EIA WPSR Summary for week ending 3-28-25

Summary

Crude: +6.4 MMB

SPR: +0.3 MMB

Cushing: +2.4 MMB

Gasoline: -1.6 MMB

Distillate: +0.3 MMB

Jet: -1.5 MMB

Ethanol: -0.7 MMB

Propane: +1.0 MMB

Other Oil: +2.2 MMB

Total: +5.4 MMB

Bearish report. Spot WTI is currently pricing $71. Prices have rebounded recently but still remain below estimated fair value based on a price model derived from reported EIA inventories.

Crude

US Crude oil supply built by 6.4 MMB. Even with the large build, crude inventories are currently 4% below the seasonal average.

0.3 MMB were added to the SPR.

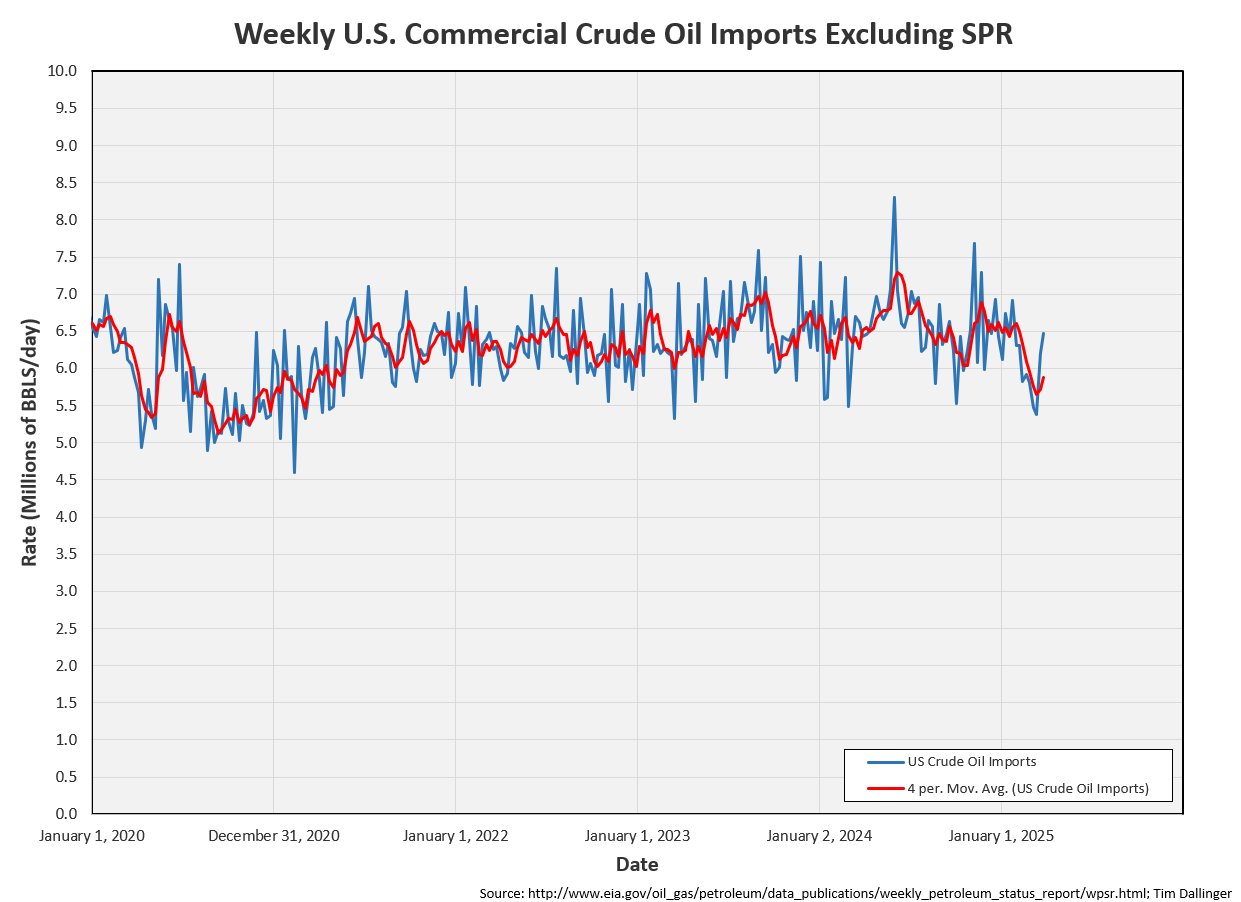

US crude imports increased week-on-week.

