EIA WPSR Summary for week ending 12-13-24

Summary

Crude: -0.9 MMB

SPR: +0.5 MMB

Cushing: +0.1 MMB

Gasoline: +2.3 MMB

Distillate: -3.2 MMB

Jet: -0.6 MMB

Ethanol: 0.0 MMB

Propane: -3.0 MMB

Other Oil: +1.4 MMB

Total: -3.2 MMB

Spot WTI is currently pricing $69. Prices remains significantly dislocated from estimated fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply drew by 0.9 MMB. US Crude inventories are currently 6% below the seasonal average. Crude oil inventories are the lowest they’ve been seasonally since 2014.

0.5 MMB were added to the SPR. SPR inventories return to November 2022 levels.

US crude imports bounced back to average levels this week.

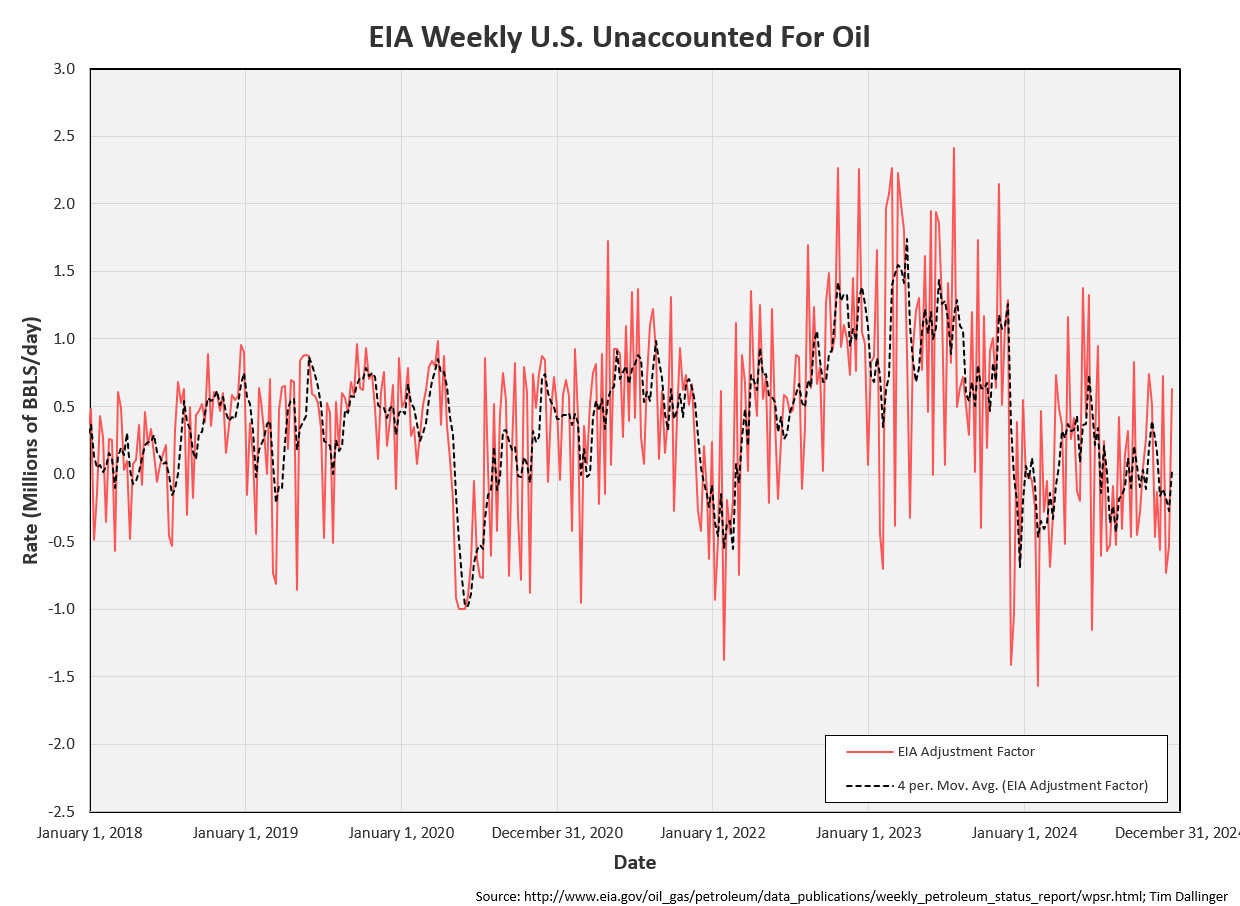

US Crude exports also jumped near annual highs. Independent ship trackers did not confirm this surge, so exports were likely overcounted. Or this was a make-up from missed barrels the previous few weeks.

Unaccounted for crude also spiked, implying that exports were indeed overcounted this week.

