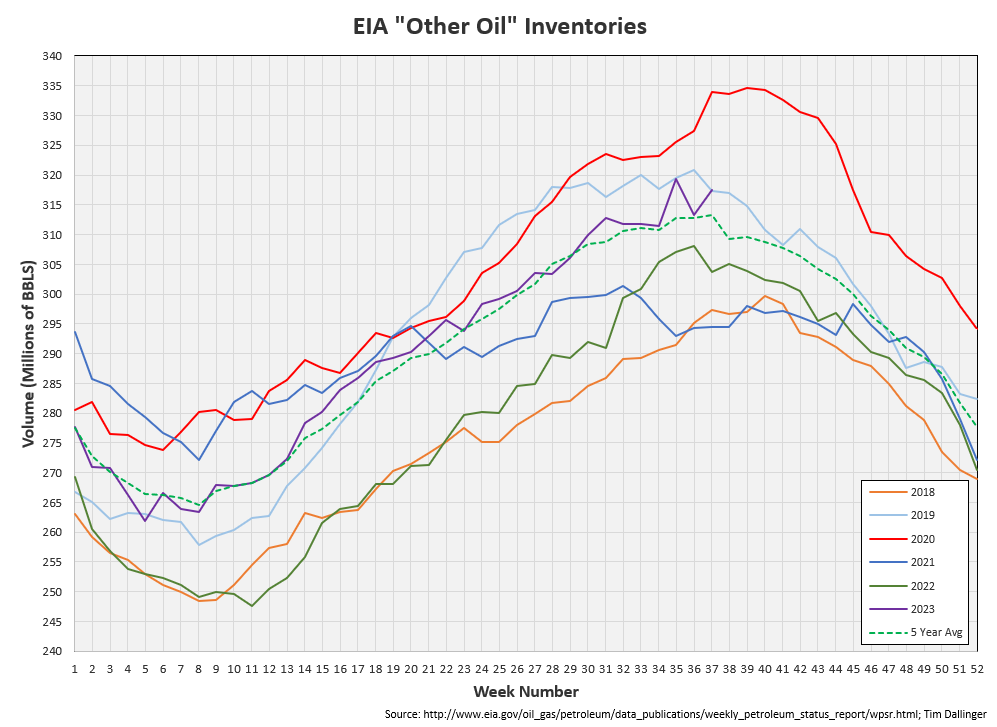

Other Oil

Other oil built 4.1 MMB.

Total Commercial Inventory

Total commercial petroleum inventories increased by 3.0 MMB. Remember this figure includes propane and other oil. Those products considered commercially more important are tighter.

Natural Gas

Natural gas inventories remain high.

The drawdown in the southern region has slowed with slightly less severe heat.

Discussion

The drop in refinery utilization shows that maintenance has begun. This will trend lower next week and through October.

The US demand proxy isn’t at record levels but it currently considerably higher than last year.

This is even more evident when considering the demand proxy for transportation fuels.

Transportation fuels draw. This will continue through October.

Crack spreads have fallen back from record levels.

Backwardation in benchmarks, especially Brent, illustrate the tightness of the physical market.

Earlier this week, a rumor started on Twitter that the US was considering draining the SPR completely drove crude prices down $2 immediately. This was never denied by the Administration, however no additional source besides a tweet from a parody account was located.

This does highlight a potential risk. While the US cannot completely drain the SPR due to the nature of salt cavern storage, there are additional barrels that can be released. One should expect the SPR will again be tapped to help ease energy prices. This tool will not likely be utilized until closer to the 2024 election.

The bullish thesis remains and the market are projected to remain healthy through year-end. However, in the near-term, commodity prices have overrun current estimated fair value. Manage risk accordingly.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

“Bottom” is a song by the American rock band Tool, included on the 1993 record Undertow.