Crude exports fell back below average levels.

Unaccounted for crude remains negative. The EIA continues to overstate supplies in the weekly figures.

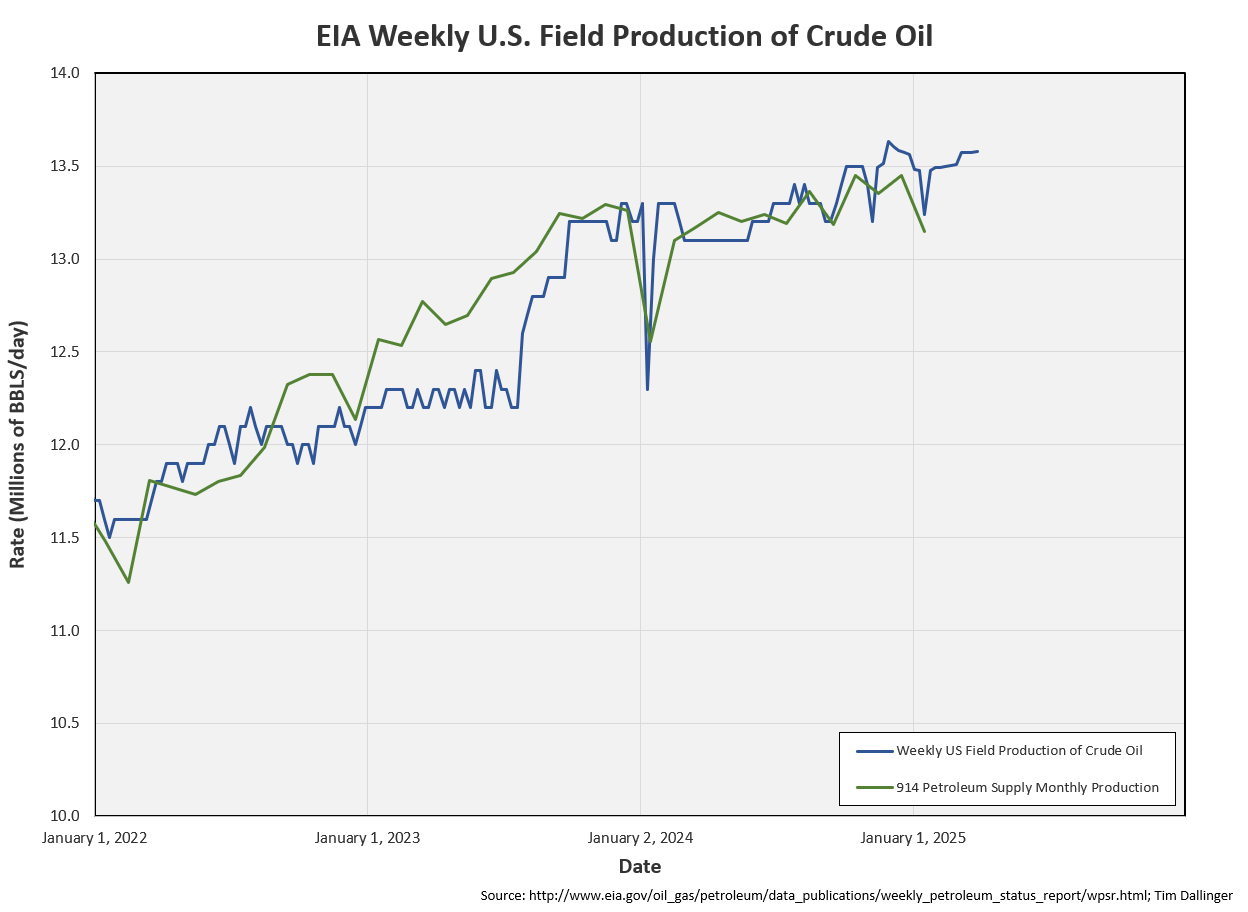

This is further demonstrated by the latest EIA monthly 914 report. The January 914 released earlier this week, shows that US production was overstated. January did have inclement weather which hampered production in West Texas and the Gulf. But that decline was captured in the weekly figures. Notice the spike down in production displayed in the blue trend below. The January monthly figures still came in lower at 13.146 MMBD. The EIA has been over-reporting production since September 2024.

This should not be news to readers of this publication. If US production is not as strong as widely reported, the modeled inventories are also overstated. Remember, the inventories reported in the WPSR are modeled, not measured. These figures are not updated with more current data. Also, the US is still expected to be the predominate growth area in the world. Yet US production has not grown meaningfully in over a year.

Cushing

Crude storage in Cushing, OK, built by 2.4 MMB week on week. This is a significant weekly build but levels are still near historic seasonal lows.

Gasoline

Total motor gasoline inventories decreased by 1.6 MMB and are about 2% above the seasonal 5-year average.

Distillate

Distillate fuel inventories increased by 0.3 MMB last week and are about 6% below the seasonal 5-year average.

Jet

Kerosene type jet fuels drew by 1.5 MMB. Jet fuel inventories are still above average.

2025 US TSA checkpoint data is tracking slightly higher than 2024.

Ethanol

Ethanol inventories decreased 0.7 MMB week-on-week. Inventories are above seasonal averages.

Propane

Propane/propylene inventories increased by 1 MMB. Propane/propylene inventories and are 8% below the seasonal five-year average.

Other Oil

Other oil built by 2.2 MMB. Other oil inventories are above seasonal averages.

Total Commercial Inventory

Total commercial inventory built by 5.4 MMB.

Natural Gas

Natural gas inventories have started to build. Gas inventories are below the seasonal average.

Refiners

The amount of crude oil refiners processes last week fell back slightly. April refinery runs are usually relatively flat. The summer ramp typically begins in a month.