Cushing

Crude storage in Cushing, OK, built by 0.1 MMB week on week. Cushing inventory remains at seasonal lows.

Gasoline

Total US motor gasoline inventories increased 2.3 MMB and are about 3% below the seasonal 5-year average. Gasoline usually builds during the winter months and the rate has been less than normal. Only 2021 has been lower in recent years.

Distillate

Distillate fuel inventories decreased by 3.2 MMB last week and are about 7% below the seasonal 5-year average. Only 2023 has been lower in recent years.

Jet

Kerosene type jet fuels decreased by 0.6 MMB. Jet inventories are high but the absolute magnitude isn’t substantial. Jet fuel demand is high too so there’s plenty of incentive to produce this product.

Average global flights and global miles traveled by air are again at record levels.

Ethanol

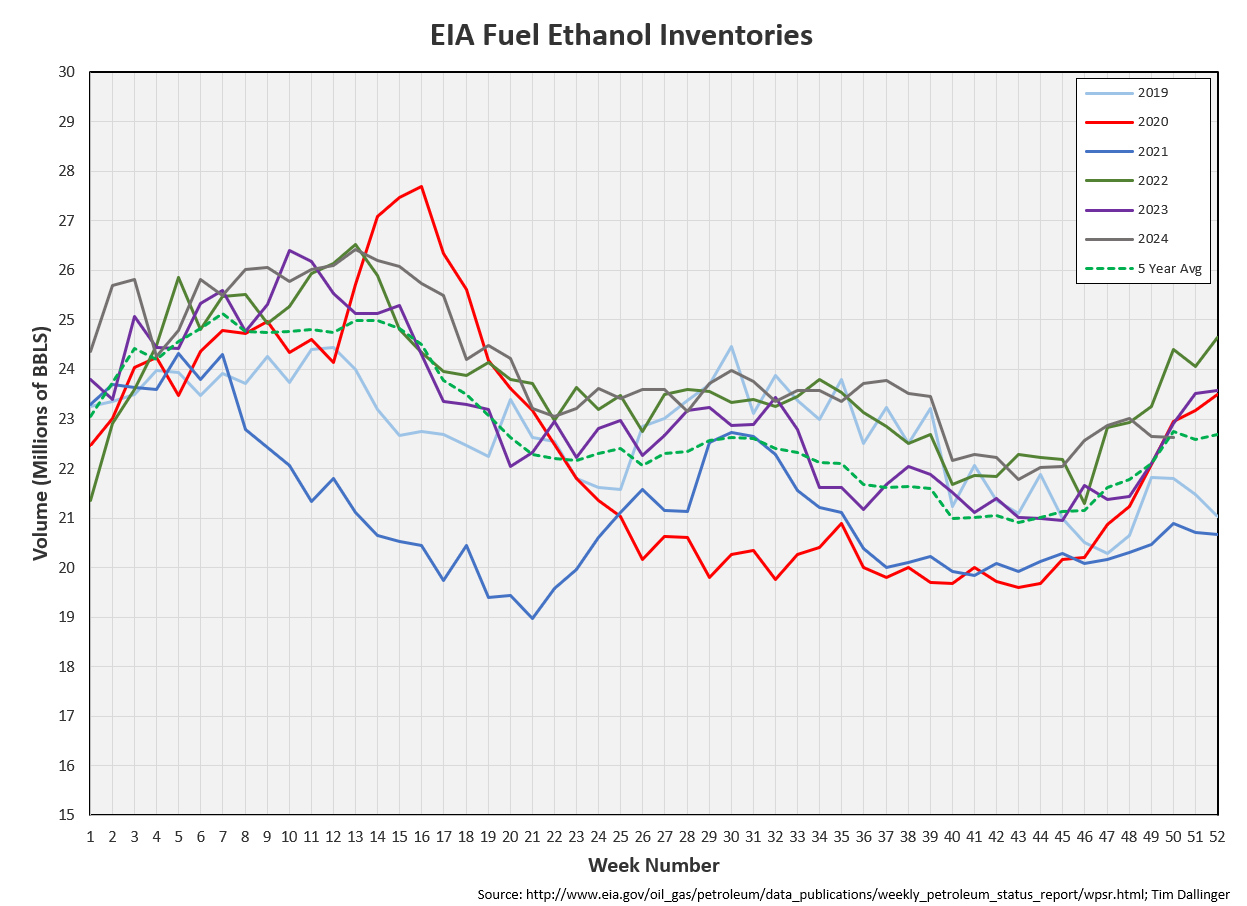

Ethanol inventories were flat week-on-week. Ethanol inventories finally fall below seasonal averages.

Propane

Propane/propylene inventories decreased by 3 MMB. Propane inventories are 7% above the seasonal five-year average. This is high but it’s now below 2023 and matching 2022.

