Summary

Bearish report, due primarily to import/export timing. This should reverse next week and crude draws are expected return.

Crude: +4.2 MMB

SPR: +0.3 MMB

Cushing: -2.4 MMB

Gasoline: +5.6 MMB

Ethanol: -0.4 MMB

Distillate: +3.9 MMB

Jet: -0.7 MMB

Other Oil: -5.9 MMB

Total: +10.4 MMB

Spot WTI is pricing $88. This is fair value, based on price model derived from reported EIA inventories.

Crude

Crude oil built by by 4.2MMB. Crude usually begins to seasonally build in mid-September. However, this week’s build is more of a result of import and export timing. That should reverse next week and draws return.

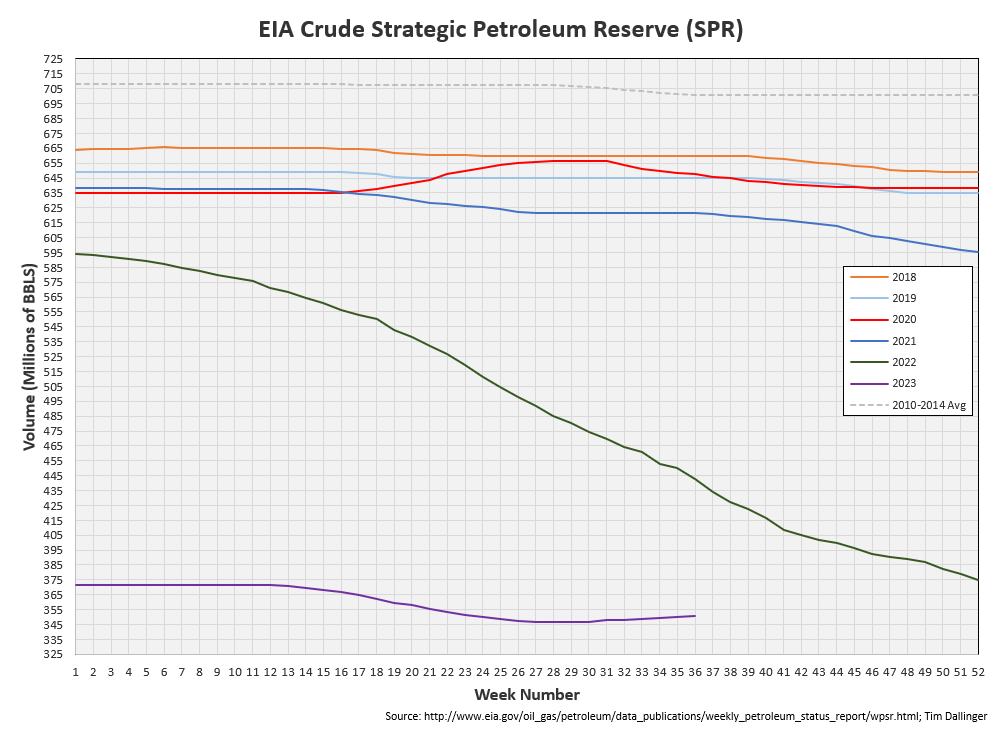

SPR built by 0.3 MMB. The US has now added 3.9 MMB back to the SPR. Another 2.1 MMB addition are planned for 2023. This volume is largely irrelevant after such significant draws over the past two years.

US crude imports hit a multi-year high.

Mexico and Brazil were the source.

At the same time, exports cratered. Independent ship trackers show Gulf loadings have returned and this should be an anomalous week.

Uaccounted for oil is near zero. While that may seem like the weekly model has improved, the EIA has simply moved that “oil” to production.

It seems unlikely that the US is nearly record production levels with current rig and frack spread numbers.

Cushing

Cushing experience another staggering draw. 2.4 MMB weekly disposition leaves Cushing at 25 MMB. Tank bottoms approach.

Gasoline

Gasoline built 5.6 MMB and are about 2% below the seasonal five-year average. This build was unexpected.

Upon further review, nearly all the build was in gasoline blending components, not finished gasoline.

Federal regulations allow winter gasoline to be sold starting September 15. Winter gasoline is cheaper to produce as it contains lighter ends such as butane. This increases the Reid Vapor Pressure (RVP), making the gasoline easier to ignite in colder weather. Additives that would be normally captured in “other oil” or the NGL category can be added to gasoline.

Ethanol

Ethanol inventories drew 0.4 MMB. They are about 2% below the five-year average.