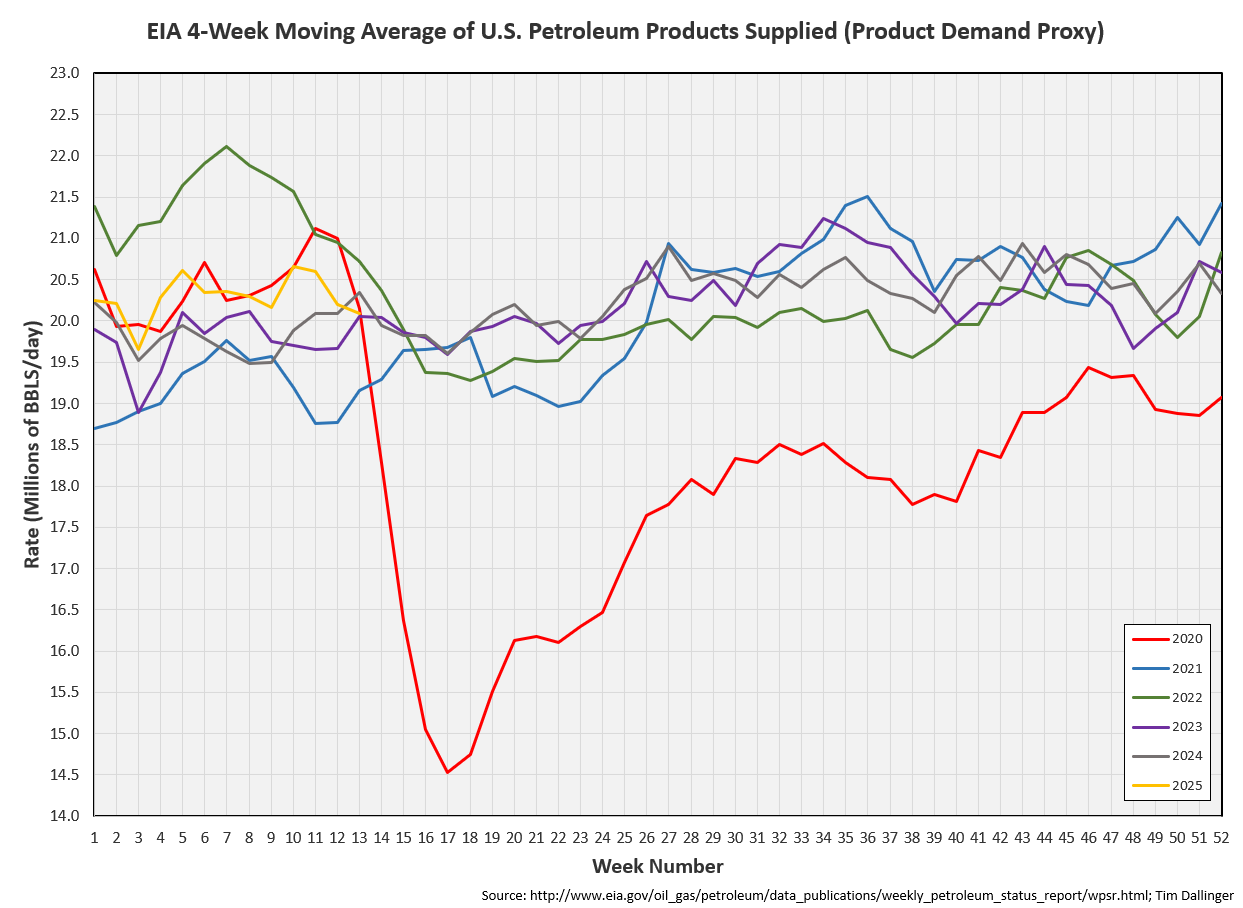

The 4-week moving average of the EIA’s product demand proxy fell slightly, nearing 2023 levels.

Implied demand for transportation inventories is near 2024 levels.

The January Petroleum Supply Monthly shows implied demand surpassed the weekly figures. Implied January demand was a seasonal record.

Transportation inventories are near seasonal average levels.

Adding crude, “Big 4” inventories match 2024.

The 321 Simple crack spread remains robust.

Discussion

Brent and WTI remain backwarded, although it appears the physical market has loosened slightly as China destocks inventories.

The January EIA 914 and the Petroleum Supply Monthly received a lot of attention this week. US production is down. US product demand is at record levels. This data directly contradicts the prevailing energy market narrative. Some argue that the fall in production was anomalous effects driven by weather interruptions. January did experience record cold and freezing precipitation across all of the oil producing regions of the US. However, it still appears that US production has been overstated for some time. February production figures will be enlightening.

Optimistic production reports have been a theme of this publication for some time. Companies often report production metrics in barrels of equivalent oil (BOE). As wells age, there’s more lease condensate, natural gas liquids and natural gas produced per crude volume. More oil can be drilled. But it’s challenging to increase production at the current strip pricing. Production costs are up. Service companies are cutting headcount to manage costs and claiming improvement in efficiencies. There certainly are some efficiency improvements, as measured by lateral distances drilled. But those metrics don’t consider the additional challenges of drilling lower quality acreage.

US Iran relations are poor. Iran has rejected the offer for direct negotiations. European leaders warn that the opportunity for a nuclear deal with Iran narrows. Meanwhile, the US continues to strike the Iranian-backed Houthis in Yemen.

Trump has threatened to impose additional sanctions on Russian energy if a peace deal with Ukraine cannot be reached.

Sweeping tariffs were announced today. The broad market sold off in response.

Not investment advice. Informational purposes only. No specific positioning or security recommendations are intended. Sources are cited when available but accuracy of 3rd party data cannot be guaranteed.

American country artist, Randy Travis, released the song, “I Told You So,” on the 1988 album, Always & Forever.