Other Oil

Other oil increased by 1.4 MMB. This is odd seasonal behavior which should be corrected next week.

Total Commercial Inventory

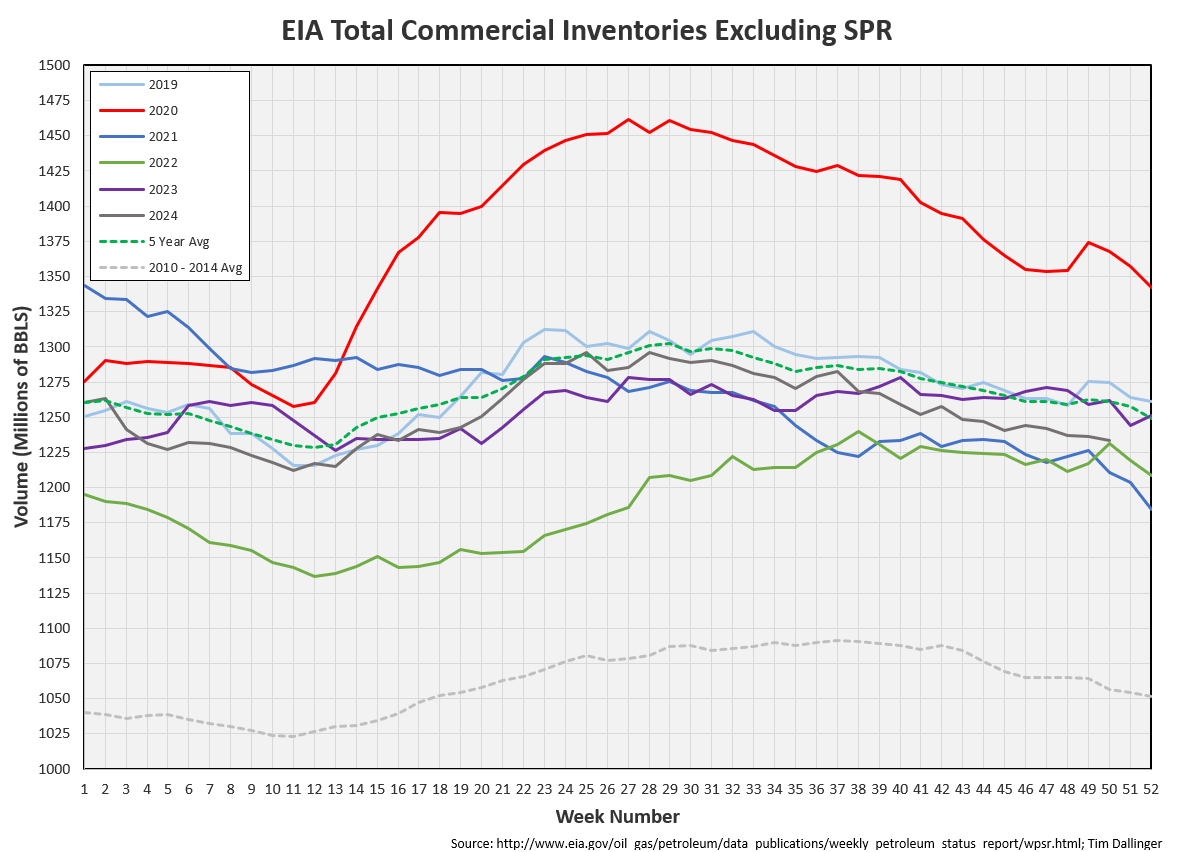

Total commercial inventory decreased by 3.2 MMB. Total commercial inventories match 2022 levels.

Natural Gas

Natural gas inventories had an unexpected, significant draw-down. There was a brief cold spell that likely spiked demand. Temperatures are more moderate this week. There does appear to be a system forming in the northeast and a very cold burst could arrive early January.

Refiners

Refiners processes slight less crude week-on-week, but still seasonal record input.

The EIA’s product demand proxy has rebounded. Even by flawed EIA metrics, consumer demand is good.

This was aided by a similar jump in implied gasoline demand.

Transportation inventories fell slightly and are near seasonal averages.

Oddly though, simple cracks took a substantial hit.

Discussion

Both WTI and Brent remain in backwardation. The spread has narrowed.

It was a relatively quiet week in energy markets. 2 Russian tankers experienced issues, spilling fuel oil. The Russian fleet is outdated. But that seems awful coincidental.

Crude prices remain depressed. Rallies are sold. Sentiment across the sector remains poor. And yet the underlying fundamentals appear healthy.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

Phil Connors, played by Bill Murray, laments the day he’s doomed live repeatedly in the 1993 dark comedy film, Groundhog Day.