Distillate

Distillate fuel inventories increased by 3.8 MMB and are about 13% below the seasonal five-year average.

Jet

Kerosene type jet fuel drew by 0.4 MMB. Inventories are about average.

Global miles traveled continue to pace just above 2019 levels.

Chinese flight rebounded off their recent drop. Further recovery is still expected.

Source: https://www.airportia.com/flights-monitor/

Propane

Other Oil

Other oil drew 5.9 MMB. This appears to be a correction from last week or related to the seasonal change in gasoline composition.

Total Commercial Inventory

Total commercial inventories built 10.4 MMB.

Natural Gas

As last week included a government holiday, the WSPR was released on the same day as the weekly natural gas storage report. Therefore. the chart is identical to that presented last week. New data will be available tomorrow.

Discussion

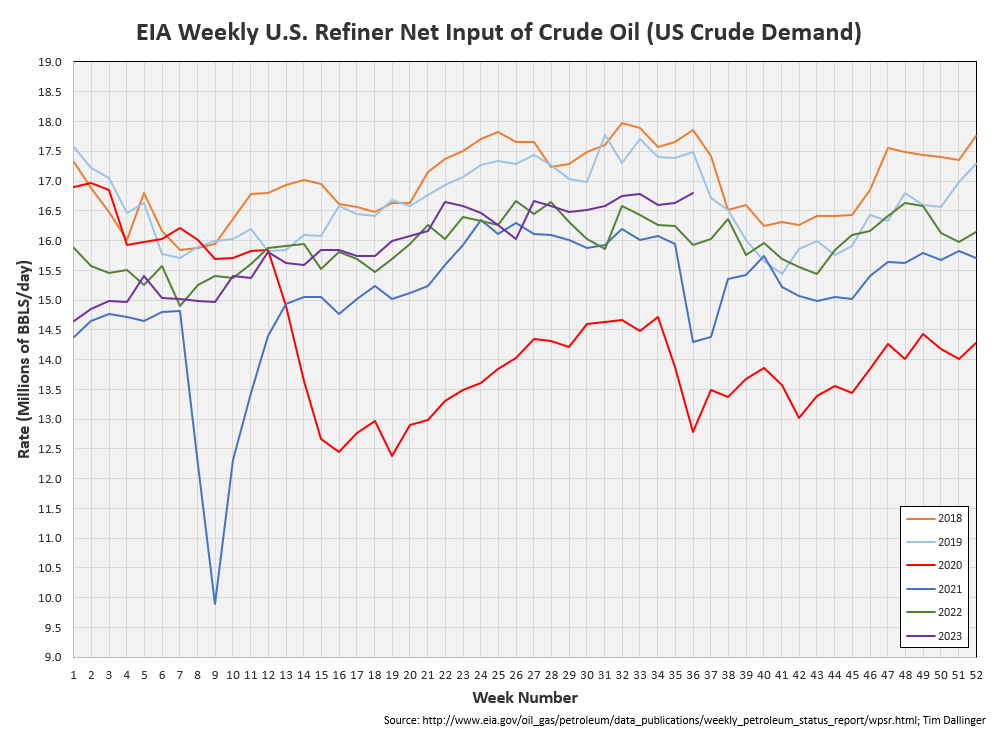

US refiners hit another 2023 high for utilization.

The EIA consumer demand proxy took a hit, primarily due to gasoline. It’s unlikely that gasoline demand fell 1 MMBD week-on-week. This proxy is just not accurate enough to capture weekly changes.

Product demand remains healthy. This is demonstrated by the high 3-2-1 crack spread, despite the significant product builds.

Libyan ports were shut down for hurricane precaution. They are reported have been reopened today. However, photos demonstrate significant flooding and damage across the region. Ship trackers will soon be able to tell if exports have resumed.

As price has rallied, spec positioning has skewed bullish, showing considerable reduction in short interest. For the price rally to continue, inventories must continue to fall. This will be challenging as US refinery maintenance season approaches, resulting in temporarily slowed crude demand. The market will turn to product inventories to assess the health of consumer demand.

Although this report primarily focuses on US data, oil is a global market. Industry leading analytic firm, KPLER, shows a 2 MMBD global deficit for September. Floating storage will continued to be pressured.

https://twitter.com/Kpler/status/1699034629909442928

While this report was bearish, the bullish thesis remains intact. However, near-term consolidation is expected. Projected crude balances suggest the rally will resume into year-end, provided the global economy avoids recession.

Not investment advice. Informational purposes only.